TIDMSSTY

RNS Number : 4612Y

Safestay PLC

09 September 2015

Safestay plc

("Safestay" or "the Company" or "the Group")

Interim Results

For the Six Months to 30 June 2015

Safestay (AIM: SSTY), the owner and operator of a new brand of

contemporary hostel, announces its unaudited interim results for

the six months ended 30 June 2015

Financial Highlights

-- Revenues in H1 2015 increased to GBP1.4m (H1 2014*: GBP0.5m)

-- EBITD in H1 2015 GBP0.258m (H1 2014* GBP0.230m)

-- Reflecting significant investment in expanding the central

infrastructure to manage the expanding portfolio, the Group

recorded a loss before tax of GBP0.249m (H1 2014*: profit before

tax of GBP0.137m)

-- Introduced dynamic pricing structure which increased the

number of beds occupied at the Elephant & Castle hostel by 5%

in the 6 months to 30 June 2015 compared with the pro forma 6 month

to 30 June 2014, whilst average bed rate (ABV) in the 6 months to

30 June 2015 reduced slightly to GBP18.73 (pro forma 6 months to 30

June 2014: GBP18.76), overall revenues increased as a

consequence

Operational Highlights

-- During the period, the Group operated Safestay hostels in Elephant & Castle and York

-- Substantially completed the refurbishment of the Holland Park

hostel which opened to the public in August 2015; upon completion

in September 2015, the Group will be able to offer 781 beds in

London each night

-- Appointment of Philip Houghton as Chief Executive Officer in

January 2015 and joined the Board in June 2015

-- After the period end, on 17 August 2015, the Company

announced the proposed acquisition of a 132 room/615 bed hostel and

student accommodation scheme in Edinburgh, a freehold property, for

GBP14.9m which when completed will lift the total number of beds

across the four hostels in the peak summer season to over 1,500

beds and to 1,200 beds in the remainder of the year

*while the Company was incorporated on 29 January 2014, the

comparative figures for H1 2014 represent 2 months' trading (from 2

May 2014 to 30 June 2014) and for the most part are for the

Elephant & Castle hostel as the York hostel was acquired on 23

May 2014

Larry Lipman, Chairman of Safestay, said:

"At the beginning of 2014, we were a private business running

one hostel, today we have three contemporary hostels operating

under the Safestay brand and we are poised to add what will be our

largest hostel to date, in a very strong location in central

Edinburgh.

A lot has happened in that time and these results reflect the

rapid changes that have taken place. Importantly demand is good, we

have invested in putting the infrastructure in place ahead of the

expansion of our portfolio and we are well positioned to continue

to grow the business, whilst underpinning the underlying value of

the Company with a mix of freehold and long leasehold

properties."

Enquiries

Safestay Tel: 020 8815 1600

Larry Lipman, Chairman

Phil Houghton, Chief Executive

Colin Stone, Finance Director

Westhouse Securities Tel: 020 7601 6100

Tom Griffiths

Richard Johnson

David Coaten

Novella Tel: 020 3151 7008

Tim Robertson

Ben Heath

For more information visit: www.safestay.com

Chairman's Statement

Introduction

I am pleased to present the unaudited interim results of

Safestay plc for the six months to 30 June 2015. The Company has

grown rapidly and these results reflect the changes that have taken

place, including the increase in Safestay hostels, the investment

in the operational team and infrastructure and the value of the

expanding portfolio.

It is difficult to extract meaningful comparisons with the

corresponding period in the prior year, as those figures represent

only two months' trading (from 2 May 2014 to 30 June 2014) and for

the most part are for the Elephant & Castle hostel as the York

hostel was acquired on 23 May 2014. What these results do show is

our significant progress in developing the business towards

establishing an expanding network of Safestay hostels.

Understanding and awareness of what a modern hostel has to offer

in terms of comfort, affordability and enjoyment is increasing.

Whilst the majority of our guests come from schools or colleges or

are young travellers, there is a growing proportion of other older

groups who are becoming aware of the option to stay in clean,

comfortable rooms located in the centres of these cities for less

than GBP15 per bed per night.

Today, Safestay operates three hostels in Holland Park, Elephant

& Castle and York with a fourth hostel in Edinburgh expected to

become part of the Group shortly.

Financial Review

For the period under review, the Company generated revenues of

GBP1.4m (2014*: GBP0.5m), the Group recorded an operating profit of

GBP0.028m (2014*: GBP0.221m) and a loss before tax of GBP0.249m

(2014*: profit of GBP137k). As a consequence, the Group reported a

loss per share of 2.84p (2014* profit: 5.1p). It is worth noting

that while the comparable figures for 2014 are for only two months'

trading and the figures for H1 2015 include a full 6 month period,

the first couple of months of the year are among the Group's

quietest trading months of the year.

During the period, the Group has invested in expanding its

operational team and structure which will be capable of supporting

a much bigger portfolio, bringing relevant hotel, booking and

management experience that will help establish a modern flexible

platform best suited to supporting the growing portfolio.

As at 30 June 2015, the Company had gross bank and loan note

borrowings of GBP9.12m (30 June 2014: GBP9.92m) secured against its

freehold properties with an average weighted interest cost of 4.5%

(30 June 2014: 5.25%).

The Company has two freehold and one leasehold properties. As at

31 December 2014, its freehold property portfolio was independently

valued at GBP15.0m.

On 12 January 2015, the Group entered into a 50 year lease on

the Holland Park hostel. In accordance with IAS 17, the lease is

accounted for as a finance lease arrangement (see note 7). Over the

50 year lease period and using a discount rate of 6%, the

capitalised value of the lease is GBP10.4m.

The Board is not declaring the payment of an interim

dividend.

*while the Company was incorporated on 29 January 2014, the

comparative figures for H1 2014 represent two months' trading (from

2 May 2014 to 30 June 2014) and for the most part are for the

Elephant & Castle hostel as the York hostel was acquired on 23

May 2014

Operational review

At the start of 2015, Safestay was offering 560 beds each night,

very shortly we will be able to offer over 1,500 beds per night (in

the peak summer season) with the addition of the Holland Park and

Edinburgh hostels. The increasing scale of the Group is an

important part of our offer as the majority of our guests are

travelling around the UK (and many of them are also travelling

around Europe), and our ability to increasingly meet all their

accommodation needs is a strong selling point and a key part of our

business model.

To achieve this aim and manage growing the scale of the

business, we have been investing in people and infrastructure to

ensure that we have the necessary skills and systems in place to

build a leading network of contemporary hostels. Most notably,

Philip Houghton joined the Group in January 2015 and was appointed

Chief Executive in June 2015; Philip is an established industry

figure and founder of Starboard Hotels who has been driving a

series of changes to manage the enlarged business.

Our Elephant & Castle hostel, located at John Smith House,

the former headquarters of the Labour Party, has had another strong

trading period with occupancy in the six months to 30 June 2015

increasing to 79.6% (H1 2014: 75.6%). The average bed rate for the

six months to 30 June 2015 was slightly reduced at GBP18.73 (H1

2014*: GBP18.76) as we have sought to price more dynamically and

fill slower periods with targeted discounts. As a result, we saw an

overall increase in total bed revenue for the six months to 30 June

2015 of GBP53k up 5% when compared with the pro forma six months to

30 June 2014.

Our York hostel, located inside the historic walls of the city,

is a 147 bed hostel operating from a freehold property which was

acquired by the Group on 23 May 2014. After a programme of

refurbishment, which was completed in December 2014, it was

launched as a Safestay branded hostel in January 2015. While the

hostel is seeing revenue and profitability growth, it is at a rate

behind management's pre-opening expectations and occupancy in H1

2015 was 47% (H1 2014*: 55%). The general manager is being replaced

and a dedicated sales and marketing resource is being employed who

will initially focus on driving York revenues and support the

Group's sales and marketing activities. Trading at York in the two

months since the half year has been ahead of management's

expectations and we expect that York will achieve its potential and

anticipated trading levels.

Our Holland Park hostel, which is located in the park itself, is

a Grade I listed building and was acquired on 12 January 2015 on a

long leasehold. Unique in many ways, this extraordinary site opened

under the Safestay brand in August 2015, offering 368 beds and upon

completion of the refurbishment project in September 2015, will

bring our total number of beds in London to 781. We expect demand

for the Holland Park hostel to be strong.

In June 2015, the Group introduced charging for breakfast at

each of its then operating hostels. The Board anticipates that this

change will increase both revenue and profit.

(MORE TO FOLLOW) Dow Jones Newswires

September 09, 2015 02:00 ET (06:00 GMT)

*while the Company was incorporated on 29 January 2014, the

comparative figures for H1 2014 represent 2 months' trading (from 2

May 2014 to 30 June 2014) and for the most part are for the

Elephant & Castle hostel as the York hostel was acquired on 23

May 2014

Proposed Acquisition of Edinburgh Hostel

On 17 August 2015, the Company announced the proposed

acquisition of a 132 room/615 bed hostel and student accommodation

scheme for a consideration of GBP14.9m. The Edinburgh hostel, which

is located in the heart of Edinburgh Old Town just off the Royal

Mile, provides a mix of hostel and student accommodation and has a

12 year contract with Edinburgh University to provide student

accommodation during the academic year. On completion, the

acquisition will significantly expand the Group's business. The

Company has convened a general meeting of shareholders to be held

on 9 September 2015 to approve among other things the acquisition

of the Edinburgh hostel.

To fund the acquisition and rebranding of the Edinburgh hostel,

the Company is proposing to raise approximately GBP18.0 million

through a mix of debt and equity. The Company has already agreed a

new GBP8.5 million secured debt facility with its bank to part

finance the acquisition and is proposing to finance the balance

through a firm placing and open offer of 13,764,938 new shares at

62p per share to raise GBP7. 44m (net of expenses) and the issue of

new Loan Notes to raise GBP1.0 million (before expenses).

Outlook

Trading has been positive in the first two months since the half

year end in both the Elephant & Castle and York hostels. The

Holland Park hostel is a superb site and we look forward to seeing

it progress over the coming year. The Edinburgh hostel is an

established business, with predictable revenue streams, but

currently occupancy is at 65% creating the opportunity under the

Safestay umbrella for this to increase. The concept for a Safestay

hostel is compelling, offering safe and stylish accommodation at

affordable rates in the heart of leading cities and consequently we

are confident in the future growth of the business.

Larry Lipman

Chairman

Condensed consolidated income Unaudited Audited

statement Unaudited Period from Period from

6 months 29 January 29 January

to to to

30 June 30 June 31 December

2015 2014 2014

Note GBP000 GBP000 GBP000

---------- ------------- ----------------

Revenue 3 1,400 502 1,938

Cost of sales (145) (41) (204)

Gross profit 1,255 461 1,734

Administrative expenses (1,227) (240) (1,154)

Operating profit 28 221 580

EBIT

--------------------------------- ------ ---------- ------------- -------------

EBITD* 258 230 710

Depreciation 230 9 130

---------- ------------- -------------

Operating profit 28 221 580

--------------------------------- ------ ---------- ------------- -------------

Finance income 1 - 1

Finance costs (278) (84) (444)

(Loss)/profit before tax (249) 137 137

Tax - (30) (22)

---------- ------------- -------------

(Loss)/profit for the financial

period attributable to owners

of the parent company (249) 107 115

---------- ------------- -------------

Basic earnings per share 4 (2.84) 5.10 1.29

Diluted earnings per share 4 (2.84) 4.68 1.18

The revenue and operating result for the periods is derived from

acquired and continuing operations in the United Kingdom

* Earnings before interest, tax and depreciation

Condensed consolidated statement Unaudited Audited

of comprehensive income Unaudited Period from Period from

29 January 29 January

6 months to to to

30 June 30 June 31 December

2015 2014 2014

GBP000 GBP000 GBP000

------------- ------------- -------------

(Loss)/profit for the period (249) 107 115

------------- ------------- -------------

Other comprehensive income

Items that will not be reclassified

to profit and loss

Revaluation of freehold land

and buildings 33 - 206

------------- ------------- -------------

Total comprehensive income

for the period attributable

to owners of the parent company (216) 107 321

------------- ------------- -------------

Condensed consolidated statement

of Unaudited Unaudited Audited

financial position 30 June 30 June 31 December

2015 2014 2014

Note GBP000 GBP000 GBP000

----------- ----------- -------------

Non-current assets

Property, plant and equipment 6 27,881 14,701 15,000

----------- ----------- -------------

Total non-current assets 27,881 14,701 15,000

----------- ----------- -------------

Current assets

Stock 2 2 4

Trade and other receivables 508 230 167

Deferred tax 21 - 21

Derivative financial instruments 6 - 7

Cash and cash equivalents 842 1,423 3,310

Total current assets 1,379 1,655 3,509

----------- ----------- -------------

Total assets 29,260 16,356 18,509

----------- ----------- -------------

Current liabilities

Loans 7 387 1,824 1,314

Trade and other payables 1,427 820 662

1,814 2,644 1,976

----------- ----------- -------------

Non-current liabilities

Bank loans, finance lease

and convertible loan notes 18,969 7,881 7,786

Derivative financial instruments 45 - 46

----------- ----------- -------------

Total non-current liabilities 19,014 7,881 7,832

----------- ----------- -------------

Total liabilities 20,828 10,525 9,808

----------- ----------- -------------

Net assets 8,432 5,831 8,701

----------- ----------- -------------

Equity

Share capital 8 192 132 192

Share premium account 6,410 3,808 6,410

Merger reserve 1,772 1,772 1,772

Share-based payment reserve 11 12 6

Revaluation reserve 239 - 206

Retained earnings (192) 107 115

Total equity attributable

to owners of the parent company 8,432 5,831 8,701

----------- ----------- -------------

Condensed consolidated statement Unaudited Audited

of cash flows Unaudited Period from Period from

6 months 29 January 29 January

(MORE TO FOLLOW) Dow Jones Newswires

September 09, 2015 02:00 ET (06:00 GMT)

to to to

30 June 30 June 31 December

2015 2014 2014

GBP000 GBP000 GBP000

------------- ------------- ---------------

(Loss)/profit before tax (249) 137 137

Adjustment for:

Depreciation 235 9 130

Finance costs 278 84 444

Finance income (1) - (1)

Share-based payments charge 5 12 6

Changes in working capital:

Decrease in stock 2 1 1

Increase in trade and other receivables (341) (113) (50)

Increase/(decrease) in trade and

other payables 764 93 (26)

Net cash generated from

operating activities 693 223 639

------------- ------------- ---------------

Cash flows from investing

activities

Interest received 1 - 1

Purchase of property, plant

and equipment (12,821) (2,510) (2,724)

Net cash outflow on acquisition

of subsidiaries - (5,320) (5,320)

-------------

Net outflow from investing

activities (12,820) (7,830) (8,043)

------------- ------------- ---------------

Cash flows from financing

activities

Issue of ordinary shares

for cash - 4,800 8,114

Payment for share issue

costs - (896) (1,549)

Repayment of borrowings (1,164) (4,546) (5,186)

Dividend paid (58) - -

Increase in borrowings 11,434 9,917 9,917

Interest paid (553) (25) (356)

Loan arrangement fees - (220) (226)

-------------

Net cash inflow from financing

activities 9,659 9,030 10,714

------------- ------------- ---------------

Net increase in cash and

cash equivalents (2,468) 1,423 3,310

Cash and cash equivalents -

at beginning of period 3,310 -

-------------

Cash and cash equivalents

at end of period 842 1,423 3,310

------------- ------------- ---------------

Condensed consolidated statement of changes in equity

For the six months to 30 June 2015 (unaudited)

Share Share Merger Share based Revaluation Retained Total

Capital premium Reserve payment Reserve earnings equity

GBP'000 account GBP'000 reserve GBP'000 GBP'000 GBP'000

GBP'000 GBP'000

------- ---------------- ------------- --------- ------------ ----------- --------- ---------

Balance at 1

January

2015 192 6,410 1,772 6 206 115 8,701

Comprehensive

income

loss for the

period - - - - - (249) (249)

Other

comprehensive

income - - - - 33 - 33

-------

Total

comprehensive

income - - - - 33 (249) (216))

Transactions

with

owners

Dividend paid - - - - - (58) (58)

Share based

payment

charge for the

period - - - 5 - - 5

------- ---------------- ------------- --------- ------------ ----------- --------- ---------

Balance at 30

June

2015 192 6,410 1,772 11 239 (192) 8,432

======= ================ ============= ========= ============ =========== ========= =========

For the six months period from 29 January 2014 to 30 June 2014

(unaudited)

Share Share Merger Share based Revaluation Retained Total

Capital premium Reserve payment Reserve earnings equity

GBP'000 account GBP'000 reserve GBP'000 GBP'000 GBP'000

GBP'000 GBP'000

------- ---------------- ------------- --------- ------------ ----------- --------- ---------

Comprehensive

income

Profit for the

period - - - - - 107 107

-------

Total

comprehensive

income - - - - - 107 107

Transactions

with

owners

Issue of shares 132 3,808 1,772 - - - 5,712

Share based

payment

charge for the

period - - - 12 - - 12

------- ---------------- ------------- --------- ------------ ----------- --------- ---------

Balance at 30

June

2014 132 3,808 1,772 12 - 107 5,831

======= ================ ============= ========= ============ =========== ========= =========

For the period from 29 January 2014 to 31 December 2014 (audited)

Share Share Merger Share Revaluation Retained Total

Capital premium Reserve based Reserve earnings equity

GBP'000 account GBP'000 payment GBP'000 GBP'000 GBP'000

GBP'000 reserve

GBP'000

---------- -------------------- --------- --------- ----------- ---------- ----------

Comprehensive income

Profit for the period - - - - - 115 115

Other comprehensive

income - - - - 206 - 206

----------

Total

comprehensive

income - - - - 206 115 321

Transactions with

owners

Issue of shares 192 6,410 1,772 - - - 8,374

Share based payment

charge for the period - - - 6 - - 6

--------- -------------------- --------- --------- ------------ --------- ----------

Balance at 31 December

2014 192 6,410 1,772 6 206 115 8,701

========= ==================== ========= ========= ============ ========= ==========

1. Basis of preparation and accounting policies

(MORE TO FOLLOW) Dow Jones Newswires

September 09, 2015 02:00 ET (06:00 GMT)

The condensed interim consolidated financial statements of the

Company and its subsidiaries ("the Group") for the 6 months to 30

June 2015 ("the period") have been prepared using accounting

policies consistent with International Financial Reporting

Standards (IFRS) as adopted by the European Union. This interim

statement does not constitute full accounts as defined by Section

434 of the Companies Act 2006.

These condensed interim financial statements have not been

audited, do not include all of the information required for full

annual financial statements and should be read in conjunction with

the Group's consolidated annual financial statements for the period

ended 31 December 2014. While the financial figures included within

this interim report have been computed in accordance with IFRS

applicable to interim periods, this report does not contain

sufficient information to constitute an interim financial report as

set out in International Accounting Standard 34 Interim Financial

Reporting.

2. Operating segments

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision makers.

The chief operating decision makers, who are responsible for

allocating resources and assessing performance of the operating

segments, have been identified as the executive directors.

Currently there is only one operating segment, which is the

operation of hostel accommodation in the UK.

3. Revenue

Revenue is stated net of VAT and comprises revenues from

overnight hostel accommodation and the sale of ancillary goods.

Accommodation and the sale of ancillary goods is recognised when

services are provided.

Sale of ancillary goods comprises sales of food, beverages and

merchandise.

Deferred income comprises deposits received from customers to

guarantee future bookings of accommodation. This revenue is

recognised once the bed has been occupied.

4. Earnings per share

Unaudited Audited

Unaudited Period from Period from

6 months 29 January 29 January

to to to

30 June 30 June 31 December

2015 2014 2014

GBP000 GBP000 GBP000

------------- -------------

(Loss)/profit for the financial period

attributable to owners of the parent

company (249) 107 115

------------- ------------- -------------

No No No

000 000 000

Weighted average number of ordinary

shares for

the purposes of basic earnings per

share 9,622 2,100 8,948

Effect of potential dilutive ordinary

shares:

share options - 189 792

------------- -------------

Weighted average number of ordinary

shares for the purposes of diluted

earnings per share 9,622 2,289 9,740

------------- ------------- -------------

Basic earnings per share (2.61)p 5.10p 1.29p

Diluted earnings per share (2.61)p 4.68p 1.18p

------------- ------------- -------------

Diluted Earnings per share is calculated by adjusting the

earnings and number of shares for the effects of dilutive options

and other dilutive potential ordinary shares.

5. Dividends

A final dividend of 0.3p per share for the period ended 31

December 2014 was paid on 26 June 2015. No interim dividend has

been declared.

6. Property, plant and equipment

For the period from 1 January 2015 to 30 June 2015

(unaudited)

Freehold Leasehold Plant and Total

land and land and equipment

buildings buildings

GBP000 GBP000 GBP000 GBP000

---------- ---------- ---------- --------

Cost

Acquisitions 12,128 - 72 12,200

Additions 2,683 -- 2,683

Revaluations 110 - 41 151

---------- ---------- ---------- --------

At 31 December

2014 14,921 - 113 15,034

---------- ---------- ---------- --------

Depreciation

Charge for

the period 96 - 34 130

Revaluation (96) - - (96)

---------- ---------- ---------- --------

At 31 December

2014 - - 34 34

---------- ---------- ---------- --------

Net book value

At 31 December

2014 14,921 - 79 15,000

---------- ---------- ---------- --------

For the period from 29 January 2014 to 30 June 2014

(unaudited)

Freehold Leasehold Plant and Total

land and land and equipment

buildings buildings buildings

GBP000 GBP000 GBP000 GBP000

--------------------- --------------------- --------------------- -------------------

Cost

Acquisitions 12,128 - 72 12,200

Additions 2,470 - 40 2,510

--------------------- --------------------- --------------------- -------------------

At 30 June 2014 14,598 - 112 14,710

--------------------- --------------------- --------------------- -------------------

Depreciation

Charge for the

period - - 9 9

At 30 June 2014 - - 9 9

--------------------- --------------------- --------------------- -------------------

Net book value

At 30 June 2014 14,598 - 103 14,701

--------------------- --------------------- --------------------- -------------------

For the period from 29 January 2014 to 31 December 2014

(audited)

Freehold Leasehold Plant and Total

land and land and equipment

buildings buildings

GBP000 GBP000 GBP000 GBP000

--------------------- --------------------- --------------------- -------------------

Cost

Acquisitions 12,128 - 72 12,200

Additions 2,683 -- 2,683

Revaluations 110 - 41 151

--------------------- --------------------- --------------------- -------------------

At 31 December

2014 14,921 - 113 15,034

--------------------- --------------------- --------------------- -------------------

Depreciation

Charge for the

period 96 - 34 130

Revaluation (96) - - (96)

--------------------- --------------------- --------------------- -------------------

At 31 December

2014 - - 34 34

--------------------- --------------------- --------------------- -------------------

Net book value

At 31 December

2014 14,921 - 79 15,000

--------------------- --------------------- --------------------- -------------------

At 30 June 2015, the carrying value of the Group's freehold

properties including fixtures and fittings was GBP15,000,000 (30

June 2014: GBP14,701,000, 31 December 2014: GBP15,000,000)

The directors valued the freehold properties using external

valuations prepared by Edward Symmons LLP and the directors'

consideration of factors. The valuations are based on the

discounted cash flows technique with a capitalisation rate of 8%

and discount rate of 10.5% applied to forecasts of future earnings

before interest, taxation and depreciation (EBITDA).

(MORE TO FOLLOW) Dow Jones Newswires

September 09, 2015 02:00 ET (06:00 GMT)

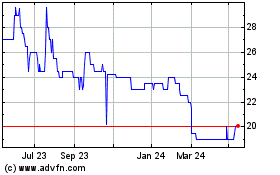

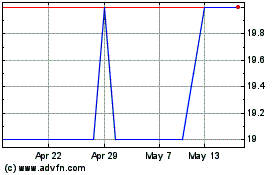

Safestay (LSE:SSTY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Safestay (LSE:SSTY)

Historical Stock Chart

From Jul 2023 to Jul 2024