TIDMVEIL

RNS Number : 7557D

Vietnam Enterprise Investments Ltd

21 October 2022

21 October 2022

Vietnam Enterprise Investments Limited

("VEIL" or "the Company")

Monthly Update

-14.2% NAV Return in September 2022

VEIL is a closed-end fund investing primarily in listed equity

in Vietnam, and a FTSE 250 constituent. The Company's NAV

performance for September 2022 is set out in this notice.

Fund Performance

-- As of 30 September, VEIL's NAV decreased 14.2% over the

previous month against a fall of 13.1% for its reference index, the

Vietnam Index ("VNI"), both in US dollar terms.

-- The Company's NAV per share was US$8.79 as of 30 September

(-14.2% for the month and -28.0% YTD) and its total NAV was

US$1.8bn.

-- In GBP terms, the Company's NAV per share was GBP7.87 as of

30 September (-10.6% for the month and -12.7% YTD) and its total

NAV was GBP1.6bn.

-- VEIL's NAV per share performance in US dollar terms is -9.9%

over three months, -23.3% over one year and +23.8% over three

years. Over the same time periods, the performance of the Vietnam

Index was -7.3%, -18.4% and +15.7%, respectively.

-- The Company's share price decreased by 12.6% in September, a

fall of 31.5% YTD, and its discount to NAV as of 30 September was

19.2%, compared with 20.7% at the end of August.

-- The Company repurchased 884,521 shares in September, to be

held in treasury, compared with 349,727 shares repurchased in

August. As of 30 September 2022, 3.1% of issued shares have been

repurchased since 1 January 2022.

Dien Vu, the Portfolio Manager of VEIL commented:

"VEIL underperformed the VNI by 1.1% as investor sentiment

turned back to weakness following an eleven-week high in August,

the market fall of 13.1% in September is its biggest monthly drop

since March 2020, and average daily turnover declined 15% compared

to August. Despite strong macroeconomic numbers being posted,

including third quarter GDP growth of 13.7% year-on-year (+8.8%

YTD), the Investment Manager is reassessing its earnings outlook

for 2022 and 2023 amid rising interest rates and concerns over

access to credit, the latter spurred by a limited bank lending

quota and a lack of clarity on new regulations relating to

corporate bond issuance.

"So far, October has also seen increased volatility in the

market following the arrests of the chairwoman and three executives

of a large property developer with extensive holdings in central Ho

Chi Minh City. In a move that may be related, the State Bank of

Vietnam took a local bank into care. Both the developer and the

bank are unlisted, and VEIL has never held a position in either

company. The arrests grew out of the bond-market intervention which

the Government launched in March, whereby it has focused a lens on

insider trading, private placements, regulator capacity, and now

investor protection. The Investment Manager believes investors will

ultimately benefit from the campaign for transparency,

institutionalisation and professionalism, by ushering in the next

phase of the market's development.

"As the US Dollar Index (DXY) continued to strengthen in

September amid the divergence of monetary policies between central

banks, in a rare move, the State Bank of Vietnam raised policy

rates by 100 basis points to defend the Vietnamese dong and ensure

inflation remains low. This caused investors to become more

cautious towards banks and property developers - the two biggest

sectors on the Ho Chi Minh Stock Exchange ("HOSE") and in VEIL's

portfolio - due to concerns about the twin risks of access to

credit caused by limited lending quota and profitability being

under pressure from higher borrowing costs.

"Thus, banking stocks were hit hardest during September's

sell-off, with almost every listed bank on the HOSE suffering

double-digit declines. VEIL is overweight in this sector due to its

exposure to select banks which the Investment Manager identifies as

displaying superior market positioning and fundamentals in a

rapidly evolving industry, however in the short-term further

challenges may arise as the Investment Manager expects that

interest rates will increase again by up to 200 basis points by the

end of Q1 2023.

"Overweight allocations to banks, materials and the retail

sector have all contributed toward the Company's short-term

underperformance of the Vietnam Index and erased VEIL's small YTD

benchmark outperformance going into September. The general sell-off

saw retail stocks underperforming despite strong sales numbers

being posted for both the economy and VEIL's core retail holdings.

The Investment Manager sees their share prices as a sign of general

investor sentiment rather than a fair valuation of their

fundamentals.

"With concerns of a global recession weighing down investor

confidence, positive domestic economic indicators and market

fundamentals in Vietnam may continue to be overlooked in place of

risk-aversion from both local and international investors. When

Moody's upgraded Vietnam to Ba2 (two notches below investment

grade) in September, changing the outlook from stable to positive,

they cited Vietnam's growing economic strengths and greater

resilience to external macroeconomic shocks. While volatility can

be expected in Vietnam's capital markets, the Investment Manager

fully expects Vietnam's overall macro outlook to remain sound."

Economic Overview

-- September's CPI rose 3.9% year-on-year from 2.9% in August.

Of the 11 major categories in the CPI basket, education rose the

most at 5.8% month-on-month but declining domestic petrol prices at

-6.0% month-on-month helped keep inflation low.

-- The Vietnamese dong depreciated 1.7% against the USD in

September and has reached -4.3% YTD as of 30 September. The

Vietnamese dong appreciated 2.8% against the pound sterling in

September and its total appreciation was 13.8% YTD as of 30

September.

-- GDP growth in Q3 2022 reached a record high of 13.7%

year-on-year, largely due to a low base following lockdowns in Q3

2021.

-- GDP growth is 8.8% YTD, the highest in over a decade. The

service sector led the way, expanding 18.9% year-on-year in Q3 2022

and 10.6% year-to-date and contributing 54.2% to overall so far in

2022.

-- The industry and construction sector grew 12.9% in Q3 2022

and 9.4% year-to-date, contributing 41.8% overall to GDP growth for

the first nine months of 2022.

-- Vietnam recorded a YTD trade surplus of US$6.8bn at end of

September following a surplus of US$1.4bn for the month. Exports

and imports YTD have amounted to US$282.3bn and US$375.6bn,

respectively.

-- While monthly exports and imports grew 9.9% and 4.9%

year-on-year, both experienced monthly declines of 14.6% and 8.6%,

respectively.

-- Disbursed FDI was US$2.6bn in September, with the total

year-to-date figure reaching US$15.4bn (+16.2% year-on-year) to the

end of September.

-- The Vietnam Purchasing Manager's Index registered at 52.5 in

September, a twelfth consecutive monthly expansion. The report by

S&P Global noted that new orders keep rising, driving higher

output and employment, although growth in new orders slowed

slightly due to weakened export demand.

-- State revenue totalled US$56bn (+22.0%) and expenditure

US$45.8bn (+5.4%) YTD, respectively. The State budget has a YTD

fiscal surplus of US$10.2bn, five times higher than the US$2bn at

the same stage of 2021

Top Ten Holdings (64.1% of NAV)

Company Sector VNI % NAV % Monthly Return One-year

% Return %

1 Mobile World Group Retail 2.1 11.7 -15.0 -3.8

================== =================== ===== ===== ============== =========

Vietnam Prosperity

2 Bank Banks 1.8 11.4 -16.6 -29.7

================== =================== ===== ===== ============== =========

Asia Commercial

3 Bank Banks 1.7 10.8 -11.5 -16.1

================== =================== ===== ===== ============== =========

4 Hoa Phat Group Materials/Resources 2.8 5.7 -9.4 -49.5

================== =================== ===== ===== ============== =========

5 FPT Corporation Software/Services 2.0 4.9 -8.7 1.2

================== =================== ===== ===== ============== =========

6 PetroVietnam Gas Energy 4.7 4.2 -7.7 11.2

================== =================== ===== ===== ============== =========

7 Vinhomes Real Estate 5.0 4.2 -18.3 -36.5

================== =================== ===== ===== ============== =========

8 Vietcombank Banks 7.8 3.9 -14.4 -7.2

================== =================== ===== ===== ============== =========

9 Dat Xanh Group Real Estate 0.3 3.8 -24.7 1.4

================== =================== ===== ===== ============== =========

10 Becamex IDC Real Estate 2.1 3.5 -3.2 95.2

================== =================== ===== ===== ============== =========

Source: Bloomberg, Dragon Capital

For further information, please contact:

Vietnam Enterprise Investments Limited

Rachel Hill

Phone: +44 122 561 8150

Mobile: +44 797 121 4852

rachelhill@dragoncapital.com

Jefferies International Limited

Stuart Klein

Phone: +44 207 029 8703

stuart.klein@jefferies.com

Buchanan

Charles Ryland / Henry Wilson / George Beale

Phone: +44 20 7466 5111

veil@buchanan.uk.com

LEI: 213800SYT3T4AGEVW864

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVBKDBDBBDDQKB

(END) Dow Jones Newswires

October 21, 2022 08:16 ET (12:16 GMT)

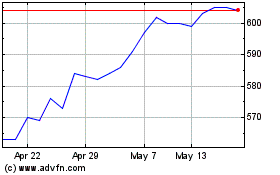

Vietnam Enterprise Inves... (LSE:VEIL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Vietnam Enterprise Inves... (LSE:VEIL)

Historical Stock Chart

From Jan 2024 to Jan 2025