Airline spares and operating equipment 29.2 38.6

Real estate for sale 14.6 33.1

Consumables used in hotels 16.4 20.6

Other inventories 13.0 22.5

Total 73.2 114.7

In financial year 2020, inventories of &euro 411.7 m (previous year &euro 619.1 m) were recognised as expense. A write-down of real

estate for sale to net realizable value resulted in expenses of &euro 17.2 m in the financial year.

(22) Cash and cash equivalents

Cash and cash equivalents

&euro million 30 Sep 2020 30 Sep 2019

Bank deposits 1,225.0 1,712.7

Cash in hand and cheques 8.1 28.8

Total 1,233.1 1,741.5

At 30 September 2020, cash and cash equivalents of &euro 324.0 m were subject to restrictions (previous year &euro 203.1 m).

On 30 September 2016, TUI AG entered into a long term agreement to close the gap between the obligations and the fund assets of defined

benefit pension plans in the UK. At the balance sheet date an amount of &euro 52.0 m is deposited as security within a bank account. TUI

Group can only use that cash and cash equivalents if it provides alternative collateral.

Further, an amount of &euro 116.5 m (previous year &euro 116.5 m) was deposited with a Belgian subsidiary without acknowledgement of debt

by the Belgian tax authorities in financial year 2013 in respect of long-standing litigation over VAT refunds for the years 2001 to 2011.

The purpose was to suspend the accrual of interest for both parties. In order to collateralise a potential repayment, the Belgian

government was granted a bank guarantee. Due to the bank guarantee, TUI's ability to dispose of the cash and cash equivalents has been

restricted. The remaining restrictions relate to funds that must be held in reserve due to legal or regulatory requirements, including

those to secure travel funds received from customers.

(23) Assets held for sale

Assets held for sale

&euro million 30 Sep 2020

Aircraft 42.4

Investments in joint ventures and associates 13.1

Other assets 1.7

Total 57.2

In March 2019 TUI Group sold Corsair S. A. to Diamondale Ltd. At the same time, TUI Group acquired a 27 % stake in Diamondale Ltd for 1

euro. Since then the investment in Diamondale Ltd is presented as an associated company with a book value of 1 euro. At the moment TUI

Group is negotiating to dispose its investment in Diamondale Ltd. As part of this transaction an aircraft together with related financial

liabilities should be transferred to Corsair S. A. The negotiations are advanced. TUI Group expects to close this transaction in the

financial year 2021.

Therefore these assets and liabilities presented within Markets & Airlines are classified as held for sale. On classification the

aircraft was measured at fair value less cost to sell. An impairment loss of &euro 46.5 m was recognized in cost of sales and the book

value of the aircraft of &euro 24.5 m as an asset held for sale.

Due to the expected sale, an additional aircraft of the sector Markets & Airlines with a book value of &euro 17.9 m was reclassified to

assets held for sale as at 30 September 2020.

On 29 September 2020, an agreement was concluded on the sale of the joint venture Karisma Hotels Caribbean S. A. The closing of the

transaction is subject to the usual terms and conditions, in particular approval by the relevant competition authorities. Accordingly,

the carrying amount of the shareholding which is presented in the segment Hotels & Resorts of &euro 13.1 m was classified as held for

sale. With this transaction the hotel portfolio in the caribbean will be focused. We do not expect a material result out of this

transaction.

Included in other assets is a cruise ship of Marella Cruises of the segment cruises with a book value of &euro 1.4 m. The cruise ship was

valued at fair value less cost to sell. The resulting impairment of &euro 52.1 m was recognized in cost of sale. The cruise ship was

decommissioned due to the renewal of the cruise ship fleet of Marella Cruise and will be sold in October 2020.

In the financial year under review, Hapag-Lloyd Kreuzfahrten GmbH was reclassified to assets held for sale. The disposal was completed at

the beginning of July 2020. In the prior year, the two specialist tour operators Berge & Meer and Boomerang in Central Region had been

carried in this item with &euro 50.0 m. These tour operators were sold as at 1 October 2019. For further details, please refer to the

section 'Divestments'.

Disposal group 'Berge & Meer' and 'Boomerang'

&euro million 30 Sep 2019

Other intangible assets and property, 4.2

plant and equipment

Trade and other receivables 2.3

Derivative financial instruments 2.9

Income tax assets 1.1

Touristic payments on account 25.7

Other non-financial assets 7.1

Cash and cash equivalents 6.1

Other assets 0.6

Total 50.0

(24) Subscribed capital

The fully paid subscribed capital of TUI AG consists of no-par value shares, each representing an identical share in the capital stock.

The proportionate share in the capital stock per no-par value share is around &euro 2.56. As the capital stock consists of registered

shares, the owners are listed by name in the share register.

The subscribed capital of TUI AG has been registered in the commercial registers of the district courts of Berlin-Charlottenburg and

Hanover. In the financial year, it rose by a total of 1,394,512 employee shares. It thus comprised 590,415,100 shares (previous year

589,020,588 shares) as at the end of the financial year. It rose by &euro 3.6 m to &euro 1,509.4 m.

The Annual General Meeting on 11 February 2020 authorised the Executive Board of TUI AG to acquire own shares of up to 5 % of the capital

stock. The authorisation will expire on 10 August 2021. The authorisation to acquire own shares has not been used to date.

In August 2020, TUI AG acquired 102,293 own shares to issue to employees as part of the employee share programme in accordance with § 71

Para. 1 No. 2 AktG. This corresponds to a purchase volume of &euro 1.0 m.

Conditional capital

The Annual General Meeting on 9 February 2016 had created conditional capital of &euro 150.0 m and authorised the Company to issue bonds.

The conditional capital authorisation to acquire bonds with conversion or option rights and profit participation (with or without a mixed

maturity) is limited to a nominal amount of &euro 2.0 bn and expires on 8 February 2021. This authorisation was fully used with the

issuance of a bond with warrants with a volume of &euro 150 m to the Economic Stabilisation Fund in October 2020.

Overall, TUI AG's total conditional capital remained flat year-on-year at &euro 150.0 m as at 30 September 2020.

Authorised capital

The Annual General Meeting on 13 February 2018 resolved to create additional authorised capital of &euro 30.0 m for the issue of employee

shares. The Executive Board of TUI AG has been authorised to use this authorised capital in one or several transactions to issue employee

shares against cash contribution by 12 February 2023. 1,394,512 (previous year 1,119,284) new employee shares were issued in the

completed financial year so that authorised capital totals around &euro 22.3 m (previous year &euro 25.8 m) at the balance sheet date.

The Annual General Meeting on 9 February 2016 resolved an authorisation to issue new registered shares against cash contribution for up

to a maximum of &euro 150.0 m. This authorisation will expire on 8 February 2021.

The Annual General Meeting on 9 February 2016 also resolved to create authorised capital for the issue of new shares against cash or

non-cash contribution for up to &euro 570.0 m. The issue of new shares against non-cash contribution is limited to a maximum of &euro

300.0 m. The authorisation for this authorised capital will expire on 8 February 2021.

At the balance sheet date, the accumulated authorised capital that had not yet been taken up amounted to &euro 742.3 m (previous year

&euro 745.8 m).

(25) Capital reserves

The capital reserves comprise transfers of premiums. They also comprise amounts entitling the holders to acquire shares in TUI AG in the

framework of bonds issued for conversion options and warrants. Premiums from the issue of shares due to the exercise of conversion

options and warrants were also transferred to the capital reserve.

Capital reserves rose by &euro 3.5 m (previous year &euro 7.0 m) due to the issue of employee shares in the completed financial year.

(26) Revenue reserves

In the completed financial year, TUI AG paid a dividend of &euro 0.54 per no-par value share to its shareholders; the total amount paid

was &euro 318.1 m (previous year &euro 423.3 m). The share of non-controlling interests declined by &euro 0.2 m (previous year &euro 52.5

m) in financial year 2020 due to the issue of dividends.

The ongoing recording of existing equity-settled stock option plans resulted in an increase in equity of &euro 2.9 m in the reporting

period. Disclosures on these long-term incentive programmes are outlined in the section on Share-based payments in accordance with IFRS

2.

In financial year 2019, the movement in the first-time consolidation of non-controlling interests was essentially attributable to the

non-controlling interests of the acquired companies in Destination Management worth &euro 3.5 m.

Foreign exchange differences comprise differences from the translation of the financial statements of foreign subsidiaries as well as

differences from the translation of goodwill denominated in foreign currencies.

The proportion of gains and losses from hedges used as effective hedges of future cash flows is carried directly in equity at &euro -

316.1 m (previous year &euro 340.0 m) (pre-tax). A reversal of this provision through profit and loss takes place in the same period in

which the hedged item has an effect on profit and loss or is no longer assessed as probable. The decrease in financial year 2020 is,

besides changes in exchange rates and fuel prices, attributable to the premature termination of hedging instruments, which have not

fulfilled the IAS 39 criteria of high likelihood of occurence of the underlying transaction any longer due to the COVID-19-pandemic.

The revaluation of pension obligations (in particular actuarial gains and losses) is also carried directly in equity.

The revaluation reserve formed in accordance with IAS 27 (old version) in the framework of step acquisitions of companies is retained

until the date of deconsolidation of the company concerned.

(27) Use of Group profit available for distribution

In accordance with the German Stock Corporation Act, the Annual General Meeting resolves the use of the profit available for distribution

carried in TUI AG's commercial-law annual financial statements. TUI AG's loss for the year amounts to &euro 2,272.6 m (previous year

&euro 120.0 m profit). Taking account of profit carried forward of &euro 1,176.0 m (previous year &euro 1,374.1 m) and a reduction of

revenue reserves of &euro 1,287.5 m, TUI AG's profit available for distribution totals &euro 190.9 m (previous year &euro 1,494.1 m). A

proposal will be submitted to the Annual General Meeting to use the profit available for distribution for the financial year under review

to carry the amount forward on account.

(28) Non-controlling interest

Non-controlling interests mainly relate to RIUSA II S. A. based in Palma de Mallorca, Spain. TUI's capital share in this hotel operator

stands at 50.0 %, as in the prior year.

The financial year of RIUSA II S. A. ends on 31 December and thus deviates from TUI Group's financial year. This reporting date was fixed

when the company was founded. In order to include the RIUSA II Group in TUI Group's consolidated financial statements as at 30 September,

the RIUSA II Group prepares sub-group financial statements as at 30 September, the balance sheet date.

RIUSA II Group, allocated to Hotels & Resorts, operates owned and leased hotels and hotels operated under management contracts in tourism

destinations of TUI Group.

The table below provides summarised financial information on RIUSA II S. A., Palma de Mallorca, Spain - the subsidiary for which material

non-controlling interests exist. It presents the consolidated financial statements of the sub-group.

Summarised financial information on RIUSA II S. A., Palma de

Mallorca, Spain *

&euro million 30 Sep 2020 / 30 Sep 2019 /

2020 2019

Current assets 153.6 215.6

Non-current assets 1,755.5 1,729.8

Current liabilities 115.8 116.8

Non-current liabilities 127.1 86.2

Revenues 449.3 850.0

Profit / loss 28.4 225.6

Other comprehensive income - 104.6 20.1

Cash inflow / outflow from operating 149.4 256.5

activities

Cash inflow / outflow from investing - 143.5 - 205.3

activities

Cash inflow / outflow from financing - 6.6 - 111.5

activities

Accumulated non-controlling interest 661.5 699.6

Profit / loss attributable to 14.2 112.8

non-controlling interest

Dividends attributable to - 51.4

non-controlling interest

* Consolidated Subgroup

(29) Pension provisions and similar obligations

A number of defined contribution and defined benefit pension plans are operated for Group employees. Pension obligations vary, reflecting

the different legal, fiscal and economic conditions in each country of operation, and usually depend on employees' length of service and

pay levels.

All defined contribution plans are funded by the payment of contributions to external insurance companies or funds. German employees

enjoy benefits from a statutory defined contribution plan paying pensions as a function of employees' income and the contributions paid

in. Several additional industry pension organisations exist for TUI Group companies. Once the contributions to the state-run pension

plans and private pension insurance organisations have been paid, the Company has no further payment obligations. Apart from Germany,

major defined contribution plans are also operated the Netherlands and in the UK. Contributions paid are expensed for the respective

period. In the reporting period, the expenses for all defined contribution plans totalled &euro 86.7 m (previous year &euro 93.4 m).

Apart from these defined contribution pension plans, the TUI Group operates defined benefit plans, which usually entail the formation of

provisions within the Company or investments in funds outside the Company.

Within this group, MER-Pensionskasse VVaG, a private pension fund in which German companies of the tourism industry are organised,

represents a multi-employer plan classified as a defined benefit plan. In accordance with the statues of the plan, the plan participants

and the employers pay salary-based contributions into the plan. There are no further obligations pursuant to the statutes of the plan; an

additional funding obligation of the participating companies is explicitly excluded. The paid-in contributions are invested in accordance

with the policies of the pension plan unless they are used in the short term for benefit payments. As the investments are pooled and are

not kept separately for each participating employer, an allocation of plan assets to individual participating employers is not possible.

The investment risk and the mortality risk are jointly shared by all plan participants. Moreover, the pension fund does not provide any

information to participating companies that would allow the allocation of any over- or underfunding or TUI's participation in the plan.

For this reason, accounting for the plan as defined benefit plan is not possible, and the plan is therefore in accordance with the

requirements of IAS 19 shown like a defined contribution plan. In the reporting period, contributions to MER-Pensionskasse VVaG totalled

&euro 6.1 m (previous year &euro 5.9 m). For the next financial year, contributions are expected to remain at that level.

TUI Group's major pension plans recognised as defined benefit plans exist in Germany and the UK. By far the largest pension plans are

operated by the Group's tour operators in the UK. They accounted for 70.6 % (previous year 70.9 %) of TUI Group's total obligations at

the balance sheet date. German plans account for a further 24.8 % (previous year 24.4 %).

Material defined benefit

plans in Great Britain

Scheme name Status

BAL Scheme closed

TUI UK Scheme closed

TAPS Scheme closed

Almost all defined benefit plans in the UK are funded externally. Under UK law, the employer is obliged to ensure sufficient funding so

that plan assets cover the pension payments to be made and the administrative costs of the funds. The pension funds are managed by

independent trustees. The trustees comprise independent members, beneficiaries of the plan and employer representatives. The trustees are

responsible for the investment of fund assets, taking account of the interests of plan members, but they also negotiate the level of the

contributions to the fund to be paid by the employers, which constitute minimum contributions to the funds. To that end, actuarial

valuations are made every three years by actuaries commissioned by the trustees. The annual contributions to be paid to the funds in

order to cover any shortfalls were last defined on the basis of the measurement as at 30 September 2016. The actuarial measurement as at

30 September 2019 had not yet been finalised at the reporting date.

Since 31 October 2018, the main sections of TUI Group's UK Pension Trust have been closed to future accrual of benefits, which has led to

a significant decrease in the current service cost for services delivered by the employees. As a result, current service cost no longer

arises for services delivered by the employees. Since 1 November 2018, increases in accrued pension benefits from the plan have been

therefore calculated in line with the rules for retired pension rights holders. With the closure of the Pension Trust for future accrual,

all existing staff in the defined benefit scheme were offered the opportunity to join the existing defined contribution plan to accrue

pension from 1 November 2018 onwards.

By contrast, defined benefit plans in Germany are mainly unfunded and the obligations from these plans are recognised as provisions. The

company assumes the obligation for payments of company pensions when the beneficiaries reach the legal retirement age. The amount of the

pension paid usually depends either on the remuneration received by the employee at the retirement date or the amount of the average

remuneration over the employee's service period. Pension obligations usually include surviving dependants' benefits and invalidity

benefits. Pension payments are partly limited by third party compensations, e. g. from insurances and MER-Pensionskasse.

Material defined benefit plans in Germany

Scheme name Status

Versorgungsordnung TUI AG open

Versorgungsordnung TUIfly GmbH open

Versorgungsordnung TUI Deutschland GmbH closed

Versorgungsordnung TUI Beteiligungs GmbH closed

Versorgungsordnungen TUI Immobilien closed

Services GmbH

In the period under review, defined benefit pension obligations created total expenses of &euro 48.0 m for TUI Group, essentially

comprising current service cost. The expenses carried in the previous financial year additionally included a negative past service cost

arising from a plan change in the TUI Group UK Pension Trust.

The net interest expense from pensions declined substantially year-on-year, as many of the pension plans in the UK have a surplus and

therefore generate an interest surplus, which nearly fully offsets the interest expense for the Group's unfunded or underfunded pension

plans.

Pension costs for defined benefit obligations

&euro million 2020 2019

Current service cost for 49.5 39.9

employee service in the period

Curtailment gains 4.0 0.7

Net interest on the net 2.5 13.4

defined benefit liability

Past service cost - - 24.0

Total 48.0 28.6

Provisions for pension obligations are established for benefits payable in the form of retirement, invalidity and surviving dependants'

benefits. Provisions are exclusively formed for defined benefit schemes under which the Company guarantees employees a specific pension

level, including arrangements for early retirement and temporary assistance benefits.

Defined benefit obligation recognised on the balance sheet

&euro million 30 Sep 2020 30 Sep 2019

Total Total

Present value of funded obligations 3,071.3 3,176.5

Fair value of external plan assets 3,373.7 3,397.9

Surplus (-) / Deficit (+) of funded - 302.4 - 221.4

plans

Present value of unfunded pension 954.1 979.4

obligations

Defined benefit obligation recognised on 651.7 758.0

the balance sheet

of which

Overfunded plans in other non-financial 363.3 310.0

assets

Provisions for pensions and similar 1,015.0 1,068.0

obligations

of which current 31.4 32.4

of which non-current 983.6 1,035.6

For funded pension plans, the provision carried only covers the shortfall in coverage between plan assets and the present value of

benefit obligations.

Where plan assets exceed funded pension obligations, taking account of a difference due to past service cost, and where at the same time

there is an entitlement to reimbursement or reduction of future contributions to the fund, the excess is recognised in conformity with

the cap defined by IAS 19. As at 30 September 2020, other non-financial assets include excesses of &euro 363.3 m (previous year &euro

310.0 m).

Development of defined benefit obligations

&euro million Present value Fair value of Total

of obligation plan assets

Balance as at 1 Oct 4,155.9 - 3,397.9 758.0

2019

Current service cost 49.5 - 49.5

Past service cost - - -

Curtailments and - 4.5 0.5 - 4.0

settlements

Interest expense (+) 58.3 - 55.8 2.5

/ interest income (-)

Pensions paid - 179.8 148.6 - 31.2

Contributions paid by - - 81.5 - 81.5

employer

Contributions paid by 1.6 - 1.6 -

employees

Remeasurements 28.2 - 53.7 - 25.5

due to changes in 8.2 - 8.2

financial assumptions

due to changes in 59.8 - 59.8

demographic

assumptions

due to experience - 39.8 - - 39.8

adjustments

due to return on plan - - 53.7 - 53.7

assets not included

in

group profit for the

year

Exchange differences - 62.8 67.7 4.9

Other changes - 21.0 - - 21.0

Balance as at 30 Sep 4,025.4 - 3,373.7 651.7

2020

Development of defined benefit obligations

&euro million Present value Fair value of Total

of obligation plan assets

Balance as at 1 Oct 3,570.8 - 2,701.1 869.7

2018

Current service cost 39.9 - 39.9

Past service cost - 24.0 - - 24.0

Curtailments and - 0.7 - - 0.7

settlements

Interest expense (+) 85.4 - 72.0 13.4

/ interest income (-)

Pensions paid - 166.2 134.6 - 31.6

Contributions paid by - - 111.5 - 111.5

employer

Contributions paid by 1.8 - 1.8 -

employees

Remeasurements 670.4 - 650.5 19.9

due to changes in 734.1 - 734.1

financial assumptions

due to changes in - 65.4 - - 65.4

demographic

assumptions

due to experience 1.7 - 1.7

adjustments

due to return on plan - - 650.5 - 650.5

assets not included

in

group profit for the

year

Exchange differences - 8.6 4.4 - 4.2

Other changes - 12.9 - - 12.9

Balance as at 30 Sep 4,155.9 - 3,397.9 758.0

2019

In the financial year under review, both pension obligations and the value of the plan assets fluctuated, at times strongly, in

particular following the outbreak of the COVID-19-crisis in March. However, at the end of the financial year under review, the Group

posted only slight year-on-year variations. The net obligation declined by &euro 106.3 m to &euro 651.7 m, primarily due to pension

payments and contributions to the pension funds.

At the balance sheet date, TUI Group's fund assets break down as shown in the table below.

Composition of fund assets at the balance sheet date

30 Sep 2020 30 Sep 2019

Quoted market price Quoted market price

in an active market in an active market

&euro yes no yes no

million

Fair value 2,902.5 471.2 2,213.5 1,184.4

of fund

assets at

end of

period

of which 36.3 - 39.3 -

equity

instruments

of which 36.2 - 33.5 -

government

bonds

of which 929.1 - 496.6 -

corporate

bonds

of which 1,449.4 - 1,181.6 -

liability

driven

investments

of absolute 184.9 - 182.8 -

return

bonds

of which 262.7 - 276.0 -

property

of which - 111.2 - 100.1

insurance

policies

of which - 130.9 - 130.3

insurance

linked

securities

of which - 204.0 - 195.9

loans

of which - 25.1 - 751.5

cash

of which 3.9 - 3.7 6.6

other

At the balance sheet date, as in the prior year, fund assets did not comprise any direct investments in financial instruments issued by

TUI AG or its consolidated subsidiaries or any property owned by the Group. For funded plans, investments in passive index tracker funds

may entail a proportionate investment in Group-owned financial instruments.

Pension obligations are measured on the basis of actuarial calculations based on country-specific parameters and assumptions. The

obligations under defined benefit plans are calculated on the basis of the internationally accepted projected unit credit method, taking

account of expected future increases in salaries and pensions. For the pension plans in the UK, expected increases in salaries are not

taken into account as they are no longer relevant for the measurement due to the plan amendment outlined above.

Actuarial assumptions

30 Sep 2020

Percentage Germany Great Other

p. a. Britain countries

Discount 0.7 1.6 0.7

rate

Projected 2.5 0.0 0.9

future

salary

increases

Projected 1.8 2.8 1.3

future

pension

increases

30 Sep 2019

Percentage Germany Great Other

p. a. Britain countries

Discount 0.7 1.7 0.2

rate

Projected 2.5 - 1.2

future

salary

increases

Projected 1.8 3.1 0.9

future

pension

increases

The interest rate applicable in discounting the provision for pensions is based on an index for corporate bonds adjusted for securities

already downgraded and under observation by rating agencies as well as subordinate bonds in order to meet the criterion for high quality

bonds (rated AA or higher) required under IAS 19. The resulting yield structure is extrapolated on the basis of the yield curves for

almost risk-free bonds, taking account of an appropriate risk mark-up reflecting the term of the obligation. In order to cover a

correspondingly broad market, an index partly based on shorter-term bonds is used (for instance for Eurozone bonds from the iBoxx &euro

Corporates AA 10+ and iBoxx &euro Corporates AA 7-10).

Apart from the parameters described above, a further key assumption relates to life expectancy. In Germany, the Heubeck reference tables

2018 G are used to determine life expectancy. In the UK, the S3NxA base tables are used, adjusted to future expected increases on the

basis of the Continuous Mortality Investigation (CMI) 2019. The pension in payment escalation formulae depend primarily on the pension

plan concerned. Apart from fixed rates of increase, there are also a number of inflation-linked pension adjustment mechanisms in

different countries.

Changes in the key actuarial assumptions mentioned above would lead to the changes in defined benefit obligations presented below. The

methodology used to determine sensitivity corresponds to the method used to calculate the defined benefit obligation. The assumptions

were amended in isolation each time; actual interdependencies between the assumptions were not taken into account. The effect of the

increase in life expectancy by one year is calculated by means of a reduction in mortality due to the use of the Heubeck tables 2018 G

for pension plans in Germany. In the UK, an extra year is added to the life expectancy determined on the basis of the mortality tables.

Sensitivity of the defined benefit obligation due to

changed actuarial assumptions

30 Sep 2020 30 Sep 2019

&euro + 50 - 50 Basis + 50 Basis - 50 Basis

million Basis points points points

points

Discount - 342.5 + 393.5 - 388.7 + 450.8

rate

Salary + 17.1 - 16.0 + 18.9 - 18.7

increase

Pension + 119.1 - 119.7 + 142.2 - 139.6

increase

+ 1 year + 1 year

Life + 177.2 - + 182.8 -

expectancy

The weighted average duration of the defined benefit obligations totalled 19.6 years (previous year 19.6 years) for the overall Group. In

the UK, the weighted duration was 19.9 years (previous year 19.9 years), while it stood at 19.6 years (previous year 19.6 years) in

Germany.

Fund assets are determined on the basis of the fair values of the funds invested as at 30 September 2020. The interest rate used to

determine the interest income from the assets of external funds is identical with the discount rate used for the defined benefit

obligation.

For the forthcoming financial year, the companies of TUI Group are expected to contribute around &euro 112.7 m (previous year &euro 94.1

m) to pension funds and pay pensions worth &euro 31.4 m (previous year &euro 32.4 m) for unfunded plans. The expected employer

contribution to the pension funds mainly includes the annual payment agreed with the trustees in the UK to reduce the existing coverage

shortfall. For funded plans, the payments to the recipients are fully made from fund assets and therefore do not result in a cash outflow

for TUI Group.

TUI Group's defined benefit plans entail various risks; some of which may have a substantial effect on the Company.

Investment risk

The investment risk plays a major role, in particular for the large funded plans in the UK. Although shares usually outperform bonds in

terms of producing higher returns, they also entail stronger volatility of balance sheet items and the risk of short-term shortfalls in

coverage. In order to limit this risk, the trustees have built a balanced investment portfolio to limit the concentration of risks.

Interest rate risk

The interest rate influences in particular unfunded schemes in Germany as a decline in interest rates leads to an increase in the defined

benefit obligations. Accordingly, an increase in the interest rate leads to a reduction in the defined benefit obligations. Funded plans

are less strongly affected by this development as the performance of the interest-bearing assets included in plan assets regularly

dampens the effects. For the funded plans in the UK, the trustees have invested a part of the plan assets in liability-driven investment

portfolios, holding credit and hedging instruments in order to largely offset the impact of changes in interest rates.

Inflation risk

An increase in the inflation rate normally increases the obligation in pension schemes linked to the final salary of beneficiaries as

inflation causes an increase in the projected salary increases. At the same time, inflation-based pension increases included in the plan

also rise. The inflation risk is reduced through the use of caps and collars. Moreover, the large pension funds in the UK hold

inflation-linked assets, which also partly reduce the risk from a significant rise in inflation. By investing, in particular, plan assets

in liability-driven investment portfolios, which hold credit and hedging instruments, they aim to largely offset the impact of the

inflation rate.

Longevity risk

An increasing life expectancy increases the expected benefit duration of the pension obligation. This risk is countered by using

regularly updated mortality data in calculating the present values of the obligation.

Currency risk

For the TUI Group, the pension schemes entail a currency risk as most pension schemes are operated in the UK and therefore denominated in

sterling. The risk is limited as the currency effects on the obligation and the assets partly offset each other. The currency risk only

relates to any excess of pension obligations over plan assets or vice versa.

(30) Other provisions

Development of provisions in the FY 2020

&euro million Balance First-time Balance Changes Usage Reversal Additions Balance

as at adoption as at with no as at

30 Sep of 1 Oct effect 30 Sep

2019 IFRS 16 2019 on 2020

restated profit

and

loss *

Maintenance 768.9 5.5 774.4 - 3.6 176.2 7.8 148.1 734.9

provisions

Restructuring 38.5 - 38.5 0.5 20.1 0.6 256.4 274.7

provisions

Provisions 49.8 - 49.8 - 1.0 - 3.6 52.4

for

environmental

protection

Provisions 35.2 - 35.2 5.6 - - 5.6 46.4

for other

taxes

Provisions 44.6 - 44.6 - 0.5 2.6 9.4 3.9 36.0

for other

personnel

costs

Provisions 22.5 - 22.5 4.5 12.8 0.2 4.8 18.8

for

Litigation

Risks from 30.9 - 6.7 24.2 - 12.4 4.1 4.2 10.1 13.6

onerous

contracts

Miscellaneous 146.5 - 0.2 146.3 - 20.3 51.1 32.2 82.9 125.6

provisions

Other 1,136.9 - 1.4 1,135.5 - 26.2 267.9 54.4 515.4 1,302.4

provisions

* reclassifications, transfers, exchange differences and changes in the group of consolidated companies

Provisions for maintenance primarily relate to contractual maintenance, overhaul and repair requirements for aircraft, engines and other

specific components arising from aircraft lease contracts. Measurement of these provisions is based on the expected cost of the next

maintenance event, estimated on the basis of current prices, expected price increases and manufacturers' data sheets. In line with the

terms of the individual contracts and the aircraft model concerned, additions are recognised on a prorated basis in relation to flight

hours, the number of flights or the length of the complete maintenance cycle.

Restructuring provisions comprise severance payments to employees as well as payments for the early termination of leases. They primarily

relate to restructuring projects as part of our Global Realignment Program for which detailed, formal restructuring plans were drawn up

and communicated to the parties concerned. At the balance sheet date, restructuring provisions totalled &euro 274.7 m (previous year

&euro 38.5 m), for the most part relating to benefits for employees in connection with the termination of employment contracts.

Provisions for environmental protection primarily relate to statutory obligations to remediate sites contaminated with legacy waste from

former mining and metallurgical activities.

Provisions for personnel costs comprise provisions for jubilee benefits and provisions for cash-settled share-based payment schemes in

accordance with IFRS 2. For information on these long-term incentive programmes, please refer to Note 39 'Share-based payments in

accordance with IFRS 2'.

Provisions for litigation are formed for existing lawsuits. For further details on lawsuits, please refer to Note 37.

Miscellaneous provisions include various provisions that, taken individually, do not have a significant influence on TUI Group's economic

position. This item includes provisions for dismantling obligations and compensation claims from customers.

Changes in other provisions outside profit and loss primarily relate to changes in the group of consolidated companies, foreign exchange

differences and reclassifications within other provisions.

Where the difference between the present value and the settlement value of a provision is material for the measurement of a non-current

provision as at the balance sheet date, the provision is recognised at its present value in accordance with IAS 37. The discount rate to

be applied should take account of the specific risks of the liability and of future price increases. This criterion applies to some items

contained in TUI Group's other provisions. Additions to other provisions comprise an interest portion of &euro 7.5 m (previous year &euro

6.0 m), recognised as an interest expense.

Terms to maturity of other provisions

30 Sep 2020 30 Sep 2019

&euro million Remaining Total Remaining Total

term more term more

than 1 year than 1 year

Maintenance 615.3 734.9 616.8 768.9

provisions

Restructuring 146.6 274.7 - 38.5

provisions

Provisions for 49.1 52.4 46.7 49.8

environmental

protection

Provisions for 26.4 46.4 23.5 35.2

other taxes

Provisions for 28.4 36.0 35.2 44.6

other personnel

costs

Provisions for 5.4 18.8 3.9 22.5

litigation

Risks from 2.1 13.6 6.5 30.9

onerous

contracts

Miscellaneous 38.8 125.6 42.4 146.5

provisions

Other provisions 912.1 1,302.4 775.0 1,136.9

(31) Financial and lease liabilities

Financial and lease liabilities

30 Sep 2020 30 Sep 2019

Remaining term Remaining term

&euro up to 1- 5 more Total up to 1- 5 more Total

million 1 years than 1 year years than 5

year 5 years

years

Bonds - 298.9 - 298.9 - 297.8 - 297.8

Liabilities 560.9 3,298 94.2 3,953. 74.9 391.0 404.1 870.0

to banks .6 7

Liabilities - - - - 130.5 658.4 706.3 1,495.

from 2

finance

leases *

Other 16.4 - - 16.4 19.2 - - 19.2

financial

liabilitie

s

Financial 577.3 3,597 94.2 4,269. 224.6 1,347. 1,110. 2,682.

liabilities .5 0 2 4 2

Lease 687.3 1,693 1,019 3,399. - - - -

liabilities .5 .1 9

* Financial liabilities include liabilities from finance leases for the last time as of 30 Sep 2019.

Having transitioned to IFRS 16 as at 1 October 2019, TUI Group no longer has to differentiate between finance leases and operating leases

as a lessee. In this context, lease liabilities are presented and explained separately in the statement of financial position and are

therefore no longer carried in financial liabilities.

Non-current financial liabilities, less any lease liabilities included in the previous year, rose by &euro 2,598.8 m to &euro 3,691.7 m

as against 30 September 2019. The increase was almost entirely driven by an increase in liabilities to banks of &euro 2,597.7 m.

The core financing instrument is a syndicated revolving credit facility (RCF) between TUI AG and the former banking syndicate or KfW,

respectively, which recently joined the banking syndicate.

Due to the impact of the COVID-19-pandemic on business operations, TUI Group's liquidity requirements rose significantly. TUI AG

additionally faced the risk of non-compliance with its covenants so that the existing terms and conditions of the RCF had to be

renegotiated.

TUI AG subsequently secured a separate credit facility of &euro 1.8 bn from KfW, granted in the framework of the German government's

state aid scheme. The credit facility increased TUI AG's existing credit agreement with its banks for &euro 1.75 bn to a total RCF volume

of &euro 3.55 bn. The agreement was signed by the existing RCF banking syndicate on 8 April 2020. According to the agreement, the RCF

comprises a credit facility of the former banking syndicate and a separate facility issued by KfW under its own terms and conditions.

As at 30 September 2020, the amounts drawn under the revolving credit facility totalled &euro 3.3 bn.

The covenant tests with respect to the existing and the increased RCF has been suspended (so-called 'covenant holiday'). It is currently

agreed to resume the covenant test in September 2021.

Current financial liabilities, less the lease liabilities included in the previous year, rose by &euro 483.2 m from &euro 94.1 m to &euro

577.3 m as against 30 September 2019. The increase includes an amount of &euro 500.0 m for the credit facility from KfW, due within one

year. For more details on the terms and conditions of the credit facility granted by KfW, please refer to the section 'Going-concern

reporting according to the UK Corporate Governance Code'.

Movements financial and lease liabilities

&euro million Bonds Short-term Long-term Other Total Lease

liabilitie liabilities financial financial liabilities

s to banks liabilities liabilities

to banks

Balance as at 297.8 74.9 795.0 19.3 1,187.0 3,861.5

1 Oct 2019

Payment in - 480.5 2,812.8 - 2.3 3,291.0 - 612.4

the period

Changes in - - 34.6 - 277.1 - - 311.7 - 7.2

scope of

consolidation

Foreign - - 0.3 11.0 - 10.7 - 145.4

exchange

movements

Other 1.0 40.4 51.2 - 0.6 92.0 303.4

non-cash

movement

Balance as at 298.8 560.9 3,392.9 16.4 4,269.0 3,399.9

30 Sep 2020

Movements financial liabilities

&euro Bonds Short-term Long-term Finance Other Total

million liabilitie liabilities Leasing financial financial

s to banks * liabilities liabilities

to banks

Balance as 296.8 64.1 716.4 1,342.6 23.0 2,442.9

at 1 Oct

2018

Payment in - - 34.2 - 25.6 - 122.3 2.2 - 179.9

the period

Acquisitions - 4.8 22.9 - - 1.1 26.6

Foreign - 1.3 1.1 53.6 - 56.0

exchange

movements

Other 1.0 38.9 80.2 221.3 - 4.8 336.6

non-cash

movement

Balance as 297.8 74.9 795.0 1,495.2 19.3 2,682.2

at 30 Sep

2019

* Financial liabilities include liabilities from finance leases for the last time as of 30 Sep 2019.

Fair values and carrying amounts of the bonds at 30 Sep 2020

30 Sep 2020 30 Sep 2019

&euro Issuer Nominal Nominal Interest Stock Carrying Stock Carrying

milli value value rate marke amount marke amount

on initial outstan % p. a. t t

ding value value

2016 TUI AG 300.0 300.0 2,125 269.5 298.9 309.6 297.8

/ 21

bond

Total 269.5 298.9 309.6 297.8

For details regarding the fixed-interest bonds with a nominal value of &euro 300.0 m issued in October 2016, please refer to Note 46

'Significant events after the balance sheet date'.

(32) Other financial liabilities

The other financial liabilities include touristic advance payments received for tours canceled because of COVID-19 restrictions of &euro

351.0 m, for which immediate cash refund options exist and which have to be repaid shortly if the customer opts for payment. Please see

the following section for more details.

(33) Touristic advance payments received

Touristic advance payments received

&euro million

Touristic advance payments received as at 1 2,824.8

Oct 2018

Revenue recognised that was included in the - 2,370.9

balance at the beginning of the period

Increases due to cash received, excluding 2,636.4

amounts recognised as revenue during the

period

Changes in the consolidation status and - 166.0

changes caused by IFRS 5

Other - 13.1

Touristic advance payments received as at 30 2,911.2

Sep 2019

Revenue recognised that was included in the - 1,811.0

balance at the beginning of the period

Increases due to cash received, excluding 3,023.3

amounts recognised as revenue during the

period

Reclassification to other financial - 351.0

liabilities

Customer refund repayments - 1,897.7

Changes in the consolidation status - 76.4

Other - 28.3

Touristic advance payments received as at 30 1,770.1

Sep 2020

Apart from the immediate cash refund option in certain jurisdictions, TUI Group offers its customers voucher /

refund credits for trips canceled because of the COVID-19-crisis. If these voucher / refund credits are not used for future bookings

within a specified period, the customer is entitled to a refund of the voucher value. Due to the high level of uncertainty regarding the

further development of the COVID-19-crisis and customer behaviour, it is not possible for TUI Group to reliably estimate the extent of

utilization of the voucher / refund credits for future bookings. Accordingly, the touristic advance payments received include &euro 184.8

m of advance payments for cancelled trips for which customers have received voucher / refund credits with no immediate cash refund

option.

(34) Other non-financial liabilities

Other non-financial liabilities

30 Sep 2020 30 Sep 2019

Remaining term Remaining term

&euro up to 1 - 5 Total up to 1 - 5 Total

million 1 year years 1 year years

Other 184.9 24.3 209.2 210.1 25.4 235.5

liabiliti

es

relating

to

employees

Other 44.3 - 44.3 45.3 - 45.3

liabiliti

es

relating

to social

security

Other 19.7 - 19.7 37.1 - 37.1

liabiliti

es

relating

to other

taxes

Other 149.2 5.6 154.8 140.9 6.0 146.9

miscellan

eous

liabiliti

es

Deferred 49.7 168.5 218.2 85.9 68.7 154.6

income

Other 447.8 198.4 646.2 519.3 100.1 619.4

non-finan

cial

liabiliti

es

(35) Liabilities related to assets held for sale

As at 30 September 2020 liabilities related to assets held for sale of &euro 24.5 m were reported. These liabilities relate to the

expected transfer of an aircraft to an associated company of TUI Group. We refer to the section 'Assets held for sale'.

As at 30 September 2019, liabilities related to assets held for sale totalled &euro 103.1 m. These liabilities exclusively related to the

'Berge & Meer' and 'Boomerang' disposal group, divested at the beginning of the financial year under review. For further details, please

refer to the section 'Divestments'.

Disposal group 'Berge & Meer' and 'Boomerang'

&euro million 30 Sep 2019

Deferred tax liabilities 4.1

Trade payables 34.1

Touristic advance payments received 58.1

Other non-financial liabilities 4.7

Other provisions and liabilities 2.1

Total 103.1

(36) Contingent liabilities

As at 30 September 2020, contingent liabilities amounted to &euro 165.6 m (previous year &euro 143.5 m). They are mainly attributable to

the granting of guarantees for the benefit of hotel and cruises activities and are reported at an amount representing the best estimate

of the expenditure required to meet the potential obligation at the balance sheet date.

(37) Litigation

TUI AG and its subsidiaries are involved in several pending or foreseeable court or arbitration proceedings, which do not have a

significant impact on their economic position as at 30 September 2020 or future periods. This also applies to actions claiming warranty,

repayment or any other compensation in connection with the divestment of subsidiaries and business units over the past few years. As in

previous years, the Group recognised adequate provisions, partly covered by expected insurance benefits, to cover all probable financial

charges from court or arbitration proceedings.

(38) Other financial commitments

Other financial commitments

30 Sep 2020 30 Sep 2019

Remaining term Remaining term

&euro up to 1- 5 more Total up to 1 - 5 more Total

million 1 years than 1 year years than

year 5 5

years years

Order 465.9 54.2 2,549. 1,427. 1,691. 87.4 3,206.

commitmen 2,028. 0 8 1 3

ts in 9

respect

of

capital

expenditu

re

Financial - - - - 717.1 1,446. 581.5 2,744.

commitmen 1 7

ts from

operatin

g lease

and

rental

contracts

*

Other 99.0 110.8 2.9 212.7 111.4 25.0 3.0 139.4

financial

commitmen

ts

Total 564.9 2,139. 57.1 2,761. 2,256. 3,162. 671.9 6,090.

7 7 3 2 4

* Prior year adjusted.

Order commitments in respect of capital expenditure relate almost exclusively to tourism and decreased by &euro 657.3 m year-on-year as

at 30 September 2020. The reduction in commitments is caused by delivery of aircraft, scheduled payments and general decrease in new

commitments undertaken. Further declines were generated with the disposal of Hapag-Lloyd Kreuzfahrten GmbH and from foreign exchange

effects for commitments denominated in non-functional currencies.

The commitments from lease, rental and charter agreements at 30 September 2019 exclusively related to leases that did not transfer all

risks and rewards of ownership of the assets to the TUI Group companies under IAS 17 (operating leases).

(39) Share-based payments in accordance with IFRS 2

As at 30 September 2020, all existing awards except the employee share program 'oneShare' are recognized as cash-settled share-based

payment schemes.

The following share-based payment schemes are in effect within TUI Group as at 30 September 2020.

1. PHANTOM SHARES IN THE FRAMEWORK OF THE Long Term Incentive Plan (LTIP)

1.1 LTIP WITH SHARE AWARDING FOR THE FINANCIAL YEAR 2020 (LTIP EPS20)

Since the 2020 financial year, the Long Term Incentive Plan (LTIP) consists of a program based on phantom shares and is measured over a

period of four years (performance reference period). The phantom shares are granted in annual tranches.

All Executive Board members have their individual target amounts defined in their service contracts. At the beginning of each financial

year, this target amount is translated into a preliminary number of phantom shares based on the target amount. It constitutes the basis

for the determination of the performance-related pay after the end of the performance reference period. In order to determine that

number, the target amount is divided by the average Xetra share price of TUI AG shares during the 20 trading days prior to the beginning

of the performance reference period (1 October of any one year). The entitlement under the long-term incentive programme arises upon

completion of the four-year performance reference period and is subject to attainment of the relevant target.

The performance target for determining the amount of the final payout after the end of the performance reference period is the average

development over four years of the earning per share based on a pro-forma adjusted EPS from continuing operations (Earnings per Share -

EPS) as reported in the annual report of the company. The average development of EPS per annum (in percent) is derived from the four

equally weighted yearly EPS development values (in percent). Each yearly EPS development value is calculated as the quotient of the EPS

of the current financial year and the EPS of the previous financial year. The initial EPS value used to determine the target achievement

is calculated at the beginning of the performance period from the first EPS in the performance period and the last EPS before the

performance period.

Target achievement for the average development of EPS per annum based on the annual amounts is determined as follows:

· An average absolute EPS of less than 50 % of the absolute EPS value determined at the beginning of the performance period corresponds

to target achievement of 0 %.

· An average absolute EPS of 50 % of the absolute EPS value determined at the beginning of the performance period corresponds to target

achievement of 25 %.

· An average absolute EPS of 50 % or more of the absolute EPS value determined at the beginning of the performance period up to an

average increase of 5 % corresponds to target achievement of 25 % to 100 %.

· An average increase of 5 % p. a. corresponds to target achievement of 100 %.

· An average increase of 5 % to 10 % p. a. corresponds to target achievement of 100 % to 175 %.

· An average increase of 10 % or more p. a. corresponds to target achievement of 175 %.

For an average absolute EPS of 50 % or more of the absolute EPS value determined at the beginning of the performance period up to an

average increase of 5 %, corresponding to a target achievement of 25 % to 100 %, and an average increase of 5 % to 10 % p. a.,

corresponding to a target achievement of 100 % to 175 %, linear interpolation is used to determine the degree of target achievement. The

degree of target achievement is rounded to two decimal places, as is customary in commercial practice.

If the prior-year EPS amounts to less than &euro 0.50, the Supervisory Board defines new absolute targets for EPS as well as minimum and

maximum amounts for determining the percentage target achievement for each subsequent financial year in the performance reference period.

In order to determine the final number of phantom shares, the degree of target achievement is multiplied by the preliminary number of

phantom shares on the final day of the performance reference period. The payout amount is determined by multiplying the final number of

phantom shares by the average Xetra share price of TUI AG shares over the 20 trading days prior to the end of the performance reference

period (30 September of any one year). The payout amount determined in this way is paid out in the month of the approval and audit of TUI

Group's annual financial statements for the relevant financial year. If the service contract begins or ends in the course of the

financial year relevant for the granting of the LTIP, the entitlement to payment of the LTIP is determined on a pro rata basis.

In case of a capital increase from company funds, the number of preliminary phantom shares would increase at the same ration as the

nominal value of the share capital. In case of a capital decrease without return of capital, the number of preliminary phantom shares

would decrease at the same ration as the nominal value of the share capital. In case of a capital increase against contributions, a

capital decrease with return of capital or any other capital or structural measures that have an effect on the share capital and cause a

material change in the value of the TUI AG share, the number of preliminary phantom shares would also be adjusted. The Supervisory Board

is entitled, at reasonable discretion, to make adjustments to neutralize any negative or positive effects from such capital or structural

measures. The same rule applies in case of a change in share price due to the payment of an usually high superdividend.

The maximum LTIP payout is capped at 240 % of the individual target amount for each performance reference period. This means that there

is an annual LTIP cap which is determined individually for each Executive Board member. The Supervisory Board is furthermore, according

to section 87 para. 1 cl. 3 German stock corporation law, authorized to cap the LTIP payout in case of extraordinary circumstances (e. g.

company mergers, segment disposals, recognition of hidden reserves or external influences).

1.2 LTIP WITH SHARE AWARDING FOR THE FINANCIAL YEARS 2018 and 2019 (LTIP EPS18 - 19)

For the financial years 2018 and 2019, the LTIP has consisted of a phantom share-based programme and has been measured over a duration of

four years (performance reference period) upon achievement of a total shareholder return (TSR) target and an earnings per share (EPS)

target. The phantom shares are granted in annual tranches.

All Executive Board members have their individual target amounts defined in their service contracts. At the beginning of each financial

year, this target amount is translated into a preliminary number of phantom shares based on the target amount. It constitutes the basis

for the determination of the performance-related pay after the end of the performance reference period. In order to determine that

number, the target amount is divided by the average Xetra share price of TUI AG shares during the 20 trading days prior to the beginning

of the performance reference period (1 October of any one year). The entitlement under the long-term incentive programme arises upon

completion of the four-year performance reference period and is subject to attainment of the relevant target.

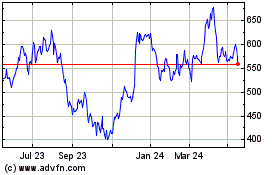

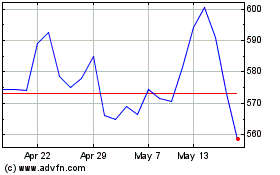

The performance target for determining the amount of the final payout after the end of the performance reference period is the

development of TSR of TUI AG relative to the development of the TSR of the STOXX Europe 600 Travel & Leisure (Index). The relative TSR is

included in the determination of target achievement with a weighting of 50 %. The degree of target achievement is determined as a

function of TUI AG's TSR rank in comparison with the TSR ranks of the index companies over the performance reference period. In order to

determine TUI AG's relative TSR, the TSR ranks established for TUI's peer companies are sorted in descending order. TUI AG's relative TSR

is expressed as a percentile (percentile rank).

The TSR is the aggregate of all share price increases plus the gross dividends paid over the performance reference period. Data from

recognised data providers (e. g. Bloomberg, Thomson Reuters) is used to establish the TSR ranks for TUI AG and the index companies. The

reference used to determine the ranks is the composition of the index on the last day of the performance reference period. The values for

companies that were not listed over the entire performance reference period are factored in on a pro rata basis. The degree of target

achievement (in percent) is established as follows for TUI AG's relative TSR based on the percentile:

· A percentile below the median of the index corresponds to target achievement of 0 %.

· A percentile equal to the median corresponds to target achievement of 100 %.

· A percentile constituting the maximum value corresponds to target achievement of 175 %.

For a percentile between the median and the maximum value, linear interpolation is used to determine the degree of target achievement at

between 100 % and 175 %. The degree of target achievement is rounded to two decimal places, as is customary in commercial practice.

Moreover the average development of EPS per annum is included in the LTIP as an additional Group indicator with a weighting of 50 %. The

averages determined for the four-year performance reference period are based on pro forma underlying earnings per share from continuing

operations, as already reported in the Annual Report.

Target achievement for the average development of EPS per annum based on the annual amounts is determined as follows:

· An average increase of less than 3 % p. a. corresponds to target achievement of 0 %.

· An average increase of 3 % p. a. corresponds to target achievement of 25 %.

· An average increase of 5 % p. a. corresponds to target achievement of 100 %.

· An average increase of 10 % or more p. a. corresponds to target achievement of 175 %.

For an average increase of 3 % to 5 % p. a., linear interpolation is used to determine the degree of target achievement at between 25 %

and 100 %. Linear interpolation is used for an average increase of between 5 % and 10 % or more p. a. to determine target achievement at

between 100 % and 175 %. Here, too, the degree of target achievement is rounded to two decimal places, as is customary in commercial

practice.

If the prior-year EPS amounts to less than &euro 0.50, the Supervisory Board defines new absolute targets for EPS as well as minimum and

maximum amounts for determining the percentage target achievement for each subsequent financial year in the performance reference period.

The degree of target achievement (in percent) is calculated from the average target achievement for the performance targets 'relative TSR

of TUI AG' and 'EPS'. In order to determine the final number of phantom shares, the degree of target achievement is multiplied by the

preliminary number of phantom shares on the final day of the performance reference period. The payout amount is determined by multiplying

the final number of phantom shares by the average Xetra share price of TUI AG shares over the 20 trading days prior to the end of the

performance reference period (30 September of any one year). The payout amount determined in this way is paid out in the month of the

approval and audit of TUI Group's annual financial statements for the relevant financial year. If the service contract begins or ends in

the course of the financial year relevant for the granting of the LTIP, the entitlement to payment of the LTIP is determined on a pro

rata basis.

The maximum LTIP payout is capped at 240 % of the individual target amount for each performance reference period. This means that there

is an annual LTIP cap which is determined individually for each Executive Board member.

1.3 LTIP WITH SHARE AWARDING UP TO AND INCLUDING FINANCIAL YEAR 2017 (LTIP)

For those members of the Executive Board whose service contracts already existed prior to financial year 2018, the replaced remuneration

system will continue to apply in parallel for LTIP for the time being. This relates only to the LTIP tranches granted before financial

year 2018 but not yet paid out due to the four-year performance reference period, which are therefore included in the future awards.

The LTIP is a share plan based on phantom shares, assessed over a period of four years (performance reference period). Phantom shares are

granted in annual tranches.

For Executive Board members, an individual target amount (Target Amount) is determined in their service contract. At the beginning of

each financial year, a preliminary number of phantom shares is determined in relation to the target amount. This number constitutes the

basis for determining the final performance-based payment after the end of the respective performance reference period. In order to

determine that number, the target amount is divided by the average Xetra share price of TUI AG shares over the 20 trading days prior to

the beginning of the performance reference period (1 October of any one year). The claim to a payment only arises upon expiry of the

performance reference period, subject to attainment of the respective performance target.

The performance target for determining the amount of the final payout after the end of the performance reference period is the

development of the total shareholder return (TSR) of TUI AG relative to the development of the TSR of the STOXX Europe 600 Travel &

Leisure (Index). To that end, the rank of the TSR of TUI AG in relation to the index companies is monitored over the entire performance

reference period. The TSR is the aggregate of all share price increases plus the gross dividends paid over the performance reference

period. Data from a recognised data provider (e. g. Bloomberg, Thomson Reuters) is used to establish the TSR values for TUI AG and the

index. The reference for determining the ranks is the composition of the index on the last day of the performance reference period. The

values for companies that were not listed over the entire performance reference period are factored in on a pro rata basis. The degree of

target achievement is established as follows depending on the TSR rank of TUI AG relative to the TSR values of the index companies over

the performance reference period:

· A TSR value of TUI AG equivalent to the bottom or second to bottom rank of the index corresponds to target achievement of 0 %.

· A TSR value of TUI AG equivalent to the third to bottom rank of the index corresponds to target achievement of 25 %.

· A TSR value of TUI AG equivalent to the median of the index corresponds to target achievement of 100 %.

· A TSR value of TUI AG equivalent to the third to top, second to top or top rank of the index corresponds to target achievement of 175

%.

For performance between the third to bottom and the third to top rank, linear interpolation is used to determine the degree of target

achievement at between 25 % and 175 %. The degree of target achievement is rounded to two decimal places, as is customary in commercial

practice.

In order to determine the final number of phantom shares, the degree of target achievement is multiplied by the preliminary number of

phantom shares on the final day of the performance reference period. The payout amount is determined by multiplying the final number of

phantom shares by the average Xetra share price of TUI AG shares over the 20 trading days prior to the end of the performance reference

period (30 September of any one year). The payout amount determined in this way is paid out in cash in the month of the adoption of the

annual financial statements of TUI AG for the fourth financial year of the performance reference period. If the service contract begins

or ends in the course of the financial year relevant for the granting of the LTIP, the claim for payment of the LTIP is determined on a

pro rata basis as a matter of principle.

There is an annual LTIP cap individually defined for each Executive Board member.

Performance Share Plan (PSP)

The PSP details the share-based payments for entitled Group executives who are not part of the Board. The scheme conditions are

harmonized with the LTIP without the earnings-per-share performance measure of the Board members with the notable exceptions of a three

year performance period instead of four years. Target amounts and grant frequency are subject to individual contractual agreements.

Since LTIP without the earnings-per-share performance measure and PSP follow common scheme principles, the following development of

awarded phantom shares under the programs are shown on an aggregated basis. The development of phantom shares awarded that are subject to

the EPS performance measure are shown separately.

Development of phantom shares awarded (LTIP EPS20, LTIP

EPS18 - 19, LTIP & PSP)

LTIP EPS20 LTIP EPS18 - 19 LTIP & PSP

Number Present Number Present Number Present

of value of value of value

shares &euro shares &euro shares &euro

million million million

Balance as - - 360,808 6.0 1,363,95 22.6

at 30 Sep 5

2018

Phantom - - 402,652 6.2 442,312 6.8

shares

awarded

Phantom - - - - - - 1.3

shares 134,355

exercised

Phantom - - - - - - 6.2

shares 452,860

forfeited

Measurement - - - - 4.1 - - 8.9

results

Balance as - - 763,460 8.1 1,219,05 13.0

at 30 Sep 2

2019

Phantom 630,699 6.2 - - 928,679 9.2

shares

awarded

Phantom - - - - - - 1.3

shares 141,508

exercised

Phantom - - - - - - 5.2

shares 722,824

forfeited

Measurement - - 4.0 - - 5.5 - - 11.3

results

Balance as 630,699 2.2 763,460 2.6 1,283,39 4.4

at 30 Sep 9

2020

Employee share program 'oneShare'

Eligible employees can acquire TUI AG shares under preferential conditions when participating in the oneShare program. The preferential

conditions include a discount on 'investment' shares bought during a twelve month investment period plus one 'matching' share per three

held investment shares, after a lock up period of two years. Investment shares are created via capital increase, while matching shares

are bought on the open market. Eligible employees decide once a year about their participation in oneShare.

As the investment and matching shares as well as the Golden shares are equity instruments of TUI AG, oneShare is accounted for as an

equity-settled share-based payment scheme in line with IFRS 2. Once all eligible employees have decided upon their yearly participation,

the fair value of the equity instrument granted is calculated once and fixed for each tranche on the basis of the proportional shares

price at grant date taking into consideration the discounted estimated dividends.

In 2020, no new tranche of oneShare was launched. The matching date occurred for Tranche 1 on 30 September and the matching shares of

Tranche 1 were subsequently transferred to participants who still held their investment shares at the beginning of the financial year.

The development of acquired investment and estimated matching shares, as well as the parameters used for the calculation of the fair

value are as follows:

Overview oneShare tranches

Tranche 1 Tranche 2 Tranche 3 Tranche 4

(2017 / 3) (2017 / 7) (2018 / 7) (2019 / 7)

Investment 1.4.2017 - 1.8.2017 - 1.8.2018 - 1.8.2019 -

period 31.7.2017 31.7.2018 31.7.2019 31.7.2020

Matching date 30.9.2019 30.9.2020 30.9.2021 30.9.2022

Acquired 349,941 524,619 1,152,598 1,394,512

investment

shares

thereof 1,228 10,216 32,859 31,724

forfeited

investment

shares

Distributed / 116,647 174,873 384,199 464,837

Estimated

matching

shares

thereof 15,256 23,953 45,928 14,035

forfeited

matching

shares

Share price at 12.99 13.27 18.30 8.99

grant datein

&euro

Fair value: 2.60 2.02 2.94 1.26

Discount per

investment

share in &euro

recognised - 0.63 0.72 0.54

estimated

dividendin

&euro

Fair value: 11.65 11.15 15.93 7.17

matching

sharein &euro

recognised 1.34 2.11 2.37 1.82

discounted

estimated

dividend in

&euro

Closed share-based payment schemes

The following share-based payment schemes are closed, resulting in no new awards being granted. Awards made in the past remain valid and

will vest according to the respective plan conditions.

TUI AG Stock option plan

The stock option plan for qualifying Group executives below Board level was closed during financial year 2016. The last tranche was

granted in February 2016 and vested in February 2018.

Bonuses were granted to eligible Group executives; the bonuses were translated into phantom shares in TUI AG on the basis of an average

share price. The phantom shares were calculated on the basis of Group earnings before interest, taxes and amortisation of goodwill

(EBITA). The translation into phantom shares was based on the average share price of the TUI share on the 20 trading days following the

Supervisory Board meeting at which the annual financial statements were approved. The number of phantom shares granted in a financial

year was, therefore, only determined in the subsequent year. Following a lock-up period of two years, the individual beneficiaries are

free to exercise their right to cash payment from this bonus within three years. Following significant corporate news, the entitlements

have to be exercised within defined timeframes. The lock-up period is not applicable if a beneficiary leaves the Company; in that case,

the entitlements have to be exercised in the next time window. The level of the cash payment depends on the average share price of the

TUI share over a period of 20 trading days after the exercise date. There are no absolute or relative return or share price targets. A

cap has been agreed for exceptional, unforeseen developments. Since the strike price is &euro 0.00 and the incentive programme does not

entail a vesting period, the fair value corresponds to the intrinsic value and hence the market price at the balance sheet date.

Accordingly, the fair value of the obligation is determined by multiplying the number of phantom shares with the share price at the

respective reporting date.

As at 30 September 2020, 30,915 share options valued at &euro 0.1 m are vested and outstanding. Since the plan is closed, no new grants

were made, 10 options were exercised (total value of &euro 0.0 m) and no options were forfeited.

Accounting for share-based payment schemes

As at 30 September 2020, all existing awards except oneShare are recognized as cash-settled share-based payment schemes and are granted

with an exercise price of &euro 0.00. The personnel expense is recognized upon actual delivery of service according to IFRS 2 and is,

therefore, spread over a period of time. According to IFRS 2, all contractually granted entitlements have to be accounted for,

irrespective of whether and when they are actually awarded. Accordingly, phantom shares granted in the past are charged on a pro rata

basis upon actual delivery of service.

In the financial year 2020, a profit of &euro 6.5 m was realized due to the release of provisions for cash-settled share-based payment

schemes (previous year: profit of &euro 12.7 m).

In the financial year 2020, personnel expenses due to equity-settled share-based payment schemes of &euro 5.1 m (previous year &euro 7.0

m) were recognised through profit and loss.

As at 30 September 2020, provisions relating to entitlements under these long-term incentive programmes totaled &euro 9.7 m (previous

year provisions of &euro 14.3 m and &euro 1.2 m liabilities).

(40) Financial instruments

Risks and risk management

Risk management principles

Due to the nature of its business operations, the TUI Group is exposed to various financial risks, including market risks (consisting of

currency risks, interest rate risks and market price risks), credit risks and liquidity risks.

In accordance with TUI Group's financial goals, financial risks have to be mitigated. In order to achieve this, policies and procedures

have been developed to manage risk associated with financial transactions undertaken.

The rules, responsibilities and processes as well as limits for transactions and risk positions have been defined in policies. The

trading, processing and control have been segregated in functional and organisational terms. Compliance with the policies and limits is

continually monitored. All hedges by the TUI Group are consistently based on recognised or forecasted underlying transactions. Standard

software is used for assessing, monitoring, reporting, documenting and reviewing the effectiveness of the hedging relationships for the

hedges entered into. In this context, the fair values of all derivative financial instruments determined on the basis of the Group's own

systems are regularly compared with the fair value confirmations from the external counterparties. The processes, the methods applied and

the organisation of risk management are reviewed for compliance with the relevant regulations on at least an annual basis by the internal

audit department and external auditors.

Within the TUI Group, financial risks primarily arise from cash flows in foreign currencies, fuel requirements (jet fuel and bunker oil)

and financing via the money and capital markets. In order to limit the risks from changes in exchange rates, market prices and interest

rates for underlying transactions, the TUI Group uses over-the-counter derivative financial instruments. These are primarily fixed-price

transactions. In addition, the TUI Group also uses options and structured products. Use of derivative financial instruments is confined

to internally fixed limits and other policies. The transactions are concluded on an arm's length basis with counterparties operating in

the financial sector, whose counterparty risk is regularly monitored. Foreign exchange translation risks from the consolidation of Group

companies not preparing their accounts in euros are not hedged.

Market risk

Market risks result in fluctuations in earnings, equity and cash flows. Risks arising from input cost volatility are more fully detailed

in the risk report section of the management report. In order to limit or eliminate these risks, the TUI Group has developed various

hedging strategies, including the use of derivative financial instruments.

IFRS 7 requires the presentation of a sensitivity analysis showing the effects of hypothetical changes in relevant market risk variables

on profit or loss and equity. The effects for the period are determined by relating the hypothetical changes in risk variables to the

portfolio of primary and derivative financial instruments as at the balance sheet date. It is assured that the portfolio of financial

instruments as at the balance sheet date is representative for the entire financial year.

The analyses of the TUI Group's risk reduction activities outlined below and the amounts determined using sensitivity analyses represent

hypothetical and thus uncertain risks. Due to unforeseeable developments in the global financial markets, actual results may deviate