TIDMRST

RNS Number : 8334L

Restore PLC

15 September 2021

15 September 2021

Restore plc

("Restore" or the "Group" or "Company")

Positive Trading Momentum Continues

Restore plc (AIM: RST), the UK's leading provider of integrated

information and data management services, secure technology

recycling, and commercial relocation solutions, is pleased to

provide the following trading update for the eight months to 31

August 2021.

Following the strong first half performance reported on 27 July

2021, the Group has achieved further positive trading momentum in

the third quarter and continues to make excellent progress on its

strategy to expand through organic growth, strategic acquisitions

and margin improvement:

-- Trading in July and August has continued the positive

momentum achieved throughout the year, supporting confidence in a

strong second half performance in line with the Board's

expectation

-- Current run rate level of revenue now at GBP254 million, with

run rate EBITDA of GBP74 million (c.18% growth above pre-COVID-19

revenue levels)

-- Customer demand continues to increase across all business

units with particularly strong demand growth experienced in

Technology, Datashred and Harrow Green in August

-- Restore continues to deliver positive net box growth in its

Records Management business and restates previous guidance of

between 1-2% box growth for 2021

-- EDM performance in line with expectations, with operational

integration expected to complete on 1 October 2021. Customer

experience during integration has been excellent. Synergies

expected to be at c.GBP2.6 million pa which is at the higher end of

the range communicated at the time of the acquisition

-- PRM Green, acquired on 10 August 2021 with average yearly

revenue of GBP3 million and EBITDA of GBP0.9m, further progressing

Restore Technology's leading position in the IT Asset Disposal and

Recycling market. Overall Restore Technology has doubled in size in

the last 18 months with run rate revenues in excess of GBP30

million pa

-- In H1 the Group completed acquisitions to the value of

GBP80.9 million and in H2 is expecting to complete acquisitions to

the value of GBP20-30 million, including the PRM Green acquisition

already completed. This is in line with Restore's stated strategy,

and there is a very good pipeline of deals for H2 at advanced

stages across all business units. Our pipeline for acquisitions for

2022 is also building strongly

-- Underlying cashflow dynamics continue to be very positive,

albeit with increasing working capital investment in the second

half to capitalise on the strong bounce back in revenue

-- Group leadership talent has significantly improved in the

last 18 months and with selective recruitment and talent from new

acquisitions, the platform for growth is strong. In addition, with

rising demand Restore is aggressively expanding the scale of

operations; specifically the Group's digital capability with a

significant recruitment plan in place for H2 across all business

units

CONTINUED DELIVERY OF GROWTH STRATEGY

The Group has a clear strategy to become the UK's leading

provider of integrated information and data management services,

secure technology recycling, and commercial relocation solutions.

Delivery of this will enable sustainable and significant profit

growth, well ahead of our underlying markets, enhanced further by

disciplined and effective investment of our cash flows into both

organic and inorganic opportunities.

Restore has made significant progress in this strategy in the

last two years, with the Group considerably enhanced in size (c.18%

larger), capability and market position. Despite the challenges

posed by the pandemic, Restore has grown its overall market share

significantly from 11% to 13% over the past 12 months. In addition,

strategic acquisitions in the last 12 months have transformed the

scale and growth opportunity of our Digital, Records Management and

Technology businesses. Datashred and Harrow Green have notably

improved their operating platforms to enhance customer experience

and increase margins and with organic demand and acquisitions

expect a very strong contribution to profit growth.

Our inve stment case is compelling with our growth strategy to

double profits in the medium term.

Charles Bligh, CEO, commented:

"Restore continues to perform very well and I am particularly

pleased with the sales activity levels across all the business

units which shows real demand for our mission critical services.

The summer period saw first half positive momentum continued and

consequently the Board remains very confident in delivering its

full year expectations and in line with our objective of

significant growth.

Importantly, the pandemic has not impacted our strategic

ambition or progress, with current run rate revenue of GBP254

million pa well above pre COVID-19 levels. We expect to deliver

further growth in H2 and are hiring talent aggressively as a

result."

Restore will hold a Capital Markets Day on 9 November 2021.

Restore plc www.restoreplc.com

Charles Bligh, CEO 020 7409 2420

Neil Ritchie, CFO

Peel Hunt LLP www.peelhunt.com

Mike Bell 020 7418 8900

Ed Allsopp

Buchanan Communications www.buchanan.uk.com

Charles Ryland 020 7466 5000

Vicky Hayns

Stephanie Whitmore

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGUGDCCSBDGBU

(END) Dow Jones Newswires

September 15, 2021 02:00 ET (06:00 GMT)

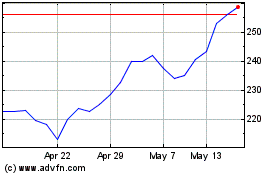

Restore (LSE:RST)

Historical Stock Chart

From Jun 2024 to Jul 2024

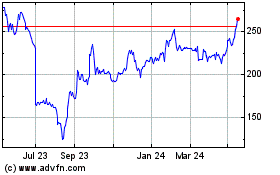

Restore (LSE:RST)

Historical Stock Chart

From Jul 2023 to Jul 2024