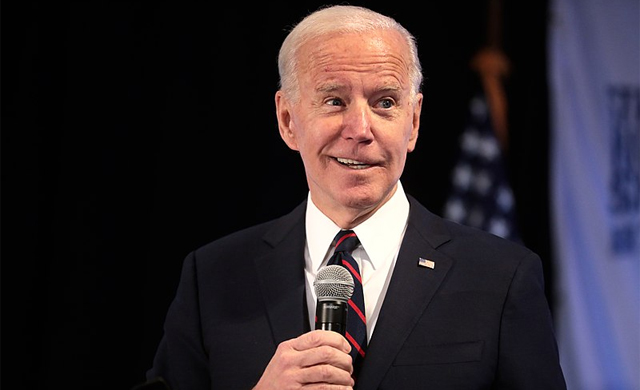

Although Biden’s infrastructure bill hasn’t been approved yet, the rate of increase in the consumer price index has already reached highs of 2008. This could be mainly contributed to the economic recovery, energy crisis, supply chain disruptions, as well as chip and labor shortages.

While understanding that inflationary pressures will not disappear any time soon,

markets have begun to prepare for a tightening of monetary policy. Even in the case of the US, the narrowing spread between 10-year and 2-year US government bond yields suggests that traders are expecting an announcement of a shift in quantitative easing at the upcoming FOMC meeting. An additional reason for this would be a sharp decline of initial jobless claims in the US.

It is worth mentioning that the pace of the monthly reduction could be $10B in Treasury securities and $5 billion in MBS every month until the asset purchases program is completed by the middle of 2022. Thus, the Fed’s balance sheet could be slightly above $9 trillion by mid-2022, up from $8.5 trillion. Still, if the Fed chooses a more relaxed plan of tapering, stocks and gold quotes could probably increase.

In England, meanwhile, likely, the country’s central bank will also begin the cycle of tightening monetary policy. To be more precise, markets expect regulators to cut the bank rate by 15 basis points. Will this help in the fight against inflation? Unlikely, but the pound could take flight.

Another important topic this week will be the meeting of the Organization of the Petroleum Exporting Countries or OPEC. Over the last month, the U.S., India, Japan, and other major oil consumers were trying to persuade cartel members to increase the production. Will the OPEC+ raise output by 400K barrels per day, or will the group revise its plan this time? It should be noted that any deviation from the current plan should again lead to increased volatility in the oil market.

In terms of geopolitics, markets will follow the situation around Brexit. Even though the UK left the EU back in January 2020, tensions between the parties have not only not decreased, but seem to have grown. From November 2, France could impose sanctions on the UK if London does not change its fisheries policy. The French are not happy with the fact that the British government restricts the issuance of fishing permits in Jersey waters. The good news is that French President Emmanuel Macron met with British Prime Minister Boris Johnson on the sidelines of the G20 summit in Rome and agreed to take action soon to reduce tensions over the issue of fishing licenses.