Acquisition

March 09 2004 - 2:01AM

UK Regulatory

RNS Number:2923W

10 Group PLC

09 March 2004

9 March 2004

10 GROUP PLC ("10 Group")

PROPOSED ACQUISITION OF OAKBURN IMPORT/EXPORT LIMITED ("Oakburn")

Key points

- Proposed acquisition of Oakburn, a supplier of flooring products

- Consideration for acquisition is an initial consideration of #400,000

satisfied by the payment of #50,000 in cash and the allotment of

35,000,000 new ordinary shares in 10 Group representing some 23.98 per cent

of the enlarged issued ordinary share capital plus a further allotment of

10,000,000 new ordinary shares subject to the achievement by Oakburn of a

pre-tax profit of a minimum of #250,000 for the financial year ending 30

September 2004

- Oakburn's directors to join the 10 Group Board, providing experience of

supplying flooring products and other DIY and home furnishings markets

- Proposed Open Offer of up to 48,964,136 New Ordinary Shares at 1p per

share on the basis of 2 New Ordinary Shares for every 1 Existing Share

held, with an excess application facility and 1 Warrant for every 2 New

Ordinary Shares subscribed, underwritten by Seymour Pierce Ellis Limited

and Placing of 16,000,000 New Ordinary Shares at 1p per share and 1 Warrant

for every 2 New Ordinary Shares subscribed

- Proposed adoption of new articles of association

- Proposed change of name to Ashdene Group Plc

Commenting on the proposed acquisition,Neil McGowan, the Chairman, said "Since

the realisation of the majority of 10 Group's assets, the Board has been seeking

to identify a suitable acquisition. The directors believe that the acquisition

of Oakburn will begin to restore shareholder value."

For further information, please contact:

10 Group Jonathan Burrow - 01562 827787

Oakburn Import/Export Limited Alan Wilson - 01926 421240

City Financial Associates Limited John Shaw - 020 7090 7800

Proposed acquisition of Oakburn Import/Export Limited, Proposed Open Offer of up

to 48,964,136 New Ordinary Shares of 1p per share on the basis of 2 New Ordinary

Shares for every 1 Existing Share held, withan excess application facility and

1 Warrant for every 2 New Ordinary Shares subscribed underwritten by Seymour

Pierce Ellis Limited and Placing of 16,000,000 New Ordinary Shares at 1p per

share and 1 Warrant for every 2 New Ordinary Shares subscribed, proposed

adoption of new articles of association and proposed change of name to Ashdene

Group Plc.

The Board of 10 Group announces the Company has conditionally agreed to acquire

the entire issued share capital of Oakburn, a supplier of flooring products, for

an initial consideration of #400,000 to be satisfied by the payment of #50,000

in cash and the allotment of 35,000,000 Initial Consideration Shares. The

Company will pay additional consideration of up to #100,000 to be satisfied by

the allotment of 10,000,000 Deferred Consideration Shares subject to the

achievement by Oakburn of a pre-tax profit of a minimum of #250,000 for the year

ended 30 September 2004. The Initial Consideration Shares will represent

approximately 23 per cent. of the Enlarged Issued Ordinary Share Capital at

Admission, assuming no exercise of the Warrants. The Vendor has undertaken not

to dispose of any Consideration Shares for a period of one year from Admission.

In order to fund the Acquisition and provide working capital for the Group after

settling certain liabilities, the Company is offering by way of an Open Offer up

to 48,964,136 New Ordinary Shares at 1p per New Ordinary Share to Shareholders

on the Company's share register on the Record Date, being 5 March 2004.

Additionally, Seymour Pierce Ellis, on behalf of the Company has placed a

further 16,000,000 New Ordinary Shares at 1p each. For every 2 New Ordinary

Shares subscribed under both the Open Offer and the Placing, the subscriber will

receive 1 Quoted Warrant.

In view of the fact that the Acquisition constitutes a reverse takeover of 10

Group under the AIM Rules, it therefore requires the prior approval of

Shareholders at an Extraordinary General Meeting.

WorkingCapital

10 Group made a loss on ordinary activities before taxation of #689,462 in the

nine months to 30 September 2003 and had net liabilities of #55,866 at that

date. In the absence of completion of the Proposals the Directors believe that

theCompany would not be able to meet its liabilities and the Directors would

have no alternative but to put the Company into liquidation.

Information on the Enlarged Group

Information on 10 Group

10 Group has continued the policy of realising the Group's assets and all

trading operations have now been sold or closed. Of the properties owned by the

Company, the freehold premises in Birmingham were sold in August 2003 for

#750,000 and this paid off the mortgages totalling #654,000.

The Company has also reached a settlement with the landlords, Taylor Nelson

Sofres plc, of its leasehold premises at 52-54 Broadwick Street and 16/16a

Dufours Place, London W1 in relation to outstanding arrears of rent and

dilapidations. The settlement totalled #496,000 payable in instalments, as more

particularly set out in the circular to shareholders. Other than an outstanding

debt of approximately #230,000, including interest, owed by the Vendor to the

Company pursuant to a loan agreement dated 5 February 2003, which was assigned

by way of security to Taylor Nelson Sofres as part of the settlement, all other

material assets of the Group have now been realised or written off.

Information on Oakburn

Background

Oakburn, which is a wholly owned subsidiary of Oakburn Holdings PLC, sources and

supplies flooring products to the DIY and residential home improvement sectors.

Oakburn commenced trading in 1997 and initially concentrated on the supply of

laminate flooring. However, due to product quality problems, losses were

incurred and growth in turnover was restricted. The directors embarked upon a

strategy of product development into new flooring product sectors. Oakburn has

reversed the trading losses made in the previous years and in the year ending 30

September 2003 made a profit before taxation of #53,918 on a turnover of

#1,479,320.

Reasons for the Acquisition

After substantially completing the asset realisation exercise the Directors

sought an acquisition to provide a profitable base for the development of the

Group. The Directors believe that the acquisition of Oakburn provides such an

opportunity and will enable the Group to enhance shareholder value.

Current Trading and Prospects of the Enlarged Group

Oakburn's business is of a seasonal nature. In the first three months of the

year ending 30 September 2003 Oakburn made a small loss in line with budget.

Oakburn is planning to launch four new ranges of vinyl flooring in the first

half of 2004.

Directors and Proposed Directors

The current directors Neil McGowan (Chairman) and Jonathan Burrow (Non-executive

Director) will remain on the Board and will be joined by Alan Wilson (Proposed

Managing Director) and Michael Daniels (Proposed Finance Director).

Change of Name

The Company is seeking shareholder approval to change its name from 10 Group PLC

to Ashdene Group Plc.

The Open Offer and Excess Applications

The Company is offering up to 48,964,136 New Ordinary Shares by way of an Open

Offer to Qualifying Shareholders to raise up to #489,641.36 before expenses on

the basis of:

2 New Ordinary Shares for every 1 Existing Share

Qualifying Shareholders may subscribe for less than their pro rata entitlement

or for their pro rata entitlement together with any further number of Open Offer

Shares.

Placing

The Company is also raising #160,000 (before expenses) by the issue of

16,000,000 Placing Shares pursuant to the Placing at 1p pershare. The Placing

Shares will represent 10.96 per cent of the Enlarged Issued Ordinary Share

Capital following the Open Offer, Placing and issue of the Initial Consideration

Shares pursuant to the Acquisition.

Quoted Warrants

Pursuant to the Placing and Open Offer, the Company will be issuing, for nil

consideration, Quoted Warrants to persons subscribing for New Ordinary Shares

under the Placing or Open Offer on the basis of one Quoted Warrant for every two

New Ordinary Shares subscribed. Each Quoted Warrant will entitle the holder to

subscribe for one new Ordinary Share at an exercise price of 1p per share. The

Quoted Warrants may be exercised at any time up to the third anniversary of

Admission at which time they will lapse.

The total number of Quoted Warrants in issue at Admission will be approximately

40,732,068 equivalent to 21.82 per cent of the Company's then issued ordinary

share capital, assuming exercise of all the Quoted Warrants but prior to the

exercise of the Non-Quoted Warrants or the allotment of the Deferred

Consideration Shares under the Acquisition Agreement.

Use of Proceeds

The Placing and Open Offer will raise proceeds of approximately #430,141 for the

Company (net of cash expenses). TheDirectors intend that the net proceeds will

satisfy the cash element of the consideration for the acquisition of Oakburn,

pay certain liabilities of the Company and the balance of the funds raised from

the Placing and Open Offer will be used as additional working capital.

Extraordinary General Meeting

The proposals are subject to shareholder approval at an EGM of the Company to be

held at 11.00 am on 1 April 2004 at the offices of Field Fisher Waterhouse, 35

Vine Street, London EC3N 2AA.

Definitions in this announcement apply as they are set out in the admission

document dated 9 March 2004 which is being sent to shareholders of 10 Group

today and is available from the offices of City Financial Associates Limited, 6

Laurence Pountney Hill, London EC4R 0BL.

Expected Timetable

Record date for the Open Offer 5 March 2004

Latest time and date for splitting Application Forms (to satisfy 3.00 p.m. on 26 March 2004

bona fide market claims only)

Latest time and date for receipt of Application Forms and payment 11.00 a.m. on 30 March 2004

under the Open Offer

Latest time and date for receipt of completed Forms ofProxy 11.00 a.m. on 30 March 2004

Extraordinary General Meeting 11.00 a.m. on 1 April 2004

Expected date of commencement of dealings on AIM in New Ordinary 2 April 2004

Shares and Quoted Warrants and CREST accounts credited by

Expected date of despatch of definitive new share and warrant 8 April 2004

certificates

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQSSFFUASLSEID

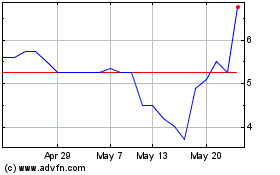

Tirupati Graphite (LSE:TGR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Tirupati Graphite (LSE:TGR)

Historical Stock Chart

From Jul 2023 to Jul 2024