TUI AG (TUI)

TUI AG: Q3 INTERIM FINANCIAL REPORT 1 October 2022 - 30 June 2023

09-Aug-2023 / 08:00 CET/CEST

The issuer is solely responsible for the content of this announcement.

=----------------------------------------------------------------------------------------------------------------------

TUI Group

Quarterly Statement

1 October 2022 - 30 June 2023

Content

Quarterly Statement Q3 2023.. 3

Summary. 3

Consolidated earnings. 9

Segmental performance.. 10

Cash Flow / Net debt / Net capex and investments. 15

Consolidated income statement. 16

Cash flow statement. 17

Financial position.. 18

Alternative performance measures. 20

Other segment indicators. 21

Cautionary statement regarding forward-looking statements. 22

Financial calendar. 22

Contacts. 22

This Quarterly Statement of TUI Group was prepared for the reporting period from 1 October 2022 to 30 June 2023.

Quarterly Statement Q3 2023

Summary

Q3 back to profitability with an underlying EBIT of EUR169.4m improving strongly by EUR196.5m year-on-year. Current booking

levels confirm our expectations for a strong Summer and we are on track to deliver on FY 2023 expectations.

. The continued popularity of our unique product offering was underlined by 5.5m customers enjoying a

holiday with us in the quarter, an increase of 0.4m or +9% versus the prior year and at 95% of Q3 2019 customer

levels on a like for like basis^1. As a result, average load factor for the quarter was 93% (Q3 2022: load factor

92%).

. Group revenue of EUR5.3bn, was 19% higher across our segments versus the prior year (Q3 2022: EUR4.4bn),

supported by higher volumes and prices. This reflects the strength of demand for our products with Group revenue

11% above pre-pandemic levels driven by improved prices (Q3 2019: EUR4.7bn).

. Q3 Group underlying EBIT at EUR169.4m, improved strongly by EUR196.5m and EUR122m excluding the impact of EUR75m

flight disruption costs in the prior year (Q3 2022: EUR-27.0m loss) and is the first profitable Q3 since the

pandemic:

? Hotels & Resorts surpassed the already strong performance in the prior year, reporting a fifth

consecutive quarter above 2019, supported by improved operational performances across our key brands.

? The recovery in Cruises continues with the segment achieving a fifth positive quarter since the start

of the pandemic. All of our three Cruise brands contributed to the positive EBIT development boosted by

increased volumes as well as higher occupancies.

? Markets & Airlines delivered a solid improvement, driven in particular by higher prices and strong

demand. In addition, the segment profited from the absence of the flight disruption costs which impacted the

prior year.

. Following the EUR1.8bn capital raise in April, we successfully extended our existing syndicated credit

lines totaling EUR2.7bn in May. Both are significant measures to improve our credit metrics, restore our balance

sheet strength and are a vote of confidence in TUI. As a result we have seen a first improvement in our credit

rating during the quarter, with S&P upgrading in April to B and Moody's upgrading in May to B2 both with a positive

outlook.

. The net debt position as of 30 June 2023 was EUR-2.2bn, an improvement of EUR1.1bn year-on-year (30 June

2022: EUR-3.3bn). This is driven by the net proceeds (following final repayment of the WSF obligations) from our

capital increase in April 2023 and a positive free cash flow.

. We confirm our expectations for a strong Summer. Bookings total 12.5m^2 for the season, a 6% increase

versus Summer 2022 and an increase of 4.3m guests since our Half-Year Financial Report H1 2023. As a result,

bookings are close to pre-pandemic levels at 95%. ASP continues to hold up strongly at +7% against the previous

season and +26% against Summer 2019.

. Bookings were impacted in the short-term as a result of the wildfires in Southern Europe and flight

cancella-tions to Rhodes, but have subsequently recovered as operations have resumed, enabling customers to enjoy

their holidays once again. As a result, bookings for the last week were +5% against Summer 2022, with ASP up +9%

over the same period and ahead of the cumulative position.

. We continue to monitor the situation concerning the wildfires in Southern Europe and remain in close

contact with local authorities. As events unfolded in Rhodes, the safety of our guests and colleagues in the

affected areas was paramount. Together with our 300 service staff, we were able to provide our guests with 24/7

support and welfare. We operated twelve repatriation flights with additional aircraft deployed to bring our guests

home safely, all highlighting the benefit of our customer proposition. However, we also want to support the

communities on the island directly affected by the fires. The TUI Care Foundation has launched a fundraising

campaign. Every donation received will be doubled by the foundation.

. In total we evacuated 8,000 of our guests, but it is also important to point out that 80% of our guest on

the island have been unaffected. Rhodes accounts for ca. 5% of our full Summer 2023 programme. The financial impact

of the wildfires in recent weeks covering cancellations & lost margin, customer compensation as well as

repatriation flights & welfare costs has added ca. EUR25m of cost to our full year 2023 results.

^1Excluding businesses sold and discontinued since 2019

^2 Bookings up to 6 August 2023 relate to all customers whether risk or non-risk and include amendments and voucher

re-bookings

. With 86% of the Summer sold, which is in line with 2022 and 2019 levels and given the latest booking

position, we are confident in our Summer 2023 capacity assumption of being close to normalised 2019 Summer levels.

. We reconfirm our expectations to increase underlying EBIT significantly for financial year 2023^1.

^1 Based on constant currency.

Sustainability as opportunity

. Sustainability is a fundamental management principle for the TUI Group and a cornerstone of our strategy

for continually enhancing the value of our company. We firmly believe that sustainable development is critical to

long-term economic success.

. We have near-term targets set for airline, cruises and hotels, to reduce emissions in line with the

latest climate science. These 2030 targets were validated by the Science Based Targets initiative (SBTi) and

published in our Q1 Interim Report in February 2023.

. Together with destinations, TUI is shaping the future of sustainable tourism. As a sign of this joint

responsibility, the government of Cape Verde, TUI Group and TUI Care Foundation have signed a Memorandum of

Understanding "Tourism for Development" to intensify their cooperation on a wide range of sustainability topics.

Their joint goal is to strengthen tourism on the islands as a force for good. The agreement introduces key

strategic focus areas that the three signatories want to focus on in their joint efforts. The agreement covers a

wide range of 18 issues - from renewable energy and environmental protection to local entrepreneurship empowerment,

cultural heritage protection and education.

. TUI is driving the sustainability transformation of the tourism sector through its initiatives. An

important milestone has been achieved for TUI´s excursion business: 1,000 excursions offered on TUI Musement

platforms have now been checked against global sustainability standards. TUI is one of the first companies in the

industry to start applying global sustainability standards to its experiences portfolio. The certified process for

experiences is designed to support local suppliers on their way to sustainable offerings and therefore advance the

entire sector.

. In our Cruise operations Mein Schiff has now successfully tested a bio-fuel blend derived from waste

cooking oil, on one of its vessels. These fuels reduce sulphur oxide particles and carbon emissions by up to 90%

compared to fossil fuels.

. Recently, TUI has successfully extended the maturity of its existing credit lines of EUR2.7bn by a further

two years. The syndicated credit line will now mature in July 2026. The interest conditions of this revolving

credit facility (RCF) are linked to the achievement of the Group's emission reduction targets confirmed by SBTi.

. Transparency on TUI´s sustainability progress is an integral part of our journey towards a net-zero

company. Independent, external evaluation of our actions means accountability towards the public. ISS ESG has

upgraded TUI Group's sustainability rating. With the new C+ rating, TUI is listed as a "Prime Investment" in the

tourism sector for the first time. The transparency level for TUI's sustainability commitment is rated as "very

high".

TUI Group - financial highlights

Q3 2023 Q3 2022 Var. 9M 2023 9M 2022 Var. Var. %

adjusted % adjusted % at

constant

EUR million currency

+ +

Revenue 5,286.0 4,433.2 19.2 12,189.4 8,930.8 36.5 + 37.9

Underlying

EBIT^1

Hotels & +

Resorts 112.5 104.9 + 7.3 262.2 189.7 38.2 + 41.0

Cruises 64.0 3.0 n. a. 79.0 - 102.3 n. a. n. a.

+

TUI Musement 13.1 13.3 - 1.6 - 13.1 - 18.1 27.9 + 53.9

Holiday + +

Experiences 189.7 121.2 56.5 328.1 69.2 373.9 + 387.8

Northern + +

Region - 1.1 - 93.1 98.9 - 270.6 - 445.7 39.3 + 33.8

Central - -

Region 8.8 20.3 56.8 - 122.4 - 62.4 96.0 - 98.9

Western + +

Region - 1.0 - 70.2 98.6 - 103.9 - 159.5 34.9 + 33.5

Markets & +

Airlines 6.3 - 143.0 n. a. - 496.9 - 667.7 25.6 + 21.3

All other - -

segments - 26.6 - 5.2 408.0 - 57.2 - 32.0 78.5 - 79.1

+

TUI Group 169.4 - 27.0 n. a. - 225.9 - 630.5 64.2 + 61.2

EBIT^1 175.4 - 42.5 n. a. - 230.8 - 657.0 +

64.9

Underlying 366.6 180.8 + 382.0 -7.7

EBITDA 102.8 n. a.

EBITDA^2 +

446.0 171.2 160.4 461.3 - 14.2 n. a.

- +

Group loss 52.5 - 331.2 n. a. - 505.5 1,039.1 51.3

Earnings per +

share^3 EUR 0.07 - 1.28 n. a. - 1.72 - 4.02 57.2

Net capex and -

investment 92.3 152.0 39.3 310.1 288.7 + 7.4

Equity ratio

(31 Mar)^4 % 4.7 - 1.2 + 5.9

Net debt (30 - - +

Jun) 2,171.9 3,314.1 34.5

Employee (30

Jun) 65,018 60,058 + 8.3 Differences may occur due to rounding. ^1 We define the EBIT in underlying EBIT as earnings before interest, income taxes and result of the measurement of the Group's interest hedges. For further details please see page 20. ^2 EBITDA is defined as earnings before interest, income taxes, goodwill impairment and amortisation and write-ups of other intangible assets, depreciation and write-ups of property, plant and equipment, investments and current assets. ^3 Earnings per share for all periods presented were adjusted for the impact of the 10-for-1 reverse stock split in February 2023 as well as the impact of the subscription rights issued in the capital increase in March 2023. ^4 Equity divided by balance sheet total in %, variance is given in percentage points. All change figures refer to the same period of the previous year, unless otherwise stated. The present Quarterly Statement Q3 2023 is based on TUI Group's reporting structure set out in the Consolidated Financial Statements of TUI AG as at 30 September 2022. See TUI Group Annual Report 2022 from page 27. Due to the re-segmentation of Future Markets from All other segments to Hotels & Resorts, TUI Musement and Central Region in the current financial year, previous year's figures have been adjusted. Trading update - Booking level remain strong for Summer 2023 supported by higher ASP, confirming customers continue to prioritise holidays. We are confident the capacity for the season will be close to normalised levels Markets & Airlines

Trading Markets & Airlines Summer season^1

Variation in % versus 2022 2022 2019

Summer 2023 last week Summer 2023

Bookings^2 + 6 + 5 - 5

ASP + 7 + 9 + 26

. We have a strong pipeline of 12.5m bookings for Summer 2023, with 4.3m bookings added since our H1 2023Report on 10 May 2023. As a result 86% of the programme has already been sold in line with Summer 2022 and Summer2019 levels. . Bookings for Summer 2023 are up +6% year-on-year and at 95% of pre-pandemic levels. . ASP continues to be well up +7% versus Summer 2022 and notably ahead of the +5% we published at H1 2023,highlighting the popularity of our summer holidays and our customers' continued willingness to prioritise spend ontravel and experiences. Compared to Summer 2019 ASP remains significantly up at +26% and in line with the ASPincrease we published in May. . Bookings were impacted in the short-term as a result of the wildfires in Southern Europe and flightcancella-tions to Rhodes, but have subsequently recovered as operations have resumed, enabling customers to enjoytheir holidays once again. As a result, bookings for the last week were +5% against Summer 2022 with ASP up +9%over the same period and ahead of the cumulative position. . The UK remains our most advanced market in terms of booking with 89% of the season sold and bookings at+1% against Summer 2022 and +4% against Summer 2019. In other key markets, bookings for Germany are up +11% againstSummer 2022 and -4% against Summer 2019. In the Netherlands the picture is similar, with bookings +5% higheragainst the prior season and -3% against pre-pandemic levels. . Given the latest booking position, we are confident in our Summer 2023 capacity assumption of being closeto normalised Summer 2019 levels. Winter 2023/24^2 . Bookings for Winter 2023/24 are at a very early stage but the season has started promisingly across ourmarkets. As usual the UK programme is most advanced at 33% sold. Bookings here are up +7% compared to Winter 2022/23. As part of our regular reporting, we expect to update on Winter 2023/24 performance with our Pre-Close TradingUpdate on 19 September 2023. ^1 Depending on the source market, Summer season starts in April or May and ends in September, October or November. ^2 Bookings up to 6 August 2023 relate to all customers whether risk or non-risk and include amendments and voucher re-bookings Holiday Experiences

Trading Holiday Experiences

July - September 2023^1

Variation in % versus July - September 2022

Hotels & Resorts^2

Available bed nights^3 + 2

Occupancy %^4 + 1 % points

Average daily rate + 5

Cruises

Available passenger cruise days^5 0

Occupancy %^6 + 13 % points

Average daily rate + 9

TUI Musement

Experiences sold + 10

Transfers in-line with Markets & Airlines Holiday Experiences Q4^1 trading remains well on track to deliver FY 2023 expectations. . Hotels & Resorts - Number of available bed nights for Q4^2 is +2% ahead of prior year. Booked occupancyis up year-on-year at +1%pts for Q4. Average daily rates are +5% ahead year-on-year for Q4, driven mainly by Riu. Popular destinations in the key summer quarter are Turkey, the Caribbean, the Balearics, Greece, the Canaries andCape Verde. . Cruises - Our three brands have a full fleet of sixteen ships in operation during the summer. Q4available passenger cruise days are in line with Q4 2022. Booked occupancy rates remain significantly higheragainst prior year and are up +13%pts for Q4. Average daily rates are +9% ahead of Q4 2022, with rates for manyitineraries achieving the peaks last seen in 2019. . TUI Musement - Our Tours and Activities business continues its expansion investing into growth whilereturning to 2019 profitability. The segment benefits from our integrated model, with a global product offering incities as well as sun and beach locations, and growth of third-party sales through the TUI Musement platform. Thetransfer business, providing support to our guests in their destination, is expected to develop in line with ourMarkets & Airlines capacity assumptions in 2023. Sales to date for our Experiences business, providing excursions,activities and tickets, are +10% higher for Q4 against the prior year quarter. The significant growth inExperiences is driven by the enlarged product offering especially online and our diversified distribution via TUI,B2C and B2B. ^1 Q4 covers July to September 2023 with trading data as of 30 July 2023 ^2 2023 trading data as of 30 July 2023 excluding Blue Diamond ^3 Number of hotel days open multiplied by beds available in the hotel (Group owned and leased hotels) ^4 Occupied beds divided by available beds (Group owned and lease hotels) ^5 Number of operating days multiplied by berths available on the operated ships ^6 Achieved passenger cruise days divided by available passenger cruise days Net debt The net debt position as of 30 June 2023 was EUR-2.2bn, an improvement of EUR1.1bn year-on-year (30 June 2022: EUR-3.3bn). This is driven by the net proceeds (following repayment of the final WSF obligations) from our capital increase in April 2023 and a positive free cash flow. Strategic priorities The TUI Group's strategy outlined in the Annual Report 2022^1 and at our FY2022 results presentation, will be continued in the current financial year. TUI's strategy aims to deliver growth in both Holiday Experiences and Markets & Airlines, embedded in one central customer ecosystem, underpinned by our sustainability agenda and our people. Our Holiday Experiences business strategy focuses on asset-right growth in differentiated content and expanding the customer base with multi-channel distribution. Having accelerated our strategic transformation of Markets & Airlines during the pandemic, and fully implemented our Global Realignment Programme, our business strategy is now focused on profitable growth. This will be achieved by offering more product choice, growing our customer ecosystem into untapped segments, and increasing customer value and thus market share. This includes increasing

the volume and proportion of dynamically sourced packages, as

well as significantly increasing our component offer in

accommodation only and flight only. We also aim to further improve

our cash position focusing on optimising working capital and cash

from operations and maintaining disciplined capital expenditure

through asset right growth. In April 2023, we successfully

completed a EUR1.8bn rights issue, facilitating the full repayment

of the remaining state aid instruments granted by the German

Economic Stabilization Fund (WSF) and enabling a significant

reduction in the size of our KfW credits lines as well as a

repayment of current drawings under our credit lines in the same

magnitude. In May we successfully extended the maturity of our

existing credit lines totaling EUR2.7bn from July 2024 to July

2026. The interest conditions of this revolving credit facility

(RCF) are also linked to the achievement of the Group's emission

reduction targets confirmed by the Science Based Targets Initiative

(SBTi). With the review and confirmation of the ambitious emission

reduction targets by the SBTi, TUI is setting new standards in the

tourism sector. Both the rights issue and RCF extension are

significant measures to improve our credit metrics and restore our

balance sheet strength. As a result we have seen a first

improvement in our credit rating during the quarter, with S&P

upgrading in April to B and Moody's upgrading in May to B2 both

with a positive outlook. FY23 Assumptions^2 - We reconfirm our

expectations to increase underlying EBIT significantly for

financial year 2023. Mid-term ambitions - We are focused on

operational excellence and execution. We have a clear strategy to

accelerate profitable market growth with new customer segments and

more product sales. Our mid-term 2025/26 ambitions are for

underlying EBIT to significantly build on EUR1.2bn^3. We have a

target to return to a gross leverage ratio^4 of well below 3.0x and

aim to return to a credit rating in line with the pre-pandemic

rating of BB / Ba territory. ^1 Details on our strategy see TUI

Group Annual Report 2022 from page 23 ^2 Based on constant

currency. ^3 FY 2019 underlying EBIT of EUR893m including EUR293m

Boeing Max cost impact ^4 Defined as gross debt (Financial

liabilities incl. lease liabilities and net pension obligation)

divided by reported EBITDA Consolidated earnings

Revenue

Q3 2023 Q3 2022 Var. 9M 2023 9M 2022 Var.

EUR million adjusted % adjusted %

-

Hotels & Resorts 258.2 259.5 0.5 687.4 638.8 + 7.6

+ +

Cruises 164.6 103.3 59.3 421.7 178.8 135.9

+ +

TUI Musement 216.1 171.3 26.2 506.1 316.9 59.7

+ +

Holiday Experiences 638.9 534.1 19.6 1,615.2 1,134.5 42.4

+ +

Northern Region 1,992.7 1,762.8 13.0 4,527.3 3,262.9 38.7

+ +

Central Region 1,861.2 1,451.9 28.2 4,237.1 3,062.7 38.3

+ +

Western Region 792.2 683.2 15.9 1,804.8 1,465.5 23.2

+ +

Markets & Airlines 4,645.9 3,897.9 19.2 10,569.1 7,791.1 35.7

-

All other segments 1.2 1.2 3.2 5.0 5.2 - 2.9

+ +

TUI Group 5,286.0 4,433.2 19.2 12,189.4 8,930.8 36.5

TUI Group (at constant + +

currency) 5,333.0 4,433.2 20.3 12,315.3 8,930.8 37.9

Underlying EBIT

Q3 Q3 2022 Var. % 9M 9M 2022 Var. %

EUR million 2023 adjusted 2023 adjusted

Hotels & Resorts 112.5 104.9 + 7.3 262.2 189.7 + 38.2

Cruises 64.0 3.0 n. a. 79.0 - 102.3 n. a.

TUI Musement 13.1 13.3 - 1.6 - 13.1 - 18.1 + 27.9

+

Holiday Experiences 189.7 121.2 + 56.5 328.1 69.2 373.9

-

Northern Region - 1.1 - 93.1 + 98.9 270.6 - 445.7 + 39.3

-

Central Region 8.8 20.3 - 56.8 122.4 - 62.4 - 96.0

-

Western Region - 1.0 - 70.2 + 98.6 103.9 - 159.5 + 34.9

-

Markets & Airlines 6.3 - 143.0 n. a. 496.9 - 667.7 + 25.6

-

All other segments - 26.6 - 5.2 408.0 - 57.2 - 32.0 - 78.5

-

TUI Group 169.4 - 27.0 n. a. 225.9 - 630.5 + 64.2

TUI Group (at constant -

currency) 170.7 - 27.0 n. a. 244.8 - 630.5 + 61.2

EBIT

Q3 Q3 2022 Var. 9M 9M 2022 Var. %

EUR million 2023 adjusted % 2023 adjusted

Hotels & Resorts 104.1 104.8 - 0.7 253.4 211.6 + 19.7

Cruises 64.0 3.0 n. a. 79.0 - 102.3 n. a.

TUI Musement 11.3 10.6 + 7.3 - 17.1 - 24.7 + 30.8

+ +

Holiday Experiences 179.5 118.4 51.6 315.2 84.6 272.7

-

Northern Region 87.0 - 97.0 n. a. 187.4 - 457.7 + 59.1

- -

Central Region 8.3 12.1 31.4 123.2 - 88.0 - 40.0

+ -

Western Region - 1.7 - 71.1 97.7 104.4 - 161.8 + 35.5

-

Markets & Airlines 93.2 - 156.0 n. a. 415.0 - 707.5 + 41.3

- -

All other segments - 97.3 - 4.9 n. a. 131.1 - 34.1 284.6

-

TUI Group 175.4 - 42.5 n. a. 230.8 - 657.0 + 64.9

TUI Group (at constant -

currency) 183.1 - 42.5 n. a. 243.3 - 657.0 + 63.0 Segmental performance

Holiday Experiences

Q3 Q3 2022 Var. 9M 2023 9M 2022 Var.

EUR million 2023 adjusted % adjusted %

Revenue + +

638.9 534.1 19.6 1,615.2 1,134.5 42.4

Underlying EBIT + +

189.7 121.2 56.5 328.1 69.2 373.9

Underlying EBIT at constant + +

currency 194.0 121.2 60.1 337.8 69.2 387.8

Hotels & Resorts

Q3 Q3 Var. 9M 2023 9M Var.

EUR million 2023 2022 % 2022 %

Total revenue^1 + +

456.7 385.2 18.6 1,199.6 909.8 31.9

Revenue - +

258.2 259.5 0.5 687.4 638.8 7.6

Underlying EBIT + +

112.5 104.9 7.3 262.2 189.7 38.2

Underlying EBIT at constant + +

currency 114.6 104.9 9.3 267.5 189.7 41.0

Available bed nights^2 ('000) + +

10,908 10,711 1.8 26,473 26,234 0.9

Riu + +

3,611 3,514 2.8 10,023 10,004 0.2

Robinson + +

1,062 1,046 1.5 2,534 2,367 7.0

Blue Diamond + +

1,525 1,363 11.9 4,489 4,030 11.4

Occupancy^3 (%, variance in %

points) 79 74 + 5 79 68 + 11

Riu 89 88 + 1 89 77 + 12

Robinson 66 61 + 5 67 59 + 8

Blue Diamond 81 82 - 1 84 78 + 6

Average daily rate^4 (EUR) + +

80 73 9.3 87 76 15.1

Riu + +

71 63 12.7 77 66 16.0

Robinson + +

98 94 3.7 102 101 1.6

Blue Diamond + +

150 140 7.3 156 134 16.0

Revenue includes fully consolidated companies, all other KPIs incl. companies

measured at equity

^1 Total revenue includes

intra-Group revenue

^2 Number of hotel days open multiplied by beds available (Group owned and leased

hotels)

^3 Occupied beds divided by available beds (Group owned and leased hotels)

^4 Board and lodging revenue divided by occupied bed nights (Group owned and leased

hotels) 9M 2023 total revenue in our Hotels & Resorts segment increased to EUR1,199.6m, up EUR289.8m year-on-year (9M 2022: EUR909.8m). 9M underlying EBIT for the segment of EUR262.2m improved by EUR72.5m year-on-year (9M 2022: EUR189.7m). Q3 2023 total revenue for the segment grew to EUR456.7m, an increase of 19% year-on-year (Q3 2022: EUR385.2m) supported by higher bed nights and rates across our portfolio of brands. Q3 underlying EBIT of EUR112.5m, was EUR7.7m ahead year-on-year (Q3 2022: EUR104.9m) and ahead of an already strong prior year quarter and achieving a fifth consecutive quarter above 2019 levels, underlining the continuing strong performance of this segment post pandemic. Results were driven by an improved operational performance for Riu as well as Robinson and were supported by higher occupancies and rates. In the Q3 period, we offered 10.9m available bed nights (capacity), an increase of 2% on 10.7m in Q3 2022. The overall occupancy rate for the segment increased across all our key brands by a total of 5%pts year-on-year to 79%, Again the Canaries, Balearics, Turkey, Greece and Cape Verde proved to be popular summer destinations for both Markets & Airlines and third-party customers. Our year-round hotel offering across the Caribbean delivered average occupancy rates of 90% at high capacity levels, with Mexico being our most popular destination, achieving 94% average occupancy in the quarter. Q3 2023 average daily rate in the segment rose by 9% year-on-year to EUR80 with rates higher in all our key destinations and in particular in the Caribbean. Riu's average daily rate increased by 13% to EUR71 (Q3 2022: EUR63) and Blue Diamond's average daily rate rose by 7% to EUR150 (Q3 2022: EUR140). Robinson achieved an average daily rate of EUR98, up 4% versus prior year (Q3 2022: EUR94). Future content growth in our Hotels & Resorts segment will be delivered both through our well-known hotel brands in existing and new destinations, as well as introducing new brands to complement our portfolio. This growth will be achieved in accordance with our asset-right strategy. Following the announcement in the previous quarter of our expansion plans for TUI Blue, we are now announcing the creation of a new off-balance sheet joint venture with Riu. This targets realising unique opportunities to invest into growth, whilst limiting the financial impact on TUI's leverage and net investments. In addition, the TUI initiated global Hansainvest hotel fund is successfully executing its first two hotel investments on Zanzibar and on Cape Verde. Here, TUI is providing hotel management and investment advisory services to support our asset-light growth development.

Cruises

Q3 Q3 Var. 9M 9M Var.

EUR million 2023 2022 % 2023 2022 %

Revenue^1 + +

164.6 103.3 59.3 421.7 178.8 135.9

Underlying EBIT -

64.0 3.0 n. a. 79.0 102.3 n. a.

Underlying EBIT at constant -

currency 64.1 3.0 n. a. 78.6 102.3 n. a.

Available passenger cruise days^2

('000)

Mein Schiff +

1,438 1,579 - 8.9 4,661 4,019 16.0

Hapag-Lloyd Cruises +

147 137 + 7.6 441 388 13.6

Marella Cruises +

717 656 + 9.3 1,965 1,397 40.6

Occupancy^3 (%, variance in %

points)

Mein Schiff 98 70 + 28 93 59 + 34

Hapag-Lloyd Cruises 73 57 + 15 69 50 + 19

Marella Cruises 95 70 + 25 94 59 + 35

Average daily rate (EUR)

Mein Schiff^4 191 188 + 1.4 154 166 - 6.8

Hapag-Lloyd Cruises^4 + +

706 619 14.1 718 611 17.5

Marella Cruises^5 (in GBP) + +

178 160 11.3 173 155 11.7

^1 No revenue is carried for Mein Schiff and Hapag-Lloyd Cruises as the joint

venture TUI Cruises is consolidated at equity

^2 Number of operating days multiplied by berths available on the operated ships.

This key figure has changed compared to previous periods

^3 Achieved passenger cruise days divided by available passenger cruise days

^4 Ticket revenue divided by achieved passenger cruise

days

^5 Revenue (stay on ship inclusive of transfers, flights and hotels due to the

integrated nature of Marella Cruises) divided by achieved passenger cruise days The Cruises segment comprises the joint venture TUI Cruises in Germany, which operates cruise ships under the brands Mein Schiff and Hapag-Lloyd Cruises, and Marella Cruises in UK. The segment operated a full fleet of 16 ships in the third quarter in line with Q3 2022 when the segment was able to return to normal operations after COVID-19 restrictions were lifted. During the quarter Mein Schiff Herz transferred from TUI Cruises to Marella and after refurbishment the newly named Marella Voyager returned to service at the beginning of June for the summer season. 9M 2023 Cruises revenue only includes Marella Cruises, as TUI Cruises is accounted for using the equity method. Revenue grew to EUR421.7m, a significant improvement of EUR242.9m year-on-year (9M 2022: EUR178.8m). 9M 2023 underlying EBIT for the segment (including the equity result of TUI Cruises) was EUR79.0m, up EUR181.3m year-on-year (9M 2022: EUR-102.3m loss). Q3 2023 revenue reflecting Marella Cruises solely, increased to EUR164.6m, up EUR61.3m year-on-year (Q3 2022: EUR103.3m). Q3 2023 underlying EBIT for the segment (including the equity result of TUI Cruises), was EUR64.0m, an improvement of EUR61.1m (Q3 2022: EUR3.0m) with all of our three Cruise brands contributing to the positive EBIT development boosted by increased volumes as well as higher occupancies. The Cruises business continues to recover post pandemic with this now being the fifth consecutive positive quarter for the segment with TUI Cruises achieving Q3 2023 EAT (earnings after tax) of EUR47m, a significant increase of EUR34m year-on-year (Q3 2022: EUR13m). Mein Schiff - Mein Schiff operated their full fleet of six ships at the end of the quarter against seven ships in the previous year following the transfer of Mein Schiff Herz to Marella Cruises during the quarter. The brand offered itineraries to the Mediterranean, Northern Europe and Asia. At EUR191, the average daily rate was 1% above prior year (Q3 2022: EUR188) and virtually in line with pre-pandemic levels (Q3 2019: 190EUR). Occupancy of the operated fleet in Q3 2023 of 98% was significantly ahead of prior year (Q3 2022: 70%) and moving close to the peaks seen in FY2019, underlining the strong demand for our German language, premium all-inclusive product. Hapag-Lloyd Cruises - Our luxury and expeditions cruise brand, offering itineraries to Europe, Asia, the America's as well as voyages to the Artic during the quarter. As in the previous year, the brand operated all five ships in Q3 2023. Q3 average daily rate was EUR706, an increase of 14% on prior year (Q3 2022: EUR619) and well above pre-pandemic levels (Q3 2019: EUR577). Q3 occupancy of the fleet was 73% (Q3 2022: 57%), highlighting the popularity of these cruises post pandemic. Marella Cruises - Our UK cruise brand offered itineraries to the Mediterranean, the Caribbean and North America in Q3. With Marella Voyager supplementing the fleet, the brand operated a full fleet of five ships towards the end of the quarter against four ships in the previous year. The business achieved an average daily rate of GBP178 up 11% year-on-year (Q3 2022: GBP160) and well above the pre-pandemic level of GBP144, driven in particular by the expansion of the fleet and itineraries to the Eastern Mediterranean. Occupancy also improved significantly to 95%, versus a prior year Q3 of 70%.

TUI Musement

Q3 Q3 2022 Var. 9M 9M 2022 Var.

EUR million 2023 adjusted % 2023 adjusted %

Total revenue^1 332.1 262.9 + 732.5 472.2 +

26.3 55.1

Revenue + +

216.1 171.3 26.2 506.1 316.9 59.7

Underlying EBIT - - +

13.1 13.3 1.6 13.1 - 18.1 27.9

Underlying EBIT at constant + +

currency 15.3 13.3 14.6 - 8.4 - 18.1 53.9

^1 Total revenue includes

intra-Group revenue In TUI Musement, our Tours and Activities business, 9M 2023 revenue of EUR506.1m, was up EUR189.2m year-on-year (9M 2022: EUR316.9m). 9M underlying EBIT loss of EUR-13.1m improved against prior year (9M 2022: EUR-18.1m loss). Q3 2023 revenue of EUR216.1m, was EUR44.8m and therefore 26% higher year-on-year (Q3 2022: EUR171.3m) highlighting the significant growth in this segment and the advantage of our integrated model as well as growth of third-party sales through the TUI Musement platform. Underlying EBIT of EUR13.1m was in line with prior year (Q3 2022: EUR13.3m). The business continues to focus on its B2C offering driving growth of Experiences sales directly to the consumer and through B2B, as well as focusing on profitability by growing the differentiated own product portfolio globally. During the quarter, TUI Musement benefited from increased guest transfers due to a higher number of tour operator guests, providing 8.2m transfers in the destinations, 1.0m more than in the same quarter last year (Q3 2022: 7.2m). In addition, 2.7m Experiences were sold across our global destinations, up 0.7m and 33% (year-on-year (Q3 2022: 2.0m) as the significant expansion of our business in this segment continued.

Markets & Airlines

EUR million Q3 2023 Q3 2022 Var. 9M 2023 9M 2022 Var.

adjusted % adjusted %

Revenue + +

4,645.9 3,897.9 19.2 10,569.1 7,791.1 35.7

Underlying EBIT n. +

6.3 - 143.0 a. - 496.9 - 667.7 25.6

Underlying EBIT at constant n. +

currency 3.4 - 143.0 a. - 525.3 - 667.7 21.3

Direct distribution mix^1

(in %, variance in %

points) 76 78 - 2 76 78 - 2

Online mix^2

(in %, variance in %

points) 52 55 - 3 52 55 - 3

Customers ('000) + +

5,514 5,069 8.8 11,257 9,215 22.2

^1 Share of sales via own channels (retail and online)

^2 Share of online sales

EBIT of EUR-496.9m, an improvement of EUR170.9m year-on-year (9M 2022: EUR-667.7m loss) supported in particular by results in Q3. The prior year results were impacted by operational flight disruptions encountered during May and June 2022 totaling EUR75m. This was mainly caused by third party suppliers and airports due to a shortage in ground handling and airports security staff, reliability issues with lease-in partners and supplier maintenance delays. Q3 2023 revenue of EUR4,645.9m, increased EUR748.0m or 19.2% year-on-year (Q3 2022: EUR3,897.9m). The Q3 underlying EBIT profit of EUR6.3m was up significantly by EUR149.3m year-on-year (Q3 2022: EUR-143.0m loss) whereby the prior year included EUR75m of costs from flight disruptions. The improvement was driven in particular by higher prices and good demand for our wide and varied product offering. Traditional short- and medium-haul destinations such as the Canaries and Egypt were again popular amongst customers, with long-haul destinations such as Mexico and the Dominican Republic also in good demand. A total of 5,514k customers departed in Q3 2023, an increase of 445k customers versus Q3 2022.

Northern Region

Q3 2023 Q3 2022 Var. 9M 2023 9M 2022 Var.

EUR million % %

Revenue + +

1,992.7 1,762.8 13.0 4,527.3 3,262.9 38.7

Underlying EBIT + +

- 1.1 - 93.1 98.9 - 270.6 - 445.7 39.3

Underlying EBIT at constant + +

currency - 4.1 - 93.1 95.5 - 294.9 - 445.7 33.8

Direct distribution mix^1

(in %, variance in % points) 94 94 - 93 94 - 1

Online mix^2

(in %, variance in % points) 69 71 - 2 68 71 - 3

Customers ('000) + +

2,219 2,095 5.9 4,373 3,511 24.5

^1 Share of sales via own channels (retail and online)

^2 Share of online sales 9M 2023 revenue of EUR4,527.3m, which was up EUR1,264.4m year-on-year (9M 2022: EUR3,262.9m). 9M underlying EBIT loss for the region of EUR-270.6m improved by EUR175.2m year-on-year (9M 2022: EUR-445.7m loss). Northern Region reported Q3 2023 revenue of EUR1,992.7m, which was up EUR229.9m year-on-year (Q3 2022: EUR1,762.8m). Q3 2023 underlying EBIT loss for the region of EUR-1.1m improved by EUR92.0m year-on-year (Q3 2022: EUR-93.1m loss) driven by improved margins and the absence of flight disruptions as in the prior year. Q3 2023 customer volumes increased by 5.9% to 2,219k versus 2,095k guests in Q3 2022 underlining the popularity of the summer season offering. Online distribution remained strong at 69% and well up on pre-pandemic levels (Q3 2019: 66%), but were down 2%pts against prior year (Q3 2022: 71%), as retail shop sales continued their recovery post pandemic. Direct distribution was at 94% in line with prior year (Q3 2022: 94%) and pre-pandemic levels (Q3 2019: 94%).

Central Region

Q3 2023 Q3 2022 Var. 9M 2023 9M 2022 Var.

EUR million adjusted % adjusted %

Revenue + +

1,861.2 1,451.9 28.2 4,237.1 3,062.7 38.3

Underlying EBIT - -

8.8 20.3 56.8 - 122.4 - 62.4 96.0

Underlying EBIT at constant - -

currency 8.7 20.3 57.3 - 124.2 - 62.4 98.9

Direct distribution mix^1

(in %, variance in % points) 56 58 - 2 55 57 - 2

Online mix^2

(in %, variance in % points) 30 31 - 1 30 31 - 1

Customers ('000) + +

2,009 1,716 17.1 4,071 3,191 27.6

^1 Share of sales via own channels (retail and online)

^2 Share of online sales

loss for the region of EUR-122.4m, up EUR59.9m against last year (9M 2022: EUR-62.4m loss). Q3 2023 revenue of EUR1,861.2m, improved EUR409.3m 28.2 %year-on-year (Q3 2022: EUR1,451.9m) whilst the underlying EBIT result for the region of EUR8.8m, was EUR11.5m lower year-on-year (Q3 2022: EUR20.3m). The improvement in operational performance especially in Germany was generated by higher volumes and prices. This was offset year-on-year by negative valuation effects from ineffective hedge positions. Customer volumes increased by 17.1% to 2,009k versus prior year (previous year 1,716k) reflecting in particular the significant recovery in customer bookings in the region. Online distribution for Central Region reached 30%, and thus virtually in line with the 31%pts in the prior year. Against pre-pandemic levels, online distribution was up by 6%pts (Q3 2019: 24%), emphasising the strong development of our online offering in this region in line with consumer demand. Direct distribution reduced 2%pts to 56% against Q3 2022 of 58% but ahead versus pre-pandemic levels (Q3 2019: 53%).

Western Region

Q3 Q3 Var. 9M 2023 9M 2022 Var.

EUR million 2023 2022 % %

Revenue + +

792.2 683.2 15.9 1,804.8 1,465.5 23.2

Underlying EBIT + +

- 1.0 - 70.2 98.6 - 103.9 - 159.5 34.9

Underlying EBIT at constant + +

currency - 0.7 - 70.2 99.0 - 106.1 - 159.5 33.5

Direct distribution mix^1

(in %, variance in % points) 76 80 - 4 77 81 - 4

Online mix^2

(in %, variance in % points) 55 60 - 5 58 62 - 4

Customers ('000) +

1,285 1,259 + 2.1 2,813 2,513 11.9

^1 Share of sales via own channels (retail and online)

^2 Share of online sales In Western Region 9M 2023 revenue of EUR1,804.8m, rose EUR339.3m year-on-year (9M 2022: EUR1,465.5m). 9M underlying EBIT loss of EUR-103.9m, decreased by EUR55.7m year-on-year (9M 2022: EUR-159.5m loss). Q3 2023 revenue of EUR792.2m, was up EUR108.9m year-on-year (Q2 2022: EUR683.2m). Q3 underlying EBIT loss of EUR-1.0m, improved by EUR69.2m year-on-year (Q3 2022: EUR-70.2m loss). This was driven in particular by an improved operational performance in both Belgium and the Netherlands supported by the absence of the flight delays and cancellations due to disruptions in particular at Schiphol Airport encountered in the prior year. Customer volumes increased by 2.1% to 1,285k guests year-on-year (Q3 2022: 1,259k). Online distribution for region stood at 55%, 5%pts below prior year but virtually in line with pre-pandemic levels (Q3 2019: 56 %). Direct distribution was down 4%pts to 76% versus last year (Q3 2022: 80%) but in line with pre-pandemic levels (Q3 2019: 76%).

All other segments

Q3 Q3 2022 Var. 9M 9M 2022 Var.

EUR million 2023 adjusted % 2023 adjusted %

Revenue 1.2 1.2 - 3.2 5.0 5.2 - 2.9

Underlying EBIT - - - -

26.6 - 5.2 408.0 57.2 - 32.0 78.5

Underlying EBIT at constant - - - -

currency) 26.7 - 5.2 410.6 57.4 - 32.0 79.1 9M 2023 underlying EBIT loss of EUR-57.2m, increased EUR25.1m year-on-year (9M 2022: EUR-32.0m loss) and Q3 2023 underlying EBIT loss of EUR-26.6m, increased by EUR21.4m year-on-year (Q3 2022: EUR-5.2m loss). Cash Flow / Net debt / Net capex and investments In the first nine months of financial year 2023, TUI Group's business volume was significantly higher than in 9M 2022 which was still impacted by measures to contain the spread of COVID-19. TUI Group's results generally also reflect the significant seasonal swing in tourism between the winter and summer travel months. TUI Group's operating cash inflow in 9M 2023 of EUR1,079.6m decreased by EUR891.0m compared to previous year, which was characterised by normalising business volumes and thus the one-time rebound of customer prepayments to a normal level following the gradual lifting of the COVID-19 travel restrictions in 2022. Net debt position as at 30 June 2023 of EUR-2.2bn was down EUR1.1bn compared to previous year level (30 June 2022: EUR-3.3bn). This improvement is driven by net proceeds (following repayment of the final WSF obligations) from our capital increase in April 2023 and a positive free cash flow.

Net debt

EUR million 30 Jun 2023 30 Jun 2022 Var. %

Financial debt 1,470.0 1,781.5 - 17.5

Lease liabilities 2,919.5 3,231.3 - 9.6

Cash and cash equivalents 2,169.1 1,583.4 + 37.0

Short-term interest-bearing investments 48.5 115.5 - 58.0

Net debt -2,171.9 -3,314.1 + 34.5

Net capex and investments

Q3 Q3 2022 Var. 9M 9M 2022 Var.

EUR million 2023 adjusted % 2023 adjusted %

Cash gross capex

- +

Hotels & Resorts 44.0 67.7 35.0 177.4 123.7 43.4

+ +

Cruises 24.8 8.0 210.0 68.6 36.3 89.0

+

TUI Musement 6.7 6.9 - 2.9 19.7 17.9 10.1

+

Holiday Experiences 75.5 82.6 - 8.6 265.6 177.9 49.3

Northern Region 6.7 6.1 + 9.8 17.9 18.9 - 5.3

+

Central Region 4.2 4.0 + 5.0 10.4 9.1 14.3

+ +

Western Region 5.5 1.0 450.0 17.1 4.4 288.6

- -

Markets & Airlines* 23.1 70.5 67.2 72.6 94.5 23.2

+ +

All other segments 37.9 27.3 38.8 103.3 77.3 33.6

- +

TUI Group 136.6 180.4 24.3 441.5 349.7 26.3

Net pre delivery payments on - +

aircraft 11.4 - 17.3 34.1 23.6 - 61.9 n. a.

- +

Financial investments 0.1 0.3 66.7 0.4 0.3 33.3

- - -

Divestments 33.0 - 11.4 189.5 155.5 0.6 n. a.

-

Net capex and investments 92.3 152.0 39.3 310.1 288.7 + 7.4 * Including EUR6.7m for Q3 2023 (Q3 2022: EUR59.4m) and EUR27.2m for 9M 2023 (9M 2022: EUR62.1m ) cash gross capex of the aircraft leasing companies, which are allocated to Markets & Airlines as a whole, but not to the individual segments Northern Region, Central Region and Western Region. Cash gross capex in 9M 2023 was EUR91.8m higher year-on-year. This increase was due, amongst others, to higher investments in Hotels & Resorts, the IT and the airline sector and at Marella for the refurbishment of Mein Schiff Herz prior to its commissioning for the UK market. Net capex and investments of EUR310.1m increased by EUR21.4m year-on-year. The divestments include an inflow of EUR71m from the sale of the stakes in RIU Hotels S.A. in financial year 2021 as well as an inflow from the sale of the non-consolidated share in Peakwork AG. Consolidated income statement

Unaudited condensed consolidated Income Statement of TUI AG for the period from 1

Oct 2022 to 30 June 2023

EUR million Q3 2023 Q3 2022 Var. % 9M 2023 9M 2022 Var. %

Revenue 5,286.0 4,433.2 +19.2 12,189.4 8,930.8 +36.5

Cost of sales 5,018.4 4,313.4 +16.3 11,908.2 9,047.8 +31.6

Gross profit / loss 267.5 119.8 +123.3 281.2 - 117.0 n. a.

Administrative expenses 253.1 189.6 +33.5 746.5 566.6 +31.8

Other income 3.2 3.3 - 3.0 14.9 34.1 - 56.3

Other expenses 32.3 2.2 n. a. 37.0 3.7 +900.0

Impairment (+) / Reversal

of impairment (-) of

financial assets 5.8 - 3.3 n. a. 9.3 - 7.8 n. a.

Financial income 22.2 4.6 +382.6 60.5 30.5 +98.4

Financial expense 142.9 127.2 +12.3 427.8 408.5 +4.7

Share of result of

investments accounted for

using the equity method 185.0 26.4 +600.8 259.0 - 9.2 n. a.

Earnings before income -

taxes 47.0 - 161.6 n. a. - 601.8 1,032.6 +41.7

Income taxes (expense

(+), income (-)) - 5.5 169.6 n. a. - 96.3 6.5 n. a.

-

Group profit / loss 52.5 - 331.2 n. a. - 505.5 1,039.1 +51.4

Group profit / loss

attributable to -

shareholders of TUI AG 22.6 - 356.7 n. a. - 597.8 1,076.7 +44.5

Group profit / loss

attributable to

non-controlling interest 29.8 25.5 +16.9 92.3 37.5 +146.1

Cash flow statement

Unaudited consolidated Cash Flow Statement of TUI AG for the period from 1 Oct 2022

to 30 June 2023

EUR million 9M 2023 9M 2022

-

Group loss - 505.6 1,039.1

Depreciation, amortisation and impairment (+) / write-backs (-) 692.1 642.8

Other non-cash expenses (+) / income (-) - 256.9 30.9

Interest expenses 419.7 394.9

Dividends from joint ventures and associates 14.3 0.2

Profit (-) / loss (+) from disposals of non-current assets 22.7 - 28.7

Increase (-) / decrease (+) in inventories - 16.8 - 18.8

-

Increase (-) / decrease (+) in receivables and other assets - 802.7 1,421.4

Increase (+) / decrease (-) in provisions - 308.3 - 90.1

Increase (+) / decrease (-) in liabilities (excl. financial

liabilities) 1,821.1 3,499.9

Cash inflow / cash outflow from operating activities 1,079.6 1,970.6

Payments received from disposals of property, plant and equipment

and intangible assets 95.8 112.6

Payments received/made from disposals of consolidated companies

(less disposals of cash and cash equivalents due to divestments) - 0.7 - 2.2

Payments received/made from disposals of other non-current assets 99.1 - 20.1

Payments made for investments in property, plant and equipment

and intangible assets - 502.1 - 376.5

Payments made for investments in other non-current assets - 2.1 - 0.3

Cash inflow / cash outflow from investing activities - 310.0 - 286.5

Payments received from capital increase by issuing new shares 1,764.1 1,522.9

Payments made for repayment of the silent participation - - 671.0

Payments made for the repurchase of equity instruments - 682.4 -

Dividends

Coupon on silent participation - 16.8 - 51.0

Subsidiaries to non-controlling interest - 25.6 -

Payments received from the raising of financial liabilities 179.2 47.2

-

Payments made for redemption of loans and financial liabilities - 742.7 1,774.4

Payments made for principal of lease liabilities - 475.2 - 437.5

Interest paid - 341.2 - 298.7

-

Cash inflow / cash outflow from financing activities - 340.6 1,662.4

Net change in cash and cash equivalents 428.9 21.7

Development of cash and cash equivalents

Cash and cash equivalents at beginning of period 1,736.9 1,586.1

Change in cash and cash equivalents due to exchange rate

fluctuations 3.3 - 24.4

Net change in cash and cash equivalents 428.9 21.7

Cash and cash equivalents at end of period 2,169.1 1,583.4

Financial position

Unaudited condensed consolidated Statement of Financial Position of TUI AG as at 30

Jun 2023

EUR million 30 Jun 2023 30 Sep 2022

Assets

Goodwill 2,957.8 2,970.6

Other intangible assets 489.6 507.6

Property, plant and equipment 3,476.7 3,400.9

Right-of-use assets 2,770.6 2,971.5

Investments in joint ventures and associates 991.7 785.4

Trade and other receivables 114.4 131.6

Derivative financial instruments 4.6 26.6

Other financial assets 11.1 10.6

Touristic payments on account 143.7 138.0

Other non-financial assets 101.9 169.7

Income tax assets 17.2 17.2

Deferred tax assets 418.4 222.0

Non-current assets 11,497.7 11,351.7

Inventories 73.9 56.1

Trade and other receivables 1,258.0 1,011.8

Derivative financial instruments 27.8 232.5

Other financial assets 48.5 85.8

Touristic payments on account 1,494.5 619.6

Other non-financial assets 120.5 135.4

Income tax assets 32.1 23.1

Cash and cash equivalents 2,169.1 1,736.9

Assets held for sale 39.7 2.7

Current assets 5,264.0 3,903.8

Total assets 16,761.7 15,255.5

Unaudited condensed consolidated Statement of Financial Position of TUI AG as at 30

Jun 2023

EUR million 30 Jun 2023 30 Sep 2022

Equity and liabilities

Subscribed capital 507.4 1,785.2

Capital reserves 9,093.2 6,085.9

Revenue reserves - 9,671.7 - 8,432.7

Silent participation - 420.0

Equity before non-controlling interest - 71.0 - 141.6

Non-controlling interest 854.7 787.3

Equity 783.7 645.7

Pension provisions and similar obligations 601.7 568.2

Other provisions 741.8 755.0

Non-current provisions 1,343.5 1,323.2

Financial liabilities 1,197.1 1,731.4

Lease liabilities 2,221.5 2,508.7

Derivative financial instruments 5.4 3.2

Other financial liabilities 2.6 2.8

Other non-financial liabilities 243.2 165.2

Income tax liabilities 11.1 11.1

Deferred tax liabilities 63.5 121.2

Non-current liabilities 3,744.3 4,543.8

Non-current provisions and liabilities 5,087.8 5,867.0

Pension provisions and similar obligations 30.8 33.1

Other provisions 375.9 541.0

Current provisions 406.7 574.2

Financial liabilities 272.9 319.9

Lease liabilities 698.0 698.8

Trade payables 2,628.3 3,316.5

Derivative financial instruments 225.7 57.5

Other financial liabilities 133.5 174.6

Touristic advance payments received 5,974.6 2,998.9

Other non-financial liabilities 495.1 519.9

Income tax liabilities 55.3 82.3

Current liabilities 10,483.5 8,168.6

Current provisions and liabilities 10,890.2 8,742.7

Total equity, liabilities and provisions 16,761.7 15,255.5 Alternative performance measures The Group's main financial KPI is underlying EBIT. We define the EBIT in underlying EBIT as earnings before interest, income taxes and expenses for the measurement of the Group's interest hedges. EBIT by definition includes goodwill impairments. One-off items carried here include adjustments for income and expense items that reflect amounts and frequencies of occurrence rendering an evaluation of the operating profitability of the segments and the Group more difficult or causing distortions. These items include gains on disposal of financial investments, significant gains and losses from the sale of assets as well as significant restructuring and integration expenses. Any effects from purchase price allocations, ancillary acquisition costs and conditional purchase price payments are adjusted. Also, any goodwill impairments are adjusted in the reconciliation to underlying EBIT.

Reconciliation to underlying EBIT

Q3 Q3 Var. 9M Var.

EUR million 2023 2022 % 2023 9M 2022 %

- n. - -

Earnings before income taxes 47.0 161.6 a. 601.8 1,032.6 +41.7

plus: Net interest expenses

(excluding expense / income from -

measurement of interest hedges) 120.7 130.6 7.6 353.8 384.4 - 8.0

plus: (Income) expense from - n.

measurement of interest hedges 7.7 11.5 a. 17.2 - 8.8 n. a.

- n. -

EBIT 175.4 42.5 a. 230.8 - 657.0 +64.9

Adjustments:

less / plus: Separately disclosed - -

items 11.7 8.3 13.4 5.0

plus: Expense from purchase price

allocation 5.7 7.2 18.4 21.5

- n. -

Underlying EBIT 169.4 27.0 a. 225.9 - 630.5 +64.2 The TUI Group's operating loss adjusted for special items decreased by EUR404.6m to EUR-225.9m in the first nine months 2023. The adjusted net income totaling EUR13.4m in the first nine months 2023 includes in particular a positive gain on disposal from the sale of the tour operator business by Sunwing Travel Group Inc., Ontario, which is accounted for using the equity method, in Northern Region as well as subsequent expenses from a company disposal in previous years in Hotels & Resorts. These were offset by adjusted restructuring expenses in various segments, including in particular an impairment loss on self-generated software in All other segments. The adjusted net expenses totaling EUR5.0m in the first nine months 2022 include restructuring expenses in the Northern Region, Central Region and TUI Musement as well as income from the sale of the shares in Nordotel S.A., fully consolidated in Hotels & Resorts, to Grupotel S.A., a joint venture of TUI Group. In addition, an adjustment was made for expenses from the revaluation of a purchase price receivable. Expenses for purchase price allocations of EUR18.4m (previous

year: EUR21.5m) relate in particular to the amortisation of

intangible assets from acquisitions made in previous years.

Key figures of income statement

Q3 Q3 Var. 9M Var.

EUR million 2023 2022 % 2022 9M 2022 %

+ n.

EBITDAR 453.1 175.8 157.8 481.7 1.7 a.

- - -

Operating rental expenses - 7.1 - 4.5 56.5 20.5 - 16.0 28.1

+ n.

EBITDA 446.0 171.2 160.4 461.3 - 14.2 a.

Depreciation/amortisation less - - - - -

reversals of depreciation* 270.6 213.8 26.6 692.1 - 642.8 7.7

- - +

EBIT 175.4 42.5 n. a. 230.8 - 657.0 64.9

Income/Expense from the measurement - n.

of interest hedges 7.7 11.5 n. a. 17.2 - 8.8 a.

Net interest expense (excluding

expense/income from measurement of -

interest hedges) 120.7 130.6 - 7.6 353.8 384.4 8.0

- - - +

EBT 47.0 161.6 n. a. 601.8 1,032.6 41.7

* on property, plant and equipment, intangible assets, right of use assets and other

assets Other segment indicators

Underlying EBITDA

Q3 2023 Q3 2022 Var. % 9M 2023 9M 2022 Var. %

EUR million adjusted adjusted

Hotels & Resorts 158.1 147.9 + 6.9 403.4 322.8 + 25.0

Cruises 82.8 20.7 + 299.8 133.8 - 49.8 n. a.

TUI Musement 19.8 19.6 + 0.9 5.9 0.1 n. a.

Holiday Experiences 260.8 188.2 + 38.6 543.1 273.1 + 98.9

Northern Region 69.4 - 10.9 n. a. - 47.4 - 212.9 + 77.7

Central Region 32.7 46.0 - 28.9 - 48.6 20.0 n. a.

Western Region 32.9 - 34.8 n. a. 1.0 - 55.2 n. a.

Markets & Airlines 134.8 0.3 n. a. - 94.8 - 248.1 + 61.8

All other segments - 28.9 - 7.8 - 272.9 - 66.3 - 32.7 - 102.9

TUI Group 366.6 180.8 + 102.8 382.0 - 7.7 n. a.

EBITDA

Q3 2023 Q3 2022 Var. % 9M 2023 9M 2022 Var. %

EUR million adjusted adjusted

Hotels & Resorts 149.7 147.8 + 1.3 394.6 344.7 + 14.5

Cruises 82.8 20.7 + 299.8 133.8 - 49.8 n. a.

TUI Musement 19.8 18.7 + 6.3 7.3 - 1.1 n. a.

Holiday Experiences 252.4 187.2 + 34.8 535.6 293.8 + 82.3

Northern Region 160.3 - 11.4 n. a. 44.3 - 214.8 n. a.

Central Region 32.4 37.8 - 14.4 - 49.1 - 3.8 n. a.

Western Region 32.9 - 34.9 n. a. 2.6 - 54.9 n. a.

Markets & Airlines 225.3 - 8.5 n. a. - 2.1 - 273.5 + 99.2

All other segments - 31.7 - 7.5 - 324.5 - 72.3 - 34.5 - 109.3

TUI Group 446.0 171.2 + 160.4 461.3 - 14.2 n. a.

Employees

30 Jun 2023 30 Jun 2022 Var. %

adjusted

Hotels & Resorts 28,587 27,212 + 5.1

Cruises* 76 64 + 18.8

TUI Musement 10,445 8,420 + 24.0

Holiday Experiences 39,108 35,696 + 9.6

Northern Region 11,002 10,191 + 8.0

Central Region 7,094 7,063 + 0.4

Western Region 5,566 5,110 + 8.9

Markets & Airlines 23,662 22,364 + 5.8

All other segments 2,248 1,998 + 12.5

Total 65,018 60,058 + 8.3

* Excludes TUI Cruises (JV) employees. Cruises employees are primarily hired by

external crew management agencies. Cautionary statement regarding forward-looking statements The present Quarterly Statement contains various statements relating to TUI Group's and TUI AG's future development. These statements are based on assumptions and estimates. Although we are convinced that these forward-looking statements are realistic, they are not guarantees of future performance since our assumptions involve risks and uncertainties that could cause actual results to differ materially from those anticipated. Such factors include market fluctuations, the development of world market prices for commodities and exchange rates or fundamental changes in the economic environment. TUI does not intend to and does not undertake any obligation to update any forward-looking statements in order to reflect events or developments after the date of this Statement. Financial calendar

Date

Quarterly Statement Q3 2023 9 August 2023

Trading Update 19 September 2023

Annual Report 2023 6 December 2023 Contacts Nicola Gehrt Group Director Investor Relations Tel: + 49 (0)511 566 1435 Adrian Bell Senior Manager Investor Relations Tel: + 49 (0)511 2332 James Trimble Investor Relations Manager Tel: +44 (0)1582 315 293 Stefan Keese Investor Relations Manager Tel: + 49 (0)511 566 1387 Anika Heske Junior Investor Relations Manager Tel: + 49 (0)511 566 1425 TUI AG Karl-Wiechert-Allee 4 30625 Hannover Tel: + 49 (0)511 566 00 www.tuigroup.com This Quarterly Statement, the presentation slides and the video webcast for Q3 2023 (published on 9 August 2023) are available at the following link: www.tuigroup.com/en-en/investors

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement, transmitted by EQS

Group. The issuer is solely responsible for the content of this

announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: DE000TUAG505

Category Code: QRT

TIDM: TUI

LEI Code: 529900SL2WSPV293B552

OAM Categories: 3.1. Additional regulated information required to be disclosed under the laws of a Member State

Sequence No.: 263250

EQS News ID: 1698881

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1698881&application_name=news

(END) Dow Jones Newswires

August 09, 2023 02:00 ET (06:00 GMT)

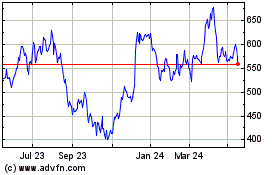

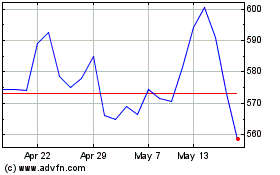

Tui (LSE:TUI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Tui (LSE:TUI)

Historical Stock Chart

From Jul 2023 to Jul 2024