TIDMSOHO

RNS Number : 0153G

Triple Point Social Housing REIT

13 March 2020

THIS ANNOUNCEMENT HAS BEEN DETERMINED TO CONTAIN INSIDE

INFORMATION FOR THE PURPOSES OF THE MARKET ABUSE REGULATION (EU)

NO. 596/2014.

13 March 2020

Triple Point Social Housing REIT plc

(the "Company" or, together with its subsidiaries, the

"Group")

RESULTS FOR THE YEARED 31 DECEMBER 2019

The Board of Triple Point Social Housing REIT plc (ticker: SOHO)

is pleased to announce its audited results for the year ended 31

December 2019.

31 December 2019 31 December 2018

--------------------------------- ----------------- -----------------

IFRS NAV per share 105.37p 103.65p

E arnings per share (basic

and diluted) 6.75p 8.37p

- IFRS basis 3.39p 2.27p

- EPRA basis

Total annual ised rental income GBP25.4m (1) GBP17.4m (1)

V alu e of the portfolio

- IFRS basis GBP471.6m GBP323.5m

- Portfolio valuation basis GBP503.8m GBP343.7m

Weighted average unexpired 25.7 yrs 27.2 yrs

lease term

Dividend paid or declared per

Ordinary S hare 5.095p 5.00p

Dividend paid per C Share - 1.29p

Financial highlights

-- IFRS net asset value per share of 105.37 pence as at 31

December 2019 (2018: 103.65 pence), an increase of 1.66 % .

-- Portfolio independently valued as at 31 December 201 9 at GBP

471.6 million on an IFRS basis (2018: GBP323.5 million) ,

reflecting a valuation uplift of 7.45 % against total invested

funds of GBP439 million (2) . The properties have been valued on an

individual basis.

-- The Group's properties were valued at GBP503.8 million on a

portfolio valuation basis (2018: GBP 343.7 million ) , reflecting a

portfolio premium of 6.82% or a GBP 32.2 million uplift against the

IFRS valuation. A portfolio valuation basis assumes the portfolio

of properties is held in a single company holding structure, is

sold to a third party on arms-length terms, and attracts lower

purchaser's costs of 2.30 %.

-- The portfolio's total annualised rental income was GBP25.4

million (1) as at 31 December 2019 (2018: GBP 17.4 million ) .

-- Operating profit for the year ended 31 December 2019 was

GBP26.9 million (2017: GBP 21. 5 million ) .

-- Ongoing Charges Ratio of 1.63% as at 31 December 2018 (2018: 1.58%) .

-- Extended existing debt facility by GBP60 million. As at 12

March 2020, GBP 29 .4 million of debt was uncommitted.

Operational highlights

-- Acquired 116 properties (843 units) during the year for a

total investment cost of GBP 130.5 million ( including costs )

bringing the total investment portfolio to 388 properties.

-- Committed approximately GBP29.8 million to forward fund the

development of nine newly built or fully-renovated bespoke

Supported Housing schemes, bringing total forward funding

agreements entered into by the Group to 22 of which 11 had reached

practical completion by the year end and 11 were on-going.

-- IFRS blended net initial yield of 5.27% based on the value of

the portfolio on an IFRS basis as at 31 December 2019 , against the

portfolio's blended net initial yield on purchase of 5.91 % .

-- Further diversif ied the portfolio:

o 11 regions

o 149 local authorities

o 300 leases

o 16 Approved Providers

o 88 care providers

-- A s at 31 December 2019 , the weighted average unexpired

lease term (" WAULT ") was 25.7 years .

-- 100% of the Group's portfolio was fully let or pre-let and

income producing during the year (1) .

-- 100% of contracted rental income was either CPI or RPI linked.

Post Balance Sheet Activity

-- The Company declared a dividend of 1.285 pence per ordinary

share in respect of the period from 1 October to 31 December 2019.

This dividend will be paid on or around 27 March 20 20 to

shareholders on the register at 13 March 20 20 .

-- The dividend payable on 27 March 2020 brings the total

dividend per Ordinary Share paid by the Company to 5.0 95 pence per

s hare in respect of the financial year to 31 December 201 9 in

line with the Company's stated target. The Company is targe ting an

increase in the aggregate dividend , underpinned by the anticipated

growth in income . The 2020 dividend target will be determined in

line with February 2020 Consumer

Price Index once this data is made available (3) .

-- The Company acquired a further seven properties (91 units)

for an aggregate purchase price of approximately GBP19.3 million

(including costs).

Notes:

1 Excluding ongoing forward funded schemes that are under an agreement for lease

2 Including acquisition costs

3 These are targets only and not a profit forecast and there can

be no assurance that they will be met

Christopher Phillips, Chairman of Triple Point Social Housing

REIT plc, commented:

" We look forward to 2020 with optimism. This follows another

successful year in 2019 which has set us up well for the next 12

months. During 2019, we deployed the proceeds of two fund-raises

into more high-quality properties. We extended our debt facility

based on continuing demand from local Commissioners and are

approaching the optimal target level of gearing. We met our

dividend target and are making progress towards fully covering the

dividend. Rent continues to be paid and on time. In 2020 we will

continue to focus on property quality and due diligence, and our

principal challenge will be to help the sector meet growing

regulatory requests and increase the Company's share price to

reflect our continuing operational success. However, building on

our success this year and in previous years, we believe we are well

equipped to meet these challenges and more as we move forward into

2020. "

FOR FURTHER INFORMATION ON THE COMPANY, PLEASE CONTACT:

Triple Point Investment Management Tel: 020 7201 8976

LLP

(Delegated Investment Manager)

James Cranmer

Ben Beaton

Max Shenkman

Justin Hubble

Akur Capital (Financial Adviser) Tel: 020 7493 3631

Tom Frost

Anthony Richardson

Siobhan Sergeant

The Company's LEI is 213800BERVBS2HFTBC58.

Further information on the Company can be found on its website

at www.triplepointreit.com .

NOTES:

The Company invests in primarily newly developed social housing

assets in the UK, with a particular focus on supported housing. The

assets within the portfolio are subject to inflation-adjusted,

long-term (typically from 20 years to 30 years), Fully Repairing

and Insuring (" FRI ") leases with Approved Providers (being

Housing Associations, Local Authorities or other regulated

organisations in receipt of direct payment from local government).

The portfolio comprises investments into properties which are

already subject to an FRI lease with an Approved Provider, as well

as forward funding of pre-let developments but does not include any

direct development or speculative development.

There is increasing political pressure and social need to

increase housing supply across the UK which is creating

opportunities for private sector investors to help deliver this

housing . The Group's ability to provide forward funding for new

developments not only enables the Company to secure fit for

purpose, modern assets for its portfolio but also addresses the

chronic undersupply of suitable supported housing properties in the

UK at sustainable rents as well as delivering returns to

investors.

Triple Point Investment Management LLP (part of the Triple Point

Group) is responsible for management of the Group's portfolio (with

such functions having been delegated to it by Langham Hall Fund

Management LLP, the Company's alternative investment fund

manager).

The Company was admitted to trading on the Specialist Fund

Segment of the Main Market of the London Stock Exchange on 8 August

2017 and was admitted to the premium segment of the Official List

of the Financial Conduct Authority and migrated to trading on the

premium segment of the Main Market on 27 March 2018. The Company

operates as a UK Real Estate Investment Trust (" REIT ") and is a

constituent of the FTSE EPRA/NAREIT index.

CHAIRMAN'S STATEMENT

Introduction

I am pleased to write to you with the results of our second full

financial year. This year we have delivered another strong set of

results - both financially and in terms of social impact.

Our IFRS NAV per share rose by 1.66% to 105.37 pence, reflecting

our secure income and portfolio strength. As expected, our existing

portfolio has performed solidly, and we have continued to deploy

funds into high-quality properties leased to Approved Providers

which continue to strengthen as a result of ongoing regulatory

engagement.

Over the last 12 months, we successfully deployed the proceeds

of both our October 2018 equity raise and our December 2018

revolving credit facility. In October 2019, we extended the

revolving credit facility by another GBP60 million to meet the

strong demand for new Specialised Supported Housing properties.

From each and every acquisition in this evolving market, we learn

and improve our due diligence process, ensuring that, now and in

the future, we always invest in the best properties we can. We now

have 388 properties in 149 different local authorities in England,

Scotland and Wales which are leased (or pre-let) to 16 different

counterparties, ensuring strong diversification.

As always, in 2019 we made sure that the impact of our

investments was more than simply financial. We launched the Company

because we saw an opportunity to do well by doing good. We realised

that Specialised Supported Housing was a sector which could be

transformed by the careful investment of private capital into

high-quality, adapted, community-based homes around the UK. In

doing so, we could achieve a steady, long-term income stream for

our investors through rental income. But, as importantly, we could

also provide housing that simultaneously improves the health of the

people who live in it and saves the Government money compared to

housing people with long-term health needs in institutional

settings like care homes and hospitals. Research suggests that

someone in our housing saves the Government about GBP200 per week

when compared to care home accommodation. This figure increases to

about GBP2,000 a week compared to having someone with long-term

health needs in hospital (1) . For these reasons, the call for new

Specialised Supported Housing by Commissioners across the country

continued throughout 2019. In fact, at the last review in 2015, the

shortfall of supported housing was expected to be 46,771 units by

2024/2025 (2) . We hope our investments continue to address this

shortfall and benefit society into 2020 and beyond.

In previous reports we have discussed the evolution of

regulation in the Supported Housing market. The impact of this

regulatory engagement has remained an important part of the market

throughout 2019 - and is likely to remain so in 2020 and beyond as

historical issues are resolved. We discuss all this in detail in

the Investment Manager's Report, but it is worth saying now that,

despite some short-term delays caused by regulatory engagement, we

strongly welcome greater regulation of a sector that is rapidly

evolving and maturing. For all the improvements already made by

Registered Providers (3) , we remain committed to taking into

account the views of all relevant stakeholders to evolve the model

and ensure that the risks that the Regulator of Social Housing set

out in its April 2019 report (4) and its non-compliant ratings for

individual Registered Providers are mitigated (5) . This is

discussed in more detail in the Investment Manager's Report. This

will ensure the sector is sustainable and provides long-term

solutions to local government, care providers and individuals with

specific care needs. We believe that private capital continues to

play an important role, recognised by the Regulator, in addressing

the chronic undersupply and in delivering high-quality new housing

(6) .

Throughout 2019 we continued to build on the quality of our

portfolio. In April, for example, we acquired our first site in

Scotland, West Bowling Green, a flagship forward funding

development in the centre of Edinburgh which will be leased to

Inclusion Housing and which is being developed in conjunction with

Edinburgh City Council. In September we acquired Park View

Apartments , a self-contained 18-unit purpose built property in

Wolverhampton, that is leased to Bespoke Supported Tenancies.

Finally, in December we acquired Delph Crescent which is leased to

Care Housing Association and that was developed in full

collaboration with Bradford Metropolitan District Council.

Investing in high-quality housing helps provide the best health

outcomes for residents and the long-term sustainability of the

properties for the benefit of Approved Providers, care providers,

local authorities and our investors. We will continue to evolve our

due diligence criteria in 2020 to ensure we always buy the best

properties that we possibly can. When acquisition opportunities are

presented, our Investment Manager's deep sector knowledge and

well-established due diligence process allows them to conduct an

initial appraisal, at which point schemes are often rejected. To

date, we have rejected in excess of GBP 500 million of potential

deals as a result of property or counterparty quality.

Forward Funding

As part of our aim to buy the highest quality housing possible

and deliver the greatest social and financial impact, this year saw

us commit a significant level of capital to forward fund the

development of new properties amounting to GBP29.8 million on nine

projects. As at 31 December 2019, we have committed GBP56.2 million

to 22 forward funded projects, with 11 projects now having

completed and the remaining 11 expected to complete in 2020.

The ability to forward fund remains a key differentiator from

our competition and ensures that we are deploying funds into the

highest quality new-build projects available. Forward funding

allows the Group to enjoy valuation uplifts on new-build

properties, benefit from the high occupancy such custom-built

properties achieve, provide higher quality accommodation for

residents, as well as bring new housing stock to market to the

benefit of wider society. As ever, we need to balance how much

forward funding we have at any one time since these projects do not

generate income during construction. However, given the significant

benefits for residents and other stakeholders, we forward fund,

wherever possible, new development projects.

Deployment

During the twelve months of 2019 we bought 116 new properties,

which provide accommodation for 843 residents, for a total

investment cost of GBP13 0.5 million (7) . All our properties are

based in communities and have specialist adaptations for the needs

of residents agreed by the care provider, Commissioner and Approved

Provider. Beyond these completed properties, as at 31 December 2019

we had outstanding commitments of GBP24.3 million relating to four

properties on which we had exchanged, and 11 forward funded

properties on which had yet to complete construction. With our

second investment into Scotland in October 2019, our

diversification continues to grow. Following our investments in

2019, our overall portfolio has grown to 388 properties as at 31

December 2019 (31 December 2018: 272). These properties provide

accommodation for 2,728 residents (31 December 2018: 1,893).

During 2019, we began working with 26 new care providers and 40

new local authorities. Overall, we now have leases in place with 16

Approved Providers - the same number as at the end of 2018 - and

own properties into which 88 care providers operate (31 December

2018: 62) and located in 149 different local authorities (31

December 2018: 109). At the end of 2019, our portfolio's weighted

average unexpired lease term (including put/call options and

reversionary leases) was 25.7 years, compared to 27.2 years in the

previous period. This reflects the greater diversification of our

portfolio from the properties initially acquired on IPO and a

maturing of the market.

Deployment in 2019 was slower than 2018. This was the result of

the Group being further through its deployment cycle and greater

regulatory engagement causing Registered Providers to focus on

consolidation rather than growth. Regulatory engagement is

discussed in detail in the Investment Manager's Report below, and

while it has slowed down the deployment of new Specialised

Supported Housing it has improved governance, financial strength

and operations which will benefit Approved Providers and the wider

sector in the long-term.

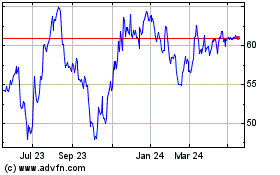

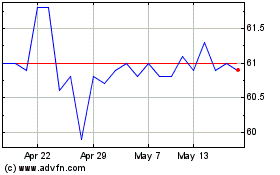

Share Price

The Company's share price came under pressure following the

publication of a report from the Regulator in April 2019 about

lease-based providers of Specialised Supported Housing. This had

the effect of reducing the Company's market capitalisation. As well

as acknowledging the benefits of private capital investing in this

sector, the report set out a number of risks for Registered

Providers.

It is true that a minority of Registered Providers operating in

this growing sector have been deemed non-compliant by the

Regulator. However, the fundamentals remain strong and it is

important to remember that the majority of Registered Providers

continue to perform well. In addition, there is persistent demand

for this type of housing, which provides better outcomes for

residents while saving the Government money. We continue to engage

with shareholders and other stakeholders to explain the strength of

the model generally and our operational performance

specifically.

Share Buybacks

During 2019, the Company bought back 450,000 Ordinary Shares at

a share price of between 83 and 83.3 pence per share. These shares

are now held in treasury. The Board decided to undertake share

buybacks because the Company's share price was trading at a

significant discount to net asset value following the publication

in April of the Regulator's report as mentioned above. The Board

took the view that share buybacks should be considered alongside

the acquisition of new properties, since share buybacks for

investment purposes are particularly attractive when the discount

to net asset value is wide, providing net asset value accretion for

ongoing shareholders.

The Company will continue to seek shareholder approval at its

annual general meeting, as a matter of course, to undertake share

buybacks at a discount to net asset value for up to 10% of the

Company's issued share capital. The Directors will consider share

buybacks if they believe them to be in the interests of

shareholders as a whole, taking into account the impact on

secondary market liquidity, the Company's ongoing charges ratio,

the terms of the Group's debt facilities, and general market

conditions including the availability of income-generating

investment opportunities.

Equity and Debt Raising

During 2019 we completed deployment of both the GBP108.2 million

of equity raised in October 2018 and the GBP70 million of debt

raised in December 2018. In October 2019, we extended that debt

facility by GBP60 million. As at 12 March 2020, GBP 29.4 million of

debt was uncommitted and available to be deployed to meet the

demand for more Specialised Supported Housing and help us achieve

full dividend cover towards the end of 2020. On a Group

consolidated basis, the current LTV is 31.1%.

Financial Results

As at 31 December 2019, our portfolio was independently valued

at GBP471.6 million on an IFRS basis. This reflects a valuation

uplift of GBP32.7 million, or 7.45%, over our total investment cost

(i.e. including transaction costs). The valuation reflects a

blended valuation net initial yield of 5.27%, which is better than

the portfolio's blended average net initial yield at purchase of

5.91%. This equates to a yield compression of 64 basis points,

reflecting our ability to buy good properties at off-market

prices.

As at 31 December 2019, our portfolio was valued at GBP503.8

million on a portfolio valuation basis (i.e. assuming a single sale

of the property-holding SPVs to a third-party on an arm's length

basis with purchaser's costs of 2.30%). The portfolio valuation

reflects a portfolio premium of GBP32.2 million against the IFRS

valuation.

IFRS earnings per share in the year was 6.75 pence and EPRA

earnings per share was 3.39 pence. The audited IFRS NAV per share

and the EPRA NAV per share were both 105.37 pence, an increase

since 31 December 2018 of 1.66%.

Dividends

The Company has paid three interim dividends of 1.27 pence per

share each for the year to 31 December 2019. On 5 March 2020 we

declared a further interim dividend of 1.285 pence per share for

the period 1 October to 31 December 2019, payable on or around 27

March 2020 to shareholders on the register on 13 March 2020,

bringing the total dividends paid or declared in respect of the

year to 31 December 2019 to 5.095 pence per share. This met our

dividend target for the whole year, representing an increase of

1.9% over 2018's aggregate dividend, in line with inflation and

reflecting the CPI-based rent reviews typically contained in the

leases over our properties.

The Company is targeting an increase in the aggregate dividend,

underpinned by the anticipated growth in income. The 2020 dividend

target will be determined in line with February 2020 Consumer Price

Index once this data is made available. It remains a priority of

ours to achieve a fully covered dividend. As at 31 December 2019,

EPRA earnings covered 66.6% of dividends. Full dividend cover by

EPRA earnings is expected in Q3 2020 once debt funds are fully

deployed. The delay in full dividend cover has resulted from the

slower than expected deployment of funds as Approved Providers have

focused on improving governance and operations, as required by the

Regulator, rather than growing their portfolios. However, on an

annualised basis, if all completed properties were

income-generating for the full period, the dividend cover would be

76%; if income on all exchanged and forward funded properties were

included, dividend cover would be 90%.

Outlook

We look forward to 2020 with optimism. This follows another

successful year in 2019 which has set us up well for the next 12

months. During 2019, we deployed the proceeds of two fund-raises

into more high-quality properties. We extended our debt facility

based on continuing demand from local Commissioners and are

approaching the optimal target level of gearing. We met our

dividend target and are making progress towards fully covering the

dividend. Rent continues to be paid and on time. In 2020 we will

continue to focus on property quality and due diligence, and our

principal challenge will be to help the sector meet growing

regulatory requests and increase the Company's share price to

reflect our continuing operational success. However, building on

our success this year and in previous years, we believe we are well

equipped to meet these challenges and more as we move forward into

2020.

Our success owes much to the strength of the Investment

Manager's network and due diligence processes. Through its hard

work, we have been able to continue buying best-in-class properties

around the country at attractive and sustainable yields.

I would like to take this opportunity to thank shareholders for

your continued support, and our Investment Manager and my fellow

Board members for their support and commitment throughout the

year.

Chris Phillips

Chairman

12 March 20 20

Notes:

1 Mencap, Funding supported housing for all (2018)

2 National Housing Federation, Supported housing: Understanding need and supply (2015)

3 See Investment Manager's report below.

4 Regulator of Social Housing, Lease-based providers of specialised supported housing (2019)

5 Regulator of Social Housing, Regulatory Notice: Bespoke Supportive Tenancies Limited (2019)

Regulator of Social Housing, Regulatory Notice: Encircle Housing

Limited (2019)

Regulator of Social Housing, Current regulatory judgement:

Inclusion Housing Community Interest Company (2019)

Regulator of Social Housing, Current regulatory judgement:

Westmoreland Supported Housing Limited (2019)

6 Regulator of Social Housing, Lease-based providers of

specialised supported housing (2019), para. 2.6.

7 Including acquisition costs

STRATEGY AND BUSINESS MODEL

The Board is responsible for the Group's Investment Objective

and Investment Policy and has overall responsibility for ensuring

the Group's activities are in line with such overall strategy. The

Group's Investment Policy and Investment Objective are published

below.

Investment Objective

The Group's investment objective is to provide shareholders with

stable, long-term, inflation-linked income from a portfolio of

social housing assets in the United Kingdom with a focus on

Supported Housing assets. The portfolio comprises investments in

operating assets and the forward funding of pre-let development

assets, the Company seeks to optimise the mix of these assets to

enable it to pay a covered dividend increasing in line with

inflation and so generate an attractive risk-adjusted total

return.

Investment Policy

To achieve its investment objective, the Group invests in a

diversified portfolio of freehold or long leasehold social housing

assets in the UK. Supported Housing assets account for at least 80%

of the Group's gross asset value. The Group acquires portfolios of

social housing assets and single social housing assets, either

directly or via SPVs. Each asset is subject to a lease or occupancy

agreement with an Approved Provider for terms primarily ranging

from 20 years to 30 years, with the rent payable thereunder subject

to adjustment in line with inflation (generally CPI). Title to the

assets remains with the Group under the terms of the relevant

lease. The Group is not responsible for any management or

maintenance obligations under the terms of the lease or occupancy

agreement, all of which are serviced by the Approved Provider

lessee. The Group is not responsible for the provision of care to

residents of Supported Housing assets.

The social housing assets are sourced in the market by the

Investment Manager.

The Group intends to hold its portfolio over the long-term,

taking advantage of long-term upward-only inflation-linked leases.

The Group will not be actively seeking to dispose of any of its

assets, although it may sell investments should an opportunity

arise that would enhance the value of the Group as a whole.

The Group may forward fund the development of new social housing

assets when the Investment Manager believes that to do so would

enhance returns for shareholders and/or secure an asset for the

Group's portfolio at an attractive yield. Forward funding will only

be provided in circumstances in which:

(a) there is an agreement to lease the relevant property upon

completion in place with an Approved Provider;

(b) planning permission has been granted in respect of the site; and

(c) the Group receives a return on its investment (at least

equivalent to the projected income return for the completed asset)

during the construction phase and before the start of the

lease.

For the avoidance of doubt, the Group will not acquire land for

speculative development of social housing assets.

In addition, the Group may engage third party contractors to

renovate or customise existing social housing assets as

necessary.

Gearing

The Group uses gearing to enhance equity returns. The Directors

will employ a level of borrowing that they consider prudent for the

asset class and will seek to achieve a low cost of funds while

maintaining flexibility in the underlying security requirements and

the structure of both the Company's portfolio and the Group.

The Directors intend that the Group will target a level of

aggregate borrowings over the medium-term equal to approximately

40% of the Group's gross asset value. The aggregate borrowings will

always be subject to an absolute maximum, calculated at the time of

drawdown, of 50% of the Group's gross asset value.

Debt will typically be secured at the asset level, whether over

a particular property or a holding entity for a particular property

(or series of properties), without recourse to the Company and

having consideration for key metrics including lender diversity,

cost of debt, debt type and maturity profiles.

Use of Derivatives

The Group may use derivatives for efficient portfolio

management. In particular, the Group may engage in full or partial

interest rate hedging or otherwise seek to mitigate the risk of

interest rate increases on borrowings incurred in accordance with

the Investment Policy as part of the Group's portfolio management.

The Group will not enter into derivative transactions for

speculative purposes.

Investment Restrictions

The following investment restrictions apply:

-- the Group will only invest in social housing assets located in the United Kingdom;

-- the Group will only invest in social housing assets where the

counterparty to the lease or occupancy agreement is an Approved

Provider. Notwithstanding that, the Group may acquire a portfolio

consisting predominantly of social housing assets where a small

minority of such assets are leased to third parties who are not

Approved Providers. The acquisition of such a portfolio will remain

within the Investment Policy provided that at least 90% (by value)

of the assets are leased to Approved Providers and, in aggregate,

all such assets within the Group's total portfolio represent less

than 5% of the Group's gross asset value at the time of

acquisition;

-- at least 80% of the Group's gross asset value will be

invested in Supported Housing assets;

-- the unexpired term of any lease or occupancy agreement

entered into (or in the case of an acquisition of a portfolio of

assets, the average unexpired term of such leases or occupancy

agreements) shall not be less than 15 years, unless the Investment

Manager reasonably expects the term of such shorter lease or

occupancy agreement (or in the case of an acquisition of a

portfolio of assets, the average term of such leases or occupancy

agreements) to be extended to at least 15 years;

-- the maximum exposure to any one asset (which, for the

avoidance of doubt, will include houses and/or apartment blocks

located on a contiguous basis) will not exceed 20% of the Group's

gross asset value;

-- the maximum exposure to any one Approved Provider will not

exceed 30% of the Group's gross asset value, other than in

exceptional circumstances for a period not to exceed three

months;

-- the Group may forward fund social housing units in

circumstances where there is an agreement to lease in place and

where the Group receives a coupon (or equivalent reduction in the

purchase price) on its investment (generally slightly above or

equal to the projected income return for the completed asset)

during the construction phase and before entry into the lease.

Forward funding equity commitments will be restricted to an

aggregate value of not more than 20% of the Group's net asset

value, calculated at the time of entering into any new forward

funding arrangement;

-- the Group will not invest in other alternative investment

funds or closed-ended investment companies (which, for the

avoidance of doubt, does not prohibit the acquisition of SPVs which

own individual, or portfolios of, social housing assets);

-- the Group will not set itself up as an Approved Provider; and

-- the Group will not engage in short selling.

The investment limits detailed above apply at the time of the

acquisition of the relevant asset in the portfolio. The Group will

not be required to dispose of any investment or to rebalance its

portfolio as a result of a change in the respective valuations of

its assets or a merger of Approved Providers.

Investment Strategy

The Group specialises in investing in UK social housing, with a

focus on Supported Housing. The strategy is underpinned by strong

local authority demand for more social housing, which is reflected

in the focus on acquiring recently developed and refurbished

properties across the United Kingdom. The assets within the

portfolio have typically been developed for pre-identified

residents and in response to demand specified by local authorities

or NHS commissioners. On acquisition, the properties are subject to

inflation-adjusted, long-term (typically from 20 years to 30

years), fully repairing and insuring leases with specialist

Approved Providers in receipt of direct payment from local

government (usually Registered Providers regulated by the Regulator

of Social Housing). The portfolio comprises investments made into

properties already subject to a fully repairing and insuring lease

as well as forward funding of pre-let developments. The portfolio

will not include any direct development or speculative development

investments.

Business Model

The Group owns and manages social housing properties that are

leased to experienced housing managers (typically Registered

Providers, which are often referred to as housing associations)

through long-term, inflation-linked, fully repairing and insuring

leases. The vast majority of the portfolio and future deal pipeline

is made up of Supported Housing homes which are residential

properties that have been adapted or built such that care and

support can easily be provided to vulnerable residents who may have

mental health issues, learning difficulties or physical

disabilities. We are focused on acquiring specially or recently

developed properties in order to help local authorities meet

increasing demand for suitable accommodation for vulnerable

residents (the drivers of this demand are discussed in the

Investment Manager's report). Local authorities are responsible for

housing these residents and for the provision of all care and

support services that are required.

The Supported Housing properties owned by the Group are leased

to Approved Providers which are usually not-for-profit

organisations focused on developing, tenanting and maintaining

housing assets in the public (and private) sectors. Approved

Providers are approved and regulated by the Government through the

Regulator of Social Housing (or in rare instances, where the Group

contracts with care providers, the Care Quality Commission). All

the Group's leases with Approved Providers are linked to inflation,

have a duration of 20 years or longer, and are fully repairing and

insuring - meaning that the obligations for management, repair and

maintenance of the property are passed to the Approved Provider.

The Approved Provider is also responsible for tenanting the

properties. Typically, the Government funds both the rent of the

individuals housed in Supported Housing and the maintenance costs

associated with managing the property. In addition, because of the

vulnerable nature of the residents, the rent and maintenance costs

are paid directly from the local authority to the Approved

Provider. The rent received from the local authority by the

Approved Provider is then paid to the Group via the lease. Ultimate

funding for the rent and maintenance comes from the Department for

Work and Pensions in the form of housing benefit.

The majority of residents housed in Supported Housing properties

require support and/or care. This is typically provided by a

separate care provider regulated by the Care Quality Commission.

The agreement for the provision of care for the residents is

between the local authority and the care provider. The care

provider is paid directly by the local authority. Usually the Group

has no direct financial or legal relationship with the care

provider and the Group never has any responsibility for the

provision of care to the residents in properties the Group owns.

The care provider will often be responsible for nominating

residents into the properties and, as a result, will normally

provide some voids cover to the Approved Provider should they not

be able to fill the asset (i.e. if occupancy is not 100% it is

often the care provider rather than the Approved Provider that will

cover the cost). The Group receives full rent regardless of

underlying occupancy, but monitors occupancy levels and the payment

of voids cover by care providers, to ensure that Approved Providers

are appropriately protected.

Many assets that the Investment Manager sources for the Group

have been recently developed and are either specifically designed

new build properties or renovated existing houses or apartment

blocks that have been adapted for Supported Housing. The benefit of

buying recently-developed stock is that it has been planned in

response to local authority demand and is designed to meet the

specific requirements of the intended residents. In addition, it

enables the Group to work with a select stable of high-quality

developers on pipelines of deals rather than being reliant on

acquiring portfolios of already-built assets on the open market.

This has two advantages: firstly, it enables the Group to source

the majority of its deals off-market through trusted developer

partners and, secondly, it ensures the Group has greater certainty

over its pipeline with visibility over the long-term deal flow of

the developers it works with and knows it will not have to compete

with other funders.

As well as acquiring recently-developed properties, the Group

can provide forward funding to developers of new Supported Housing

properties. Being able to provide forward funding gives the Group a

competitive advantage over other acquirers of Supported Housing

assets as it enables the Group to offer developers a single funding

partner for both construction and the acquisition of the completed

property. This is often more appealing to developers than having to

work with two separate funders during the build of a new property

as it reduces practical and relationship complexity. As well as

strengthening developer relationships, forward funding enables the

Group to have a greater portion of new build properties in its

portfolio which typically attract higher valuations, are modern and

have been custom-built to meet the needs of the residents they

house, helping to achieve higher occupancy levels. The Group

benefits from the Investment Manager's long track record of

successfully forward funding a range of property and infrastructure

assets. The Group will only provide forward funding when the

property has been pre-let to an Approved Provider and other

protections, such as fixed-priced build contracts and deferred

developer profits, have been put in place to mitigate construction

risk.

Since the Company's IPO, the Group has set out to build a

diversified portfolio that contains assets leased to a variety of

Approved Providers, in a range of different counties, and serviced

by a number of care providers. This has been possible due to the

Investment Manager's 14-year track record of asset-backed

investments, its active investment in the Supported Housing sector

since 2014, and the strong relationships it has enjoyed with local

authorities for over a decade. These relationships have enabled the

Group, in a relatively short space of time, to work with numerous

Approved Providers, care providers and local authorities to help

deliver new Supported Housing assets that provide homes to some of

the most vulnerable members of society.

KEY PERFORMANCE INDICATORS

In order to track the Group's progress the following key

performance indicators are monitored:

KPI AND DEFINITION RELEVANCE TO STRATEGY PERFORMANCE EXPLANATION

1. Dividend

--------------------------- ---------------------------- --------------------------- ----------------------------

Dividends paid to The dividend reflects the Total dividends of 5.095 The Company has declared a

shareholders and declared Company's ability to pence per share were paid dividend of 1.285 p ence

during the period. deliver a low risk but or declared in respect of per Ordinary share in

growing the period 1 respect of the period

income stream from the January 2019 to 31 1 October 2019 to 31

portfolio. December 2019. December 2019, which will

be paid on 27 March 2020.

(2018: 5.00p) Total dividends paid

and declared for the period

are in line with the

Company's target.

---------------------------- --------------------------- ----------------------------

2. IFRS NAV per share

--------------------------- ---------------------------- --------------------------- ----------------------------

The value of our assets The IFRS NAV reflects our 105.37 pence at 31 The IFRS NAV per share at

(based on an independent ability to grow the December 2019 IPO was 98.0 pence.

valuation) less the book portfolio and to add value

value of our liabilities, to it throughout (2018: 103.65 pence ) This is an increase of

attributable to the life cycle of our 7.52% since IPO driven by

shareholders. assets. growth in the underlying

asset value of the

investment properties.

---------------------------- --------------------------- ----------------------------

3. Loan to GAV

A proportion of our The Company uses gearing to 31 .1 % Loan to GAV at 31 As at 31 December 2019:

investment portfolio is enhance equity returns. December 2019. GBP68.5 million private

funded by borrowings. Our placement of loan notes

medium to long term (2018: 15.5%) with MetLife; and

target Loan to GAV is 40% a GBP130 million secured

with a hard cap of 50%. revolving credit facility

with Lloyds/NatWest of

which GBP101 million

was drawn at 31 December

2019.

4. Earnings per S hare

--------------------------- ---------------------------- --------------------------- ----------------------------

The post-tax earnings The EPS reflects our 6.75 pence per share EPS decreased by 19.35%

generated that are ability to generate for the year ended 31 during the year owing to

attributable to earnings from our portfolio December 2019, based on the weighted average number

shareholders. including valuation earnings including the of shares in

increases. fair value gain on the financial year being

properties, higher than the previous

calculated on the weighted financial year.

average number of shares

in issue during the year. The outlook remains

positive and we continue to

(2018: 8.37 pence) invest to generate an

attractive total return.

---------------------------- --------------------------- ----------------------------

5 . Weighted A verage U nexpired L ease T erm (WAULT)

--------------------------------------------------------- --------------------------- ----------------------------

The average unexpired The WAULT is a key measure 25.7 years at 31 December As at 31 December 2019, the

lease term of the of the quality of our 2019 (includes put and portfolio's WAULT stood at

investment portfolio, portfolio. Long lease terms call options). 25.7 years and remains well

weighted by annual passing underpin the ahead of

rents. security of our income (2018: 27.2 years) the Group's minimum term of

Our target is a WAULT of stream. 15 years.

at least 15 years.

---------------------------- --------------------------- ----------------------------

6 . Adjusted Portfolio E arnings P er S hare

--------------------------------------------------------- --------------------------- ----------------------------

The post-tax earnings The Adjusted EPS reflects 15.92 pence per share for The adjusted EPS shows the

adjusted for the market the application of using the value per share on a long

portfolio valuation the portfolio premium value year ended 31 December term basis under the

including portfolio and reflects 2019, special assumption

premium the potential increase in as shown in the of a hypothetical sale of

. value the Group could Financial Statements. the underlying property

realise if assets are sold investment portfolio in one

on a portfolio (2018: 12.91 pence) single transaction

basis.

---------------------------- --------------------------- ----------------------------

7. Portfolio NAV

---------------------------------------------------------- ---------------------------- ----------------------------

The IFRS NAV adjusted for The Portfolio NAV measure The Portfolio NAV of The Portfolio NAV per share

the market portfolio is to highlight the fair GBP401.9 million equates to shows a good market growth

valuation including value of net assets on an a Portfolio NAV of 114.53 p in the underlying asset

portfolio premium. ongoing, long-term ence per Ordinary value of the

basis and reflects the Share, as shown in the investment properties.

potential increase in value Financial Statements.

the Group could realise

under the special (2018: Portfolio NAV

assumption of a GBP384.3 million equated to

hypothetical sale of the 109.40 p ence per ordinary

underlying property share)

investment portfolio in one

single

transaction.

---------------------------- ---------------------------- ----------------------------

8. Exposure to Largest Approved Provider

----------------------------------------------------------------------------------------------------------------------

The percentage of the The exposure to the largest 20.6% Our target is lower than

Group's gross assets that Approved Provider must be 25%. We are substantially

are leased to the single monitored to ensure that we (2018: 15.8%) below our maximum exposure

largest Approved are not target with

Provider. overly exposed to one our largest Approved

Approved Provider in the Provider, Inclusion

event of a default Housing.

scenario.

---------------------------- ---------------------------- ----------------------------

9. Total Return

----------------------------------------------------------------------------------------------------------------------

IFRS NAV plus total The total return measure IFRS NAV 105.37 pence at 31 The IFRS NAV per share at

dividends paid during the highlights the gross return December 2019. 31 December 2019 was 105.37

year. to investors including Total dividends paid during pence. Adding back

dividends paid the year ended 31 December dividends paid during

since the prior year. 2019 were 5.06 pence the year of 5.06 pence per

Ordinary Share to the IFRS

Total return was 6.5% for NAV at 31 December 2019

the year to 31 December results in an

2019. increase of 6.5%.

(2018: 7.5%)

---------------------------- ---------------------------- ----------------------------

EPRA PERFORMANCE MEASURES

The table below shows additional performance measures,

calculated in accordance with the Best Practices Recommendations of

the European Public Real Estate Association (EPRA). We provide

these measures to aid comparison with other European real estate

businesses.

Full reconciliations of EPRA Earning and NAV are included in

Notes 3 6 and 3 7 of the consolidated financial statements

respectively. A full reconciliation of the other EPRA performance

measures are included in the Unaudited Performance Measures section

of the Annual Report .

KPI AND DEFINITION PURPOSE PERFORMANCE

1. EPRA Earnings per S hare

EPRA Earnings per share excludes A measure of a Group's underlying 3.39 pence per share for the year to

gains from fair value adjustment on operating results and an indication 31 December 2019

investment property that of the extent to which

are included in the IFRS calculation current dividend payments are (2018: 2.27 pence)

for Earnings per share. supported by earnings.

3.39 pence per share for the year

ended 31 December 2019. The Group is

currently in ramp up

phase and undertaking forward funding

developments resulting in a lag in

the Company's ability

to fully cover dividends. Our

priority remains to achieve a fully

covered dividend from operations.

We expect this to be achieved by Q3

2020.

======================================

2. EPRA NAV per S hare

-------------------------------------- -------------------------------------- --------------------------------------

EPRA NAV makes certain adjustments to Provides stakeholders with the most GBP369.7 m/105.37 pence per share as

IFRS NAV to exclude items not relevant information on the fair at 31 December 2019

expected to crystalise value of the assets and

in a long-term investment property liabilities within a true real estate GBP364.2 m/103.65 pence per share as

business model. As at 31 December investment company with a long-term at 31 December 2018

2019 both the EPRA NAV investment strategy.

and the IFRS NAV are equivalent.

-------------------------------------- -------------------------------------- --------------------------------------

3 . EPRA N NN AV per S hare

-------------------------------------- -------------------------------------- --------------------------------------

EPRA NAV adjusted to include the fair Makes an adjustment to EPRA NAV to GBP364.7m/103.93 pence per share as

values of: provide stakeholders with the most at 31 December 2019

1. financial instruments; relevant information

2. debt; and on the fair value of the assets and GBP364 .0 m/103.60 pence per share as

3. deferred taxes. liabilities within a true real estate at 31 December 2018

investment company.

-------------------------------------- -------------------------------------- --------------------------------------

4 . EPRA Net Initial Yield (NIY)

Annualised rental income based on the A comparable measure for portfolio 5.29% at 31 December 2019

cash rents passing at the balance valuations. This measure should make

sheet date, less non-recoverable it easier for investors 5.13% at 31 December 2018

property operating expenses, divided to judge for themselves how the

by the market value of the property, valuation of a portfolio compares

increased with (estimated) with others.

purchasers' costs.

======================================

5 . EPRA 'Topped-Up' NIY

This measure incorporates an The topped-up net initial yield is 5.29% at 31 December 2019

adjustment to the EPRA NIY in respect useful in that it allows investors to

of the expiration of rent-free see the yield based 5.21% at 31 December 2018

periods (or other unexpired lease on the full rent that is contracted

incentives s uch as discounted rent at 31 December 2019.

periods and step rents).

======================================

6 . EPRA Vacancy Rate

Estimated Market Rental Value (ERV) A "pure" percentage measure of 0.00% as at 31 December 2019

of vacant space divided by ERV of the investment property space that is

w hole portfolio. vacant, based on ERV. 0.00% as at 31 December 2018

======================================

7. EPRA Cost Ratio

====================================== ====================================== ======================================

Administrative & operating costs A key measure to enable meaningful 28.35% as at 31 December 2019

(including & excluding costs of measurement of the changes in a

direct vacancy) divided by Group's operating costs. 39.02% as at 31 December 2018

gross rental income.

====================================== ====================================== ======================================

INVESTMENT MANAGER'S REPORT

Review of the Group's Portfolio

Looking back over the Group's second full financial year, there

is much to be happy about. The Group's portfolio is performing

well. During the year, the Group bought 116 new properties - many

of them off-market - providing accommodation for 843 new residents.

The Group's portfolio now comprises 388 properties with

accommodation for 2,728 residents. It is diversified across 16

Approved Providers, 88 Care Providers and 149 local authorities.

The Group's WAULT remains high at 25.7 years. To date all of the

Group's rent has been received in full. The Group's portfolio was

independently valued at GBP471.6 million, an uplift of 7.45%

against total funds invested of GBP439 million.

In achieving all this, the Group spent the proceeds of the

equity and debt raises secured at the end of 2018, before

successfully securing a GBP60 million extension to the same debt

facility based on the strength of the sector's fundamentals and our

investment processes. Indeed, our due diligence evolves with every

transaction, and many deals are rejected despite falling within our

strict investment criteria. As you would expect, on each and every

transaction we analyse a wide and growing range of matters such as

legal title, property condition, Commissioner support, rent

support, and our counterparties' covenant strength. Central to our

due diligence is the physical quality of our properties.

High-quality properties mean safer housing, better outcomes for

residents, greater demand from local Commissioners and lower

maintenance costs for Registered Providers.

Ensuring that our investments have a positive social impact has

always been fundamental to our processes. However, we have recently

formalised the assessment of impact into our due diligence

documentation. This will allow us to measure and track impact as

well as we can, ensuring our investments always benefit society as

much as our shareholders. All future transactions will be formally

assessed against impact measures in both our upfront due diligence

questionnaire and our detailed due diligence tracker. Our

investment Committee will only allow investments to proceed to

completion if they demonstrate a clear social impact, primarily

through delivering more housing, saving the Government money, and

improving health outcomes for residents.

As part of our aim to make the Company one of the UK's leading

social impact REITs, we are commissioning a market-leading provider

of commercial due diligence in healthcare to conduct the largest

exercise in gathering primary data that the Specialised Supported

Housing sector has yet seen. The report will gather as much data as

is currently available on the size of the market, current demand,

future demand, the cost implications of this type of housing, and

the health outcomes it provides. This data will be gathered through

Freedom of Information requests, telephone interviews with

Commissioners and local authorities, reviews of Housing Strategy

papers, and analysis of portfolios from Registered Providers and/or

care providers operating in the sector. In collecting all this

data, the report should provide the most comprehensive and

up-to-date picture yet of the size, demand, and costs and benefits

of Specialised Supported Housing. We hope to have the report

completed in mid- 2020 and look forward to sharing it with all

stakeholders.

The publication of the Regulator's risk report in April 2019

focused on the risks that Registered Providers should consider when

operating the long-lease model. However, improvements continue to

be made by Registered Providers and operating performance remains

strong, as reflected in the positive momentum of the Company's

share price towards the end of 2019. Indeed, the reasons why the

Group was launched in the first place are still readily apparent on

the ground. Across the country there is still enormous demand -

from Commissioners, care providers and Approved Providers - for

this housing because it saves the Government money at the same time

as improving the lives of people living in it. It is exactly these

societal benefits which underpin the Group's rental income for its

investors. Without the Group's investment, its residents could

still be living in inappropriate settings to the detriment of

themselves, their families and the taxpayer.

Market Review

The rapid growth of the Supported Housing sector that

characterised 2016, 2017 and early 2018 has now matured into a

period of steadier growth and greater regulatory scrutiny during

2019. The sector, which traditionally had little regulatory

involvement, has been the subject of increasing engagement with the

Regulator of Social Housing. This engagement resulted in a series

of regulatory notices and judgements. In February, at the end of a

routine In-Depth Assessment, the Regulator published a Regulatory

Judgement on Inclusion Housing C.I.C., deeming it non-compliant in

terms of financial viability (V3) and governance (G3) (1) .

Inclusion's non-compliant judgement focused on the general risks of

leasing rather than owning properties.

Encircle Housing and Bespoke Supportive Tenancies Limited both

received non-compliant ratings in April and May respectively (2) .

Neither was given a formal rating because they had fewer than 1,000

units under management at the time the Regulator conducted its

investigations. Their judgements focused on specific issues

relating to risk management and indeed on 12 August 2019 a further

short notice was published about Bespoke Supportive Tenancies

concerning shortcomings in its compliance checks at certain

properties.

Finally, on 30 September 2019 the Regulator downgraded

Westmoreland Supported Housing's original governance rating from G3

to G4 (with its viability remaining at V3) (3) . This followed a

winding up petition submitted - but then withdrawn - by one of

Westmoreland's landlords over disputed rent. The Regulator deemed

that Westmoreland had a governance shortcoming as it had allowed

this to happen. Westmoreland has now had three new board members

appointed by the Regulator to improve its governance. All payments

under the Group's leases with Westmoreland continue to be paid on

time.

As at 31 December 2019, the Group had 90 properties leased to

Inclusion ( 20.6 % of the Group's G AV as at 31 December 2019), two

properties leased to Encircle (0. 6 % of G AV), 41 leased to

Bespoke Supportive Tenancies ( 6.1 % of G AV), and 15 leased to

Westmoreland ( 3.2 % of G AV). As at 31 December 2019, a ll rents

to the Group continue d to be paid in full.

Beyond these specific regulatory judgements, the Regulator's

April 2019 addendum to its 2018 Sector Risk Profile focused on the

risks of providers of Specialised Supported Housing which

predominantly lease, rather than own, properties owned by public or

private funds. The report acknowledged the importance of private

investment into this sector but focused on the risks that should be

borne in mind by both Registered Providers and investors into the

sector. After discussing these risks, the report stated that the

Regulator intends to work with Registered Providers to help them

mitigate these risks. This work presumably has had some success

because the 2019 Sector Risk Profile suggests that, despite

continuing concerns, these concerns relate to only some Registered

Providers. Importantly, when these regulatory judgements and

notices relate to properties owned by the Group they have not

affected the valuation of the Group's investments. The independent

account's valuer, JLL, have demonstrated strong evidence that,

regardless of the regulatory activities, the appetite from

investors for these assets remained unaffected and that similar

assets leased to the affected Registered Providers continued to

trade in the market without any discount. In the light of this JLL

concluded not to risk-adjust the respective yields in relation to

these assets in order to reflect lower market values.

In response to this regulatory engagement, Registered Providers

in this sector have been working to improve their governance, their

operations, and their financial positions. The 14 Registered

Providers we lease properties to have appointed 46 board members

since the start of 2018. These board members have backgrounds in

housing, care, finance and law. Operationally, Registered Providers

are recruiting more staff and are signing up to better software

packages to improve reporting. Financially, Registered Providers

are, as expected, using growing surpluses to diversify from leasing

properties into buying freehold properties, giving them asset bases

and more income. Over the last two financial years, the average net

asset value of our 14 Registered Providers increased by 34%.

In our view, these are the right responses to the risks properly

identified by the Regulator. As we said in our article in Social

Housing magazine in November 2019, we are working with Registered

Providers to ensure the standards of the Regulator are met. Even

though we are not regulated by the Regulator, as a long-term

stakeholder in this sector we are committed to ensuring the sector

works as well as it can for the long-term. We regularly meet our

Approved Providers to discuss financial reporting and governance

and help them to address specific property-related issues. We

continue to expand our property management team with a focus on

property inspections as well relationships with Registered

Providers and care providers.

In parallel, we continue to meet senior members of Government to

explain the nature and benefits of our investment model,

discussions which we hope will soon be informed by the

data-gathering report referred to above. We are also discussing

what adjustments we can make to the model that will uphold

financial and governance standards while attracting further private

investment. Already we have been rolling out a new force majeure

clause that allows tenants to re-negotiate rents in the event of a

change in Government rent policy. Likewise, we have been giving

tenants call options allowing them to extend the length of their

leases.

For all the Regulator's concerns about the performance of some

Registered Providers in this sector, they have recognised the

benefits of private investment (4) . The fundamentals of this

sector remain as compelling as ever. The House of Commons Library's

paper The Future of Supported Housing states that most supported

housing is "exceptionally good value for money, providing

significant cost savings for the wider public sector, while

maximising quality of life for tenants" (5) . In the same way,

Mencap's analysis has found that each person in Specialised

Supported Housing saves the Government about GBP200 per week

compared to being in a care home and about GBP2,000 per week

compared to being in a hospital (6) . Multiplying these costs

savings across the 2,728 units in the Group's portfolio (as at 31

December 2019) gives some indication of the scale of the

cost-savings the Group alone delivers.

Given these benefits, there is a strong case to use private

investment to fill the shortfall of Supported Housing that is

expected to be 46,771 units by 2024/25 (7) . Beyond the wider

housing crisis in the UK, demand for Specialised Supported Housing

specifically has grown for a number of reasons. As well as the

general population growing, the proportion of people living to

working age with health needs has increased as medical advances

have extended lifespans (8) . In addition, the Government continues

its policy - enshrined in the Care Act 2014 and the Transforming

Care Programme of 2015 - of moving people from institutional

settings into community-based settings (9) . It is perhaps no

surprise that we regularly hear from Commissioners in all parts of

the UK calling for more Specialised Supported Housing. As recently

as February 2020, the CQC released a report stating that "too many

people with a learning disability and autistic people are in

hospital because of a lack of local, intensive community services"

(10) . Our portfolio continues to diversify across the UK to meet

this demand - with two investments into Scotland in 2019, for

example. With demand for this type of housing as strong as ever,

pricing in the market remains competitive.

Politically, the strong Conservative majority won on 13 December

2019 is likely to lead to a period of stable Government after three

years of uncertainty and gridlock. The Government's parliamentary

majority will enable it to deal with Brexit transition negotiations

as quickly and efficiently as possible to take the issue off the

front pages. In any case, housing and social care - which are UK

based - are relatively insulated from the impact of Brexit.

Indeed, as well as giving the Government the ability to resolve

Brexit sooner, the Conservative majority will enable Government to

address other policy areas including social care and housing. The

Conservative manifesto promised another GBP74 million for care

packages over three years, which will benefit the care providers on

the Group's schemes. Likewise, the Government is targeting building

another million new homes over the course of the parliament. A

White Paper on social housing due to be published in 2020 is

expected to empower tenants and support the continued supply of

social homes (11) . Overall, the Group is well protected from the

impact of Brexit and should benefit from the new Government's

domestic policies.

Financial Review

As at 31 December 2019, the annualised rental income of the

Group was GBP25.4 million (excluding forward funding transactions)

(as at 31 December 2018, GBP17.4 million). The Group is a UK REIT

for tax purposes and is exempt from corporation tax on its property

rental business.

A fair value gain of GBP11.8 million was recognised during the

year on the revaluation of the Group's properties.

Slower than expected deployment, resulting from the engagement

of Registered Providers with the Regulator, has delayed when the

Group will achieve full dividend cover. Our priority remains to

achieve a fully covered dividend from operations, which we expect

to be achieved in this financial year. Earnings per share and EPRA

earnings per share are calculated on the weighted average number of

shares in issue during the period.

The audited IFRS NAV per share was 105.37 pence, a continual

increase from 103.65 pence as at 31 December 2018 as a result of

profits generated from rental income and an uplift in fair value

gain on investment property less dividends paid. The Group's EPRA

NAV per share is the same as the IFRS NAV at 105.37 pence. The IFRS

NAV adjusted for the portfolio valuation (including portfolio

premium) was GBP401.9 million, which equates to a Portfolio NAV of

114.53 pence per share.

The ongoing charges ratio is calculated as a percentage of the

average net asset value for the period under review. The ongoing

charges ratio for the year was 1.63% compared to 1.58% in the year

to 31 December 2018. This is due to the Investment Management fees

for the year increasing in line with deployment as fees are not

taken on cash.

At the year end, the portfolio was independently valued at

GBP471.6 million on an IFRS basis, reflecting a valuation uplift of

7.45% against the portfolio's aggregate purchase price (including

transaction costs). The valuation reflects a portfolio yield of

5.27%, against the portfolio's blended net initial yield of 5.91%

at the point of acquisition. This equates to a yield compression of

64 basis points, reflecting the quality of the Group's property

selection and off-market acquisition process.

The Group's properties were valued at GBP503.8 million on a

portfolio valuation basis, reflecting a portfolio premium of 6.82%

or a GBP32.2 million uplift against the IFRS valuation. The

portfolio valuation assumes a single sale of the property holding

SPVs to a third-party on an arm's length basis with purchaser's

costs of 2.30%.

Debt Financing

In October 2019, the Group secured a GBP60 million extension to

its existing GBP70 million Revolving Credit Facility ("RCF")

previously provided exclusively by Lloyds Bank plc. As part of the

extension, National Westminster Bank plc provided debt alongside

Lloyds Bank plc on identical terms. The Group now has the ability

to draw a total of up to GBP130 million under the RCF. The

extension of the RCF widens the Group's lender pool while providing

the Group with additional committed capital at an attractive

margin, to help finance the acquisition of supported housing assets

from its pipeline.

The RCF and its subsequent extension followed the long-dated,

fixed-rate, interest-only private placement of loan notes signed

with MetLife in July 2018 for GBP68.5 million which was fully

deployed in 2018. During the year, the Group drew down GBP100.6

million of the RCF, equating to 77% of the debt available under the

facility. The Group is planning to undertake further draws in the

first half year of 2020 and aims to be fully drawn in Q3 2020.

Both the MetLife facility and the RCF have been secured and

drawn at an initial loan-to-value ("LTV") of 40% against defined

pool of assets which is in line with the Company's investment

policy of a long-term level of aggregate borrowings equal to 40% of

the Group's gross asset value. As at 31 December 2019, the LTV for

MetLife was 37.8% and 40% for the RCF. On a Group consolidated

basis the current LTV is 31.1%.

The MetLife facility is split into two tranches, Tranche--A in

an amount of GBP41.5 million has a term of 10 years from

utilisation expiring in 30 June 2028 and Tranche--B in an amount of

GBP27 million has a term of 15 years from utilisation will expire

in 30 June 2033. The RCF has an initial four-year term expiring on

20 December 2022 and, subject to lender approval, may be extended

by a further two years to 20 December 2024.

The MetLife facility requires the Group to maintain an asset

cover ratio of x2.25 and an interest cover ratio of x1.75. The RCF

requires the Group to maintain on drawn funds a LTV ratio of lower

than 50% and an interest cover ratio in excess of x2.75. At all

times the Group has complied with debt covenants on both

facilities. As at 31 December 2019, the RCF remained unhedged. The

Board regularly reviews potential hedging arrangements which can be

put in place at any time during the duration of the facility.

The Group will continue to monitor capital requirements to

ensure we take advantage of developments in the market and achieve

dividend cover.

Strategic Alignment and Property Selection

In 2019, the Group has continued to execute its investment

strategy, delivering inflation-protected income underpinned by a

careful selection of secure, long-let and index-linked properties.

During the year, the Group bought 116 properties, which included

nine new forward funding transactions, for a total investment cost

of GBP13 0.5 million (including transaction costs).

31 December 31 December Change in

2019 2018 2019

# of Properties 388 272 +116

# of Leases 300 189 +111

# of Units 2,728 1,893 +835

# of APs 16 16 -

# of FFAs 22 13 +9

WAULT 25.7 27.2 -1.5

In addition, as at 31 December 2019 the Group had outstanding

commitments of GBP24.3 million (including transaction costs),

comprising GBP6.6 million for contracts exchanged on four

properties at the period end and GBP17.6 million for outstanding

forward funding commitments.

Committed Capital Total Funds GBP/million

------------------------------ ------------------------

Total Invested since IPO 439

Exchanges 6.6

Forward Funding Commitments 17.6

Total Invested and Committed

Capital 463.2

Property Portfolio and Asset Management

As at 31 December 2019, the property portfolio comprised 388

properties with 2,728 units and showed a broad geographic

diversification across the UK. The four largest concentrated areas

by market value were the North West (21.8%), West Midlands (15.9%),

East Midlands (14.2%) and London (11.3%). The IFRS value of the

property portfolio at 31 December 2019 was GBP471.6 million.

During 2019, the Group continued its forward funding programme

which forms an integral part of the Group's investment strategy,

creating significant value-add to the property portfolio. Through

forward funding, the Group enjoys valuation uplifts on new-build

properties and benefits from the high occupancy such custom-built

properties achieve driven by strong Commissioner demand. As at 31

December 2019, the Group had entered into a total of 22 forward

funding projects with 11 schemes having reached practical

completion and 11 schemes still under construction. Our asset

management team aims to visit every property in the Group's

portfolio each year, inspecting the quality of each asset and

meeting the Care Provider to ensure properties are maintained in

accordance with health and safety and the FRI leases; ultimately

safeguarding tenant welfare. Our dedicated Relationship Manager is

further strengthening our relations with Approved Providers and

Care Providers. The Group's portfolio is actively asset managed

with opportunities to improve environmental efficiencies factoring

heavily in addition to other asset management initiatives.

Rental Income

As at 31 December 2019, the property portfolio was fully let

(with all properties either let or pre-let on financial close),

comprising 300 fully repairing and insuring leases which excludes

the agreement for leases in relation to current forward funding

transactions. The total annualised rental income of GBP25.4 million