TIDMSONG

RNS Number : 7369L

Hipgnosis Songs Fund Limited

10 September 2019

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, DIRECTLY OR

INDIRECTLY, IN OR TO THE UNITED STATES, AUSTRALIA, CANADA, THE

REPUBLIC OF SOUTH AFRICA, JAPAN OR ANY MEMBER STATE OF THE EEA

(OTHER THAN THE UNITED KINGDOM) OR ANY OTHER JURISDICTION IN WHICH

THE PUBLICATION, DISTRIBUTION OR RELEASE OF THIS ANNOUNCEMENT WOULD

BE UNLAWFUL. PLEASE SEE THE SECTION ENTITLED "IMPORTANT NOTE"

TOWARDS THE OF THIS ANNOUNCEMENT.

This announcement contains Inside Information as defined under

the Market Abuse Regulation (EU) No. 596/2014.

10 September 2019

Hipgnosis Songs Fund Limited ("Hipgnosis" or the "Company")

Proposed C Share Issue

The Board of Hipgnosis Songs Fund Limited and its Investment

Adviser, The Family (Music) Limited, announce that the Company is

considering increasing its capital base through an issue of C

shares at a price of 100 pence per C share, targeting gross

proceeds of GBP300 million (the "Issue"). It is anticipated that

the structure of any fundraising will include an issue of C shares,

an offer for subscription and intermediaries offer, and another 12

month share issuance programme.

Any issue of C shares will be used to take advantage of an

attractive pipeline of opportunities that The Family (Music)

Limited continues to identify in line with the Company's investment

policy. The relevant investments (or part thereof, as appropriate)

and income accrued thereon will be allocated to the pool of assets

and NAV attributed to the C shares and will be accounted for in

this separate pool of C share assets until the C shares convert

into new ordinary shares.

Any issue of C shares will be subject to the approval of a

prospectus in connection with the Issue by the FCA (the

"Prospectus"). It is currently expected that, should the Company

proceed with the Issue, the Prospectus in connection with the Issue

will be published before the end of September 2019 and trading in

the C shares will commence before the end of October 2019.

Move to the Premium Segment of the Main Market

The Company also confirms its intention to apply to the FCA for

the Company's ordinary shares (and any C shares to be issued in

connection with the Issue) to be admitted to the premium segment of

the Official List of the UK Listing Authority and to the London

Stock Exchange for the ordinary shares (and any C shares to be

issued in connection with the Issue) to be admitted to the premium

segment of the Main Market in the near future (the "Migration").

The Migration is expected to broaden the Company's share register

and facilitate the Company's eligibility for inclusion in the FTSE

UK Index Series.

The Company will make further announcements in respect of the

Issue and Migration in due course.

For further information, please contact:

The Family (Music) Limited Tel: +44 (0)1481 742742

Merck Mercuriadis

N+1 Singer Tel: +44 (0)20 7496

James Maxwell / James Moat (Corporate 3000

Finance)

Alan Geeves / James Waterlow / Sam Greatrex

(Sales)

J.P. Morgan Cazenove Tel: +44 (0)20 7742

William Simmonds / Ed Murray / Jérémie 4000

Birnbaum (Corporate Finance)

James Bouverat / Eddie Nissen (Sales)

The Outside Organisation Tel: +44 (0)7711 081

Alan Edwards / Nick Caley 843

NOTES TO EDITORS

About Hipgnosis Songs Fund Limited

(www.hipgnosissongs.com)

Hipgnosis, which was founded by Merck Mercuriadis, is a Guernsey

registered investment company established to offer investors a

pure-play exposure to songs and associated musical intellectual

property rights. The Company has raised a total of approximately

GBP395 million (gross equity capital) through its Initial Public

Offering on the Specialist Fund Segment of the London Stock

Exchange's main market on 11 July 2018, and subsequent placings in

April 2019 and August 2019.

About The Family (Music) Limited

The Company's Investment Adviser is The Family (Music) Limited,

which was founded by Merck Mercuriadis, former manager of globally

successful recording artists, such as Elton John, Guns N' Roses,

Morrissey, Iron Maiden and Beyoncé, and hit songwriters such as

Diane Warren, Justin Tranter and The-Dream, and former CEO of The

Sanctuary Group plc. The Investment Adviser has assembled an

Advisory Board of highly successful music industry experts which

include award winning members of the artist, songwriter,

publishing, legal, financial, recorded music and music management

communities, all with in-depth knowledge of music publishing.

Members of The Family (Music) Limited Advisory Board include Nile

Rodgers, The-Dream, Giorgio Tuinfort, Starrah, Nick Jarjour, David

Stewart, Bill Leibowitz, Ian Montone, and Jason Flom.

IMPORTANT NOTE

The shares that will be the subject of the Issue or a subsequent

issue under the share issuance programme (each a "Subsequent

Issue") are not being offered or sold to any person in the European

Union, other than to "qualified investors" as defined in Article

2.1 of Directive 2003/71/EC, which includes legal entitles which

are regulated by the Financial Conduct Authority or entities which

are not so regulated whose corporate purpose is solely to invest in

securities.

All offers of shares will be made pursuant to the Prospectus. In

the United Kingdom, this announcement is being directed solely at

persons in circumstances in which section 21(1) of the Financial

Services and Markets Act 2000 (as amended) does not apply. This

announcement does not constitute or form part of, and should not be

construed as, any offer or invitation or inducement for sale,

transfer or subscription of, or any solicitation of any offer or

invitation to buy or subscribe for or to underwrite, any share in

the Company or to engage in investment activity (as defined by the

Financial Services and Markets Act 2000) in any jurisdiction nor

shall it, or any part of it, or the fact of its distribution form

the basis of, or be relied on in connection with, any contract or

investment decision whatsoever, in any jurisdiction. This

announcement does not constitute a recommendation regarding any

securities.

The information in this announcement is for information purposes

only and does not purport to be full or complete. No reliance may

be placed for any purpose on the information contained in this

announcement or its accuracy or completeness. The material set

forth herein is not intended, and should not be construed, as an

offer of securities for sale or subscription in the United States

or any other jurisdiction. Any purchase of shares should be made

solely on the basis of the information contained in the

Prospectus.

This announcement is not for publication or distribution,

directly or indirectly, in or into the United States (including its

territories and possessions, any state of the United States and the

District of Columbia), Australia, Canada, South Africa or Japan.

The distribution of this announcement may be restricted by law in

certain jurisdictions and persons into whose possession any

document or other information referred to herein comes should

inform themselves about and observe any such restriction. Any

failure to comply with these restrictions may constitute a

violation of the securities laws of any such jurisdiction.

The Company will not be registered under the US Investment

Company Act of 1940, as amended. In addition, the Company's shares

referred to herein have not been and will not be registered under

the US Securities Act of 1933 (the "Securities Act") or under the

securities laws of any state of the United States and may not be

offered or sold in the United States or to or for the account or

benefit of US persons absent registration or pursuant to an

exemption from, or in a transaction not subject to, the

registration requirements of the Securities Act and in compliance

with any applicable State securities laws. The offer and sale of

Company's shares referred to herein has not been and will not be

registered under the Securities Act or under the applicable

securities laws of any state, province or territory of Australia,

Canada, South Africa or Japan. Subject to certain exceptions, the

Company's shares referred to herein may not be offered or sold in

Australia, Canada, South Africa or Japan or to, or for the account

or benefit of, any national, resident or citizen of Australia,

Canada, South Africa or Japan. There will be no offer of the

Company's shares in the United States, Australia, Canada, South

Africa or Japan.

N+1 Singer is authorised and regulated in the United Kingdom by

the Financial Conduct Authority, and is acting exclusively for the

Company and no-one else in connection with the Issue and each

Subsequent Issue. They will not regard any other person as their

respective clients in relation to the Issue and each Subsequent

Issue and will not be responsible to anyone other than the Company

for providing the protections afforded to their respective clients,

nor for providing advice in relation to the Issue and each

Subsequent Issue, the contents of this announcement or any

transaction, arrangement or other matter referred to herein.

None of the Company, the Investment Adviser or N+1 Singer or any

of their respective affiliates accepts any responsibility or

liability whatsoever for/or makes any representation or warranty,

express or implied, as to this announcement, including the truth,

accuracy or completeness of the information in this announcement

(or whether any information has been omitted from the announcement)

or any other information relating to the Company whether written,

oral or in a visual or electronic form, and howsoever transmitted

or made available or for any loss howsoever arising from any use of

the announcement or its contents or otherwise arising in connection

therewith. The Company, the Investment Adviser and N+1 Singer and

their respective affiliates accordingly disclaim all and any

liability whether arising in tort, contract or otherwise which they

might otherwise have in respect of this announcement or its

contents or otherwise arising in connection therewith.

This announcement may include statements that are, or may be

deemed to be, "forward-looking statements". These forward-looking

statements involve known and unknown risks and uncertainties, many

of which are beyond the Company's control and all of which are

based on the Company's board of directors' current beliefs and

expectations about future events. These forward-looking statements

may be identified by the use of forward- looking terminology,

including the terms "believes", "estimates", "plans", "projects",

"anticipates", "expects", "intends", "may", "will" or "should" or,

in each case, their negative or other variations or comparable

terminology, or by discussions of strategy, plans, objectives,

goals, future events or intentions. These forward-looking

statements include all matters that are not historical facts.

Forward-looking statements may and often do differ materially from

actual results. Any forward-looking statements reflect the

Company's current view with respect to future events and are

subject to risks relating to future events and other risks,

uncertainties and assumptions relating to the Company's business,

the results of operations, financial condition prospects, growth

and dividend policy of the Company and the industry in which it

operates. Forward-looking statements speak only as of the date they

are made and cannot be relied upon as a guide to future

performance. These forward-looking statements and other statements

contained in this announcement regarding matters that are not

historical facts involve predictions. No assurance can be given

that such future results will be achieved; actual events or results

may differ materially as a result of risks and uncertainties facing

the Company. Such risks and uncertainties could cause actual

results to vary materially from the future results indicated,

expressed or implied in such forward-looking statements. Forward

looking statements speak only as of the date of this

announcement.

The Company has a limited trading history. Potential investors

should be aware that any investment in the Company is speculative,

involves a high degree of risk, and could result in the loss of all

or substantially all of their investment. Results can be positively

or negatively affected by market conditions beyond the control of

the Company or any other person. Past performance cannot be relied

upon as a guide to, or guarantee of, future performance.

Prospective investors are advised to seek expert legal, financial,

tax and other professional advice before making any investment

decision. The value of investments may fluctuate.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IOECKCDBDBKBDCK

(END) Dow Jones Newswires

September 10, 2019 02:02 ET (06:02 GMT)

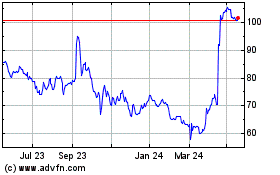

Hipgnosis Songs (LSE:SONG)

Historical Stock Chart

From Jun 2024 to Jul 2024

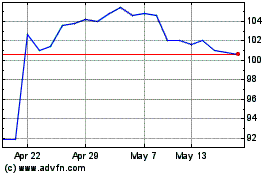

Hipgnosis Songs (LSE:SONG)

Historical Stock Chart

From Jul 2023 to Jul 2024