TIDMSND

RNS Number : 5788P

Sanderson Group PLC

09 June 2015

FOR IMMEDIATE RELEASE 9 JUNE 2015

SANDERSON GROUP PLC

Interim Results for the six months to 31 March 2015

"Continued progress, improved sales order intake and a very

strong order book; interim dividend up 12.5%

Appointment of Ian Newcombe as Chief Executive Officer"

Sanderson Group plc ('Sanderson' or 'the Group'), the software

and IT services business specialising in multi-channel retail and

manufacturing markets in the UK and Ireland, announces its interim

results for the six month period to 31 March 2015.

Commenting on the results, Chairman, Christopher Winn, said:

"The Group has made further progress during the period with

revenue increasing to GBP9.09 million (2014: GBP7.94 million) and

operating profit rising to GBP1.37 million (2014: GBP1.21 million).

Pre-contracted licence and ongoing support services recurring

revenue grew to GBP4.76 million (2014: GBP4.41 million)

representing 52% of total revenue in the period. Gross margin has

been maintained at a robust 85% (2014: 87%), reflecting our

continuing emphasis on the supply of Sanderson 'owned' proprietary

software and services. The Group's order book at the period end was

very strong and stood at GBP2.84 million (2014: GBP2.47

million).

"I am also very pleased to announce that Ian Newcombe, who has

made a major contribution to the formulation of the Group's

strategy and who has personally driven the development of the

multi-channel business has been appointed as Group Chief Executive

with immediate effect".

Highlights - Financial

-- Revenue increased to GBP9.09 million (2014: GBP7.94 million).

-- Pre-contracted recurring revenues of GBP4.76 million (2014: GBP4.41 million), representing

approximately 52% of total revenue.

-- Multi-channel retail division revenue and operating profits* increased to GBP5.96 million

(2014: GBP4.71 million) and GBP1.01 million (2014: GBP0.85 million) respectively; increased

levels of business from new customers and trend towards bigger orders from existing customers;

-- Manufacturing division revenue and operating profits* of GBP3.14 million (2014: GBP3.23 million)

and GBP0.36 million (2014: GBP0.37 million) respectively.

-- Operating profit* increased 13% to GBP1.37 million (2014: GBP1.21 million).

-- Profit before tax of GBP0.91 million (2014: GBP0.78 million).

-- Basic earnings per share of 1.5 pence (2014: 1.4 pence).

-- Net cash at period-end of GBP3.95 million (2014: GBP5.07 million) after acquisition related

cash consideration payments of GBP1.8 million.

-- Interim dividend up 12.5% to 0.9 pence per share (2014: 0.8 pence; 2013: 0.65 pence).

Highlights - Operational

-- Strong trading momentum maintained, complemented by increased levels of new business

-- Very strong order book of GBP2.84 million at period end (2014: GBP2.47 million)

-- Five new multi-channel retail customers during period, including Anzac Wines & Spirits; number

of large orders from existing customers including Superdry; eight new customers added by manufacturing

including Nutrifresh; several large projects with existing customers including Cook Trading.

-- Continued investment in proprietary solutions using mobile technologies.

-- Appointment today of Ian Newcombe as Group CEO.

* Operating profit is stated before amortisation of

acquisition-related intangibles, share-based payment charges and

acquisition-related costs

On current trading and prospects, Mr Winn, added:

"Whilst the Group will continue to invest across all of its

businesses, particular emphasis will be placed on further

developing the range of solutions for mobile and ecommerce

businesses, for the food and drink processing sector and for entry

level systems in the manufacturing division. Mobile solutions

continue to be developed across all of the Group's target markets.

To augment organic growth, selective acquisition opportunities will

continue to be considered. However, in the current year, management

intends to focus on delivering another set of "on target" trading

results.

The general economic environment continues to show signs of

improvement, though sales cycles remain protracted. The Board

remains cautious in its approach but a strong order book and

healthy balance sheet together with a long list of sales prospects,

provides the Board with a good level of confidence that the Group

will continue to make further progress and deliver trading results

in line with market expectations for the current year ending 30

September 2015."

Enquiries:

Christopher Winn, Chairman Telephone: 0333 123 1400

Ian Newcombe, Group Chief Executive

Adrian Frost, Finance Director

Paul Vann, Walbrook PR Limited Telephone: 0117 985 8989

or 07768 807631

Mark Taylor, Charles Stanley Securities Telephone: 020 7149 6000

(Nominated Advisor)

SANDERSON GROUP PLC

Interim Results for the six months to 31 March 2015

chairman's statement

Sanderson Group plc ('Sanderson' or 'the Group'), the software

and IT services business specialising in multi-channel retail and

manufacturing markets in the UK and Ireland, announces its interim

results for the six month period ended 31 March 2015 ('the

period').

Results

The Group has made further progress during the period with

revenue increasing to GBP9.09 million (2014: GBP7.94 million) and

operating profit rising to GBP1.37 million (2014: GBP1.21 million).

Pre-contracted licence and ongoing support services recurring

revenue grew to GBP4.76 million (2014: GBP4.41 million)

representing 52% of total revenue in the period. Gross margin has

been maintained at a robust 85% (2014: 87%), reflecting our

continuing emphasis on the supply of Sanderson 'owned' proprietary

software and services. The Group's order book at the period end was

very strong and stood at GBP2.84 million (2014: GBP2.47

million).

The Sanderson Board remains committed to pursuing a growth

strategy based upon a conservative financing policy, the

cornerstone of which is a strong balance sheet. The Group has an

established history of converting substantially all of its profit

to cash. During the period, the collection of a number of sales

ledger balances slipped beyond the period end, with a total of

GBP435,000 being received in the first week of April. At 31 March

2015, after the payment of GBP1.80 million consideration and

deferred consideration in respect of acquired businesses, the

Group's net cash balance was GBP3.95 million (2014: GBP5.07

million).

Dividend

The Board is also committed to maintaining a progressive

dividend policy and is pleased to declare an increase of 12.5% in

the level of the interim dividend to 0.90 pence per share (2014:

0.80 pence). The dividend will be paid on 14 August 2015 to

shareholders on the register at the close of business on 17 July

2015.

Acquisition of Warehouse Management Software provider,

Proteus

On 5 December 2014, the Group acquired a supplier of warehouse

management solutions, Proteus Software Limited ('Proteus'), for an

initial cash consideration of GBP1.40 million. Up to a further

GBP0.5 million is payable in March 2016, based upon the trading

performance of Proteus in the twelve months following acquisition.

Proteus solutions, which complement the Group's own products,

services and customers are used by businesses operating in the

areas of third party logistics, warehouse management and supply

chain distribution.

Business review

The primary target market for Sanderson products and services is

generally small and medium sized businesses whose current business

outlook we would describe as 'cautiously optimistic'. At the core

of the Group's well-developed business model is a strategy to

foster long-term customer relationships resulting in a high

proportion of sales arising from pre-contracted recurring revenue.

Sanderson software is licensed to customers on a 'right to use'

basis and these licence revenues are supplemented by support,

implementation and project management services provided by Group

staff.

The Group's solutions are developed and marketed to provide

customers with 'value for money' IT systems which offer tangible

business benefits. These solutions typically enable customers to

increase sales and revenue whilst also achieving additional

efficiencies by making and maintaining cost savings, often within

twelve months of implementation. The Group has continued to invest

in both the development of software products and services, as well

as in sales and marketing. Particular emphasis has been placed on

the Group businesses specialising in the UK food and drink

processing sector ('food and drink') and more especially in the

development of mobile commerce solutions which enable retailers to

capitalise on the huge growth in the widespread adoption of

smartphones and tablets and to exploit mobile as a sales channel

integrated with existing business systems.

Reflecting prior and continuing investment in the Group's sales

and marketing capacity and capability, Sanderson achieved an

improved intake of sales orders in the period of GBP4.94 million

compared with GBP4.27 million last year. Thirteen new customers

being gained (2014: twelve).

Review of multi-channel retail

Sanderson provides comprehensive IT solutions to businesses

operating in the ecommerce, mobile commerce, wholesale

distribution, cash and carry and retail sectors of the UK. Mobile

enablement and deployment continues to be a key business driver in

this sector with increasing levels of business activity. The

wholesale distribution and cash and carry market has been a slower

area of business during the period for the Group but prospects for

the second half year are good, driven by the release in February

2015 of our latest enhanced version of software. Proteus has made a

steady start to being part of Sanderson and has helped to further

expand the Group's presence in the areas of warehousing, logistics

and supply chain. A number of internal 'joint' sales opportunities

are being developed.

Five new customers were gained during the period, including

Anzac Wines & Spirits, Lavitta, Quba & Co and Matthew

Algie. This compares with seven in the comparative period of 2014.

The multi-channel retail division has continued to also gain a

number of large orders from existing customers including JD Sports,

Kingstown Associates, Healthspan and Superdry.

Divisional revenue was GBP5.96 million (2014: GBP4.71 million)

and operating profit rose by just under 20% to GBP1.01 million

(2014: GBP0.85 million). The period end order book was very strong

at GBP1.80 million (2014: GBP1.19 million) and with good sales

prospects, the multi-channel retail business is well-positioned to

achieve its increased trading targets for the current financial

year ending 30 September 2015.

Review of manufacturing

Businesses in the engineering, plastics, aerospace, electronics,

print ('general manufacturing') and food and drink processing

sectors represent the main areas of specialisation for Sanderson in

manufacturing markets. Sanderson continues to invest in product

development and in its sales and marketing capability for its food

and drink business. Traceability of products and ingredients

through the food manufacturing and supply chain is a strong feature

of the Sanderson food and drink solution - a key requirement for

businesses operating in the food and drink industry. Although, the

overall divisional trading performance was flat as compared with

the comparative period of 2014, the Sanderson general manufacturing

business improved its trading performance compared with the first

half of 2014 and this improvement is expected to continue into the

second half of the current year. The Group's food and drink

business experienced some delays in the receipt of expected sales

orders.

Eight new customers were gained during the period, including

Simtom Food Products, Summit Chairs, St Marcus Fine Foods, Wine

Bottling Solutions and NutriFresh. This compares with five new

customers in the comparative period of 2014. Large projects with

existing customers included Magnadata, Cook Trading, Food Partners

and Freddy Hirsch.

The Group has had some success with its entry level Unity ERP

('Enterprise Resource Planning) product which is aimed at smaller

and emerging businesses and over the coming months we expect to

further develop our software and to launch new products, including

further cloud-based solutions, into our target manufacturing

markets.

Revenue for the period was GBP3.14 million (2014: GBP3.23

million) and operating profit was GBP365,000 (2014: GBP367,000).

Recurring revenue represents over 61% of total divisional revenue

and covers over three-quarters of divisional overheads. The order

book is GBP1.04 million (2014: GBP1.28 million) and together with a

strong sales prospect list, should ensure that the manufacturing

division achieves another improved trading result for the full year

ending 30 September 2015.

Management and staff

I am pleased to announce that Ian Newcombe, who has made a major

contribution to the formulation of the Group's strategy and who has

personally driven the development of the multi-channel business,

has been appointed as Group Chief Executive with immediate effect.

The Sanderson executive plc team comprises myself as Executive

Chairman, Ian Newcombe as Group Chief Executive, and Adrian Frost

as Group Finance Director.

The Board of Sanderson Group plc has been further strengthened

by the appointment of David Gutteridge, as a non-executive

director. David has considerable business experience including with

Financial Objects plc, Cyan Holdings plc and Sanderson Group plc as

a non-executive director between IPO in 2004 up until 2012. David

was Chairman of Tinglobal Limited until May 2014, when he led a

successful trade sale to Singapore Listed, Declout Plc.

Sanderson now employs 223 staff with a high level of experience

and specialist expertise in the market sectors which the Group

addresses. On behalf of the Board, I would again like to thank

everyone for their hard work, support, dedication and contribution

to the ongoing development of the Group.

Strategy

The strategy of the Board is to achieve sustained growth by

further building and developing the Sanderson businesses operating

within the multi-channel retail and manufacturing target markets.

Whilst the Group will continue to invest across all of its

businesses, particular emphasis will be placed on further

developing the range of solutions for mobile and ecommerce

businesses, for the food and drink processing sector and for entry

level systems in the manufacturing division. Mobile solutions

continue to be developed across all of the Group's target

markets.

In order to augment organic growth, selective acquisition

opportunities will continue to be considered. However, in the

current year, management intends to focus on delivering another set

of 'on target' trading results.

Outlook

The general economic environment continues to show signs of

improvement, though sales cycles remain protracted. The Board

remains cautious in its approach but a strong order book and

healthy balance sheet together with a long list of sales prospects,

provides the Board with a good level of confidence that the Group

will continue to make further progress and deliver trading results

in line with market expectations for the current year ending 30

September 2015.

Christopher Winn

Chairman

9 June 2015

CONSOLIDATED INCOME STATEMENT

Note Unaudited Unaudited Audited

six months six months year to

to 31/03/15 to 31/03/14 30/09/14

GBP000 GBP000 GBP000

Revenue 2 9,090 7,940 16,411

Cost of sales (1,388) (1,028) (2,483)

------------ ------------ ---------

Gross profit 7,702 6,912 13,928

Other operating expenses (6,696) (6,061) (11,880)

------------ ------------ ---------

Results from operating activities 2 1,006 851 2,048

Results from operating activities

before adjustments in respect

of the following: 2 1,374 1,215 2,839

Amortisation of acquisition-related

intangibles (236) (172) (387)

Acquisition related costs (87) (157) (303)

Share-based payment charges (45) (35) (101)

------------ ------------ ---------

Results from operating activities 2 1,006 851 2,048

------------------------------------ ----- ------------ ------------ ---------

Net finance expense (101) (72) (132)

------------ ------------ ---------

Profit before taxation 905 779 1,916

Taxation (71) (59) (318)

------------ ------------ ---------

Profit for the period attributable

to equity holders of the parent 834 720 1,598

============ ============ =========

Earnings per share

From profit attributable to the

owners of the parent undertaking

during the period

Basic earnings per share 41.5p 1.4p 3.1p

Diluted earnings per share 41.5p 1.3p 2.9p

==== ==== ====

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Unaudited Unaudited Audited

six months six months year to

to 31/03/15 to 31/03/14 30/09/14

GBP000 GBP000 GBP000

Profit for the period 834 720 1,598

Other comprehensive income/(expense)

Items that will not subsequently

be reclassified to profit

or loss

Actuarial result on defined

benefit pension schemes - - (834)

Income tax relating to components

of other comprehensive income - - 183

------------- ------------- ----------

- - (651)

Items that will subsequently

be reclassified to profit

or loss

Change in the fair value

of available for sale financial

asset (22) 42 17

Foreign exchange translation

differences (6) - 23

Total comprehensive income

for the period 806 762 987

------------- ------------- ----------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

Unaudited Unaudited Audited

as at as at as at

31/03/15 31/03/14 30/09/14

GBP000 GBP000 GBP000

Non-current assets

Intangible assets 30,573 28,160 28,514

Property, plant & equipment 359 325 294

Deferred tax asset 1,048 1,221 1,145

---------- ---------- ----------

31,980 29,706 29,953

---------- ---------- ----------

Current assets

Inventories 27 5 4

Trade and other receivables 5,157 4,874 4,706

Current tax - - -

Other short-term financial

assets 200 247 222

Cash and cash equivalents 3,954 5,067 6,159

---------- ---------- ----------

9,338 10,193 11,091

---------- ---------- ----------

Current liabilities

Trade and other payables (3,431) (3,523) (3,355)

Deferred consideration (860) (645) (815)

Current tax liabilities (39) (5) (47)

Deferred income (4,853) (4,427) (4,412)

---------- ---------- ----------

(9,183) (8,600) (8,629)

---------- ---------- ----------

Net current assets 155 1,593 2,462

Non-current liabilities

Deferred tax liabilities (747) (453) (581)

Deferred consideration (606) (1,399) (1,213)

Pension and other employee

obligations (4,600) (4,072) (4,804)

(5,953) (5,924) (6,598)

---------- ---------- ----------

Net assets 26,182 25,375 25,817

---------- ---------- ----------

Equity

Called-up share capital 5,455 5,184 5,406

Share premium 9,015 7,699 8,809

Available for sale reserve 69 116 91

Foreign exchange reserve (15) (32) (9)

Retained earnings 11,658 12,408 11,520

---------- ---------- ----------

Total equity 26,182 25,375 25,817

---------- ---------- ----------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six month period to 31 March 2015

Share Share premium Other Retained Total equity

capital GBP000 reserves earnings GBP000

GBP000 GBP000 GBP000

At 1 October 2014 5,406 8,809 82 11,520 25,817

Exercise of share options 49 206 - (150) 105

Dividend paid - - - (544) (544)

Settlement of share options - - - (47) (47)

Share-based payment charge - - - 45 45

Transactions with owners 49 206 - (696) (441)

--------- -------------- ---------- ---------- -------------

Profit for the period - - - 834 834

Other comprehensive income:

Foreign exchange translation

difference - - (6) - (6)

Change in market value of

short-term financial asset - - (22) - (22)

Total comprehensive expense - - (28) 834 806

--------- -------------- ---------- ---------- -------------

At 31 March 2015 5,455 9,015 54 11,658 26,182

--------- -------------- ---------- ---------- -------------

For the six month period to 31 March 2014

Share Share premium Other reserves Retained Total equity

capital GBP000 GBP000 earnings GBP000

GBP000 GBP000

At 1 October 2013 4,380 4,302 42 12,175 20,899

Shares issued on placing 636 2,864 - - 3,500

Costs associated with placing - (180) - - (180)

Shares issued as consideration 131 619 - - 750

Exercise of share options 37 94 - (82) 49

Dividend paid - - - (440) (440)

Share-based payment charge - - - 35 35

--------- -------------- --------------- ---------- -------------

Transactions with owners 804 3,397 - (487) 3,714

--------- -------------- --------------- ---------- -------------

Profit for the period - - - 720 720

Other comprehensive income:

Change in market value of

short-term financial asset - - 42 - 42

--------- -------------- --------------- ---------- -------------

Total comprehensive expense - - 42 720 762

--------- -------------- --------------- ---------- -------------

At 31 March 2014 5,184 7,699 84 12,408 25,375

--------- -------------- --------------- ---------- -------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY (continued)

For the year ended 30 September 2014

Share Share Other reserves Retained Total

capital premium GBP000 earnings equity

GBP000 GBP000 GBP000 GBP000

At 1 October 2013 4,380 4,302 42 12,175 20,899

Exercise of share options 258 1,206 - (830) 634

Issue of shares 768 3,482 - - 4,250

Costs incurred in respect

of share issue - (181) - - (181)

Dividend paid - - - (873) (873)

Share-based payment charge - - - 101 101

Transactions with owners 1,026 4,507 - (1,602) 3,931

--------- --------- --------------- ---------- --------

Profit for the year - - - 1,598 1,598

Other comprehensive income:

Remeasurement of net defined

benefit liability - - - (834) (834)

Deferred tax on above - - - 183 183

Foreign exchange translation

differences - - 23 - 23

Change in fair value of

available for sale financial

asset - - 17 - 17

--------- --------- --------------- ---------- --------

Total comprehensive expense - - 40 947 987

--------- --------- --------------- ---------- --------

At 30 September 2014 5,406 8,809 82 11,520 25,817

--------- --------- --------------- ---------- --------

CONSOLIDATED STATEMENT OF CASH FLOWS

Unaudited Unaudited Audited

six months six months year to

to 31/03/15 to 31/03/14 30/09/14

Note GBP000 GBP000 GBP000

Profit for the period 834 720 1,598

Adjustments for:

Depreciation and amortisation 490 326 765

Share-based payment charges 45 35 101

Net finance expense 101 72 132

Income tax expense 71 59 318

============= ============= ==========

Operating cash flow from continuing

operations before working capital

movements 1,541 1,212 2,914

Movement in working capital (792) (204) (224)

============= ============= ==========

Cash generated by continuing operations 749 1,008 2,690

Interest paid - - (2)

Payments to defined benefit pension

scheme (300) (180) (360)

Net cash from operating activities 449 828 2,328

------------- ------------- ----------

Investing activities

Purchases of property, plant &

equipment (101) (66) (113)

Acquisition of subsidiary, net

of cash acquired (948) (2,046) (2,046)

Deferred consideration paid (845) (50) (100)

Dividend received - - 15

Bank interest received 12 - 13

Expenditure on product development (286) (190) (680)

============= ============= ==========

Net cash received used in investing

activities (2,168) (2,352) (2,911)

============= ============= ==========

Financing activities

Equity dividends paid 5 (544) (440) (873)

Issue of shares, net of costs 105 3,369 3,953

Settlement of share options (47) - -

Net cash (used in)/arising from

financing activities (486) 2,929 3,080

============= ============= ==========

(Decrease)/increase in cash and

cash equivalents (2,205) 1,405 2,497

Cash and cash equivalents at start

of the period 6,159 3,662 3,662

Cash and cash equivalents at end

of the period 3,954 5,067 6,159

------------- ------------- ----------

NOTES TO THE INTERIM RESULTS

1. Basis of preparation

The Group's interim results for the six month period ended 31

March 2015 are prepared in accordance with the Group's accounting

policies which are based on the recognition and measurement

principles of International Financial Reporting Standards ('IFRS')

as adopted by the EU and effective, or expected to be adopted and

effective, at 30 September 2015. As permitted, this interim report

has been prepared in accordance with the AIM rules and not in

accordance with IAS34 'Interim financial reporting'.

These interim results do not constitute full statutory accounts

within the meaning of section 434(5) of the Companies Act 2006 and

are unaudited. The unaudited interim financial statements were

approved by the Board of Directors on 8 June 2015.

The consolidated financial statements are prepared under the

historical cost convention as modified to include the revaluation

of financial instruments. The statutory accounts for the year ended

30 September 2014, which were prepared under IFRS, have been filed

with the Registrar of Companies. These statutory accounts carried

an unqualified Auditors' Report and did not contain a statement

under either Section 498(2) or (3) of the Companies Act 2006.

2. Segmental reporting

The Group is managed as two separate divisions, manufacturing

and multi-channel retail. Substantially all revenue is generated

within the UK.

Manufacturing Multi-channel retail Total

Six Six Year Six Six Year Six Six Year

months months Ended months months Ended months months Ended

31/03/15 31/03/14 30/09/14 31/03/15 31/03/14 30/09/14 31/03/15 31/03/14 30/09/14

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------- --------- ---------- --------- --------- ---------- ---------- ---------- ----------

Revenue 3,135 3,227 6,736 5,955 4,713 9,675 9,090 7,940 16,411

--------- --------- ---------- --------- --------- ---------- ---------- ---------- ----------

Operating

profit

before

adjustments* 365 367 952 1,009 848 1,887 1,374 1,215 2,839

--------- --------- ---------- --------- --------- ---------- ---------- ---------- ----------

Amortisation (27) (26) (53) (209) (146) (334) (236) (172) (387)

Share-based

payment (4) (2) (22) (41) (33) (79) (45) (35) (101)

Acquisition-

related

costs - - - (87) (157) (303) (87) (157) (303)

--------- --------- ---------- --------- --------- ---------- ---------- ---------- ----------

Operating

profit 334 339 877 672 512 1,171 1,006 851 2,048

--------- --------- ---------- --------- --------- ----------

Net finance

expense (101) (72) (132)

---------- ---------- ----------

Profit before tax; continuing operations 905 779 1,916

---------- ---------- ----------

* Adjustments to operating profit in respect of amortisation of

acquisition-related intangibles, share-based payment charges and

acquisition-related costs.

3. Acquisition

On 5 December 2014 the Group acquired the entire issued ordinary

share capital of Proteus Software Limited for a maximum aggregate

consideration of GBP1.9 million. Cash consideration of GBP1.40

million was paid at completion with up to a further GBP500,000

payable by reference to the profitability of the business in the

year ending on the anniversary of the acquisition date.

The business provides warehouse management solutions to

businesses operating in the areas of third party logistics,

warehouse management and supply chain distribution. The business

complements the Group's existing operations in these areas, a major

reason for the Group completing the acquisition. Following

completion of the transaction, the Group controls 100% of the

voting rights of Proteus Software Limited.

In the period from acquisition to 31 March 2015 the business

contributed revenue of GBP866,000 and an operating profit of

GBP47,000 before amortisation of acquisition-related intangibles

and acquisition-related costs. Had Proteus Software Limited been

owned from 1 October 2014 the results of the Group set out in the

Income Statement would not have been materially different from

those shown.

It is estimated that the acquisition had the following effect on

the Group's assets and liabilities at the acquisition date:

Pre-acquisition Fair value Recognised

carrying adjustment value on

amount acquisition

GBP000 GBP000 GBP000

Property, plant and equipment 32 - 32

IPR 390 260 650

Other intangibles assets - 410 410

Stock 42 - 42

Trade and other receivables 692 (8) 684

Cash and cash equivalents 452 - 452

Deferred income (640) (144) (784)

Trade and other payables (370) (394) (764)

Deferred taxation - (192) (192)

---------------- ------------

Net identifiable assets and

liabilities 598 (68) 530

---------------- ------------

Goodwill on acquisition 1,135

-------------

1,665

=============

Cash consideration paid at completion 1,400

Deferred contingent cash consideration 265

-------------

Net consideration payable 1,665

=============

Deferred contingent cash consideration is stated at the

directors' estimate of the amount payable, based on trading

forecasts of the acquired business. The directors have not

discounted the deferred consideration as the full amount is payable

within twelve months of the reporting date.

Goodwill arising on the acquisition is not tax deductible.

4. Earnings per share

Unaudited Unaudited Audited

six months six months year to

to 31/03/15 to 31/03/14 30/09/14

GBP000 GBP000 GBP000

Earnings:

Result for the year from continuing

operations 834 720 1,598

Amortisation of acquisition-related

intangibles 236 172 387

Share-based payment charges 45 35 101

Acquisition-related costs 87 157 303

Adjusted profit for the year from

continuing operations 1,202 1,084 2,389

============ ============ =========

Number of shares: Unaudited Unaudited Audited

six months six months year to

to 31/03/15 to 31/03/14 30/09/14

No. No. No.

In issue at the start of the year 54,063,808 43,800,946 43,800,946

Effect of shares issued in the year 152,155 6,830,766 8,057,990

Weighted average number of shares

at year end 54,215,963 50,631,712 51,858,936

Effect of share options 1,465,785 2,901,219 2,328,723

Weighted average number of shares

(diluted) 55,681,748 53,532,931 54,187,659

============ ============ ==========

Earnings per share: Audited

Unaudited Unaudited year to

six months six months

to 31/03/15 to 31/03/14 30/09/14

(pence) (pence) (pence)

Total attributable to equity holders

of the parent undertaking:

Basic 1.5 1.4 3.1

Diluted 1.5 1.3 2.9

------------- ------------- ---------

Earnings per share, adjusted, from

continuing operations:

Basic 2.2 2.1 4.6

Diluted 2.2 2.0 4.4

--- --- ---

5. Equity dividends paid

Unaudited Unaudited Audited

Six months Six months Year to

to 31/03/15 to 31/03/14 30/09/14

GBP000 GBP000 GBP000

Interim dividend - - 432

Final dividend 544 440 440

------------- ------------- ----------

Total dividend paid in period 544 440 872

------------- ------------- ----------

6. Interim report

The Group's interim report will be sent to the Company's

shareholders. This report will also be available from the Company's

registered office and on the Company's website

www.sanderson.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR EAAKPEENSEAF

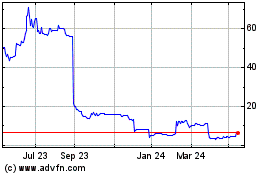

Sondrel (holdings) (LSE:SND)

Historical Stock Chart

From Aug 2024 to Sep 2024

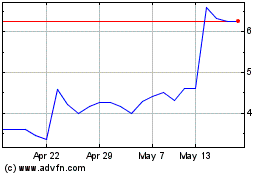

Sondrel (holdings) (LSE:SND)

Historical Stock Chart

From Sep 2023 to Sep 2024