TIDMUOG

RNS Number : 8367L

United Oil & Gas PLC

23 April 2018

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, THE REPUBLIC OF SOUTH AFRICA, THE

REPUBLIC OF IRELAND, JAPAN OR ANY OTHER JURISDICTION IN WHICH SUCH

RELEASE, PUBLICATION OR DISTRIBUTION WOULD VIOLATE THE RELEVANT

SECURITIES LAWS OF SUCH JURISDICTION.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION, RECOMMENDATION,

OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE

OR DISPOSE OF ANY SECURITIES IN UNITED OIL & GAS PLC OR ANY

OTHER ENTITY IN ANY JURISDICTION. NEITHER THIS ANNOUNCEMENT NOR THE

FACT OF ITS DISTRIBUTION SHALL FORM THE BASIS OF, OR BE RELIED ON,

IN CONNECTION WITH ANY INVESTMENT DECISION IN RESPECT OF UNITED OIL

& GAS PLC.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF THE MARKET ABUSE REGULATION (596/2014/EU) ("MAR"). IN ADDITION,

MARKET SOUNDINGS, AS DEFINED IN MAR, WERE TAKEN IN RESPECT OF THE

PROPOSED PLACING WITH THE RESULT THAT CERTAIN PERSONS BECAME AWARE

OF INSIDE INFORMATION, AS PERMITTED BY MAR. THAT INSIDE INFORMATION

IS SET OUT IN THIS ANNOUNCEMENT AND HAS BEEN DISCLOSED AS SOON AS

POSSIBLE IN ACCORDANCE WITH PARAGRAPH 7 OF ARTICLE 17 OF MAR.

THEREFORE, THOSE PERSONS THAT RECEIVED INSIDE INFORMATION IN A

MARKET SOUNDING ARE NO LONGER IN POSSESSION OF INSIDE INFORMATION

RELATING TO THE COMPANY AND ITS SECURITIES.

Note: Capitalised terms in this announcement are defined in the

Company's Circular dated 23 April 2018 unless the context otherwise

requires.

For immediate release 23 April 2018

United Oil & Gas Plc

("UOG", "United" or the "Company")

Posting of Circular in relation to

Notice of General Meeting

Further to the announcement of 20 April 2018 in which United Oil

& Gas Plc announced that it had conditionally raised GBP2.5

million gross by the issue of 58,823,530 new ordinary shares in the

capital of the Company at a price per share of 4.25 pence (the

"Fundraising"), the Company is pleased to announce that it is today

posting a Circular and Notice of General Meeting to Shareholders

and which will also be made available on www.uogplc.com

Background

57,411,766 new ordinary shares (the "Placing Shares") have been

conditionally placed by the Company's joint brokers Optiva

Securities Limited ("Optiva") and S.P. Corporate Finance LLP ("SP

Angel"), on behalf of the Company with institutional and other

investors (including high net worth and retail investors).

1,411,764 new ordinary shares (the "Subscription Shares") have been

conditionally subscribed for by Graham Martin, being the

Non-Executive Chairman and Director. Together, the Placing Shares

and the Subscription Shares are the "New Ordinary Shares".

Following completion of the placing of 31,250,000 new ordinary

shares undertaken by the Company on or around 27 December 2017, the

Company does not currently have any remaining Shareholder

authorities to implement the Fundraising and issue the New Ordinary

Shares. Accordingly, the Company is seeking Shareholder approval to

grant the Directors the authority to allot equity securities and to

disapply statutory pre-emption rights in respect of an allotment of

equity securities for cash in connection with the Fundraising.

The General Meeting is to be held at Kerman & Co LLP, 200

Strand, London, WC2R 1DJ on 10 May 2018 at 11.00 a.m. to consider

and, if thought appropriate, pass the resolutions as referred to

above (the "Resolutions").

Further information

As at today's date, the Prospectus is currently being finalised

and when published will be available on the Company's website at

www.uogplc.com.

Recommendation

The Directors believe that the Fundraising will promote the

success of the Company for the benefit of the Company and

Shareholders as a whole. Accordingly, the Board unanimously

recommends that Shareholders vote in favour of the Resolutions to

be proposed at the General Meeting, as each Director (who is a

Shareholder) intends to do in respect of their own beneficial

holdings, amounting to (in aggregate) 14,633,501 Ordinary Shares

and representing approximately 6.3 per cent. of the issued ordinary

share capital of the Company as at the date of this

announcement.

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Announcement of the Fundraising 20 April 2018

Posting of the Circular and the 23 April 2018

Form of Proxy

Date of the Circular and the Form 23 April 2018

of Proxy made available online

Latest time and date for receipt 11.00 a.m. on

of Forms of Proxy Tuesday 8 May

2018

General Meeting 11.00 a.m. on

Thursday 10 May

2018

Announcement of results of the Thursday 10 May

General Meeting and the Fundraising 2018

Admission of the New Ordinary 8.00 a.m. on Friday

Shares to trading on the Official 11 May 2018

List and commencement of dealings

CREST accounts to be credited 8.00 a.m. on Friday

for the New Ordinary Shares to 11 May 2018

be held in uncertificated form

Despatch of definitive share certificates Within 7 days

for the New Ordinary Shares to of Admission

be held in certificated form

Notes:

(1) All references to time in this document are to London (UK)

time unless otherwise stated.

(2) The dates and times given in this document are based on the

Company's current expectations and may be subject to change. If any

of the above times or dates should change at the discretion of the

Company, the revised times and/or dates will be notified to

Shareholders by an announcement on a Regulatory Information

Service.

For more information please visit the Company's website at

www.uogplc.com or contact:

United Oil & Gas Plc (Company)

===================================== ================================

Brian Larkin brian.larkin@unitedoilandgas.eu

===================================== ================================

Beaumont Cornish Limited (Financial

Adviser)

===================================== ================================

Roland Cornish and Felicity +44 (0) 20 7628

Geidt 3396

===================================== ================================

Optiva Securities Limited (Joint

Broker)

===================================== ================================

+44 (0) 20 3137

Christian Dennis 1902

===================================== ================================

+44 (0) 20 3411

Tejas Padalkar 1881

===================================== ================================

S.P. Angel Corporate Finance +44 (0) 20 3470

LLP (Joint Broker) 0470

===================================== ================================

Richard Redmayne

===================================== ================================

Richard Hail

===================================== ================================

Murray (PR Advisor) +353 (0) 87 6909735

===================================== ================================

Joe Heron jheron@murrayconsultanta.ie

===================================== ================================

Beaumont Cornish Limited ("Beaumont Cornish"), which is

authorised and regulated by the FCA in the conduct of investment

business, is acting exclusively for the Company and for no-one else

in connection with the Placing and Admission and will not be

responsible to anyone other than the Company for providing the

protections afforded to customers of Beaumont Cornish or for

providing advice in relation to the contents of the Document,

Admission, or any transaction, arrangement, or other matter

referred to in the Document.

Optiva Securities Limited ("Optiva"), which is authorised and

regulated by the FCA in the conduct of investment business, is

acting exclusively for the Company and for no-one else in

connection with the Placing and Admission and will not be

responsible to anyone other than the Company for providing the

protections afforded to customers of Optiva or for providing advice

in relation to the contents of the Document, the Placing,

Admission, or any transaction, arrangement, or other matter

referred to in the Document.

S. P. Angel Corporate Finance LLP ("SP Angel"), which is

authorised and regulated by the FCA in the conduct of investment

business, is acting exclusively for the Company and for no-one else

in connection with the Placing and Admission and will not be

responsible to anyone other than the Company for providing the

protections afforded to customers of SP Angel or for providing

advice in relation to the contents of the Document, the Placing,

Admission , or any transaction, arrangement, or other matter

referred to in the Document.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCEASLDASFPEFF

(END) Dow Jones Newswires

April 23, 2018 11:54 ET (15:54 GMT)

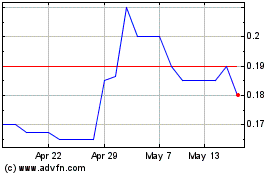

United Oil & Gas (LSE:UOG)

Historical Stock Chart

From Oct 2024 to Nov 2024

United Oil & Gas (LSE:UOG)

Historical Stock Chart

From Nov 2023 to Nov 2024