RNS Number:4929L

Panther Securities PLC

26 April 2005

CHAIRMAN'S STATEMENT

Introduction

It has been an exciting and busy year. I am delighted to report that our pre tax

profit for the year ended 31st December 2004 amounted to #3,139,000 compared to

#3,413,000 last year. However, these figures do not include the #6,670,000

realised profit transferred from revaluation reserves.

This realised profit previously shown in our reserves arose from the sale of our

largest asset, the Panther House complex, together with some other smaller sales

mentioned below. Despite these sales, our rental income receivable increased to

a very healthy level of slightly over #9 million for the year.

Eurocity Properties PLC

On 27th May 2004 we sold Eurocity (Crawley) Limited, a wholly owned subsidiary

of Eurocity Properties PLC. The company was sold for #718,000 less selling costs

which was satisfied by a cash payment of #68,000 and #650,000 in shares and loan

notes in Real Estate Investors PLC which was a new AIM listed property company.

In addition the purchasers repaid the inter-company debt due of #634,000 in

cash. The ordinary shares were issued to us at the placing price of 10p each.

The current market price is 10.5p per share which means that if sold at these

values we would recoup most of the cost of Eurocity Properties PLC from one

third of its assets.

Panther House/Gray's Inn Road/Churchills public house

Panther House, Mount Pleasant and 156/164 Gray's Inn Road, London WC1 were sold

at auction in July 2004. They sold for #8,810,000, a figure which matched our

most optimistic expectations and Churchills public house in Mount Pleasant was

sold after the auction at #940,000. Yardworth Limited, our wholly owned

subsidiary, took a 5 year management lease (with an option to break at the end

of the 2nd year) on Panther House at #400,000 per annum. This is mostly covered

by income from sub-licensees but includes a rent for the use of the offices we

occupy.

Most shareholders will know that Panther House was the company's Head Office for

70 years. It was initially bought by the original Levers Optical Company when it

went public in 1934 and, since my involvement with the company in 1972 we have

strenuously endeavoured to maximize its value.

Our first step was to create London's first business centre offering small

licensed units available at affordable terms to developing/embryonic businesses.

We subsequently acquired an adjoining leasehold and negotiated for 25 years with

London Regional Transport to acquire their freehold interest of this leasehold

property. At the same time we started to put forward various applications for

planning permission to further develop the site - all to little avail but much

frustration. The final outcome was financially successful after years of effort.

Hawtin PLC

On 21st June we acquired 15% of Hawtin PLC, an AIM listed company, at a cost of

#1,487,976 (Portnard Limited, one of my private companies, having previously

acquired 14.5%). The purchase price in both instances was 13p per share. Hawtin

PLC was previously a conglomerate which, in recent years, had sold off all of

its trading businesses whilst retaining its freehold factories as investments.

In addition it holds 35 acres of land in Blackwood/Gwent, South Wales which is

zoned for residential and industrial use. The latest revalued book value of

Hawtin PLC's net assets is approximately 16p per share. I have been appointed to

its Board have confidence that our investment will be successful.

Wickford, Essex

For some years we have owned a factory estate in Wickford, Essex which was held

on a long lease at a low fixed ground rent from Basildon District Council. In

May we purchased the freehold at auction for approximately #650,000 including

costs and whilst this expenditure produces little extra income, the factory

estate is now freehold and the quality of the investment is much improved.

Burslem, Stoke-on-Trent

In November 2004 we purchased a 1.6 acre freehold town centre factory investment

for #900,000, producing #70,000 per annum rent from The Royal Staffordshire

Tableware Limited. The property comprises over 100,000 square feet of

accommodation.

Abraxus

On 17th November 2004 we acquired approximately 25% of the equity of this small

AIM listed shell company for about #300,000.

Post Balance Sheet Trading Events

We sold the Abraxus holding for #90,000 profit on 17th January 2005.

Shareholders have been advised that on 28th February 2005 we completed the sale

of Copthall House, Coventry, at a price of #9,250,000, which was #4,000,000 in

excess of its December 2003 independent valuation. We consider this was an

excellent result.

Towards the end of February 2005, we also sold 14-18 King Street, Stirling,

Scotland for #525,000. This was one of the Eurocity Properties portfolio and

realized approximately 10% in excess of its book value.

The profits on all of these transactions will come into the current year's

figures.

Finance

In December 2004 we completed arrangements for a new #75,000,000 seven year loan

facility with HSBC Holdings plc, who are our main lenders, and with whom we have

had an extremely good business relationship for over 24 years. The interest rate

margin was on slightly better terms than previously and #50,000,000 of this loan

is now on a fixed rate. We still have approximately #24,000,000 of this facility

undrawn and available towards future investment acquisitions.

Dividends

An Interim Dividend of 4p per share was paid on 29th October 2004 and the

Directors are recommending a final dividend of 4p per share for the year ended

31st December 2004. In view of the sale of Copthall House in February 2005, the

Directors will be paying a special Interim Dividend of 10p per share for the

year in progress on the same date as the final dividend payment.

My Pension

A personal self-administered pension fund was set up for me in 1985 by the

Company which has made total contributions of approximately #280,000 (only one

fifth of the maximum under the new lifetime limits). My fund has been very

successful and as is usual with this Government under the new "pension

simplification process" I will be penalized for success with an extremely heavy

55% tax charge should I wish to draw the maximum pension available to me in due

course. To rectify this problem I am being paid a bonus of #350,000 for the year

ending 31st December 2004, and again for the current year. I am proposing to

waive my personal entitlement to the special 10p dividend payable in 2005 which

amounts to #426,000 so that other shareholders will not be unduly disadvantaged

by my bonuses. The net cost to the company for the two years would be about

#126,000.

Directors

It is with much sadness that I have to report that Peter Rowson will be retiring

after this AGM. Peter has been with the Company for 32 years and throughout that

time has shown a loyalty, diligence and work ethic that is an example to us all.

His ability to deal with all types of people and difficult situations calmly and

fairly has long been a source of amazement to me. On behalf of all staff and

shareholders I wish him well in his retirement.

For some years now at our AGM I have been asked about succession on my

retirement from active work, usually by shareholders who are much older than me.

I have no intention of retiring at present, but to ensure continuity of the

Board, I am pleased to announce that we are appointing to our Board as from 1st

July 2005 John Doyle (age 32), manager of our surveying department, John Perloff

(age 36), letting manager, and Simon Peters (age 28), as finance director and

company secretary.

WHAT A SHAMBLES

Shareholders will by now be very well aware of my immense irritation at both the

pervasive bureaucratic nightmare caused by ludicrous regulations imposed upon us

all by those who claim to be "protecting our interests" and the excessive

amounts of taxation levied.

Whilst I have only ever had shareholders comment that they agree with my views,

I am sure some do not and are not interested in reading about some of my

experiences and views as they are not strictly relevant to the company's

accounts or progress. For this reason I have written a supplement to my

statement and shareholders thus can read or ignore my views.

Outlook

I comment at length in my supplement on the political situation which I believe

creates the greatest risks and burdens to a small company such as ours.

Your Board, however, are unanimous in its view that whilst caution is the order

of the day, our group, which holds over #20,000,000 in cash and with our undrawn

facilities is well equipped to take advantage of any opportunities that may come

our way or indeed the stormy financial conditions that are sure to arise after

the next election.

Finally I would like to thank all our staff, professional advisors and the

numerous firms we deal with and of course our tenants who have helped to make

this another successful year.

A. S. Perloff

Chairman

26th April 2005

WHAT A SHAMBLES

Planning /Housing

In the current climate with low interest rates and strong demand, builders and

developers could easily provide more housing at lower cost more affordably for

first time buyers. There is a popular misconception that there is insufficient

land on which to build. This statement is utter rubbish. The only bottleneck is

the incompetence in the planning process accompanied by local authorities'

political correctness and their barely legal blackmail of developers with their

ridiculous demands for money payments under section 106 agreements for social

housing provision.

Ministers have shed bucket-loads of crocodile tears over the lack of suitable

low cost housing for essential workers and first time buyers, and in an effort

to shift the blame from themselves, commissioned a leading economist to report

on the housing market.

Before Kate Barker even put her pen to paper I knew what conclusion this

government will take from her report - TAX IT! - this is of course not the

answer to the problem.

An investigation of the property market should also have looked at all the

property auctions of the previous two or three years and seen what a huge amount

of housing, developed buildings and land had been sold by local authorities,

N.H.S. or other unaccountable bureaucratic bodies - much of this could have been

utilised towards solving the social housing and essential worker accommodation

problem.

The reason why they sell outright is that the money is needed to pay for the

Bloated Payrolls & Pensions of all planners, town centre improvement officers/

Bat/Spider/Newt protection officers, licensing officers, shopfront inspectors,

ethnic advice/legal aid centres etc etc. These people are all very well paid,

very well pensioned, have very good working conditions as well as having a work

absenteeism rate much higher than the private sector and of course well paid

holidays, all of which are risk free and paid for by the general taxes/council

tax mostly provided by the private sector for whom they have so little regard.

Our Company owns a vacant, derelict site in the centre of Ramsgate, which would

be ideal for 24/26 flats. Our architects consulted meticulously with the

planners as to what would be an acceptable development. Numerous revisions were

made until the planner was satisfied. The application was submitted with

optimistic expectation by our architects (not by me though!) and sure enough

three or four months later the senior planning officer recommended the

application should be refused, and it was. Almost as annoyingly, a week later I

received a letter, from a Ramsgate Town Centre's Improvement Officer,

complaining about the derelict site and threatening us that if we did not bring

it into use soon they might compulsorily purchase the property. They had a short

sharp answer to their letter which unfortunately required me to show some

self-restraint in the way I normally express myself.

I am currently in the process of trying to obtain planning permission to rebuild

my own house. This is normally a simple process as new for old is allowed even

in the "green belt" where I live. My application was submitted after long

consultation. After a suitable interval I phoned to ascertain when the

application would be submitted to the planning committee and I was told it was

going to be refused by way of "delegated powers" by the senior planning officer.

The reasons given were so patently incorrect that it was clear that the planning

department had not investigated the scheme at all. I phoned my local councillor

to complain and to ask him to request that it be heard by the planning committee

(only a councillor can make this request). It seemed the democratic process

began to work. The councillor investigated the matter and the "delegated

refusal" was abandoned and a thorough investigation was implemented which

revealed the new house was only 10% bigger than the old house - not the 30% the

planning officer had actually believed. The planning officer did not believe the

independent computer calculations of cubic content and required hand written

calculations. To further complicate matters we received a letter from "Batwoman"

(Hertfordshire environment officer) who informed us that our area was known to

have bats and a bat survey was required. This we did and the "Batologist" looked

in the rafters, up the eaves, down the nooks and round the crannies. He did not

find Bats, but concluded that because it was hibernation time it was possible a

Bat family could be hidden almost anywhere. He did however find two tiny pieces

of old bat droppings and thus a new survey will have to be carried out when Mr

Bat Van Winkle wakes up. It appears a Bat family has the right to claim asylum

in my rafters and would have to be provided with suitable alternative

accommodation if I wish to redevelop. To date, no rare spiders, newts, frogs or

flora have been found, all of whom appear to have "rights" which human Council

Tax payers do not appear to have.

For 18 years I have owned an old cinema in Hyde, south of Manchester, which was

always slightly unprofitable, but about 9 years ago, a multiplex cinema opened

nearby and thereafter I doubt if we even had 50 customers each week. The cinema

was closed and a planning application was made and granted for alternative

leisure uses and despite extensive marketing no user was forthcoming. Eventually

I obtained a new planning permission to demolish and rebuild with 29 much needed

assisted flats on the site. Within four or five months a number of local

residents petitioned the heritage department - which after a cursory inspection

- listed the property. The local residents are intent on converting the cinema

back to its original use as a theatre. The cost of this would be #2 to #3

million and the losses on running this venture would be hundreds of thousands of

pounds a year.

The theatre-lover promoters want lottery money for the capital costs and the

losses presumably to be paid by the local authority (none of their own money, of

course). I am a great believer in protecting our heritage, but this cinema is a

particularly unattractive building with a low level of Grade Listing. The

proposed squandering of so much public money is absurd as the building next door

to mine is a modern theatre which more than adequately provides for Hyde's

thespian needs. What is urgently required in Hyde is "Tuppence worth" of common

sense.

Whilst these restrictions to develop are going on throughout the country, it

appears that if you are a scruffy, mess making group of people who pay no

council tax, probably don't pay road tax or car insurance, but live (probably on

state benefits) in caravans, you can do as you like. The caravans you plonk down

on green belt land, in nice areas, which have been bought cheaply because of the

lack of possible planning permission, and if you call yourself "travellers",

then judges override all the objections and planning laws and grant "living

rights" under the "human rights" act.

That's the shambles of the planning system.

Transport

We all know that there are too many cars on roads laid out before the full

impact of the car transport revolution was fully understood. But how do our

representatives deal with the problem? They employ thousands of road planners

and specialist traffic consultants who after much thought and deliberation on

how to improve traffic flow find the solution - BUS LANES - which reduce the

useable road space into major towns by 25%. This alone causes major delays and

confusion. However, once bus lanes had been implemented, many traffic planners

may be out of a job - thus bicycle lanes are devised reducing fluidity and

creating more congestion. Further havoc is created by humps - bumps - bollards

and barricades being instigated - these of course have the added benefit of

needing regular changes, when a new more efficient design for road impediment is

designed.

In the first three miles of my journey home (mainly through Islington) I go over

60 bumps/humps - ie one every 100 yards. I calculate the extra cost to repairs/

servicing the nation's stock of motor vehicles because of this persistent

shaking is probably over #6 billion per year - I doubt if there are any net

benefits and probably explains why some of the 2.7 million people are able to

claim disability benefits because their bodies are being regularly jolted!!! I

am sure it is nothing to do with the fact that being classified as disabled

means the state pays you #20 a week more than if you are on the dole or that it

helps to keep unemployment figures looking impressively low.

This is bad enough, but in an effort to punish the motorist still further, not

only do local authorities forever carry out minor road works, they also allow

any Tom, Dick or Harry of a utility company to dig up the road for their own

purposes without proper consultation. These bodies do not liaise with each

other, thus making journeys on the roads far longer and more traumatic than

necessary. I am sure you will have noticed that the majority of road works which

are coned off, causing restricted traffic, rarely have any builders working. I

believe this is because jobs are awarded at lowest cost to contractors who take

on three or four times the work they have staff to immediately carry out - thus

having to take much longer on each job by moving workers from job to job to job.

There is no consultation or consideration for the road user.

This is the shambles of the roads.

The local authority has to devise ways to allocate street parking for its own

residents. It extracts more money from its residents by charging a fee for a

permit to park near their own home on the roads already paid for out of

exorbitant petroleum taxes. Most people are happy to accept this allocation

arrangement, but if a council creates 30,000 resident spaces it sells 40,000

permits. (I understand this is the case with all London Boroughs, but obviously

the figures vary): I call this fraud.

It could be said "Airlines do the same". Yes of course this does happen and

occasionally we may get "bumped off a flight" but then compare what happens.

Airline staff apologise profusely, offer alternative arrangements, free meals,

compensate you with money or put you up at their cost at a nice hotel. The

council's attitude to a resident who finds all the "resident spaces" full and

who either has to stop to take their children into school or collect a slow

walking elderly relative, or rush into a local chemist for an urgent

prescription is to issue a parking ticket for #50 if you pay without question,

the fine doubles if you dispute the situation. (This payment method I call soft

fraud)

To escalate this fraud councils directly or indirectly employ a uniformed army

of people most of whom unfortunately seem uninterested in your personal parking

predicament when you point out that you are a resident whose space has been sold

twice and used by someone else.

Whilst still on roads it's worth mentioning that police forces up and down the

country became jealous of the huge amounts of cash that local authorities were

milking from motorists and then realised they had the technology to grab their

share of the loot - speed cameras.

Under the false pretext of making roads safer, speed cameras proliferated. The

cameras are hidden away behind bridges or placed unobtrusively on dual

carriageway roads that should have higher speed limits or placed a few hundred

yards before or after a fast road speed limit changes - especially placed to

catch the unwary. In the last three years numbers of speeding fines have gone up

to an estimated 2.5 million per annum. Does this mean the public have taken up

formula one racing on our streets? - of course not. It just means better

technology has allowed for more motorists to be milked of their cash. This

advanced camera/computer technology could easily be focused on "real" criminals

with stolen cars, non-taxed, non-insured, non-registered vehicles or convoys of

travellers moving towards some scenic area.

But it won't happen - there is no money in catching criminals.

Taxation

We have a grossly unjust taxation system upon which I have written at length in

previous reports but I still feel repetition is not amiss.

Higher rate taxpayers, who as entrepreneurs substantially own the company they

work for, pay 40% income tax and over 20% National Insurance Tax on part of

their income. The profit in the company is further taxed at 30%. The company

also has paid: 3% or 4% stamp duty tax on property purchases; 5% insurance

premium tax; VAT at 17.5%, some of which is irrecoverable, and commercial

property rates even on empty properties.

After these deductions and corporation tax having been paid, if any money is

paid out in dividends a further 25% is paid by most recipient shareholders and

when this money is spent by them a further 17.5% is paid in VAT on most

purchases. In cases of purchases of petrol, cigarettes or alcohol, approximately

80% is tax. Additionally, very high Local Council Taxes have to be paid.

When one retires and sells one's assets, up to 40% tax can be taken in one hit

on the capital appreciation even if it has taken 40 years to accumulate.

Ultimately a further 40% tax is taken when you die.

The government spending is over #8,000 per year for every single person in the

UK.

This level of taxation as well as being inequitable is a disincentive to

enterprise and detrimental to the economy.

Capital taxation on disposal of shareholdings in a large diversified property

investment company such as ours which provides huge benefits to the small

business and entrepreneurial economy of the country is taxed at the highest

rate, whereas if one manufactured guns, land mines, poisons, flick-knives or

parking warden uniforms one would receive the most favourable tax treatment.

New legislation shortly coming into force will allow same sex marriages, where

leaving aside the potential for a "Brian Rix" theatrical farce out of this, one

asks why? - it is so some people whose sexual predilection is different from the

majority can benefit from the tax benefits that married couples enjoy, eg

exemption from inheritance tax to one's partner on death, together with pension

and asset transfer rights. A widow and widower who choose to live together for

companionship and to possibly ease the heavy cost of normal every day life and

council tax, or an elderly widow wanting to leave her home to a son, daughter or

friend who lives with her and looks after her don't get similar tax concessions

- What a disgrace!

It is truly ludicrous that inheritance tax payments can be different because of

one's sexual predilections. Morally repugnant is an inadequate description for

such a tax system.

Because same sex marriage is really only a tax concession, I would not be

surprised in due course to see the Inland Revenue investigate "civil

partnership" agreements to test that it is not an "avoidance scheme" and to ask

for visible proof that the partnership has been "properly consummated".

With so much publicity recently of the 60th anniversary of the liberation of

Auschwitz I am reminded of many years ago when this company was still trying

hard to make a profit in our optical business, our top salesman was a European

Holocaust survivor who spoke with a thick mid European accent, worked very hard

and produced profitable sales for the company. I often felt that he had had more

than his fair share of misfortune in life. He had iron leg braces, his only

daughter was disabled and when he rolled up his sleeves to collect the boxes of

spectacle frames he was selling, you could clearly see the tattooed number on

his arm which said volumes for the hardship he had suffered under a

democratically elected government. He never ever talked or complained about

these previous hardships - which was in some ways surprising considering his

non-stop complaints about what was happening in our optical business.

One day he stormed into my office complaining, about what, I cannot remember !

but I remember his words well "Ven de fish shtinks it shtinks from de head". At

that time I thought he meant that the two optical directors were letting him

down on supplying the goods he had sold to his customers either in the

production process or delivering late. The words stuck in my memory and

gradually I came to realise it referred to me - I was the ultimate head of the

organisation - I did not understand the business, or give it enough attention

and let things run on without proper guidance. I was occupied elsewhere with

problems in our property interests - I WAS THE STINKER!

This story conveniently brings me to what is the cause of so many of our

problems - Central Government. Legislation is enacted on a mass of subjects by

people who have no experience in the subjects about which they are legislating

and they then compound the problem by not carrying out proper scrutiny. Vast

amounts of money are allocated to cure perceived problems in the mistaken belief

that this alone will create improvements.

Increased taxation charges on pension funds have reduced considerably the

expectations of a comfortable retirement for millions. Current younger high

achievers have had their ability to build a large pension fund curtailed, whilst

the M.P.s who passed the legislation, gold plate their own pension arrangements

with surreptitious amendments to the Finance Act and thus exclude themselves and

the judiciary from the pension fund limits. Once again it is a case of do what I

say and not as I do.

Most business owners are forced to have intricate discussions with the Inland

Revenue as to what are allowable business expenses - I doubt if M.P.s,

especially M.E.P.s, have the same vigorous inspection for their own large tax

free expenses - wives, girlfriends etc etc all go on the payroll etc. M.P.s are

allowed a second home allowance because it is assumed they need a house near

Westminster and one in their constituency. At least one MP claims #20,000 per

annum for a second home when it is rented out at #20,000 per annum - THIS IS

DISGRACEFUL.

M.P.s don't pay the congestion charge. Many M.P.s don't pay the huge

environmental tax charge that company car owners have to pay. If an MP uses his

private car for his constituency business he is allowed to charge 57p per mile.

Private owners using their car for business purposes are only allowed 40p per

mile - WHY? - most M.P.s have private parking provided for them untaxed - if

companies provide this for staff they are taxed as a benefit in kind. Some

Labour M.P.s promote restrictions on private education yet educate their own

children privately. They also recommend certain types of vaccination for

children but almost certainly carry out different, more expensive and probably

better vaccinations for their own children - in short, many M.P.s seem to be

bloody hypocrites.

In the early 19th century, the rapidly growing London was having health problems

caused by the huge amount of sewage flowing into the Thames, which at that time

still provided much of London's drinking water. However, when in 1858 a hot

summer produced such smells from the Thames that Parliament had to move out of

Westminster temporarily it was forced to provide the extra funds and impetus to

enable Bazalgette to complete the new sewage system throughout London and which,

amazingly, is still very much in use today. That year was called "The Great

Stink" of 1858.

When the populace as a whole realise how they have been ripped off with massive

additional taxes for no extra benefit; have had over 1,000 new regulations with

potentially imprisonable offences foisted upon them (even Passports for Horses &

Asses!!); have had uncontrolled and unquantified immigration to these shores

without consultation; have been persecuted insensitively by all and every form

of authority, then I believe 2005 or 2006 might become this century's "Great

Stink". This is why we are making a #25,000 donation to the Conservative Party -

on the basis that they can run the country on a far more efficient, honest and

equitable basis than the current bunch of STINKERS.

CONSOLIDATED PROFIT AND LOSS ACCOUNT

for the year ended 31st December 2004

2004 2003

#000 #000

Turnover 9,292 9,791

Cost of sales (1,487) (1,654)

------- -------

Gross profit 7,805 8,137

Administrative expenses (1,988) (1,336)

------- -------

Operating profit 5,817 6,801

Income from current asset investments 45 426

Income from associate 37 (67)

Profit on disposal of property 527 -

Profit on sale of subsidiary 303 -

Profit on disposal of investments 43 (20)

------- -------

Profit on ordinary activities before interest 6,772 7,140

Interest receivable 363 293

Interest payable (3,996) (4,020)

------- -------

Profit on ordinary activities before taxation 3,139 3,413

Taxation (1,605) (880)

------- -------

Profit on ordinary activities after taxation 1,534 2,533

Minority interests (4) 9

------- -------

Profit attributable to members of the

parent undertaking 1,530 2,542

Dividends (1,360) (2,125)

------- -------

Retained profit for the year 170 417

Transferred from revaluation reserve 6,670 -

Retained profit brought forward 12,714 12,297

------- -------

Retained profit carried forward 19,554 12,714

------- -------

Earnings per share 9.0p 15.0p

CONSOLIDATED BALANCE SHEET

at 31st December 2004

2004 2003

#000 #000

Fixed assets

Tangible assets 87,821 93,996

Intangible asset - negative goodwill (571) (793)

Investments 2,893 723

-------- --------

90,143 93,926

-------- --------

Current assets

Stock 9,755 8,790

Current asset investments 323 797

Debtors: due within one year 4,263 5,580

Cash at bank and in hand 15,337 2,444

-------- --------

29,678 17,611

-------- --------

Creditors:

amounts falling due within one year (5,814) (5,767)

-------- --------

Net current assets 23,864 11,844

-------- --------

Total assets less current liabilities 114,007 105,770

Creditors:

amounts falling due after more than one year (58,925) (55,578)

Minority interests (94) (90)

-------- --------

Net assets 54,988 50,102

-------- --------

Capital and reserves

Called up share capital 4,250 4,250

Share premium account 2,886 2,886

Revaluation reserve 27,515 29,471

Capital redemption reserve 571 571

Negative goodwill reserve 212 210

Profit and loss account 19,554 12,714

-------- --------

Equity shareholders' funds 54,988 50,102

-------- --------

Net assets per share 323.5p 294.8p

CONSOLIDATED CASH FLOW STATEMENT

for the year ended 31st December 2004

2004 2003

#000 #000 #000 #000

Cash flow from operating activities 7,360 2,242

Returns on investments and servicing of finance (3,594) (3,727)

Taxation (1,353) (1,097)

Investing activities 7,436 (3,388)

Acquisitions and disposals (42) -

Equity dividends paid (1,360) (2,036)

------- --------

Cash outflow before financing 8,447 (8,006)

Financing

Net proceeds of share issue - 48

Increase in debt 4,447 750

------- --------

4,447 798

------- --------

(Reduction)/Increase in cash in the period 12,894 (7,208)

------- --------

Reconciliation of net cash flow to

movement in net debt

Increase/(Reduction) in cash in the

period 12,894 (7,208)

Cash inflow from increase in debt (4,447) (750)

------- --------

Change in net debt resulting from cash flows 8,447 (7,958)

-------- --------

Movement in net debt in the period 8,447 (7,958)

Disposal of debt on sale of subsidiary 1,732 -

Net debt at 1st January 2003 (53,977) (46,019)

-------- --------

Net debt at 31st December 2003 (43,798) (53,977)

-------- --------

At 1st At 31st

January Cash Other December

2004 Flow Movements 2004

#000 #000 #000 #000

Analysis of net debt

Cash at bank 2,444 12,893 - 15,337

Overdrafts (1) 1 - -

-------- -------- -------- --------

2,443 12,894 - 15,337

-------- -------- -------- --------

-

Net debt due after 1 year (55,576) (5,087) 1,738 (58,925)

Net debt due within 1 year (844) 640 (6) (210)

-------- -------- -------- --------

(56,420) (4,447) 1,732 (59,135)

-------- -------- -------- --------

Total (53,977) 8,447 1,732 (43,798)

CONSOLIDATED STATEMENT OF TOTAL RECOGNISED

GAINS AND LOSSES

for the year ended 31st December 2004

2004 2003

#000 #000

Profit for the financial year after taxation and minority interest 1,530 2,542

Unrealised surplus on revaluation of properties and investments 4,714 11,399

------ -------

Total gains and losses relating to the year 6,244 13,941

------ -------

NOTE OF CONSOLIDATED HISTORICAL COST

PROFITS AND LOSSES

for the year ended 31st December 2004

2004 2003

#000 #000

Reported profit on ordinary activities before taxation 3,139 3,413

Realisation of property revaluation gains 6,670 -

------ -------

Historical cost profit before taxation 9,809 3,413

------ -------

Historical cost retained profit 170 417

------ -------

Notes

1. Basis of preparation - Report and Accounts

The preliminary results of the group, which are not statutory accounts, have

been prepared on the basis of the accounting policies as set out in the report

and accounts for the year ended 31 December 2003.

The financial information for the year ended 31st December 2003 is extracted

from the group's financial statements to that date which received an unqualified

auditor's report and have been filed with the Registrar of Companies.

The group accounts for the year ended 31st December 2004 have not yet been filed

with the Registrar of Companies or reported on by the auditors.

2. Dividends

The company has already paid an interim dividend of 4p per share (net) (2003:

3.5p (net)) and the Directors now recommend payment of a final dividend of 4p

per share (net) (2003: 4p (net)). The final dividend will be payable on 28th

June 2005 to shareholders on the register at the close of business on 27th May

2005.

3. Earnings

The calculation of earnings per ordinary share is based on earnings, after

minority interests, of #1,530,000 (2003 - #2,542,000) and on 16,998,151 ordinary

shares being the weighted average number of ordinary shares in issue during the

year (2003 - 16,922,408).

4. Annual General Meeting

The Annual General Meeting will be held on 23rd June 2005.

5. Copies of the Report and Accounts will be posted to shareholders shortly and

will be available from the Company's registered office at Panther House, 38

Mount Pleasant, London WC1X 0AP.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UVSNRVBRSUAR

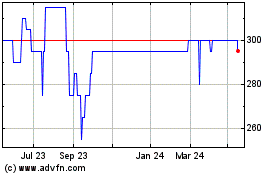

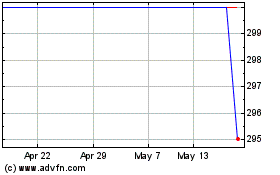

Panther Securities (LSE:PNS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Panther Securities (LSE:PNS)

Historical Stock Chart

From Nov 2023 to Nov 2024