Tatton Asset Management PLC Trading Update and Notice of Results (4450P)

October 19 2021 - 2:00AM

UK Regulatory

TIDMTAM

RNS Number : 4450P

Tatton Asset Management PLC

19 October 2021

For release: 07.00, 19 October 2021

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Tatton Asset Management plc

("TAM plc" or the "Group")

AIM: TAM

Trading Update and Notice of Results

Tatton Asset Management plc (AIM: TAM), the investment

management and IFA support services business, is today providing an

unaudited period end update on the Group's performance for the six

months ended 30 September 2021 (the "Period"). The unaudited

results for the Period will be announced on Wednesday, 17 November

2021.

The Group delivered strong growth across all its key metrics

during the Period, including revenue, profits and assets under

management ("AUM") and the Group is trading in line with

expectations.

TAM continues to execute its strategy successfully, growing AUM

both organically and through acquisition in the Period. Total AUM

increased by 20.0% or GBP1.797 billion to GBP10.787 billion (Mar

2021: GBP8.990 billion) in the Period with organic growth

contributing 12.8%.

Tatton net inflows were GBP0.652 billion, increasing 98.8%

compared to the same period last year (Sep 2020: GBP0.328 billion).

In addition, strong investment performance increased AUM by over

5.0% adding GBP0.495 billion and the recent Verbatim acquisition

contributed a further GBP0.650 billion.

Total GBPbn

---------------------------------- -----------

Opening AUM 1 April 2021 8.990

Net inflows 0.652

Market and investment performance 0.495

Acquisition of Verbatim funds 0.650

Closing AUM 30 September 2021 10.787

Paradigm, the Group's IFA support services business, also

continued to grow, with Mortgage firms increasing to 1,646 (31

March 2021: 1,612) and Consulting member firms increasing to 418

(31 March 2021: 407). Paradigm Mortgages saw an increase in market

activity in the Period driven by the stimulus of the UK

Government's stamp duty holiday coupled with an improved lending

environment. As a result, mortgage completions increased to GBP6.5

billion (30 September 2020: GBP5.0 billion), an increase of

30.0%.

Paul Hogarth, Founder and CEO of Tatton Asset Management plc,

said:

"We continued to make excellent progress in the first six months

of this financial year delivering very good growth across all parts

of our business. We are delighted to have reached GBP10.8 billion

of AUM at the end of September. This has been delivered through a

combination of strong organic growth of 12.8% and the acquisition

of Verbatim funds, announced towards the end of the Period, which

added a further GBP0.7 billion to the total.

"Following the recent acquisition of the Verbatim fund range and

strategic partnership with Fintel, we remain excited about the

future opportunity for the Group. We are pleased with the start we

have made and look forward to developing stronger relationships

with the firms over the rest of this year and beyond. Alongside

this, Paradigm continues to perform well as we continue to attract

new firms to our services, with the value of mortgage completions

during the Period reaching record levels.

"As we look forward to the rest of the year, we are confident of

making further progress and delivering against our strategic

objectives."

For further information please contact:

Tatton Asset Management plc

Paul Hogarth (Chief Executive Officer)

Paul Edwards (Chief Financial Officer)

Lothar Mentel (Chief Investment

Officer) +44 (0) 161 486 3441

Zeus Capital - Nomad and Broker

Martin Green (Corporate Finance)

Dan Bate (Corporate Finance and

QE) +44 (0) 20 3829 5000

Singer Capital Markets - Joint Broker

Peter Steel, Rachel Hayes, Amanda

Gray (Investment Banking)

+44 (0) 20 7496 3000

Belvedere Communications - Financial

PR +44 (0) 7407 023147

John West / Llew Angus (media) + 44 (0) 7715 769078

Cat Valentine / Keeley Clarke (investors) tattonpr@belvederepr.com

Trade Media Enquiries

Roddi Vaughan Thomas (Head of Communications) +44 (0) 7469 854 011

For more information, please visit:

www.tattonassetmanagement.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTMZMMGNRFGMZM

(END) Dow Jones Newswires

October 19, 2021 02:00 ET (06:00 GMT)

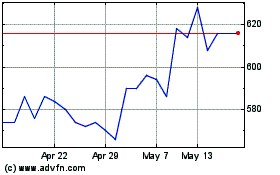

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jun 2024 to Jul 2024

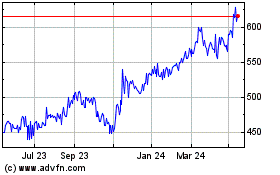

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jul 2023 to Jul 2024