Court Documents Tie Huawei to Iran, Syria, Sudan, Describe New Banking Links

August 21 2019 - 10:31AM

Dow Jones News

By Dan Strumpf

New details about the U.S. sanctions-busting case against Huawei

Technologies Co. emerged in court filings in Canada, including

about the Chinese telecom giant's alleged dealings in Iran, Syria

and Sudan.

The filings also detailed discussions Huawei held with Citigroup

Inc. and BNP Paribas about its Iran business.

The hundreds of pages of court documents released in Vancouver

on Tuesday shed new light on the U.S. case against Huawei and its

finance chief, Meng Wanzhou, who was arrested in Canada in December

at the behest of the U.S. and is fighting extradition.

In the latest filings, U.S. authorities more closely tie Huawei

to a company known as Skycom Tech Co., a Hong Kong company that did

business in Iran and that is at the heart of the U.S. case against

Huawei. The U.S. has alleged that Skycom was under Huawei's control

for much longer than the company disclosed to its banks.

The entity that bought Skycom from Huawei in 2007 -- a

Mauritius-registered company called Canicula Holdings Ltd. -- was

operated by Huawei as "an unofficial subsidiary in Syria,"

according to the filings. In addition, Huawei lent Canicula EUR13.8

million ($15.3 million) to buy Skycom from Huawei in a series of

transactions beginning in 2009, according to the documents.

The documents also described a Huawei unit in Sudan and said the

company referred to its business in Sudan under the code name "A5,"

the filings disclose. Its business in Syria was known as "A7."

A Huawei spokesman declined to comment on a continuing legal

case.

The U.S. has accused Ms. Meng and Huawei in an indictment in the

Eastern District of New York of bank fraud and violating sanctions

on Iran. Huawei and Ms. Meng have denied all charges. Her lawyers

are arguing that U.S. authorities committed an abuse of process by

attempting to use her case as a bargaining chip in trade

negotiations with China.

The court filings also shed new light on discussions between

Huawei and its banks about the company's alleged dealings in

Iran.

The U.S. indictment of Ms. Meng and Huawei, issued in January,

described four unnamed financial institutions as being misled by

Huawei about its business in Iran. The Wall Street Journal has

reported that HSBC and Standard Chartered PLC were among the

institutions told by Huawei that it wasn't doing business in Iran

through Skycom.

The documents released Tuesday allege that Huawei also had

discussions with two other banks, Citigroup and BNP, about its Iran

business, following the publication by Reuters of articles in 2012

and 2013 alleging that Huawei sold U.S.-made computer equipment in

Iran via Skycom in violation of U.S. sanctions.

They allege that Huawei representatives -- including the

company's treasurer and Ms. Meng -- told Citigroup that the company

was in compliance with all sanctions, according to a 2017 email

described in the filings. They also describe a 2014 BNP document in

which Huawei described Skycom as "one of the business partners of

Huawei."

HSBC and Standard Chartered have cut business ties with Huawei,

deeming working with the company too risky, The Wall Street Journal

reported in December. As of the end of last year, Citigroup

continued to provide day-to-day banking services with Huawei

outside the U.S., the Journal reported.

A spokesman for Citigroup declined to comment. A Standard

Chartered spokeswoman and a BNP spokeswoman declined to comment. An

HSBC spokesman didn't immediately respond to a request for

comment.

Ms. Meng, the daughter of the billionaire founder of Huawei, Ren

Zhengfei, is fighting her extradition to the U.S., arguing that she

was unlawfully detained, searched and interrogated at the Vancouver

airport "under a ruse" carried out by Canadian and American

authorities in December, according to separate documents disclosed

on Tuesday.

The case is one of several flashpoints between the U.S. and

Huawei, the world's largest maker of telecommunications equipment

and the No. 2 manufacturer of smartphones. The U.S. i n a separate

indictment this year has accused Huawei of stealing smartphone

testing technology from T-Mobile US Inc. Huawei denies the charges.

It has also blacklisted the company as a national security threat,

blocking companies from selling it U.S. technology without a

license.

Write to Dan Strumpf at daniel.strumpf@wsj.com

(END) Dow Jones Newswires

August 21, 2019 10:16 ET (14:16 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

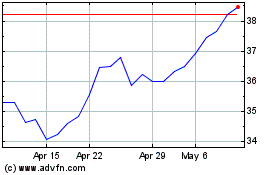

BNP Paribas (QX) (USOTC:BNPQY)

Historical Stock Chart

From Sep 2024 to Oct 2024

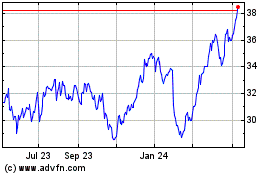

BNP Paribas (QX) (USOTC:BNPQY)

Historical Stock Chart

From Oct 2023 to Oct 2024