TIDMTSCO

RNS Number : 9141Y

Tesco PLC

18 May 2021

18 May 2021

Tesco PLC

Annual Report and Financial Statements and Notice of Annual

General Meeting 2021

Further to the release of its preliminary results announcement

on 14 April 2021, Tesco PLC (the "Company") announces that it has

today published its Annual Report and Financial Statements 2021. In

addition, the Company announces that its Notice of Annual General

Meeting 2021 (the "Notice") has been sent to shareholders. The 2021

Annual General Meeting will be held at our Heart building, Shire

Park, Welwyn Garden City, Herts, AL7 1TW on Friday, 25 June 2021 at

9.30 am (the "AGM").

We recognise the ongoing importance of engaging with investors,

especially during these unprecedented times. In light of the

current UK Government restrictions, we propose to follow a slightly

different format for this year's events. We invite investors to

join a Virtual Shareholder Event on Friday, 18 June 2021 at 2.00pm.

This will allow shareholders to hear from the Board and ask

questions relating to the business of the AGM. During this event,

shareholders will receive presentations from the Group Chair, John

Allan, and the Group Chief Executive, Ken Murphy, on the

performance and activities of Tesco during the past year. This new

event will also allow those shareholders who vote in advance of the

AGM to do so after having heard from the Board. Following the

latest guidance issued by the UK Government, it is not clear

whether all shareholders who may wish to attend the AGM in person

will be able to do so. Therefore, it is proposed that we hold the

AGM with the minimum number of shareholders present (which will be

facilitated by Tesco) as is required under the Company's articles

of association to enable the business of the AGM to be conducted.

Further information and the current arrangements for the AGM can be

found on our website at www.tescoplc.com/AGM2021.

The Company's Annual Report and Financial Statements 2021,

Notice of Annual General Meeting 2021 and Little Helps Plan

Progress Update can be viewed on the Company's website at

www.tescoplc.com .

In accordance with Listing Rule 9.6.1R, copies of the following

documents have been submitted to the National Storage Mechanism and

will shortly be available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

-- Annual Report and Financial Statements 2021;

-- Notice of Annual General Meeting 2021; and

-- Proxy Form for the 2021 Annual General Meeting.

The Company's preliminary consolidated financial information and

information on important events that have occurred during the year,

and their impact on the financial statements were included in the

Company's preliminary results announcement on 14 April 2021. That

information, together with the information set out below, which is

extracted from the Annual Report and Financial Statements 2021,

constitute regulated information, which is to be communicated to

the media in full unedited text through a Regulatory Information

Service in accordance with the FCA's Disclosure Guidance and

Transparency Rules ("DTR"), Rule 6.3.5R. This announcement is not a

substitute for reading the full Annual Report and Financial

Statements 2021. Page and note references in the text below refer

to page numbers and note references in the Annual Report and

Financial Statements 2021. To view the preliminary results

announcement, visit the Company's website: www.tescoplc.com .

Enquiries: Robert Welch

Company Secretary

Tesco PLC

Tesco House

Shire Park

Kestrel Way

Welwyn Garden City

Hertfordshire

AL7 1GA

Tel: 07793 222569

LEI Number: 2138002P5RNKC5W2JZ46

Principal risks and uncertainties

Key Elements of our risk management framework

Our established risk management framework enables us to manage

and report the risks that we face as a business. A risk that can

seriously affect our performance, future prospects or reputation is

termed a principal risk.

To manage our risks effectively we have identified a risk

appetite which is driven by the following factors:

- our performance should be competitive, responsible and focused

on creating value for all our stakeholders including customers,

colleagues, suppliers and shareholders;

- our behaviours must be in line with our Code of Business

Conduct to protect and enhance our reputation;

- we aim to operate our business within the capital allocation

framework we have set out; and

- we seek to ensure that our principal risks are effectively managed.

Principal risks are discussed and agreed by Executive management

and the Audit Committee. These risks are cascaded to the business

units (top-down), who manage and report on the principal risks and

any additional significant business unit risks. Business units also

escalate risks as appropriate (bottom-up) to the Executive

Committee. Our regular risk discussions consider emerging risks and

include horizon scanning, which are reported at business unit and

Executive Committee levels.

The principal risks are discussed and evaluated through regular

meetings with senior management. The Board discusses each principal

risk at least annually to provide oversight and ensure they remain

well-managed and relevant.

The seven steps of the risk, controls and assurance framework on

page 31 are embedded within our business as key elements of how we

manage our risks and ensure appropriate controls are in place.

The risk assessment process relies on our evaluation of the

likelihood and impact of risks, and on the development and

monitoring of appropriate internal controls. Risk registers,

detailing the risks we face, are an important component of how we

manage our risks.

Risk Management

We have carried out a robust review of our principal risks,

which includes periodic assessments of the risks we believe could

threaten our business model, future performance, solvency or

liquidity.

The Brexit risk has reduced since last year when there was no

clarity on the long-term trading relationship between the UK and EU

once the transition period expired on 31 December 2020. The new

UK-EU Trade and Cooperation Agreement (TCA) removed the uncertainty

of a no-deal Brexit. While this has reduced the Brexit risk,

uncertainty remains around the full effect of Brexit, how the TCA

will be implemented and how the trading relationship will

develop.

We reported the COVID-19 pandemic as a new principal risk last

year, and it remains an elevated risk. The pandemic has had a more

profound impact on economies and people than was then expected.

Uncertainty remains as to whether the recent lockdowns and

vaccination programme are sufficient to bring the pandemic under

control and allow normal life to return and, if so, when. The

impact of the pandemic is also reflected across many of the

principal risks and our mitigation strategies for them.

Climate change has become a widely acknowledged global emergency

and a key priority for governments, businesses and citizens around

the world. While risks relating to climate change and

sustainability have previously been integral parts of several of

our principal risks, we have now included climate change as a

separate principal risk.

Tesco Bank has been through a challenging year due to increased

macroeconomic uncertainty driven by, among others, the COVID-19

pandemic, thereby increasing its risk profile.

During the year, we recognised the potential disruption arising

from the lengthy regulatory processes involved in the sale of our

businesses in Thailand and Malaysia, which was completed in

December 2020. The actions we took to monitor and manage these

risks proved effective.

The following table sets out our principal risks, their movement

during the year, and a summary of key controls and mitigating

factors. They do not include all our risks and they are not set out

in priority order. Additional risks not presently known, or that we

currently deem to be less material, may also have adverse

effects.

As part of our continuous improvement approach to risk

management, and aided by the appointment of a new Chief Audit and

Risk Officer in September 2020, we will continue to develop our

methodology and risk framework. This will enhance risk management

in supporting effective decision-making. As part of this, we also

continue to develop and enhance our approach to risk appetite.

Principal risk Risk movement Key controls and mitigating

factors

Brexit

Failure to adapt The new UK-EU Trade

to the UK's new trading and Cooperation Agreement * We continue to assess and monitor the potential risks

relationship with (TCA) came into effect of Brexit and its impacts on our customers,

the EU, and how it from 1 January 2021, colleagues and shareholders. We are also taking

may develop as further setting out the conditions appropriate mitigation measures to address challenges

agreements are reached for tariff-free trading including logistics, resourcing and supply with clear

or political decisions with the EU and removing oversight by senior leaders and our Brexit Governance

made, results in the uncertainty of Group.

disruption to our a no-deal Brexit.

business, cost inflation The business is impacted

and impacts on our by more cumbersome * Our focus has been on avoiding transportation delays

ability to supply border controls, and bottlenecks. We are also working to ensure the

our customers with goods inspection, accuracy of documentation to avoid waste and to

the products and and customs documentation, ensure we maximise the shelf life of our fresh

at the prices they with the most trade produce by working with our logistics partners.

expect. These and friction being between

any adverse impact Great Britain and

of Brexit on the Northern Ireland * We continue to work closely with Government,

UK economy could and Ireland. The regulatory bodies and industry on implementing the

affect our business, full effect of Brexit TCA, sharing data and analysis to inform

financial results on the business will policymaking.

and operations. emerge as new trade

patterns are established

and the new regulatory

framework is better

understood.

Risk decreasing

--------------------------- ------------------------------------------------------------

COVID-19

The continuing global During the year,

COVID-19 pandemic governments around * The safety and wellbeing of our colleagues and

may have a significant the world introduced customers has been and continues to be our overriding

and prolonged impact emergency public priority. Our Executive Committee is monitoring

on global economic measures, including events closely with regular Board oversight,

conditions, disrupt travel bans, quarantines evaluating the impacts and designing appropriate

our supply chain and public lockdowns. response strategies.

(including our supplier These measures have,

base, specifically to varying degrees,

regarding business been relaxed then * Our teams continue to work tirelessly to implement

closure and consolidation, reintroduced as COVID-19 specific actions to minimise disruption faced by our

labour shortage, transmission subsided customers in these challenging times. This includes

raw material supply before surging again, increasing our retail store colleague headcount (with

and cost inflation), with new variants redeployment of colleagues where possible), securing

increase employee adding to the speed additional supply chain capacity to meet changes in

absences and adversely of transmission. demand, implementing changes to stores (including

impact our operations Vaccines have been hours, additional security, hygiene and social

(including Tesco developed and are distancing measures), and extending support to

Bank). Failure to being rolled out colleagues and customers at increased risk.

adapt to changes with significant

brought about by coverage in our core

this and any future UK market, however * We have developed practices within our stores and

pandemics in our uncertainty remains distribution centres, as well as for office

markets and the as to whether recent colleagues working from home, to help people adapt to

environment lockdowns and the the new ways of working. We have aligned our controls

in which we operate vaccination programme accordingly with appropriate assurance measures in

may adversely affect are sufficient to place.

our competitiveness bring the pandemic

and financial results. under control and

allow normal life * The availability of cash resources and committed

to return and, if facilities, together with our strong cash flow, are

so, when. It is also supporting Tesco's liquidity and longer-term

unclear how the pandemic viability.

will have changed

the environment in

which we operate

and the choices customers

make.

No risk movement

--------------------------- ------------------------------------------------------------

Data security and data privacy

Failure to comply As a retail organisation,

with legal or regulatory we hold a large amount * We put our customers and colleagues at the heart of

requirements relating of personal data all decisions we make in relation to the processing

to data security on customers and of personal data. Our data privacy and protection

and data privacy colleagues. The threat policies clearly set out how we can protect and

in the course of landscape has been appropriately restrict customer, supplier and

our business activities ever-growing while colleague data. Our multi-year technology security

results in reputational we continue to invest programme is driving enhanced data security

damage, fines or in our security and capabilities.

other adverse privacy programmes.

consequences. The move to homeworking

This includes criminal for most office-based * We have an established team in our security

penalties and colleagues during operations centre to detect, report and respond to

consequential the pandemic has security incidents.

litigation which presented its own

may result in an security challenges

adverse impact on and response requirements. * We have a third-party supplier assurance programme

our financial performance focusing on third-party data security and privacy

or unfavourable effects No risk movement risks.

on our ability to

do business.

* We have a privacy compliance programme, which

includes assessment and monitoring of risk across our

global business.

* There is regular reporting on progress and results of

the security and privacy programmes to governance and

oversight committees.

* We recognise the importance of training and

communication to help prevent data security and

privacy-related incidents and have regular induction,

awareness and refresher courses for our colleagues.

* We have next-generation, behaviour-based anti-virus

and malware solutions, data and payment encryption

and threat detection tools that help us reduce the

likelihood of being compromised.

--------------------------- ------------------------------------------------------------

Health and safety

Failure to meet safety The pandemic has

standards in relation presented unique * We have a business-wide, risk-based safety framework

to our workplace challenges for the which defines how we implement and report on safety

results in death safety of our customers controls to ensure that colleagues, contractors and

or injury to our and colleagues. It customers have a safe place to work and shop.

customers, colleagues, has driven the need

or third parties, for rigorous risk

or in damage to our assessment, the rapid * We require each business to maintain a comprehensive

operations and leads rollout of new ways risk register and safety improvement plan to document

to adverse financial of serving customers and track enhancements.

and reputational and of working for

consequences. colleagues, clear

communication, and * Governance and oversight are established in the form

close attention to of our Group Risk and Compliance Committee and

and compliance with business unit-specific health and safety committees.

Government pronouncements. These committees review critical metrics and monitor

the effectiveness of related controls.

No risk movement

* Our safety audits, whistleblowing arrangements and

the results of our annual colleague surveys inform

management on the delivery of targeted safety

initiatives, including communication plans.

* Our assurance activities, such as store and

distribution compliance reviews, safety health checks

and audits, help us assess our compliance with

established policies and processes. They enable us

continuously to seek and identify areas for potential

improvement.

--------------------------- ------------------------------------------------------------

Climate change

Climate change has Climate change has

the potential to become a widely * Our Little Helps Plan on pages 12 to 16 sets out our

change dramatically acknowledged ambitions and action plans for addressing climate

the world in which global emergency, change. The Board's Corporate Responsibility

we live and operate, moving from an emerging Committee provides governance and oversight.

and tackling climate risk to a principal

change, by taking risk for the business.

measures to limit * We have established a number of metrics with

its impact to manageable New risk appropriate management oversight and governance

levels, has become mechanisms to enable us to monitor progress. We are

a key priority for working with third-party organisations to continue

governments, businesses developing this suite of metrics. There is a level of

and citizens around external assurance over the metrics, and we are

the world. Even if working to further enhance and extend this.

manageable, the effect

of climate change

will be quite profound, * We seek to align our climate-related ambitions with

and these measures our financial policies and have launched our first

will themselves have sustainability-linked bond. We have also extended our

a significant impact climate-related financial disclosures.

on economies and

the choices people

make. Climate change

has, therefore, moved

from an emerging

risk to a principal

risk for the business.

--------------------------- ------------------------------------------------------------

Responsible sourcing and supply chain

Failure to meet product The pandemic (and

safety standards to an extent contingency * Our product standards, policies and guidance help

results in death, planning for Brexit) ensure that products are safe, legal and of the

injury or illness put significant stress required quality. They cover food and non-food, as

to customers. Failure on our supply chain well as goods and services not for resale.

to ensure that products during the year.

are sourced responsibly Surges in demand

across our supply placed pressures * We have policies and guidance to help ensure human

chain (including on supply, and some rights are respected and environmental impacts are

fair pay for workers, suppliers were unable responsibly managed. These include a focus on

adhering to human to maintain operating appropriately monitoring conditions and progress,

rights, clean and capacity. We have tackling endemic sector risks and addressing wider

safe working environments, also had to adopt community needs.

meeting climate change new approaches to

and sustainability our technical and

commitments) and supplier audits to * We run colleague training programmes on food and

that all social and ensure our standards product safety, responsible sourcing, hygiene

environmental standards have been met. We controls, and also provide support for stores. We

are met, results have continued to also provide targeted training for colleagues and

in supply chain drive our environmental suppliers dealing with specific challenges such as

disruption, agenda, including modern slavery.

regulatory breaches, actions relating

and reputational to deforestation

impacts of not meeting and animal welfare. * Our crisis management procedures are embedded within

societal expectations. operations to quickly resolve issues if non-compliant

No risk movement products are produced or sold with clear escalation

protocols.

* We operate supplier audit and product analysis

programmes to monitor product safety, traceability

and integrity, human rights and environmental

standards. They include unannounced audits of

suppliers' sites and facilities.

--------------------------- ------------------------------------------------------------

Competition and markets

Failure to deliver We continue to face

an effective, coherent the challenges of * Our Board develops and regularly challenges the

and consistent strategy a changing competitive strategic direction of our business to enhance our

in response to our landscape and price ability to remain competitive on price, range and

competitors and changes pressures across service. This includes developing our online channels

in market conditions our markets. Our and multiple formats to allow us to compete in

result in a loss strategies are different markets.

of market share and well-developed

profitability. and we review them

regularly to remain * Our Executive Committee and operational management

competitive and informed regularly review markets, trading opportunities,

by competitor and competitor strategy and activity.

market activity.

No risk movement * We carry out market scanning and competitor analysis

to refine our customer proposition.

--------------------------- ------------------------------------------------------------

Transformation

Failure to achieve There has been ongoing

our transformation delivery of key programmes * We have clear market strategies and business plans to

objectives due to to meet our transformation address changes to business priorities, strategic

poor prioritisation, objectives while objectives and external market factors.

ineffective change we continue to push

management and a forward with new

failure to understand initiatives. * We have executive-level governance and oversight for

and deliver the technology all activities to ensure programmes are adequately

required, results No risk movement resourced, milestones achieved, and key rollout

in an inability to decisions approved.

progress sufficiently

quickly to maintain

a competitive cost * Real-time independent assurance activities are

structure and generate conducted during the transformation programme.

sufficient cash to

meet business objectives.

--------------------------- ------------------------------------------------------------

Political, regulatory and compliance

Failure to comply Long-term changes

with legal and other in the global political * Wherever we operate, we aim to ensure that we

requirements in an environment and societal incorporate the impacts of political and regulatory

increasingly restrictive expectations are changes in our strategic planning and policies.

regulatory environment leading to greater

due to changes in regulation of business

the global political and potential penalties. * We have compliance programmes and committees to

landscape, results In some markets, manage our most important risks (e.g. anti-bribery

in fines, criminal regulations can result and competition law) and we conduct assurance

penalties for Tesco in favouring local activities for each key risk area.

or colleagues, companies.

consequential

litigation and an No risk movement * Our Code of Business Conduct and various policies

adverse impact on (e.g. gifts and entertainment, conflicts of interest)

our reputation, financial are supported by new starter and annual compliance

results, and/or our training and other tools such as our whistleblowing

ability to do business. hotline.

* The engagement of leadership and senior management is

critical to the successful management of this risk

area. We have established structured communication

plans to provide a clear tone from the top.

--------------------------- ------------------------------------------------------------

Technology

Failure of our IT Dependence on technology

infrastructure or continues to grow * Our multi-year programme continues to enhance our

key IT systems results throughout the Group. technology infrastructure and resilience

in a loss of information, We continue to improve capabilities. This involves significant investment in

inability to operate our technology environment our hosting strategy, partnering with cloud providers

effectively, financial and invest in disaster and re-engineering some of our legacy retail systems,

or regulatory penalties, recovery and business while building redundancy for key business systems.

and negative impacts continuity, which

on our reputation. are helping manage

Further, failure our exposure to external * Our investment in data centre facilities is providing

to build resilience threats. greater resiliency and oversight for our key systems.

at the time of investing

in and implementing No risk movement

new technology results * Our technology security programme continues to

in potential loss enhance our information security capabilities,

of operating capability. thereby strengthening our infrastructure and

information technology general controls.

* We have combined governance processes to ensure

alignment between our technology disaster recovery

and business continuity activities.

--------------------------- ------------------------------------------------------------

People

Failure to attract, Market competition

retain and develop for key leadership * Our talent planning and people development processes

the required capability and specialist talent are established across the Group.

and to embed our remains strong. The

values in our culture year has also presented

results in an impact significant people * Talent and succession planning are regularly

on the delivery of challenges in supporting discussed by line management and the Executive

our purpose and business vulnerable colleagues, Committee, with regular oversight by the Nominations

performance. recruiting and training and Governance Committee and the Board.

huge numbers of new

permanent and temporary

colleagues, supporting * We have clear potential and performance criteria and

the shift to homeworking talent principles, underpinned by our employer value

for most office-based proposition and strategy.

colleagues, reinforcing

our culture and driving

our diversity and * An independent assessment of all leadership-level

inclusion programmes promotions and external hires is conducted to ensure

harder. capability, potential, leadership and values.

No risk movement

* The Remuneration Committee agrees the objectives and

remuneration arrangements for senior management.

* Our 'how to' and 'when to' speak up programmes across

all areas include our protector line and complaints

process. These allow colleagues to raise in

confidence any workplace concerns such as dishonest

activity, bias or something that endangers colleagues

,

the public or the environment.

* Our established Group Diversity and Inclusion

strategy ensures that everyone is welcome and that we

provide all our colleagues with equal opportunities

for growth and development. This is embedded in our

values, and we are committed to building an inclusive

workplace.

--------------------------- ------------------------------------------------------------

Customer

Uncertainties (including There remains considerable

the pandemic and uncertainty as to * We have a value, price, promotions and Clubcard

the effects of Brexit) the further impact strategy that drives our business priorities with

and macroeconomic on the economy and governance and oversight mechanisms.

conditions impact employment from the

our customers' budgets pandemic and on

and force customers households. * We have a consistent approach to building impactful

to reappraise the Also, the full effects customer propositions, offering high-quality and

concepts of value of Brexit on the competitive value while improving the customer

and loyalty in a economy in the short experience.

way to which we are and longer term are

unable to respond. unclear. However,

we feel we have the * We undertake Group-wide customer insight analysis to

right strategies improve our propositions by understanding and

and processes in leveraging trends around customer behaviour,

place to monitor expectations and experience across the different

this risk and manage parts of the business.

it as far as circumstances

will allow. The pandemic

has seen a significant * We have well-established product development and

shift in consumer quality management processes, which keep the needs of

demand for online our customer central to our decision-making.

shopping which led

us to significantly

increase our capacity. * We monitor the effectiveness of our processes by

regularly tracking our business and competitors

No risk movement against measures that customers tell us are important

to their shopping experience.

--------------------------- ------------------------------------------------------------

Brand, reputation and trust

Failure to create There has been widespread

brand reappraisal recognition of the * Our Group policies, procedures and our Code of

opportunities to steps we took to Business Conduct set out the detailed expectations

improve quality, feed the nation while and behaviours that enable us to make the right

value and service keeping customers decisions for our customers, colleagues, suppliers,

perceptions, as well and colleagues safe communities and investors.

as meet societal during the year,

expectations in relation prioritising vulnerable

to climate and customers and providing * We listen to our customers and stakeholders as part

sustainability, support for local of our communication and engagement programmes. We

results in a negative communities around reflect their needs in our plans, which include

impact on the trust the country. We are, health, community, sourcing, climate and

which our communities however, very aware sustainability initiatives.

and stakeholders that hard-won reputations

place in our brand. can be quickly lost,

and we continue to * The Board's Corporate Responsibility Committee

implement initiatives oversees all corporate responsibility activities and

and activities aligned initiatives, including climate and sustainability

to our strategic programmes, to ensure alignment with customer

priorities to continue priorities and our brand strategy.

to build and maintain

trust.

No risk movement * We continue to use the advice of specialist external

agencies and our in-house marketing expertise to

maximise the value and impact of our brand.

--------------------------- ------------------------------------------------------------

Tesco Bank

Tesco Bank is exposed The pandemic has

to a number of risks, resulted in lower * The Bank has a formal structure for reporting,

the most significant trading activity, monitoring and managing risks. This comprises, at its

of which are operational, lending balances highest level, the Bank's risk appetite, approved by

regulatory, credit, and income in the the Bank Board and supported by the risk management

funding, liquidity, Bank and increased framework.

market and business provisions for expected

risk. credit losses, reflecting

forecast unemployment, * The Tesco PLC Board also reviews and approves the

resulting in a loss Bank's financial risk appetite. Risk appetite defines

for the year. The the type and amount of risk that the Bank is prepared

Bank continues to to accept to meet its strategic objectives. It forms

actively manage the a link between the day-to-day risk management of the

risks to which it business and its strategic priorities, long-term plan

is exposed and maintains ,

significant regulatory capital planning and stress-testing. Adherence to

capital. While the risk appetite is monitored monthly.

overall risks facing

the Bank are similar

to that of a year * The risk management framework brings together

ago, the risk profile governance, risk appetite, the three lines of defence

is judged to have ,

increased, reflecting the policy framework and risk management tools to

the uncertainty as support the business in managing risk as part of its

to the timing and day-to-day activities. The framework includes

strength of a recovery scenario analysis and regular stress-testing of

in the economy on financial resilience.

which the financial

performance of the

Bank relies. * There is Bank Board risk reporting throughout the

year, with updates to the Tesco PLC Audit Committee

Risk increasing provided by the Bank's Chief Financial Officer and

Audit Committee Chairman. A member of the Tesco PLC

Board or Executive Committee is normally a member of

the Bank's Board to enhance visibility and knowledge

sharing.

--------------------------- ------------------------------------------------------------

Liquidity

Failure of our business Tesco Group has traded

performance to deliver robustly overall * We maintain an infrastructure of systems, policies

cash as expected; through the pandemic and reports to ensure discipline and oversight on

access to funding and the injection liquidity matters, including specific treasury and

markets or facilities of GBP2.5bn from debt-related issues.

being restricted; the proceeds of the

failures in operational sale of our Asia

liquidity and currency business has greatly * Our treasury policies are regularly reviewed by

risk management; reduced the prospect management, the Executive Committee and the Board.

Tesco Bank cash call; of having to make

or adverse changes further pension deficit

to the pension deficit contributions in * The Group's funding strategy is approved annually by

funding requirement the future. The Group the Board and includes maintaining appropriate levels

create calls on cash has maintained an of working capital, undrawn committed facilities and

higher than anticipated, Investment Grade access to the capital markets.

leading to impacts rating from the credit

on financial performance, rating agencies,

cash liquidity or and maturing bonds * We regularly review liquidity levels and sources of

the ability to continue and the revolving cash, and we maintain access to committed credit

to fund operations. credit facilities facilities and debt capital markets.

were refinanced.

No risk movement * We have a long-term funding framework in place for

the pension deficit and there is ongoing

communication and engagement with the Pension

Trustees.

* While recognising that Tesco Bank is financially

separate from Tesco PLC, we continue to monitor the

activities of Tesco Bank that could give rise to

risks to Tesco PLC.

* The Audit Committee reviews and annually approves our

viability and going concern statements and reports

into the Board.

--------------------------- ------------------------------------------------------------

Indicates that the principal risk has been included as part of

the longer-term viability scenarios as detailed on pages 38 and

39.

Internal control

The key elements of the Group's internal control framework are

monitored throughout the year and the Audit Committee has conducted

a review of the effectiveness of the Group's risk management and

internal control systems on behalf of the Board. To support the

Board's annual assessment, Group Risk and Audit prepared a report

on the Group's principal risks and internal controls. This

describes the risk management systems and key internal controls, as

well as the work conducted in the year to improve the risk and

control environment, including the level of assurance undertaken.

The internal control framework is intended to effectively manage

rather than eliminate the risk of failure to achieve our business

objectives. It can only provide reasonable, but not absolute,

assurance against the risk of material misstatement or financial

loss.

Statement of Directors' responsibilities

The Directors are responsible for preparing the Annual Report

and the financial statements in accordance with applicable law and

regulations.

Company law requires the Directors to prepare financial

statements for each financial year. Under that law the Directors

are required to prepare the Group financial statements in

accordance with international accounting standards in conformity

with the requirements of the Companies Act 2006 and International

Financial Reporting Standards adopted pursuant to Regulation (EC)

No 1606/2002 as it applies in the European Union. The Group

Financial Statements are also prepared in accordance with IFRS as

issued by the International Accounting Standards Board. The

Directors have also chosen to prepare the Parent Company financial

statements in accordance with United Kingdom Generally Accepted

Accounting Practice (United Kingdom Accounting Standards and

applicable law), including Financial Reporting Standard (FRS) 101

Reduced Disclosure Framework. Under company law the Directors must

not approve the financial statements unless they are satisfied that

they give a true and fair view of the state of affairs of the

Company and of the profit or loss of the Company for that

period.

In preparing the Parent Company financial statements, the

Directors are required to:

- select suitable accounting policies and then apply them consistently;

- make judgements and accounting estimates that are reasonable and prudent;

- state whether applicable UK Accounting Standards have been

followed, subject to any material departures disclosed and

explained in the financial statements; and

- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business.

In preparing the Group financial statements, International

Accounting Standard 1 requires that Directors:

- properly select and apply accounting policies;

- present information, including accounting policies, in a

manner that provides relevant, reliable, comparable and

understandable information;

- provide additional disclosures when compliance with the

specific requirements in IFRSs are insufficient to enable users to

understand the impact of particular transactions, other events and

conditions on the entity's financial position and financial

performance; and

- make an assessment of the Company's ability to continue as a going concern.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

the financial statements comply with the Companies Act 2006. They

are also responsible for safeguarding the assets of the Company and

hence for taking reasonable steps for the prevention and detection

of fraud and other irregularities. The Directors are responsible

for the maintenance and integrity of the corporate and financial

information included on the Company's website. Legislation in the

United Kingdom governing the preparation and dissemination of

financial statements may differ from legislation in other

jurisdictions. Each of the serving Directors, whose names and

functions are set out on pages 42 to 46, confirm that, to the best

of their knowledge:

- the financial statements, prepared in accordance with the

relevant financial reporting framework, give a true and fair view

of the assets, liabilities, financial position and profit or loss

of the Company and the undertakings included in the consolidation

taken as a whole;

- the Strategic report includes a fair review of the development

and performance of the business and the position of the Company and

the undertakings included in the consolidation taken as a whole,

together with a description of the principal risks and

uncertainties that they face; and

- the Annual Report and Financial Statements, taken as a whole,

are fair, balanced and understandable and provide the information

necessary for shareholders to assess the Company's position and

performance, business model and strategy.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSDKOBNCBKDPPD

(END) Dow Jones Newswires

May 18, 2021 02:00 ET (06:00 GMT)

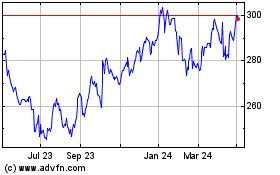

Tesco (LSE:TSCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

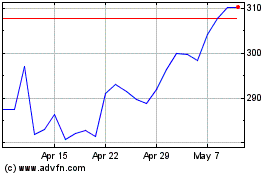

Tesco (LSE:TSCO)

Historical Stock Chart

From Apr 2023 to Apr 2024