Restore PLC AGM Trading Update (1657M)

May 20 2022 - 2:00AM

UK Regulatory

TIDMRST

RNS Number : 1657M

Restore PLC

20 May 2022

20 May 2022

Restore plc

("Restore" or the "Group" or "Company")

AGM Trading Update

Continued strong trading momentum

Restore (AIM: RST), the UK's leading provider of digital and

information management and secure lifecycle services, provides the

following trading update ahead of its Annual General Meeting to be

held later today.

Trading for the four months to 30(th) April was in line with

Board's expectation.

-- Strong momentum seen in H2 2021 continued throughout the period:

-- Revenue c.37% ahead of the comparative period driven by

organic growth (+14%), acquisition effects (+18%) and COVID-19

repair (+5%).

-- Run rate revenue expanded from GBP255 million reported in

January 2022 to more than GBP265 million at end of the period.

-- Digital and Information Management division experienced high

organic growth rates through storage expansion and strong demand

for integrated services with Restore Digital winning and executing

on major contract wins in the period, including Scottish

Census.

-- Secure Lifecycle Services showed continued revenue momentum

with growing underlying demand in Restore Technology, sustained

project delivery across UK from Harrow Green and growing revenues

from Restore Datashred as office activity increases and from strong

paper pricing.

-- Cost inflation greater than anticipated but largely mitigated

to date through productivity and pricing.

-- Acquisition strategy progressed in the period with two

transactions completed and c.GBP10m of capital deployed to acquire

Ultratec, expanding the capability of Restore Technology, together

with a small bolt-on in Records Management. The pipeline of

strategic deals remains very strong across the Group with a number

of potential acquisitions currently in exclusivity.

The Group's interim results will be announced on the 28(th) July

2022.

Charles Bligh, CEO, commented:

"After a record year in 2021, Restore has continued its strong

momentum in 2022. Revenue continues to expand and we are hiring

staff to support increasing activity levels for the essential

services we provide to customers as they also rebound, transform

their business and seek to reduce their costs.

We continue to progress our strategic pipeline of acquisition

opportunities and are seeing an increasing number of businesses

coming to market and anticipate substantial opportunities to invest

whilst maintaining our disciplined approach to valuation and

integration.

This combination of strong organic expansion and acquisition

driven growth are the foundations of our strategy and we believe

will provide strong returns to shareholders over the medium to long

term."

For further information:

Restore plc www.restoreplc.com

Charles Bligh, CEO

Neil Ritchie, CFO +44 (0) 207 409 2420

Investec (Nominated Adviser and Joint www.investec.com

Broker)

Carlton Nelson

James Rudd +44 (0) 207 597 5970

Canaccord Genuity (Joint Broker, Corporate www.canaccordgenuity.com

Advisor) )

Max Hartley

Chris Robinson +44 (0) 207 523 8000

Citi (Joint Broker) www.citigroup.com

Stuart Field

Luke Spells +44 (0) 207 986 4074

Buchanan Communications (PR enquiries) www.buchanan.uk.com

Charles Ryland

Stephanie Whitmore +44 (0) 207 466 5000

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEASSNFSFAEFA

(END) Dow Jones Newswires

May 20, 2022 02:00 ET (06:00 GMT)

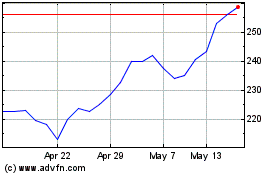

Restore (LSE:RST)

Historical Stock Chart

From Jun 2024 to Jul 2024

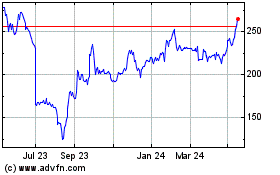

Restore (LSE:RST)

Historical Stock Chart

From Jul 2023 to Jul 2024