Shell Weighs More Divestments as Its Profit Falls Sharply -- WSJ

January 31 2020 - 3:02AM

Dow Jones News

By Sarah McFarlane

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 31, 2020).

LONDON -- Royal Dutch Shell PLC said it could ratchet up

divestments as it reported a sharp drop in profit for 2019.

The company slowed the pace of spending on share buybacks,

fueling doubts that it would meet its goal of completing the $25

billion program this year, and cut the value of its U.S. Appalachia

assets amid low natural gas prices.

"All macroeconomic indicators are working against us," said

Shell's Chief Executive Ben van Beurden on Thursday.

Shell and many of its energy-sector peers have suffered from

lower commodity prices and weaker refining and chemical margins in

the past year, with weaker results making it more difficult for

some companies to keep up their returns to shareholders.

U.S. energy giants Exxon Mobil Corp. and Chevron Corp. are set

to report results on Friday.

The difficult market conditions are challenging Shell's plans to

transform itself into a lower-carbon business as governments focus

on tackling climate change by supporting new technologies such as

electric vehicles and renewable energy.

Shell said its investments in 2020 would be at the low end of

the range it had targeted of $24 billion to $29 billion. The

company confirmed that this would mean spending on energy projects

such as wind and solar power would also be at the low end of the

previous guidance of between $1 billion and $2 billion.

The company has spent $2.3 billion on so-called new energies

since 2017 and at its management day in June last year set out

ambitions to incrementally increase its spending in this area.

"The weak macro backdrop is not conducive to Shell being able to

decarbonize unless they can reduce their debt," said Christyan

Malek, head of oil-and-gas research for Europe, the Middle East and

Africa at JPMorgan. "This places a strong emphasis on their oil and

gas business which is critical to funding its transformation."

Shell plans to divest $10 billion in assets in the 2019 to 2020

period and has already achieved around half of that, but Mr. Van

Beurden said the company was working on deals that could amount to

about $13 billion for the period.

"How that pans out depends a little bit on the pace at which we

can close deals, and we will be driven by an economic rationale,

rather than a desire to have early cash," he said.

Shell divested around $30 billion of assets in the 2016 to 2018

period, after its $50 billion acquisition of BG Group.

That deal also saw Shell commit to a $25 billion share buyback

program that started in July 2018 and has reached $15 billion so

far. The company plans to cut spending on the program to $1 billion

in the period to April 27 from $2.75 billion for the three months

ended Jan. 27.

Biraj Borkhataria, co-head of European energy research at RBC

Capital Markets, said Shell was unlikely to reach the $25 billion

target by the end of 2020, and mid-2021 was a more realistic time

frame.

The company's shares were down 3.7% in European trading on

Thursday.

The decision to slow the pace of spending on buying back shares

came after Shell's gearing level -- its net debt as a percentage of

total capital -- rose to 29% in the fourth quarter, above the

company's target of 25% and the 28% level reported for the third

quarter. Gearing levels are one of the measures used by credit

credit-rating firms to assess the risk a company faces. Lenders and

investors tend to perceive a gearing level below 25% as low

risk.

Ratings agency Moody's lead analyst for Shell, Sven Reinke, said

that even with Shell's weak fourth-quarter results the company

"remains solidly positioned with no immediate negative rating

pressure."

Shell confirmed a $2.24 billion impairment charge, mainly

because a global oversupply of natural gas has weighed on U.S.

prices. This follows billions of dollars of cuts to asset values

since October by companies including Chevron, Spain's Repsol SA,

the U.K.'s BP PLC, and Norway's Equinor ASA.

--Adriano Marchese in Barcelona contributed to this article.

Write to Sarah McFarlane at sarah.mcfarlane@wsj.com

(END) Dow Jones Newswires

January 31, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

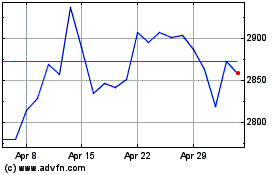

Shell (LSE:SHEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

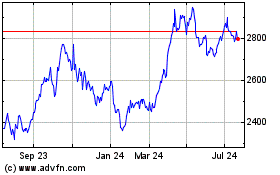

Shell (LSE:SHEL)

Historical Stock Chart

From Apr 2023 to Apr 2024