TIDMRBW

RNS Number : 6231R

Rainbow Rare Earths Limited

30 October 2023

30 October 2023

Rainbow Rare Earths Limited

("Rainbow" or "the Company")

LSE: RBW

Preliminary Results for the Year ended 30 June 2023

Rainbow Rare Earths is pleased to announce its preliminary

results for the year ended 30 June 2023 ("FY 2023" or the "Year").

The financial information in this release does not constitute the

Financial Statements. The Group's Annual Report, which includes the

audit report and audited Financial Statements for the year ended 30

June 2023, will be available on the Company's website at

www.rainbowrareearths.com .

Highlights

-- Demand for the rare earth elements ("REEs") used in permanent

magnets is forecast to rise significantly to meet global

decarbonisation targets due to their essential use in electric

vehicles ("EVs") and wind turbines.

-- Rapid progress has been made towards Rainbow's aim to be a

forerunner in the establishment of an independent and ethical

supply chain of REEs.

-- Rainbow has the opportunity to be a multi-asset rare earth

developer with two opportunities targeting secondary sources of

rare earths: the Phalaborwa phosphogypsum project in South Africa

and, post Year-end via the Memorandum of Understanding signed with

the Mosaic Company ("Mosaic"), the earlier stage Uberaba

phosphogypsum project in Brazil.

-- Both Phalaborwa and Uberaba host all four of the critical

magnet rare earths, being neodymium and praseodymium ("NdPr") and

the heavies Dysprosium ("Dy") and Terbium ("Tb"), which is where

the most severe supply shortages are forecast.

-- The Preliminary Economic Assessment ("PEA") published in

October 2022 highlighted Phalaborwa as one of the lowest cost rare

earth projects in development today, allowing for strong cash

generation in all foreseeable REE pricing scenarios.

-- Phalaborwa's proposed processing flow sheet to recover REEs

was confirmed via the delivery of mixed rare earth sulphate in

September 2023 from the front-end pilot plant in Johannesburg,

South Africa; the back-end pilot plant in Lakeland, USA has

completed commissioning and is expected to deliver separated rare

earth oxides during the current quarter.

-- Rainbow continued to cement its position within an

independent and ethical supply chain via offtake agreements in

principle with UK-based Less Common Metals for future rare earth

oxide production, and with NEXUS in South Africa for its gypsum

by-product.

-- Phalaborwa project is founded on principles of circularity

via the extraction of value from 'waste' products; planned sale of

gypsum by-product will allow for complete environmental

rehabilitation of site.

-- Phalaborwa ownership increased from 70% to 85% with an option to acquire the remaining 15%.

-- Rainbow has been working with carbon and climate change

advisors to further understand Phalaborwa's potential environmental

impacts and will provide its first annual disclosure in line with

the recommendations of the Task Force on Climate-related Financial

Disclosures in its 2023 Annual Report.

-- Following the change in focus of Rainbow's business the

Directors decided against investing significant amounts in Burundi

to develop a formal mineral resource resulting in an impairment

review for the Gakara cash generating unit, which has been written

down to a net asset value of nil.

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Market Abuse Regulation (EU) No 596/2014 ("MAR") which has been

incorporated into UK law by the European Union (Withdrawal) Act

2018 until the release of this announcement.

For further information, please contact:

Rainbow Rare Earths George Bennett

Ltd Company Pete Gardner +27 82 652 8526

IR Cathy Malins +44 7876 796 629

cathym@rainbowrareearths.com

Matthew Armitt

Jennifer Lee

Berenberg Broker Detlir Elezi +44 (0) 20 3207 7800

Tavistock Communications PR/IR Charles Vivian +44 (0) 20 7920 3150

Tara Vivian-Neal rainbowrareearths@tavistock.co.uk

Notes to Editors:

Rainbow Rare Earths aims to be a forerunner in the establishment

of an independent and ethical supply chain of the rare earth

elements that are driving the green energy transition. It is doing

this successfully via the identification and development of

secondary rare earth deposits that can be brought into production

quicker and at a lower cost than traditional hard rock mining

projects, with a focus on the permanent magnet rare earth elements

neodymium and praseodymium, dysprosium and terbium.

The Company is focused on the development of the Phalaborwa Rare

Earths Project in South Africa and the earlier stage Uberaba

Project in Brazil. Both projects entail the recovery of rare earths

from phosphogypsum stacks that occur as the by-product of

phosphoric acid production, with the original source rock for both

deposits being a hardrock carbonatite. Rainbow intends to use a

proprietary separation technique developed by and in conjunction

with its partner K-Technologies, Inc., which simplifies the process

of producing separated rare earth oxides (versus traditional

solvent extraction), leading to cost and environmental

benefits.

The Phalaborwa Preliminary Economic Assessment has confirmed

strong base line economics for the project, which has a base case

NPV(10) of US$627 million ([1]) , an average EBITDA operating

margin of 75% and a payback period of less than two years. Pilot

plant operations commenced in 2023, with the project expected to

reach commercial production in 2026, just five years after work

began on the project by Rainbow.

For more information, visit www.rainbowrareearths.com

Chairman's Statement

Dear Shareholder,

The world is currently in the midst of a new industrial

revolution - the transition to a sustainable green energy system.

This shift is set to drive a huge increase in the requirements for

the minerals needed to power clean energy technologies. Of these

minerals, REEs are recognised as amongst those with the highest

risk for supply shortages, as well as displaying considerable

supply chain vulnerability due to China's dominant position in the

market.

REEs are essential components of permanent magnets, which are

found in a plethora of high tech products, including smartphones,

camera lenses, plasma screens, hard drives and even artificial

joints. However, it is their use in electric vehicles ("EVs") and

wind turbines that is driving major future market growth, with

Argus Media Ltd estimating that supply of the magnet rare earths,

NdPr, Dy and Tb, will need to grow by ca. 8% per annum by 2032 in

order to match demand.

Rainbow's aim is to be a forerunner in the establishment of an

independent, sustainable and ethical supply chain of REEs and I am

delighted to note that we made excellent progress towards this aim

in the Year via the advancement of the Phalaborwa project in South

Africa and, post Year end, via the MOU entered into with Mosaic to

jointly develop the Uberaba project in Brazil.

Both projects target secondary sources of rare earths, being

phosphogypsum stacks that are the residue of phosphoric acid

production. These stacks sit at surface, thereby eliminating the

traditional geological risk and cost of mining, and are therefore

expected to have a significantly lower capital intensity and

operating expenditure ("opex") than traditional rare earth mining

projects. Furthermore they can be considered "near-term" production

opportunities - for example, the Phalaborwa project is expected to

commence operations in 2026, which is just five years after Rainbow

secured the project.

The outstanding economics of the Phalaborwa project were

confirmed via the publication of its Preliminary Economic

Assessment ("PEA") in October last year, which noted a base case

NPV(10) of US$627 million, an average EBITDA operating margin of

75% and a payback period of less than two years. This very high

margin sets Phalaborwa apart from other development projects in our

space as it can withstand significant pricing volatility.

Post Year-end, the Phalaborwa project recorded a major milestone

with the recovery of the first mixed rare earth sulphate from the

front-end pilot plant in Johannesburg. This material is considered

to be a commercially saleable product that could be a standalone

revenue stream for the project, with an estimated sales value of

ca. 60% of the global price for separated rare earth oxides. The

mixed rare earth sulphate will be used as the feed stock to produce

separated rare earth oxides at the back end pilot plant at K-Tech's

facility in Florida.

Responsible supply

Rainbow's business model is driven by the shift to cleaner

energy, in that we will produce the materials required to make

permanent magnets needed for EVs and wind turbines - with this

comes a responsibility to operate in a sustainable manner. We have

the opportunity at Phalaborwa to clean up legacy environmental

issues on site, the main one being acid water which has accumulated

over the unlined gypsum stacks. The acid water will be neutralised

and used as process water, with the remnant gypsum then deposited

on new lined stacks according to International Finance Corporation

("IFC") / Equator Principles. This gypsum is intended to be further

on-sold as a clean and benign feed for the cement and other

industries, leaving the site rehabilitated to its original state

over time.

Phalaborwa's potential to be a near-term source of ethical

magnet rare earth supply was recognised by Less Common Metals Ltd

("LCM"), with whom we have entered into a strategic supply

agreement for Phalaborwa production. LCM is currently the only rare

earth metal and alloy manufacturing facility in the UK and one of

the only facilities in the EU. Its location is of strategic

importance to Rainbow as the Group's aim is to play an important

part in the establishment of a Western supply chain for critical

REEs outside of Chinese control.

Portfolio development

Post Year-end, the agreement with Mosaic represents a major

opportunity for Rainbow to replicate Phalaborwa at a potentially

larger scale. The Uberaba phosphogypsum material is similar to

Rainbow's Phalaborwa project in South Africa in that the original

feedstock was based on a hardrock carbonatite phosphate deposit.

Initial assay analysis from samples have indicated an average grade

of 0.58% total rare earth oxides ("TREO"), which is more than 30%

higher than the 0.44% TREO for Phalaborwa, and confirmed that the

Uberaba basket contains all four of the most economically important

rare earths, NdPr at ca. 25% of the basket and includes the two

"heavy" permanent magnet rare earths, Dy and Tb.

Further to the acquisition of the Phalaborwa project in December

2020 and the subsequent development of processing technology to

recover REEs from phosphogypsum as a by-product of phosphoric acid

production, the Directors have re-focused the business on secondary

sources of REEs where they consider higher returns are available.

As such, the Directors no longer intend to invest significant

capital at the Gakara asset in Burundi to convert the existing

resource target to a reserve status. This resulted in an impairment

review being carried out for the Gakara assets in the year ended 30

June 2023 and led to the net assets being written down to nil as at

30 June 2023.

Corporate development

Rainbow's successful development in FY 2023 was rewarded by

continued strong backing for the Company in the market, with a

placing to raise US$9.5 million in May 2023 achieved at a premium

of 30% to the share price, and a placing post Year-end in September

2023 to raise US$5.4 million achieved at a minor discount of 3% to

the share price.

Both fundraisings included cornerstone participation by TechMet

Limited ("TechMet"), a private investment company developing world

class projects across the critical metals for the global energy

transition, and which counts the US International Development

Finance Corporation ("DFC") as a major backer.

Pursuant to the nomination right held by TechMet, Darryll Castle

(currently Director of Operations for TechMet) joined the Rainbow

Board in June 2023. Through his extensive career Darryll has served

as an executive director of a number of mining and production

companies and has first-hand operations and projects experience

globally. We welcome Darryll to the Board.

Responsible production is a core component of our business model

and Rainbow has made good progress this year with setting up the

structural aspects that will ensure ESG is integrated into our

operations. Post Year-end, the Board approved a new Sustainability

Policy for the Group and we have committed to a number of United

Nations Sustainable Development Goals ("SDGs"), which will provide

a focal point for our sustainability strategy and plans.

We have been working with carbon and climate change advisors to

further understand Phalaborwa's potential environmental impacts and

have provided our first annual disclosure in line with the

recommendations of the Task Force on Climate-related Financial

Disclosures ("TCFD").

Poised for success

I believe Rainbow offers a compelling investment opportunity in

our space. Further to the MOU with Mosaic in Brazil, Rainbow has

become one of the only rare earth development companies in the

world with multiple near-term production opportunities, as well as

occupying a unique position in the pipeline given our ability to

utilise innovative and proprietary technology to take the

processing of our material all the way through to separated rare

earth oxides.

This is an exciting time for the Group and I look forward to the

imminent production of separated rare earth oxides in Q4 calendar

year ("CY") 2023, bearing in mind Rainbow will be one of the first

companies to do this on US soil, which further validates our vision

to be an integral part of an independent and Western supply chain

of rare earths.

I would like to thank the host countries in which we operate and

all our staff who have worked so diligently in laying the platform

for delivering one of the most exciting rare earth stories in the

world.

Adonis Pouroulis

Non-Executive Chairman

Q&A with the CEO

What do you consider to be the key achievements of FY 2023?

FY 2023 has been a period of further rapid development for

Rainbow and the progression of our aim to be a forerunner in the

establishment of an independent and ethical supply chain of the

rare earth elements driving the green energy transition.

The publication of the Phalaborwa PEA in October last year

demonstrated that this was one of the lowest cost rare earth

projects in development today and, not only that, it could be

brought into production at much quicker pace than traditional

projects, as it involves the processing of gypsum stacks already

sitting at surface, thereby eliminating the cost and risk of

mining.

Phalaborwa will use a unique processing flowsheet that was

developed by and in conjunction with our partner K-Tech and which

incorporates continuous ion exchange ("CIX") and continuous ion

chromatography ("CIC"). While this technology was proven at

lab-scale, we wanted to demonstrate that it is commercially viable

and this was achieved both during the Year and post Year-end via

the successful operation of our pilot plant and the production of

the mixed rare earth sulphate.

This validates Rainbow's business model and has allowed us to

target other phosphogypsum resources globally. Post Year-end, we

signed an MOU with Mosaic in Brazil with regards to the Uberaba

phosphogypsum stack, which is expected to have comparable

characteristics to Phalaborwa due to the similarities of the host

rock. This deal has opened up the future for Rainbow to become a

multi-asset producer of rare earth elements from secondary

sources.

Post Year-end, we also entered into a strategic supply agreement

with LCM, the UK-based world leader in the manufacture and supply

of complex alloy systems and metals. Securing a buyer of our

separated rare earth oxides that shares our values and aspirations

was of strategic importance to Rainbow, especially as the vast

majority of rare earth processing and manufacturing companies are

based in China.

The intention is for the separated rare earth oxides produced by

Phalaborwa to be manufactured by LCM into metal in order to create

an alloy, which is then supplied to permanent magnet manufacturers

in the EU and the USA, with the ultimate customer of the rare earth

permanent magnets being clearly defined and in alignment with the

positioning of both Rainbow and LCM in a Western supply chain.

And what were the key challenges?

We continued to see turbulence in the global geopolitical

landscape, which had ramifications for economies worldwide,

particularly with the ongoing disruption to supply chains and the

rising cost of various inputs and commodities. This compounded the

issue of slower global economic activity and growth that was

already an issue further to the impacts of the Covid-19

pandemic.

We have found that this has played out with investors taking a

"risk-off" approach, especially with regards to smaller companies

in the resources sector. In spite of these external, macro-economic

challenges, we continue to be greatly encouraged by the progress we

have been able to make internally and fortunately we have a host of

catalyst points over the next six months to two years, as we

deliver on the various milestones that bring Phalaborwa closer to

first production in 2026.

Another challenge relates to volatility in the pricing of rare

earths experienced during the Year, albeit Rainbow is not in

production as of yet. Pricing performed strongly in the year ended

30 June 2022 ("FY 2022") due to surging demand, especially

following a rush to install offshore wind capacity in China to take

advantage of government subsidies, combined with the continued

adoption of EVs worldwide. Pricing was also positively impacted by

supply disruptions due to the COVID-19 pandemic and the start of

the conflict between Ukraine and Russia. However, in FY 2023 we saw

a correction in pricing as China increased supply, set against a

backdrop of softer economic conditions.

At the time of this Report, pricing has recovered from the lows

and expectations are for further improvements into 2024.

We remain confident that the long-term outlook for rare earth

demand and pricing is positive as there is a mandated shift to the

electrification of our transport system, as well as the exponential

roll-out of offshore wind capacity worldwide in order to meet

global decarbonisation and net zero targets.

Can you give an update on the Phalaborwa project?

Work at Phalaborwa has continued apace and we are underway with

all the various workstreams required for the Definitive Feasibility

Study ("DFS"), which we plan to complete by the end of H2 CY 2024

subject to funding.

A major component of this was the construction, commissioning

and operation of the pilot plant to prove up our proprietary

separation technology, both at scale and on a continuous basis, as

well as to produce sufficient quantities of separated permanent

magnet rare earth oxides for testing and marketing purposes.

During the Year, the decision was made to split the pilot plant,

so that the front-end, which will produce a high-value mixed rare

earth sulphate, would remain in South Africa close to the

Phalaborwa project, while the back-end, which will produce

separated rare earth oxides, would be built and run at the premises

of our partner, K-Tech. This would deliver cost and time

efficiencies as a result of removing the logistics involved in

transporting pilot-scale equipment from the USA, where it is

designed, fabricated, and tested, to South Africa, where it would

have to be reassembled and commissioned, as well as ensuring that

key K-Tech personnel would be available on site to oversee and

optimise the process in real-time.

Post Year-end, we achieved a major milestone with the production

of the first mixed rare earth sulphate from Phalaborwa

phosphogypsum material at the pilot plant front-end pilot plant in

Johannesburg. This was a significant de-risking event for the

project and the Group, as it confirms Phalaborwa as a rare earth

producer and can provide a standalone revenue stream for the

project.

This material will be used as feed for the back-end pilot plant

and will be processed further to produce separated rare earth

oxides in Q4 CY 2023.

How does the Phalaborwa project compare to other rare earth

development projects globally?

Phalaborwa is a unique project with exceptional economics, as

demonstrated by the PEA. One of the main aspects that attracted me

to the project was its comparatively low cost base, which provides

resilience against pricing volatility:

-- firstly, as this is not a traditional mining project there

are no costs associated with drilling, blasting, crushing, milling

and flotation to produce a mixed rare earth concentrate;

-- secondly, the phosphogypsum material has already been

chemically "cracked" because it is the by-product of phosphoric

acid production, meaning it has already been subjected to heat and

sulphuric acid - the cracked material allows for a simpler

hydrometallurgical process to produce separated and purified rare

earth oxides; and

-- thirdly, the CIX / CIC separation technology developed by

K-Tech replaces traditional solvent extraction ("SX") technology,

which uses toxic and flammable solvents and diluents and requires

many different stages, thereby delivering a process that is safer

and more environmentally responsible, as well as reduced capital

and operating costs due to a simplified flowsheet.

The project also has exceptional sustainability-related

opportunities as it is founded on the principles of circularity. We

will be taking a waste product (the existing phosphogypsum stacks),

cleaning it and extracting value from it - both via the recovery of

the REEs and then via the sale of the benign gypsum that is

produced as the by-product of the process. Our operations will see

the clean-up of the legacy environmental issues, namely the acid

water on site, and will fully deplete the gypsum stacks over time,

thereby allowing for a full-circle environmental rehabilitation of

the site.

Finally, a key benefit of targeting a secondary source of rare

earths in this manner is that the project can be brought into

production in a much quicker manner than traditional mining

projects. In fact, we are targeting for the project to begin

production just five years after we commenced work on site.

What are the key risks to its development?

As the process developed with and by K-Tech is a novel process,

albeit using existing technologies and equipment, investors

undoubtedly saw technology risk as a key hurdle to investment. This

was why the successful production of a mixed rare earth sulphate

from the front-end pilot plant in August 2023 was an important

milestone; however, we expect to see the benefit of a "de-risked"

investment case once the backend pilot plant produces the separated

rare earth oxides - expected in Q4 2023.

Management has always had a high level of confidence in the

technology. For us, it is more about timing of the project

development and what could impact that. Permitting in South Africa

is a factor, which is why we are running the various workstreams

required already, alongside or incorporated with the DFS

requirements. The fact that the project will be cleaning up the

legacy issue of acid water on site I think incentivises the

permitting process to stay on track as it is to the benefit of the

local environment and communities.

In terms of financing, we believe that Phalaborwa will continue

to be of interest to strategic investors, especially since it will

produce all four of the critical rare earths for permanent magnets,

including the heavies Dy and Tb, which are of even scarcer supply.

In fact, McKinsey released a report in 2023 noting that of all the

critical minerals it surveyed, Dy could see the most severe

imbalances of supply with potential "shortages of up to 70% of

demand". These heavy rare earths are essential to produce the kind

of high-performance permanent magnets needed for EVs and wind

turbines.

Our job is to ensure that Phalaborwa maintains its position in

an independent and responsible supply chain. This will open the

door to investment from the various US initiatives that have been

set up to fund US interests in the green transition. We have

already seen this via the involvement of TechMet, which has a 12%

stake in Rainbow, and, indirectly, their major shareholder the

DFC.

What are the priorities for FY 2024?

The production of the separated rare earth oxides in the

back-end pilot plant will be the most important milestone in the

project to date and it is even more exciting and symbolic that they

will be produced in the US. This favourable position has led us to

consider permanently basing our oxide separation process in the US

and we will continue to evaluate this.

We will maintain the pace of the project development to date

with the continued progress with the environmental and social

impact assessment ("ESIA") and publication of the DFS by the end of

FY 2024 and that will set the scene to commence project finance and

on to construction.

We will look to gain a better understanding of the mineralogy of

the Uberaba stack, which will inform the future work programme

around resource delineation and development of a flowsheet adapted

to the Uberaba material.

We will continue to work with OCP and UM6P to evaluate the

optimal technique for the extraction of REEs from

sedimentary-sourced phosphogypsum. While this is a longer-term

project, it represents an exciting opportunity for Rainbow due to

the scale of the opportunity if test work can achieve favourable

results, as it will unlock the enormous potential of rare earths

contained in sedimentary-sourced phosphogypsum material.

Finally we will also be continuing to develop our sustainability

approach and practices within the Group, bearing in mind these are

an essential part of our future success, and are conducting a life

cycle assessment ("LCA") at Phalaborwa to understand the

environmental impacts associated with the lifecycle of rare earths

production.

It's an exciting period ahead. I would like to thank the Rainbow

team, as well as our various partners and contractors, for working

tirelessly to deliver the results we have to date.

George Bennett

Chief Executive Officer

Financial Review

Rainbow's strategic focus is to identify and develop secondary

rare earth deposits that can be brought into production quicker and

at a lower cost than traditional hard rock mining projects. As a

developer, Rainbow capitalises the costs of exploration and

evaluation for each identifiable project once the legal right to

the project has been secured. During the Year, as a result of the

successful PEA released for Phalaborwa and the growing pipeline of

growth opportunities from the associated processing technology, the

Directors decided against investing significant amounts in Burundi

to develop a formal mineral resource. As a result an impairment

review was carried out on the Gakara cash generating unit, which

has been written down to a net asset value of nil. As a result, the

Financial Statements now reflect the updated business strategy,

with the exploration and evaluation assets on the balance sheet

relating solely to Phalaborwa and the income statement dominated by

the impairment charge against Gakara.

Profit and Loss

The loss for the Year reflects the impairment of the Gakara cash

generating unit and the ongoing administrative costs for the

Group.

As noted above, due to the change in strategy an impairment

review was carried out for the Gakara cash generating unit during

the Year, which comprised both intangible and tangible fixed assets

together with cash, mineral concentrate, royalty receivables and

consumables held in stock. The liabilities associated with the

Gakara project include a loan, decommissioning, site rehabilitation

and environmental costs, tax liabilities and trade payables. Based

on the assessment of both the legal and political position in

Burundi, the Directors were unable to foresee a date when the

operations at the project would be able to restart and accordingly

have written the net assets of the Gakara cash generating unit to

nil, with an impairment charge of US$9.6 million recognised.

Within administration expenses, the costs associated with

maintaining the Gakara project on care and maintenance totalled

US$0.9 million (FY 2022: US$1.3 million) including US$0.3 million

of non-cash depreciation associated with the tangible fixed assets

prior to the impairment (FY 2022: U$0.4 million). The Group

continues to focus on minimising costs associated with the

asset.

The Group's other corporate costs totalled US$2.6 million (FY

2022: US$2.3 million). This increase was driven primarily by an

increase in business development costs as the Group started to

develop its pipeline of growth opportunities including both Uberaba

and OCP.

Net finance income of US$0.2 million (FY 2022: costs of US$0.3

million) represents foreign exchange differences, primarily

relating to movements between the Burundian Franc ("BIF") and US

dollars, the functional currency of the Group. Finance costs also

include US$0.1 million (FY 2022: US$0.1 million) associated with

the FinBank loan in Burundi.

Balance Sheet

As set out above, the Gakara impairment has had a significant

impact on the Group balance sheet, with US$9.8 million of

non-current assets at 30 June 2022 relating to Gakara (US$8.6

million of exploration and evaluation costs and tangible fixed

assets with a net book value of US$1.0 million) being written down

to nil. The Gakara cash generating unit now includes US$0.7 million

of mineral concentrate inventory, carried at cost, which is offset

by the FinBank loan (US$0.4 million) and other net liabilities of

US$0.3 million dominated by tax and government liabilities in

Burundi which have not been settled whilst the suspension of

activities persists.

A total of US$2.9 million of exploration and evaluation assets

were capitalised in the Year relating to Phalaborwa, leaving a

closing capitalised cost of US$4.8 million. Expenditure accelerated

following completion of the PEA in October 2022 as pilot test work

commenced alongside other activities to develop a DFS. At the

balance sheet date, the Group has no tangible fixed assets and no

obligations for environmental closure at the Phalaborwa site.

At 30 June 2023, the Group held US$8.1 million of cash and cash

equivalents which is predominantly held with Barclays Bank in

London, having raised US$9.5 million in May 2023 at a price of

10.377 pence per share.

Going Concern

In July 2023, US$5 million was paid to Barak Fund SPC Limited on

behalf of Bosveld Phosphates (Pty) Limited to secure a path to 100%

ownership of Phalaborwa. As a result of the payment, the Group

secured an immediate 85% interest in Phalaborwa and was granted an

option to acquire the remaining 15% via the issue of US$7 million

in shares. In September 2023, the Company replenished the funds

spent on the Phalaborwa acquisition, raising US$5.5 million at a

price of 15 pence per share, of which US$0.7 million is subject to

shareholder approval at the forthcoming AGM.

Based on a review of cash flow forecasts for the period to 31

December 2024, at least US$3.4 million of additional funding will

need to be raised before 31 December 2024, the timing of which is

dependent primarily on the speed at which the Phalaborwa DFS is

completed, which is within management's control. Whilst this

funding requirement does represent a material uncertainty which may

cast significant doubt on the ability of the Company to continue as

a going concern, the Board is confident that this funding will be

secured based on its history of successful fundraising.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 30 June 2023

Year ended Year ended

30 June 30 June

Notes 2023 2022

US$'000 US$'000

Revenue - -

Cost of sales - -

---------- ----------

Gross profit - -

Administration expenses (3,509) (3,585)

Impairment of Gakara assets 3 (9,575) (69)

Loss from operating activities (13,084) (3,654)

---------- ----------

Finance income 377 216

Finance costs (158) (543)

Loss before tax (12,865) (3,981)

---------- ----------

Income tax expense - (4)

Total loss after tax and comprehensive expense for the year (12,865) (3,985)

========== ==========

Total loss after tax and comprehensive expense for the year is attributable to:

Non-controlling interest (881) (105)

Owners of parent (11,984) (3,880)

---------- ----------

(12,865) (3,985)

========== ==========

The results of each year are derived from continuing operations

Loss per share (cents)

Basic 4 (2.23) (0.76)

Diluted 4 (2.23) (0.76)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 June 2023

Year ended Year ended

Notes 30 June 30 June

2023 2022

US$'000 US$'000

Non-current assets

Exploration and evaluation assets 5 4,830 10,588

Property, plant and equipment 6 27 1,043

Right of use assets 39 108

Total non-current assets 4,896 11,739

----------- -----------

Current assets

Inventory 718 858

Trade and other receivables 365 401

Cash and cash equivalents 8,107 4,134

----------- -----------

Total current assets 9,190 5,393

----------- -----------

Total assets 14,086 17,132

----------- -----------

Current liabilities

Trade and other payables (1,250) (909)

Borrowings (201) (235)

Lease liabilities (23) (32)

Total current liabilities (1,474) (1,176)

Non-current liabilities

Borrowings (285) (518)

Lease liabilities (21) (81)

Provisions (55) (61)

----------- -----------

Total non-current liabilities (361) (660)

Total liabilities (1,835) (1,836)

----------- -----------

NET ASSETS 12,251 15,296

Equity

Share capital 7 50,937 41,442

Share-based payment reserve 1,719 1,467

Other reserves - -

Retained loss (38,483) (26,572)

----------- -----------

Equity attributable to the parent 14,173 16,337

Non-controlling interest (1,922) (1,041)

TOTAL EQUITY 12,251 15,296

=========== ===========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 30 June 2023

Share- Share Attributable

Share based warrant Other Accumulated to the Non-controlling

capital Payments reserve reserves losses parent interest Total

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

Balance at 1

July 2021 32,465 1,295 - 60 (22,878) 10,942 (936) 10,006

----------- ---------- ---------- ---------- ----------- ------------ --------------- --------

Total

comprehensive

expense

Loss and total

comprehensive

loss for year - - - - (3,880) (3,880) (105) (3,985)

Transactions

with owners

Shares placed

during the

year for cash

consideration 8,779 - - - - 8,779 - 8,779

Share placing

transaction

costs (240) - - - - (240) - (240)

Non-cash issue

of shares

during the

period, net of

costs 157 - - - - 157 - 157

Eliminate

historic

discount on

extinguishment

of interest

free bridge

loan - - - (60) 60 - - -

Fair value of

employee share

options in

year - 298 - - - 298 - 298

Share options

exercised in

the year, net

of costs 281 (126) - - 126 281 - 281

Balance at 30

June 2022 41,442 1,467 - - (26,572) 16,337 (1,041) 15,296

----------- ---------- ---------- ---------- ----------- ------------ --------------- --------

Total

comprehensive

expense

Loss and total

comprehensive

loss for year - - - - (11,984) (11,984) (881) (12,865)

Transactions

with owners

Shares placed

during the

year for cash

consideration 9,485 - - - - 9,485 - 9,485

Share placing

transaction

costs (115) - - - - (115) - (115)

Fair value of

employee share

options in

year - 325 - - - 325 - 325

Share options

cancelled in

year - (13) - - 13 - - -

Share options

exercised in

the year, net

of costs 125 (60) - - 60 125 - 125

Balance at 30

June 2023 50,937 1,719 - - (38,483) 14,173 (1,922) 12,251

----------- ---------- ---------- ---------- ----------- ------------ --------------- --------

CONSOLIDATED CASH FLOW STATEMENT

For the year ended 30 June 2023

For year ended For year ended

30 June 30 June

2023 2022

US$'000 US$'000

Cash flow from operating activities

Loss from operating activities (13,084) (3,654)

Adjustments for:

Depreciation 382 380

Impairment 9,575 69

Share-based payment charge 325 297

Operating loss before working capital changes (2,802) (2,908)

Net decrease in inventory - 5

Net increase in trade and other receivables (31) (29)

Net decrease in trade and other payables (94) (100)

--------------- ---------------

Cash used by operations (2,927) (3,032)

Realised foreign exchange gains 156 186

Finance income - -

Finance costs - -

Taxes paid - (2)

--------------- ---------------

Net cash used in operating activities (2,771) (2,848)

--------------- ---------------

Cash flow from investing activities

Purchase of property, plant & equipment (28) (42)

Exploration and evaluation costs (2,510) (837)

Net cash used in investing activities (2,538) (879)

--------------- ---------------

Cash flow from financing activities

Repayment of borrowings (61) (1,009)

Interest payments on borrowings (78) (138)

Payment of lease liabilities (42) (24)

Proceeds from the issuance of ordinary shares 9,610 9,077

Transaction costs of issuing new equity (115) (275)

Net cash generated by financing activities 9,314 7,631

--------------- ---------------

Net increase in cash and cash equivalents 4,005 3,904

--------------- ---------------

Cash & cash equivalents at the beginning of the year 4,134 573

Foreign exchange loss on cash and cash equivalents (32) (343)

Cash & cash equivalents at the end of the year 8,107 4,134

=============== ===============

NOTES:

1. BASIS OF PREPARATION

The financial information set out herein does not constitute the

Group's statutory financial statements for the year ended 30 June

2023, but is derived from the Group's audited financial statements.

The auditors have reported on the FY 2023 financial statements and

their reports were unqualified. The financial information in this

statement is audited but does not have the status of statutory

accounts.

The financial statements and the information contained in this

announcement have been prepared in accordance with International

Financial Reporting Standards (IFRS) as adopted by the European

Union (EU), including International Accounting Standards and

Interpretations issued by the International Financial Reporting

Interpretations Committee (IFRIC). This is consistent with the

accounting policies in the 30 June 2022 financial statements.

2. GOING CONCERN

As at 30 June 2023, the Group had total cash of US$8.1 million.

During Q3 CY2023 the Group paid out a total of US$7.3 million

including costs of US$5.7 million to secure an immediate 85%

interest in the Phalaborwa project. On 27 September 2023 the

Company announced a private placement raising GBP4.5 million

(approximately US$5.5 million) before costs estimated at US$0.1

million, of which GBP3.9 million had been received at 27 October

2023. Going forward the Group expects further cash income of GBP0.6

million from the equity fund raise that is subject to shareholder

approval, which is expected to be received at the Company's AGM on

20 November 2023, and has no commitments.

The Board have reviewed a range of potential cash flow forecasts

for the period to 31 December 2024, including reasonable possible

downside scenarios. This has included the following

assumptions:

Corporate

The forecast includes US$3.2 million of ongoing general and

administrative costs of the Group over the 18-month period from 1

July 2023 to 31 December 2024 (the "Period"), based on the current

administrative costs of the Group. This includes US$0.2 million in

respect of pursuing new business opportunities, which will cover

only the initial test work at the opportunities identified to date

including the opportunity with OCP in Morocco and the opportunity

with the Mosaic Company in Brazil.

Management's reasonably plausible downside scenario includes a

10% contingency for unexpected costs plus a further US$0.25 million

per annum for business development costs.

Phalaborwa

The forecast includes US$5.7 million of costs relating to the

acquisition of the 85% ownership in Phalaborwa, including relevant

transaction costs, which was announced on 28 June 2023 and paid in

Q3 2023 as noted above. The forecast also includes all costs

required for the completion of the Phalaborwa DFS, estimated at

US$5.9 million, inclusive of a 10% contingency. This includes all

costs associated with the ongoing pilot test work campaign underway

in both South Africa and USA.

The forecast also includes salary and consultant costs of US$0.6

million for the core project team tasked with advancing the

project. No further contingency on the costs associated with the

DFS was considered necessary for management's reasonably plausible

downside scenario as the base case forecast includes relevant

contingencies. Management's reasonably plausible downside scenario

includes a 10% contingency on the costs of the core project

team.

Uberaba

A memorandum of understanding was signed on 17 July 2023 with

Mosaic to jointly develop a process flowsheet and conduct a

preliminary economic assessment related to the extraction of rare

earth elements from Mosaic's phosphogypsum stack in the Uberaba

area of Minas Gerais in Brazil. At the date of this Report, the

Group has no commitments in respect of this project. A detailed

budget for the anticipated work stream is not yet available and

will need to be agreed with Mosaic, but it is noted that

management's reasonably plausible downside scenario would not be

sufficient for a resource to be defined and a PEA to be developed

and further funding may be required to allow for the Uberaba

opportunity to be de-risked, the timing of which cannot be

accurately predicted at this time.

Gakara

The cash flow forecasts assume ongoing care and maintenance

costs totalling US$0.6 million, including amounts payable under the

FinBank loan facility in Burundi. The Group has determined that no

additional cash outflows will be incurred on Gakara until the

export ban and mining suspension has been lifted. In the event that

the Gakara project did return to operations, stock of rare earth

concentrates with a current estimated gross sales value of US$1.0

million would be sold to provide the funds to re-commence

operations. The re-start would be conditional on the Gakara project

not requiring additional financial support from Rainbow Rare Earths

Limited at then current rare earth prices.

Conclusion

The base case forecast includes a total cash outflow over the

Period of US$16.1 million. Management's reasonably plausible

downside scenario, which includes a 10% contingency for corporate

costs, fixed costs at Phalaborwa and Gakara costs, together with a

further allowance for business development opportunities, includes

a total cash outflow of US$16.9 million.

At 30 June the Group had US$8.1 million of available cash which

together with US$5.4 million of net funds raised in September 2023

provides US$13.5 million of available resources, which confirms

that the Group will need to raise additional funds before 31

December 2024, the timing of which is dependent primarily on the

speed at which the Phalaborwa DFS is completed, which is within

managements control. Management's reasonably plausible downside

scenario suggests that at least US$3.4 million will need to be

raised, along with any funds required to progress the Uberaba

opportunity in Brazil.

The Board is confident that this funding will be secured, based

on its history of successful fundraising. However, it also

acknowledges that this funding is not, at the present time, in

place. Accordingly, the Board acknowledges that the need for

additional funding represents a material uncertainty which may cast

significant doubt on the ability of the Group to continue as a

going concern and, therefore, that it may be unable to realise its

assets and discharge its liabilities in the normal course of

business. The financial statements do not include any adjustments

that would result if the Group was unable to continue as a going

concern.

3. IMPAIRMENT OF GAKARA ASSETS

The assets associated with the Gakara project include both

intangible and tangible fixed assets together with cash, mineral

concentrate, royalty receivables and consumables held in stock. The

liabilities associated with the Gakara project include a loan,

decommissioning, site rehabilitation and environmental costs, tax

liabilities and trade payables.

Despite the ongoing suspension, the Directors note that the

Government of Burundi has not suggested that the licence will be

withdrawn. The Directors also continue to believe that the licence

area represents a significant area of rare earth mineral potential.

However, the Directors do consider that an indicator of impairment

exists at 30 June 2023 due to the re-focus of Rainbow's business on

the Phalaborwa asset and growth opportunities from the associated

processing technology. As such, the Directors do not envisage

investing significant amounts in Burundi to develop a formal

mineral resource and therefore an impairment review is required

under IFRS 16 paragraph 20.

Based on the assessment of both the legal and political position

in Burundi, the Directors were unable to foresee a date when the

operations at the project would be able to restart and accordingly

have written the net assets of the Gakara cash generating unit to

nil, with a total impairment cost of US$9.6 million recognised in

the Year.

4. LOSS PER SHARE

The earnings per share calculations for 30 June 2023 reflect the

changes to the number of ordinary shares during the Year.

At the start of the Year, 524,405,810 shares were in issue.

During the Year, a total of 74,452,846 new shares were allotted

(see note 7 Share Capital) and on 30 June 2023, 598,858,656 shares

were in issue. The weighted average of shares in issue in the Year

was 536,805,149.

The loss per share has been calculated using the weighted

average number of ordinary shares in issue. The Group was loss

making for all periods presented, therefore the dilutive effect of

share options has not been accounted for in the calculation of

diluted earnings per share, since this would decrease the loss per

share for each reporting period.

Basic and diluted

2023 2022

---------------- ---------------

Loss for the year (US$'000) attributable to ordinary equity holders (11,984) (3,880)

Weighted average number of ordinary shares in issue during the Year 536,805,149 508,566,911

Loss per share (cents) (2.23) (0.76)

---------------- ---------------

5. EXPLORATION AND EVALUATION ASSETS

Gakara Phalaborwa Total

US$'000 US$'000 US$'000

At 1 July 2021 8,635 1,116 9,751

Additions - 837 837

At 30 June 2022 8,635 1,953 10,588

------------------ ------- ---------- -------

Additions - 2,877 2,877

Impairment (8,635) - (8,635)

At 30 June 2023 - 4,830 4,830

------------------ ------- ---------- -------

Only costs relating to the Phalaborwa Project were capitalised

during the Year. The Burundi Project has been under care and

maintenance throughout the Year and, accordingly, none of the costs

meet the requirements under the Group's accounting policy for

capitalisation.

On 12 April 2021, RMB received notification from the Ministry of

Hydraulics, Energy and Mines of the Republic of Burundi of a

temporary suspension on the export of concentrate produced from the

trial mining and processing operations at the Gakara Project. On 29

June 2021, a further notification was received temporarily

suspending all trial mining and processing operations pending

negotiations on the terms of the Gakara mining convention signed in

2015.

The Directors have confirmed from independent legal advisors

that the mining convention in place between RMB and the Government

of Burundi remains legally binding on both parties, and that the

actions of the Government of Burundi have not been in accordance

with that legally binding agreement. However, despite ongoing

engagement with the Government of Burundi since the export ban was

initially imposed, RMB has not received permission to re-start

operations and is unable to reliably estimate when such a re-start

may be possible.

Since acquiring the Phalaborwa project in December 2020 and the

subsequent development of processing technology to recover rare

earth elements from phosphogypsum as a by-product of phosphoric

acid production, the Directors have re-focused the business on

secondary sources of rare earth elements where they consider higher

returns are available. As such the Directors no longer intend to

invest significant amounts at Gakara to convert the existing

resource target to a reserve capable of supporting long term

commercial production, resulting in an impairment review being

carried out for the Gakara exploration and evaluation assets in the

year ended 30 June 2023.

Based on an assessment of both the legal and political position

in Burundi, the Directors consider that the fair value of the

Gakara exploration and evaluation assets calculated in accordance

with IAS 36 is nil and an impairment loss has been recognised.

FinBank SA hold security over the fixed and floating assets of

RMB which include the impaired exploration and evaluation assets

associated with the Gakara mining permit in Burundi.

6. PROPERTY, PLANT AND EQUIPMENT

US$'000 Mine development costs Plant & machinery Vehicles Office equipment Total

------------------------------- ---------------------- ----------------- -------- ---------------- -----

Cost

---------------------- ----------------- -------- ---------------- -----

At 1 July 2021 183 2,847 1,582 45 4,657

Additions - 42 - - 42

---------------------- ----------------- -------- ---------------- -----

At 30 June 2022 183 2,889 1,582 45 4,699

------------------------------- ---------------------- ----------------- -------- ---------------- -----

Additions - - 24 4 28

At 30 June 2023 183 2,889 1,606 49 4,727

------------------------------- ---------------------- ----------------- -------- ---------------- -----

Depreciation

At 1 July 2021 73 2,667 539 24 3,303

Charge for year 26 1 316 10 353

---------------------- ----------------- -------- ---------------- -----

At 30 June 2022 99 2,668 855 34 3,656

Charge for the year 25 5 317 2 349

Impairment 59 216 410 10 695

------------------------------- ---------------------- ----------------- -------- ---------------- -----

At 30 June 2023 183 2,889 1,582 46 4,700

------------------------------- ---------------------- ----------------- -------- ---------------- -----

Net Book Value at 30 June 2023 - - 24 3 27

------------------------------- ---------------------- ----------------- -------- ---------------- -----

Net Book Value at 30 June 2022 84 221 727 11 1,043

------------------------------- ---------------------- ----------------- -------- ---------------- -----

Net Book Value at 30 June 2021 110 180 1,043 21 1,354

------------------------------- ---------------------- ----------------- -------- ---------------- -----

As set out in note 5, the Directors recognise that the ongoing

suspension of all activities of RMB in Burundi and the subsequent

decision not to commit investment for the conversion of the Gakara

resource target to reserves requires an impairment review for the

tangible fixed assets relating to the project in accordance with

IAS36. Based on an assessment of both the legal and political

position in Burundi, the Directors consider that the fair value of

the property, plant and equipment associated with the Gakara

project calculated in accordance with IAS 36 is nil and an

impairment loss has been recognised.

FinBank SA hold security over the fixed and floating assets of

RMB which include the impaired property, plant, and equipment in

Burundi

7. SHARE CAPITAL

Year Ended Year Ended

30 June 2023 30 June 2022

US$'000 US$'000

Share Capital 50,937 41,442

------------- -------------

Issued Share Capital 50,937 41,442

------------- -------------

The table below shows a reconciliation of share capital

movements:

Number of shares US$'000

At 30 June 2021 476,411,434 32,465

July 2021 - Exercise of share options (cash receipts) 2,500,000 182

October 2021 - Share placing - Cash receipts net of costs 32,900,000 6,557

November 2021 - Share placing - Cash receipts net of costs 10,000,000 1,982

December 2021 - Pipestone Loan repayment shares 875,389 175

April 2022 - Exercise of share options (cash receipts) 1,718,987 116

Costs associated with exercise of share options and loan settlement - (35)

---------------- --------

At 30 June 2022 524,405,810 41,442

November 2022 - Exercise of share options (cash receipts) 2,000,000 125

May 2023 - Share placing (cash receipts) 72,452,846 9,485

Costs associated with exercise of share options and share placing - (115)

At 30 June 2023 598,858,656 50,937

---------------- --------

On 13 July 2021, the Australian Special Opportunity Fund, LP

exercised options over 2.5 million shares at an exercise price of

5.28p per share, raising gross cash proceeds of US$182k.

On 13 October 2021, the Company issued 32.9 million shares at a

price of 15 pence per share, raising gross cash proceeds of US$6.8

million (before costs of $221k).

On 15 November 2021, the Company issued a further 10.0 million

shares at a price of 15 pence per share, raising gross cash

proceeds of US$2.0 million (before costs of $18k).

On 25 April 2022, the Australian Special Opportunity Fund, LP

exercised options over 1,718,987 million shares at an exercise

price of 5.28p per share, raising gross cash proceeds of

US$116k.

On 10 November 2022, the Australian Special Opportunity Fund, LP

exercised options over 2,000,000 shares at an exercise price of

5.28p per share, raising gross cash proceeds of US$125k.

On 9 May 2023, the Company issued 72,452,846 shares at a price

of 10.377 pence per share, raising gross cash proceeds of US$9.5

million (before costs of US$0.1 million).

On 5 October 2023 a further 26,412,257 shares were issued at a

price of 15 pence per share.

8. POST BALANCE SHEET EVENTS

On 28 June 2023, the Company announced an agreement with Bosveld

Phosphates (Pty) Limited ("Bosveld") to secure a path to 100%

ownership of the Phalaborwa project. As a result, in July 2023 the

Company paid US$5 million to Barak Fund SPC Limited on behalf of

Bosveld as a result of which the Company secured an immediate 85%

interest in the Phalaborwa project and was granted an option to

acquire the remaining 15% via the issue of US$7 million in shares.

As a result of the transaction a success fee of GBP500,000 was paid

to Magna in July 2023.

On 17 July 2023, the Company announced that it had entered into

a memorandum of understanding with Mosaic to jointly develop a

process flowsheet and conduct a preliminary economic assessment

related to the extraction of rare earth elements from Mosaic's

phosphogypsum stack in the Uberaba area of Minas Gerais in

Brazil.

On 27 September 2023, the Company announced the successful

completion of a private placement raising GBP4.5 million

(approximately US$5.5 million) via the issue of 30 million new

Ordinary Shares of no par value at an issue price of GBP0.15 per

share. The initial tranche of 25,786,541 shares was allotted and

admitted to trading on 5 October 2023 under the disapplication of

pre-emption rights granted at the Company's last Annual General

Meeting held on 22 November 2022. The final tranche of 4,213,459

shares are subject to the approval of shareholders at the next

Annual General Meeting to be held in November 2023.

[1] Net present value using a 10% forward discount rate

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR PPGAUUUPWGBB

(END) Dow Jones Newswires

October 30, 2023 03:00 ET (07:00 GMT)

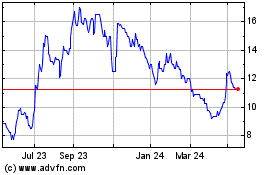

Rainbow Rare Earths (LSE:RBW)

Historical Stock Chart

From Oct 2024 to Nov 2024

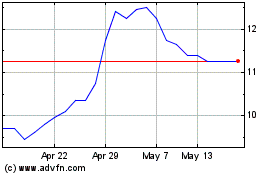

Rainbow Rare Earths (LSE:RBW)

Historical Stock Chart

From Nov 2023 to Nov 2024