TIDMUKOG

RNS Number : 8205T

UK Oil & Gas PLC

23 July 2020

UK Oil & Gas PLC

("UKOG" or the "Company")

Entry into potential high-impact Turkish oil appraisal and

exploration project

UK Oil & Gas PLC (London AIM: UKOG) is pleased to announce

that it has signed a binding heads of agreement with Aladdin Middle

East Ltd ("AME"), an independent oil company with 60 years of

operational experience in Turkey, to take a 50% non-operated

working interest in the 305 km(2) Resan Licence ("Licence"). UKOG

will take an active technical role in a 5-well oil appraisal and

step-out exploration drilling programme, which, Covid and weather

permitting, is expected to commence this year.

The Licence lies within the SE Anatolian basin, a geological

continuation of the prolific Zagros "fold-belt" petroleum system

within the foothills of the Taurus-Zagros mountains in Iraq, Iran

and Turkey, one of the Middle East's major oil producing areas.

Multiple producing oil fields lie to the immediate west and south

east of the Licence, containing significant proven recoverable

reserves.

Material discovered resource potential

A June 2020 report prepared by Xodus Group Ltd ("Xodus") for AME

calculates that two identified geological targets within the

Licence's Cretaceous Mardin limestones, the undeveloped Basur oil

discovery and the Resan "missed" oil pay opportunity contain an

aggregate unrisked gross mean oil in place, or oil in the ground

before extraction ("OIP"), of approximately 253 million barrels

("mmbbl"), with a significant high case (P10) gross aggregate OIP

of 495 mmbbl.

The Company's and AME's evaluations of the available 1950s and

1960s well and geological data conclude that potentially

significant moveable oil within the naturally fractured Mardin has

been overlooked by prior operators in both Basur and Resan (i.e.

missed oil pay).

An undrilled exploration target in the shallower Garzan

limestones, Prospect A, adds further unrisked upside OIP potential

of between 68-112 mmbbl in the mean and high case (P10),

respectively.

Note that UKOG's internal evaluation sees further upside

resource potential than is currently identified by Xodus.

The Basur discovery, made in 1964, whose primary target was the

shallow Cretaceous age Garzan reefal limestones, recovered 600 bbl

of oil to surface from deeper naturally-fractured and dolomitised

Cretaceous Mardin limestones. Core and cuttings contained live oil.

Of the oil to surface, 500 bbl were produced over a 6-hour test

period, equating to an extrapolated rate of 2,000 barrels of oil

per day ("bopd").

Similarly, wells drilled in the 1950s at Resan originally

targeted the overlying shallower Garzan but found good oil shows

within the Mardin, although short tests were inconclusive. As the

Mardin's natural fracture potential was largely unrecognised at the

time, it is AME's and the Company's view that the Resan wells were

not adequately tested.

Both Basur and Resan were drilled before the potential of

naturally fractured Cretaceous limestone oil reservoirs was fully

demonstrated by the giant fractured Cretaceous limestone field

discoveries made in the same petroleum system within the Kurdistan

region of Iraq including Taq Taq, Tawke, Peshkabir. The giant

Kurdistan discoveries were made after 2002.

Basur and Resan are also both geological look-alikes to AME's

producing East Sadak field, discovered and put on production in

2014, some 20 km to the south east. East Sadak lies directly along

the same folded elongated anticlinal (dome shaped) geological

feature containing Basur and Resan and produces light 42deg API oil

from the Mardin limestones, with initial well rates of up to 1,300

bopd.

Based upon East Sadak field performance and geologically similar

producing fracture-enhanced oil fields, including those in the

Kurdistan region of Iraq, Xodus cite that, in the success case, the

percentage of OIP that can reasonably be expected to be recovered

to surface over field life will likely range between 10-20%.

The Company believes the occurrence of moveable oil in Basur and

Resan has been reasonably demonstrated by prior wells and,

therefore, the greatest remaining technical uncertainty is whether

the Mardin reservoir can deliver oil at commercial rates and

volumes i.e. the usual uncertainty associated with appraisal

drilling. Both the Basur-1 well test and East Sadak field

performance give confidence in this respect.

Should Basur and Resan prove successful, the Licence therefore

offers UKOG the realistic potential of adding significant net

recoverable reserves greater than those within its current UK

portfolio.

Rapid success case monetisation

Turkey, which has a c. 91% oil import dependency, actively

encourages its domestic oil sector. The right to produce any

commercially viable discovered hydrocarbons is enshrined in Turkish

Petroleum law. It is a licensee's obligation to produce such

discovered hydrocarbons and the law gives an "explorer" the same

right to produce during the 5-year exploration phase as if the

Licence were in a production phase.

Monetising a successful oil well in Turkey is therefore

potentially rapid and largely in the control of the operator, as

the completed well can be put on long-term production directly from

a flow test and well completion. Permanent production can therefore

be accomplished as soon as practicable, taking months rather than

the 3-5 years it takes in the UK onshore.

The Turkish petroleum fiscal regime is also amongst the most

globally competitive, giving a licensee a post-tax share of

production revenues of around 60.5% (inclusive of a 5% withholding

tax for repatriated profits to a foreign parent company). The

comparable UK post-tax share is 60%.

Turkish petroleum law also guarantees that any domestically

produced oil must be accepted by Turkish refineries and purchased

at market price. Crude prices are benchmarked to Arab Medium or

Arab Heavy, dependent on oil density/API gravity and are

approximately equivalent to or marginally higher than Brent crude,

the UK benchmark.

Drilling costs are also forecast to be significantly lower than

for a comparable well in the UK. AME's cost estimates for a 1500 m

depth well in the Licence are around $3 million gross. The

equivalent well in the UK would cost the Company GBP5-6+ million

gross.

Any future oil production is therefore expected to be

economically robust at current $40/bbl oil prices as front end

capital costs per barrel are relatively low and expected operating

costs, derived from those at AME's nearby East Sadak field, are

forecast to be comparable with UKOG's Horse Hill field operating

costs at around $15/bbl. An equivalent production stream in Turkey

will therefore pay back far quicker than in the UK.

As per nearby fields, any future oil production will be exported

via road tanker to the nearest oil refinery at Batman,

approximately 50 miles (80 km) from the Licence, around half the

distance of UKOG's Horse Hill field's export route to Perenco's

Hamble facility.

Likelihood of success

In terms of the likelihood of success, the Company believes the

Licence's discovered and "missed pay" opportunities are as good as,

if not better than its similar Loxley and Arreton appraisal

projects in the UK. Basur has brought oil to surface at good rates

and Resan oil shows and electric log data are at a comparable level

of supporting evidence for the presence of moveable oil as the

Company's Arreton discovery data.

However, Basur and Resan have the distinct advantage of

considerably higher recoverable resource upside, the projected

drilling costs are under half those of equivalent wells in the UK

and perhaps most importantly, success can be monetised far

quicker.

Transaction structure

To earn its 50% interest in the Licence, the Company has agreed

to fund 100% of the first of 5 commitment wells in the Licence's

5-year exploration term, together with a small 2D seismic survey

with an expected cost of $1-$1.5 million. UKOG's net expenditure

for the one well plus seismic programme is capped at USD$5 million

maximum expenditure. Thereafter, the Company will fund its 50%

interest share expected to be c. $1.5 million per well.

The exploration phase expires in June 2023 but can either be

extended for a further 2-years, or in the success case converted

directly into a 20-year production lease. The Licence's 5 well

commitment to the Turkish government has a gross monetary

equivalent of $7.66 million (UKOG $3.83 million), however UKOG

understands that should any of the commitment wells not be drilled,

a modest penalty of c. $30-50,000 is payable to the government.

The assignment of the 50% interest from AME to UKOG is subject

to Turkish governmental approval, which is expected to take around

2 months from submittal of the necessary standard documentation. It

is expected that these documents will be submitted over the next

few weeks whilst the formal agreements between UKOG and AME are

finalised.

There was no attributable profit or loss in relation to the

licence interest in the last year as it incurred no exploration

expenditure.

Whilst the Company believes that at current oil prices a

successful initial programme can likely self-fund further

production drilling, it may be necessary at some stage for the

Company to raise future working capital to bring the project to

fruition.

Forward Plans

The first commitment well, currently planned to appraise and

flow test the Basur oil discovery, must commence drilling before 27

June 2021. Drilling and seismic are therefore expected to commence

before the end of this year, Covid, weather and Turkish

governmental transaction approval permitting.

Given the relatively modest well costs, it is expected that a

near continuous drilling campaign could be undertaken to ensure the

Licence is fully evaluated and that oil recovered to surface can be

monetised as rapidly as possible.

About AME

AME is a private E&P company that has operated successfully

in Turkey for almost sixty years. It holds 7 production leases and

3 exploration licences in Turkey, with a gross licenced area of

around 3,000 km (2) . AME owns and operates drilling and workover

rigs, testing and cementing units, enabling quick and low cost well

operations. Headquartered in Wichita Kansas, its operational base

is in Ankara, Turkey and is managed by an experienced,

predominantly Turkish, team. More information can be found at

www.aladdinmiddleeast.com.

Stephen Sanderson, UKOG's Chief Executive, commented:

"Whilst we remain committed to growing our core UK business,

this was an irresistible opportunity to expand our horizons and to

expose the company to potentially transformational recoverable oil

reserves that can be rapidly monetised.

The quality of the Licence's geological address and opportunity

is compelling, the targets being directly on trend with the

geological look-alike East Sadak field and located within the same

petroleum system as the major oil producing Kurdistan region of

Iraq.

The Basur and Resan appraisal opportunities compare well with

our Loxley and Arreton projects. However, they offer significantly

larger upside potential, are much cheaper to drill and can be

monetised far more quickly than any of our UK projects. The overall

post-tax share of gross revenues is also marginally better than in

the UK.

The low cost of drilling compared to the UK also means that, in

the success case, we plan to have a near continuous drilling

programme, hopefully commencing this year, Covid and weather

permitting. We expect this programme will provide a regular stream

of newsflow.

Our new partners, AME, are a proven leading Turkish operator,

oil producer and successful Turkish explorer. We will undoubtedly

benefit greatly from their unrivalled Turkish knowledge and

experience."

Qualified Person's Statement

Matt Cartwright, UKOG's Commercial Director, who has 37 years of

relevant experience in the global oil industry, has approved the

information contained in this announcement. Mr Cartwright is a

Chartered Engineer and member of the Society of Petroleum

Engineers.

For further information, please contact:

UK Oil & Gas PLC

Stephen Sanderson / Kiran Morzaria Tel: 01483 941493

WH Ireland Ltd (Nominated Adviser

and Broker)

James Joyce / James Sinclair-Ford Tel: 020 7220 1666

Cenkos Securities PLC (Joint Broker)

Joe Nally / Neil McDonald Tel: 020 7397 8919

Novum Securities (Joint Broker)

John Belliss Tel: 020 7399 9400

Communications

Brian Alexander Tel: 01483 941493

Glossary

deg API a measure of the density of crude oil, as defined

by the American Petroleum Institute

dolomite/dolomitisation a crystalline form of calcium carbonate or

lime. The geological process of turning the

more common calcite crystalline form of calcium

carbonate into dolomite . increases the pore

space in the rock by approximately 13% thus

improving the rocks ability to store oil and

improve potential oil flow

----------------------------------------------------

limestone a sedimentary rock predominantly composed of

calcite (a crystalline mineral form of calcium

carbonate or lime) of organic, chemical or

detrital origin. Minor amounts of dolomite,

chert and clay are common in limestones. Chalk

is a form of fine-grained limestone

----------------------------------------------------

mean value the expected or average outcome of a defined

probability distribution, in this case the

calculated distribution of oil in place

----------------------------------------------------

o il discovery an o il accumulation for which one or several

exploratory wells have established through

testing, sampling and/or electric logging the

existence of a significant quantity of potentially

moveable hydrocarbons

----------------------------------------------------

o il field an accumulation, pool or group of pools of

o il in the subsurface that produces o il to

surface

----------------------------------------------------

O IP or o il in the quantity of o il that is estimated to exist

place in naturally occurring accumulations within

the ground before any extraction to surface

via production

----------------------------------------------------

prospect a project associated with a potential accumulation

that is sufficiently well defined to represent

a viable drilling target

----------------------------------------------------

P10 value high case scenario with a 10% probability that

a stated volume will be equalled or exceeded

----------------------------------------------------

recoverable volumes those quantities of petroleum (oil in this

& recovery factor case) estimated, as of a given date, to be

potentially recoverable from known accumulations.

The recovery factor represents the percentage

of the OIP that can be recovered to surface

via production

----------------------------------------------------

reserves reserves are those quantities of hydrocarbons

which are anticipated to be

commercially recovered from known accumulations

from a given date forward

----------------------------------------------------

oil show the presence of visible live oil in drill

cuttings and or core at surface and or as a

fluorescent liquid under UV light

----------------------------------------------------

well test, flow involves testing a well by flowing hydrocarbons

test to surface, typically through a test separator

over a flowing period. Key measured parameters

are gas flow rates, downhole pressure and surface

pressure. The overall objective is to identify

the well's capacity to produce hydrocarbons

at a commercial flow rate and volumes.

----------------------------------------------------

UKOG Licence Interests

The Company has interests in the following UK licences:

Asset Licence UKOG Licence Operator Area Status

Interest Holder (km

(2)

)

Field currently

UKOG (GB) IGas Energy temporarily

Avington (1) PEDL070 5% Limited Plc 18.3 shut in

------------------------------- ---------- -------------- -------------- ------ -------------------

BB-1/1z oil

discovery,

Broadford Bridge/Loxley/Godley Loxley/Godley

Bridge (2, UKOG (234) UKOG (234) Bridge gas

3, 8) PEDL234 100% Ltd (4) Ltd (4) 300.0 discovery

------------------------------- ---------- -------------- -------------- ------ -------------------

Finalising

new site

selection

to drill

Portland

and Kimmeridge

A24 (3) PEDL143 67.5% UKOG UKOG (7) 91.8 prospects

------------------------------- ---------- -------------- -------------- ------ -------------------

UKOG (GB) IGas Energy Field in

Horndean (1) PL211 10% Limited Plc 27.3 stable production

------------------------------- ---------- -------------- -------------- ------ -------------------

Horse Hill Horse Hill

Horse Hill Developments Developments Field in

(1) PEDL137 85.635% Ltd Ltd 99.3 stable production

------------------------------- ---------- -------------- -------------- ------ -------------------

Horse Hill Horse Hill

Horse Hill Developments Developments Field in

(1) PEDL246 85.635% Ltd Ltd 43.6 stable production

------------------------------- ---------- -------------- -------------- ------ -------------------

Planning

application

submitted

Isle of Wight for Arreton

(Onshore) (2, oil appraisal

3) PEDL331 95% UKOG UKOG 200.0 well

------------------------------- ---------- -------------- -------------- ------ -------------------

Notes:

1. Oil field currently in stable production.

2. Oil discovery pending development and/or appraisal

drilling.

3. Exploration asset with drillable prospects and leads.

4. Contains the Loxley Portland gas accumulation, the Broadford

Bridge-1/1z Kimmeridge oil discovery, plus further undrilled

Kimmeridge exploration prospects.

5. Portland and Kimmeridge oil field with productive and

commercially viable zones, HH-1 in stable oil production, HH-2z EWT

ongoing, production planning consent granted in September 2019,

long term Production consent granted March 2020.

6. UKOG has a direct 77.9% interest in HHDL, which has a 65% interest in PEDL137 and PEDL246.

7. OGA consent received for the transfer of operatorship from Europa to UKOG

8. Gas discovery pending appraisal drilling and development with underlying Kimmeridge potential

The information contained within this announcement is deemed by

the Company to constitute inside information under the Market Abuse

Regulation (EU) No. 596/2014

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDDBGDRUXDDGGD

(END) Dow Jones Newswires

July 23, 2020 02:00 ET (06:00 GMT)

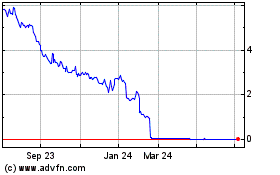

Uk Oil & Gas (LSE:UKOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

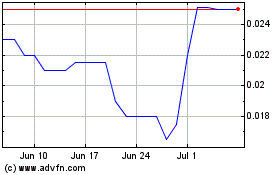

Uk Oil & Gas (LSE:UKOG)

Historical Stock Chart

From Apr 2023 to Apr 2024