First Day of Dealings on AIM

March 04 2010 - 3:01AM

UK Regulatory

TIDMDGB

RNS Number : 0454I

Digital Barriers plc

04 March 2010

4 March 2010

DIGITAL BARRIERS PLC

First Day of Dealings on AIM

Summary

Digital Barriers plc ("Digital Barriers" or the "Company"), a newly-incorporated

company, focused on the provision of specialist products and services to the

homeland security market, is pleased to announce the commencement of trading in

its shares on AIM (ticker symbol DGB).

The Company has also raised GBP20.0 million (before expenses) in a placing of

20,000,000 Ordinary Shares (the "Placing"). On admission and at the placing

price of 100 pence per share, Digital Barriers is expected to have a market

capitalisation of approximately GBP24.8 million.

Given the ongoing threat to the UK from international and domestic terrorism,

the Directors believe that the homeland security market continues to represent a

compelling commercial opportunity and, accordingly, they intend to develop

Digital Barriers through strategic acquisitions and ongoing organic growth.

Their intention is for the Company to become a mid-market specialist, working

directly with end-customers and internationally through key partner

organisations, to provide focused, proportionate and effective solutions for the

protection of high-profile targets, crowded spaces and the critical national

infrastructure.

Investec Investment Banking, a division of Investec Bank plc, is the nominated

adviser and broker to Digital Barriers.

Placing details

+-----------------------------------------+--------------------+

| Placing Price | 100 pence |

+-----------------------------------------+--------------------+

| Number of ordinary shares in issue on | 24,782,500 |

| admission | |

+-----------------------------------------+--------------------+

| Net proceeds of the Placing receivable | GBP19.0 million |

| by the Company | |

+-----------------------------------------+--------------------+

| Percentage of the enlarged share | 80.7 per cent |

| capital placed | |

+-----------------------------------------+--------------------+

| Market capitalisation of the Company | GBP24.8 million |

| following the Placing at the Placing | |

| Price immediately following admission | |

+-----------------------------------------+--------------------+

Tom Black, Executive Chairman, commenting on the Admission, said:

"At present, the most significant threat to our security comes not from

state-to-state conflict, but from international and domestic terrorism,

specifically attacks on crowded public spaces, high-profile targets and the

critical national infrastructure. To effectively protect these locations we must

ensure they appear hostile to a potential terrorist attack. The IPO of Digital

Barriers provides us with an exciting opportunity to develop a business that can

provide this homeland security market with specialist products and services to

do just that.

We are delighted by the level of interest the Placing has received and the

calibre of institutions which have made commitments of long-term capital to the

Company. We are particularly encouraged that investors are as excited by this as

we are. We believe that the homeland security market represents a compelling

commercial opportunity, and our team look forward to implementing the first

phase of our strategy in the coming months."

For further details

+-----------------------------------+----------------+

| Digital Barriers plc | 020 7940 4740 |

+-----------------------------------+----------------+

| Tom Black, Executive Chairman | |

+-----------------------------------+----------------+

| Colin Evans, Managing Director | |

| | |

+-----------------------------------+----------------+

| | |

+-----------------------------------+----------------+

| Investec Investment Banking | 020 7597 5970 |

+-----------------------------------+----------------+

| Andrew Pinder/Erik Anderson | |

| | |

+-----------------------------------+----------------+

| | |

+-----------------------------------+----------------+

| Financial Dynamics | 020 7831 3113 |

+-----------------------------------+----------------+

| Edward Bridges/Matt Dixon | |

+-----------------------------------+----------------+

Disclaimer

The contents of this communication, which have been prepared by and are the sole

responsibility of Digital Barriers plc, have been approved by Investec

Investment Banking, a division of Investec Bank plc ("Investec") solely for the

purposes of section 21(2)(b) of the Financial Services and Markets Act 2000.

Investec, which is authorised and regulated in the United Kingdom by the

Financial Services Authority, is acting exclusively for Digital Barriers plc in

connection with the proposed admission of the Company to trading on the AIM

market of the London Stock Exchange plc and is not acting for any person other

than Digital Barriers plc and will not be responsible to any other person than

Digital Barriers plc for providing the protections afforded to its customers or

for providing advice to any other person in connection with the proposed

admission to trading.

This announcement shall not, and no part of it shall, constitute or form part of

any offer for sale or subscription, or any solicitation of any such offer, nor

shall it, or any part of it, form the basis of or be relied upon in connection

with any contract or commitment whatsoever. Any eventual acquisition of, or

application for, shares in Digital Barriers plc should be made solely on the

basis of information contained in a formal admission document relating to

Digital Barriers plc issued in connection with its proposed admission to

trading. The price and value of, and income from, shares may go down as well as

up. Persons needing advice should consult a professional adviser.

Ends

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCUGUWWWUPUGQW

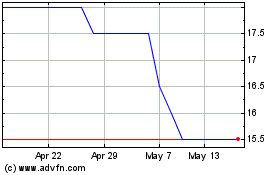

Thruvision (LSE:THRU)

Historical Stock Chart

From Jul 2024 to Aug 2024

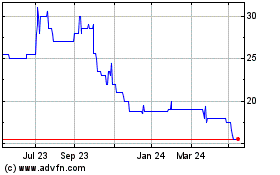

Thruvision (LSE:THRU)

Historical Stock Chart

From Aug 2023 to Aug 2024