RNS No 3302r

POLICY MASTER GROUP PLC

8 April 1999

PRELIMINARY RESULTS FOR THE YEAR ENDED 31 DECEMBER 1998

FINANCIAL HIGHLIGHTS

* The Company's results in the first year as a publicly quoted

company represent a substantial improvement on 1997.

* Operating profit before goodwill amortisation up 35 per cent. at #1.1m

(1997: #0.8m*).

* Turnover has increased by 30 per cent. to #11.3m (1997: #8.7m*).

* Adjusted EPS+ of 7.5 pence (1997: 5.5 pence*).

* The Company continues with an effective nil rate of corporation

tax with #4.1m of tax losses available at the year-end.

* Recurring revenue of #4.7m (1997: #3.9m*).

* A final dividend of 1p per share is proposed.

* and ** refers to the notes following the accounts.

CHAIRMAN'S STATEMENT

REVIEW OF RESULTS

Turnover of #11.3m represents a 30 per cent. growth on 1997, * reflecting

the ongoing strong demand for Policy Master's products and

services. Operating profit before goodwill amortisation was #1.1m,

up 35 per cent. on 1997.* Operating profit margins before goodwill

amortisation moved up from 8.9 per cent. to 9.3 per cent.

Adjusted earnings per share (EPS) of 7.5p for the year was up 36 per cent.

on 1997+. The adjusted EPS is based on operating profits before

the effect of the interest charges and amortisation of goodwill

arising from the MBO in January 1997.

Net assets improved during the year to end at #4.2m. Operating

activities generated #662,000 of cash during the year. Principal

uses of cash during the year included the purchase of the premises

adjoining the Head Office at Sutton Coldfield and of Swift

Financial Systems Ltd. Arrangements post-year end have been made

to put in place a mortgage on the property repayable over a ten-

year period.

Although growth was experienced in all areas of the business, it

was particularly pleasing to see delivery to the first Gemini and

Sirius customers. Interest in Sirius has been particularly strong,

resulting in a growing order book. The success of Sirius confirms

Policy Master's abilities to produce high-value tailored solutions

designed to maintain the business needs of an increasing number of

specialists in our market. The traditional business of UK broking

systems benefited from three significant orders during 1998 which

added 150 new sites. One of these customers, CGU, continues to

install Policy Master systems into its tied agents in 1999.

Sales overseas were 17 per cent. of total turnover, a similar level to

previous years and the Group's considerable recurring revenue

continued to grow to #4.7m (#3.9m in 1997), representing 42 per cent. of

total sales.

ACQUISITION

Following the Company's successful flotation in July, on 15

October Policy Master purchased the share capital of Swift

Financial Systems Ltd. Historically Swift was primarily involved

in the development of a new Windows-based Life & Pensions back-

office system for the Independent Financial Adviser (IFA). Policy

Master research indicated this was a market-leading product that

had already secured a number of prestige sales. Since the

acquisition, the business has been integrated into Policy Master

and continues to broaden the functionality of its product range.

As well as making sales to IFAs, of particular benefit to existing

Policy Master customers will be the integration of the Swift

product with PM Broking, thus providing full inter-operability for

the composite broker.

During the course of 1999 it is anticipated that the Swift product

will make an increasing contribution to the Group's results.

STRATEGIC REVIEW

Following the advent of new products and the Group's entry into

solution sales, the management team identified a need for a new

structure to meet the needs of the growing diversity of customers.

A full strategic review by the management team has led to the

introduction of a new channel structure for 1999. This will allow

for customer segmentation and is discussed in more detail later.

CURRENT TRADING AND FUTURE PROSPECTS

The Group starts 1999 with a strong order book. As well as

expanding its Sirius solution sales, the Group continues to

install broking systems at a high run rate. 1999 should also see

the benefits of the Swift product range as it becomes established

with an even stronger customer base.

EMPLOYEES

Although the employment market for certain specialist skills

remains difficult, the Group has continued to grow its workforce

to meet resource requirements to support its growing sales.

Following the Swift acquisition, total headcount has now reached

220, and staff turnover continues to better the industry average.

The Group launched an Employee SAYE scheme in October 1998 with 77

people subscribing to the scheme, in addition to the sizeable

number of staff that participated in the share offers at the time

of the MBO and flotation. In line with the Group's continued

commitment to wider employee share ownership, a further scheme

will be introduced during 1999.

Finally, on behalf of the whole Board I thank all of our staff for

their continuing commitment and contribution to the Group's

success.

John A Kimberley

Chairman

CHIEF EXECUTIVES STATEMENT

A YEAR OF GROWTH

1998 was very exciting year for Policy Master as making our entry

to the Alternative Investment Market (AIM) of the London Stock

Exchange, it was a year in which we started to see the benefits of

our ongoing investment in new technology.

At the time of our flotation, we said that Sirius, our new

Microsoft Windows-based technologies and products, positioned us

well to exploit several opportunities for growth:

* increased market share of packaged systems

* higher-value contracts from larger customers

* supplying high-valued tailored solutions to more sophisticated

and specialist organisations which are evolving from the changes taking

place in the market.

I am pleased to report that we have been able to exploit these

opportunities.

Increased Market Share

1998 has been our best year ever for sales of new systems. We

took orders for over 200 new sites, 75 per cent. of them displacing

existing systems from major competitors. These gains include

multi-site systems to A-Plan and to Secure Trust, two of the UK's

larger retail broking chains. We were also delighted to win a

contract to supply new systems to the 100-strong, tied agent base

of CGU. These sales have increased our market share and have

stimulated interest from other organisations seeking technology

which is both innovative and cost-effective.

Larger Contracts

As in previous years, we continue to be successful in increasing

our average order value by attracting a number of larger broking

customers such as RA Rossborough in the Channel Islands. We are

actively targeting this end of the market and have continued to

achieve further notable contract wins.

Tailored Solutions

We believe the provision of tailored solutions, built using our

component-based Sirius technology, is the Group's most exciting

opportunity for growth. Development of the Sirius components began

in 1996 and during 1998 we were able to start the build and

deployment of our first customer solutions, which included

developments for Royal Bank Insurance Services and MiniBus Plus,

the UK's leading provider of minibus insurance. Importantly, we

enter 1999 with a strong order book to provide Sirius solutions

for a wide range of customers.

NEW PRODUCT LAUNCHES

As well as delivering our first Sirius systems, we also released

new versions of existing products. Notable new product versions

included DocuMaster Enterprise (DME), an enhanced version of our

document & image management software for larger and more complex

organisations. We also added more functionality and more

commercial lines products to our Gemini software.

For 1999 we are delighted to have gained significant support from

major insurance companies to provide funding to develop Gemini II,

our new generation of Windows-based personal lines insurance

systems. We believe Gemini II will enable us to further increase

our market share of packaged systems and to provide more advanced

systems for direct marketers and call centre operations.

Later in the year we plan to launch our next generation of

packaged products for brokers with our new 'Sirius for Broking'

back-office software. We believe that the strong functionality of

this new product, combined with its use of the Windows

environment, will enable us to win new business and secure

additional upgrade revenues from existing customers.

ACQUISITION OF SWIFT

For some time we have believed there is significant opportunity in

providing software for independent financial advisers (IFAs). Our

own broker customers with IFA arms to their business had been

asking for Windows software with more specialist features and

better compliance monitoring. Rather than build our own new

generation of Life & Pensions software, we resolved to acquire a

specialist software house that would strengthen this part of our

portfolio. With Swift Financial Systems, we gained a market-

leading Windows product, a customer base of corporate IFAs,

pension providers and life insurers as well as a team of

specialist staff and developers. Policy Master customers have

reacted well to the Swift acquisition and a strong sales line is

being built both for new and existing customers.

PARTNERSHIPS

Policy Master sees partnerships, such as our relationship with

Microsoft and Compaq, as pivotal in enabling us to provide the

'total solution' of end-user application, third-party software and

hardware that our customers increasingly require. Our relationship

with Microsoft has strengthened since our Sirius technology was

awarded their Designed for BackOffice(TM) logo accreditation, ahead

of any other insurance software house worldwide, in 1997. We have

now earned Microsoft Solution Provider Partner status, once

again ahead of our competitors. Our partnership relationship

with Compaq is more recent, having been formed during 1998.

Together we have already been able to present a number of

innovative system propositions that have enabled us to win some

large contracts as well as providing a cost-effective bundled

offering for smaller businesses.

STRENGTHENED MANAGEMENT TEAM

The addition of divisional directors to two new roles on the

operating board has strengthened our management team. Mike Dodd,

who joined us as Business Development Director, is well known in

the industry and was previously the Sales and Marketing Director

of one of our competitors, Quotel. Mike's role is to develop

strategies for growth and increased market share for our UK broker

and insurer business. Mike Payne joined us as Corporate Solutions

Director, bringing senior management experience gained in banking

and financial organisations, to help exploit our opportunities for

solution sales.

GOING FORWARD

Customer Segmentation and Channels to Market

Policy Master's customer base is becoming more diverse, ranging

from the sole trader IFA to the multi-national underwriter. Our

research makes it clear that different types of customers have

different needs, expectations and budgets. This year, we recognise

this by a reorganisation of our sales and support activities by

market segment and channels to market rather than by product. Our

aim is to provide each of our customers with a service that more

fully matches their requirements and circumstances. We believe

that this will lead to a measurable improvement in customer

satisfaction and will help to increase sales.

Emergent Technologies and a Changing Market

Over the last few years, the insurance industry has undergone

significant change with the growth of direct writing, insurer and

intermediary consolidation and the emergence of tied agents.

Policy Master has turned much of this change into opportunity and

we are now serving many of these new channels to market. In the

future, we see the emergent electronic commerce technologies of

the internet and interactive digital television as one of the

strongest factors driving further change in our industry. Our

customers will look to us to provide software that enables them to

survive and compete in the world of E-commerce. With this in mind,

we have already developed the software that will allow our broker

and insurer customers to extend their systems to electronically

service their end-user clients. We are also working on a project

with a major customer to allow them to sell insurance using

digital television. Consequently, we have high expectations from

our E-commerce applications in the years ahead.

Continued Growth

The Group is exceptionally well placed to exploit its considerable

opportunities. We have a quality customer base, a good reputation

and a track record, a whole new range of state-of-the-art products

and technologies and a clear vision for the Group's future. We

have an excellent team of people who are highly motivated with a

sense of ownership of the Group and its objectives. All of this we

believe will enable us to continue to achieve strong organic

growth in our marketplace of insurance and financial services.

Whilst our focus is very much on organic growth, we also believe

there are opportunities for further acquisition. We will be

looking for opportunities that would enable us to widen our

corporate customer base, acquire more skilled staff and expand our

activities internationally.

In summary, we enter 1999 with confidence in our people, our

products and our ability to exploit the opportunities for growth

that being a technology provider to the insurance and financial

services market presents at this time.

Stephen J Verrall

Chief Executive

GROUP PROFIT AND LOSS ACCOUNT

For the year ended 31 December 1998

1998 1997

# #

Turnover

Continuing operations

- ongoing 11,116,558 8,195,069

- acquisitions 221,847 -

---------- ---------

11,338,405 8,195,069

Cost of sales 6,235,452 4,798,936

---------- ---------

Gross profit 5,102,953 3,396,133

Distribution costs 1,534,275 936,957

Administrative expenses

(excluding goodwill amortisation) 2,508,538 1,701,223

---------- ----------

Operating profit before goodwill

amortisation 1,060,140 757,953

Goodwill amortisation (129,253) (103,806)

---------- ---------

Operating profit

Continuing operations

- ongoing 905,326 654,147

- acquisitions 25,561 -

-------- -------

930,887 654,147

Interest receivable 39,163 22,970

Interest payable and similar charges (272,660) (241,509)

--------- ---------

Profit on ordinary activities

before taxation 697,390 435,608

Tax on profit on ordinary activities (368) (690)

Profit for the financial period

attributable to members of the parent

company 697,022 434,918

Dividends

Equity dividends on ordinary shares 141,333 -

Non-equity dividend on cumulative

participating preferred ordinary

shares 1,473 2,758

------- -----

142,806 2,758

------- -----

Retained profit for the financial

period 554,216 432,160

Earnings per share (p) ------- -------

- basic 5.88 5.65

- diluted 5.86 5.65

There have been no recognised gains or losses during the year

other than the profit for the year.

The 1997 results are for a statutory 14 month period and include

11 months of trading of Policy Master Plc, a subsidiary

undertaking, compared with 12 months in 1998.

GROUP BALANCE SHEET AT 31 DECEMBER 1998

1998 1997

# #

Fixed assets

Intangible assets 2,992,386 2,161,050

Tangible assets 1,461,820 366,785

--------- ---------

4,454,206 2,527,835

Current assets

Stocks 143,671 31,680

Debtors 3,195,550 2,084,143

Cash at bank and in hand 122,852 513,097

--------- ----------

3,462,073 2,628,920

Creditors: amounts falling

due within one year

(2,815,675) (1,805,511)

---------- ---------

Net current assets 646,398 823,409

---------- ---------

Total assets less current liabilities 5,100,604 3,351,244

Creditors:

amounts falling due after more than

one year (744,742) (2,006,817)

Accruals and deferred income

Deferred income (202,113) (357,125)

---------- ---------

4,153,749 987,302

---------- ---------

Capital reserves

Called up share capital 143,448 63,855

Share capital to be issued 250,000 -

Share premium account 2,320,775 38,137

Merger reserve 453,150 453,150

Profit and loss account 986,376 432,160

---------- -------

4,153,749 987,302

---------- -------

Shareholders' funds:

Equity 4,151,634 952,806

Non-equity 2,115 34,496

--------- -------

4,153,749 987,302

--------- -------

GROUP STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 31 DECEMBER 1998

1998 1997

# #

Net cash inflow from operating

activities 661,966 842,234

-------- -------

Returns on investments and servicing

of finance

Interest received 37,748 20,570

Interest paid (203,627) (135,838)

Interest element of finance lease

rental payments (23,414) (4,181)

Issue costs on long-term loans (40,000) (104,903)

Cumulative participating preferred

ordinary dividends paid (2,970) (1,261)

------- --------

(232,263) (225,613)

-------- ---------

Taxation

Corporation tax paid

(including advance corporation tax) (374) (316)

-------- ------------

Capital expenditure and financial investment

Payments to acquire tangible

fixed assets (842,691) (214,447)

--------- ------------

Acquisition

Purchase of subsidiary undertaking (426,678) (2,252,207)

Net overdraft acquired with subsidiary

undertaking (154,925) (30,174)

--------- -----------

(581,603) (2,282,381)

--------- -----------

Net cash outflow before financing (994,965) 1,880,523)

Financing

Issue of ordinary and cumulative participating

preferred ordinary share capital 2,725,000 125,059

Share issue costs (362,769) (43,097)

New long-term loans 500,000 1,000,000

Repayment of long-term loans (800,000) (200,000)

Repayment of unsecured loan stock (1,467,000) -

Movement on unsecured loan stock issued - 1,467,000

Repayment of capital element of

finance leases and hire purchase

contracts (66,667) (25,428)

--------- ---------

528,564 2,323,534

----------- ----------

(Decrease)/Increase in cash (466,401) 443,011

----------- -----------

NOTES

1. The summary of the results for the year ended 31 December

1998 does not constitute full financial statements within the

meaning of Section 240 of the Companies Act 1985. The full

statutory accounts have received an unqualified audit report but

have not yet been delivered to the Registrar of Companies. The

statutory accounts for the period ended 31 December 1997 have

received an unqualified audit report and have been delivered to

the Registrar of Companies. The statutory accounts for the

periods ended 31 December 1998 and 31 December 1997 did not

contain statements under Section 237(2) or (3) of the Companies

Act 1985.

2. The calculation of basic earnings per ordinary share is based

on earnings of #695,549 (1997: #432,160), being profit for the

year of #697,022 (1997: #434,918) less preference dividends in

respect of shares of #1.473 (1997: #2,758), and on 11,834,988

ordinary shares (1997: 7,647,760) ordinary shares, being the

weighted average number of ordinary shares in issue during the

year.

The diluted earnings per share is based on profit for the

year of #695,549 (1997: #432,160), and on 11,863,149 (1997:

7,647,760) ordinary shares, calculated as follows:

1998 1997

No. No.

Basic weighted average number of shares 11,834,988 7,647,760

Dilutive potential ordinary shares:

Executive share options 33 -

Deferred consideration 28,128 -

---------- ---------

11,863,149 7,647,760

---------- ---------

** The adjusted EPS is calculated from operating profit before goodwill

amortisation and on 14,133,327 ordinary shares of 1p being the share

capital structure in place on 31 December 1998. This effectively assumes the

flotation proceeds were received at the beginning of the year and the interest

costs and the MBO loan costs have been added back to profit.

3. The dividend, when approved by the shareholders at the AGM, will be payable

on 25 May 1999 to shareholders on the register on 23 April 1999.

4. The Annual General Meeting will be held at Swinfen Hall Hotel, Nr

Lichfield, Staffs on Tuesday 18 May 1999 at 10.00am.

5. Copies of the Report and Accounts for the year ended 31 December 1998 are

being sent to shareholders in due course. Further copies are available

from the Company's registered office at Policy Master House, Reddicroft,

Sutton Coldfield, West Midlands B73 6BN.

* Policy Master Group PLC (PMG) was incorporated on 5

November 1996 as Foray 978 Limited to effect the management buy-

out of Policy Master Plc (PM). It acquired the entire share

capital of PM on 27 January 1997 and accordingly, its consolidated

financial statements for the period ended 31 December 1997 include

only eleven months trading for PM. For the purposes of comparison

1997 was prepared on a combined basis, incorporating the eleven

months trading results disclosed in the PMG financial statements

aggregated with the one months trading included in PM's financial

statements prior to acquisition. This approach is entirely

consistent with figures presented in the prospectus at the time of

flotation.

END

FR CCOCBKDKBKQK

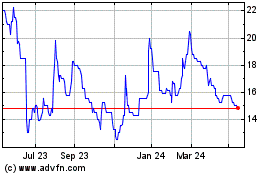

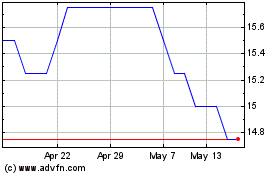

Parkmead (LSE:PMG)

Historical Stock Chart

From Sep 2024 to Oct 2024

Parkmead (LSE:PMG)

Historical Stock Chart

From Oct 2023 to Oct 2024