TIDMRBW

RNS Number : 9349L

Rainbow Rare Earths Limited

11 September 2023

11 September 2023

Rainbow Rare Earths Limited

("Rainbow" or "the Company")

LSE: RBW

Rainbow enters into strategic supply agreement with UK-based

Less Common Metals to develop a responsible Western supply chain

for rare earth elements

-- Rainbow will supply LCM with rare earth elements designated

as critical minerals due to their essential role in the green

energy transition

-- LCM is the only rare earth metal and alloy manufacturing

facility in the UK and one of the only facilities in the Western

world

-- Both Rainbow and LCM are aligned in their values and their

ambitions to play a part in the establishment of a Western supply

chain for critical rare earth elements

NEWS RELEASE

Rainbow Rare Earths is pleased to announce that it has entered

into a strategic supply agreement with Less Common Metals Ltd

("LCM") to be a supplier of the magnet separated rare earth oxides

neodymium and praseodymium ("NdPr"), dysprosium ("Dy") and terbium

("Tb"). These are the most economically important rare earth

elements as they are used to make the permanent magnets essential

to decarbonisation, via their use in electric vehicles and wind

turbines, as well as to defence and other high-tech products.

These elements are also designated as 'critical minerals' in the

UK's Critical Minerals Strategy as they are defined as having a

high criticality for the UK, according to the economic

vulnerability and supply risk criteria used for the assessment.

LCM is a world leader in the manufacture and supply of complex

alloy systems and metals. The separated rare earth oxides supplied

by Rainbow will be used for manufacturing into metal in order to

create an alloy, which is then supplied to permanent magnet

manufacturers in the EU and the USA.

LCM is based in Ellesmere Port, Cheshire; it is currently the

only rare earth metal and alloy manufacturing facility in the UK

and one of the only facilities in the Western world. Its location

is of strategic importance to Rainbow as the Company's aim is to

play a part in the establishment of a Western supply chain for

critical rare earth elements outside of Chinese control.

This is in alignment with LCM's ambitions, which is currently in

discussions to invest in expanded capacity in North America, the EU

and Asia.

LCM has been looking to partner with a supplier with similar

values in order to secure ethical supply of the feedstock required

for their business and it has chosen Rainbow after a lengthy

evaluation process of the various rare earth development companies

globally. This decision was based on Rainbow's capability to take

its rare earth material further downstream to the separated rare

oxide stage, using the proprietary technology developed by, and in

conjunction with, its partner K-Technologies, Inc.

George Bennett, CEO of Rainbow, commented: "Securing a buyer of

our separated rare earth oxides that shares our values and

aspirations was of strategic importance to Rainbow. We are

dedicated to establishing an independent, responsible and ethical

supply chain of the rare earth elements that are driving the green

energy transition.

With over 30 years of experience in the manufacture and supply

of metals and alloys to the permanent magnet industry, LCM is a

fantastic partner for Rainbow. Using its expertise to expand in the

USA and the EU, LCM will be instrumental in meeting the huge and

growing demand for permanent magnets."

Albert Slot, Managing Director of LCM, commented: "LCM occupies

a unique position in the rare earth pipeline as it is the only

company in the Western world commercially producing both t he

highly specialised strip-cast alloys and all of the required rare

earth metals needed for the production of the highest-performance

neodymium iron boron magnets. Furthermore, LCM's expertise in the

commercial production of neodymium metal and neodymium praseodymium

alloy is unique in the Western world.

Given the concentration of the rare earth supply chain, a

relationship with Rainbow offers the opportunity for LCM to secure

ethical supply of all four of the magnet rare earth oxides vital

for our business. This partnership will therefore ensure that

together we can continue to develop a responsible and independent

supply chain of rare earth elements to the benefit of the Western

world."

Rainbow's Phalaborwa project is estimated to have one of the

lowest costs of production of Western producers, as it will involve

the processing of gypsum waste residue stacks, hence removing the

cost and risk of mining. This low production cost gives the project

resilience against rare earth pricing volatility in all plausible

pricing scenarios, an important consideration for LCM based upon

its 32 year history in the rare earth magnet chain.

Crucially, Rainbow expects to be able to supply all four of the

permanent magnet rare earth elements, including the 'heavy' rare

earths Dy and Tb, which are essential for improving the performance

of neodymium magnets. LCM only recently expanded its metal making

capabilities to include Dy and Tb and Rainbow will be one of the

only producers of these oxides outside of Asia.

A framework will be set out in due course for Rainbow and LCM to

negotiate a binding offtake agreement for separated rare earth

oxides from Phalaborwa, with the ultimate customer of the rare

earth permanent magnets being clearly defined and in alignment with

both LCM's existing customer base and the positioning of both

companies in an expanding Western supply chain.

Volumes will be driven by LCM's requirements for its expanded

facilities, constrained by Phalaborwa's total productive capacity,

and pricing will be as per published rare earth oxide prices at

that point in time. Any surplus production from Phalaborwa not

required for LCM's facilities will be sold on the open market to

third parties.

For further information, please contact:

Rainbow Rare Earths George Bennett

Ltd Company Pete Gardner +27 82 652 8526

Cathy Malins +44 7876 796 629

(IR) cathym@rainbowrareearths.com

Matthew Armitt

Berenberg Broker Jennifer Lee +44 (0) 20 3207 7800

Tavistock Communications PR/IR Charles Vivian +44 (0) 20 7920 3150

Tara Vivian-Neal rainbowrareearths@tavistock.co.uk

Notes to Editors:

About LCM:

Less Common Metals is a world leader in the manufacture and

supply of complex alloy systems and metals, and are specialists in

those based on rare earth elements. With over 30 years of

experience in the production of materials to tight compositional

tolerances and controlled microstructures, LCM offers an innovative

and highly flexible approach to a wide range of material

requirements.

Since 2017, LCM has been making neodymium (Nd) and neodymium

praseodymium (NdPr) metal on their premises in the UK commercially

at +120 tons per annum. More recently (April 2023), the company

expanded metal making production to dysprosium iron (DyFe),

dysprosium (Dy) and terbium (Tb) to further enhance their expertise

as a complementary supply chain alternative.

More information can be found at www.lesscommonmetals.com .

About Rainbow:

Rainbow Rare Earths aims to be a forerunner in the establishment

of an independent and responsible supply chain of the rare earth

elements that are driving the green energy transition. It is doing

this successfully via the identification and development of

secondary rare earth deposits that can be brought into production

quicker and at a lower cost than traditional hard rock mining

projects, with a focus on the permanent magnet rare earth elements

neodymium and praseodymium, dysprosium and terbium.

The Company is focused on the development of the Phalaborwa Rare

Earths Project in South Africa and the earlier stage Uberaba

Project in Brazil. Both projects entail the recovery of rare earths

from phosphogypsum stacks that occur as the by-product of

phosphoric acid production, with the original source rock for both

deposits being a hardrock carbonatite. Rainbow will use a

proprietary separation technique developed by and in conjunction

with its partner K-Technologies, Inc., which simplifies the process

of producing separated rare earth oxides (versus traditional

solvent extraction), leading to cost and environmental

benefits.

The Phalaborwa Preliminary Economic Assessment has confirmed

strong base line economics for the project, which has a base case

NPV(10) of US$627 million [1] , an average EBITDA operating margin

of 75% and a payback period of < two years. Pilot plant

operations commenced in 2023, with the project expected to reach

commercial production in 2026, just five years after work began on

the project by Rainbow. More information on the company is

available at www.rainbowrareearths.com .

[1] Net present value using a 10% forward discount rate

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEAPNEFAADEFA

(END) Dow Jones Newswires

September 11, 2023 02:00 ET (06:00 GMT)

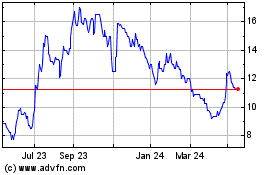

Rainbow Rare Earths (LSE:RBW)

Historical Stock Chart

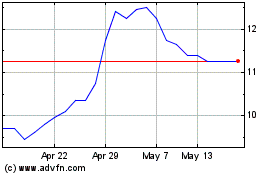

From Oct 2024 to Nov 2024

Rainbow Rare Earths (LSE:RBW)

Historical Stock Chart

From Nov 2023 to Nov 2024