PipeHawk PLC Acquisition of Utsi Electronics Limited (1253N)

January 28 2021 - 2:00AM

UK Regulatory

TIDMPIP

RNS Number : 1253N

PipeHawk PLC

28 January 2021

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) no. 596/2014 (which forms

part of domestic UK law pursuant to the European Union (Withdrawal)

Act 2018) ("MAR"). With the publication of this announcement via a

Regulatory Information Service, this inside information is now

considered to be in the public domain.

28 January 2021

PipeHawk plc

("PipeHawk", "Company" or the "Group")

Acquisition of Utsi Electronics Limited

PipeHawk is pleased to announce that it has acquired the entire

issued share capital of Utsi Electronics Limited ("UtEl") for a

maximum consideration of GBP2 million (the "Acquisition").

Further details on UtEl

UtEl is a UK based manufacturer and designer of a wide range of

special purpose ground penetrating radar ("GPR") systems which are

sold around the world under the Groundvue brand through mature

distribution channels. With these products and markets being

complementary to those of PipeHawk's own brand systems, the Board

of PipeHawk believes the acquisition will provide an enlarged

portfolio of GPR system offerings into a significantly wider range

of markets as well as offering excellent opportunity to extend

R&D activities into the highly desirable

Environmental/Water/Structural Faults markets and increase unit

profitability across the dual product ranges achieved through

enhanced marketing, rationalised designs and parts sourcing.

In the year ended 5 April 2020, UtEl recorded unaudited revenues

of approximately GBP398,300 and an unaudited profit before tax of

approximately GBP150,750. As at 5 April 2020, UtEl had net assets

of approximately GBP715,000.

Further details on the Acquisition

The consideration for the Acquisition will be satisfied as an

initial cash payment of GBP500,000, subject to adjustment based on

UtEl's net asset value on completion, with any excess over

GBP500,000 to be satisfied as 50 per cent. in cash and 50 per cent.

in ordinary shares in PipeHawk (based on the Company's volume

weighted average price of a PipeHawk ordinary share for the

preceding 30 business days) ("Deferred Payment Shares").

In addition, UtEl will be entitled to further earn out

consideration equivalent to 50 per cent. of the profits before tax

attributable to UtEl (after adding back any management charges made

by PipeHawk) in each of the first and second years following

completion of the Acquisition, subject to a minimum of GBP2,000 per

annum (the "Earn Out Consideration"). The Earn Out Consideration

will be satisfied as to 50 per cent in cash and 50 per cent. in

ordinary shares in PipeHawk (based on the Company's volume weighted

average price of a PipeHawk ordinary share for the preceding 30

business days ("Earn Out Shares")). The total consideration payable

to UtEl has been capped at GBP2 million.

The vendors of UtEl have undertaken not to transfer any legal or

equitable interest in any Deferred Payment Shares or Earn Out

Shares for a period of two years after the date of issue of such

shares with orderly market arrangements thereafter.

Gordon Watt, the Chairman of PipeHawk, has provided a personal

guarantee to the vendors of UtEl under which he has guaranteed the

prompt, full and complete performance of any and all existing

duties and obligations of PipeHawk to the vendors of UtEl and the

payment of any and all sums due to the vendors of UtEl under the

terms of the sale agreement entered into in respect of the

Acquisition. The maximum claim by the vendors of UtEl under this

guarantee is limited to GBP500,000 provided that the initial cash

payment of GBP500,000 has been made.

Application will be made for any Deferred Payment Shares and/or

any Earn Out Shares to be admitted to trading on AIM in due

course.

Gordon Watt, Chairman of PipeHawk, commented : "We have worked

very well with UtEl in the past and I am delighted that we have

been able to merge the PipeHawk GPR Division with UtEl. "

Enquiries:

PipeHawk Plc Tel. No. 01252 338 959

Gordon Watt (Chairman)

Allenby Capital (Nomad and Broker) Tel. No. 020 3328 5656

David Worlidge/Asha Chotai

Notes to Editors

For further information on the Company and its subsidiaries, please visit: www.pipehawk.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQUBUWRAVUAUAR

(END) Dow Jones Newswires

January 28, 2021 02:00 ET (07:00 GMT)

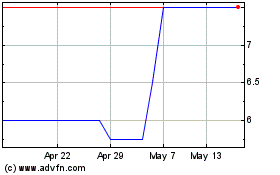

Pipehawk (LSE:PIP)

Historical Stock Chart

From Dec 2024 to Jan 2025

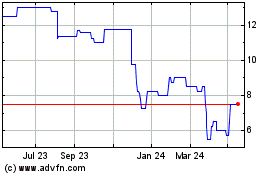

Pipehawk (LSE:PIP)

Historical Stock Chart

From Jan 2024 to Jan 2025