TUI AG (TUI)

TUI AG: Annual Financial Report - Part 1

10-Dec-2020 / 07:00 CET/CEST

Dissemination of a Regulatory Announcement, transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

10 December 2020

TUI GROUP

Full year results to 30 September 2020

2020 IN REVIEW

· First half of FY20 opened with record bookings in January 2020, strong

outlook and increased capacity planned for Summer 2020

· C-19 global pandemic led to a suspension of operations in March 2020

impacting most of our financial second half

· Significant self-help actions taken to address the impact of the C-19

pandemic, with cash fixed costs reduced by more than 70% during the

immediate lockdown period and substantial reduction in cash capex

· Swift and disciplined liquidity management during the crisis including

three support packages agreed

· Liquidity further enhanced with completion of compensation agreement

with Boeing as well as Hapag-Lloyd Cruises disposal to TUI Cruises in a

challenging market environment

· Global Realignment Programme launched to permanently reduce costs -

target increased from &euro300m to &euro400m p.a.

· TUI was the first tour operator to successfully restart across multiple

markets and destinations as travel restrictions eased worldwide from

mid-June, demonstrating the advantage of our integrated and diversified

business model

FY20 RESULTS

· As a result of C-19 travel restrictions during Summer 2020, FY20 revenue

declined by 58% with a full-year Group underlying EBIT loss of &euro3.0bn1

· Full-year customer volume of 8.1m, down 62% on prior year, as direct

result of imposed travel restrictions (FY19: 21.1m). Since restart of

operations in mid-June, more than 2m customers have enjoyed their holidays

with us

· Dividend suspended as required by terms of German Support Packages

1 At constant currency

LATEST DEVELOPMENTS

· As a result of the increasing travel restrictions caused by the rising

number of infections and the associated later booking behaviour of some

customers, we currently expect to operate an adjusted capacity2 of 20% for

Winter 2020/21 which will be weighted towards our financial Q2. We

continue to expect to operate an adjusted capacity2 of 80% for Summer

2021, which will be flexed as we gain more visibility on future imposed

travel restrictions

· Agreed additional support package for &euro1.8bn with Unifirm Ltd, a

syndicate of underwriting banks, KfW and the German Economic Support Fund

(Wirtschaftsstabilisierungsfonds - WSF), strengthening our position and

providing sufficient liquidity reserves in this volatile market

environment

· As at 30 November 2020, cash and available facilities on a pro forma

basis including additional support package would amount to &euro2.5bn,

post &euro300m anticipated senior notes redemption

· On 15 March 2020, the Executive Board of TUI AG withdrew its guidance

for financial year 2020 in view of the significant uncertainties relating

to future developments and still feels unable to announce specific

guidance in light of the ongoing situation

2 Adjusted capacity refers to capacity % planned to be operated versus 2019

programme

EXECUTIVE SUMMARY

· Transformed TUI will be leaner, less cost, less capital intensive and

more digital, driving return to profitable growth

· Strongly positioned to benefit from market recovery, resuming growth

trajectory

· Optimised investments and accelerated digitalisation will increase

agility and strengthen TUI's competitive position

ANNUAL REPORT AND FY20 RESULTS INVESTOR & ANALYST AUDIO WEBCAST

Our year-end announcement and a full copy of our Annual Report can be found

on our corporate website: http://www.tuigroup.com/en-en/investors [1]. An

audio webcast for investors and analysts will take place today at 08.00 GMT

/ 09.00 CET. Our year-end presentation alongside details of the webcast,

will be made available via our website beforehand.

FY20 KEY FINANCIALS (IAS 17 basis)

Year ended 30 September

&eurom 2020 2019 Change

Adjusted7

Revenue 7,953 18,928 -58.0%

Underlying EBIT3 -3,033 894 n.a

Reported EBIT4 -2,963 769 n.a

(Loss)/Earnings before tax5 -3,129 691 n.a

Group (loss)/profit attributable -3,077 532 n.a

to shareholders of TUI AG

Underlying (loss)/earnings per -&euro5.45 &euro0.89 n.a

share6

Dividend per share &euro0.00 &euro0.54 n.a

Net (debt)/cash -4,557 -910 -3,647

3 Underlying EBIT has been adjusted for gains on disposal of investments,

major gains and losses from the disposal of assets, major restructuring and

integration

expenses. The indicator is also adjusted for all effects from purchase price

allocations, ancillary acquisition costs and conditional purchase price

payments.

4 Reported EBIT comprises earnings before net interest result, income tax

and result from the measurement of interest hedges

5 For reconciliation of loss/earnings before tax to underlying EBIT, please

refer to page 58 of the Annual Report

6 For calculation of underlying loss/earnings per share please refer to page

32 of the Annual Report

7 FY19 figures adjusted as a result of revised classification of certain

expense items to cost of sales and revisions to PPAs, please refer to page

155 of the Annual Report for further details

FY20 RESULTS

· In line with our achieved cost reductions, underlying EBIT for the year

was a loss of -&euro3.0bn at constant currency, down &euro3.9bn on prior

year. The year-on-year movement reflects the significant impact of C-19,

as shown below.

In &eurom (IAS 17 basis)

FY19 Underlying EBIT 893

5M (Oct 19 to Feb 20) Underlying performance incl. +97

one-offs

FY20 Pre-C-19 Underlying EBIT at constant currency 990

C-19 Impact

H2 MAX costs impact YoY (non-repeat of FY19 Q4 impact of +144

&euro144m)

-3,416

C-19 Impact all other

-505

C-19 Impairments

-248

C-19 Hedging Ineffectiveness

FY20 Underlying EBIT at constant currency -3,035

Foreign exchange translation 2

FY20 Underlying EBIT at actual rates -3,033

Underlying FY20 at FY19 Variance at FY20 at Variance at

EBIT in constant constant actual

&eurom currency currency rates

rates1 rates

actual

rates

(IAS 17

basis)

Hotels & -379.7 451.8 -831.5 -399.6 -851.4

Resorts

Cruises -327.0 366.0 -693.0 -322.8 -688.8

TUI Musement -116.6 55.7 -172.3 -114.6 -170.3

Holiday -823.3 873.5 -1,696.8 -837.0 -1,710.5

Experiences

Northern -984.4 58.5 -1,042.9 -975.1 -1,033.6

Region

Central -620.8 101.9 -722.7 -619.8 -721.7

Region

Western -445.7 -28.6 -417.1 -440.8 -412.2

Region

Markets & -2,050.8 131.8 -2,182.6 -2,035.7 -2,167.5

Airlines

All other -160.8 -111.8 -49.0 -160.2 -48.4

segments

Total TUI -3,035.0 893.5 -3,928.3 -3,032.8 -3,926.3

Group

· Hotels & Resorts saw the majority of the portfolio closed during the

height of the pandemic, with around 40% of our 355 group hotels operating

by the end of the financial year.

· Our model of diversified locations has been an advantage during the

pandemic, with differing regional restrictions enabling an earlier

reopening of some of our destinations, such as in Germany, Mexico and

Egypt which were able to host domestic customers.

· Underlying EBIT loss of &euro380m at constant currency reflects lost

contribution attributable to forced closures across our business in the

third quarter, limited capacity operated during the final quarter and

impairment charges amounting to &euro205m, triggered by C-19 related WACC

increases, under IAS 36.

· FY occupancy rate declined by 16% pts to 66% with average rate per bed

improving by 8% to &euro71 as a result of mix.

· For further commentary and brand split for Hotels & Resorts, please see

page 61 of the Annual Report.

· Cruise has been heavily impacted as travel restrictions triggered

worldwide port closures resulting in cancelled itineraries across all

three brands during the third quarter.

· We have been one of the few cruise operators who have been able to

restart partial operations during the fourth quarter, with Germany

permitting sailings within European waters for TUI Cruises and Hapag-Lloyd

Cruises.

· Marella Cruises operations remained suspended as at the end of the

financial year in line with UK government advice.

· Underlying EBIT loss of &euro327m at constant currency, reflects limited

restart of operations during our key second half, and impairment charges

of &euro150m for Marella Cruises, triggered by C-19 related WACC

increases, under IAS 36.

· For further commentary and brand split for Cruise, please see page 62 of

the Annual Report.

· TUI Musement (renamed from Destination Experiences as of 1 October 2020)

saw tours and activities suspended from March, with partial restart from

mid-June, in line with Markets & Airlines.

· Underlying EBIT loss of &euro117m, reflects the pause in operation

during Q3 and partial restart from mid-June.

· 2.6m excursions & activities sold, down 73% versus prior year.

· During the second half, we accelerated our digital transformation plans

- including the prioritisation of our 'Digital First' service model and

developing additional app functionalities as we incorporate C-19 safety

protocols.

· For further commentary on TUI Musement, please see page 63 of the Annual

Report.

· Markets & Airlines opened the year with a record booking position and a

strong outlook prior to C-19 pandemic.

· In line with worldwide government advice from mid-March, our operations

were suspended as we contributed to the global efforts to mitigate the

spread of C-19.

· With the advantage of our diversified model, we were the first tour

operator to successfully restart operations from Germany in mid-June,

followed by the rest of our European markets including the UK in July.

· Since travel bans were lifted, 2.3m customers enjoyed their holidays

with us between June and October.

· Overall full-year volume of 8.1m customers is down by 62% as a result of

our business suspension throughout most of the third quarter and a partial

programme operated in the peak fourth quarter.

· Underlying EBIT loss of &euro2,051m at constant currency is driven by

factors above, compounded by fuel and FX hedging ineffectiveness of

&euro252m and partly offset by non-repeat of MAX costs in the prior year.

· For further commentary on Markets & Airlines, please refer to pages 63

to 65 of the Annual Report.

· All other segments

· The result of All other segments declined by &euro49m at constant

currency versus prior year, reflecting Corsair-related impairments,

partially offset by immediate cost saving measures.

· Reported EBIT loss of &euro2,963m at constant currency firstly reflects

the acute impact of C-19 business suspension as described above.

Adjustments improved by &euro195m versus prior year, predominantly driven

by a &euro476m gain on disposal from the divestment of Hapag-Lloyd Cruises

and a &euro90m gain on disposal from the divestment of our German

specialist businesses Berge & Meer and Boomerang, partially offset by

restructuring charges in line with our announced Global Realignment

Programme and WACC-driven goodwill and property impairments totalling

&euro496m. For further detail on Adjustments, please refer to page 58 &

171 of the Annual Report. In FY21, we expect total Adjustments in the

range of &euro180m to &euro200m to be incurred.

· Underlying loss per share for the year was -&euro5.45 (FY19: EPS of

&euro0.89) reflecting the impact of the C-19 pandemic as described above.

For the calculation of underlying loss per share, please refer to page 32

of the Annual Report.

GLOBAL REALIGNMENT PROGRAMME - TARGET INCREASED TO &euro400M P.A

In response to the C-19 pandemic we initiated a Global Realignment Programme

as one of our self-help measures to address group-wide costs with a target

of permanently saving more than &euro300m, with the first benefits to be

delivered from FY20 and full benefits to be achieved by FY23. Projects

announced and underway across core functions, Markets & Airlines and TUI

Musement (formerly Destination Experiences) are already expected to deliver

close to the &euro300m target savings and we have therefore increased our

target to &euro400m per annum. In addition to restructuring charges of

&euro303m realised in FY20, we expect restructuring costs of &euro120m in

FY21 and &euro40m in FY22.

As a result of these measures, we are confident TUI Group will emerge

stronger, leaner, more digitalised and more agile, in what is likely to be a

much more consolidated market.

NET DEBT

Closing financial position deteriorated from &euro3,850m (IAS 17 basis) as

at 30 June 2020 to &euro4,557m net debt as at 30 September 2020. The

increase in net debt in the final quarter of &euro707m is in line with our

cash outflow expectations.

The year-end net debt position of &euro4,557m (IAS 17 basis) versus the

prior year (FY19: net debt &euro910m) reflects the full draw down of our

original Revolving Credit Facility of &euro1,535m and the first tranche of

state aid amounting to &euro1.8bn as part of our support package agreed

(second and third support package of &euro1.2bn and &euro1.8bn both

finalised post balance sheet date).

In the financial year 2020 we transitioned to IFRS16. All leases are

recognised as right-of-use assets and lease liabilities in our statement of

financial position. According to IFRS16 our year-end net debt position

amounts to &euro6,421m.

CASH OUTFLOW/ LIQUIDITY POSITION

Pro forma cash and available facilities as at 30 November 2020, including

third support package, would amount to &euro2.5bn (post &euro300m senior

notes redemption).

For FY21 Q1, we expect lower working capital from settlement of supplier

payments and as a result of more extensive local restrictions across our key

markets since November, which has forced us to cancel departures and

affected booking momentum. Overall, we now expect monthly cash outflow to be

in the range of &euro400m to &euro450m per month.

ADDITIONAL SUPPORT PACKAGE

On 2 December 2020, we announced an agreement with Unifirm Ltd, a syndicate

of underwriting banks, KfW and the German Economic Support Fund

(Wirtschaftsstabilisierungsfonds - WSF) on a further financing package of

&euro1.8bn.

The package includes in summary -

· a capital increase with subscription rights of approx. &euro500m;

· a silent participation, convertible into shares by the WSF of &euro420m;

· a non-convertible silent participation by the WSF of &euro280m;

· a state guarantee of &euro400m, or, alternatively, a respective increase

of the non-convertible silent participation by the WSF; and

· an additional credit facility by KfW of &euro200m, and a prolongation of

an existing credit facility by KfW until July 2022.

The package is, inter alia, subject to the approval of the European

Commission under state aid rules, the granting of the necessary merger

control approvals (where there is a prohibition on implementation) and the

respective resolutions at our Extraordinary General Meeting envisaged for

January.

The financing package strengthens our position and provides us with

sufficient liquidity reserves in this volatile market environment. It also

balances out the presumed travel restrictions until the beginning of the

2021 summer season. The package became necessary due to the increasing

travel restrictions caused by the rising number of infections and the

associated later booking behaviour of some customers. Further details of the

support package can be found in our Ad-hoc release of 2 December 2020 as

well as on pages 152 to 154 of our Annual Report.

BREXIT

With regard to the UK's exit from the EU as of 31 January 2020, a main

concern remains whether our airlines will continue to have full access to EU

airspace after the transition period. We are continuing to address the

importance of there being a special and comprehensive agreement for aviation

between the EU and the UK post Brexit to protect consumer choice with the

relevant UK and EU decision makers. We follow the political negotiations

closely and continue to develop scenarios and mitigating strategies for

various outcomes, including the potential exit of the UK from the EU on 31

December 2020 without a comprehensive free trade agreement, with a focus on

alleviating potential Brexit impacts on the Group. As at 30th November 2020

our EU level of ownership, excluding the UK, was >50%.

BUSINESS ASSUMPTIONS

There is still considerable uncertainty regarding the likelihood and nature

of further lockdowns and travel restrictions over the next few months, the

distribution of an effective vaccine and the shape of the economic recovery.

As a result the TUI Executive Board refrains from issuing new guidance for

the Financial Year 2021 under the current circumstances.

WINTER 2020/21 - we currently expect to operate an adjusted capacity8 of 20%

for Winter 2020/21, a reduction of 20% since our Pre-Close trading update

which reflects the more extensive local restrictions across our key markets

during the first quarter. We expect our adjusted capacity8 plans to be

weighted towards our financial Q2 as travel restrictions are eased, with a

notable pick up in recent bookings in those markets with softening local

restrictions.

Anecdotally we have observed an immediate uplift in demand when destinations

reopen with long-haul destinations such as Jamaica and St Lucia reporting

load factors of over 90% on reopening. Whilst many of the popular winter

destinations as well as long-haul options may at present not be permitted,

our integrated model means we are well positioned to resume both medium and

long-haul programmes as soon as destinations are reopened again. Our Winter

bookings9 are currently down 82%, in line with adjusted capacity, compared

to normal levels of prior year as well as reflecting an overall later

customer booking pattern in recent months as a result of the short notice

changes in travel advice. ASP for Winter 20/21 is up 4%.

SUMMER 2021 - we currently plan to operate an adjusted capacity8 of 80%, in

line with our last trading update. Bookings are down 10% versus this same

point last year for Summer 2020 and ASP is up 14%9, made up of both new

bookings and re-bookings. Compared to the same stage of the Summer 2019

programme, our current level of bookings would be 3% ahead. UK bookings9 are

up 19% reflecting the typical earlier booking behaviour for the region. The

absolute and relative change in overall bookings position since our

Pre-Close trading update reflects a slowdown in booking momentum during

November as a result of local restrictions across our key markets and

particularly strong comparables in the wake of the Thomas Cook insolvency.

We expect the later booking behaviour to be less pronounced as local travel

restrictions ease, vaccine programmes become available and we return to a

more normalised environment for leisure travel (supported by a pickup in

recent bookings following positive vaccine news). The integrated nature of

our business model means we have a high level of flexibility to adapt our

programme as we gain more visibility. People's continuing passion for

holidays is evident in external research10 which identifies holidays as

being one of the most missed activities during the C-19 pandemic.

8 Adjusted capacity refers to capacity % planned to be operated versus 2019

programme

9 These statistics are up to 29 November 2020, shown on a constant currency

basis and relate to all customers whether risk or non-risk

10 BCG COVID-19 consumer sentiment survey UK, US, Italy and France

https://www.bcg.com/en-gb/publications/2020/covid-consumer-sentiment-survey-

snapshot-5-18-20 [2]

BOEING 737 MAX

With regards to the Boeing 737 MAX, the US FAA issued an Airworthiness

Directive on 18 November 2020 which allows for the resumption of commercial

operations of the B-737MAX after the implementation of the specified means

of compliance. EASA issued a draft Airworthiness Directive relating to the

B-737MAX on the 24 November for consultation. EASA have publicly indicated

its intention to issue final certification within a matter of weeks, subject

to the 28-day consultation process and various other required steps. It is

our view that airlines in the EASA region are likely to be permitted to

return the Boeing 737 MAX to commercial service during the first quarter of

2021. We anticipate further updates as EASA completes their final steps for

recertification.

RETURN TO PROFITABLE GROWTH

We expect FY21 to be a year of transition and for the Group to return to

profitable growth from FY22 onwards. The additional financing package agreed

strengthens our position and provides us with sufficient liquidity reserves

in this volatile market environment, balancing out the presumed travel

restrictions until the beginning of the 2021 Summer season. We are actively

streamlining the business through targeted cost cutting, whilst prioritising

growth spend on digitalisation initiatives. We will be selective in our

investment strategy which will be supported by disposals and we will be

focussed on asset light structures. Our trusted, leading brand with

differentiated products is strongly positioned to benefit from the expected

market consolidation. Our digitalisation transformation, underpinned by cost

control, and balance sheet discipline will drive our return to healthy

financial metrics and profitable growth.

EXTRAORDINARY GENERAL MEETING

TUI Group plans to hold an EGM and seek approval for its new support package

in January 2021.

ANALYST & INVESTOR ENQUIRIES

Mathias Kiep, Group Director Tel: +44 (0) 1293 645 925

Investor Relations and

Corporate Finance

+49 (0) 511 566 1425

Nicola Gehrt, Director, Head Tel: +49 (0) 511 566 1435

of Group Investor Relations

Contacts for Analysts and Investors in UK, Ireland and

Americas

Hazel Chung, Senior Investor Tel: +44 (0) 1293 645 823

Relations Manager

Tel: +49 (0) 170 566 2321

Corvin Martens, Senior

Investor Relations Manager

Contacts for Analysts and Investors in Continental

Europe, Middle East and Asia

Ina Klose, Senior Investor Tel: +49 (0) 511 566 1318

Relations Manager

Jessica Blinne, Junior Tel: +49 (0) 511 566 1442

Investor Relations Manager

ISIN: DE000TUAG000

Category Code: ACS

TIDM: TUI

LEI Code: 529900SL2WSPV293B552

OAM Categories: 1.1. Annual financial and audit reports

Sequence No.: 89397

EQS News ID: 1154159

End of Announcement EQS News Service

1: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=redirect&url=8e080343e3e3e5bb48431aa13ff7cbdd&application_id=1154159&site_id=vwd&application_name=news

2: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=redirect&url=256189eab10d2c7a15fbdf9e7af63850&application_id=1154159&site_id=vwd&application_name=news

(END) Dow Jones Newswires

December 10, 2020 01:00 ET (06:00 GMT)

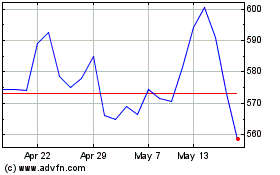

Tui (LSE:TUI)

Historical Stock Chart

From Jun 2024 to Jul 2024

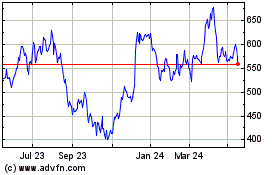

Tui (LSE:TUI)

Historical Stock Chart

From Jul 2023 to Jul 2024