TUI AG reaches agreement with private investors, banks and the German federal government on additional financing package of ?... (1152339)

December 02 2020 - 9:43AM

UK Regulatory

TUI AG (TUI)

TUI AG reaches agreement with private investors, banks and the German

federal government on additional financing package of &euro1.8 billion

02-Dec-2020 / 15:43 CET/CEST

Dissemination of a Regulatory Announcement that contains inside information

according to REGULATION (EU) No 596/2014 (MAR), transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

TUI AG reaches agreement with private investors, banks and the German

federal government on additional financing package of &euro1.8 billion,

including an approx. &euro 500 million capital increase with subscription

rights and a &euro 420 million convertible silent participation by the

Economic Support Fund

Inside information pursuant to Article 17 MAR

TUI AG has agreed with Unifirm Ltd., a syndicate of underwriting banks, KfW

and the Economic Support Fund (_Wirtschaftsstabilisierungsfonds_ - WSF) on a

further financing package of &euro 1.8 billion for TUI.

The package includes

- a capital increase with subscription rights of approx. &euro 500m;

- a silent participation convertible into shares of TUI by the WSF of &euro

420m;

- a non-convertible silent participation by the WSF of &euro 280m;

- a state guarantee of &euro 400m, or, alternatively, a respective increase

of the non-convertible silent participation by the WSF; and

- an additional credit facility by KfW of &euro 200m, and a prolongation of

an existing credit facility by KfW until July 2022.

The financing package strengthens TUI's position and provides it with

sufficient liquidity reserves in this volatile market environment. It also

balances out the presumed travel restrictions until the beginning of the

2021 summer season. The package became necessary due to the increasing

travel restrictions caused by the rising number of infections and the

associated more short-term booking behaviour of some customers.

This further financing package supplements the existing financing measures

of the Federal Republic of Germany in the form of a KfW credit line at a

total of &euro 2.85 billion and a WSF warrant bond of &euro 150 million with

option rights for approx. 58.7 million shares.

The financing package includes a WSF financing measure in the form of a

silent participation without a participation in losses generated by TUI,

which can be converted into shares of TUI, in the amount of &euro 420

million (Silent Participation I), and a further silent participation with a

participation in losses generated by TUI of &euro 280 million (Silent

Participation II).

The conversion price for the WSF in respect of the Silent Participation I is

&euro 1.00 per share. In case of a conversion of the Silent Participation I

the WSF will obtain a participation in TUI of not more than 25% plus one

share.

The agreement on the silent participations is, _inter alia_, subject to the

approval of the European Commission under state aid rules, the granting of

the necessary merger control approvals (where there is a prohibition on

implementation) and the implementation of the other components of the

financing package.

In addition, KfW has undertaken - subject to market standard conditions - to

participate in a further secured credit line of &euro 200 million and to

grant a prolongation of a portion of the existing KfW credit line. The

prolongation relates to a part of the existing KfW credit line of &euro 500

million, which would have otherwise ceased to be available on 1 April 2021

and which will after the prolongation have the same maturity as the rest of

the existing KfW credit line. The agreement on the participation by KFW is,

_inter alia_, subject to the implementation of the other components of the

financing package.

The financing package also provides for a reduction of TUI's share capital

from &euro 2.56 per share to &euro 1.00 per share (without merging shares),

followed by a capital increase by means of a rights issue of approx. 509

million shares. The reduction of the share capital, the capital increase and

the conversion rights of the WSF under the Silent Participation I are to be

resolved at an extraordinary general meeting of TUI in January 2021. The

subscription price shall be &euro 1.07 per share, implying net proceeds

after fees and expenses of approx. &euro509 million. As TUI's largest single

shareholder, holding approx. 24.89 % of the shares, Unifirm Ltd. has

irrevocably committed to exercise its subscription rights in this capital

increase (the Confirmed Acquisition Declaration).

The remainder of the capital increase will be safeguarded through

underwriting commitments, subject to certain terms and conditions. In this

respect, Unifirm Ltd. has undertaken, in addition to its Confirmed

Acquisition Declaration, and if the current shareholders do not subscribe to

their new share entitlements, that it will (i) subscribe for further newly

issued shares up to a total stake of 36%, where this is possible without

making a mandatory offer to the other shareholders of TUI based on an

exemption from BaFin under the German Securities and Takeover Act

(Wertpapiererwerbs- und Übernahmegesetz, _WpÜG_) (the Conditional

Commitment), and (ii) otherwise subscribe for further newly issued shares up

to a total stake of 29.9% (the Unconditional Underwriting Commitment). The

remaining part of the capital increase will be secured through a market

standard underwriting by a banking syndicate, subject to terms and

conditions in line with market practice for similar transactions, also as

far as the aforementioned exemption for Unifirm Ltd. should not be granted

by BaFin.

The proceeds of the capital increase will be used to repay &euro 300 million

senior notes of TUI (due in October 2021) and so will provide a significant

contribution to the extension of TUI's maturity profile. The remaining

amount of the capital increase, and more generally the financing package, is

intended to strengthen TUI's liquidity or to be used for general corporate

purposes.

The financing measure shall also include a guarantee credit facility in the

amount of &euro 400 million. The guarantee credit facility will be supported

by a state guarantee, potentially including the federal states. It is

intended to enable access to funds currently deposited for so-called cash

collaterals by replacing the cash collaterals with guarantees. As an

alternative, the Silent Participation II of the WSF will be increased.

Including the financing package now agreed, as of 30 November 2020 TUI has

pro forma financial resources and credit facilities of &euro 2.5 billion

post &euro 300m Senior Notes redemption.

In addition to the restrictions under the existing KfW loan, such as TUI's

waiver of dividend payments and a restriction on share buy-backs, the silent

participations by the WSF come with further restrictions, including relating

to investments in other companies as long as the WSF remains invested. In

addition, to the extent permitted by law, the Executive Board and the

Supervisory Board shall procure that two persons nominated by the WSF become

members of the Supervisory Board of TUI.

Given the UK Listing Rules applicable to TUI as a premium-listed company on

the London Stock Exchange, TUI points out the following: the maximum

aggregate underwriting commitment of Unifirm Ltd. (for the purposes of the

UK Listing Rules, i.e. beyond the exercise of the subscription rights for

Unifirm's existing stake in TUI as per the Confirmed Acquisition

Declaration) is &euro 130.7 million and it, together with the maximum fees

payable, falls within the smaller related party transactions provisions of

UK Listing Rule 11.1.10R. Unifirm Ltd. will receive an underwriting fee of

2.75% for its Unconditional Underwriting Commitment and an underwriting fee

of 2.00% for its Conditional Underwriting Commitment.

As required by Listing Rule 11.1.10R, Merrill Lynch International, which is

acting as joint sponsor, together with Deutsche Bank AG, London Branch, to

TUI for UK Listing Rules purposes in respect of the related party

transaction described above, has provided written confirmation to TUI that

the terms of Unifirm Ltd.'s underwriting commitments, in its opinion, are

fair and reasonable as far as the shareholders of TUI are concerned.

Not least in view of the imminent availability of vaccines against COVID-19,

TUI expects a significant reduction in current travel restrictions, and thus

a significant further improvement in its working capital and liquidity

situation. Holidays continue to be a high priority for our customers, and we

continue to work on different demand scenarios for the coming seasons.

*ANALYST & INVESTOR ENQUIRIE**S*

Mathias Kiep, Group Director Investor Tel: +44 (0)1293 645 925/

Relations +49 (0)511 566 1425

and Corporate Finance

Nicola Gehrt, Director, Head of Group Tel: +49 (0)511 566 1435

Investor Relations

*Contacts for Analysts and Investors

in UK, Ireland and Americas*

Hazel Chung, Senior Investor Relations Tel: +44 (0)1293 645 823

Manager

Corvin Martens, Senior Investor Tel: +49 (0)170 566 2321

Relations Manager

*Contacts for Analysts and Investors

in Continental Europe, Middle East and

Asia*

Ina Klose, Senior Investor Relations Tel: +49 (0)511 566 1318

Manager

*Media*

Kuzey Alexander Esener, Head of Media Tel: + 49 (0)511 566 6024

Relations

DISCLAIMER

This announcement contains a number of statements related to the future

development of TUI. These statements are based both on assumptions and

estimates. Although we are convinced that these future-related statements

are realistic, we cannot guarantee them, for our assumptions involve risks

and uncertainties which may give rise to situations in which the actual

results differ substantially from the expected ones. The potential reasons

for such differences include market fluctuations, the development of world

market fluctuations, the development of world market commodity prices, the

development of exchange rates or fundamental changes in the economic

environment. Actual results may also differ from those expressed or implied

in the forward-looking statements as a result of the effects of the COVID-19

pandemic and uncertainties about its impact and duration. TUI does not

intend or assume any obligation to update any forward-looking statement to

reflect events or circumstances after the date of this announcement.

The shares of the Company are not and will not be registered under the U.S.

Securities Act of 1933, as amended (Securities Act), and may not be offered

or sold in the United States absent registration or an applicable exemption

from the registration requirements of the Securities Act.

Deutsche Bank, AG (London Branch) and Merrill Lynch International are each

acting exclusively for TUI AG in connection with the related party

transaction described above and for no one else and will not be responsible

to anyone other than TUI AG for providing the protections afforded to their

respective clients or for providing advice in relation to such matters.

ISIN: DE000TUAG000

Category Code: MSCU

TIDM: TUI

LEI Code: 529900SL2WSPV293B552

OAM Categories: 2.2. Inside information

Sequence No.: 88926

EQS News ID: 1152339

End of Announcement EQS News Service

(END) Dow Jones Newswires

December 02, 2020 09:43 ET (14:43 GMT)

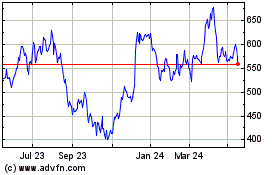

Tui (LSE:TUI)

Historical Stock Chart

From Jun 2024 to Jul 2024

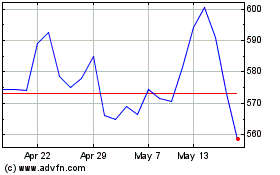

Tui (LSE:TUI)

Historical Stock Chart

From Jul 2023 to Jul 2024