TIDMSPDI

RNS Number : 7184Q

Secure Property Dev & Inv PLC

30 June 2022

Secure Property Development & Invest PLC/ Index: AIM / Epic:

SPDI / Sector: Real Estate

30 June 2022

Secure Property Development & Investment PLC ('SPDI' or 'the

Company')

2021 Annual Results

Secure Property Development & Investment PLC, the AIM quoted

South Eastern European focused property company, is pleased to

announce its full year audited financial results for the year ended

31 December 2021.

Corporate Overview

The Company maintains its strategy to maximise value for

shareholders through continued discussions with Arcona on the

contribution of SDPI's property portfolio

Significant asset backing behind the Company:

-- NAV per share stood at 15p a share as at 31 December 2021 -

52% higher than share price at year end and 58% higher than the

current share price

-- Post period end, further progress of Stage 2 of the indirect

merger with Arcona Property Fund N.V (Arcona) with the transfer of

the following Romanian assets:

o Transfer of Lelar Holdings Limited ( Delenco Office Building

asset in Bucharest) to Arcona

o Transfer of N-E Real Estate Park First Phase SRL (EOS Business

Park in Bucharest) to Arcona

-- SPDI now has a total holding of 1,072,910 shares in Arcona

and 259,627 warrants over shares in Arcona which based on the

closing price of Arcona's shares on 29 June 2022, values the SPDI's

stake in Arcona at c.EUR6.7 million (excluding the issue of the

warrants), while based on the current net asset value per Arcona

share (as at 31 March 2022), values the stake at EUR12.75 million

(excluding the issue of the warrants)

-- Stage 2 is ongoing with the remaining assets in the Kiev

region of Ukraine. Discussions regarding Stage 3 of the transaction

are at a preliminary stage and will be intensified upon successful

closing of Stage 2

Financial Overview

-- Net income from continuing operations increased during 2021

to EUR2,397,646 (2020: EUR1,468,609) due to increased residential

unit sales

-- EBITDA from total operations of EUR819,431 (2020: loss of EUR199,213)

-- Operating results after finance and tax for the year reached

EUR144,828 (2020: loss of EUR994,039)

Lambros G. Anagnostopoulos, Chief Executive Officer, said ,

"Despite the headwinds faced during 2021 while the world continued

to battle a global pandemic, progress was made during the financial

year under review, leading to the delayed completion of two

Romanian asset disposals included in Stage Two of the Arcona

transaction earlier in 2022.

"While we saw a significant improvement in the economies of

Romania and Ukraine with the lifting of Covid-19 restrictions, the

war in Ukraine has, obviously, meant a reprioritisation of our

efforts to ensure the safety first and foremost of our team on the

ground and the consequent ongoing delays in the progress of the

Ukrainian aspect of the Arcona transaction.

"Following the transfer of SPDI's interests in Delenco and EOS

Business Park in Romania in March and June this year, the total

number of Arcona Shares issued to SPDI totals 1,072,910 to date, or

25.3% of the total issued shares in the company."

Copies of the Annual report and Accounts are being posted to

Shareholders today and are available on the Company's website at

www.secure-property.eu .

* *S * *

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014

For further information please visit www.secure-property.eu or

contact:

Lambros Anagnostopoulos SPDI Tel: +357 22 030783

Rory Murphy Strand Hanson Limited Tel: +44 (0) 20 7409 3494

Ritchie Balmer

Jon Belliss Novum Securities Limited Tel: +44 (0) 207 399 9400

Catherine Leftley St Brides Partners Ltd Tel: +44 (0) 20 7236 1177

Charlotte Page

1. Letter to Shareholders

30 June 2022

Dear Shareholder

2021 was the second year straight that our world, our continent

and our business experienced the impacts of COVID-19. Despite the

vaccines being available for much of the year, lockdowns were

frequent and fatalities increased. Consequently, our effort to

complete the merger with the Amsterdam and Prague listed Arcona

Property Fund N.V. ('APF') - with assets in Poland, Czech Republic

and Slovakia) took more time than expected. With the start of the

year bringing improvements on the health front, the process picked

up pace and is now progressing meeting SPDI's strategic objectives

to create a regional property platform of reference in South

Eastern Europe by offering exposure to our shareholders to a much

larger and broader East European regional property company.

The Romanian part of Stage 2, which in whole involves the

transfer of the remaining Ukraine assets and the Romanian portfolio

to APF, closed within H1 2022. Obviously, completing the Ukraine

part of Stage 2 has taken second stage to ensuring the life and

wellbeing of our Ukrainian executives and their families, all of

which we are happy to report are safe. We hope the unnecessary

military conflict in Ukraine with the untold catastrophes in the

country's population, society and infrastructure, as well as the

substantial consequences to our continent's present and future,

will end soon. As such the Ukrainian component may take longer, but

APF, in which we now own 25% and have our chairman as one of the

four supervisory board members, is committed to meeting its

obligations. With our directors consequently broadening their scope

of interest to include the future good management of APF, as per

their fiduciary responsibility to our shareholders, management's

focus has shifted towards monetising the remaining SPDI assets that

are not part of the APF deal and settling any remaining

liabilities, while reducing operating expenses to a minimum

(including management and directors fees).

2022 is expected to be the last year of SPDI operations as we

know them with its net assets turned into APF shares and cash,

within the year or soon after, and opex being reduced to mostly

listing and legal related costs. When such APF shares and cash are

distributed to our shareholders they will be able to either

monetise their investment by selling them or retain them and follow

APF's growth into a dividend issuing pan-East Europe property

company, the preferred way of safeguarding their investment value

together with having the option of further value generation.

Management and directors of SPDI are committed to see a swift

conclusion of the transaction, so that they will ensure the

transformation of our Company.

Best regards,

Lambros G. Anagnostopoulos, Chief Executive Officer

2. Management Report

2.1 Corporate Overview & Financial Performance

SPDI's core property asset portfolio consists of South Eastern

European prime commercial and industrial real estate, the majority

of which is let to blue chip tenants on long leases. During 2021,

management in line with the Company's strategy to maximise value

for shareholders, continued the discussions with Arcona Property

Fund N.V (Arcona) in relation to the conditional implementation

agreement for the sale of Company's property portfolio, excluding

its Greek logistics property (which has now also separately been

sold), in an all-share transaction to Arcona, an Amsterdam and

Prague listed company that invests in commercial property in Central

Europe. Arcona originally held high yielding real estate investments

in Czech Republic, Poland and Slovakia, with the transaction valuing

the SPDI NAV at EUR29m, significantly higher than the current

market value of the Company as a whole.

The combination of two complementary asset portfolios is expected

to create a significant European property company, benefiting

both the Company's and Arcona's respective shareholders.

Following the completion of Stage 1 of the transaction in 2019,

which involved the sale of two land plots in Ukraine and residential

and land assets in Bulgaria and resulted in Company receiving

a total of 593.534 Arcona shares and 144.084 warrants over Arcona

shares, in June 2021, the two parties signed SPA agreements for

Stage 2 of the Arcona transaction. This stage involves the transfer

of the EOS and Delenco assets in Romania and the Kiyanovskiy and

Rozny land plots in Ukraine with a total net asset value of EUR8,2

million, in exchange for approximately 560.000 new ordinary shares

in Arcona and approximately 135.000 warrants over shares in Arcona,

as well as EUR1m in cash, subject to, inter alia, standard form

adjustment and finalisation in accordance with the relevant agreements.

However, the rapid development of COVID-19 affected during the

second half of 2021, all related countries and therefore all participants

in this process, causing major delays.

Finally, in March and June 2022 the parties signed the closing

documents of the transactions regarding the Delenco and the EOS

assets in Romania, and in particular the transfer of a 24,4% stake

in Delenco in exchange for the issue to SPDI of 362.688 new shares

in Arcona and 87.418 warrants over shares in Arcona, as well as

a 100% stake in EOS in exchange for the issue to SPDI of 116.688

new shares in Arcona and 28.125 warrants over shares in Arcona.

The invasion of Ukraine by Russia during February 2022, suspended

the transfer process of the relevant Ukrainian assets included

in Stage 2 of the Transaction. Any development of such process

is expected to take place in the future upon normalization of

current conditions.

Moreover, the war in Ukraine has also affected our standard local

business. In particular, despite submitting the official request

to the City of Kiev to extend the lease of Tsymlyanskiy for another

5 years last November (as we have first extension rights over

any other interested party) we have not managed to get an official

approval yet. The first step in the process whereby the presiding

committee of the municipality, before the final approval by the

City Council, did not place as too many other cases had accumulated

which had time priority over our case. During the period between

15 December 2021 and 20 January 2022, the committee did not convene

at all as is usual during holiday and vacation times. Once the

holiday season was over, the main focus of the committee and the

City Council unfortunately were on issues not related to property

lease extensions, but rather more pressing matters for the interests

and operational stability of the City of Kiev. From there on,

all decisions have been put on hold due to the Russian invasion

of Ukraine. However, management remains confident that the Company

will be awarded the lease extension once the war status permits.

Regarding the economic environment in which the Company operates,

the Romanian economy which constitutes the main operating market

of the Company, grew by 5,9% in 2021 following the downturn in

2020 due to the pandemic. Consumer spending has remained robust,

but lost momentum on the back of lower pent-up demand and price

increases. Inflation has surged, far above the central bank target

band, mainly driven by sharp increases in food and energy prices.

Labour market conditions improved, with the number of registered

unemployed moving towards to its pre-pandemic level. Real estate

investment volume picked up, with office assets representing 43%

of the annual volume, while industrial projects attracted 30%

and retail 21%.

Total operating income increased by 25% during 2021 to EUR2,6m

as a result of the increased sales of residential units throughout

the period, leading to an increase of net operating income of 14%

to EUR1,9m. Overall, the administration costs, adjusted by the

one-off costs associated with the transaction with Arcona, the

legal costs for the acceptance by Euroclear of the new custodian as

a result of Brexit, and ad-hoc previous periods and re-financing

costs, decreased by 5%, while at the same time profit realized from

associates and dividends income increased further recurring EBITDA

to EUR0,82m from losses EUR0,2m in 2020.

As a result, operating results after finance and tax for the

year reached EUR0,13m as compared to losses of EUR1,0m in 2020.

Table 1

EUR 2021 2020

----------------------------------------------------------------------- ---------------------------------------------------------------------------

Continued Discontinued Total Continued Discontinued Total

Operations Operations Operations Operations

----------------- ---------------------- ----------------------- ---------------------- ------------------------ ----------------------- ------------------------

Rental,

Utilities,

Management &

Sale of

electricity

Income 1,047,137 1,593,287 2,640,424 795,700 1,323,232 2,118,932

Income from

Operations 1,047,137 1,593,287 2,640,424 795,700 1,323,232 2,118,932

Asset operating

expenses - (763,024) (763,024) - (470,548) (470,548)

Net Operating

Income 1,047,137 830,263 1,877,400 795,700 852,684 1,648,384

Share of

profits from

associates - 344,746 344,746 - (179,775) (179,775)

Dividends

income - 175,500 175,500 - - -

Net Operating

Income

from

investments 1,047,137 1,350,509 2,397,646 795,700 672,909 1,468,609

Administration

expenses (1,367,129) (211,086) (1,578,215) (1,449,834) (217,988) (1,667,822)

Operating

Result

(EBITDA) (319,992) 1,139,423 819,431 (654,134) 454,921 (199,213)

Finance Cost,

net 298,663 (854,114) (555,451) 228,776 (861,559) (632,783)

Income tax

expense (51,824) (67,328) (119,152) (117,656) (44,387) (162,043)

Operating

Result after

Finance and

Tax Expenses (73,153) 217,981 144,828 (543,014) (451,025) (994,039)

Other income /

(expenses),

net 69,643 (12,510) 57,133 191,222 3,058 194,280

One off costs

associated

to Arcona

transaction (204,101) - (204,101) (81,346) - (81,346)

One off costs

associated

with previous

periods

and

re-financing

activities (90,313) (78,000) (168,313) (170,000) - (170,000)

One off costs

associated

with new

custodian

due to Brexit (136,750) - (136,750) - - -

Fair value

adjustments

from Investment

Properties (754,979) (754,979) - (3,495,700) (3,495,700)

Net gain/(loss)

on

disposal of

investment

property 748 - 748 - - -

Fair Value

adjustment

on financial

investments 683,478 - 683,478 (824,634) - (824,634)

Foreign exchange

differences,

net (65,147) (253,666) (318,813) (60,142) (318,925) (379,067)

Result for the

year 184,405 (881,174) (696,769) (1,487,914) (4,262,592) (5,750,506)

Exchange

difference

on I/C loans to

foreign

holdings - - - - (61,936) (61,936)

Exchange

difference

on translation

due

to presentation

currency - 64,299 64,299 - (1,392,153) (1,392,153)

Total

Comprehensive

Income for the

year 184,405 (816,875) (632,470) (1,487,913) (5,716,681) (7,204,594)

----------------- ---------------------- ----------------------- ---------------------- ------------------------ ----------------------- ------------------------

2.2 Property Holdings

The Company's portfolio at year-end consists of commercial

income producing and residential properties in Romania, as well as

land plots in Ukraine and Romania.

Commercial Property Location Key Features

EOS Business Park

Bucharest, Romania Gross Leaseable Area: 3.386 sqm

-------------------- --------------------------- -------------------------------------------

Anchor Tenant: Danone Romania

-------------------- --------------------------- -------------------------------------------

Occupancy Rate: 100%

---------------------------------------------------------------------- -------------------------------------------

Delenco (SPDI has a 24,35% interest)

Bucharest, Romania Gross Leaseable Area: 10.280 sqm

-------------------- --------------------------- -------------------------------------------

Anchor Tenant: ANCOM (Romanian telecoms regulator)

-------------------- --------------------------- -------------------------------------------

Occupancy Rate: 100%

---------------------------------------------------------------------- -------------------------------------------

Innovations Logistics Park

Bucharest, Romania Gross Leaseable Area: 16.570 sqm

-------------------- --------------------------- -------------------------------------------

Anchor Tenant: Favorit Business Srl

-------------------- --------------------------- -------------------------------------------

Occupancy Rate 2019: 37%

---------------------------------------------------------------------- -------------------------------------------

Occupancy Rate Currently: 83%

---------------------------------------------------------------------- -------------------------------------------

Kindergarten

Bucharest, Romania Gross Leaseable Area: 1.400 sqm

-------------------- --------------------------- -------------------------------------------

Anchor Tenant: International School for Primary Education

-------------------- --------------------------- -------------------------------------------

Occupancy Rate: 100%

---------------------------------------------------------------------- -------------------------------------------

Land & Residential Assets Location Key Features

Kiyanovskiy Residence Kiev, Ukraine Plot of land ( th. sqm): 6

Tsymlyanskiy Residence* Kiev, Ukraine Plot of land ( th. sqm): 4

Rozny Lane Kiev, Ukraine Plot of land ( th. sqm): 420

GreenLake Land

(SPDI has a 44% interest) Bucharest, Romania Plot of land ( th. sqm): 40

Monaco, Blooming,

GreenLake Romania Sold units during 2021: 22

GreenLake Romania Available units (end 2021): 11

*As of November 2021, the Company had submitted an official

request to the City of Kiev to extend the lease of the property for

another 5 years (since it has first extension rights over any other

interested party). The first step in the process whereby the

presiding committee of the municipality, before the final approval

by the City Council, did not place as too many other cases had

accumulated which had time priority over our case. During the

period between 15 December 2021 and 20 January 2022, the committee

did not convene at all as is usual during holiday and vacation

times. Once the holiday season was over, the main focus of the

committee and the City Council unfortunately were on issues not

related to property lease extensions, but rather more pressing

matters for the interests and operational stability of the City of

Kiev. From there on, all decisions have been put on hold due to the

Ukrainian invasion by Russia. Management remains confident that the

Company will be awarded the lease extension once the war status

permits.

In 2021, the Company's accredited valuers, namely CBRE Ukraine

for the Ukrainian Assets, and NAI RealAct for the Romanian Assets,

remained appointed. The valuations have been carried out by the

appraisers on the basis of Market Value in accordance with the

current Practice Statements contained within the Royal Institution

of Chartered Surveyors ("RICS") Valuation - Global Standards (2017)

(the "Red Book") and are also compliant with the International

Valuation Standards (IVS).

Following disposals of previous periods, SPDI's portfolio has

became more concentrated in terms of geography. At the end of the

reporting period, Romania is the prime country of operations (88%)

in terms of Gross Asset Value, while in Ukraine (12%) the Company

still has interests in land plots.

In respect of the Company's income generation capacity, Romania

has become the single operating income source.

The table below summarizes the main financial position of each

of the Company's assets (representing the Company's participation

in each asset) at the end of the reporting period.

2021

Property Country GAV* EURm Debt * NAV

Innovations Logistics Park Rom 9,7 6,5 3,2

EOS Business Park Rom 6,7 3,5 3,2

------------ ----- ------------- --------

Delenco (associate) Rom 5,1 0 5,1

------------ ----- ------------- --------

Kindergarten Rom 0,7 0,3 0,4

------------ ----- ------------- --------

Residential units Rom 0,4 0 0,4

------------ ----- ------------- --------

Land banking Rom & Ukr 6,6 3,8 3,1

------------ ----- ------------- --------

Total Value 29,2 14,1 15,1

----- ------------- --------

Other balance sheet items, net ** +8,1

----- ------------- --------

Net Asset Value total 23,2

Market Cap in EUR as at 31/12/2021 (Share price at GBP0,0725) 11 , 1

Market Cap in EUR as at 16/06/2022 (Share price at GBP0,0625) 9 ,4

Discount of Market Cap in EUR at 16/06/2022 vs NAV at 31/12/2021 -60%

* Reflects the Company's participation at each asset

**Refer to balance sheet and related notes of the financial statements

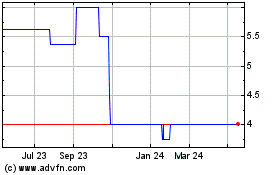

The Net Equity attributable to the shareholders as at 31

December 2021 stood at EUR23,2m vs EUR23,7m in 2020. The table

below depicts the discount of Market Share Price over NAV since

2012.

The NAV per share as at 31 December 2021 stood at GBP 0,15 and

the discount of the Market Value vis a vis the Company's NAV

denominated in GBP stands at 52% at year-end.

2.3 Financial and Risk Management

The Group's overall bank debt exposure at the end

of the reporting period was EUR14,06m (calculating

relative to the Company's percentage shareholding

in each), comprising the following:

a) EUR3,5m debt financing of EOS Business Park with

Patria Bank Romania.

b) EUR6,5m finance lease of Innovations Logistics

Park with Piraeus Leasing Romania.

c) EUR0,26m being the Company's portion of debt financing

of Kindergarten with Eurobank Ergasias.

d) EUR3,8m being the Company's portion of land plot

related debt financing in Romania.

Throughout 2021, the Company focused on managing and

preserving liquidity through cash flow optimisation.

In this context, Management secured a) collection

of scheduled re-payments of loans provided to third

parties, b) continuous sale of residential assets

and c) advancement of discussions related to the transaction

with Arcona Property Fund N.V. which partially materialised

in 2022.

2.4 2022 and beyond

2022 is expected to be the period in which the Company will

change completely, with all its assets expected to be sold.

Consequently its main operations will be minimised, subject to

constraints brought by the pandemic and the current war situation.

Despite such constraints, Management is working, along the guidance

of the board for the closing of the transaction with Arcona

Property Fund N.V., which will mark effectively the maximisation of

Company's value and will give our shareholders the opportunity to

gain direct exposure to an entity of considerably larger size, with

a dividend distribution policy, and active in a more diversified

and faster growing region (Central and South Eastern Europe) of the

European property market.

Having already completed during 2022 the transfers of Delenco

and EOS assets in Romania, the Management is currently working

towards completion of the remaining parts of the transaction,

monitoring closely any developments in Ukraine, as well as with all

other open issues which if resolved will effectively result in the

Company having as assets only Arcona shares and cash.

3. Regional Economic Developments (1)

After a strong recovery in the first half of 2021, economic

activity in Romania has been cooling as a result of the fourth

COVID-19 wave. Supply-chain disruptions have dampened manufacturing

activity while the rapid growth of coronavirus infections has

damaged confidence. Overall the economy grew by 5,9% in 2021 with

the agricultural sector leading with a 13,5% growth, following its

steep drop in 2020. The industrial sector following saw a 5%

growth, while the construction sector contracted by 1,7%.

Unemployment rate is estimated lower at 5,6%, while inflation

increased as a result of price increases mainly in foods and

energy, at 4,1% with an increasing trend.

Assuming the pandemic remains under control, economic growth in

2022 is projected to decelerate as a result of the Russia-Ukraine

war. The current energy crisis is expected to lead to further

increases in prices, leading in turn to an almost 20-year high

inflation level, affecting household consumption. At the same time

and for the same reasons, private investment activity is expected

to drop, however, EU-backed investments should provide some

counterbalance, provided that absorption of EU funds will remain

successful.

Macroeconomic data

Romania 2015 2016 2017 2018 2019 2020 2021f

GDP (EUR bn) 160,3 170,4 187,5 202,9 223,4 218,2 231,4

----- ----- ----- ----- ----- ----- -----

Population (mn) 19,9 19,8 19,6 19,5 19,5 19,3 19,2

----- ----- ----- ----- ----- ----- -----

Real GDP (y-o-y

%) 3,9 4,8 7,0 4,1 4,1 -3,7 5,9

----- ----- ----- ----- ----- ----- -----

CPI (average, y-o-y

%) -0,6 -1,5 1,3 4,6 3,3 2,3 4,1

----- ----- ----- ----- ----- ----- -----

Unemployment rate

(%) 6,8 5,9 4.3 3,6 3,1 6,1 5,6

----- ----- ----- ----- ----- ----- -----

In 2021, Ukraine's economy grew by 3,4% due to the easing of

COVID-19 restrictions which supported domestic demand, while at the

same time a bigger harvest offset effectively the drags of higher

global energy prices. Inflation rate showed incremental trends and

was estimated at 10% at year end, similarly the unemployment rate

which closed at 10,6%, leading the National Bank of Ukraine to

increase interest rates to 9% by the end of the year. Public sector

financial needs are expected to grow due to increases in minimum

wages and social transfers, limiting space for public investment,

and fueling further inflationary pressures in a supply-constrained

economy.

Following the invasion of Ukraine by Russia in February 2022,

Ukraine's economy is expected to shrink by an estimated 45% this

year, although the magnitude of the contraction will depend on the

duration and intensity of the ongoing war. The Russian invasion is

delivering a massive blow to Ukraine's economy and it has caused

enormous damage to country's infrastructure, so that the country is

in need of immediate financial support in order to keep its economy

going and the government providing aid to the population who face

an extreme situation.

Macroeconomic data

Ukraine 2015 2016 2017 2018 2019 2020 2021f

GDP (USD bn) 87,5 92,3 113,0 130,9 154,7 155,6 160,0

---- ---- ----- ----- ----- ----- -----

Population (mn) 42,6 42,4 42,2 42,0 41,9 41,5 41,4

---- ---- ----- ----- ----- ----- -----

Real GDP (y-o-y

%) -9,8 2,4 2,4 3,3 3,2 -3,8 3,4

---- ---- ----- ----- ----- ----- -----

CPI (average, y-o-y

%) 43,3 12,4 13,7 9,8 4,1 5,0 10,0

---- ---- ----- ----- ----- ----- -----

Unemployment rate

(%) 9,1 9,3 9,5 8,8 8,2 8,9 10,6

---- ---- ----- ----- ----- ----- -----

[1] Sources: World Bank Group, Eurostat, EBRD, National

Institute of Statistics- Romania, National Institute of Statistics

- Ukraine, IMF, European Commission.

4. Real Estate Market Developments (2)

4.1 Romania

Total real estate investment volume in Romania in 2021 reached

Euro 910 million, representing a 10% y-o-y increase. Despite the

pandemic, the investment volume reached in 2021 is one of the

highest in the past 10 years, proving the attractivenesss of

Romanian assets. The office segment represented 43% of the annual

volume, followed by logistics/ industrial sector (30%) and retail

(21%). Bucharest secured c.60% of country's investment volume,

driven mainly by office transactions. In contrast, logistics/

industrial parks accounted for 60-65% of regional cities

transactions.

Compression across all sectors is the trend that describes

yields in Romania during 2021. Prime office yields dropped to

6,75%, while industrials reached 7,5%, and retail 7%. Foreign

investors represent 91% of total investment volume, with the

remaining 9% attributed to local investors from 6% in 2020.

With c.600.000 sq m delivered during 2021, the total modern

industrial/ logistics stock reached c.5,8 million sq m. Almost 66%

of the new deliveries were in Bucharest area, being by far the

largest consumer market in the country. The total take-up reached

860.000 sq m, from which c.21% consists of prolongations and

renegotiations. Logistics/ Distribution sector accounted for 34% of

annual take-up, followed by Manufacturing/ Industrial (26%) and

Retail (19%). Pipeline consists of c.650.000 sq m deliverable in

2022 which would elevate the total stock to 6,5 million sq m. Such

deliverables are related mostly to regional cities, as only 45%

represent projects in Bucharest, with Timisoara, Oradea, Cluj,

Brasov and Arad to account for a total share of c.44% of the

pipeline. The vacancy rates showed a decreasing trend, estimated at

4,9% at the national level and 5,2% at the Bucharest level.

It is estimated that over 270.000 sq m in 13 buildings were

completed in 2021, which is the largest office supply delivered in

the past 5 years. Modern office stock stands at c.3,5 million sq m,

from which 72% are considered as Class A. The largest supply in

2021 was completed in Central West Bucharest submarket (27%), North

Bucharest (25%) and Central Bucharest (22%). Current pipeline

includes office deliverables of c.150.000 sq m in 2022 and another

c.93.000 sq m in 2023, with the majority to be located in Central

and Central-West Bucharest submarkets. On the other hand, annual

total leasing activity in 2021 reached c.297.000 sq m, from which

renewals accounted for 38% of the annual activity and pre-leases

for 17%. Leasing activity was 70% driven by Hi-tech/ Computers,

Medical & Pharma and Professional Services sectors.

In 2021, c.183.000 residential units were sold at a national

level, registering an increase of 50% compared to previous year,

and constituting 2021 as the most active year in terms of

residential sales. Approximately 30% of total sales transacted in

Bucharest. At the end of the year, the average selling prices in

Bucharest stood at 1.620 Euros per sq m, reflecting a 13,7%

year-on-year increase. Part of that increase came from the newer

stock and is directly attributed to the increased construction

costs and material prices. Regarding new supply, it is estimated

that during the first 9 months of the year, 14.600 units were

completed in Bucharest, a number similar to the total number

completed in 2020 and almost 50% higher than that of 2019. The

introduction of the Consumer Credit Reference Index (IRCC) for

consumer loans in Romania, has not affected demand which is

expected to continue to be strong.

2 Sources : Eurobank, CBRE Research , Colliers International ,

Cushman & Wakefield , Crosspoint Real Estate, Knight Frank,

Coldwell Banker Research, National Institute of Statistics- Romania

, State Statistics Service-Ukraine, NAI Real Act

4.2 Ukraine

Real estate investment in Ukraine during 2021 continued to be

weak on the back of the COVID-19 pandemic impact, tensions with

Russia, and lack of financing. The only exception is the

residential market, which during the first nine monts of the year,

and before the climax of the tensions with Russia, showed signs of

recovery. During that period, demand was reported to be stronger,

despite slowing construction activity, while property prices, as

well as land values and rents, were rising. Existing unit prices in

Kiev rose by +5%, to an average of $1.090 per sq m.

The demand for land plots started increasing in 2016, especially

for those suitable for commercial development, a trend which

stopped in 2020 mainly due to the effects of COVID-19 pandemic.

During the first half of 2021 land values increased significantly,

a trend that stopped with the increasing tension with Russia.

During that period, in the Kiev region, land values increased by

12,4% compared to previous year, while in the Odessa region the

relevant increase was 13,4%.

5. Property Assets

5.1 EOS Business Park - Danone headquarters, Romania

The park consists of 5.000 sqm of land including a class "A"

office building of 3.386 sqm GLA and 90 parking places. It is

located next to the Danone factory, in the North-Eastern part of

Bucharest with access to the Colentina Road and the Fundeni Road.

The ark is very close to Bucharest's ring road and the DN 2

national road (E60 and E85) and is also served by public

transportation. The park is highly energy efficient.

The Company acquired the office building in November 2014. The

complex is fully let to Danone Romania, the French multinational

food company, until 2025. The asset was sold in June 2022 as part

of Stage 2 of the Arcona transaction.

5.2 Delenco office building, Romania

The property is a 10.280 sqm office building, which consists of

two underground levels, a ground floor and ten above-ground floors.

The building is strategically located in the very center of

Bucharest, close to three main squares of the city: Unirii, Alba

Iulia and Muncii, only 300m from the metro station.

The Company acquired 24,35% of the property in May 2015. As at

the end 2021, the building is 99% let, with ANCOM (the Romanian

Telecommunications Regulator) being the anchor tenant (81% of GLA).

The stake in the asset was sold in March and June 2022 as part of

Stage 2 of the Arcona transaction.

5.3 Innovations Logistics Park, Romania

The park incorporates approximately 8.470 sqm of multipurpose

warehousing space, 6.395 sqm of cold storage and 1.705 sqm of

office space. It is located in the area of Clinceni, south west of

Bucharest center, 200m from the city's ring road and 6km from

Bucharest-Pitesti (A1) highway. Its construction was completed in

2008 and was tenant specific. It comprises four separate

warehouses, two of which offer cold storage.

As at the year end the terminal was 65% leased, while currently

is 73,5% leased. Anchor tenant with 46% is Favorit Business Srl, a

large Romanian logistics operator, which accommodates in the

terminal their new business line which involves as end user

Carrefour. Following recent relevant agreement, Favorit's leases

extended until 2026. In 2019, the Company also signed short term

lease agreements for ambient storage space with Chipita Romania

Srl, one of the fastest growing regional food companies. The asset

is planned to be part of Stage 3 of the Arcona transaction.

5.4 Kindergarten, Romania

Situated on the GreenLake compound on the banks of Grivita Lake,

a standalone building on ground and first floor, is used as a

nursery by one of the Bucharest's leading private schools. The

building is erected on 1.428.59 sqm plot with a total gross area of

1.198 sqm.

The property is 100% leased to International School for Primary

Education until 2032.

5.5 Residential Portfolio

- Monaco Towers, Bucharest, Romania

Monaco Towers is a residential complex located in South

Bucharest, Sector 4, enjoying good car access due to the large

boulevards, public transportation, and a shopping mall (Sun Plaza)

reachable within a short driving distance or easily accessible by

subway.

Following extended negotiations for two years with the company

which acquired Monaco's loan, the SPV holding Monaco units, in

2019, entered into insolvency status in order to protect itself

from its creditors. During 2020 the relevant loan has been fully

re-paid and in 2021 the SPV exited insolvency status and proceeded

to the sale of al 5 remaining units.

- Blooming House, Bucharest, Romania

Blooming House is a residential development project located in

Bucharest, Sector 3, a residential area with the biggest

development and property value growth in Bucharest, offering a

number of supporting facilities such as access to Vitan Mall,

kindergartens, café, schools and public transportation (both bus

and tram). During 2021 the last unit of the project was sold.

- GreenLake, Bucharest, Romania

A residential compound of 40.500 sqm GBA, which consists of

apartments and villas, situated on the banks of Grivita Lake, in

the northern part of the Romanian capital - the only residential

property in Bucharest with a 200 meters frontage to a lake. The

compound also includes facilities such as one of Bucharest's

leading private schools (International School for Primary

Education), outdoor sports courts and a mini-market. Additionally

GreenLake includes land plots totaling 40.360 sqm. SPDI owns 43% of

this property asset portfolio.

During 2021, 16 apartments and villas were sold while at the end

of the year 11 units remained unsold. The asset is planned to be

part of Stage 3 of the Arcona transaction.

5.6 Land Assets

-- - Kiyanovskiy Residence - Kiev, Ukraine

The property consists of 0,55 Ha of freehold and leasehold land

located at Kiyanovskiy Lane, near Kiev city center. It is destined

for the development of businesses and luxury residences with

beautiful protected views overlooking the scenic Dnipro River, St.

Michaels' Spires and historic Podil.

The asset is part of Stage 2 of the Arcona transaction and the

relevant SPA for its disposal has already been signed in June 2021

while closing has been postponed due to the invasion of Ukraine by

Russia.

-- Tsymlyanskiy Residence - Kiev, Ukraine

The 0,36 Ha plot is located in the historic and rapidly

developing Podil District in Kiev. The Company owns 55% of the SPV

which leases the plot, with a local co-investor owning the

remaining 45%.

The extension of the lease, originally expected during 2021, was

delayed and currently is on hold due to the invasion of Ukraine by

Russia. The asset is planned to be part of Stage 3 of the Arcona

transaction.

-- Rozny Lane - Kiev Oblast, Kiev, Ukraine

The 42 Ha land plot located in Kiev Oblast is destined to be

developed as a residential complex. Following a protracted legal

battle, it has been registered under the Company pursuant to a

legal decision in July 2015.

The asset is part of Stage 2 of the Arcona transaction and

relevant SPA for its disposal has already been signed in June 2021

while closing has been postponed due to the invasion of Ukraine by

Russia.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 31 December 2021

Note 2021 2020

EUR EUR

Continued Operations

Income 10 1.047.137 795.700

Net Operating Income 1.047.137 795.700

Administration expenses 12 (1. 798.293 (1.701.180)

)

Gain/(Loss) on disposal of subsidiary 20 748 -

Fair Value gain/(loss) on Financial

Assets at FV through P&L 26 683.478 (824.634)

Other operating income/ (expenses),

net 15 69 .643 191.222

Operating profit / (loss) 2. 713 (1.538.892)

Finance income 16 489.072 503.527

Finance costs 16 (190.409) (274.751)

Profit / (Loss) before tax and foreign 301.376 (1.310.116)

exchange differences

Foreign exchange loss, net 17a (65.147) (60.142)

Profit/(Loss) before tax 236.229 (1.370.258)

Income tax expense 18 (51.824) (117.656)

Profit/(Loss) for the year from continuing 184.405 (1.487.914)

operations

Loss from discontinued operations 9b (881.174) (4.262.592)

Profit/ (Loss) for the year (696.769) (5.750.506)

Other comprehensive income

Exchange difference on I/C loans to

foreign holdings 17b - (61.936)

Exchange difference on translation

of foreign operations 29 64.299 (1.392.155)

Total comprehensive income for the (632.470) (7.204.597)

year

Profit/ (Loss) for the year from continued

operations attributable to:

Owners of the parent 184.405 (1.487.914)

Non-controlling interests - -

184.405 (1.487.914)

Profit/ (Loss) for the year from discontinued

operations attributable to:

Owners of the parent (659.215) (2.851.952)

Non-controlling interests (221.959) (1.410.640)

(881.174) (4.262.592)

Profit/ (Loss) for the year attributable

to:

Owners of the parent (474.810) (4.339.866)

Non-controlling interests (221.959) (1.410.640)

(696.769) (5.750.506)

Total comprehensive income attributable

to:

Owners of the parent (459.449) (7.115.161)

Non-controlling interests (173.021) (89.436)

(632.470) (7.204.597)

Earnings/(Losses) per share (Euro

per share):

Basic earnings/(losses) for the year

attributable to ordinary equity owners

of the parent 37b (0,00) (0,03)

Diluted earnings/(losses) for the

year attributable to ordinary equity

owners of the parent 37b (0,00) (0,03)

Basic earnings/(losses) for the year

from discontinued operations attributable

to ordinary equity owners of the parent 37c (0,00) (0,02)

Diluted earnings/(losses) for the

year from discontinued operations

attributable to ordinary equity owners

of the parent 37c (0,00) (0,02)

The notes form an integral part of these consolidated financial

statements.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

For the year ended 31 December 2021

Note 2021 2020

EUR EUR

ASSETS

Non--current assets

Tangible and intangible assets 23 1.628 2.859

Long-term receivables and prepayments 24 824 836

Financial Assets at FV through 26 7.470.722 6.787.244

P&L

7.473.174 6.790.939

Current assets

Prepayments and other current 25 4. 510.381 6.880.076

assets

Cash and cash equivalents 27 2.160.576 129.859

------------- -------------

6.670. 957 7. 009.935

Assets classified as held for 9d 39.011.516 41.791.409

sale

Total assets 53.155. 647 55.592.283

EQUITY AND LIABILITIES

Issued share capital 28 1.291.281 1.291.281

Share premium 72.107.265 72.107.265

Foreign currency translation reserve 29 8.969.787 8.954.426

Exchange difference on I/C loans

to foreign holdings 39.3 (211.199) (211.199)

Accumulated losses ( 58.903.610 ( 58.428.800

) )

Equity attributable to equity 23.253.524 23.712.973

holders of the parent

Non-controlling interests 30 5.748.132 5.921.153

Total equity 29.001.656 29.634.126

Non--current liabilities

Borrowings 31 126.066 95.977

Bonds issued 32 1.033.842 1.033.842

Tax payable and provisions 35 627.130 663.062

------------- -------------

1.787.038 1.792.881

Current liabilities

Borrowings 31 1.577.500 2.054.400

Bonds issued 32 293.214 225.081

Trade and other payables 33 4.396.123 4.036.962

Tax payable and provisions 35 256.437 620.365

6 . 523.274 6.936.808

Liabilities directly associated

with assets classified as held

for sale 9d 15.843.679 17.228.468

22.366.953 24.165.276

Total liabilities 24.153.991 25.958.157

Total equity and liabilities 53.155. 647 55.592.283

Net Asset Value (NAV) EUR per share: 37d

Basic NAV attributable to equity

holders of the parent 0,18 0,18

Diluted NAV attributable to equity

holders of the parent 0,18 0,18

On 28 June 2022 the Board of Directors of SECURE PROPERTY

DEVELOPMENT & INVESTMENT PLC authorised these financial

statements for issue.

Lambros Anagnostopoulos Michael Beys Theofanis Antoniou

Director & Chief Executive Director & Chairman CFO

Officer of the Board

The notes form an integral part of these consolidated financial

statements.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 31 December 2021

Attributable to owners of the Company

------------------------------------------------------------------------------------ ------------ --------------

Share Share Accumulated Exchange Foreign Total Non- Total

capital premium, losses, difference currency controlling

Net(1) net of on I/C translation interest

non-controlling loans reserve

interest(2) to foreign (4)

holdings

(3)

EUR EUR EUR EUR EUR EUR EUR EUR

Balance - 31

December

201 9 1.291.281 72.107.265 (54.088.934) (149.263) 10.232.119 29.392.468 7.446.255 36.838.723

Loss for the

year - - (4.339.866) - - (4.339.866) (1.410.640) (5.750.506)

Exchange

difference

on

I/C loans

to foreign

holdings

( Note 17b) - - - (61.936) - (61.936) - (61.936)

Foreign (1.277.693) (114.462)

currency

translation

reserve - - - - (1.277.693) (1.392.155)

Balance - 31

December

2020 1.291.281 72.107.265 (58.428.800) (211.199) 8.954.426 23.712.973 5.921.153 29.634.126

Loss for the ( 474.810 ( 474.810 ( 696.769

year - - ) - - ) (221.959) )

Foreign

currency

translation

reserve - - - - 15.361 15.361 48.938 64.299

Balance - 31

December (58. 903.610

2021 1.291.281 72.107.265 ) (211.199) 8.969.787 23. 253.524 5.748.132 29.001.656

(1) Share premium is not available for distribution.

(2) Companies which do not distribute 70% of their profits after

tax, as defined by the relevant tax law, within two years after the

end of the relevant tax year, will be deemed to have distributed as

dividends 70% of these profits. Special contribution for defence at

17% and GHS contribution at 1,7%-2,65% for deemed distributions

after 1 March 2019 will be payable on such deemed dividends to the

extent that the ultimate shareholders are both Cyprus tax resident

and Cyprus domiciled. The amount of deemed distribution is reduced

by any actual dividends paid out of the profits of the relevant

year at any time. This special contribution for defence is payable

by the Company for the account of the shareholders.

(3) Exchange differences on intercompany loans to foreign

holdings arose as a result of devaluation of the Ukrainian Hryvnia

during previous years. The Group treats the mentioned loans as a

part of the net investment in foreign operations (Note 39.3).

(4) Exchange differences related to the translation from the

functional currency of the Group's subsidiaries are accounted for

directly to the foreign currency translation reserve. The foreign

currency translation reserve represents unrealized profits or

losses related to the appreciation or depreciation of the local

currencies against the euro in the countries where the Group's

subsidiaries own property assets.

The notes form an integral part of these consolidated financial

statements.

CONSOLIDATED STATEMENT OF CASH FLOWS

For the year ended 31 December 2021

Note 2021 2020

EUR EUR

CASH FLOWS FROM OPERATING ACTIVITIES

Profit/(Loss) before tax and non-controlling

interests-continued operations 236.229 (1.370.258)

Profit/(Loss) before tax and non-controlling

interests-discontinued operations 9b (813.846) (4.218.205)

----------- -----------

Profit/(Loss) before tax and non-controlling

interests (577.617) (5.588.463)

Adjustments for:

(Gain)/Loss on revaluation of investment

property 13 754.979 3.495.700

Net loss on disposal of investment property 14.1 (653.567) (281.886)

Fair Value (gain)/ loss on Financial Assets

at FV through P&L 26 (683.478) 824.634

(Reversal) /Impairment of prepayments and

other current assets 15 5.932 (16.035)

Accounts payable written off 15 (18.536) (253.957)

Depreciation/ Amortization charge 12 2.101 4.883

Interest income 16 (498.438) (512.919)

Interest expense 16 1.044.296 1.071.822

Share of profit from associates 21 (344.746) 179.775

Gain on disposal of subsidiaries 20 (748) -

Effect of foreign exchange differences 17a 318.813 379.067

Cash flows from/(used in) operations before

working capital changes (651.009) (697.379)

Change in prepayments and other current

assets 25 ( 61.750 ) (104.272)

Change in trade and other payables 33 (486.081) (687.428)

Change in VAT and other taxes receivable 25 (17.181) (87.279)

Change in provisions 35 28.954 6.080

Change in other taxes payables 35 18.580 136.512

Change in deposits from tenants 34 - (3.038)

(1. 168.487

Cash generated from operations ) (1.436.804)

Income tax paid (515.938) (206.194)

(1. 684.425

Net cash flows provided in operating activities ) (1.642.998)

CASH FLOWS FROM INVESTING ACTIVITIES

Sales proceeds from disposal of investment

property 14.1 3.245.322 2.427.184

Dividend received from associates 21 183.583 242.403

Increase/(Decrease) in long term receivables 24 (18.251) (281)

Repayment of principal and interest of

loan receivable 25 2.289.683 240.000

Net cash flows from / (used in) investing

activities 5.700.337 2.909.306

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds from bank and non-bank loans 31 3.500.000 1.729.400

Repayment of bank and non-bank loans 31 (2.538.099) (2.083.700)

Interest and financial charges paid (117 . 032) (386.545)

Decrease in financial lease liabilities 36 (3.176.182) (392.441)

Net cash flows from / (used in) financing

activities (2.331.313) (1.133.286)

Net increase/(decrease) in cash at banks 1.684.599 133.022

Cash:

At beginning of the year 27 870.647 737.625

At end of the year 27 2.555.246 870.647

----------- -----------

The notes form an integral part of these consolidated financial

statements.

Notes to the Consolidated Financial Statements

For the year ended 31 December 2021

General Information

Country of incorporation

SECURE PROPERTY DEVELOPMENT & INVESTMENT PLC (the "Company")

was incorporated in Cyprus on 23 June 2005 and is a public limited

liability company, listed on the London Stock Exchange (AIM): ISIN

CY0102102213. Its registered office is at Kyriakou Matsi 16, Eagle

House, 10th floor, Agioi Omologites, 1082 Nicosia, Cyprus while its

principal place of business is in Cyprus at 6 Nikiforou Foka

Street, 1060 Nicosia, Cyprus.

Principal activities

The principal activities of the Group are to invest directly or

indirectly in and/or manage real estate properties, as well as real

estate development projects in South East Europe (the "Region").

These include the acquisition, development, commercializing,

operating and selling of property assets in the Region.

The Group maintains offices in Nicosia, Cyprus, Bucharest,

Romania and Kiev, Ukraine.

As at 31 December 2021, the companies of the Group employed

and/or used the services of 15 full time equivalent people, (2020 à

15 full time equivalent people).

2. Basis of preparation

The consolidated financial statements have been prepared in

accordance with International Financial Reporting Standards (IFRSs)

as adopted by the European Union (EU) and the requirements of the

Cyprus Companies Law, Cap.113. The consolidated financial

statements have been prepared under the historical cost as modified

by the revaluation of investment property and investment property

under construction, of financial assets at fair value through other

comprehensive income and of financial assets at fair value through

profit and loss.

The preparation of financial statements in conformity with IFRSs

requires the use of certain critical accounting estimates and

requires Management to exercise its judgment in the process of

applying the Company's accounting policies. It also requires the

use of assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities at

the date of the financial statements and the reported amounts of

revenues and expenses during the reporting period. Although these

estimates are based on Management's best knowledge of current

events and actions, actual results may ultimately differ from those

estimates.

Following certain conditional agreement signed in December 2018

with Arcona Property Fund N.V for the sale of Company's non-Greek

portfolio of assets, the Company classifies its assets since 2018

as discontinued operations (Note 4.3) .

Going concern basis

The financial statements have been prepared on a going concern

basis which assumes the Company will be able to realize its assets

and discharge its liabilities in the normal course of business for

the foreseeable future.

In particular, the Company is in a process of disposing of its

portfolio of assets in an all share transaction with Arcona

Property Fund N.V., meaning that as soon as this transaction

consummates the Company will be left with its corporate receivables

and liabilities.

These conditions raise some doubt about the Company's ability to

continue as a going concern within the next twelve months from the

date these financial statements are available to be issued. The

ability to continue as a going concern is dependent upon positive

future cash flows.

Management believes that the Company will be able to finance its

needs given the fact that the additional corporate receivables, as

well as the consideration received in the form of Arcona shares is

estimated that it can effectively discharge all corporate

liabilities. At the same time, the transaction with Arcona Property

Fund N.V., which is a cash flow generating entity, will result in

the Company being a significant shareholder, entitled to dividends

according to the dividend policy of Arcona Property Fund N.V.

3. Adoption of new and revised Standards and Interpretations

During the current year the Company adopted all the new and

revised International Financial Reporting Standards (IFRS) that are

relevant to its operations and are effective for accounting periods

beginning on 1 January 2021. This adoption did not have a material

effect on the accounting policies of the Company.

4. Significant accounting policies

The principal accounting policies adopted in the preparation of

these consolidated financial statements are set out below. These

policies have been consistently applied to all years presented in

these consolidated financial statements unless otherwise

stated.

Local statutory accounting principles and procedures differ from

those generally accepted under IFRS. Accordingly, the consolidated

financial information, which has been prepared from the local

statutory accounting records for the entities of the Group

domiciled in Cyprus, Romania, and Ukraine reflects adjustments

necessary for such consolidated financial information to be

presented in accordance with IFRS.

4.1 Basis of consolidation

The consolidated financial statements incorporate the financial

statements of the Company and entities (including special purpose

entities) controlled by the Company (its subsidiaries).

Subsidiaries are all entities (including structured entities)

over which the Group has control. The Group controls an entity when

the Group is exposed to, or has rights to, variable returns from

its involvement with the entity and has the ability to affect those

returns through its power over the entity.

The Group applies the acquisition method to account for business

combinations. The consideration transferred for the acquisition of

a subsidiary is the fair values of the assets transferred, the

liabilities incurred to the former owners of the acquiree and the

equity interests issued by the Group. The consideration transferred

includes the fair value of any asset or liability resulting from a

contingent consideration arrangement. Identifiable assets acquired,

liabilities and contingent liabilities assumed in a business

combination are measured initially at their fair values at the

acquisition date. The Group recognizes any non-controlling interest

in the acquiree on an acquisition-by-acquisition basis, either at

fair value or at the non-controlling interest's proportionate share

of the recognized amounts of acquiree's identifiable net

assets.

If the business combination is achieved in stages, the

acquisition date carrying value of the acquirer's previously held

equity interest in the acquiree is re-measured to fair value at the

acquisition date; any gains or losses arising from such

re-measurement are recognized in profit or loss.

Any contingent consideration to be transferred by the Group is

recognized at fair value at the acquisition date. Subsequent

changes to the fair value of the contingent consideration that is

deemed to be an asset or liability is recognized in accordance with

IAS 39, either in profit or loss or as a change to other

comprehensive income. Contingent consideration that is classified

as equity is not re-measured and its subsequent settlement is

accounted for within equity.

If the initial accounting for a business combination is

incomplete by the end of the reporting period in which the

combination occurs, the Group reports provisional amounts for the

items for which the accounting is incomplete. Those provisional

amounts are adjusted during the measurement period (see above), or

additional assets or liabilities are recognized, to reflect new

information obtained about facts and circumstances that existed at

the acquisition date that, if known, would have affected the

amounts recognized at that date.

Business combinations that took place prior to 1 January 2010

were accounted for in accordance with the previous version of IFRS

3.

Inter-company transactions, balances and unrealized gains on

transactions between group companies are eliminated. Unrealized

losses are also eliminated. When necessary, amounts reported by

subsidiaries have been adjusted to conform with the Group's

accounting policies.

Changes in ownership interests in subsidiaries without change of

control and Disposal of Subsidiaries

Transactions with non-controlling interests that do not result

in loss of control are accounted for as equity transactions - that

is, as transactions with the owners in their capacity as owners.

The difference between fair value of any consideration paid and the

relevant share acquired of the carrying value of net assets of the

subsidiary is recorded in equity. Gains or losses on disposals of

non-controlling interests are also recorded in equity.

When the Group ceases to have control, any retained interest in

the entity is re-measured to its fair value at the date when

control is lost, with the change in carrying amount recognized in

profit or loss. The fair value is the initial carrying amount for

the purposes of subsequently accounting for the retained interest

as an associate, joint venture or financial asset. In addition, any

amounts previously recognized in other comprehensive income in

respect of that entity are accounted for as if the Group had

directly disposed of the related assets or liabilities. This may

mean that amounts previously recognized in other comprehensive

income are reclassified to profit or loss.

4.2 Functional and presentation currency

Items included in the Group's financial statements are measured

applying the currency of the primary economic environment in which

the entities operate ("the functional currency"). The national

currency of Ukraine, the Ukrainian Hryvnia, is the functional

currency for all the Group's entities located in Ukraine, the

Romanian leu is the functional currency for all Group's entities

located in Romania, and the Euro is the functional currency for all

Cypriot subsidiaries.

4.2 Functional and presentation currency (continued)

The consolidated financial statements are presented in Euro,

which is the Group's presentation currency.

As Management records the consolidated financial information of

the entities domiciled in Cyprus, Romania, Ukraine in their

functional currencies, in translating financial information of the

entities domiciled in these countries into Euro for inclusion in

the consolidated financial statements, the Group follows a

translation policy in accordance with IAS 21, "The Effects of

Changes in Foreign Exchange Rates", and the following procedures

are performed:

-- All assets and liabilities are translated at closing rate;

-- Equity of the Group has been translated using the historical rates;

-- Income and expense items are translated using exchange rates

at the dates of the transactions, or where this is not practicable

the average rate has been used;

-- All resulting exchange differences are recognized as a separate component of equity;

-- When a foreign operation is disposed of through sale,

liquidation, repayment of share capital or abandonment of all, or

part of that entity, the exchange differences deferred in equity

are reclassified to the consolidated statement of comprehensive

income as part of the gain or loss on sale;

-- Monetary items receivable from foreign operations for which

settlement is neither planned nor likely to occur in the

foreseeable future and in substance are part of the Group's net

investment in those foreign operations are recongised initially in

other comprehensive income and reclassified from equity to profit

or loss on disposal of the foreign operation.

The relevant exchange rates of the European and local central

banks used in translating the financial information of the entities

from the functional currencies into Euro are as follows:

Average 31 December

Currency 2021 2020 2021 2020 2019

-------- -------- -------- -------- -------

USD 1,1827 1,1422 1,1326 1,2270 1,1234

-------- -------- -------- -------- -------

UAH 32,3009 30,8013 30,9226 34,7396 26,422

-------- -------- -------- -------- -------

RON 4,9204 4,8371 4,9481 4,8694 4,7793

-------- -------- -------- -------- -------

4.3 Discontinued operations

A discontinued operation is a component of the Group's business,

the operations and cash flows of which can be clearly distinguished

from the rest of the Group and which:

-- represents a separate major line of business or geographic area of operations;

-- is part of a single coordinated plan to dispose of a separate

major line of business or geographic area of operations; or

-- is a subsidiary acquired exclusively with a view to resale.

Classification as a discontinued operation occurs at the earlier

of disposal or when the operation meets the criteria to be

classified as held-for-sale.

When an operation is classified as a discontinued operation, the

comparative statement of profit or loss and OCI is re-presented as

if the operation had been discontinued from the start of the

comparative year.

4.4 Investment Property at fair value

Investment property, comprising freehold and leasehold land,

investment properties held for future development, warehouse and

office properties, as well as the residential property units , is

held for long term rental yields and/or for capital appreciation

and is not occupied by the Group. Investment property and

investment property under construction are carried at fair value,

representing open market value determined annually by external

valuers. Changes in fair values are recorded in the statement of

comprehensive income and are included in other operating

income.

A number of the land leases (all in Ukraine) are held for

relatively short terms and place an obligation upon the lessee to

complete development by a prescribed date. It is important to note

that the rights to complete a development may be lost or at least

delayed if the lessee fails to complete a permitted development

within the timescale set out by the ground lease.

In addition, in the event that a development has not commenced

upon the expiry of a lease then the City Authorities are entitled

to decline the granting of a new lease on the basis that the land

is not used in accordance with the designation. Furthermore, where

all necessary permissions and consents for the development are not

in place, this may provide the City Authorities with grounds for

rescinding or non-renewal of the ground lease. However Management

believes that the possibility of such action is remote and was made

only under limited circumstances in the past.

4.4 Investment Property at fair value (continued)

Management believes that rescinding or non-renewal of the ground

lease is remote if a project is on the final stage of development

or on the operating cycle. In undertaking the valuations reported

herein, the valuer of Ukrainian properties CBRE has made the

assumption that no such circumstances will arise to permit the City

Authorities to rescind the land lease or not to grant a

renewal.

Land held under operating lease is classified and accounted for

as investment property when the rest of the definition is met.

Investment property under development or construction initially

is measured at cost, including related transaction costs.

The property is classified in accordance with the intention of

the management for its future use. Intention to use is determined

by the Board of Directors after reviewing market conditions,

profitability of the projects, ability to finance the project and

obtaining required construction permits.

The time point, when the intention of the management is

finalized is the date of start of construction. At the moment of

start of construction, freehold land, leasehold land and investment

properties held for a future redevelopment are reclassified into

investment property under development or inventory in accordance to

the final decision of management.

Initial measurement and recognition

Investment property is measured initially at cost, including

related transaction costs. Investment properties are derecognized

when either they have been disposed of or when the investment

property is permanently withdrawn from use and no future economic

benefit is expected from its disposal. Any gains or losses on the

retirement or disposal of an investment property are recognized in

the consolidated statement of comprehensive income in the period of

retirement or disposal.

Transfers are made to investment property when, and only when,

there is a change in use, evidenced by the end of owner occupation,

or the commencement of an operating lease to third party. Transfers

are made from investment property when, and only when, there is a

change in use, evidenced by commencement of owner occupation or

commencement of development with a view to sale.

If an investment property becomes owner occupied, it is

reclassified as property, plant and equipment, and its fair value

at the date of reclassification becomes its cost for accounting

purposes. Property that is being constructed or developed for

future use as investment property is classified as investment

property under construction until construction or development is

complete. At that time, it is reclassified and subsequently

accounted for as investment property.

Subsequent measurement

Subsequent to initial recognition, investment property is stated

at fair value. Gains or losses arising from changes in the fair

value of investment property are included in the statement of

comprehensive income in the period in which they arise.

If a valuation obtained for an investment property held under a

lease is net of all payments expected to be made, any related

liabilities/assets recognized separately in the statement of

financial position are added back/reduced to arrive at the carrying

value of the investment property for accounting purposes.

Subsequent expenditure is charged to the asset's carrying amount

only when it is probable that future economic benefits associated

with the item will flow to the Group and the cost of the item can

be measured reliably. All other repairs and maintenance costs are

charged to the statement of comprehensive income during the

financial period in which they are incurred.

Basis of valuation

The fair values reflect market conditions at the financial

position date. These valuations are prepared annually by chartered

surveyors (hereafter "appraisers"). The Group appointed valuers in

2014, which remain the same in 2021:

-- CBRE Ukraine, for all its Ukrainian properties,

-- NAI Real Act for all its Romanian properties.

The valuations have been carried out by the appraisers on the

basis of Market Value in accordance with the appropriate sections

of the current Practice Statements contained within the Royal

Institution of Chartered Surveyors ("RICS") Valuation - Global

Standards (2018) (the "Red Book") and is also compliant with the

International Valuation Standards (IVS).

"Market Value" is defined as: "The estimated amount for which a

property should be exchanged on the date of valuation between a

willing buyer and a willing seller in an arm's-length transaction

after proper marketing wherein the parties had each acted

knowledgeably, prudently and without compulsion".

4.4 Investment Property at fair value (continued)

Basis of valuation (continued)

In expressing opinions on Market Value, in certain cases the

appraisers have estimated net annual rentals/income from sale.

These are assessed on the assumption that they are the best

rent/sale prices at which a new letting/sale of an interest in

property would have been completed at the date of valuation

assuming: a willing landlord/buyer; that prior to the date of

valuation there had been a reasonable period (having regard to the

nature of the property and the state of the market) for the proper

marketing of the interest, for the agreement of the price and terms

and for the completion of the letting/sale; that the state of the

market, levels of value and other circumstances were, on any

earlier assumed date of entering into an agreement for lease/sale,

the same as on the valuation date; that no account is taken of any

additional bid by a prospective tenant/buyer with a special

interest; that the principal deal conditions assumed to apply are

the same as in the market at the time of valuation; that both

parties to the transaction had acted knowledgeably, prudently and

without compulsion.

A number of properties are held by way of ground leasehold

interests granted by the City Authorities. The ground rental

payments of such interests may be reviewed on an annual basis, in

either an upwards or downwards direction, by reference to an

established formula. Within the terms of the lease, there is a

right to extend the term of the lease upon expiry in line with the

existing terms and conditions thereof. In arriving at opinions of

Market Value, the appraisers assumed that the respective ground

leases are capable of extension in accordance with the terms of

each lease. In addition, given that such interests are not

assignable, it was assumed that each leasehold interest is held by

way of a special purpose vehicle ("SPV"), and that the shares in

the respective SPVs are transferable.

With regard to each of the properties considered, in those

instances where project documentation has been agreed with the

respective local authorities, opinions of the appraisers of value

have been based on such agreements.

In those instances where the properties are held in part

ownership, the valuations assume that these interests are saleable

in the open market without any restriction from the co-owner and

that there are no encumbrances within the share agreements which

would impact the sale ability of the properties concerned.

The valuation is exclusive of VAT and no allowances have been

made for any expenses of realization or for taxation which might

arise in the event of a disposal of any property.

In some instances the appraisers constructed a Discounted Cash

Flow (DCF) model. DCF analysis is a financial modeling technique

based on explicit assumptions regarding the prospective income and

expenses of a property or business. The analysis is a forecast of

receipts and disbursements during the period concerned. The

forecast is based on the assessment of market prices for comparable

premises, build rates, cost levels etc. from the point of view of a

probable developer.

To these projected cash flows, an appropriate, market-derived

discount rate is applied to establish an indication of the present

value of the income stream associated with the property. In this

case, it is a development property and thus estimates of capital

outlays, development costs, and anticipated sales income are used

to produce net cash flows that are then discounted over the

projected development and marketing periods. The Net Present Value

(NPV) of such cash flows could represent what someone might be

willing to pay for the site and is therefore an indicator of market

value. All the payments are projected in nominal US Dollar/Euro

amounts and thus incorporate relevant inflation measures.

Valuation Approach

In addition to the above general valuation methodology, the

appraisers have taken into account in arriving at Market Value the

following:

Pre Development

In those instances where the nature of the 'Project' has been

defined, it was assumed that the subject property will be developed

in accordance with this blueprint. The final outcome of the

development of the property is determined by the Board of Directors

decision, which is based on existing market conditions,

profitability of the project, ability to finance the project and

obtaining required construction permits.

Development

In terms of construction costs, the budgeted costs have been

taken into account in considering opinions of value. However, the

appraisers have also had regard to current construction rates

prevailing in the market which a prospective purchaser may deem

appropriate to adopt in constructing each individual scheme.