RNS Number:9464U

TriVest VCT PLC

01 December 2005

TRIVEST VCT PLC

PRELIMINARY RESULTS FOR THE YEAR ENDED 30 SEPTEMBER 2005

CHAIRMAN'S STATEMENT

I am pleased to present to Shareholders the preliminary results of the Company

for the year ended 30 September 2005.

The performance of the portfolio this year has been excellent. Capital gains

have been realised in the year which has resulted in the Board proposing to pay

to Shareholders an interim capital dividend of 2.5 pence per share in respect of

the year ending 30 September 2006. Provided that the performance of the

portfolio is satisfactory, the Board expects to be able to pay a similar capital

dividend at the beginning of the 2007 calendar year. This interim capital

dividend is in addition to the proposed final dividend for the year ended 30

September 2005 of 0.75 pence per share to be paid from income.

Net Asset Value

At 30 September, 2005, the Company's Net Asset Value (NAV) per share had risen

to 122.98 pence (2004: 80.02 pence), a rise of nearly 54%. The Company,

including the proposed final income dividend of 0.75 pence per share and the

proposed capital dividend of 2.5 pence per share referred to above, will have

distributed dividends of 8.7 pence per share since the Company's launch. This

total return since launch (including these dividends) of 129.18 pence compares

with the initial NAV (after the launch expenses of the issue) of 94.5 pence per

share (excluding tax reliefs available to Shareholders).

Economic Background

The economy has been growing modestly at around 1.5% pa over the recent period.

Notwithstanding the impact of oil prices the FTSE 100 has continued to rise,

possibly aided by the low interest rate environment. The AIM index has also

rallied well since its low point in May 2005. Commentators suggest continued

positive growth in the economy, although there are worries in the retailing

sector, to which the Company is not overly exposed.

TriVest's Portfolio

At present, Foresight Venture Partners Limited (Foresight) manage some 54% of

the portfolio with Matrix Private Equity Partners (MPEP) managing 39% and Nova

Capital Management Limited (Nova) the balance. By market sector, the portfolio

is dominated by investments in technology companies at 59%, with manufacturing

companies at 11%, construction and building materials at 9% and the balance in a

variety of other sectors. When the portfolio is considered by stage of

development, the portfolio is more evenly spread with over 44% invested in MBO /

MBI situations, 43% in AIM quoted stocks, 11% in development capital companies

and 2% in early stage investments.

The last six and twelve months have seen active periods in the Foresight

portfolio. In June and September 2005 further investments of #62,496 and

#159,624 were made into Aigis Engineering Solutions Limited. In September 2005

this company changed its name to Aigis Blast Protection Limited. In May and

August 2005 additional investments of #28,181 and #100,000 were made into

Camwood Limited and Aquasium Technology Limited respectively. A further

investment of #62,000 was made as a loan to DCG Datapoint Group Limited in

September 2005. Disappointingly, Broadreach Group did not prove a successful

investment for the Manager. TriVest's investment in Broadreach Train Services

Limited was disposed of for #16,050 in September and Broadreach Networks Limited

was sold shortly after the year-end. In January 2005 a further investment of

#459,375 was made into Oxonica Limited as part of a rights issue. In May 2005

the company made a pre-float capital re-organisation which was followed in July

this year by the conversion by shareholders of the loan stocks into equity. On

20 July 2005, Oxonica was floated on the AIM market. The company is currently

standing at a substantial premium to both our cost and float prices. Blue Curve

Limited was sold to Mondas plc during November 2005.

Within the MPEP portfolio Holloway White Allom ("HWA") continues to trade

strongly. In April 2005, TriVest made a partial divestment of 16,472 ordinary

shares of HWA at a price of #63.15 per share which realised proceeds of #1.16m

and profit of #1.13m. In June 2005 TriVest also realised its Cumulative

Convertible Redeemable Participating Preference Shares in HWA for #250,000

crystallising a capital profit of #212,000. In May 2005, a further investment of

#436,047 was made into the Hunter Rubber Company. In August 2005, a new

investment of #150,000 was made into the ordinary shares of Sectorguard plc, a

security company providing manned guarding, mobile patrols and alarm response

services. In September 2005, this was followed by a new investment of #721,280

into Ministry of Cake Limited (previously Maynard Scott Limited), a manufacturer

and seller of frozen desserts to the foodservice industry. In October 2005,

after the year end, a new investment of #1,000,000 was made into the Youngman

Group Limited a manufacturer and supplier of aluminium access towers and

ladders.

Within the Nova portfolio, TriVest's interest in Watkins Books was disposed of

in August 2005 for #17,299. An additional investment of #87,170 was made in

September 2005 into Biomer Technology.

Revenue Account

The return on ordinary activities after taxation has fallen by #88,464.

Principally, this is because underlying total income has fallen by #67,231. This

decline is due to the redemption/disposal of several loan stocks and a

preference share investment that generated higher loan interest and dividends in

the previous year. Such income fell by #178,233. Against this, the proceeds

arising from these transactions generated higher levels of income from the lower

yielding OEIC money-market funds, which earned #424,720 this year, compared to

#313,817 last year, a rise of #110,903.

Fund management fees charged to the revenue account increased this year by

#41,546 as the increase in underlying portfolio values during the year started

to feed through to higher fees. Overhead costs have remained broadly constant.

Dividends

The Company's revenue return per Ordinary Share was 0.80 pence per share (2004:

0.99 pence per share). As noted above, your Board will be recommending a final

dividend of 0.75 pence per Ordinary Share in respect of the year under review at

the Annual General Meeting to be held on 31 January 2006. The Board also

proposes to pay an interim capital dividend of 2.5 pence per Ordinary Share in

respect of the year ending 30 September 2006. The dividends will be paid on 14

February 2006 to shareholders on the Register on 13 January 2006.

Dividend Investment Scheme

We are also proposing to offer to Shareholders the opportunity to re-invest all

or part of their dividends into new Ordinary Shares of the Company at the latest

published NAV per share at the time of issue. Members of the Board have

indicated that they will be mandating their holding to the Dividend Investment

Scheme for the purposes of the dividends referred to above. Full details of the

Dividend Investment Scheme are included with this Report, together with an

election form. The form should be returned to Capita Registrars at the address

given on the form to arrive by 31 January 2006 to ensure that, subject to

Shareholder approval at the AGM, you qualify to participate in the Dividend

Investment Scheme for the dividends referred to above.

Valuation Policy

All quoted stocks have been valued at their mid-market prices. It is worth

commenting that the Fund does hold a number of relatively early stage AIM listed

stocks. AIM stocks can experience considerable volatility. Additionally,

limited marketability can mean that the price at which a sizeable block of

shares could be traded, if at all, may vary significantly from the market price

used. Next year, in compliance with IFRS, the Company will apply bid prices to

its quoted investments. If applied to this year's valuations, this would have

reduced valuations by #472,000, or 3% of the quoted portfolio, and a reduction

in the net asset value of 1.12 pence per share.

Share buy-backs

During the year ended 30 September 2005, the Company continued to implement its

buy-back policy and, accordingly, bought back 1,122,264 Ordinary Shares

(representing 2.8%) of the shares in issue at the period end) at a total cost of

#869,045 (net of expenses). These shares were subsequently cancelled by the

Company.

Summary Financial Statement

You will have received an earlier letter from me proposing to distribute a

Summary of the Annual Report to Shareholders rather than the full version

(unless you opted to receive the latter). In recent years the Company's Annual

Report and Accounts have become longer and more complex, principally due to the

requirements of new statutory, corporate governance and other reporting

regulations. As a result, we have decided to follow the example of a number of

other companies and produce a Summary Financial Statement for the year to 30

September 2005 and subsequent financial years. We hope that this will be more

informative for many of our Shareholders and that running costs will be reduced.

TriVest Website

The Company is about to finalise its own website and the full Annual Report and

Accounts will be available once published at www.trivestvct.co.uk.

Investor Allstars 2005 Awards

At the recent Investor Allstars 2005 Awards ceremony, Matrix Private Equity

Partners won the award for the Venture Capital Trust Manager of the Year based

in part upon its TriVest performance numbers. Foresight Venture Partners,

another of our Managers, was also a finalist in this category. Jamie Richards, a

manager with Foresight Venture Partners, won the award for Young Personality of

the Year.

This has been a busy and a positive year for the Board with a number of

initiatives having been undertaken, which are highlighted above. The Board is

pleased with the growth the portfolio has made and we look forward to continuing

this progress over the coming months. I would like to take this opportunity to

thank Shareholders for their continued support.

Colin Hook

Chairman

30 November 2005

STATEMENT OF TOTAL RETURN

(incorporating the Revenue Account of the Company)

for the year ended 30 September 2005

Year ended 30 September 2005 Year ended 30 September 2004

Revenue Capital Total Revenue Capital Total

# # # # # #

Unrealised gains on

investments - 16,602,058 16,602,058 - 2,774,109 2,774,109

Realised gains on

investments - 1,080,192 1,080,192 - 666,281 666,281

Income 1,163,788 - 1,163,788 1,163,180 - 1,163,180

Investment management fees (193,717) (581,150) (774,867) (152,171) (456,512) (608,683)

Other expenses (537,493) - (537,493) (441,468) - (441,468)

Return on ordinary

activities before taxation 432,578 17,101,100 17,533,678 569,541 2,983,878 3,553,419

Tax on ordinary activities (106,870) 106,047 (823) (155,369) 131,914 (23,455)

Return on ordinary

activities after taxation 325,708 17,207,147 17,532,855 414,172 3,115,792 3,529,964

Dividend (299,376) - (299,376) (515,996) - (515,996)

Transfer to/(from) reserves 26,332 17,207,147 17,233,479 (101,824) 3,115,792 3,013,968

Return per Ordinary Share -

basic and diluted 0.80p 42.19p 42.99p 0.99p 7.48p 8.47p

The revenue column is the profit and loss account of the Company.

All revenue and capital items in the above statement derive from continuing

operations.

No operations were acquired or discontinued in the period.

BALANCE SHEET

as at 30 September 2005

as at 30 September 2005 as at 30 September 2004

# #

Fixed assets

Investments 39,223,922 20,746,041

Current assets

Debtors and prepayments 1,386,381 424,795

Current investments 6,345,873 7,926,941

Cash at bank 2,926,233 4,633,219

10,658,487 12,984,955

Creditors: amounts falling due within one year

Corporation tax - 24,456

Other creditors 335,798 546,681

Accruals 159,721 128,131

(495,519) (699,268)

Net current assets 10,162,968 12,285,687

Net assets 49,386,890 33,031,728

Capital and reserves

Called up share capital 401,574 412,797

Capital redemption reserve 16,441 5,218

Special reserve 32,229,429 38,777,875

Capital reserve - realised 3,410,293 (3,215,081)

Capital reserve - unrealised 13,099,065 (3,152,837)

Revenue reserve 230,088 203,756

49,386,890 33,031,728

Net asset value per Ordinary Share - basic and diluted 122.98p 80.02p

CASH FLOW STATEMENT

for the year ended 30 September 2005

Year ended Year ended

30 September 2005 30 September 2004

Operating activities # #

Investment income received 1,105,903 1,028,129

Investment management fees paid (774,866) (601,168)

Other cash payments (426,129) (415,146)

Net cash (outflow)/inflow from operating activities (95,092) 11,815

Taxation

UK Corporation tax paid (25,279) (96,917)

Investing activities

Acquisition of investments (3,660,979) (4,589,395)

Disposal of investments 2,885,804 3,151,097

(775,175) (1,438,298)

Equity Dividends

Payment of equity dividends (514,191) (521,837)

Cash outflow before financing and liquid resource management (1,409,737) (2,045,237)

Management of liquid resources

Decrease/(increase) in monies held pending investment 581,068 (1,176,232)

Financing

Purchase of own shares (878,317) (281,976)

(878,317) (281,976)

Decrease in cash for the year (1,706,986) (3,503,445)

INVESTMENT PORTFOLIO SUMMARY

as at 30 September 2005

Cost at Valuation at Valuation at % of

portfolio

30-Sep-05 30-Sep-04 30-Sep-05 by value

Foresight Venture Partners

Oxonica plc 2,136,763 1,677,389 8,984,935 22.91%

Specialist in the design, manipulation and engineering of

properties of materials at the nano-scale

Sarantel Group plc 1,611,752 2,156,625 3,820,125 9.74%

Developer and manufacturer of antennae for mobile phones

and other wireless devices

Aquasium Technology Limited 700,000 600,000 2,067,997 5.27%

Business engaged in the design, manufacturing and marketing

of bespoke electron beam welding and vacuum furnace

equipment

SmartFOCUS Group plc 700,000 893,333 1,920,454 4.90%

Provider of analytic software to support targeting and

execution of marketing campaigns

Camwood Limited 1 1,028,181 1,000,000 1,780,937 4.54%

Provider of software repackaging services

Alaric Systems Limited 1 595,802 588,059 595,762 1.52%

Software developer and provider of support services in the

credit/debit card authorisation and payments market

ANT plc 462,816 1,323,106 489,164 1.25%

Provider of embedded browser/email software for consumer

electronics and Internet appliances

Blue Curve Limited 567,000 396,666 450,183 1.15%

Provider of software for automating the production and

distribution of research information by banks and fund

managers

Aigis Blast Protection Limited 1 272,120 50,000 333,320 0.85%

(formerly Aigis Engineering Solutions Limited)

Specialist blast containment materials company

DCG Datapoint Group Limited 312,074 250,000 312,074 0.80%

Design, supply and integration of data storage solutions

Wire-e Limited 500,000 250,000 250,000 0.64%

Provider of mobile data communication services

Monactive Limited 339,285 218,749 160,667 0.41%

Provider of software management tools that monitor usage of

software versus licences held

Broadreach Networks Limited 1,143,000 1,143,000 15,000 0.03%

Public access WLAN and fixed line Internet Service Provider

- Broadreach Train Services Limited n/a 107,000 n/a 0.00%

Other investments in the portfolio 2 250,000 Nil Nil 0.00%

10,618,793 10,653,927 21,180,618 54.01%

Matrix Private Equity Partners Limited

HWA Limited (trading as Holloway 69,105 2,198,247 3,219,023 8.20%

White Allom Limited) 1

Refurbishment, restoration and construction of notable

public buildings and top-end residential dwellings in and

around London

Image Source Group Limited 1 1,000,000 1,041,902 2,618,253 6.68%

Royalty free picture library

Special Mail Services Limited 1,230,256 651,786 2,590,494 6.60%

Specialist, secure credit card delivery business

Original Additions (Beauty Products) Limited 1 1,000,000 1,000,000 2,301,687 5.87%

Manufacturer and distributor of beauty products

Brookerpaks Limited 500,000 1,140,503 1,033,058 2.63%

Importer and distributor of garlic and vacuum-packed

vegetables to supermarkets and the wholesale trade

BBI Holdings plc 369,890 393,500 755,520 1.93%

Manufacturer of gold conjugate for the medical diagnostics

industry

Ministry of Cake Limited (fomerly Maynard Scotts Limited) 721,280 n/a 721,280 1.84%

Manufacturer of desserts and cakes for the food service

industry

Tottel Publishing Limited 514,800 n/a 514,800 1.31%

Publisher of specialist legal and taxation titles

Letraset Limited 1,000,000 967,367 487,737 1.24%

Manufacturer and worldwide distributor of graphic art

products

FH Ingredients Limited 403,303 n/a 403,303 1.03%

Processor of frozen herbs for the food manufacturing

industry

Inca Interiors Limited 350,000 100,000 300,562 0.77%

Design, supply and installation of quality kitchens to house

developers

SectorGuard plc 1 150,000 n/a 150,000 0.38%

Provider of manned guarding, mobile patrols and alarm

response services

B G Consulting Group Limited 1,000,000 125,000 125,000 0.32%

Technical training business

Stortext-FM Limited 3 380,435 n/a Nil 0.00%

Integrated outsourced document storage business

The Hunter Rubber Company Limited 936,047 500,000 Nil 0.00%

Manufacturer of Wellington boots, safety footwear and diving

suits

9,625,116 8,118,305 15,220,717 38.80%

Tikit Group plc 517,624 623,912 904,347 2.30%

Provider of consultancy, services and software solutions for

law firms

Biomer Technology Limited 137,170 50,000 753,837 1.92%

Developer of biomaterials for medical devices

I-DOX plc 737,625 764,000 751,903 1.92%

Provider of document storage systems

NexxtDrive Limited (Formerly DriveTec (UK) Limited) 1 500,000 408,570 412,500 1.05%

Developer of transmissions technologies for applications in

the automotive, construction and industrial sectors

Stortext-FM Limited 3 n/a 14,827 Nil 0.00%

Integrated outsourced document storage business

Watkins Books Limited n/a 112,500 Nil 0.00%

Supplier of books in alternative sciences, health,

philosophy and related sectors

Other investments in the portfolio 2 3,988,529 Nil Nil 0.00%

5,880,948 1,973,809 2,822,587 7.19%

Total 26,124,857 20,746,041 39,223,922 100.00%

1 The percentages of equity held for these companies may be subject to further

dilution of an additional 1% or more if, for example, management of the investee

company exercises share options.

2 'Other investments in the portfolio' comprises those investments that have

been valued at nil and from which the Directors only expect to receive small

recoveries. This comprises iDesk plc in the Foresight portfolio and LeSac

Limited, The Good Book Guide Limited, Trident Publishing Limited and Zynergy

Group Limited in the Nova portfolio.

3 During the year, Stortext Group Limited merged with a similar company F-M

Image Management Limited to form a new company Stortext-FM Limited. The new

company is managed as part of the MPEP portfolio.

Notes

1. In accordance with the policy statement published under "

Management and Administration" in the Company's Prospectus dated 13 October

2000, the Directors have charged 75% of the investment management expenses

to capital reserve.

2. The basic revenue return per Ordinary Share is based on the net

revenue from ordinary activities after taxation of #325,708 (2004: #414,172)

and on 40,786,094 (2004: 41,647,506) Ordinary Shares, being the weighted

average number of Ordinary Shares in issue during the year.

3. The basic capital return per Ordinary Share is based on net

realised capital return of #17,207,147 (2004: #3,115,792) and on 40,786,094

(2004: 41,647,506) Ordinary Shares, being the weighted average number of

Ordinary Shares in issue during the year.

4. The financial information set out in these statements does not

constitute the Company's statutory accounts for the year ended 30 September

2005 but is derived from those accounts. Statutory accounts will be

delivered to the Registrar of Companies after the Annual General Meeting.

5. The Company revoked its investment company status on 30 November

2005 which means that it is now able to make capital distributions from

realised profits when previously it could only pay dividends from income.

6. The Company proposes to pay a final dividend of 0.75 pence

(2004: 1.25 pence) per share. The Board also intends to pay an interim

capital dividend of 2.5 pence per Ordinary Share in respect of the year

ending 30 September 2006. The dividends will be paid on 14 February 2006

to shareholders on the Register on 13 January 2006.

7. The Annual General Meeting will be held at 11.00 am on 31

January 2006 at One Jermyn Street, London SW1Y 4UH.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR WUGAPGUPAGMU

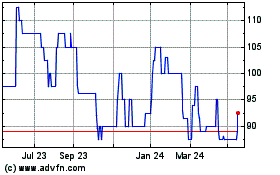

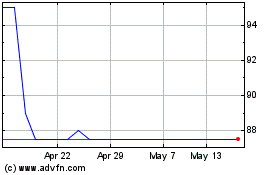

Touchstar (LSE:TST)

Historical Stock Chart

From Jun 2024 to Jul 2024

Touchstar (LSE:TST)

Historical Stock Chart

From Jul 2023 to Jul 2024