TIDMDGB

RNS Number : 1257U

Digital Barriers plc

28 November 2013

28 November 2013

Digital Barriers plc

("Digital Barriers" or the "Group")

Interim Results for the six months ended 30 September 2013

Digital Barriers (LSE AIM: DGB), the specialist provider of

advanced surveillance technologies to the international homeland

security and defence markets, announces unaudited results for the

six months ended 30 September 2013.

Key Highlights

-- Group revenues increased 12% to GBP9.0m (2012: GBP8.1m) in

the six-month period to 30 September 2013, with international

product revenues increasing 36% and exports now accounting for 33%

of Group revenues (2012: 27%).

-- The Group raised GBP18.0m (net of placing costs) through the

issue of new ordinary shares on 4 November 2013 to further

implement its stated strategy and address its working capital

requirements.

-- The Group has seen significant interest for its RDC ground

sensors during the period, including a GBP2.3m contract extension

with a UK customer and its first major overseas sale in the form of

an initial GBP1.0m contract with an Asia Pacific government

customer.

-- The Group is also continuing to see increasing exports of its

TVI video surveillance platform, with sales to 18 countries during

the period, including its second major US federal agency and OEM

arrangements with both SingTel and BT Redcare.

Commenting on the results, Tom Black, Executive Chairman of

Digital Barriers, said:

"We are delivering increased sales momentum overseas with

exactly those flagship customers we sought to secure since

establishing the Group. We track this strategic sales momentum

around the world and we continue to see increasing demand across

each of our regions, with our world-class TVI and RDC technologies

seeing especially strong interest across major government and

commercial customers. This is the best indicator of the future

potential of the Group. The recent share placing also demonstrated

the excellent ongoing support we have from existing shareholders

and attracted significant new investors into the Group. Both the

traction of our disruptive technologies and the ongoing shareholder

support, reaffirm my confidence in the longer-term prospects for

the Group"

For further information please contact:

Digital Barriers plc +44 (0)20 7940 4740

Tom Black, Executive Chairman

Colin Evans, Managing Director

Zak Doffman, Managing Director

Investec Investment Banking +44 (0)20 7597 5970

Andrew Pinder / Dominic Emery /

Patrick Robb

FTI Consulting +44 (0)20 7831 3113

Edward Bridges / Matt Dixon / Elodie

Castagna

About Digital Barriers

Digital Barriers provides advanced surveillance technologies to

the international homeland security and defence markets,

specialising in 'edge-intelligent' solutions that are designed for

remote, hostile or complex operating environments. We work with

governments, multinational corporations and system integrators in

the defence, law enforcement, critical infrastructure,

transportation and natural resources sectors. Our surveillance

technologies have been successfully proven on some of the most

demanding operational and environmental deployments around the

world.

www.digitalbarriers.com

Chairman's Statement

Introduction

This period has been characterised by several strategically

important international contract wins where initial sales value is

modest but with the potential for very significant follow-on orders

with each of these organisations over the next few years. We have

sold into 30 countries during the period and the 36% increase in

international product revenues, which made up 33% of Group revenues

in the period, was very encouraging.

During the period, we secured the sale of our TVI video

technology as an enterprise solution into a second US federal

agency and received an initial order for unattended ground sensors

valued at GBP1.0m into a high-profile border protection programme

in the Asia Pacific region. This is typical of what we are seeing

with other sales to international governments because the initial

order has been many months in gestation with our technology coming

through several extensive and competitive trials to secure its

position on a very significant national-level programme.

We continue to experience greater levels of seasonality than

originally envisaged which is exacerbating the peaks and troughs of

our sales and delivery cycles. This, combined with the need to

purchase and integrate third-party equipment into large-scale

solutions built around Digital Barriers' intellectual property for

delivery to customers, places increased demands on our cash

resources. Therefore on 4 November we raised an additional GBP18.0m

(net of placing costs) from existing and new shareholders.

Our Services business continues to operate in the UK only. The

focus of this division remains the provision of integration

services for government departments, which has been a challenging

sector given the current spending climate in the UK. This has

inevitably led to revenues from our Services division declining in

the period, although we are now seeing material interest from

customers within our Services division in technology offerings such

as TVI video streaming solutions.

Our very clear focus is on developing our international product

revenues and, in the short to medium term, our growth will continue

to be built on the significant market traction we are seeing for

RDC and TVI, whilst ThruVision remains a compelling medium-term

opportunity.

RDC Unattended Ground Sensors

The Group is seeing significant customer interest around the

world for its fully integrated unattended ground sensor solution,

and is actively engaged in discussions or trials with customers

across twelve countries for major defence and border protection

programmes. Highlights include:

-- In July 2013 the Board announced a contract extension valued

at GBP2.3m with a UK-based customer for its fully integrated

unattended ground sensor solution.

-- In September 2013 it announced its first significant overseas

sale of the same technology, with an initial contract award valued

at GBP1.0m for the protection of a high-profile border in the Asia

Pacific region.

-- The Group has also recently made its first sale of this

technology into a major US defence customer, with the successful

trial of the technology followed by an initial order valued at

GBP0.1m.

-- The technology has been selected for trial by an oil and gas

multinational as part of a major facility protection programme in

the Middle East.

The Board believes that this international traction is

indicative of the significant demand the Group can generate for

this technology solution around the world.

TVI Video Surveillance Platform

The Group has continued to export its world-class TVI video

surveillance platform internationally and has sold the technology

into eighteen countries during the period, highlights include:

-- Following the announcement in January 2013 that the Group had

won a contract with a US federal agency for the development of a

high-definition version of its core TVI video streaming technology,

the Group has in the period secured an enterprise-grade TVI sale

into its second US federal agency, with an initial contract valued

at GBP0.2m for TVI products, including the Group's first enterprise

sale of TVI encoding software to run on iOS devices operated by

frontline law enforcement agents. The opportunity for the TVI

surveillance platform to be deployed across defence and law

enforcement sectors is now well established, and the Group is

focused on securing initial enterprise grade TVI sales that can

lead to significant follow-on orders over the coming years.

-- The Group now has TVI solutions that operate on its own

hardware, on iOS and Android devices, and embedded in third-party

products. During the period, the Group launched a variant of TVI

technology to work with IP cameras, opening up significant new

markets and the high-definition version of TVI is scheduled to

launch in late 2013. TVI has also been successfully tested with a

potential customer organisation in the Middle East on 4G/LTE

networks during the period.

-- In addition to the core TVI video streaming technology, the

Group is now working to integrate key technologies from its

acquired companies onto the TVI platform to significantly enhance

the functionality of its products. This includes real-time video

content analytics and facial recognition capabilities that the

Group is adapting to operate on its own surveillance products and

on smartphones.

-- The Group's OmniPerception technology, acquired in January

2013, is now being adapted to operate as an embedded technology on

platforms including TVI devices, smartphones and IP cameras. The

Board believes this represents a larger opportunity than marketing

facial recognition technology on specialist dedicated hardware and

will significantly increase the market potential for such

technology.

-- Following the announcement at the beginning of the period

that SingTel had selected TVI as the delivery platform for its

video surveillance as a service ("VSaaS") offering, the Group is

now actively working with SingTel to support their sales efforts

into their enterprise customers. In August 2013, the Group

announced that it would also supply BT Redcare, the UK's largest

provider of CCTV surveillance infrastructure and alarm signalling,

with TVI products on an OEM basis. The Group is now developing

specifically adapted TVI products for this OEM reseller market; it

is expected that these products will be launched early in 2014.

-- The Group is actively engaged in discussions with multiple

mobile network operators around potential TVI reseller arrangements

under similar annuity revenue models. The Board believes that the

Group can generate significant revenues in the medium to long term

by productising and selling its IP through multinational technology

and telecoms organisations. As with the Group's sales into

government customers, the pattern of modest initial sales with the

potential for very significant follow-on revenues in later years

also applies here.

-- The Group announced in October, post period end, the sale of

its first video management solution into a major public

transportation network in the Asia Pacific region. The contract,

valued at approximately GBP0.75m, is expected to be fulfilled

during the course of this financial year and next, and lead to

follow-on orders with the same customer. The contract represents a

significant early reference for the Group's newly launched video

management capabilities within the transportation sector.

ThruVision Passive People Screening

The Group has made positive progress in the period with its

ThruVision technology. This remains an early stage technology and

the Group continues to further develop and promote it within

sectors where the Board believes there is short to medium term

sales potential. Highlights in the period include:

-- Successfully delivering the significant customs sale into

Asia Pacific that was announced last year. This system is now fully

operational and further sales are expected to the same

customer.

-- The force protection sector has continued to show great

interest in our ThruVision technology as part of some larger

technology deployment programmes.

-- ThruVision has been trialled successfully by one of the UK's

largest retail organisations to reduce shrinkage within its

distribution centres, and the customer now anticipates a wider

deployment.

Financials

Group

Revenue in the period was GBP9.0m (2012: GBP8.1m), generating a

gross profit of GBP3.8m (2012: GBP3.7m) and margin of 42% (2012:

46%). The lower gross margin is due to both product mix as well as

a low margin in the Services division, in line with expectations

and is forecast to increase in the second half. The adjusted loss

before tax was GBP(6.8)m (2012: GBP(5.0)m) and on an unadjusted

basis was GBP(7.2)m (2012: GBP(7.1)m). The increased adjusted loss

is driven by higher Corporate overheads at GBP(4.6)m (2012:

GBP(3.3)m), reflecting strategic investment in sales and marketing,

some additional central overheads and an increased charge for

LTIPs.

Revenue

Product revenue in the period increased 12% to GBP7.3m (2012 pro

forma(1) : GBP6.5m), driven by TVI and RDC, which in combination

grew 255% to GBP3.9m (2012: GBP1.1m). Services revenue in the

period contracted 30% to GBP1.7m (2012: GBP2.4m), reflecting a

tightening in UK government spending and longer sales lead

times.

Export product revenue accounted for 33% of Group revenue (2012:

27%), the majority of which was to Asia Pacific and North

America.

(1) Assuming all prior period acquisitions occurred on 1 April

2012 and excluding all current year acquisitions.

Cash

The Group ended the period with a GBP1.1m cash balance (31 March

2013: GBP5.5m). Net cash outflow from operating activities was

GBP(3.9)m including a GBP2.1m working capital inflow less GBP(6.0)m

of other operating flows, primarily cash loss before tax. The other

GBP(0.5)m of outflows is mostly capital expenditure and payments of

deferred consideration.

The working capital inflow is driven by a GBP6.0m decrease in

trade and other receivables, reflecting an unwind of the

significant GBP13.2m 31 March 2013 balance caused by high March

2013 monthly revenues. Trade and other payables decreased

GBP(1.9)m, also impacted by the high March 2013 revenues, whilst

inventory increased by GBP(2.0)m.

Outlook

With our technology solutions seeing strong international sales

momentum, the outlook for the future prospects of the Group is

increasingly compelling as it continues to deliver very strong

overseas sales growth and moves towards break-even.

The Board remains comfortable with its expectations for this

financial year.

Independent review report to Digital Barriers plc

Introduction

We have been engaged by the Company to review the condensed set

of financial statements in the half-yearly financial report for the

6 months ended 30 September 2013 which comprises the consolidated

income statement, the consolidated statement of comprehensive

income, the consolidated balance sheet, the consolidated statement

of changes in equity, the consolidated statement of cash flows, and

related notes 1 to 7. We have read the other information contained

in the half-yearly financial report and considered whether it

contains any apparent misstatements or material inconsistencies

with the information in the condensed set of financial

statements.

This report is made solely to the Company in accordance with

guidance contained in International Standard on Review Engagements

2410 (UK and Ireland) "Review of Interim Financial Information

Performed by the Independent Auditor of the Entity" issued by the

Auditing Practices Board. To the fullest extent permitted by law,

we do not accept or assume responsibility to anyone other than the

company, for our work, for this report, or for the conclusions we

have formed.

Directors' Responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the Directors. The Directors are responsible

for preparing the half-yearly financial report in accordance with

International Accounting Standards 34, "Interim Financial

Reporting," as adopted by the European Union and the AIM Rules

issued by the London Stock Exchange.

As disclosed in note 1, the annual financial statements of the

Group are prepared in accordance with IFRSs as adopted by the

European Union. The condensed set of financial statements included

in this half-yearly financial report has been prepared in

accordance with International Accounting Standards 34, "Interim

Financial Reporting, " as adopted by the European Union.

Our Responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Scope of Review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK and Ireland) and consequently does not enable us to

obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the 6 months ended 30

September 2013 is not prepared, in all material respects, in

accordance with International Accounting Standard 34 as adopted by

the European Union and the AIM Rules issued by the London Stock

Exchange.

Ernst & Young LLP

London

27 November 2013

DIGITAL BARRIERS PLC

Consolidated income statement

for the six months ended 30 September 2013

6 months 6 months

ended ended Year ended

30 September 30 September

2013 2012 31 March 2013

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

----------------------------- ----- ------------- ------------- --------------

Revenue 2 9,009 8,078 23,272

Cost of sales (5,223) (4,353) (13,322)

----------------------------- ----- ------------- ------------- --------------

Gross profit 3,786 3,725 9,950

Administration costs (11,490) (10,299) (20,823)

Other income 489 647 1,484

Other costs - (1,087) (1,336)

----------------------------- ----- ------------- ------------- --------------

Operating loss (7,215) (7,014) (10,725)

Finance revenue 1 15 69

Finance costs (20) (62) (100)

----------------------------- ----- ------------- ------------- --------------

Loss before tax (7,234) (7,061) (10,756)

Income tax 334 417 840

----------------------------- ----- ------------- ------------- --------------

Loss for the period /

year (6,900) (6,644) (9,916)

----------------------------- ----- ------------- ------------- --------------

Adjusted loss: 3

Loss before tax (7,234) (7,061) (10,756)

Amortisation of intangibles

initially recognised

on acquisition 867 1,123 2,029

Acquisition costs - 35 369

Adjustments to deferred

consideration (472) (585) (1,384)

Impairment of intangibles - 1,087 1,336

Reorganisation costs - 372 769

Adjusted loss before

tax for the period (6,839) (5,029) (7,637)

----- ------------- -------------

(Loss) per share - basic 4 (13.54p) (15.18p) (21.78p)

(Loss) per share - diluted 4 (13.54p) (15.18p) (21.78p)

(Loss) per share - adjusted 4 (12.87p) (11.06p) (16.45p)

(Loss) per share - adjusted

diluted 4 (12.87p) (11.06p) (16.45p)

----------------------------- ----- ------------- ------------- --------------

The results for the period and the prior period are derived from

continuing activities

DIGITAL BARRIERS PLC

Consolidated statement of comprehensive income

for the six months ended 30 September 2013

6 months 6 months

ended ended Year ended

30 September 30 September

2013 2012 31 March 2013

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

------------------------------ ------ ------------- ------------- --------------

Loss for the period /

year (6,900) (6,644) (9,916)

Other comprehensive income

to be reclassified to

profit or loss in

subsequent periods

------------------------------ ------ ------------- ------------- --------------

Exchange differences

on retranslation of foreign

operations (27) 13 25

-------------------------------------- ------------- ------------- --------------

Net other comprehensive

income to be reclassified

to profit or

loss in subsequent periods (27) 13 25

-------------------------------------- ------------- ------------- --------------

Total comprehensive loss

attributable to owners

of the parent (6,927) (6,631) (9,891)

-------------------------------------- ------------- ------------- --------------

DIGITAL BARRIERS PLC

Consolidated balance sheet

at 30 September 2013

30 September 30 September

2013 2012 31 March 2013

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

------------------------------ ----- ------------- ------------- --------------

Assets

Non current assets

Property, plant and

equipment 1,245 1,197 1,370

Goodwill 24,647 21,880 24,647

Other intangible assets 4,931 5,986 5,828

------------------------------ ----- ------------- ------------- --------------

30,823 29,063 31,845

Current assets

Inventories 3,743 2,896 1,779

Trade and other receivables 7,261 5,523 13,239

Current tax recoverable 1,102 761 972

Cash and cash equivalents 1,145 7,258 5,544

------------------------------ ----- ------------- ------------- --------------

13,251 16,438 21,534

------------------------------ ----- ------------- ------------- --------------

Total assets 44,074 45,501 53,379

------------------------------ ----- ------------- ------------- --------------

Equity and liabilities

Attributable to owners

of the parent

Equity share capital 6 510 438 510

Share premium 57,989 48,012 57,989

Capital redemption

reserve 4,735 4,735 4,735

Merger reserve 454 454 454

Translation reserve (248) (233) (221)

Other reserves (307) (307) (307)

Retained earnings (23,904) (14,177) (17,267)

------------------------------ ----- ------------- ------------- --------------

Total equity 39,229 38,922 45,893

Non current liabilities

Deferred tax liabilities 305 184 363

Financial liabilities 207 1,031 202

------------------------------ ----- ------------- ------------- --------------

512 1,215 565

Current liabilities

Trade and other payables 4,115 4,170 6,038

Financial liabilities 218 1,194 883

------------------------------ ----- ------------- ------------- --------------

4,333 5,364 6,921

Total liabilities 4,845 6,579 7,486

------------------------------ ----- ------------- ------------- --------------

Total equity and liabilities 44,074 45,501 53,379

------------------------------ ----- ------------- ------------- --------------

DIGITAL BARRIERS PLC

Consolidated statement of changes in equity

for the 6 months ended 30 September 2013

Profit

Share Capital and

Share premium redemption Merger Translation Other loss Total

capital account reserve reserve reserve reserves reserve equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- --------- --------- ------------ --------- ------------ ---------- --------- --------

At 31 March

2012 437 48,012 4,735 348 (246) (307) (7,687) 45,292

--------------------- --------- --------- ------------ --------- ------------ ---------- --------- --------

Total comprehensive

income / (loss) - - - - 13 - (6,644) (6,631)

Share-based

payment credit - - - - - - 154 154

Issue of shares

regarding the

acquisition

of Keeneo 1 - - 106 - - - 107

--------------------- --------- --------- ------------ --------- ------------ ---------- --------- --------

At 30 September

2012 438 48,012 4,735 454 (233) (307) (14,177) 38,922

--------------------- --------- --------- ------------ --------- ------------ ---------- --------- --------

Total comprehensive

income / (loss) - - - - 12 - (3,272) (3,260)

Share-based

payment credit - - - - - - 182 182

Share issue

cost - (351) - - - - - (351)

Share placement 72 10,328 - - - - - 10,400

At 31 March

2013 510 57,989 4,735 454 (221) (307) (17,267) 45,893

--------------------- --------- --------- ------------ --------- ------------ ---------- --------- --------

Total comprehensive

loss for the

period - - - - (27) - (6,900) (6,927)

Share-based

payment credit - - - - - - 263 263

--------------------- --------- --------- ------------ --------- ------------ ---------- --------- --------

At 30 September

2013 510 57,989 4,735 454 (248) (307) (23,904) 39,229

--------------------- --------- --------- ------------ --------- ------------ ---------- --------- --------

DIGITAL BARRIERS PLC

Consolidated statement of cash flows

for the 6 months ended 30 September 2013

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2013 2012 2013

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------------------- ------------- ------------- -----------

Operating activities

Loss before tax (7,234) (7,061) (10,756)

Non-cash adjustment to reconcile

loss before tax to net cash flows

Depreciation of property,

plant and equipment 394 318 771

Amortisation of intangible

assets 929 1,168 2,102

Impairment of intangible assets - 1,087 1,336

Share-based payment transaction

expense 263 154 336

Release of deferred consideration (260) (647) (678)

Reassessment of deferred consideration (229) - (805)

Disposal of fixed assets (2) - 226

Finance income (1) (15) (69)

Finance costs 20 62 100

Working capital adjustments:

Decrease / (increase) in trade

and other receivables 5,966 1,260 (6,096)

(Increase) / decrease in inventories (1,964) (959) 351

Decrease in trade and other

payables (1,937) (2,637) (1,163)

---------------------------------------- ------------- ------------- -----------

Cash utilised in operations (4,055) (7,270) (14,345)

Tax received 146 81 275

----------------------------------------- ------------- ------------- -----------

Net cash flow from operating

activities (3,909) (7,189) (14,070)

----------------------------------------- ------------- ------------- -----------

Investing activities

Sale of property, plant & equipment 2 - -

Purchase of property, plant &

equipment (269) (616) (1,453)

Expenditure on intangible assets (32) (33) (97)

Acquisition of subsidiaries - (144) (3,349)

Payment of deferred consideration (188) (60) (822)

Acquisition of cash and cash

equivalents of subsidiaries - - (41)

Interest received 1 15 69

----------------------------------------- ------------- ------------- -----------

Net cash flow from investing

activities (486) (838) (5,693)

----------------------------------------- ------------- ------------- -----------

Financing activities

Proceeds from issue of shares - - 10,400

Share issue costs - - (351)

Interest paid (3) - -

----------------------------------------- ------------- ------------- -----------

Net cash flow from financing

activities (3) - 10,049

----------------------------------------- ------------- ------------- -----------

Net decrease in cash and cash

equivalents (4,398) (8,027) (9,714)

Cash and cash equivalents at

beginning of period / year 5,544 15,289 15,289

Effect of foreign exchange rate

changes on cash and cash equivalents (1) (4) (31)

----------------------------------------- ------------- ------------- -----------

Cash and cash equivalents at

end of period / year 1,145 7,258 5,544

----------------------------------------- ------------- ------------- -----------

DIGITAL BARRIERS PLC

Notes to the financial statements

for the 6 months ended 30 September 2013

1. Accounting policies

Basis of preparation

The consolidated interim financial statements include those of

Digital Barriers plc and all of its subsidiary undertakings

(together "the Group") drawn up at 30 September 2013, and have been

prepared in accordance with International Accounting Standard 34,

"Interim Financial Reporting" ("IAS 34") as adopted for use in the

European Union ("EU"). The consolidated interim financial

statements have been prepared using accounting policies and methods

of computation consistent with those applied in the financial

statements for the period ended 31 March 2013. The Group's

forecasts and projections, taking account of reasonably possible

changes in trading performance, show that the Group should be able

to operate within its current level of cash reserves of GBP1.1m, as

at 30 September 2013, and the equity fund raise of GBP18.0m, net of

expenses, received on 4 November 2013. The Directors have a

reasonable expectation that the Group has adequate resources to

continue operating for the foreseeable future, and for this reason

they have adopted the going concern basis in these consolidated

interim financial statements.

The annual consolidated financial statements of the Group are

prepared on the basis of International Financial Reporting

Standards ("IFRS"). The consolidated interim financial statements

are presented on a condensed basis as permitted by IAS 34 and

therefore do not include all the disclosures that would otherwise

be required in a full set of financial statements and should be

read in conjunction with the most recent Annual Report and Accounts

which were approved by the Board of Directors on 28 May 2013 and

have been filed with Companies House. The condensed interim

financial statements do not constitute statutory accounts as

defined in Section 434 of the Companies Act 2006 and are unaudited

for all periods presented. The financial information for the 12

month period ended 31 March 2013 is extracted from the financial

statements for that period. The auditors' report on those financial

statements was unqualified and did not contain an emphasis of

matter reference and did not contain a statement under section

498(2) or (3) of the Companies Act 2006.

The Company is a limited liability company incorporated and

domiciled in England & Wales and whose shares are quoted on

AIM, a market operated by The London Stock Exchange.

The following new and revised international financial reporting

standards are effective for this interim period:

IAS 1 Presentation of Items of Other Comprehensive Income -

Amendments to IAS 1. Effective for annual periods beginning on or

after 1 July 2012. IAS 1 changes the grouping of items presented in

OCI. Items that could be reclassified to profit and loss at a

future point in time are presented separately from items that will

never be reclassified. This amendment will affect presentation in

these financial statements.

IFRS 13 Fair Value Measurement. Effective for annual periods

beginning on or after 1 January 2013. IFRS 13 provides guidance on

how to measure fair value, but does not change when fair value is

required or permitted under IFRS. The standard is not expected to

significantly affect the Group's results or financial position.

2. Segmental information

The Group is organised into the Services and Products divisions

for internal management, reporting and decision-making, based on

the nature of the products and services of the Group's businesses.

These are the reportable operating segments in accordance with IFRS

8 "Operating Segments". As the Group continues to develop and

change, the Directors closely monitor these reporting operating

segments to ensure they remain relevant to the management of the

Group.

6 months ended 30 September 6 months ended 30

2013 September 2012

---------------------------------- ----------------------------------

Services Products Total Services Products Total

Unaudited Unaudited Unaudited Unaudited Unaudited Unaudited

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- ---------- ---------- ---------- ---------- ---------- ----------

Total segment revenue 1,672 7,414 9,086 2,395 5,926 8,321

Inter-segment revenue - (77) (77) - (243) (243)

----------------------- ---------- ---------- ---------- ---------- ---------- ----------

Revenue 1,672 7,337 9,009 2,395 5,683 8,078

----------------------- ---------- ---------- ---------- ---------- ---------- ----------

Segment operating

(loss) / profit (290) (1,904) (2,194) 150 (1,808) (1,658)

Corporate overheads (4,626) (3,324)

Net adjusted loss

items (see note 3) (395) (2,032)

Operating loss (7,215) (7,014)

----------------------- ---------- ---------- ---------- ---------- ---------- ----------

Finance income 1 15

Finance costs (20) (62)

----------------------- ---------- ---------- ---------- ---------- ---------- ----------

Loss before tax (7,234) (7,061)

----------------------- ---------- ---------- ---------- ---------- ---------- ----------

Income tax 334 417

----------------------- ---------- ---------- ---------- ---------- ---------- ----------

Loss for the period (6,900) (6,644)

----------------------- ---------- ---------- ---------- ---------- ---------- ----------

Year ended 31 March 2013

-------------------------------

Services Products Total

Audited Audited Audited

GBP'000 GBP'000 GBP'000

----------------------- --------- --------- ---------

Total segment revenue 6,289 17,324 23,613

Inter-segment revenue - (341) (341)

----------------------- --------- --------- ---------

Revenue 6,289 16,983 23,272

----------------------- --------- --------- ---------

Segment operating

profit / (loss) 735 (1,455) (720)

Corporate overheads (6,886)

Net adjusted loss

items (see note 3) (3,119)

Operating loss (10,725)

----------------------- --------- --------- ---------

Finance income 69

Finance costs (100)

----------------------- --------- --------- ---------

Loss before tax (10,756)

----------------------- --------- --------- ---------

Income tax 840

----------------------- --------- --------- ---------

Loss for the year (9,916)

----------------------- --------- --------- ---------

3. Adjusted loss before tax

An adjusted loss before tax measure has been presented as the

Directors believe that this is a more relevant measure of the

Group's underlying performance. Adjusted loss is not defined under

IFRS and has been shown as the Directors consider this to be

helpful for a better understanding of the performance of the

Group's underlying business. It may not be comparable with

similarly titled measurements reported by other companies and is

not intended to be a substitute for, or superior to, IFRS measures

of profit. The net adjustments to loss before tax are summarised

below:

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2013 2012 2013

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

--------------------------------------- ------------- ------------- -----------

Amortisation of intangibles initially

recognised on acquisition 867 1,123 2,029

Acquisition costs - 35 369

Adjustments to deferred consideration

(i) (472) (585) (1,384)

Impairment of intangible assets - 1,087 1,336

Reorganisation costs - 372 769

--------------------------------------- ------------- ------------- -----------

Total adjustments 395 2,032 3,119

--------------------------------------- ------------- ------------- -----------

(i) The final financial target was not met in relation to the

Zimiti acquisition, resulting in the release of GBP260,000 of

deferred consideration. The potential deferred consideration in

respect of the Visimetrics acquisition has been reassessed with

reference to performance to date and future expectations resulting

in a reduction to the short term deferred consideration of

GBP229,000. The longer term fair value of deferred consideration of

GBP207,000 is unchanged. These amounts were offset by the unwind of

the discount on deferred consideration of GBP17,000.

4. Loss per share

The basic loss per share is calculated on the loss after tax and

the weighted average number of shares in issue during the

period.

The basic adjusted loss per share is calculated on the adjusted

loss after tax and the weighted average number of shares in issue

during the period.

Diluted earnings per share measures are calculated using the

same number of shares as the basic loss per share measures, as the

inclusion of potential Ordinary Shares arising from share options

and Incentive Shares in issue would be anti-dilutive.

The following reflects the loss and share data used in the basic

and diluted loss per share calculations:

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2013 2012 2013

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Loss after tax (6,900) (6,644) (9,916)

Amortisation of acquired intangible

assets, net of tax 815 1,044 1,658

IPO, placing and deal costs - 35 369

Adjustments to deferred consideration (472) (585) (1,384)

Impairment of intangibles, net

of tax - 936 1,015

Reorganisation costs - 372 769

--------------------------------------- --------------- --------------- -----------

Adjusted loss after tax (6,557) (4,842) (7,489)

--------------------------------------- --------------- --------------- -----------

Weighted average number of shares 50,963,166 43,776,498 45,530,712

--------------------------------------- --------------- --------------- -----------

Basic and diluted loss per share (13.54p) (15.18p) (21.78p)

--------------------------------------- --------------- --------------- -----------

Basic and diluted adjusted loss

per share (12.87p) (11.06p) (16.45p)

--------------------------------------- --------------- --------------- -----------

5. Business combinations

Business combinations during the 6 months ended 30 September

2013

There have been no acquisitions by the Group in the 6 months

ended 30 September 2013.

Business combinations during the 12 months ended 31 March

2013

On 23 April 2012, the Group acquired the complete product set

and intellectual property, along with certain customer contracts,

of Enterprise Technologies (UK) Limited ("E-Tech"). The initial

cash consideration paid on completion was GBP149,000. In addition,

deferred consideration of GBP200,000 has been paid.

On 4 January 2013, the Group acquired 100% of the voting equity

interests in Visimetrics (UK) Limited ("Visi") including its

subsidiary OmniPerception Limited. The initial cash consideration

paid on completion was GBP3,200,000. No deferred consideration has

been paid.

Movements on deferred consideration

Since 31 March 2012 the following movements in the amounts

recognised for deferred consideration have taken place:

Zimiti Keeneo Stryker LMW E-Tech Visi Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------- -------- -------- -------- -------- -------- -------- --------

At 31 March 2012 1,606 107 729 90 - - 2,532

---------------------- -------- -------- -------- -------- -------- -------- --------

On acquisition - - - - 227 - 227

Unwind of discount 42 - 16 - 4 - 62

Paid (i) - (107) - (60) - - (167)

Released (617) - - (30) - - (647)

---------------------- -------- -------- -------- -------- -------- -------- --------

At 30 September 2012 1,031 - 745 - 231 - 2,007

---------------------- -------- -------- -------- -------- -------- -------- --------

On acquisition - - - - - 421 421

Unwind of discount 27 - 5 - - 5 37

Paid - - (750) - (12) - (762)

Released - - - - (31) - (31)

Reassessed (805) - - - - - (805)

---------------------- -------- -------- -------- -------- -------- -------- --------

At 31 March 2013 253 - - - 188 426 867

---------------------- -------- -------- -------- -------- -------- -------- --------

Unwind of discount 7 - - - - 10 17

Paid - - - - (188) - (188)

Released (260) - - - - - (260)

Reassessed - - - - - (229) (229)

At 30 September 2013 - - - - - 207 207

---------------------- -------- -------- -------- -------- -------- -------- --------

(i) Final Keeneo payment settled via the issue of Ordinary Shares.

As at 30 September 2013, the maximum deferred consideration

payable in the future is GBP4.7m (31 March 2013: GBP8.6m), up to

GBP3.5m (31 March 2013: GBP5.4m) of which may be satisfied through

the issue of new Ordinary Shares, and the remainder satisfied in

cash. The deferred consideration at 30 September 2013 is payable

over the period to 31 December 2014 subject to revenue and profit

targets. Up to GBP2.35m of the deferred consideration is based on

revenue and profit targets for the year ended 31 December 2013 and

a further GBP2.35m on the year ended 31 December 2014.

Deferred consideration is carried at fair value applying a Level

3 fair value hierarchy technique based on the probability weighted

average of expected cash flows. All other financial instruments are

carried at amortised cost and the directors consider that their

carrying value is not significantly different to their fair

value.

6. Issued share capital

On 5 September 2013, 25,171 Ordinary Shares were issued to

satisfy obligations under the long term incentive plan.

As at 30 September 2013, there were 50,984,761 Ordinary Shares

in issue (30 September 2012: 43,787,176, 31 March 2013:

50,959,590).

7. Post Balance Sheet Event

On 4 November 2013, the Group raised GBP18.0m cash, net of

GBP0.7m placing costs, by way of a share placing of 13,357,143 new

Ordinary Shares at 140 pence per share. Following the placing,

there were 64,341,904 Ordinary Shares in issue.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR PGGUCGUPWGBM

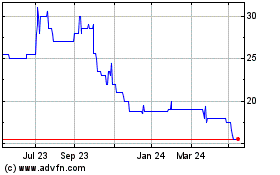

Thruvision (LSE:THRU)

Historical Stock Chart

From Jun 2024 to Jul 2024

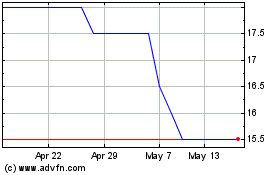

Thruvision (LSE:THRU)

Historical Stock Chart

From Jul 2023 to Jul 2024