TUI AG (TUI) TUI AG: Q4 Pre-Close Trading Update 20-Sep-2022 /

08:00 CET/CEST Dissemination of a Regulatory Announcement,

transmitted by EQS Group. The issuer is solely responsible for the

content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

20 September 2022

TUI GROUP

Q4 Pre-Close Trading Update

Prior to entering its close period ahead of reporting its full

year results for the twelve months ending 30 September 2022 in

December, TUI Group announces the following trading update.

Summer 2022 set to close in line with our expectations, later

booking pattern continues into Winter with strong ASP

-- Q4 expected to deliver further strong progress - Hotels &

Resorts set to deliver its 5th consecutivepositive quarter. Cruise

and TUI Musement with significant improvement. Markets &

Airlines significantly profitabledespite airport disruptions

Market & Airlines

-- Overall Summer 2022 programme^1 totals 12.9m bookings, an

increase of 1.4m since Q3 update, with bookingsat 91% of Summer

2019 levels. The key departure months of July and August closed at

94% of Summer 2019 levels

-- ASP continues to hold up strongly at +18% versus Summer 2019,

which will help to soften the impact fromthe current higher

inflationary environment

-- UK Summer 2022 cumulative bookings remain +4% ahead of Summer

2019, with booking momentum in Germany andNetherlands well ahead of

Summer 2019 levels since our Q3 update

-- Flight disruption costs remain at elevated levels but

continued to improve through Q4

-- Winter 2022/23 bookings^1 are at an early stage and our

current assumption is for a Winter programmeclose to normalised

pre-pandemic levels with the option to flexibly adjust capacity in

line with customer demand.We will leverage our flexible and

integrated business model to ensure we provide our customers not

only with thebest winter holiday experience but also the assurance

that TUI remains the best choice for holiday travel

-- Against this background, Winter 2022/23 bookings^1 stand at

78% of Winter 2018/19 levels with the neardeparture months of

November and December at 81%. To date Winter ASP is higher at

26%

-- As usual, the UK, with 36% of the programme sold, is the most

advanced booked at +9% and ASP up +22%versus Winter 2018/19

-- Q1 bookings, which represent a mix of late Summer and early

Winter, are 54% sold compared to around 60%in a normalised year

-- As in Summer, we continue to see a trend towards a higher

share of short-term bookings for Winter andstrong pricing,

confirming solid customer demand for holiday travel

Holiday Experiences

-- Hotels & Resorts continues to perform strongly in Q4,

with July and August occupancies broadly in linewith and average

rates above pre-pandemic levels, highlighting the strength of our

integrated business model andour strong distribution power. We

expect to see continued strong demand for Winter 2022/23 especially

in theCanaries and the Caribbean

-- Cruises continues to recover in Q4, with occupancies building

strongly and rates achieving 2019 levels.Winter 2022/23 occupancies

are developing in line with our expectations at rates above 2019

levels. Short-termbookings continue to represent a large proportion

of overall bookings, however, the proportion of mid-term bookingsis

increasing as customer confidence returns

-- TUI Musement has significantly increased the sale of tours

and activities to 6.3m year-to date (1.2myear-to-date prior

year)

TUI Group

-- For financial year 2022, we re-confirm our expectations to

return to significant positive underlying EBIT^2 and also remain

committed to deliver our mid-term ambitions: underlying EBIT to

significantly build on FY19^3,driven by both top line growth and

GRP4 benefits and to return to a gross leverage ratio5 of less than

3.0x

-- ESG Update: Sustainability and ambitious ESG standards are a

very high priority for the Board and GroupExecutive Committee. The

criteria and approaches of the Global Sustainable Tourism Council

(GSTC) are ouraspiration and the benchmark for our actions in more

and more areas. We are taking a new approach to applying theGSTC

sustainability standards to our excursion portfolio. Our aim is to

create a broad offer for our customers andlead them to more

sustainable excursions. TUI is also pursuing ambitious climate

targets to make the agreements ofthe Paris Climate Agreement and

the EU Green Deal a success. TUI has submitted its emissions

reduction targets tothe Sciene Based Targets Initiative (SBTi) and

will transparently document its targets, actions and timeline

toSBTi. The sustainability agenda is to be presented after

confirmation of the targets by SBTi

-- TUI Group will issue its Annual Report on Wednesday 14

December 2022 and hold a presentation forinvestors and analysts on

the same day. Further details will follow

^1 These statistics are up to 11th September 2022, shown on a

constant currency basis and relate to all customers whether risk or

non-risk

^2 In view of the ongoing COVID 19 pandemic and the war in

Ukraine, the assumptions for underlying EBIT are subject to

considerable uncertainty. The greatest area of uncertainty will be

the impact on consumer confidence, should travel restrictions be

reintroduced, should there be further cost inflation volatility

and/or an escalation of the war in Ukraine

^3 FY19A underlying EBIT of EUR893m excluding EUR293m Boeing MAX

cost impact

^4 Global Realignment Programme

^5 Defined as gross debt (Financial liabilities incl. lease

liabilities & net pension obligations) divided by underlying

EBITDA/R

Chief Executive Officer of TUI Group, Fritz Joussen, and CFO,

Sebastian Ebel, commented:

"In 2022, we see a strong travel summer almost at the same level

as summer 2019. We confirm our guidance and will successfully close

the 2022 financial year with a significantly positive underlying

EBIT. In the UK, bookings continue to be well above pre-crisis

levels at +4% and bookings in Germany and the Netherlands have also

been above pre-crisis levels in recent weeks. The trend has been

towards higher value or longer holidays with a higher overall

holiday budget. This is encouraging and shows the current

importance of holidays and travel experiences in the post-Corona

era. Our strong brand, exclusive product portfolio with proprietary

holiday experiences at hotels, clubs and cruise ships, and strong

presence in destinations are competitive advantages that will

continue to pay off and that we are building on. Through the

efficiency programmes successfully implemented during the pandemic,

we have also significantly and sustainably reduced our cost

structure. We are leaner, more digital and more efficient. This

gives us the freedom to invest in the customer and the holiday

experience: Quality, service and sustainability are our focus."

Current Trading

Overall Summer 2022 programme1 now totals 12.9m bookings, an

increase of 1.4m since our August update, with bookings currently

at 91% of Summer 2019 levels. Overall ASP continues to hold up

strongly at +18% versus Summer 2019, reflecting a higher mix of

package products and the popularity of our summer holidays which

will help to soften the impact from the current higher inflationary

environment. Over 5.3m customers departed for their TUI holiday

during the main Summer months of July and August, doubling the 2.6m

customers who travelled in July and August last year and closed at

94% of Summer 19 levels. The UK continues to remain our most

advanced market in terms of bookings, with cumulative volumes

remaining ahead of Summer 2019 at +4%. In particular, we see strong

booking momentum in Germany and Netherlands since the Q3 update,

with bookings up +13% and +16% respectively against Summer 2019

levels. The Canaries, the Balearics, Greece and Turkey continue to

be popular Summer destinations for customers. We are pleased to see

flight disruption, predominately experienced in the UK throughout

May & June, improve through Q4, although still at elevated

levels.

Winter 2022/23 bookings1 are at an early stage and our current

assumption is for a Winter programme close to normalised

pre-pandemic levels with the option to flexibly adjust capacity in

line with customer demand. We will leverage our flexible and

integrated business model to ensure we provide our customers not

only with the best winter holiday experience but also the assurance

that TUI remains the best choice for holiday travel. At this early

stage 26% of the programme has been sold, with bookings at 78% and

the near departure months of November and December at 81% of Winter

2018/19 levels. Winter ASPs to date are higher at 26%. As usual,

the UK, with 36% of the programme sold, is the most advanced booked

at +9% and ASP up +22% versus Winter 2018/19. The Canaries, Mexico,

Egypt and Cape Verde are likely to form a key part of our holiday

offer this upcoming winter. Q1 bookings, which represent a mix of

late Summer and early Winter, are 54% sold compared to around 60%

in a normalised year. As in Summer, we continue to see a trend

towards a higher share of short-term bookings for Winter and strong

pricing, confirming solid customer demand for holiday travel.

In Hotels & Resorts, as of the end of August, 350 hotels

were in operation across key destinations such as the Canaries, the

Balearics, Greece and Turkey for both Markets & Airlines and

third-party customers. Hotels & Resorts continues to perform

strongly in Q4, with July and August occupancies broadly in line

and average rates above pre-pandemic levels, highlighting the

strength of our integrated business model and our strong

distribution power. For Winter 2022/23, we expect to see continued

strong demand for year-round destinations such as the Canaries and

the Caribbean with occupancies and average rates developing

strongly, however, with the short-term booking environment to

remain.

(MORE TO FOLLOW) Dow Jones Newswires

September 20, 2022 02:00 ET (06:00 GMT)

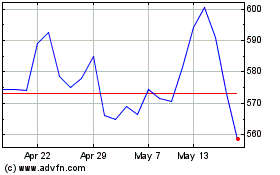

Tui (LSE:TUI)

Historical Stock Chart

From Jun 2024 to Jul 2024

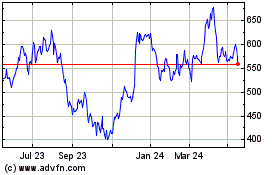

Tui (LSE:TUI)

Historical Stock Chart

From Jul 2023 to Jul 2024