TIDMSOLI

RNS Number : 7299U

Solid State PLC

07 December 2021

Solid State plc

( "Solid State", the " Group " or the "Company" )

Interim Results for the six months ended

30 September 2021

Analyst Briefing & Investor Presentation

Solid State plc (AIM: SOLI), the specialist value added

component supplier and design-in manufacturer of computing, power,

and communications products, announces results for the six months

to 30 September 2021.

Highlights in the period include:

H1 2021/22 H1 2020/21 Change

Reported revenue GBP39.4m GBP33.1m 19.0%

Reported operating profit margin 5.6% 7.3% (170bps)

Adjusted operating profit margin* 8.6% 7.8% 80bps

Reported profit before tax GBP2.11m GBP2.37m (11.0%)

Adjusted profit before tax* GBP3.27m GBP2.55m 28.2%

Reported diluted earnings per share 19.8p 24.0p (17.5%)

Adjusted diluted earnings per share 32.7p 25.6p 27.7%

Interim dividend 6.25p 5.25p 19.0%

Net cash flow from operations GBP4.97m GBP1.91m 160.2%

* Adjusted performance metrics are reconciled in note 5, the

adjustments relate to IFRS 3 acquisition amortisation, share-based

payments charges, effect of the enacted 19% to 25% tax rate

increase to deferred tax and non-recurring charges in respect of

acquisition costs and fair value adjustments.

H1 2021/22 FY 2020/21 Change

Net cash / (net debt)** (GBP1.9m) (GBP4.4m) (56.8%)

Open order book @ 30 September / 31 March GBP61.5m GBP41.3m 48.9%

** Net cash / debt includes net cash with banks GBP3.3m (H1

2020/21: GBP4.0m), the fair value of deferred contingent

consideration of GBP5.3m (H1 2020/21: GBPNil) and excludes the

right of use lease liabilities of GBP2.3m (H1 2020/21:

GBP2.1m).

Financial highlights:

-- Revenue and adjusted profit before tax up 19.0% and 28.2% respectively.

-- Adjusted operating cash generation of GBP4.97m to deliver

operating cash conversion of 148%.

-- Reported Net Debt (including deferred contingent

consideration) on 30 September 2021 decreased to GBP1.9m (31 March

2021: GBP4.4m) after payment of the prior year final dividend of

GBP0.9m.

-- Increased the fair value of the earn out deferred contingent

consideration by GBP0.3m due to Active Silicon and Willow

Technologies outperforming management expectations.

-- Record open order book at 30 November 2021 of GBP70.3m, up

14.3% on 30 September 2021 of GBP61.5m, and up 70% on year end

figure of GBP41.3m at 31 March 2021.

Operational highlights:

-- Previously announced $4.6m defence contract within the

Components Division which secured a three year contract renewal

with a global defence technology customer to supply components for

its defence aerospace programme.

-- Completed the commissioning of the Group's in-house

Electromagnetic Compatibility (EMC) testing facility and continued

to invest in enhancing the Group's capabilities through the

capital

investment programme.

-- Continued progress on our R&D programmes in respect of

own brand component development as well as computing, security,

antenna products and our BMS (Battery Management Systems)

solutions.

-- Post completion of Willow and Active, implementation of cross

Group training to maximise collaboration and improve understanding

and awareness of the enlarged Group's capabilities.

Commenting on the results and prospects, Nigel Rogers, Chairman

of Solid State, said:

" Our half year results are particularly pleasing given the

widely reported challenges in the global supply chain and more

local pressures in staffing and the foreign exchange headwinds at a

revenue level.

"The successful acquisition programme has added resilience and

opened up opportunities to grow the business in targeted regions

and industry sectors. We continue to see acquisitions as a pillar

of our growth strategy.

"Group-wide we have worked closely with customers and suppliers

in response to the rebound in the economy. This is evident in the

order flow and the strong open order book, which gives the Board

confidence in meeting expectations(1) for the full year."

(1) Analysts from brokers WH Ireland Limited, finnCap Limited,

and Edison Investment Research Limited, provide equity research on

Solid State, and the Company considers the average of their

research forecasts to represent market expectations, being, for

Solid State's 2021/22 financial year, revenue of GBP78.4m, and

adjusted profit before tax* of GBP5.9m.

Analyst Briefing: 9.30 a.m. today, Tuesday 7 December 2021

An online briefing for Analysts will be hosted by Gary Marsh,

Chief Executive, and Peter James, Group Finance Director, at 9.30

a.m. today, Tuesday 7 December 2021, to review the results and

prospects. Analysts wishing to attend should contact Walbrook PR on

solidstate@walbrookpr.com or on 020 7933 8780.

Investor Results Presentation: 4 p.m. on Thursday 9 December

2021

Gary Marsh, Chief Executive , and Peter James, Group Finance

Director, will hold a presentation to cover the results and

prospects at 4 p.m. on Thursday 9 December 2021. The presentation

will be hosted through the digital platform Investor Meet Company.

Investors can sign up to Investor Meet Company for free and add to

meet Solid State plc via the following link

https://www.investormeetcompany.com/solid-state-plc/register-investor

. Investors who have already registered and added to meet the

Company will automatically be invited.

Questions can be submitted pre-event to

solidstate@walbrookpr.com , or in real time during the presentation

via the "Ask a Question" function.

For further information please contact:

Solid State plc Via Walbrook

Gary Marsh - Chief Executive

Peter James - Group Finance Director

WH Ireland (Nominated Adviser & Joint

Broker)

Mike Coe / Sarah Mather (Corporate

Finance)

Jasper Berry (Corporate Broking /

Sales) 020 7220 1666

finnCap (Joint Broker)

Ed Frisby (Corporate Finance)

Rhys Williams / Tim Redfern (Sales

/ ECM) 020 7220 0500

Walbrook PR (Financial PR) 020 7933 8780

Tom Cooper / Nick Rome 0797 122 1972

solidstate@walbrookpr.com

Analyst Research Reports: For further analyst information and

research see the Solid State plc website:

https://solidstateplc.com/research/

Notes to Editors:

Solid State plc (SOLI) is a value added electronics group

supplying commercial, industrial and military markets with durable

components, assemblies and manufactured units for use in specialist

and harsh environments. The Group's mantra is - 'Trusted technology

for demanding applications'. To see an introductory video on the

Group - https://bit.ly/3kzddx7

Operating through two main divisions: Systems (Steatite &

Active Silicon) and Components (Solid State Supplies, Pacer, Willow

Technologies & AEC); the Group specialises in complex

engineering challenges often requiring design-in support and

component sourcing for computing, power, communications,

electronic, electro-mechanical and opto-electronic products.

Headquartered in Redditch, UK, Solid State employs approximately

300 staff across UK and US, serving specialist markets in

industrial, defence and security, transportation, medical and

energy.

Solid State was established in 1971 and admitted to AIM in June

1996. The Group has grown organically and by acquisition - having

made 12 acquisitions since 2002.

Unaudited Interim Results of the six months ended

30 September 2021

I am pleased to report an excellent first half, with Group

revenue of GBP39.4m (H1 2020/21: GBP33.1m) which is 19% up on the

prior period (like for like organic revenue growth is 8%) despite

the significant challenges presented by the well-publicised

electronics supply chain constraints. Reported revenue growth was

held back as a result of a weaker US dollar, however the profit

effect of this was mitigated by a natural hedge from US dollar

denominated component purchases, benefitting the gross margin

percentage.

The Group's sector diversity continues to provide a resilient

business model. Order intake has been strong across all sectors

including in those markets which had previously shown some weakness

during the Pandemic, specifically energy and aerospace. This has

resulted in a record open order book on 30 November 2021 of

GBP70.3m (Comparatives: 30 September 2021: GBP61.5m; 31 March 2021:

GBP41.3m; 30 November 2020: GBP34.3m) .

The contribution from the acquisitions of Willow and Active

Silicon at the end of last year has exceeded management's

expectations, supporting the Group's progress in delivering its

growth strategy. The Board is making good progress in updating its

5-year vision and strategy for the period to 2027. As part of that

work, and going forward, we will simplify the descriptions of the

respective divisions to better describe their core activities.

The Group's "Components Division" (previously Value Added

Supplies) manufactures and sells own brand and franchise

components. The Components Division has products and services

across Semiconductors, Opto-electronics, Electromechanical,

Embedded Solutions, Sourcing & Obsolescence and value added

services. The Group's "Systems Division" (previously Manufacturing)

provides products and systems across three key business unit areas

of Power, Computing and Communications. The Board considers that

this simplification will help stakeholders better understand the

Group's capabilities, and where and how we add value to our

customers.

The strong trading performance in the period has been held back

by component shortages, and had supply chains been more normal, we

would have seen even stronger organic revenue growth. In the

period, Group gross margins have increased to 32.7% (H1 2020/21:

29.9%). While FX has benefitted reported margins by circa 1%,

underlying margins in both divisions have seen improvements year on

year, as a consequence of the execution of the Group's strategy and

the recent acquisitions.

Despite these challenges, adjusted diluted earnings per share of

32.7p (H1 2020/21: 25.6p) is 28% higher than the prior year and we

believe this sets the Group up well to deliver a record full year

result and meet expectations . Based on the trading in the first

half and prospects for the full year, the Board is increasing the

interim dividend to 6.25p (H1 2020/21: 5.25p).

The Group continued to deliver strong cash generation in the

first half with cash inflow from operations of GBP5.0m (H1 2020/21:

GBP1.9m) albeit the period benefitted from a working capital

in-flow which is expected to unwind in the second half, however,

the strong cash generation means net debt has fallen 49% to GBP1.9m

(31 March 2021: GBP4.4m).

The macro-economic environment continues to be problematic, and

the Group is working hard with customers and suppliers to manage

supply chain challenges. This has resulted in some increase in

stocking at Solid State during the period and post period end,

requiring investment in working capital, and some commitments to

longer order schedules by both Solid State and its customers. As a

result, there is reduced mid / long term visibility over supplies

which makes forecasting more testing.

Current order intake continues to be strong and trading since

the period end has been in-line with management expectations.

Prospects for the remainder of the financial year are underpinned

by the near-term open order book and the resilience and diversity

of the Group. Whilst there is still some uncertainty as to the

impacts of supply chain challenges for the remainder of our

financial year, the Board is confident of meeting its expectations

for the year ending 31 March 2022.

Business Overview

The Group supplies electronic products, technology, and

solutions, primarily designed for demanding applications where

safety, performance, reliability, and quality are critical;

enabling customers to focus on their core business with confidence

by providing trusted technology for demanding applications.

The Group is focused on the supply and support of specialist

electronics equipment and solutions from components,

sub-assemblies, products, and embedded systems, through to complete

integrated electronic solutions.

The Group operates through two operating divisions: Components

and Systems. They have distinct characteristics in their respective

markets; however, they have a common mission, a clear strategy, and

consistent business values.

The Components Division is developing its offering in three

areas: own brand manufactured components, franchised components and

the provision of value-added services such as Sourcing &

Obsolescence management. The Components Division is a specialist in

delivering innovative, valuable, technical solutions for customers

seeking cutting edge, electronic, opto-electronic,

electro-mechanical components and displays with market leading

value-added capabilities.

The Systems Division has market leading capabilities in the

design, development and supply of high specification industrial

computers, circuit board level design and manufacturing

capabilities, primarily for image capture, processing,

transmission, custom battery packs providing portable power and

energy storage solutions and advanced communication systems,

encompassing wideband antennas and high-performance radio

products.

The Group is the subject matter expert for its customers, with

deep industry knowledge and longstanding key supplier

relationships. In designing-in solutions to address the customer

needs, the Group selects the most appropriate component, module,

computing technology, cell chemistry, or communications solution

which ensures Solid State is a trusted partner.

The Group constantly seeks to add value for its customers, who

are typically looking to embrace the adoption of the enabling

technologies where Solid State has industry leading component and

manufacturing expertise, such as electronic and optoelectronic

component design-in, image processing, artificial intelligence

(AI), IOT, fossil fuel replacement, switching, cordless &

portable power, and leading-edge communications / antenna

solutions.

Our stated strategy is to supplement organic growth with

selective acquisitions within the electronics industry which

complement our existing Group companies and facilitate the

internationalisation of the Group and/or provide additional

products / talent / technology / IP and knowhow which can

accelerate our progress in our target growth markets.

Chief Executive's first half review

Key stakeholder engagement

The first half of the year has seen unprecedented shortages in

the electronic components sector. We anticipated these shortages

during FY20/21 and engaged with our customers to increase order

cover. Where possible we placed longer order schedules with our key

suppliers to mitigate these shortages. Continued disruption in the

supply chains is expected in the second half and through FY22/23.

We are working with customers and suppliers to manage this

disruption as effectively as we can.

In managing the supply chain challenges we are facing increased

working capital demands to secure product. The Group's strong

balance sheet puts Solid State in a good position to ensure that it

can secure product, albeit the lead times are significantly

extended. In managing purchase price rises, which vary

significantly, we have communicated these supply chains challenges

carefully to our customers, and there has been clear recognition of

the need for the financial effects to be passed on into selling

prices.

Positively, the Group is seeing record customer demand for our

products and components and the open order book at the end of H1

was GBP61.5m (31 March 2021: GBP41.3m), which is up 49%. The

increased demand is across our business, we have seen a recovery in

some of the markets which were adversely impacted during the

pandemic such as energy and aerospace, combined with several new

projects which had been deferred now being delivered. Pleasingly,

we have also seen strong demand in our growth markets such as AI,

edge computing and autonomy.

Benefitting from our recent acquisitions

In the first half of the financial year 2021/22 we have

benefitted from the acquisitions of Willow Technologies and Active

Silicon. The acquisitions have exceeded management expectations.

The engagement from the acquired business teams to maximise the

benefits of being part of an enlarged Group has delivered tangible

opportunities. We are currently bidding on projects that would not

have been achievable without the acquired capabilities.

Delivery of the strategy

Enhancing our international sales channels

Following the acquisition of Willow and Active, the Group has

been working to develop its international sales channels in the EU

and the USA for its own brand components within the Hermaseal(R)

and Durakool(R) portfolio as well as the Pacer branded

components.

The Group has started to develop the USA sales channel by

expanding its representative network in the USA. Representatives

benefit from being able to sell own brand components as well as our

own brand products from our Systems Division such as our antenna

solutions and our own brand TEMPEST computing offering.

In addition to the own brand components that can be sold

globally, the Group also has several pan-European franchises that

provide opportunities to deliver organic growth as the Group

develops its EU sales channel. The acquisitions brought the Group

some local representatives and distribution partners in the USA as

well as local resources in the EU. These foundations provide an

initial platform from which the Group is looking to develop its

international sales channels.

Broadening our components portfolio

Our Components Division has continued to develop its portfolio

of franchise manufacturers in the period taking on the ASUS

industrial computing component line which provides IoT platforms

enhancing our portfolio of industrial computing components.

During this period of shortages in the electronics sector, our

breadth of components has enabled us to support customers in

designing-in and supplying second sources for many components,

providing customers with some resilience. This work adds value and

provides new opportunities for the Group.

We have strengthened the USA component manufacturing facility

(AEC) leadership team, by appointing a General Manager, and

bolstering the local sales resource. The Group continues to invest

in our R&D projects further developing our portfolio of own

brand electro-mechanical components.

Manufacturing portfolio of own brand modular products

The Systems Division has made significant progress in our

product development. The computing business unit has extended our

own brand fan-less computing offering to include a low magnetic

signature computing product offering which is increasingly

important for defence applications including those with demanding

EMC requirements. In addition, we have seen our TEMPEST accredited

security product portfolio become market ready which includes the

Group's keyboard video mouse (KVM) product and

high-attenuation-smart-enclosure HASE units.

In the Communications business unit, the development of the

standard and semi-custom antenna portfolio (horns, spirals and

sinuous antennas) has delivered a stable platform of run rate

business over which longer term and larger programmes are being

targeted to provide upside opportunities for organic growth.

Within our Power business unit, the development of our scalable

and flexible modular pack solutions, continues to progress

positively, albeit COVID and supply chain challenges have meant the

progress with our application development partners is taking longer

than anticipated. These products are applicable to multiple high

growth, un-commoditised industrial markets that are adopting either

a low carbon power source, or an off-grid power source.

We continue to develop our supply chain partnerships with cell

manufacturers focussed on additional lithium and non-lithium

chemistries such as lithium iron phosphate and nickle metal

hydride.

Lithium iron phosphate has performance characteristics which are

well suited to higher peak power applications which we are

developing for Combustion Engine Replacement Programmes (CERP).

Nickle metal hydride cell voltage remains constant until the

battery is almost completely discharged, and they have a wide

operating temperature range which means they are well suited to

applications which require small, lightweight, portable, and

handheld applications.

We are keeping pace with the emerging solid state battery

technology being driven by the automotive sector. We remain a

subject matter expert offering our customers the most appropriate

chemistry for their given application.

Developing product range for strategic growth markets

The Group's opto-electronic component manufacturing team is

continuing to develop the portfolio of optical sensing components

that are supplied to tier one OEMs within the medical sector. We

are also developing our COTS (commercial off-the-shelf) own brand

portfolio of optical components which will enable these products to

be sold internationally.

Following the acquisition of Willow, our Components Division

supplies all the major components used within EV charging posts

including: electromechanical switches, contactors, displays,

Bluetooth and cellular interfaces and the embedded processing.

The addition of the Active Silicon's vision and image processing

technology and circuit board level design, combined with our

industrial embedded computing and engineering capability, has

enabled our enlarged Systems Division to provide more integrated

system solutions for our strategic growth markets for industrial

image processing. A good example of this is the transport sector

where the Group's new hardware products and solutions deliver next

generation technology for automatic number plate recognition (ANPR)

and various rail accredited image processing and monitoring

applications.

Enhancing our technical manufacturing expertise

As reported at year end, the Group has made significant

investments further enhancing its manufacturing and assembly

capabilities with new automated die bonding capabilities, state of

the art spectrum analysis equipment and an in-house electromagnetic

compatibility (EMC) chamber which was commissioned during first

quarter of FY21/22. The die bonder significantly increases

throughput and quality, enhancing our capability to manufacture die

level optical sensor components primarily for medical applications.

The chamber now gives us the ability to complete pre-compliance EMC

testing in-house. These facilities combined with technical and

engineering expertise mean the Group has a differentiated offering,

providing class leading manufacture, test and measurement

capabilities which are utilised across the Group.

In a similar vein, the Group is planning to enhance its

environmental chamber to enable the Group to conduct pre-compliance

testing of its products to aerospace standards.

During Q2, the Power business unit ordered its first wire bonder

to enable semi automation of pack manufacturing. In addition to the

investment in manufacturing equipment, we continue to enhance our

capabilities and accreditations such as ATEX and our certification

to build battery packs that are used in explosive atmospheres.

Pleasingly, we are seeing growth in this particular niche

capability.

Industry leading talent development

Talent development and engagement is a core value of the Group

and is a strength which underpins the retention of our industry

leading team. The increasing size and scale of the Group provides

additional opportunities for development.

The acquisitions of both Willow and Active Silicon have added

significant talent to the Group across all areas. In particular,

Active Silicon strengthening the Systems Division's engineering

capabilities.

Our Components Division has continued to invest in external

talent building the cleanroom expertise in opto-electronic

component manufacturing in Weymouth and in the new year an industry

leading expert will join the sourcing team.

Likewise, the Systems Division has also added expertise, with

additions to procurement and finance across the division and

engineering resource in the Power business unit. This growing

talent pool will underpin both Divisions' ability to deliver future

growth. The Group continues to actively seek additional skills

across the business to drive the exciting organic growth

opportunities which the Group is targeting.

Financial Review

Group revenue is up 19% at GBP39.4m (H1 2020/21: GBP33.1m) with

the Group benefiting from the acquisitions of Willow Technologies

and Active Silicon completed at the end of last financial year.

Reported revenue growth was depressed due to a weaker US dollar,

although the profit effect was mitigated by a natural hedge from

component purchases also denominated in US dollars, resulting in an

enhanced gross margin percentage. Underlying revenue on a like for

like and constant exchange rate basis reflects organic growth of

approximately 8%, however, this has been significantly held back as

a result of the component shortages and extended lead times.

The Group has continued to benefit from demand in government

funded sectors such as transport, security, and defence. Revenues

in the Components Division of GBP24.1m (H1 2020/21: GBP19.5m)

benefitted from the acquisition of Willow Technologies, where its

electromechanical products have been less significantly impacted by

the semiconductor shortages. The Systems Division revenues of

GBP15.2m (H1 2020/21: GBP13.5m) likewise benefitted from the Active

Silicon acquisition. Power business unit (BU) revenues are slightly

down on a record first half in the prior year. This is primarily

due to customer design in programmes progressing more slowly due to

the combination of COVID, compounded by the extended component and

cell lead times. However, the level of design activity and the

order book is strong which provides confidence for FY23 and beyond.

Demand in our Computing Systems and Communications business units

has been growing and our inventory holdings has enabled us to

deliver despite the extended lead times. The Group's diversity

provides some resilience enabling the Group to mitigate projects

delays in any given area.

First half order intake has been at record levels across the

Group with a recovery in sectors hit hard by COVID such as energy

and commercial aerospace. Lengthening lead times mean the benefit

of this is not reflected in H1 and the billings benefit is not

expected to be realised until FY22/23 and beyond.

Group gross margins saw a significant improvement to 32.7% (H1

2020/21: 29.9%) albeit there is a circa 1% gain from the weaker US

dollar as noted above. FX aside, underlying Group margins have

benefitted from the strategic actions, both organic and

acquisitive, to enhance the mix of products sold, increasing the

proportion of own brand products and high value-added systems,

solutions, and services which command high margins.

Reported overheads have increased to GBP10.7m (H1 2020/21:

GBP7.5m) principally due to; the additional share-based payment and

amortisation of acquisition intangibles totalling circa GBP0.7m,

the additional overhead associated with the acquisitions adding

circa GBP2.0m, and a GBP0.5m increase in overheads as post COVID

activities start to return to normal levels, albeit overheads

remain below pre COVID levels.

Adjusted operating margin, an increasingly important measure of

Group performance, has increased to 8.6% (H1 2020/21: 7.8%). The

Components Division has seen improvement in adjusted operating

margin, benefitting from the richer mix with more own brand

components and reduced bad debt expense compared to the prior COVID

year. This has been offset by investment in talent and modest

dilution arising from the Active Silicon acquisition (albeit lower

than expected) in the Systems Division.

Adjusted profit before tax for the first half is up 28% at

GBP3.27m (H1 2020/21: GBP2.55m). As a result of the impact of IFRS3

acquisition accounting charges and higher share-based payments

charges, reported profit before tax was down at GBP2.11m (H1

2020/21: GBP2.37m). This is reported after a share-based payments

charge of GBP0.18m (H1 2020/21: GBPNil), amortisation of

acquisition intangibles at GBP0.51m (H1 2020/21: GBP0.18m), an

increase to the earn out deferred consideration of GBP0.30m (H1

2020/21: GBPNil) and the unwind of the stock fair value adjustment

of GBP0.17m (H1 2020/21: GBPNil). The fair value adjustment to the

deferred contingent consideration and the fair value of stock

adjustment are expected to be one-off in nature whereas the

amortisation and share based payments will be incurred at a similar

level in the second half.

Adjusted profit after tax was also up 28% at GBP2.85m (H1

2020/21: GBP2.22m). Reported profit after tax was GBP1.73m (H1

2020/21: GBP2.08m).

Going forward, the increase in corporate tax rates to 25% from

19% for the financial year 2023-24 will result in an increased

effective tax rate albeit the benefit of R&D tax credits will

continue to mean our effective rate is below the standard rate of

corporation tax.

This translates to an excellent start to our financial year with

adjusted diluted earnings per share at 32.7p (H1 2020/21: 25.6p)

and with basic EPS of 20.2p (H1 2020/21: 24.3p). The inflow of cash

from operating activities was GBP4.8m (H1 2020/21 inflow GBP1.9m)

giving an adjusted operating cash conversion of 148% (H1 2020/21:

72%).

During the period we invested in a significant increase in

inventories, however, most cash payments for these inventories fell

into the second half, which combined with effective cash

collections resulted in a working capital inflow for the first

half. With component shortages expected to continue into FY23, we

anticipate working capital outflows in excess of GBP3.0m in the

second half reflecting cash committed to both inventory and

proforma payments to secure inventories.

The Group has invested GBP0.8m in capital projects (H1 2020/21

GBP0.1m) reflecting resumed confidence after new planned capex

projects were suspended in the comparative period. Deferred

consideration for acquisitions totals GBP5.25m ( 31 March 2021:

GBP7.52m) after settlement of the Completion Accounts balances

totalling GBP2.6m and an increase in fair value due to performance

exceeding initial expectations posted in H1 of GBP0.3m.

The Group has net cash with banks which stood at GBP3.32m on 30

September 2021 (GBP3.16m on 31 March 2021) following a small net

cash inflow in the first half. Net debt at 30 September 2021 was

down 56% to GBP1.93m (31 March 2021: GBP4.36m) which includes the

remaining deferred contingent consideration of GBP5.25m.

Our cash reserves in addition to our GBP7.5m bank facilities

mean the Group is in a strong financial position to fund future

working capital requirements, capital investment and acquisition

opportunities as they arise.

Dividends

The Board typically declares an interim dividend which is

approximately 1/3 of the anticipated full year dividend. The Board

is pleased to be able to continue to adopt this approach in the

current period. Based on the trading performance in the first half

of the year and prospects for the full year, the Board has decided

to declare an increase in the interim dividend of 19% to 6.25p per

share (H1 2020/21: 5.25p).

The interim dividend will be paid on 18 February 2022 to

shareholders on the register at the close of business on 28 January

2022. The shares will go ex-dividend on 27 January 2022.

Statement of Directors' Responsibilities

The Directors confirm that this condensed consolidated interim

financial information has been prepared in accordance with

International Accounting Standard 34, 'Interim Financial Reporting'

as adopted by the European Union, and that the interim management

report herein includes a fair review of the information required by

DTR 4.2.7 and DTR 4.2.8, namely:

-- an indication of important events that have occurred during

the first six months and their impact on the condensed consolidated

interim financial information, and a description of the principal

risks and

uncertainties for the remaining six months of the financial year; and

-- material related party transactions in the first six months

and any material changes in the related

party transactions described in the last annual report.

Forward-looking statements

Certain statements in this half year report are forward-looking.

Although the Group believes that the expectations reflected in

these forward-looking statements are reasonable, we can give no

assurance that these expectations will prove to be correct. Because

these statements involve risks and uncertainties, actual results

may differ materially from those expressed or implied by these

forward-looking statements.

We undertake no obligation to update any forward-looking

statements whether arising as a result of new information, future

events or otherwise.

Outlook

Having completed two acquisitions at the end of our last

financial year, the first half has seen a record underlying trading

period, against an extremely challenging market backdrop. The

Group's strategy and focus on ensuring we have sector, product and

customer diversity to provide a resilient business model has

continued to prove its value.

The development in capabilities which the Group now has to offer

(including enhanced component manufacturing in opto-electronics and

electro-mechanical components, enhanced test and measurement and

circuit board level design and manufacturing) positions the Group

to be able to engage with its tier one customers on opportunities

which we would not have been able to target previously.

Our cross-division collaboration, offering the full range of

Group capabilities and products means the Group continues to be

well placed to deliver organic growth, developing own brand

products and solutions for the Group's target growth markets.

In delivering the Group's strategy of complementing organic

growth with strategically aligned M&A, the Group has focused

its M&A efforts in two areas: facilitation of the

internationalisation of the Group and acquisition of additional

products / technology / IP and knowhow which is accelerating

progress in our target growth markets beyond inhouse development to

deliver additional shareholder value. We have a pipeline of

potential acquisition targets which are at the early stages of

discussion and evaluation. As ever, the Board will continue to

apply its rigorous due diligence processes in implementing its

acquisition strategy.

The open order book stood at record level of GBP70.3m as at 30

November 2021. The order intake has remained strong in the post

balance sheet period with customers continuing to place longer

order schedules to help manage and mitigate supply chain

challenges. We have seen continued demand across all sectors

including those which had previously shown some weakness during the

Pandemic, specifically the energy and aerospace sectors. Trading

since the end of the first half of the year has been in-line with

management expectations albeit component lead times mean that the

conversion of orders into billings is significantly extended.

Whilst there is still some uncertainty as to potential impacts

of component shortages and lead times for the remainder of our

financial year and in to FY22/23, the Board is confident of meeting

its expectations for the year ending 31 March 2022. There is

potential upside in the second half of the year, delivery of which

is dependent upon careful management of the constraints imposed by

supply chain challenges.

Finally, the Board continues to recognise that the excellent

progress and execution of the Group's strategy is only possible

because of the hard work and contribution from our staff across the

whole of the Group. Consequently, the Board would like to extend

its thanks to all Group employees.

Gary Marsh

Chief Executive Officer

INTERIM CONSOLIDATED INCOME STATEMENT

for the six months ended 30 September 2021

Unaudited Unaudited Audited

Six months Six months Year to

to to 31 Mar

30 Sept 30 Sept 21

21 20 GBP'000

GBP'000 GBP'000

Continuing Operations

Revenue 39,381 33,073 66,281

Cost of sales (26,495) (23,184) (46,362)

_______ _______ _______

Gross profit 12,886 9,889 19,919

Sales, general and administration

expenses (10,671) (7,477) (15,634)

_______ _______ _______

Profit from operations 2,215 2,412 4,285

Finance costs (106) (39) (85)

_______ _______ _______

Profit before taxation 2,109 2,373 4,200

Taxation expense (379) (296) (247)

_______ _______ _______

Adjusted profit after taxation 2,845 2,219 4,733

Adjustments to profit (1,115) (142) (780)

Profit after taxation 1,730 2,077 3,953

_______ _______ _______

PROFIT ATTRIBUTABLE TO EQUITY HOLDERS

OF THE PARENT 1,730 2,077 3,953

_______ _______ _______

Other comprehensive income - - -

_______ _______ _______

TOTAL COMPREHENSIVE INCOME FOR THE

PERIOD 1,730 2,077 3,953

_______ _______ _______

Earnings per share (see note 6)

Basic EPS from profit for the period 20.2p 24.3p 46.4p

Diluted EPS from profit for the period 19.8p 24.0p 45.7p

INTERIM CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the six months ended 30 September 2021 (unaudited)

Share Share Foreign Capital Shares

capital premium exchange redemption Retained held

reserve reserve reserve earnings in Total

treasury

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 March

2020 427 3,626 (7) 5 18,521 (43) 22,529

Total comprehensive

income for the period - - - - 2,077 - 2,077

Foreign exchange - - (2) - - - (2)

Dividends - - - - (620) - (620)

Share issue 1 (1) - - - - -

_______ _______ ______ _______ _______ _______ ______

Balance at 30 September

2020 428 3,625 (9) 5 19,978 (43) 23,984

Total comprehensive

income for the period - - - - 1,876 - 1,876

Purchase of treasury

shares - - - - - (95) (95)

Foreign exchange - - 15 - - - 15

Transfer of treasury

shares to All Employee

Share Plan - - - - (68) 68 -

Dividends - - - - (449) - (449)

Share based payment

credit - - - - 171 - 171

_______ _______ ______ _______ _______ _______ ______

Balance at 31 March

2021 428 3,625 6 5 21,508 (70) 25,502

Total comprehensive

income for the period - - - - 1,730 - 1,730

Foreign exchange - - 35 - - - 35

Dividends - - - - (920) - (920)

Share based payment

credit - - - - 179 - 179

_______ _______ ______ _______ _______ _______ ______

Balance at 30 September

2021 428 3,625 41 5 22,497 (70) 26,526

_______ _______ ______ _______ _______ _______ ______

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

on 30 September 2021

Unaudited Unaudited Audited

as at as at as at

30 Sept 21 30 Sept 20 31 Mar 21

ASSETS GBP'000 GBP'000 GBP'000

NON-CURRENT ASSETS

Property, plant and equipment 3,404 2,553 2,981

Right of use lease assets 2,206 1,924 2,476

Intangible assets 16,027 8,018 16,557

_______ _______ _______

TOTAL NON-CURRENT ASSETS 21,637 12,495 22,014

CURRENT ASSETS

Inventories 12,728 8,762 10,629

Trade and other receivables 14,986 12,091 14,222

Deferred tax asset 203 86 188

Cash and cash equivalents 5,323 3,952 6,914

_______ _______ _______

TOTAL CURRENT ASSETS 33,240 24,891 31,953

_______ _______ _______

TOTAL ASSETS 54,877 37,386 53,967

LIABILITIES

CURRENT LIABILITIES

Trade and other payables (12,759) (6,388) (11,890)

Contract liabilities (2,720) (2,642) (2,299)

Deferred consideration on acquisitions (4,200) - -

- current

Corporation tax liabilities (986) (1,118) (801)

Right of use lease liabilities (694) (518) (741)

_______ _______ _______

TOTAL CURRENT LIABILITIES (21,359) (10,666) (15,731)

NON-CURRENT LIABILITIES

Non-current borrowings (2,000) - (3,750)

Provisions (694) (697) (741)

Deferred tax liability (1,666) (507) (1,491)

Right of use lease liabilities (1,582) (1,532) (1,802)

Deferred consideration on acquisitions (1,050) - (4,950)

_______ _______ _______

TOTAL NON-CURRENT LIABILITIES (6,992) (2,736) (12,734)

_______ _______ _______

TOTAL LIABILITIES (28,351) (13,402) (28,465)

_______ _______ _______

TOTAL NET ASSETS 26,526 23,984 25,502

CAPITAL AND RESERVES ATTRIBUTABLE TO EQUITY HOLDERS OF THE PARENT

Share capital 428 428 428

Share premium reserve 3,625 3,625 3,625

Capital redemption reserve 5 5 5

Foreign exchange reserve 41 (9) 6

Retained earnings 22,497 19,978 21,508

Shares held in treasury (70) (43) (70)

_______ _______ _______

TOTAL EQUITY 26,526 23,984 25,502

_______ _______ _______

CONSOLIDATED STATEMENT OF CASH FLOWS

for the six months ended 30 September 2021

Unaudited Unaudited Audited

Six months Six months Year to

to to 31 Mar

30 Sept 30 Sept 21

21 20

GBP'000 GBP'000 GBP'000

OPERATING ACTIVITIES

Profit before taxation 2,109 2,373 4,200

Adjustments for:

Property, plant and equipment depreciation 326 220 614

Right of use asset depreciation 365 254 497

Amortisation 691 348 978

(Profit) / loss on disposal of property,

plant and equipment (14) (4) (22)

Share based payment expense 179 - 171

Finance costs 106 39 85

_______ _______ _______

Profit from operations before changes

in working capital and provisions 3,762 3,230 6,523

(Increase) / decrease in inventories (2,084) 886 1,852

(Increase) / decrease in trade and

other receivables (731) 1,735 1,925

Increase / (decrease) in trade and

other payables 4,084 (3,988) (3,363)

Decrease in provisions (47) (7) (7)

_______ _______ _______

Cash generated from operations 4,984 1,856 6,930

Income taxes (paid) / received (13) 51 (432)

_______ _______ _______

(13) 51 (432)

Net cash flows from operating activities 4,971 1,907 6,498

INVESTING ACTIVITIES

Purchase of property, plant and equipment (756) (98) (356)

Capitalised own costs and purchase

of intangible assets (160) (153) (302)

Proceeds from sale of property, plant

and equipment 33 14 77

Payments for acquisition of subsidiaries

net of cash acquired (2,572) - (4,119)

_______ _______ _______

Net cash flow from investing activities (3,455) (237) (4,700)

FINANCING ACTIVITIES

Repurchase of ordinary shares into

treasury - - (95)

Borrowings drawn - - 3,750

Borrowings repaid (1,750) (333) (333)

Payment obligations for right of

use assets (394) (239) (575)

Interest paid (75) (22) (37)

Dividends paid to equity shareholders (920) (620) (1,069)

_______ _______ _______

Net cash flow from financing activities (3,139) (1,214) 1,641

_______ _______ _______

(DECREASE) / INCREASE IN CASH AND

CASH EQUIVALENTS (1,623) 456 3,439

Unaudited Unaudited Audited

as at as at as at

30 Sept 30 Sept 31 Mar

21 20 21

GBP'000 GBP'000 GBP'000

Translational foreign exchange on opening

cash 32 (21) (42)

Net (decrease) / increase in cash and

cash equivalents (1,623) 456 3,439

Cash and cash equivalents brought forward 6,914 3,517 3,517

_______ _______ _______

Cash and cash equivalents carried forward 5,323 3,952 6,914

_______ _______ _______

Unaudited Unaudited Audited

as at as at as at

30 Sept 30 Sept 31 Mar

21 20 21

GBP'000 GBP'000 GBP'000

Represented by:

Cash available on demand 5,323 3,952 6,914

_______ _______ _______

NOTES TO THE INTERIM REPORT

for the six months ended 30 September 2021

1. Basis of preparation of interim financial information

General information

Solid State PLC ("the Company") is a public company

incorporated, domiciled and registered in England and Wales in the

United Kingdom. The registered number is 00771335 and the

registered address is: 2 Ravensbank Business Park, Hedera Road,

Redditch, B98 9EY.

The interim financial statements are unaudited and do not

constitute statutory accounts within the meaning of section 434 of

the Companies Act 2006. Statutory accounts for the year ended 31

March 2021, prepared in accordance with IFRS, have been filed with

the Registrar of Companies. The Auditors' Report on these accounts

was unqualified, did not include any matters to which the Auditors

drew attention by way of emphasis without qualifying their report

and did not contain any statements under section 498 of the

Companies Act 2006.

Basis of preparation

These condensed interim financial statements for the six months

ended 30 September 2021 have been prepared in accordance with IAS

34, 'Interim financial reporting', as contained in UK-adopted

International Accounting Standards. The condensed interim financial

statements should be read in conjunction with the annual financial

statements for the year ended 31 March 2021, which have been

prepared in accordance with international accounting standards in

conformity with the requirements of the Companies Act 2006.

The consolidated interim financial statements have been prepared

in accordance with the recognition and measurement principles of

UK-adopted International Accounting Standards expected to be

effective at the year end of 31 March 2022.

In assessing going concern the Directors gave careful

consideration of the potential impact of the on-going COVID

pandemic and the global electronic component shortages on the

cashflows and liquidity of the Group over the next 12 month

period.

Throughout the COVID pandemic, and the United Kingdom's exit

from the European Union, customer demand has remained solid and in

recent months we have continued to see customers extending order

cover to help to manage the global electronics supply chain issues.

The most significant impact on the Group future performance is the

uncertainty arising from the extending electronic component lead

times. Management have taken all possible actions to minimise and

mitigate the potential impact of shortage.

If shortages continue into the later part of the financial year

2021/22 as expected the risk does have the potential to adversely

impact performance. While the actions do not mitigate the risk

fully it certainly has significantly reduced the impact in the

first half of 2021/22 and positions the Group to manage the period

beyond as effectively as possible. In assessing going concern for

the period ended 30 September 2021, the financial modelling applied

various sensitivity scenarios to a base case to 31 March 2023 which

was prepared based on an extension of the budget for FY21/22.

The Directors have a reasonable expectation that the Group has

adequate resources to continue in operational existence for the

next 12 months, therefore it is appropriate to adopt a going

concern basis for the preparation of the interim financial

information. Accordingly, this interim financial information does

not include any adjustments to the carrying amount or

classification of assets and liabilities that would result if the

Group and Company were unable to continue as a going concern.

2. Accounting policies

The accounting policies are unchanged from the financial

statements for the year ended 31 March 2021 other than as noted

below.

Financial Instruments

The carrying value of cash, trade and other receivables, other

equity instruments, trade and other payables and borrowings also

represent their estimated fair values. There are no material

differences between carrying value and fair value at 30 September

2021.

Additional disclosure of the basis of measurement and policies

in respect of financial instruments are described on pages 102 to

108 of our 31 March 2021 Annual Report and remain unchanged at 30

September 2021.

Estimates

The preparation of interim financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results may differ from these estimates.

In preparing these condensed interim financial statements, the

significant judgements made by management in applying the Group's

accounting policies and the key sources of estimation uncertainty

were the same as those that applied to the consolidated financial

statements for the year ended 31 March 2021.

Impairment

No Impairment charges have been recognised in the period to 30

September 2021.

Recent accounting developments

The accounting policies adopted are consistent with those of the

previous financial year except as described below:

In preparing the interim financial statements, the Group has

adopted the following Standards, amendments and interpretations,

which are effective for 2021/22 and will be adopted in the

financial statements for the year ended 31 March 2022:

-- Amendments to IFRS 9, IAS 39, IFRS 17: - Interest rate benchmark reform.

The adoption of these standards and amendments has not had a

material impact on the interim financial statements.

3. Principal risks and uncertainties

The principal risks and uncertainties impacting the Group are

described on pages 11 to 15 of our 31 March 2021 Annual Report and

remain unchanged at 30 September 2021.

They include: Acquisitions, product / technology change, supply

chain interruption, retention of key employees, competition,

forecasting and financial liquidity, legislative environment and

compliance, failure of or malicious damage to IT systems and

natural disasters.

4. Segmental information

Unaudited Unaudited Audited

Six months Six months Year

to to to

30 Sept 30 Sept 31 Mar

21 20 21

GBP'000 GBP'000 GBP'000

Revenue

Systems 15,234 13,546 27,299

Components 24,147 19,527 38,982

_______ _______ _______

Group revenue 39,381 33,073 66,281

_______ _______ _______

5. Adjusted profit measures

Unaudited Unaudited Audited

Six months Six months Year to

to to 31 Mar

30 Sept 30 Sept 21

21 20 GBP'000

GBP'000 GBP'000

Acquisition fair value adjustments

within cost of sales 168 - 72

Acquisition fair value adjustments

and reorganisation costs 300 - 264

Amortisation of acquisition intangibles 514 176 680

Share based payments 179 - 171

Taxation effect (221) (34) (226)

Deferred tax rate change impact on 175 - -

acquisition intangibles and share

based payments

Non-recurring tax credits - - (181)

_______ _______ _______

Total adjustments to profit 1,115 142 780

_______ _______ _______

Reported gross profit 12,886 9,889 19,919

Adjusted gross profit 13,054 9,889 19,992

Reported operating profit 2,215 2,412 4,285

Adjusted operating profit 3,374 2,588 5,472

Reported operating profit margin percentage 5.6% 7.3% 6.5%

Adjusted operating profit margin percentage 8.6% 7.8% 8.3%

Reported profit before tax 2,109 2,373 4,200

Adjusted profit before tax 3,268 2,549 5,387

Reported profit after tax 1,730 2,077 3,953

Adjusted profit after tax 2,845 2,219 4,733

6. Earnings per share

The earnings per share is based on the following:

Unaudited Unaudited Audited

Six months Six months Year to

to to 31 Mar

30 Sept 30 Sept 21

21 20 GBP'000

GBP'000 GBP'000

Adjusted continuing earnings post

tax 2,845 2,219 4,733

Reported continuing earnings post

tax 1,730 2,077 3,953

_______ _______ _______

Weighted average number of shares 8,550,531 8,556,193 8,524,883

Diluted weighted average number of

shares 8,698,270 8,668,786 8,650,237

_______ _______ _______

Reported EPS

Basic EPS from profit for the period 20.2p 24.3p 46.4p

Diluted EPS from profit for the period 19.8p 24.0p 45.7p

Adjusted EPS

Adjusted basic EPS from profit for

the period 33.2p 25.9p 55.5p

Adjusted d iluted EPS from profit

for the period 32.7p 25.6p 54.7p

7. Dividends

Dividends paid during the period from 1 April 2020 to 30

September 2021 were as follows:

23 September 2020 Final dividend year ended 31 March 2020 7.25p

per share

19 February 2021 Interim dividend year ended 31 March 2021 5.25p

per share

24 September 2021 Final dividend year ended 31 March 2021 10.75p

per share

The Directors are intending to pay an interim dividend for the

year ending 31 March 2022 on 18 February 2022 of 6.25p per share.

This dividend has not been accrued at 30 September 2021.

8. Share capital

Unaudited Unaudited Audited

Six months Six months Year to

to to 31 Mar

30 Sept 30 Sept 21

21 20

Allotted issued and fully paid

Number of ordinary 5p shares 8,564,878 8,564,878 8,564,878

Unaudited Unaudited Audited

Six months Six months Year to

to to 31 Mar

30 Sept 30 Sept 21

21 20 GBP'000

GBP'000 GBP'000

Allotted issued and fully paid

Ordinary 5p shares 428 428 428

9. Related party transactions

Consistent with the year ended 31 March 2021 the only related

party transactions in the period were those with the trading

companies which are used by the non-executive directors for their

consultancy services. These transactions are disclosed in the

remuneration report in the annual report to the 31 March 2021 and

will be updated in the full year report to the year ending 31 March

2022. There are no other related party transactions.

10. Non-current assets

Unaudited Unaudited Audited

Six months Six months Year to

to to 31 Mar

30 Sept 30 Sept 21

21 20 GBP'000

GBP'000 GBP'000

Goodwill 9,898 6,300 9,898

Acquisition intangibles 5,923 1,537 6,436

Research and development 50 100 100

Software 156 81 123

_______ _______ _______

Intangible assets 16,027 8,018 16,557

Property plant and equipment 3,404 2,553 2,981

Right of use asset 2,206 1,924 2,476

_______ _______ _______

Total non-current assets 21,637 12,495 22,014

_______ _______ _______

11. Net Debt

Unaudited Unaudited Audited

Six months Six months Year to

to to 31 Mar

30 Sept 30 Sept 21

21 20 GBP'000

GBP'000 GBP'000

Bank borrowing due within one year - - -

Bank borrowing due after one year (2,000) - (3,750)

_______ _______ _______

Total borrowings (2,000) - (3,750)

Deferred consideration on acquisitions

within one year (4,200) - (2,572)

Deferred consideration on acquisitions

after one year (1,050) - (4,950)

Cash and cash equivalents 5,323 3,952 6,914

_______ _______ _______

(Net debt) / net cash (1,927) 3,952 (4,358)

_______ _______ _______

During the period we have reviewed the fair value of the

deferred contingent consideration which was provided at the year

end. As a result of the improved performance of the acquired

business we concluded that it was appropriate to increase the

provision for deferred contingent consideration by GBP0.30m in the

period. This has been expensed through P&L and has been

excluded from the adjusted performance metrics as an exceptional

item as set out in note 5.

The statement will be available to download on the Company' s

website: www.solidstateplc.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFFRFALRIIL

(END) Dow Jones Newswires

December 07, 2021 01:59 ET (06:59 GMT)

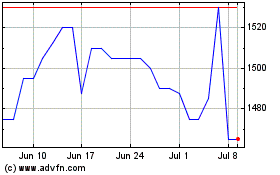

Solid State (LSE:SOLI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Solid State (LSE:SOLI)

Historical Stock Chart

From Apr 2023 to Apr 2024