For immediate release

28 April, 2004

Panther Securities PLC ("Panther")

Results for the year ended 31st December 2003

CHAIRMAN'S STATEMENT

Introduction

I am delighted to report the results for the year ended 31st December 2003.

Pre-tax profits amount to �3,413,000 compared to �2,956,000 for previous year.

The rental income receivable for the year rose to �9,100,000 compared with �

8,000,000.

This year the vast majority of our portfolio was independently revalued by

Donaldsons. This valuation revealed an increase in value of our investment

portfolio of approximately �11,400,000 so not only are our profits at near

record levels but our net asset value has increased by an impressive 30% from

226.2p to 294.8p per share. The revaluation of our properties held as trading

stock revealed a potential surplus of �3,180,000 which, after allowing for tax,

would produce an extra net asset value of 13p per share. Stock revaluations in

excess of cost are not included in the accounts.

Disposals

The only property disposals were 3 small freehold shops in Cheam, sold

profitably, which were part of our trading stock.

Acquisitions

In August 2003 we acquired 32 & 32A Darley Street, Bradford. This property,

located in the best part of the pedestrianised section of Bradford, cost �1.82

million and produces approximately �150,000 per annum exclusive from

Specsavers, Orange Group and Game Station. Included in the property is some

vacant space that could be refurbished to produce extra income and we are

currently investigating this possibility.

In December 2003 we acquired 29, 59 and 61 Central Avenue, West Molesey,

Surrey. These three properties are mainly single storey freehold factories with

a total floor space of approximately 80,000 sq ft. The properties were

purchased from the administrative receiver of Arcolectric Holdings PLC for �3.6

million. The properties were simultaneously leased to Elektron PLC at �417,500

p.a. on 10 year full repairing and insuring leases.

To provide Elektron PLC with additional working capital and assist with the

purchase of the majority of Arcolectric's business from the receiver, Panther

formed and then sold Aridmark Limited, whose sole asset was �500,000 cash in

exchange for 9,090,909 shares in Elektron (equivalent to a value of 5.5p per

Elektron ordinary share). This resulted in Panther holding approximately 11.9%

of Elektron's enlarged capital. Elektron PLC is AIM listed and carries out a

similar electrical parts manufacturing business as the former Arcolectric PLC.

We are optimistic that this acquisition will produce substantial benefits for

Elektron PLC which hopefully will in due course be reflected in the value of

our shareholding in this company.

Bid for Oakburn Properties PLC

I, together with my personal pension fund, held 29.9% of an AIM listed property

company called Grosvenor Land PLC. As with so many small property companies,

the management enjoyed a disproportionate share of benefits from the company.

Panther was in the process of purchasing these shares on favourable terms to

Panther with a view to making a bid for Grosvenor. When however Grosvenor's

management became aware of possible bid intentions, they issued new shares for

cash and purchased a property company partly paying for the acquisition with

new shares. This appeared to give the management and its associates over 42% of

the voting rights making an unwelcome take-over bid virtually impossible.

29% of the Grosvenor Land shares (listed under directors' interests) were held

by Oakburn Properties PLC and I became aware that not all shareholders of this

company were happy. In fact, some were keen to sell.

On 17th October 2003 Panther announced it would bid for Oakburn. On 23rd

October Panther purchased 225,000 Oakburn shares at 576.67p per share

representing 26.6% of its capital and on 29th October a further 22,124 Oakburn

shares were purchased at the same price.

The family directors of Oakburn outmanoeuvred us by finding a "white knight" to

partner them and outbid us. We therefore failed in our attempt to obtain

control of Grosvenor Land PLC but this failure was more than compensated by the

�450,000 profit (before costs) on the sale of our shares. Shareholders will be

pleased to note that the successful bidder for Oakburn, Terrace Hill Group PLC,

was subsequently obliged to bid for the entire share capital of Grosvenor Land

PLC.

Eurocity Properties PLC

Our successful bid for Eurocity PLC was completed in January 2003. Having

removed the majority of the group's management costs Eurocity produced a profit

contribution to our Group of approximately �350,000 through rental profits

alone.

Panther House Redevelopment

As mentioned in my interim statement we have agreed terms with two potential

purchasers to sell the entire Panther House/Grays Inn Road/Churchills Pub site.

Under terms agreed with both these potential purchasers we would receive an

initial substantial sum and a share of the profits on any future redevelopment.

Due to the revaluation of our properties the proposed initial price is only

slightly ahead of the new book value. However our profit share is speculative

and not immediately quantifiable but in the event of a successful development

by the purchaser, we would expect to receive extra profits some time in the

future. A sale of this size may require shareholders approval in due course.

Bristol Redevelopment

I can only reiterate what I said in my interim statement. Whilst it appears

that Wm Morrison Supermarkets PLC have now obtained their required changes to

implement the scheme, we have indicated to Bristol City Council that we are not

prepared to proceed with the joint venture unless there is a more realistic

assessment placed on the value of our interests. Our own local valuers indicate

that even under compulsory purchase we would receive better terms than

currently offered by Bristol Council who still insist on an excessive amount of

social benefits to be paid out from the funds raised from the sale of the site.

Tax & Regulations

For the last four or five years I have devoted a substantial part of my

statement complaining about the ever increasing tax burdens and "red tape"

regulations which continue to hamper the business environment and this year is

no exception.

This country's tax system penalises enterprise, initiative, hard work, success

and self-sufficiency whereas laziness, dependency on the state and fecklessness

are encouraged.

Our Government presents much of the legislation they propose in a deceptive

manner. It penalises and restricts private pensions but massively increases its

own. One of the Government's first actions upon coming into power was to tax

pension funds, inevitably weakening substantially those that were less well

funded. It now proposes that the remaining solvent private company pension

funds pay into a safety fund to protect those pensions whose funds fail in the

future. It seems to me that the �5-6 billion tax taken from pension funds

probably all goes to pay the Government's own bureaucrats' pensions which have

cast iron guarantees. All these former state employees' pensions should have a

1% or 2% "security" charge to provide a fund to assist those who lose out

through no fault of their own and whose pension had no public guarantee.

"New Labour"! came into power in 1997 and achieved their dream, the right to

spend Other Peoples Money. The property industry has been heavily targeted.

Stamp Duty on larger property purchases has been raised 400% and recently Stamp

Duty on new leases has been raised massively, in some cases more than 1000%.

The obvious result of this is that many investors try to avoid (that's legal)

this tax on investment. The Government's response to this is to introduce more

red tape. On every purchase a new seven page form with 71 questions has to be

completed and submitted to the Inland Revenue. The time cost for solicitors

dealing with the form (up to 1 hour) is paid by the purchaser. However there

has to be a bureaucrat checking that the forms are correct. He has to be paid

and pensioned. This of course is paid out of our taxes creating yet more waste.

Property owners have been subjected to an avalanche of new health & safety and

building regulations, disability regulations etc. The cost falls upon the

owners or users of property. The benefits are unquantified but probably minimal

but the costs huge and probably unquantifiable.

The latest daft piece of legislation is the Proceeds of Crime Act which forced

many solicitors, accountants and estate agents to write to their clients

informing them that if they believe that a crime had been committed they must

report it to the authorities without telling the client. When you have had a

longstanding relationship with a client for many years, it is an insult to be

forced to treat them in this manner. What makes the situation more farcical is

that what constitutes a crime doesn't just cover the house agent who buys two

tons of fertiliser, a couple of barrels of diesel oil and an old white van on

his business account which would seem suspicious, but it also covers a

secretary using the office stamps to post her personal Christmas cards or an

employee who inflates his expenses or indeed any other trivial misdemeanour

that would normally go unreported. The penalty for failing to report the crime

being far more severe than any possible penalty for the "crime". You truly have

to have taken leave of your senses if you believe that this type of legislation

will help to prevent the type of terrorism it is aiming to prevent. However, it

will necessitate employing many thousands of bureaucrats to supervise the

system. Surely we would be better protected with these extra functionaries

guarding our ports of entry. I am forever amazed at the complete lack of common

sense in this Government which is legislatively incontinent and incompetent.

There has been mention of possible legislation to allow listed property

companies such as ours to convert to Real Estate Investment Trusts (REIT's) and

in particular the creation of REIT's for purely residential investment. In

other countries REITS receive favourable tax treatment. However expecting any

tax concessions from this Government is akin to expecting the shareholders

cocktail party to be a lasting success having invited Lucretia Borgia to mix

the cocktails.

I believe that this Government has been bad for industry and the property

industry in particular and will continue to be unreasonable. Their most recent

budget even introduces a form of retrospective property tax legislation, i.e.,

a transaction that was legitimate when carried out, perhaps some years ago,

would now carry a special penal tax liability. Any Government that brings in

retrospective tax legislation is threatening the very basis of business life.

I have added an extra resolution to our normal resolutions for shareholders to

consider. This is that the company should donate �25,000 to the Conservative

Party. As this is my personal suggestion I will not vote my controlling

shareholding but would hope that not only will the main body of shareholders

support the resolution but also that many other property companies will follow

our lead and carry out similar moves to emphasise their distaste for the

heavy-handed tax treatment and interference in their industry.

Most of our shareholders are private individuals who probably own their own

home and sleep content in those homes secure in the knowledge of its

substantial capital appreciation over the years. However, whilst they sleep

soundly they should be aware our Chancellor probably lies awake at night trying

to devise ways of taxing this great tsunami of capital wealth. His problem is

not how to tax, that's easy, but how to do it in such a way as to be able to

disguise it under another name and justify the new imposition by saying

something such as "this charge is an environmentally sound and economically

advantageous way to produce a fair and prudent allocation of national resources

towards those less advantaged in our society" whereas this is a euphemism for

"rob the careful and prudent to buy votes from the foolish, the feckless and

the fiddlers" as we already have sufficiently high tax rates to support the

genuinely disadvantaged members of society.

Finance

Due to the increased value of our investment portfolio we have recently agreed

to draw down the balance of our loan facility with HSBC and will thus have a

total sum of �11 million cash available for further investment.

Dividends

On 20th June 2003 we paid a special 30th anniversary dividend of 5p per share.

Additionally on 31st October 2003 we paid a 3.5p interim dividend and it is

your Board's intention to recommend a final dividend of 4p per share.

Outlook

Most major developed countries run monumental Government budget deficits and

consequently rely on borrowing untold billions of dollars, pounds, yen or euros

from the private sector. This probably exacerbates currency instability and

volatility. With oil and commodity prices at extreme highs, although thankfully

currently cushioned by a dollar depreciation, is there not a strong possibility

that some major upset will cause interest rates to rise much higher than

anticipated? If this happens it will cause problems for many companies,

particularly property companies who are very highly geared or indeed the many

private residential owners and investors who have taken the view that

residential property only ever increases in value and have geared up

accordingly.

Because of these concerns we have adopted a cautious approach to expansion but

with our finance arrangements at fixed rates, substantial liquidity and

positive cash flow from our wide mixed property portfolio spread throughout the

country, we believe our company will continue to prosper.

Finally I would like to thank all our staff, professional advisors and the

numerous firms we deal with and of course our tenants who have helped to make

this another successful year.

A.S. Perloff

Chairman

28 April 2004

Consolidated Profit and Loss Account

for the year ended 31 December 2003

2003 2002

�'000 �'000

Turnover 9,791 8,240

Cost of sales (1,654) (1,389)

Gross Profit 8,137 6,851

Administrative expenses (1,336) (1,194)

Operating profit 6,801 5,657

Income from current asset investments 426 -

(Loss)/Income from participating interests (67) 9

Profit on disposal of property - 342

Loss on disposal of investments (20) -

Profit on ordinary activities before 7,140 6,008

interest

Interest receivable 293 327

Interest payable (4,020) (3,379)

Profit on ordinary activities before 3,413 2,956

taxation

Taxation (880) (951)

Profit on ordinary activities after 2,533 2,005

taxation

Minority interests 9 (11)

Profit attributable to members of the 2,542 1,994

parent undertaking

Dividends (2,125) (1,183)

Retained profit for the year 417 811

Transferred from revaluation reserve - 151

Purchase of own shares - (67)

Transfer from negative goodwill reserve - 911

Retained profit brought forward 12,297 10,491

Retained profit carried forward 12,714 12,297

Earnings per share 15.0p 11.8p

Consolidated Balance Sheet

as at 31 December 2003

2003 2002

�'000 �'000

Fixed assets

Tangible assets 93,996 79,769

Intangible asset - negative goodwill (793) (893)

Investments 223 290

93,426 79,166

Current assets

Stock 8,790 7,147

Current asset investments 1,297 1,015

Debtors: due within one year 5,580 1,999

Cash at bank and in hand 2,444 9,690

18,111 19,851

Creditors: amounts falling due within one (5,767) (7,258)

year

Net current assets 12,344 12,593

Total assets less current liabilities 105,770 91,759

Creditors: amounts falling due after more (55,576) (53,253)

than one year

Minority interests (90) (266)

Net assets 50,104 38,240

Capital and reserves

Called up share capital 4,250 4,226

Share premium account 2,886 2,862

Revaluation reserve 29,471 18,072

Capital redemption reserve 571 571

Negative goodwill reserve 212 212

Profit and loss account 12,714 12,297

Equity shareholders' funds 50,104 38,240

Net assets per share 294.8p 226.2p

Consolidated Cash Flow Statement

for the year ended 31st December 2003

2003 2002

�'000 �'000 �'000 �'000

Cash flow from operating activities 2,242 3,651

Returns on investments and servicing of (3,727) (3,052)

finance

Taxation (1,097) (864)

Investing activities (3,388) (7,464)

Acquisitions and disposals - (507)

Equity dividends paid (2,036) (1,524)

Cash outflow before financing (8,006) (9,760)

Financing

Net proceeds of share issue 48 -

Increase in debt 750 10,289

Purchase of own shares - (67)

798 10,222

(Reduction)/Increase in cash in the (7,208) 462

period

Reconciliation of net cash flow to

movement in net debt

(Reduction)/Increase in cash in the (7,208) 462

period

Cash inflow from increase in debt (750) (10,289)

Loans acquired on acquisition - (8,094)

Change in net debt resulting from cash (7,958) (17,921)

flows

Movement in net debt in the period (7,958) (17,921)

Net debt at 1st January 2003 (46,019) (28,098)

Net debt at 31st December 2003 (53,977) (46,019)

At 1st Cash At 31st

January Cash December

2003 Flow 2003

�'000 2002 �'000

�'000

Analysis of net debt

Cash at bank 9,690 (7,246) 2,444

Overdrafts (39) 39 -

9,651 (7,207) 2,444

Net debt due after 1 year (53,252) (2,325) (55,577)

Net debt due within 1 year (2,418) 1,574 (844)

(55,670) (751) (56,421)

Total (46,019) (7,958) (53,977)

Consolidated statement of total recognised gains and losses

For the year ended 31st December 2003

2003 2002

�'000 �'000

Profit for the financial year after 2,533 2,005

taxation

Unrealised surplus on revaluation of 11,399 310

properties and investments

Total gains and losses relating to the 13,932 2,315

year

Note of consolidated historical cost profits and losses

For the year ended 31st December 2003

2003 2002

�'000 �'000

Reported profit on ordinary activities 3,413 2,956

before taxation

Realisation of property revaluation gains - 151

Historical cost profit before taxation 3,413 3,107

Historical cost retained profit 417 1,806

Notes to the Results

Notes

1. Dividends

The Company has already paid a special dividend of 5p (2002: nil) and interim

dividend of 3.5p per share (net) (2002: 3.5p (net)) and the Directors now

recommend payment of a final dividend of 4p per share (net) (2002: 3.5p (net)).

The final dividend will be payable on 25th June 2004 to shareholders on the

register at the close of business on 28th May 2004.

2. Earnings per ordinary share

The calculation of earnings per ordinary share is based on earnings, after

minority interests, of �2,542,000 (2002 - �1,994,000) and on 16,992,408

ordinary shares being the weighted average number of ordinary shares in issue

during the year (2002 - 16,926,761).

3. Report and Accounts

The financial information for the year ended 31st December 2002 is extracted

from the group's financial statements to that date which received an

unqualified auditor's report and have been filed with the Registrar of

Companies.

The financial information presented does not constitute statutory accounts as

defined in Section 240 of the Companies Act 1985. The results for the year

ended 31st December 2003 have been extracted from the group's financial

statements to that date which received an unqualified auditor's report and will

be filed with the Registrar of Companies in due course.

4. Annual General Meeting

The Annual General Meeting will be held on 16th June 2004.

5. Copies of the Report and Accounts will be posted to shareholders shortly and

will be available from the Company's registered office at Panther House, 38

Mount Pleasant, London WC1X 0AP.

Further Enquiries:

Panther Securities P.L.C

Peter Rowson 020 7278 8011

John East & Partners

David Worlidge 020 7628 2200

END

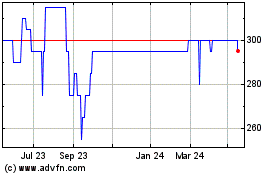

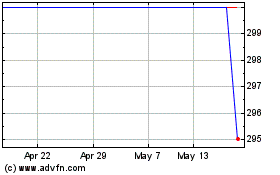

Panther Securities (LSE:PNS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Panther Securities (LSE:PNS)

Historical Stock Chart

From Nov 2023 to Nov 2024