Aisi Realty Public Limited Half Yearly Report -13-

September 05 2012 - 2:00AM

UK Regulatory

Intangible assets are initially recorded at acquisition cost

and are amortized on a straight line basis over their useful

economic life. Intangible assets that are acquired through a

business combination are initially recorded at fair value at

the date of acquisition. Intangible assets with indefinite useful

life are reviewed for impairment at least once per year. The

impairment test is performed using the discounted cash flows

expected to be generated through the use of the intangible assets,

using a discount rate that reflects the current market estimations

and the risks associated with the asset. When it is impractical

to estimate the recoverable amount of an asset, the Group estimates

the recoverable amount of the cash generating unit in which the

asset belongs to.

* Provision for deferred taxes

Deferred tax is not provided in respect of the revaluation of

the investment property and investment property under construction

as the Group is able to control the timing of the reversal of

this temporary difference and the management has intention not

to reverse the temporary difference in the foreseeable future.

The properties are held by subsidiary companies in Ukraine. The

management estimates that the assets will be realised through

a share deal rather than through an asset deal. Should any subsidiary

be disposed of, the gains generated from the disposal will be

exempt from any tax.

6. Earnings and net assets per share attributable to equity

holders of the parent

a. Weighted average number of ordinary shares

H1 2012 H1 2011

--------------------------------------------------- ----------- ----------

Issued ordinary shares capital 10.259.555 4.142.727

--------------------------------------------------- ----------- ----------

Weighted average number of ordinary shares (Basic) 9.621.375 4.142.727

--------------------------------------------------- ----------- ----------

Diluted weighted average number of ordinary shares 9.621.375 4.142.727

--------------------------------------------------- ----------- ----------

b. Basic diluted and adjusted earnings per share

Earnings per share 30/06/2012 30/06/2011

-------------------------------------------------------------- ------------ -------------

US$ US$

-------------------------------------------------------------- ------------ -------------

Profit/(Loss) after tax attributable to owners of the parent (2.225.695) (16.591.735)

-------------------------------------------------------------- ------------ -------------

Basic (0,23) (4,01)

-------------------------------------------------------------- ------------ -------------

Diluted (0,23) (4,01)

-------------------------------------------------------------- ------------ -------------

c. Net assets per share

Net assets per share 30/06/2012 30/06/2011

--------------------------------------------------------- ----------- -----------

US$ US$

--------------------------------------------------------- ----------- -----------

Net assets attributable to equity holders of the parent 30.670.606 8.409.774

--------------------------------------------------------- ----------- -----------

Number of ordinary shares 10.259.555 4.142.727

--------------------------------------------------------- ----------- -----------

Diluted weighted number of ordinary shares 11.243.760 4.142.727

--------------------------------------------------------- ----------- -----------

Basic 2,99 2,03

--------------------------------------------------------- ----------- -----------

Diluted 2,73 2,03

--------------------------------------------------------- ----------- -----------

7. Revenues

H1 2012 H1 2011

------------------------------------------- -------- ------------

US$ US$

------------------------------------------- -------- ------------

Operational Income 757.502 184.633

------------------------------------------- -------- ------------

Valuation losses from investment property - (7.833.811)

(note 12)

------------------------------------------- -------- ------------

Total Revenues 757.502 (7.649.178)

------------------------------------------- -------- ------------

Operational income represents rental and service charged income

generated during the reporting period by the rental

agreementsconcluded with tenants of the Terminal Brovary Logistics

centre. Vacancy rate of the Terminal has reduced to 17% as at the

reporting date.

Valuation losses from investment property represent the

adjustment for the period of the fair value of the Investment

Property that was effected during the restructuring of the Group in

the summer of 2011, representing increased operational and property

risks as estimated at that time.

8. Administration Expenses

The table below presents the breakdown of the administration

expenses. As the Group is addressing a few remaining legacy

(pre-reorganisation of 2011) issues, Management opts to present the

H1 2012 expenses further broken down in two categories:

a. "Recurring expenses" include expenses that are related to the

Group's ongoing business and are therefore expected to appear in

the financial statements in the future.

b. Non-recurring/One-off expenses are either related to the

legacy pre-reorganisation issues and therefore consists of one-off

events not to be repeated in the future, or are related to previous

years charges resulting from contracts/operations not previously

recorded.

H1 2012 H1 2011

--------------------------------------- ---------------------------------- ----------

US$ US$

--------------------------------------- ---------------------------------- ----------

Recurring Non Recurring-One-off

Expenses Expenses

--------------------------------------- ---------- ---------------------- ----------

Management fees - - 1.402.955

--------------------------------------- ---------- ---------------------- ----------

Salaries and Wages 355.329 284.571 251.029

--------------------------------------- ---------- ---------------------- ----------

Directors and Management remuneration 308.400 - 82.291

--------------------------------------- ---------- ---------------------- ----------

Consulting fees 264.213 40.796 66.154

--------------------------------------- ---------- ---------------------- ----------

Legal fees 149.401 257.500 179.224

--------------------------------------- ---------- ---------------------- ----------

Travelling expenses 144.062 - 30.000

--------------------------------------- ---------- ---------------------- ----------

Administrative expenses 100.347 - 219.593

--------------------------------------- ---------- ---------------------- ----------

Public group expenses 93.480 - -

--------------------------------------- ---------- ---------------------- ----------

Audit and accounting fees 83.612 - 372.676

--------------------------------------- ---------- ---------------------- ----------

Taxes and duties 27.228 - 24.469

--------------------------------------- ---------- ---------------------- ----------

Other expenses 25.589 - 39.967

--------------------------------------- ---------- ---------------------- ----------

1.551.661 582.867 2.668.358

--------------------------------------- ---------- ---------------------- ----------

Total Administration Expenses 2.134.528 2.668.358

--------------------------------------- ---------------------------------- ----------

8.1 Non-recurring/ One-off Expenses

Management fee refers to the Investment Management contract

between the Company and AISI Realty Capital LLC, which as of

1/7/2011 is no longer in effect.

Salaries and Wages represent amounts paid to AISI Realty Capital

LLC and some of its employees in relation to their settlement

agreement effect in July 2011.

Legal and consulting expenses represent one-off expenses paid

during the period in relation to the Company's restructuring and

other old extraordinary events.

8.2 Recurring Expenses

Secure Property Developm... (LSE:SPDI)

Historical Stock Chart

From Jun 2024 to Jul 2024

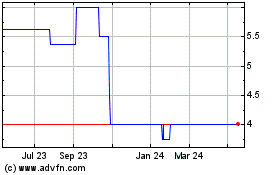

Secure Property Developm... (LSE:SPDI)

Historical Stock Chart

From Jul 2023 to Jul 2024