Technology Minerals PLC GBP5 million Convertible Bond Facility (8666Y)

January 08 2024 - 2:00AM

UK Regulatory

TIDMTM1

RNS Number : 8666Y

Technology Minerals PLC

08 January 2024

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

8 January 2024

Technology Minerals Plc

("Technology Minerals" or the "Company")

GBP5 million Convertible Bond Facility, CLN Extension, and Offer

to Warrantholders

Technology Minerals Plc (LSE: TM1), the first listed UK company

focused on creating a sustainable circular economy for battery

metals, is pleased to announce that it has entered into a GBP5.0

million convertible bond facility (the "Facility") with CLG Capital

LLC ("CLG").

Details of the Proposed Facility

Technology Minerals has entered into an agreement with CLG

Capital LLC ("CLG") to issue up to GBP5.0 million Floating Rate

24-month Convertible Bonds ("the Facility"). The Convertible Bonds

are subject to a 40 day lock up period after issue before they may

be converted into Ordinary Shares in the Company, such conversion

to be at a price of 95% of the average of the Volume Weighted

Average Price ("VWAP") of the Shares on three Trading Days

(selected by CLG) during the 10 consecutive Trading Days

immediately prior to the receipt by the Company of the relevant

Conversion Notice. The Facility is secured against the Company's

shares in Recyclus Group Ltd. The Company will pay to CLG a fee of

3% of the aggregate principal amount of each Tranche of Convertible

Bonds issued on the Issue Date.

The Company will initially draw down two tranches under the

Facility, totalling GBP1.0 million for general working capital

purposes during the ramp up at Recyclus' lithium-ion ("Li-ion")

battery recycling plant in Wolverhampton. The Company owns 48.35%

of Recyclus. The Company has the right to draw down two further

tranches totalling GBP1.0 million before the completion of the

proposed reverse takeover of Recyclus, with the balance of funds

drawn as agreed between the parties.

CLG will be issued with warrants based on 30% of the notional

value of the first tranche under the Facility, 35% of the second

tranche, 40% of the third tranche, and 45% of any subsequent

tranche. The exercise price of the warrants will be calculated as

130% of the VWAP of the Company's Ordinary shares during the five

trading days immediately preceding the issuance of the

warrants.

CLG Capital specialises in structured transactions to high

growth companies providing patient capital for the companies it

invests in.

Extension of Convertible Loan Note

On 6 July 2023, the Company announced that it had raised

GBP500,000 from a long-term shareholder through the issue of

convertible loan notes (the "Convertible Loan Notes" or

"CLNs").

The Convertible Loan Notes carried a coupon of 6% for a term of

six months from issue and were convertible into Ordinary Shares at

1.8 pence per Ordinary Share. The Company has extended these CLNs

to 4 July 2024 with a revised conversion price of 1p per share.

Interest of GBP30,000 for the period up to 4 January 2024 will be

paid to the subscriber and interest of 1.25% per calendar month to

4 July 2024 is payable each month in arrears.

Offer to Warrantholders

Further to the Company's announcement on 17 November 2023, it

has written to warrantholders holding warrants exercisable at 3.375

and 2.25p to make a limited time offer to enable such

warrantholders to exercise their warrants over an aggregate of

353,164,631 Ordinary shares at a price of 1.2p per share provided

such offer is taken up by 15 January 2024.

All other terms and conditions of the Share Warrants remain

unchanged. Initial warrants were issued as part of a long-term

financing strategy to secure future investments from our existing

investors. This funding will bolster our current portfolio,

aligning with our commitment to delivering enhanced value for our

shareholders.

Related Party Transactions

Chang Oh Turkmani, Non-Executive Director, and Philip Beard,

Non-Executive Director, each are beneficial Warrant holders;

therefore, the Proposed Transaction is a related party transaction

under Disclosure and Transparency Rule 7 ("RTP"). The Board has

established procedures to ensure that RTPs are approved by

independent board members.

Alex Stanbury, CEO of Technology Minerals, said: "We are pleased

to enter into this facility with CLG and we look forward to their

ongoing support as a long-term funding partner. The fundraise will

further strengthen our position and support the Company's growth

during an exciting period. With our proposed acquisition of

Recyclus progressing well, operations continue to ramp up at its

industrial scale lithium-ion battery recycling plant, while there

has been good progress through the commissioning phase at the lead

acid battery recycling facility. The commencement of commercial

operations with revenues coming through, alongside other key

milestones achieved over recent months, has given us an excellent

foundation for a successful 2024 and beyond."

Enquiries:

Technology Minerals Plc

Robin Brundle, Executive Chairman

Alexander Stanbury, Chief Executive

Officer +44 (0)20 4582 3500

Oberon Investments Limited

Nick Lovering, Adam Pollock +44 (0)20 3179 0535

Gracechurch Group

Harry Chathli, Alexis Gore, Rebecca

Scott +44 (0)20 4582 3500

Technology Minerals Plc

Technology Minerals is developing the UK's first listed,

sustainable circular economy for battery metals, using cutting-edge

technology to recycle, recover, and re-use battery technologies for

a renewable energy future. Technology Minerals is focused on raw

material exploration required for Li-ion batteries, whilst solving

the ecological issue of spent Li-ion batteries, by recycling them

for re-use by battery manufacturers. Further information on

Technology Minerals is available at

www.technologyminerals.co.uk.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEDLFBZFLZBBK

(END) Dow Jones Newswires

January 08, 2024 02:00 ET (07:00 GMT)

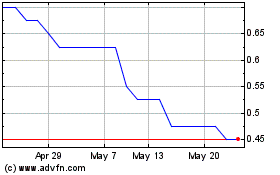

Technology Minerals (LSE:TM1)

Historical Stock Chart

From Dec 2024 to Jan 2025

Technology Minerals (LSE:TM1)

Historical Stock Chart

From Jan 2024 to Jan 2025