TIDMTIFS

RNS Number : 9578I

TI Fluid Systems PLC

07 April 2020

7 April 2020

TI Fluid Systems plc

(the "Company")

Annual Report and Accounts 2019 and Annual General Meeting

2020

The Company announces that today it has released the below

listed documents:

-- Annual Report and Accounts for the financial year ended 31

December 2019 ("Annual Report and Accounts 2019");

-- Notice of the Annual General Meeting 2020 ("AGM"); and

-- Form of Proxy for the AGM.

In accordance with Listing Rule 9.6.1, these documents have been

submitted to the National Storage Mechanism and will shortly be

available for inspection at new National Storage Mechanism ('NSM')

https://data.fca.org.uk/#/nsm/nationalstoragemechanism and on the

Company's website at www.tifluidsystems.com .

The AGM is scheduled to be held at 9:00 am EST on Thursday 14

May 2020 at 2020 Taylor Road, Auburn Hills, Michigan 48326, United

States.

Enquiries:

TI Fluid Systems

plc +1 (248) 376 8624

David J Royce

Investor Relations

FTI Consulting +44 (0)20 3727 1340

Richard Mountain

Nick Hasell

Matthew Paroly +44 (0)1865 871855

Company Secretary

About TI Fluid Systems plc

TI Fluid Systems plc, (LSE: TIFS) is a leading global

manufacturer of highly engineered automotive fluid storage,

carrying and delivery systems primarily for the light duty

automotive market. With nearly 100 years of automotive fluid

systems experience, TI Fluid Systems has manufacturing facilities

in 108 locations across 28 countries serving all major global

OEMs.

Appendix

The information below, which is extracted from the Annual Report

and Accounts 2019, is included solely for the purpose of complying

with DTR 6.3.5 and the requirements it imposes on issuers as to how

to make public annual financial reports. It should be read in

conjunction with the Company's preliminary results announcement

released on 17 March 2020. This announcement is not a substitute

for reading the full Annual Report and Accounts 2019. Page, note

and section references in the text below refer to page numbers,

note and section references in the Annual Report and Accounts

2019.

Statement of Directors' responsibilities in respect of the

financial statements

The directors are responsible for preparing the Annual Report

and the financial statements in accordance with applicable law and

regulation.

Company law requires the directors to prepare financial

statements for each financial year. Under that law the directors

have prepared the group financial statements in accordance with

International Financial Reporting Standards (IFRSs) as adopted by

the European Union and parent company financial statements in

accordance with International Financial Reporting Standards (IFRS)

as adopted by the European Union. Under company law the directors

must not approve the financial statements unless they are satisfied

that they give a true and fair view of the state of affairs of the

group and parent company and of the profit or loss of the group and

parent company for that period. In preparing the financial

statements, the directors are required to:

-- select suitable accounting policies and then apply them

consistently

-- state whether applicable IFRS as adopted by the European

Union have been followed for the group financial statements and

IFRSs as adopted by the European Union have been followed for the

company financial statements, subject to any material departures

disclosed and explained in the financial statements

-- make judgements and accounting estimates that are reasonable

and prudent; and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the group and parent

company will continue in business.

The directors are also responsible for safeguarding the assets

of the group and parent company and hence for taking reasonable

steps for the prevention and detection of fraud and other

irregularities.

The directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the group and

parent company's transactions and disclose with reasonable accuracy

at any time the financial position of the group and parent company

and enable them to ensure that the financial statements and the

Directors' Remuneration Report comply with the Companies Act 2006

and, as regards the group financial statements, Article 4 of the

IAS Regulation.

The directors are responsible for the maintenance and integrity

of the parent company's website. Legislation in the United Kingdom

governing the preparation and dissemination of financial statements

may differ from legislation in other jurisdictions.

Directors' confirmations

The directors consider that the Annual Report and Accounts,

taken as a whole, is fair, balanced and understandable and provides

the information necessary for shareholders to assess the group and

parent company's position and performance, business model and

strategy.

Each of the directors, whose names and functions are listed in

the Board of Directors section of this report confirm that, to the

best of their knowledge:

-- the parent company financial statements, which have been

prepared in accordance with IFRS as adopted by the European Union,

give a true and fair view of the assets, liabilities, financial

position and profit of the company

-- the group financial statements, which have been prepared in

accordance with IFRS as adopted by the European Union, give a true

and fair view of the assets, liabilities, financial position and

profit of the group; and

-- the Strategic Review includes a fair review of the

development and performance of the business and the position of the

group and parent company, together with a description of the

principal risks and uncertainties that it faces.

In the case of each director in office at the date the

Directors' Report is approved:

-- so far as the director is aware, there is no relevant audit

information of which the group and parent company's auditors are

unaware; and

-- they have taken all the steps that they ought to have taken

as a director in order to make themselves aware of any relevant

audit information and to establish that the group and parent

company's auditors are aware of that information.

This responsibility statement was approved by the Board of

Directors on 16 March 2020 and is signed on its behalf by:

William L. Kozyra, Chief Executive Officer and President

Ronald Hundzinski, Chief Financial Officer

Principal risks and uncertainties

The Board is responsible for the Group's system of risk

management and internal controls. The Audit & Risk Committee

supports the Board by advising on the Group's overall risk

appetite, tolerance and strategy, current risk exposures and future

risk strategy.

A review of the Group's risk management framework used to

collate, report and manage business critical risks was presented to

the Audit & Risk Committee in March 2020. The Board has

concluded that a robust assessment of the Group's principal risks

had been undertaken.

TI Fluid Systems' global operations are exposed to a number of

risks which could, either on their own, or in combination with

others, have an adverse impact on the Group's results, strategy,

business performance and reputation which, in turn, could impact

upon shareholder returns. The following section highlights the

major risks that may affect the Group's ability to deliver the

strategy, as set out on pages 28 to 31, including an assessment of

any change in risk assessment this year.

The management and mitigation activities described below will

help to reduce the impact or likelihood of the major risk

occurring, although the Board recognises it will not be possible to

eliminate these risks entirely. The Board also recognises there

could be risks that may be unknown or that may be judged to be

insignificant at present, but may later prove to be

significant.

Global light vehicle production volumes Risk Trend - No

Change

Description

TI Fluid Systems has 108 manufacturing locations in 28 countries

on five continents and a substantial amount of its revenue is

closely linked to the economic cycle and the general

macroeconomic

environment.

Impact

Historically, there has been close correlation between economic

growth and the global light vehicle production volumes. The cost

structure of the business, operating across manufacturing

facilities in 108 locations, means that a large reduction in

revenue will have an impact on profitability.

Controls and mitigation

-- TI Fluid Systems' presence in 28 countries supplying a wide

range of customers acts as a hedge to neutralise localised economic

volatility.

-- The Group has an extensive manufacturing presence in emerging

and other low-cost markets which currently have relatively low

rates of light vehicle penetration per head of population and are

believed to have strong growth potential.

-- Although the Group's products are primarily for light

vehicles, it operates across both a broad geographic footprint and

a diversified range of vehicle platforms, brands and models.

-- A proportion of the Group's workforce in a number of local

markets are employed on temporary contracts, which provides some

flexibility in the cost-base.

-- The Group monitors closely and responds to any changes in

customer demand on a local or Group-wide basis.

Product quality Risk Trend - No Change

Description

TI Fluid Systems' business is based on the repeatable supply and

delivery of components and parts to an agreed specification and

time.

Impact

Failure to meet customer requirements or specifications can have

financial consequences, such as the loss of a customer, warranty

claims and product liability, and cause long-term damage to the

Group's reputation.

Controls and mitigation

-- TI Fluid Systems operates rigorous quality control systems

designed to ensure a high-quality standard for all products,

including testing and validation during the design and production

phases.

-- The Group collaborates with key customers to evaluate and

improve quality control standards and to confirm the compliance of

its manufacturing processes with customers'

-- quality standards.

-- Quality systems and processes operated at local manufacturing

level are subject to oversight by divisional quality teams.

-- Where necessary, the Group's manufacturing facilities

maintain relevant industry accreditations, such as TS 16949.

-- The Group monitors the field performance of its products in

order to seek to continuously improve product quality.

Competition and customer pricing pressure Risk Trend - No

Change

Description

This risk encompasses a number of identified global trends in

the markets in which TI Fluid Systems operates. The Group operates

in a dynamic competitive environment and faces competition from

other manufacturers and suppliers of automotive components in each

of the market segments in which it operates. The Group may be

subject to pressure from customers to reduce costs on current

contracts. The environment for bidding and securing new contract

awards from OEMs is competitive.

Impact

The Group's customers face constant pressure to lower their

selling and production costs to be competitive against their peers

and may require reductions in the selling price of the Group's

systems and components over the term of a vehicle platform or

model. Commercial activity by competitors, or changes in their

products or technologies, could impact upon the Group's market

share and profitability.

Controls and mitigation

-- The Group seeks to offset pricing pressure by achieving

improved operating efficiencies and cost reductions.

-- A growing trend by customers to standardise and globalise

vehicle platforms has the potential to minimise the Group's

exposure to the cancellation of any single vehicle platform

-- or model.

-- TI Fluid Systems has a strong reputation and industry-leading

technology which supports its status as a key supplier to its

customers.

-- The Group engages in extensive and regular dialogue and has

strong commercial and engineering relationships with key

customers.

-- The Group uses market intelligence and competitor analysis to

support its market activities and inform investment decisions.

-- Across the Group there is an emphasis on research and

development and improving the technical content of products.

-- The Group also leverages a robust screening process to

evaluate new business proposals.

-- The Group is considered to be a top supplier or strategic

supplier by many of its OEM customers.

Business continuity Risk Trend - No Change

Description

TI Fluid Systems' business is based upon reliable, high-volume

manufacturing across all its locations in order to supply products

to customers, often on a just-in-time basis. Business continuity

encompasses a number of areas of risk to the Group, including fire,

flood and other casualties, equipment breakdown, key supplier

failure, exposure to price fluctuations of key raw materials,

maintaining stable labour relations, and ensuring the reliability

of the Group's business management systems and IT infrastructure.

In addition, the Group is exposed to risks from accidents and

incidents arising from health and safety failures.

Impact

A loss of production capability at a facility could lead to an

inability to supply customers, reduce volumes and/or increase

claims made against the business. In periods of high demand or in

the event of supplier difficulties, availability of raw materials

may be constrained which could interrupt production or result in

price increases, all of which could have an impact on the

profitability of the Group's operations. In certain circumstances

the loss of a supplier, or supplier quality failing, could lead to

an inability to obtain materials and sub-components necessary to

supply products in a timely or efficient manner.

The loss of systems capability at a Group facility, as a result

of IT failure or cyber-attack, could impact the Group's ability to

operate one or more plants and supply its customers. Injuries

arising from health and safety incidents could result in lost time,

reduce employee morale and possible changes in working practices.

Serious incidents can also have a detrimental impact on the Group's

reputation.

Controls and mitigation

-- The Group continues to expand its business continuity

planning (BCP) to enhance the localised continuity planning

strategy operated at each facility.

-- The Group's global network of facilities provides a degree of

backup capacity.

-- The Group maintains a scheduled programme of maintenance and

inspection of all equipment.

-- The wide geographic spread of operations, purchasing and

supply chain functions allows the Group to use a range of

techniques to address potential supply disruption, such as

long-term purchase contracts, dual sourcing and ongoing research

and development into alternative materials and solutions.

-- In certain markets the Group uses preferred suppliers for key

components and materials.

-- The Group maintains casualty, property and business

interruption insurance, including cyber incident coverage.

-- The Group participates in a number of works councils and

other represented employee forums and seeks to establish and

maintain good relationships with its employees and unions.

-- The Group continues to assess and strengthen its cyber

security programme. In 2019 the Group introduced enhanced systems

penetration testing and data security audits.

-- The Group's decentralised IT systems worldwide provide some

resilience against the loss of production or systems capability to

the Group as a whole.

-- IT has developed and implemented a disruption recovery plan

for the organisation.

-- The Group has an embedded health and safety culture and

operates a global health and safety policy, with local health and

safety operations in place in each manufacturing facility.

-- Health and safety performance is monitored regularly by each

division and by the Group.

Product development and changes in technology Risk Trend - No

Change

Description

The automotive industry is subject to changes in technology and

the Group's products are subject to changes in regulatory

requirements to reduce emissions and increase fuel economy.

Operating across numerous markets and territories requires

compliance with a wide variety of regulations. Changes in consumer

demand, e.g. the popularity of a particular vehicle type, model,

platform or technology such as HEVs and EVs, may also impact on

demand for the Group's products. In addition, the Group's products

have performance-critical applications and have high levels of

technical content and know-how.

Impact

Failure to keep up with changes in technology in the light

vehicle automotive industry or in competitive technologies may

render certain existing products obsolete or less attractive as

well as damage the Group's market position and reputational

strength. Failure to comply with all relevant regulatory

requirements could affect the Group's reputation and/or its ability

to operate in certain markets or territories. Changing

environmental regulations could affect demand for certain products.

The Group's technologies and intellectual property rights need to

be kept current through continuous improvement and research and

development and are susceptible to theft, infringement, loss and/or

replication by competitors.

Controls and mitigation

-- The Group is engaged in continued investment in alternative

engineering solutions and the development of more advanced designs

and innovative products to ensure compliance with changes to

environmental regulations and customer demand.

-- TI Fluid Systems has an international network of four

technical centres which focus on research and development.

-- The Group seeks to maintain close relationships and technical

partnerships with key customers.

-- The Group has established eight regional application centres

which focus on application engineering worldwide.

-- Both Group and divisional management monitor and assess

relevant regulatory requirements and the likelihood and impact of

any changes.

-- The Group's products, materials and processes are continually

developed and enhanced through research and development and

technical input.

-- TI Fluid Systems actively registers, manages and enforces its

intellectual property rights.

-- The Group operates in the automotive industry where

performance-critical technology evolves and is adopted in a

deliberate and measured manner.

Operating globally and regulatory compliance Risk Trend - No

Change

Description

TI Fluid Systems has operations globally, with manufacturing

facilities in 28 countries across five continents. The markets in

which the Group operates are covered by a range of different

regulatory systems and complex compliance requirements and may also

be subject to cycles, structural change and other external factors,

such as changes in tariffs, customs arrangements and other

regulations. In addition, operating across a number of territories

exposes the Group to currency exchange rate variations.

Impact

A substantial downturn in one or more key markets could have a

material adverse impact on the Group's profitability, cash flow and

carrying value of its assets. Significant changes to the different

regulatory systems and compliance requirements in and between the

countries and regions in which the Group operates may have a

negative impact on the Group's operations in a particular country

or market. The risks associated with Brexit are not considered

material to the Group. High foreign exchange volatility may

increase financing costs.

Controls and mitigation

-- The Group's international footprint provides some protection

against a downturn in particular territories or regions.

-- The markets and any changes to the regulatory environment in

which TI Fluid Systems operates, including tariffs and trade

policies, are continually monitored and assessed.

-- Changes to the Group's investment strategy and cross-border

relocation might result from a significant change in the regulatory

environment in a particular country or region.

-- The Group's treasury policy covers, inter alia, the use of

currency contracts, investment hedging policy and regular reporting

of foreign exchange exposure.

-- Focus throughout the Group on adherence to our Code of

Business Conduct (COBC), including ongoing training and review of

policies and procedures.

Key personnel dependencies Risk Trend - No Change

Description

The future success of TI Fluid Systems is dependent upon the

continued services of key personnel. Succession is a routine

consideration given some of the Group's key global positions at all

levels, including business unit, division and Group.

Impact

TI Fluid Systems competes globally to attract and retain

personnel in a number of key roles. A lack of new talent, the

inability to retain and develop existing talent, or replace

retiring senior management could hinder the Group's operations and

strategy. A loss of key personnel, with associated intellectual

property and know-how, could disrupt our business and strategy. In

a number of local markets the Group may experience a shortage of

skilled and experienced personnel for certain

key roles.

Controls and mitigation

-- The Group applies bespoke terms and conditions of employment

for key personnel where appropriate.

-- The Group has in place incentive arrangements, including

bonuses, pensions and long-term incentive plans.

-- The Group operates established recruitment and development

programmes.

-- Succession plans continue to be reviewed for relevant key

positions.

Developing risks

The Board recognises that an essential part of risk management

is the ability to monitor and respond to new and emerging risks.

The existence of new and developing strategic risks potentially

impacting the Group was considered at its May 2019 Board as part of

its annual business strategy review and discussed further at the

March 2020 Board meeting. The primary focus of these discussions

was on risks that may arise in terms of technological obsolescence

and customer (OEM) consolidation. The current year assessment was

that neither of these new risks were material to the Group but

would be monitored.

The dramatic developments in recent months concerning COVID-19

have also been a focus for the Board at the start of 2020. The

COVID-19 outbreak represents a current operating performance

challenge for us and the automotive industry generally. It also has

the potential to impact, beyond the immediate term, the performance

of the Group as further disruption may impact our customer's

production activity levels, the efficiency and operations of the

automotive market supply chain and the availability of resources

generally.

At present it is difficult to assess likely developments arising

as a result of COVID-19. We believe in terms of our assessment of

our principal risks that any prolonged or more significant impact

from COVID-19 would manifest itself in the risks already noted

above.

The Board intends to continue and enhance its assessment of

emerging risks.

Related Party Transactions

Transactions with Affiliates of the funds managed by Bain

Capital

The 'funds managed by Bain Capital' represent affiliates of and

funds advised by Bain Capital LLC.

During the year, the Group procured products and materials

totalling EUR0.2 million (2018: EUR0.3 million) from companies in

which the funds managed by Bain Capital, the Group's ultimate

controlling party since 30 June 2015, had investment interests.

These transactions were completed on the basis of normal

commercial terms.

The Group does not incur management charges from Bain Capital

LLC.

Transactions with Group Companies

Balances and transactions between Group companies have been

eliminated on consolidation, and are not disclosed in this note

except for subsidiaries that are not wholly owned. Transactions

with those companies are made on the Group's standard terms of

trade.

The Group holds 73% of the shares in Hanil Tube Corporation

('Hanil') which is located in South Korea. At 31 December 2019,

Hanil had trade and loan receivables net of payables from other

Group undertakings amounting to EUR25.6 million (2018: EUR23.6

million) and made sales within the Group during the year of EUR7.3

million (2018: EUR7.6 million).

The Group holds 97% of the shares in Bundy India Ltd. At 31

December 2019, Bundy India Ltd had trade and loan payables net of

receivables to other Group undertakings amounting to EUR6.1 million

(2018: EUR7.2 million) and made sales within the Group during the

year of EUR8.4 million (2018: EUR9.8 million).

Ultimate controlling party

The funds managed by Bain Capital, via BC Omega Holdco Ltd, have

been the Company's ultimate controlling party since its

incorporation.

Transactions with Associates

Transactions with related parties other than subsidiaries are

attributable solely to the ordinary business activities of the

respective company and were conducted on an arm's-length basis.

2019 2018

EURm EURm

Amounts owed to associates 1.3 1.9

------ ------

Purchases from associates

in the year 10.5 13.7

------ ------

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCFLFVESAIRIII

(END) Dow Jones Newswires

April 07, 2020 02:00 ET (06:00 GMT)

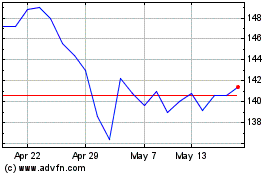

Ti Fluid Systems (LSE:TIFS)

Historical Stock Chart

From Oct 2024 to Nov 2024

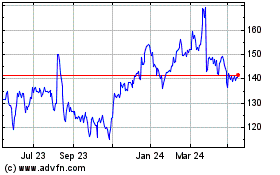

Ti Fluid Systems (LSE:TIFS)

Historical Stock Chart

From Nov 2023 to Nov 2024