Aisi Realty Public Limited Half Yearly Report -12-

September 05 2012 - 2:00AM

UK Regulatory

4.1.3 Property Market price risk

Market price risk is the risk that the value of the Company's

portfolio investments will fluctuate as a result of changes in

market prices. The Group's assets are susceptible to market price

risk arising from uncertainties about future prices of the investments.

The Group's market price risk is managed through diversification

of the investment portfolio, continuous elaboration of the market

conditions and active asset management.

The prevailing global economic conditions throughout 2008-2010

and the ensuing Euro zone Sovereign Debt crisis have had a considerable

effect on the market prices of the current portfolio investments

of the Group.

In cases that the BoD deemed necessary, it has taken provisions

on the assets' valuation in order to ensure that the asset value

is presented within the financial statements of the Group in

such a way as to take into account various uncertainties. To

quantify the value of its assets and/or indicate the possibility

of impairment losses, the Company commissioned internationally

acclaimed valuers.

4.1.4 Interest rate risk

Interest rate risk is the risk that the value of financial instruments

will fluctuate due to changes in market interest rates.

The Group's income and operating cash flows are substantially

independent of changes in market interest rates as the Group

has no significant interest--bearing assets apart from its cash

balances that are mainly kept for liquidity purposes.

The Group is exposed to interest rate risk in relation to its

borrowings. Borrowings issued at variable rates expose the Group

to cash flow interest rate risk. Borrowings issued at fixed rates

expose the Group to fair value interest rate risk. All of the

Group's borrowings are issued at a variable interest rate. Management

monitors the interest rate fluctuations on a continuous basis

and acts accordingly.

4.1.5 Credit risk

Credit risk arises when a failure by counter parties to discharge

their obligations could reduce the amount of future cash inflows

from financial assets at hand at the end of the reporting period.

Cash balances are held with high credit quality financial institutions

and the Group has policies to limit the amount of credit exposure

to any financial institution.

Management has been in continuous discussions with banking institutions

monitoring their ability to extend financing as per the Group's

needs. The sovereign debt crisis has affected the pan-European

banking system during 2011 and has imposed financing uncertainties

for new development projects.

Management also monitors the developing Eurozone debt crisis

situation in respect of its possible effects on the Region's

banking system. More specifically Management evaluates the probability

that the parent Italian, Austrian and Greek banks liquidity related

issues affect negatively the local subsidiaries of the said banks.

4.1.6 Currency risk

Currency risk is the risk that the value of financial instruments

will fluctuate due to changes in foreign exchange rates.

Currency risk arises when future commercial transactions and

recognized assets and liabilities are denominated in a currency

that is not the Group's functional currency. Most of the Group's

transactions, including the rental proceeds are denominated in

the functional currency (USD). For the rest of the foreign exchange

exposure Management monitors the exchange rate fluctuations on

a continuous basis and acts accordingly.

As a precaution against probable depreciation of local currencies,

and especially of the UAH, the majority of the Group's liquid

assets are held in USD denominated deposit accounts.

4.1.7 Capital risk management

The Group manages its capital to ensure that it will be able

to continue as a going concern while maximizing the return to

shareholders through the optimization of the debt and equity

balance. The Group's core strategy is described in note 27 of

the financial statements.

4.1.8 Compliance risk

Compliance risk is the risk of financial loss, including fines

and other penalties, which arises from non--compliance with laws

and regulations of the state.

Although the Group is trying to limit such risk, the uncertain

environment in which it operates increases the complexities handled

by Management. A new compliance policy is expected to be implemented

in 2012.The Group's exposures are discussed under note 27.

4.1.9 Litigation risk

Litigation risk is the risk of financial loss, interruption of

the Group's operations or any other undesirable situation that

arises from the possibility of non--execution or violation of

legal contracts and consequentially of lawsuits. The risk is

restricted through the contracts used by the Group to execute

its operations and is discussed in note 25.

4.1.10 Reputation risk

The risk of loss of reputation arising from the negative publicity

relating to the Group's operations (whether true or false) may

result in a reduction of its clientele, reduction in revenue

and legal cases against the Group. Following the Group's distress

period between 2010 and mid 2011 and the settlement of its known

liabilities Management expects that the risk of negative publicity

is reduced.

4.2. Operational risk

Operational risk is the risk that derives from the deficiencies

relating to the Group's information technology and control systems

as well as the risk of human error and natural disasters. The

Group's systems are evaluated, maintained and upgraded continuously.

4.3 Fair value estimation

The fair values of the Group's financial assets and liabilities

approximate their carrying amounts at the end of the reporting

period.

5. Critical accounting estimates and judgements

The preparation of financial statements in conformity with IFRSs

requires the use of certain critical accounting estimates and

requires Management to exercise its judgement in the process

of applying the Group's accounting policies. It also requires

the use of assumptions that affect the reported amounts of assets

and liabilities and disclosure of contingent assets and liabilities

at the date of the financial statements and the reported amounts

of revenues and expenses during the reporting period. These estimates

are based on Management's best knowledge of current events and

actions and other factors, including expectations of future events

that are believed to be reasonable under the circumstances. Actual

results though may ultimately differ from those estimates.

As the Group makes estimates and assumptions concerning the future

the resulting accounting estimates will, by definition, seldom

equal the related actual results. The estimates and assumptions

that have a significant risk of causing a material adjustment

to the carrying amounts of assets and liabilities within the

next financial year are discussed below:

* Provision for impairment of receivables

The Group reviews its trade and other receivables for evidence

of their recoverability. Such evidence includes the counter party's

payment record, and overall financial position as well as the

state's ability to pay its dues (VAT receivable). If indications

of irrecoverability exist, the recoverable amount is estimated

and a respective provision for impairment of receivables is made.

The amount of the provision is charged through profit or loss.

The review of credit risk is continuous and the methodology and

assumptions used for estimating the provision are reviewed regularly

and adjusted accordingly.

-- Fair value of investment property

The fair value of investment property is determined by using

various valuation techniques. The Group selects highly reputed

international companies with local presence to effect such valuations.

Such valuers use their judgement to select a variety of methods

and make assumptions that are mainly based on market conditions

existing at each financial reporting date. The fair value of

the investment property has been estimated based on the fair

value of their individual assets.

* Income taxes

Significant judgement is required in determining the provision

for income taxes. There are transactions and calculations for

which the ultimate tax determination is uncertain during the

ordinary course of business. The Group recognises liabilities

for anticipated tax audit issues based on estimates of whether

additional taxes will be due. Where the final tax outcome of

these matters is different from the amounts that were initially

recorded, such differences will impact the income tax and deferred

tax provisions in the period in which such determination is made.

* Impairment of tangible assets

Assets that are subject to depreciation are reviewed for impairment

whenever events or changes in circumstances indicate that the

carrying amount may not be recoverable. An impairment loss is

recognized for the amount by which the asset's carrying amount

exceeds its recoverable amount. The recoverable amount is the

higher of an asset's fair value less costs to sell and value

in use. For the purposes of assessing impairment, assets are

grouped at the lowest levels for which there are separately identifiable

cash flows (cash-generating units).

* Impairment of intangible assets

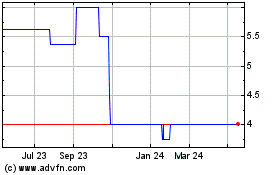

Secure Property Developm... (LSE:SPDI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Secure Property Developm... (LSE:SPDI)

Historical Stock Chart

From Jul 2023 to Jul 2024