Tatton Asset Management PLC Grant of Options and PDMR Dealing

February 05 2025 - 11:37AM

RNS Regulatory News

RNS Number : 0702W

Tatton Asset Management PLC

05 February 2025

5

February 2025

Tatton Asset Management

plc

(or "the

Company")

Grant of Options and PDMR

Dealings

Tatton Asset Management

PLC (AIM: TAM), the investment management

and IFA support services group announces that it has issued a new

annual award under the Company's EMI scheme to the following Directors/PDMRs by way of nil cost options ("EMI

Award").

The EMI Awards entitle the PDMRs to

acquire Ordinary Shares up to a maximum number of shares set out

below, subject to the satisfaction of certain performance criteria

over a three-year vesting period to the year ended 31 March

2027.

|

PDMR

|

Position

|

EMI Award - Maximum

number of Ordinary Shares exercisable

|

Total number of options

outstanding and unexercised following the EMI

Award1

|

|

Paul Hogarth

|

Chief Executive Officer

|

110,887

|

481,743

|

|

Paul Edwards

|

Chief Financial Officer

|

70,565

|

283,223

|

|

Lothar Mentel

|

Chief Investment Officer

|

70,565

|

1,349,338

|

|

Total

|

|

252,017

|

2,114,3042

|

Note1: the total number of options outstanding

excludes any options that the PDMRs may hold in the Company wide

employee sharesave scheme

Note2: The total number of Options vested but not yet

exercised is 1,712,287

In common with previous awards, the

number of options to vest will be dependent on the level of

achievement between certain performance conditions, as previously

detailed in the Company's Annual Remuneration Committee Report. The

Remuneration Committee believe the performance criteria to be fair

and appropriate conditions to sufficiently incentivise and reward

participants to achieve long term profitable growth.

For

further information please contact:

|

Tatton Asset Management plc

Paul Hogarth (Chief Executive

Officer)

Paul Edwards (Chief Financial

Officer)

Lothar Mentel (Chief Investment

Officer)

|

+44 (0) 161 486

3441

|

|

Zeus - Nomad and Broker

Martin Green (Investment

Banking)

Dan Bate (Investment Banking and

QE)

|

+44 (0) 20 3829

5000

|

|

Singer Capital Markets - Joint Broker

Peter Steel (Investment

Banking)

|

+44 (0) 20 7496

3000

|

|

Gracechurch Group - Financial PR and IR

Heather Armstrong / Henry Gamble /

Rebecca Scott

|

+44 (0) 20 4582

3500

tatton@gracechurchpr.com

|

|

Trade Media Enquiries

Roddi Vaughan Thomas

|

+44 (0) 7469 854

011

|

For more information, please

visit: www.tattonassetmanagement.com

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them.

The

information below, set out in accordance with the requirements of

the MAR, provides further detail.

|

|

Details of the person discharging

managerial responsibilities / person closely associated

|

|

a)

|

Name

|

Paul Hogarth

|

|

2

|

Reason for the

notification

|

|

a)

|

Position/status

|

PDMR, Chief Executive Officer

|

|

b)

|

Initial notification

/Amendment

|

Initial notification

|

|

3

|

Details of the issuer, emission

allowance market participant, auction platform, auctioneer or

auction monitor

|

|

a)

|

Name

|

Tatton Asset Management

plc

|

|

b)

|

LEI

|

213800G2F8I1N7HTVP88

|

|

4

|

Details of the transaction(s):

section to be repeated for (i) each type of instrument; (ii) each

type of transaction; (iii) each date; and (iv) each place where

transactions have been conducted

|

|

a)

|

Description of the financial

instrument, type of instrument

Identification code

|

Ordinary Shares of

£0.20 each

ISIN: GB00BYX1P358

|

|

b)

|

Nature of the transaction

|

a) Grant of EMI

options

|

|

c)

|

Price(s) and volume(s)

|

a)

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

a)

|

|

e)

|

Date of the transaction

|

a) 03 February 2025

|

|

f)

|

Place of the transaction

|

a) Outside a trading

venue

|

|

|

Details of the person discharging

managerial responsibilities / person closely associated

|

|

a)

|

Name

|

Paul Edwards

|

|

2

|

Reason for the

notification

|

|

a)

|

Position/status

|

PDMR, Chief Financial Officer

|

|

b)

|

Initial notification

/Amendment

|

Initial notification

|

|

3

|

Details of the issuer, emission

allowance market participant, auction platform, auctioneer or

auction monitor

|

|

a)

|

Name

|

Tatton Asset Management

plc

|

|

b)

|

LEI

|

213800G2F8I1N7HTVP88

|

|

4

|

Details of the transaction(s):

section to be repeated for (i) each type of instrument; (ii) each

type of transaction; (iii) each date; and (iv) each place where

transactions have been conducted

|

|

a)

|

Description of the financial

instrument, type of instrument

Identification code

|

Ordinary Shares of

£0.20 each

ISIN: GB00BYX1P358

|

|

b)

|

Nature of the transaction

|

a) Grant EMI

Options

|

|

c)

|

Price(s) and volume(s)

|

a)

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

a)

|

|

e)

|

Date of the transaction

|

a) 03 February 2025

|

|

f)

|

Place of the transaction

|

a) Outside a trading

venue

|

|

|

Details of the person discharging

managerial responsibilities / person closely associated

|

|

a)

|

Name

|

Lothar Mentel

|

|

2

|

Reason for the

notification

|

|

a)

|

Position/status

|

PDMR, Chief

Investment Officer

|

|

b)

|

Initial notification

/Amendment

|

Initial notification

|

|

3

|

Details of the issuer, emission

allowance market participant, auction platform, auctioneer or

auction monitor

|

|

a)

|

Name

|

Tatton Asset Management

plc

|

|

b)

|

LEI

|

213800G2F8I1N7HTVP88

|

|

4

|

Details of the transaction(s):

section to be repeated for (i) each type of instrument; (ii) each

type of transaction; (iii) each date; and (iv) each place where

transactions have been conducted

|

|

a)

|

Description of the financial

instrument, type of instrument

Identification code

|

Ordinary Shares of

£0.20 each

ISIN: GB00BYX1P358

|

|

b)

|

Nature of the transaction

|

a) Grant of EMI

options

|

|

c)

|

Price(s) and volume(s)

|

a)

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

a)

|

|

e)

|

Date of the transaction

|

a) 03 February 2025

|

|

f)

|

Place of the transaction

|

a) Outside a trading

venue

|

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

DSHSSLFMIEISEDE

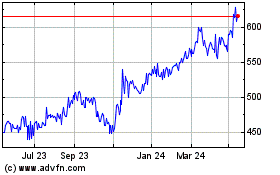

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jan 2025 to Feb 2025

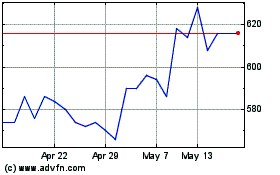

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Feb 2024 to Feb 2025