Aisi Realty Public Limited Half Yearly Report -5-

September 05 2012 - 2:00AM

UK Regulatory

For the six months ended 30 June 2012

Note 30 June 30 June

2012 2011

US$ US$

CASH FLOWS FROM OPERATING ACTIVITIES

Loss before tax and non-controlling interest (2.231.859) (16.593.611)

Adjustments for:

Loss on revaluation of investment property 7 - 7.833.811

Impairment loss/(reversal) of prepayments

and current assets 10 (54.881) 4.802.851

Depreciation of property, plant and equipment 8.125 19.921

Other expenses/(income) (48.200) 504.409

Interest expense 9 570.563 547.768

Interest income 9 (767) (2.299)

Effect of foreign exchange difference 9 12.709 120.683

Cash flows used in operations before working (1.744.310) (2.766.467)

capital changes

(Increase)/Decrease in prepayments

and other current assets 13 329.767 (103.914)

Increase in trade and other payables 20 15.694 927.980

Decrease in financial lease liabilities 23 (11.594) (28.147)

Increase in payables due to related parties 20 139.134 1.221.904

473.001 2.017.823

Net cash flows used in operating activities (1.271.309) (748.644)

CASH FLOWS FROM INVESTING ACTIVITIES

Decrease in VAT receivable 141.622 43.035

Decrease in payables to constructors 20 (300.384) (10.671)

Additions to investment property 12 (80.133) (90.157)

Changes of property, plant and equipment (1.204) 50.035

Net cash flows used in investing activities (240.099) (7.758)

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds from issue of share capital 16 1.351.965 -

Proceeds from Shareholder's Advances 16 130.000 -

Proceeds from other borrowings - 471.999

Interest paid (570.481) -

Net cash flow used in financing activities 911.484 471.999

Effect of foreign exchange rates on cash (44) 11.854

Net decrease in cash at banks 15 (599.968) (272.549)

Cash:

At beginning of the period 754.640 291.053

At end of the period 154.672 18.504

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

For the six months ended 30 June 2012

1. General Information

Country of incorporation

AISI Realty Public Ltd (the "Company") was incorporated in

Cyprus on 23 June 2005 and is a public limited liability company,

listed on the London Stock Exchange (AIM). Its registered office is

at Kyriakou Matsi 16, Eagle House, 10th floor, Agioi Omologites,

1082 Nicosia, Cyprus.

Principal activities

The principal activities of the Group are directly or indirectly

to invest in and/or manage real estate properties as well as real

estate development projects in Central and South East Europe (the

"Region"). These include the acquisition, development, operation

and selling of property assets, in major population centres in the

Region.

The Group maintains offices in Kiev, Ukraine and Nicosia,

Cyprus, while it has an affiliate in Bucharest, Romania.

As at the reporting date, the Group has 16 Full Time Equivalent

(FTEs) employed persons, including the CEO and the CFO (30/6/2011 -

21, 31/12/2011 - 19).

2. Adoption of new and revised Standards and Interpretations

The Group has adopted all the new and revised Standards and

Interpretations issued by the International Accounting Standards

Board (the IASB) and the International Financial Reporting

Interpretations Committee (the IFRIC) of the IASB, which are

relevant to its operations and are effective for accounting periods

commencing on 1 January 2012.

The accounting policies adopted for the preparation of the

Interim Condensed Financial Statements for the six months ended 30

June 2012 are consistent with those followed for the preparation of

the annual financial statements for the year ended 31 December

2011, except for the adoption by the Group of standards, amendments

and interpretations as of 1 January 2012, which did not have any

material impact on the Group's financial statements.

The Group has not early adopted any other standard,

interpretation or amendment that was issued but is not yet

effective.

3. Significant accounting policies

3.1 Statement of compliance

The Interim Condensed Financial Statements have been prepared

in accordance with International Financial Reporting Standards

(IFRSs) as adopted by the European Union (EU) and the requirements

of the Cyprus Companies Law, Cap.113.

The Interim Condensed Financial Statements have been prepared

under the historical cost convention as modified by the revaluation

of investment property and investment property under construction

to fair value.

3.2 Basis of preparation

The principal accounting policies adopted in the preparation of

these Interim Condensed Financial Statements are set out below.

These policies have been consistently applied to all years presented

in these consolidated financial statements unless otherwise stated.

Items included in the Group's financial statements are measured

applying the currency of the primary economic environment in which

the entities operate ("the functional currency"). The national

currency of Ukraine, the Ukrainian Hryvnia, is the functional

currency for all the Group's entities, except for the parent company

and its subsidiaries Aisi Capital Ltd and Aisi Logistics Ltd for

which the United States Dollar is the functional currency.

Ukrainian statutory accounting principles and procedures differ

from those generally accepted under IFRS. Accordingly, the consolidated

financial information, which has been prepared from the Ukrainian

statutory accounting records for the entities of the Group domiciled

in Ukraine, reflects adjustments necessary for such consolidated

financial information to be presented in accordance with IFRS.

3.3 Going Concern

These Interim Condensed Financial Statements have been prepared

on a going concern basis, which contemplates the realization of

assets and the satisfaction of liabilities in the normal course

of business.

The Group incurred a loss of US$ 2.225.695 for the six months

ended 30 June 2012 and as at that date its current liabilities

exceed its current assets by US$ 16.161.038, out of which US$15.813.857

is related to the EBRD loan (note 19) whose repayment schedule

begins at the end of September 2012.

The directors have prepared these Interim Condensed Financial

Statements on the going concern basis, based on the fact that

the Group has turned operationally wise cash flow positive but

nevertheless for the immediate future the Group is still dependent

on the continuing financial support of its shareholders and its

bankers.

3.4 Basis of consolidation

The Interim Condensed Financial Statements incorporate the financial

statements of the Company and entities (including special purpose

entities) controlled by the Company (its subsidiaries). Control

is achieved where the Company has the power to govern the financial

and operating policies of an entity so as to obtain benefits from

its activities.

Income and expenses of subsidiaries acquired or disposed of during

the year are included in the statement of comprehensive income

from the effective date of acquisition and up to the effective

date of disposal, as appropriate. Total comprehensive income of

subsidiaries is attributed to the owners of the Company and to

the non-controlling interests even if this results in the non-controlling

interests having a deficit balance.

The financial statements of all the Group companies are prepared

using uniform accounting policies. When necessary, adjustments

are made to the financial statements of subsidiaries to bring

their accounting policies into line with those used by other members

of the Group.

All intra-group transactions, balances, income and expenses are

eliminated in full on consolidation.

3.4.1 Changes in the Group's ownership interests in existing

subsidiaries

Changes in the Group's ownership interests in subsidiaries that

do not result in the Group losing control over the subsidiaries

are accounted for as equity transactions. The carrying amounts

of the Group's interests and the non-controlling interests are

adjusted to reflect the changes in their relative interests in

the subsidiaries. Any difference between the amount by which

the non-controlling interests are adjusted and the fair value

of the consideration paid or received is recognized directly

in equity and attributed to owners of the Company.

When the Group loses control of a subsidiary, the profit or loss

on disposal is calculated as the difference between (i) the aggregate

of the fair value of the consideration received and the fair

value of any retained interest and (ii) the previous carrying

amount of the assets (including goodwill), and liabilities of

Secure Property Developm... (LSE:SPDI)

Historical Stock Chart

From Jun 2024 to Jul 2024

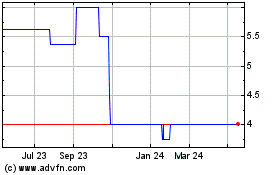

Secure Property Developm... (LSE:SPDI)

Historical Stock Chart

From Jul 2023 to Jul 2024