SThree: Q3 Trading Update (872961)

September 13 2019 - 2:00AM

UK Regulatory

SThree (STHR)

SThree: Q3 Trading Update

13-Sep-2019 / 07:00 GMT/BST

Dissemination of a Regulatory Announcement, transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

13th September 2019

SThree plc

Q3 Trading Update

Robust Q3 performance with good momentum in Contract

SThree plc ("SThree" or the "Group"), the international specialist staffing

business focused on roles in Science, Technology, Engineering and

Mathematics ('STEM'), is pleased to issue a trading update covering the

period from 1st June 2019 to date. Financial information relates to the

quarter ended 31st August 2019(1).

Highlights

· Good Q3 performance underpinned by our specialist focus on STEM

disciplines, Contract and international market exposure

· Group net fees adjusted for working days up 6%(2) YoY

· Group net fees up 4% YoY

· Good net fee growth in Contract, in line with strategic focus

· Contract up 7% YoY

· Contract increased to 75% of Group net fees in Q3 (Q3 2018: 73%)

· Permanent net fees down 5%

· Growth in net fees across all international markets(3)

· DACH(4) net fees up 8%, USA up 5% and Japan up 82%

· Net fees generated from international markets increased to 86% (2018:

84%)

· Group period-end sales headcount up 8% YoY, with Q3 headcount down 1%

versus Q2

Mark Dorman, Chief Executive, commented:

"The Group's unique and specialised business model has continued to deliver

year-on-year growth in the third quarter, driven by a strong performance

across all of the Group's international markets which constitute the

majority of the Group. On a like-for-like basis after adjusting for working

days, this growth shows a 6%(2) increase in Group net fees. Furthermore, our

deliberate focus on Contract, a natural function of our STEM specialism,

continues to be a strong contributor to Group performance and remains a key

strategic priority for the Group.

"We remain excited about the scale of the market opportunity in front of us.

We continue to see strong demand across our key regions for STEM roles and

remain committed to our vision of being the number one STEM talent provider

in the best STEM markets.

"Our robust financial position, specialised STEM and Contract focus with

international reach provides the Group with a well-established and resilient

platform as we enter the final quarter of the year. Whilst we remain

cognisant of significant macro market uncertainties, we remain confident

that we have the right niche focus, vision and teams to deliver continued

growth, and our expectations for the full year remain unchanged."

Financial Highlights(1)

Q3 2019 Q2 2019 Q1 2019

Net Fees Q3 2019 Q3 2018 YoY % YoY % YoY %

Contract GBP66.0m GBP60.4m +7% +13% +12%

Permanent GBP21.8m GBP22.3m -5% -2% +1%

Group GBP87.8m GBP82.7m +4% +9% +9%

Continental Europe GBP50.1m GBP47.0m +5% +14% +12%

USA GBP20.4m GBP18.2m +5% +10% +17%

UK&I GBP12.1m GBP13.0m -7% -12% -7%

Asia Pac & Middle East GBP5.2m GBP4.5m +14% +20% +5%

Group GBP87.8m GBP82.7m +4% +9% +9%

Technology GBP39.4m GBP35.9m +8% +12% +10%

Life Sciences GBP17.7m GBP17.4m +2% +8% +3%

Banking & Finance GBP9.4m GBP10.5m -12% -13% -3%

Energy GBP10.2m GBP9.3m +8% +29% +25%

Engineering GBP8.6m GBP8.0m +6% +9% +19%

Other(5) GBP2.5m GBP1.6m +5% -3% +11%

Group GBP87.8m GBP82.7m +4% +9% +9%

Business Performance

Group net fees adjusted for working days increased by 6%(2). Group net fees

increased by 4% YoY, after one less working day across the Group and one

additional public holiday in Continental Europe, compared with the prior

year. Three of the Group's four regions, which account for 86% (2018: 84%)

of net fees, delivered good growth in the quarter.

Performance was driven by Continental Europe, up 5% and the USA, up 5%. DACH

continued to be the stand out performer within Continental Europe, with net

fees in the quarter up 8% YoY. This demonstrates the benefits of our focus

on the growing and resilient STEM market. Asia Pac & Middle East delivered

double digit growth of 14% driven by a strong performance in Japan. UK&I net

fees were down 7%, against a more challenging macro-economic backdrop.

Technology, Life Sciences, Energy and Engineering sectors delivered growth

in the quarter.

Contract delivered a good performance with net fees up 7%. USA continues its

strong performance with growth of 16%. Continental Europe delivered growth

of 9% with DACH up 12%. Continental Europe and USA combined now represent

80% of Contract net fees (Q3 2018: 79%) in line with our strategy to focus

on the world's biggest STEM contract recruitment markets.

Permanent net fees were down 5% in Q3. Continental Europe net fees were down

4% in the quarter against strong prior year comparatives. DACH, our largest

Perm region was level YoY. USA net fees declined 20% YoY, reflecting

previously reported leadership and strategic changes made in 2018. Our Japan

Permanent business continues to grow rapidly, up 84% YoY.

Period end sales headcount was up 8% YoY, with greater focus on Contract up

10%. Contract sales headcount represented 69% of total sales headcount at

period end (2018: 68%). Q3 headcount was down 1% versus Q2, with sequential

investment in DACH, USA and Japan of 4% offset by a managed reduction in our

other geographies of 6%.

Balance Sheet

The Group continues to be highly cash generative. Net debt at 31st August

2019 decreased to circa GBP12m (31st August 2018: Net debt of circa GBP24m). The

Group has a GBP50m revolving credit facility ("RCF") with Citibank and HSBC,

which is committed to 2023.

Analyst conference call

SThree is hosting an analyst conference call today at 0830 GMT. The details

are as follows:

Telephone number: 0800 358 9473

For access to the call please enter PIN: 33642306#

A replay facility will be available for 90 days on 0800 358 2049 Passcode:

301298950#

The Group will host a Capital Markets Day on 21st November 2019.

The Group will issue a trading update for the year ended 30th November 2019

on 13th December 2019.

(1) All year on year financial growth %s in this announcement are expressed

at constant currency

(2) In Q3, the Group was impacted by one less working day and Continental

Europe had one more public holiday, as the Whit Monday holiday fell in Q3

2019 (Whit Monday was in Q2 in 2018). The adjusted growth normalises for

this impact on our Contract business. We have only adjusted for this where

explicitly indicated.

(3) Denotes markets other than UK&I

(4) DACH - Germany, Austria and Switzerland

(5) Other includes Creative, Procurement & Supply Chain and Sales &

Marketing

- Ends -

Enquiries:

SThree plc 020 7268 6000

Mark Dorman, Chief Executive Officer

Alex Smith, Chief Financial Officer

Kirsty Mulholland, Senior Company Secretary

Assistant/ IR Enquiries

Alma PR 020 3405 0205

Rebecca Sanders-Hewett SThree@almapr.co.uk

Hilary Buchanan

Notes to editors

SThree is a leading international STEM specialist staffing business,

providing permanent and contract specialist staff to a diverse client base

of over 9,000 clients.

The Group's operations cover the Technology, Banking & Finance, Energy,

Engineering and Life Sciences sectors. With a multi-brand strategy, the

Group establishes new operations to address growth opportunities. SThree

brands include Computer Futures, Huxley Associates, Progressive and The Real

Staffing Group. The Group has a network of 46 offices in 16 countries, of

which 39 are outside the UK, with

circa 3,100 employees.

SThree plc is quoted on the Official List of the UK Listing Authority under

the ticker symbol STHR and also has a US level one ADR facility, symbol

SERTY.

Important notice

Certain statements in this announcement are forward looking statements. By

their nature, forward looking statements involve a number of risks,

uncertainties or assumptions that could cause actual results or events to

differ materially from those expressed or implied by those statements.

Forward looking statements regarding past trends or activities should not be

taken as representation that such trends or activities will continue in the

future. Certain data from the announcement is sourced from unaudited

internal management information and is before any exceptional items.

Accordingly, undue reliance should not be placed on forward looking

statements.

ISIN: GB00B0KM9T71

Category Code: QRT

TIDM: STHR

LEI Code: 2138003NEBX5VRP3EX50

Sequence No.: 19944

EQS News ID: 872961

End of Announcement EQS News Service

(END) Dow Jones Newswires

September 13, 2019 02:00 ET (06:00 GMT)

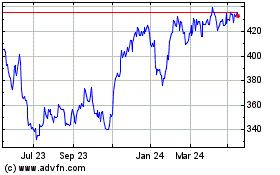

Sthree (LSE:STEM)

Historical Stock Chart

From Jul 2024 to Aug 2024

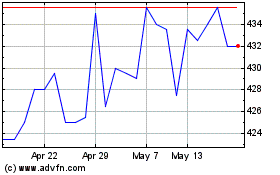

Sthree (LSE:STEM)

Historical Stock Chart

From Aug 2023 to Aug 2024