TIDMPDL

RNS Number : 5239M

Petra Diamonds Limited

15 September 2023

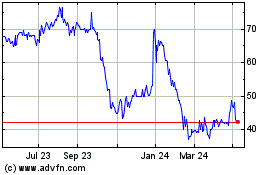

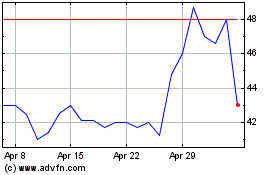

15 September 2023 LSE: PDL

Petra Diamonds Limited

("Petra or "the Company")

Preliminary Results for FY 2023 (unaudited)

Strengthened Balance Sheet and Stabilising Production sets Path

for Growth

Petra announces its preliminary results (unaudited) for the year

ended 30 June 2023 (FY 2023 or Year).

Richard Duffy, Chief Executive Officer of Petra, commented:

"FY 2023 has demonstrated the improved resilience of Petra's

operating model as we realise value from our operations, placing us

in a strong position to deliver on our stated target of increasing

annual group production by up to 1.3 million carats in FY 2026 as

we continue to develop the long-term potential of our large

resource base.

Production in FY 2023 at 2.67 Mcts, while marginally below

revised guidance on the back of some operating challenges, showed

an improving trend during the second half as operating performance

stabilised. Williamson restarted production in July 2023 and is

ramping up ahead of schedule. Key Group operational guidance is

maintained.

In line with our objective of reducing gross debt while

investing in organic growth and life extension, we successfully

repurchased just over one-third, or US$144.6 million, of the

Company's 2026 loan notes during the Year, both strengthening our

balance sheet and reducing future interest costs. This, coupled

with our flexible sales process, enabled us to delay the sales of

some diamonds from our last two Tenders of FY 2023, in expectation

of improved pricing.

The first Tender of FY 2024 reflected persistent softer market

conditions due to prevailing macro-economic uncertainties around

high interest and inflation rates. Although there has been some

stabilisation in global economies and growth outlooks for CY 2023,

the economic outlook for CY 2024 is now more subdued.

Notwithstanding this, we continue to see the prevailing structural

supply deficit of diamonds providing market support in the medium

to longer term.

Actions taken to strengthen our business and improve cash flow

generation, together with our capital discipline around investing

in the growth and life extension of our operations, means that

Petra is resilient in the short-term and well placed in the medium

to longer term to leverage these continued supportive diamond

market fundamentals."

Balance sheet remains robust despite lower production and

deferred tender sales

-- The results, where appropriate, exclude Koffiefontein which

has been classified as a discontinued operation

-- FY 2023 revenue amounted to US$325.3 million (FY 2022:

US$563.7 million), including revenue from profit share agreements

of US$1.4 million (FY 2022: US$1.1 million)

-- The average realised price in FY 2023 was US$139/ct, down 14%

from US$161/ct in FY 2022, largely due to product mix, partially

offset by a 2% like-for-like price increase

-- Adjusted mining and processing costs benefitted from a weaker

ZAR:USD, lower production volumes and royalties, cost savings and

diamond inventory movement. These factors were partly offset by

cost inflation and care & maintenance costs at Williamson

following the Tailings Storage Facility (TSF) failure

-- Adjusted EBITDA, being profit from mining activities less

adjusted corporate overheads, reduced to US$113.1 million (FY 2022:

US$277.8 million), representing a margin of 35%, driven by lower

production, Williamson being on care and maintenance for around 7

months of the Year and the reduced contribution from Exceptional

Stones (those sold for US$5 million or more each), partially

off-set by a weaker ZAR:USD

-- Adjusted net loss of US$2.3 million down from US$115.2 million profit (FY 2022)

-- Adjusted loss per share of USc2.96, down from USc48.01 profit (FY 2022)

-- Operational free cash outflow of US$66.5 million (FY 2022:

US$230.0 million inflow) due to reduced sales, including the

deferral of sales to FY 2024, and the planned increase in capital

expenditure

-- Consolidated net debt increased to US$176.8 million (30 June 2022: US$40.6 million)

-- In September 2022, the Group repurchased a portion of the

2026 loan notes which reduced the Group's loan and borrowings to

US$247.5 million at Year-end, and reduced future interest costs

US$m unless stated otherwise FY 2023 FY 2022 Variance

Restated(2)

Rough diamonds sold (carats) 2,329,817 3,499,412 -33%

Revenue 325.3 563.7 -42%

Average realised price per carat

(US$/carat) 139 161 -14%

Adjusted mining and processing costs 202.1 272.5 -26%

Adjusted EBITDA(1) 113.1 277.8 -59%

Adjusted EBITDA margin (%)(1) 35% 49% -29%

Adjusted profit before tax (1) 8.3 155.1 -95%

Adjusted (loss) / profit after tax

(1) (2.3) 115.2 -102%

Net (loss) / profit after tax (102.4) 88.1 -216%

Basic (loss) / profit per share (USc) (38.10) 40.74 -193%

Adjusted (loss) / profit per share(1)

(USc) (2.96) 48.01 -106%

--------------------------------------- ---------- ------------- ---------

Capital expenditure 117.1 51.6 127%

Operational free cashflow (1) (66.5) 230.0 -129%

--------------------------------------- ---------- ------------- ---------

Consolidated net debt(1) 176.8 40.6 335%

Unrestricted cash 44.1 271.9 -84%

Consolidated net debt : Adjusted

EBITDA (1) 1.6x 0.15x 970%

--------------------------------------- ---------- ------------- ---------

Note 1: For all non-GAAP measures refer to the Summary of

Results table within the Financial Results section below

Note 2: During the Year, Koffiefontein was place on care and

maintenance activities in the run-up to a responsible closure.

Koffiefontein is classified as a discontinued operation in FY 2023

as it has been 'abandoned" in terms of IFRS 5. For comparative

purposes, the relevant FY 2022 results have been restated to

exclude Koffiefontein

Ongoing focus on sustainability and zero harm working

environment

Our Sustainability Framework is being embedded into Petra's

operating model. Sustainability targets will be detailed in the FY

2023 Sustainability Report due to be released in October 2023.

Valuing our people

-- In FY 2023, we recorded 17 lost time injuries (LTIs), a 13%

increase from FY 2022, which translated to a lost time injury

frequency rate (LTIFR) of 0.24 per 200,000 hours worked, up from

0.22 in FY 2022. This largely reflected the ramping up of the two

extension projects at Cullinan Mine and Finsch and a single,

blasting-related, incident at Cullinan Mine in which four employees

were regrettably injured and have since fully recovered

-- In striving for a zero-harm environment, we continue to focus

on remedial actions and behaviour-based intervention programmes

across our operations

-- New Petra Culture Code roll out underway

Respecting our Planet

-- Progress on Petra's response to Climate Change was achieved

through formulating a Climate Change Mitigation and Adaptation

Strategy, setting interim milestones to reach a 35-40% reduction by

2030 (against the 2019 baseline) towards our ambition to reach

net-zero for Scopes 1 and 2 emissions by 2040

-- Following the TSF failure at Williamson, efforts focused on

achieving soil remediation and restoring the ecological

functionality of the affected areas, with preliminary indicators

reflecting positive outcomes

Driving Shared Value Partnerships

-- Our support for local communities was accelerated through our

committed efforts in generating sustainable value through our

Social and Labour compacts

-- Prioritised actions were taken to ensure all affected

community members following Williamson's TSF failure were provided

alternative arrangements, including temporary and new

accommodation, livelihood restoration and health and wellness

support

Delivering Reliable Production

-- Continuing focus on stabilising operational performance, with

Cullinan Mine on track, Williamson's ramp-up ahead of schedule and

Finsch experiencing some volatility

-- Our on-mine capital investments increased by 129% to US$115.3

million, of which US$72.4m was spent on life extension projects

that will contribute to our increased carat production over the

coming years

Adjusted profit contribution per mine

US$ millions FY 2023(1) FY 2022 Restated(1,2)

CDM FDM WDL Central Total CDM FDM WDL Central Total

------ ------ ------ ------- ------- ------ ------- -------

Revenue 182.9 93.3 49.1 - 325.3 322.4 165.7 75.9 (0.3) 563.7

Adjusted mining

and processing

costs(3) (82.0) (65.6) (54.3) (0.2) (202.1) (116.7) (109.0) (45.5) (1.3) (272.5)

Other direct

income/(expenses) - 0.1 (0.6) - (0.5) (0.7) (0.4) 0.1 - (1.0)

Adjusted profit

from mining activities 100.9 27.8 (5.8) (0.2) 122.7 205.0 56.3 30.5 (1.6) 290.2

------ ------ ------ ------- ------- ------

Adjusted profit

margin 55% 30% -12% 38% 64% 34% 40% 52%

------ ------ ------ ------- ------- ------- ------- ------ ------- -------

Other corporate

income Not allocated per mine 1.0 Not allocated per mine 0.6

------------------------------- ---------------------------------

Adjusted Group

G&A (10.6) (13.0)

------ ------ ------ ------- ------- ------- ------- ------ ------- -------

Adjusted EBITDA(1) 113.1 277.8

------ ------ ------ ------- ------- ------- ------- ------ ------- -------

Note 1: For all non-GAAP measures refer to the Summary of

Results table within the Financial Results section below

Note 2: FY 2022 restated to exclude Koffiefontein which is

classified as a discontinued operation.

Note 3: Adjusted mining and processing costs include certain

technical and support activities which are conducted on a

centralised basis; these include sales & marketing, human

resources, finance & supply chain, technical, and other

functions. For purposes of above, these costs have been allocated

60% to CDM and 40% to FDM. For more information, refer to

operational cost reconciliation available on the analyst guidance

pages on our website.

Adjusted profit from mining activities decreased 58% to US$122.7

million (FY 2022: US$290.2 million), mainly due to lower sales of

Exceptional Stones ( those sold for US$5 million or more each)

during the Year, the impact of lower carats recovered and increased

costs at Williamson for care and maintenance following the TSF

failure.

Capital expenditure breakdown

US$ millions FY 2023 FY 2022 Adjusted(1)

Cullinan Cullinan

Mine Finsch Williamson Central Total Mine Finsch Williamson Central Total

-------- ------ ---------- ------- ----- -------- ------ ---------- ------- -----

Extension 41.1 31.3 - - 72.4 27.3 7.0 - - 34.3

Stay in

Business 11.7 11.9 19.3 1.8 44.7 7.7 5.0 3.3 1.3 17.3

-------- ------ ---------- ------- ----- -------- ------ ---------- ------- -----

Total 52.8 43.2 19.3 1.8 117.1 35.0 12.0 3.3 1.3 51.6

-------- ------ ---------- ------- ----- -------- ------ ---------- ------- -----

Note 1: FY 2022 restated to exclude Koffiefontein, classified as

a discontinued operation

Total capital expenditure amounted to US$117.1 million for the

Year following the ramping up of underground extension projects at

both Cullinan Mine and Finsch.

The increase in stay in business capital expenditure was largely

due to the replacement of underground fleet at Finsch to mitigate

the machine availability challenges encountered during the Year and

an increase at Williamson due to the construction of the new TSF

facility.

Dividends

In line with our dividend policy, no dividends are proposed for

FY 2023 and the Board will review this again in FY 2024.

Group production summary

Below is a summary of Group production for FY 2023 (excluding

Koffiefontein)

Production FY 2023 FY 2022

-------- ----------

ROM tonnes Tonnes 8,637,232 10,772,811

----------------------------- -------- ---------- -----------

Tailings and other tonnes Tonnes 399,877 416,335

----------------------------- -------- ---------- -----------

Total tonnes treated Tonnes 9,037,109 11,189,146

----------------------------- -------- ---------- -----------

ROM diamonds Carats 2,517,309 3,112,956

----------------------------- -------- ---------- -----------

Tailings and other diamonds Carats 149,216 205,412

----------------------------- -------- ---------- -----------

Total diamonds Carats 2,666,525 3,318,368

----------------------------- -------- ---------- -----------

Outlook

Actions taken to strengthen our business and improve cash flow

generation, together with our capital discipline, means that Petra

is well placed to take advantage of the medium and longer-term

supportive diamond market fundamentals. In FY 2024, we will

continue to focus on stabilising operational performance. Our

projects remain on track to contribute to the Group's increased

annual production by up to 1.3 million carats in FY 2026 as we

continue to develop the long-term potential of our large resource

base. We remain confident that we will continue to generate

sufficient cash to fund capex.

Market outlook

We expect rough diamond demand will continue to be subdued in

the short-term on account of increased polished inventory,

prolonged weakness in the Chinese market, lab-grown diamond sales

in the bridal jewellery segment and higher interest rates impacting

the mid-stream in particular. Although demand for lab grown goods

increased, this was coupled with further price depreciation that

continues to substantially differentiate this market segment from

our unique and rare natural diamonds that provide enduring benefit

in celebrating life's most significant moments. As a result, the

Group expects ongoing price volatility in the short-term, but

remains confident that the structural supply deficit will support

medium to long-term diamond prices.

Group pricing assumptions

Set out below are the Group's current diamond pricing

assumptions for each of its mines for FY 2024 and how these compare

to FY 2023 achieved prices. Future diamond prices are influenced by

a range of factors outside of the Group's control and so these

assumptions are internal estimates only and no reliance should be

placed on them. The Company's pricing assumptions will be

considered on an ongoing basis and may be updated by the Company

from time to time.

Average US$ per carat price FY 2023 achieved FY 2024 assumptions(1)

Cullinan Mine 139(2) 125 - 140

Finsch 110(2) 105 - 120

Williamson 280 (H1 only) 240 - 270

------------------------------ ------------------ ------------------------

Note 1: Excluding the contribution of Exceptional Stones of

US$15 million or more, as defined below

Note 2: Prices achieved were impacted by the deferral of sales

to FY 2024

Given the impact of product mix on average prices, tender to

tender price variability is expected.

Williamson is expected to see some variability in its product

mix and prices over coming tenders as it continues its ramp-up to

steady-state production.

Change to the Company's definition of Exceptional Stones

The Company has historically defined diamonds which sell for

US$5 million or more as being Exceptional Stones. From FY 2024, the

Company has amended this definition to diamonds which sell for

US$15 million or more. Since 2016, only three Exceptional Stones

have been sold that meet this new threshold, highlighting the

rarity of such diamonds. Revenue from Exceptional Stones exceeding

US$15 million may be regarded as windfall earnings for the Group,

to be applied in line with our Capital Allocation framework.

Key operational guidance maintained

FY 24E FY 25E FY 26E

Total carats recovered (Mcts) 2.9 - 3.2 3.4 - 3.7 3.7 - 4.0

Cash on-mine costs and G&A(1) (US$m) 270 - 290 270 - 290 280 - 300

Extension capex(1) (US$m) 124 - 135 109 - 125 85 - 92

Sustaining capex(1) (US$m) 31 - 36 24 - 28 24 - 28

--------------------------------------- ---------- ---------- ----------

Note 1: Real amounts stated in FY 2024 money terms using 6% SA

CPI & 2.5% US CPI. US$ equivalent for SA operations converted

at USD:ZAR exchange rate of 18.36

More detailed guidance is available on Petra's website at

https://www.petradiamonds.com/investors/analysts/analyst-guidance/

PRESENTATION DETAILS

Richard Duffy, CEO, Jacques Breytenbach, CFO, will present the

results to investors and analysts.

Online at 09.30 BST

To join

https://stream.brrmedia.co.uk/broadcast/64be9e441589e5759adc7f73

Dial in details

-- South Africa (toll free): 0800 980 512

-- UK: +44 (0)33 0551 0200

-- USA: +1 786 697 3501

Password: Quote Petra Diamonds when prompted by the operator

Recording of presentation

A recording of the webcast will be available later today on

Petra's website at

https://www.petradiamonds.com/investors/presentations or on

https://brrmedia.news/PDL_FY23

Investor Meet company presentation 14.30 BST

Petra will present the results on the Investor Meet company

platform, predominantly aimed at retail investors. To join:

https://www.investormeetcompany.com/petra-diamonds-limited/register-investor

FURTHER INFORMATION

Petra Diamonds, London +44 207 494 8203

Patrick Pittaway investorrelations@petradiamonds.com

Julia Stone

Kelsey Traynor

Camarco (Financial PR)

Gordon Poole Telephone: +44 20 3757 4980

Owen Roberts petradiamonds@camarco.co.uk

Elfie Kent

ABOUT PETRA DIAMONDS

Petra Diamonds is a leading independent diamond mining group and

a supplier of gem quality rough diamonds to the international

market. The Group's portfolio incorporates interests in three

underground mines in South Africa (Finsch, Cullinan Mine and

Koffiefontein) and one open pit mine in Tanzania (Williamson).

Petra's strategy is to focus on value rather than volume

production by optimising recoveries from its high-quality asset

base in order to maximise their efficiency and profitability. The

Group has a significant resource base which supports the potential

for long-life operations.

Petra strives to conduct all operations according to the highest

ethical standards and only operates in countries which are members

of the Kimberley Process. The Group aims to generate tangible value

for each of its stakeholders, thereby contributing to the

socio-economic development of its host countries and supporting

long-term sustainable operations to the benefit of its employees,

partners and communities.

Petra is quoted with a premium listing on the Main Market of the

London Stock Exchange under the ticker 'PDL'. The Group's loan

notes due in 2026 are listed on the Irish Stock Exchange and

admitted to trading on the Global Exchange Market. For more

information, visit www.petradiamonds.com .

FINANCIAL RESULTS

SUMMARY RESULTS (unaudited)

(Restated)

Year ended 30 June 2023 Year ended 30 June 2022

("FY 2023") ("FY 2022")

US$ million US$ million

------------------------- --------------------------

Revenue 325.3 563.7

--------------------------------------------------------------- ------------------------- --------------------------

Adjusted mining and processing costs(1) (202.1) (272.5)

--------------------------------------------------------------- ------------------------- --------------------------

Other net direct mining income / (expense) (0.5) (1.0)

--------------------------------------------------------------- ------------------------- --------------------------

Adjusted profit from mining activity(2) 122.7 290.2

--------------------------------------------------------------- ------------------------- --------------------------

Other corporate income 1.0 0.6

--------------------------------------------------------------- ------------------------- --------------------------

Adjusted corporate overhead (3) (10.6) (13.0)

--------------------------------------------------------------- ------------------------- --------------------------

Adjusted EBITDA(4) 113.1 277.8

--------------------------------------------------------------- ------------------------- --------------------------

Depreciation and Amortisation (80.5) (85.0)

--------------------------------------------------------------- ------------------------- --------------------------

Share-based expense (2.3) (1.1)

--------------------------------------------------------------- ------------------------- --------------------------

Net finance expense (8) (22.0) (36.6)

--------------------------------------------------------------- ------------------------- --------------------------

Adjusted profit before tax 8.3 155.1

--------------------------------------------------------------- ------------------------- --------------------------

Tax expense (excluding taxation credit on unrealised foreign

exchange gain / (loss)) (5) (10.6) (39.9)

--------------------------------------------------------------- ------------------------- --------------------------

Adjusted net (loss)/profit after tax(6) (2.3) 115.2

--------------------------------------------------------------- ------------------------- --------------------------

Impairment reversal - operations and other receivables(7) 52.7 24.3

--------------------------------------------------------------- ------------------------- --------------------------

Impairment charge - operations and non-financial

receivables(7) (37.6) (4.4)

--------------------------------------------------------------- ------------------------- --------------------------

Transaction costs and acceleration of unamortised costs on (9.1) -

partial redemption of Notes (8)

--------------------------------------------------------------- ------------------------- --------------------------

Gain on extinguishment of Notes 0.6 -

--------------------------------------------------------------- ------------------------- --------------------------

Williamson tailings facility - remediation costs (10.7) -

--------------------------------------------------------------- ------------------------- --------------------------

Williamson tailings facility - accelerated depreciation (5.2) -

--------------------------------------------------------------- ------------------------- --------------------------

WDL blocked parcel inventory write down and related receivable (12.5) -

recognition(14)

--------------------------------------------------------------- ------------------------- --------------------------

WDL receivable recognition(14) 12.4

--------------------------------------------------------------- ------------------------- --------------------------

Movement in provision for unsettled and disputed tax claims 0.3 -

--------------------------------------------------------------- ------------------------- --------------------------

Human rights IGM claims provision and transaction (costs) /

reversal of settlement agreement (8.5) 0.8

--------------------------------------------------------------- ------------------------- --------------------------

Net unrealised foreign exchange loss (29.4) (36.4)

--------------------------------------------------------------- ------------------------- --------------------------

Taxation credit on unrealised foreign exchange loss(4) 1.2 2.2

--------------------------------------------------------------- ------------------------- --------------------------

Taxation charge on impairment reversal (13.8) -

--------------------------------------------------------------- ------------------------- --------------------------

(Loss) / profit from continuing operations (61.9) 101.7

--------------------------------------------------------------- ------------------------- --------------------------

Loss on discontinued operations, net of tax(7) (40.5) (13.6)

--------------------------------------------------------------- ------------------------- --------------------------

Net (loss) / profit after tax (102.4) 88.1

--------------------------------------------------------------- ------------------------- --------------------------

Earnings per share attributable to equity holders of the

Company -

US cents

--------------------------------------------------------------- ------------------------- --------------------------

Basic (loss) / profit per share - from continuing and

discontinued operations (54.21) 35.53

--------------------------------------------------------------- ------------------------- --------------------------

Basic (loss) / profit per share - from continuing operations (38.10) 40.74

--------------------------------------------------------------- ------------------------- --------------------------

Adjusted (loss) / profit per share - from continuing

operations(9) (2.96) 48.01

--------------------------------------------------------------- ------------------------- --------------------------

As at

As at 30 June 2023 30 June 2022

Unit (US$ million) (US$ million)

-------- -------------------

Cash at bank - (including restricted amounts) US$m 61.8 288.2

----------------------------------------------------------------- -------- ------------------- ----------------

Diamond debtors US$m 8.9 37.4

----------------------------------------------------------------- -------- ------------------- ----------------

Diamond inventories(14) US$m 65.9 52.7

/Cts 715,222 453,380

-------------------------------------------------------------------------- ------------------- ----------------

Loan notes (issued March 2021) (10) US$m 247.5 366.2

----------------------------------------------------------------- -------- ------------------- ----------------

Bank loans and borrowings(11) US$m - -

----------------------------------------------------------------- -------- ------------------- ----------------

Consolidated net debt(12) US$m 176.8 40.6

----------------------------------------------------------------- -------- ------------------- ----------------

Bank facilities undrawn and available(11) US$m 53.1 61.5

----------------------------------------------------------------- -------- ------------------- ----------------

Consolidated net debt : Adjusted EBITDA (rolling twelve months) 1.6x 0.15x

--------------------------------------------------------------------------- ------------------- ----------------

The following exchange rates have been used for this

announcement: average for FY 2023 US$1:ZAR17.77 (FY 2022:

US$1:ZAR15.22); closing rate as at 30 June 2023 US$1:ZAR18.83 (30

June 2022: US$1:ZAR16.27).

Notes :

The Group uses several non-GAAP measures above and throughout

this report to focus on actual trading activity by removing certain

non-cash or non-recurring items. These measures include adjusted

mining and processing costs, profit from mining activities,

adjusted EBITDA, adjusted net profit after tax, adjusted earnings

per share, adjusted US$ loan note, and consolidated net debt for

covenant measurement purposes. As these are non-GAAP measures, they

should not be considered as replacements for IFRS measures. The

Group's definition of these non-GAAP measures may not be comparable

to other similarly titled measures reported by other companies. The

Board believes that such alternative measures are useful as they

exclude one-off items such as the impairment charges and non-cash

items to provide a clearer understanding of the underlying trading

performance of the Group.

1. Adjusted mining and processing costs are mining and

processing costs stated before depreciation.

2. Adjusted profit from mining activities is revenue less

adjusted mining and processing costs plus other direct income.

3. Adjusted corporate overhead is corporate overhead expenditure

less corporate depreciation, tender offer transaction costs and

share-based expense.

4. Adjusted EBITDA is stated before depreciation, amortisation

of right-of-use asset, share-based expense, net finance expense,

tax expense, impairment reversal/(charges), expected credit loss

release/ (charge), recovery of fees relating to investigation and

settlement of human rights abuse claims, Williamson tailings

facility remediation costs and accelerated depreciation, unrealised

foreign exchange gains and (losses) and loss on discontinued

operations.

5. Tax expense is the tax expense for the Period excluding

taxation credit on unrealised foreign exchange gain/(loss)

generated during the Year; such exclusion more accurately reflects

resultant adjusted net profit.

6. Adjusted net (loss)/profit after tax is net (loss)/profit

after tax stated before impairment (charge)/reversal, Williamson

tailings facility remediation costs and accelerated depreciation,

recovery of fees relating to investigation and settlement of human

rights abuse claims net unrealised foreign exchange losses and

excluding taxation credit on net unrealised foreign exchange losses

and excluding a taxation charge on impairment reversals.

7. Net impairment reversal of US$15.1 million (30 June 2022:

US$19.9 million reversal) was due to the Group's impairment review

of its operations and other receivables. Refer to note 15 for

further details.

The loss on discontinued operations reflects the results of the

Koffiefontein operation (net of tax), including impairment, of

US$40.5 million (FY 2022 results have been amended for

comparability) as per the requirements of IFRS 5 for an abandoned

operation; refer to Note 18.

8. Transaction costs and acceleration of unamortised costs on

partial redemption of Notes comprise transaction costs of US$0.8

million included within corporate expenditure (refer to note 5) and

US$8.3 million in respect of the redemption premium and

acceleration of unamortised costs included within Finance expense

(refer to note 6).

9. Adjusted EPS from continuing operations is stated before

impairment reversal, gain on extinguishment of Notes net of

unamortised costs, acceleration of unamortised costs on Notes,

Williamson tailings facility remediation costs and accelerated

depreciation, costs relating to investigation and settlement of

human rights abuse claims, and net unrealised foreign exchange

gains and losses, and excluding taxation credit on net unrealised

foreign exchange gains and losses and excluding a taxation charge

on impairment reversals .

10. The 2026 US$336.7 million loan notes, originally issued

following the capital restructuring (the "Restructuring") completed

during March 2021, have a carrying value of US$247.5 million (30

June 2022: US$366.2 million) which represents the outstanding

principal amount of US$209.7 million (after the debt tender offers

as announced in September and October 2022) plus US$48.1 million of

accrued interest and is stated net of unamortised transaction costs

capitalised of US$10.3 million. Refer to Note 8 for further

detail.

11. Bank loans and borrowings represent the Group's ZAR1 billion

(US$53.1 million) revolving credit facility which remained undrawn

at Year end and available. Subsequent to Year end, as a result of

the deferment of the June 2023 diamond tender, the Group drew down

ZAR850 million (US$45.1 million) on the RCF.

During the FY 2022, the South African banking facilities held

with the Group's previous consortium of South African lenders were

settled and cancelled, comprising of the revolving credit facility

of ZAR404.6 million (US$24.9 million) (capital plus interest) and

the term loan of ZAR893.2 million (US$54.9 million) (capital plus

interest) .

12. Consolidated Net Debt is bank loans and borrowings plus loan

notes, less cash and less diamond debtors.

13. Operational free cashflow is defined as cash generated from

operations less cash outflows on the acquisition of property, plant

and equipment.

14. Diamond inventories for periods prior to 30 June 2023

include the 71,654.45 carat Williamson parcel of diamonds blocked

for export during August 2017, with a carrying value of US$12.5

million. Under the Framework Agreement entered into with the

Government of Tanzania (GoT) in December 2021, it is stated that

the proceeds from the sale of this parcel are to be applied to the

Williamson mine to assist with the restart of operations and that

in the event such proceeds are not received by Williamson,

Williamson is not required to pay a US$20 million liability

relating to the settlement of past tax disputes. During recent

discussions, the GoT confirmed that the blocked parcel was

partially sold during the period and so this parcel has been

excluded from diamond inventories and expensed to other direct

mining expense with the calculated fair value proceeds of US$12.3

million for the blocked parcel recognised as other direct mining

income and trade and other receivables as at 30 June 2023. During

these recent discussions, the parties also confirmed their intent

to resolve the treatment of the blocked parcel sale proceeds and

the related US$20 million settlement liability.

Principal Business Risks

The Group is exposed to a number of risks and uncertainties

which could have a material impact on its long-term sustainability.

Performance and management of these risks forms an integral part of

the management of the Group.

A summary of the risks identified as the Group's principal

external, strategic and operational risks (in no order of

priority), which may impact the Group over the next 12 months is

listed below. A more detailed description of the Group's principal

risks will be included in the Company's FY 2023 Annual Report.

External Risks Change in FY 2023

1. Rough diamond prices Higher - whilst diamond prices for Q1 to Q3 FY 2023

Risk appetite: High remained robust, like-for-like diamond

Risk Rating: Medium prices softened in Q4 FY 2023, with Tender 5 (May) seeing

Nature of risk: Long term a 13% reduction in like-for-like

prices on Tender 4 (March). Due to continuing softer

prices resulting from elevated inventory

levels in the mid-stream on the back of what we consider

to be a temporary slowdown in demand

for rough diamonds, the majority of sales from Tender 6,

together with the c. 76kcts withdrawn

from Tender 5, were deferred and offered for sale in

Tender 1 of FY 2024 in August 2023, with

like-for-like prices in Tender 1 declining by 4.3% on

Tender 5. While subdued demand and pricing

volatility are expected to continue in the short-term,

including from increased polished inventory,

prolonged weakness in the Chinese market, lab-grown

diamond sales in the bridal jewellery

segment and higher interest rates impacting the

mid-stream in particular, we see the prevailing

structural supply deficit providing market support in the

medium to longer term.

----------------------------------------------------------

2. Currency Lower - The ZAR/USD rate weakened during FY 2023, opening

Risk appetite: High at R16.27 and ending the Year at

Risk Rating: Medium R18.83, averaging R17.77 over the twelve-month period.

Nature of risk: Long term Since Q3 FY 2023, various domestic

South African factors have contributed to the Rand's

continuing weakness which positively

impacted Petra's FY 2023 financial results.

----------------------------------------------------------

3. Country and political No change - The risk of political instability remains in

Risk appetite: High South Africa and with general elections

Risk Rating: Medium due in 2024, is expected to increase. In addition,

Nature of risk: Long term increased levels of load shedding/curtailment

in the Year continued to disrupt South Africa.

Furthermore, South Africa's non-aligned stance

in the war between Russia and Ukraine has been

increasingly questioned.

Country and political risk in Tanzania has decreased due

to the positive economic and structural

changes implemented by the government which was well

received by the international community.

This has resulted in a significant increase in Foreign

Direct Investment and an upgrade in

the country's credit rating.

----------------------------------------------------------

Strategic Risks Change in FY 2023

----------------------------------------------------------

4. Group Liquidity Higher - Whilst the Group's balance sheet was

Risk appetite: Medium strengthened through the repurchase of the

Risk Rating: Medium Company's loan notes totalling US$144.6m, resulting in

Nature of risk: Short to long term annual interest savings of c.US$15m,

the Group experienced softening rough diamond prices (see

above) and operational challenges

in FY 2023, including lower grades at the Cullinan Mine,

lower tonnes mined at Finsch and

the production suspension and remediation costs at

Williamson arising from the TSF failure

in November 2022, which all impacted Petra's liquidity

position. A number of ongoing mitigating

actions are being taken to address these challenges.

Koffiefontein was placed on care and

maintenance during the Year with activities underway

towards closure.

----------------------------------------------------------

5. Licence to operate: regulatory and social impact & No Change - In light of operations at Koffiefontein

community relations having ceased and the mine being placed

Risk appetite: Medium on care and maintenance, community tensions in H1 of FY

Risk Rating: High 2023 increased, though improved relations

Nature of risk: Long term have been observed in H2 FY 2023 following extensive

engagements with the local communities,

the DMRE and the local municipality.

At Williamson, the IGM became operational at the end of

November 2022 with the commencement

of the pilot scheme and following completion of

feasibility studies for the ASM and ADI projects,

the remaining escrow funds will now be committed towards

the ADI projects.

Whilst no fatalities or serious injuries were reported

after the TSF failure at Williamson,

the livelihoods of a number of community members were

affected. A variety of short-term measures

were initially taken, followed by an assessment of the

impact on the surrounding communities

and longer-term remediation measures. An Entitlement

Framework has been developed that enables

community members impacted by the TSF failure to be

appropriately compensated, with Phase

1 and 2 compensation payments having already been made.

----------------------------------------------------------

Operating Risks Change in FY 2023

----------------------------------------------------------

6. Mining; production (including ROM grade and product Higher - Lower grades at the Cullinan Mine are expected

mix volatility) to continue through FY 2024. This

Risk appetite: Medium is attributable to the C-Cut cave maturity as the cave

Risk Rating: High progresses from SW to NE and the earlier

Nature of risk: Long term than anticipated waste ingress from the overlying

depleted mining blocks. Several mitigating

actions are underway to address these grade issues,

including:

-- Tailings treatment has been maximised to partially

offset lower carats from the C-Cut.

-- The re-opening of Tunnel 36 (which has already

occurred) and Tunnel 41 and the establishment

of Tunnels 46 and 50 (the development of which was

approved by the Board in FY 2023) will

provide additional volume from FY 2025 and, in

conjunction with production from the CC1E development

(expected to contribute meaningfully from FY 2025), will

see grades move back towards 40cpht.

Finsch's production target fell short of guidance largely

attributable to low machine availability

owing to an ageing underground fleet, challenges with the

centralised blasting system and

emulsion quality and an extended rock-winder breakdown,

with mitigating actions in place to

stabilise production, with the extension projects at

Finsch expected to improve grade and

production levels.

Whilst production at Williamson was suspended for the

remainder of FY 2023 due to the TSF

failure in November 2022, commissioning of the interim

TSF took place in July 2023, enabling

operations to restart at the beginning of Q1 FY 2024,

ahead of schedule.

Operations at Koffiefontein have ceased and the mine has

been placed on care and maintenance.

----------------------------------------------------------

7. Labour relations No Change - Stable labour relations were experienced at

Risk appetite: Medium all operations throughout FY 2023,

Risk Rating: Medium noting that at Koffiefontein a section 189 retrenchment

Nature of risk: Short to medium term process was concluded, with the mine

subsequently being placed on care and maintenance. For FY

2023, the Group has introduced a

quarterly production bonus scheme for lower band

employees to ensure alignment with other

incentive structures across the Group.

Discussions with organised labour concerning a new wage

agreement for the South African operations

are planned to commence in the coming months given the

current agreement ends in June 2024.

A Collective Bargaining Agreement with TAMICO, the

majority union at Williamson, was signed

in November 2022.

----------------------------------------------------------

8. Safety Higher - LTIFR and LTIs marginally increased to 0.24 and

Risk appetite: Medium 17 respectively in comparison to

Risk Rating: Medium FY 2022 (0.22 and 15). The increased activities

Nature of risk: Short to medium term associated with the ramping up of extension

projects at the Cullinan and Finsch Mines has contributed

to this regression in safety performance

and increased risk. Whilst FY 2023 safety indicators

showed a declining trend, improvements

have been made in Q4 FY 2023. Remedial actions,

Group-wide learnings, visible felt leadership

and behaviour intervention programmes with various focus

areas have been undertaken to address

this trend.

----------------------------------------------------------

9. Environment Higher - Following the TSF failure at Williamson in

Risk appetite: Medium November 2022, significant work was undertaken

Risk Rating: Medium to contain the breach, determine the extent of the

Nature of risk: Long term environmental impact and commence environmental

remediation. An investigation is being conducted to

determine the root cause of the TSF failure.

WDL continues to engage with Tanzania's environmental

regulator regarding the breach.

Elevated water levels at the tailings facility (No 7 Dam)

at the Cullinan Mine have required

permitted emergency releases of water to be made. The

releases have resulted in water quality

and volume requirements being temporarily exceeded which

is permitted for emergency releases.

Short- and long-term mitigation measures to address water

levels at the dam are being taken.

----------------------------------------------------------

10. Climate Change No Change - During the Year, the Company developed its

Risk appetite: High Climate Change Position Statement

Risk Rating: Medium and engaged Ernst & Young to develop a Climate Scenario

Nature of risk: Long term Analysis which identifies key climate

risks and opportunities using different scenarios across

different time horizons, together

with the impacts of these risks and opportunities and

existing and future resilience measures.

Petra also initiated a renewables strategy that, once

implemented, will be key in enabling

Petra to reach its 2030 interim target of a 35-40%

reduction in Scope 1 & 2 emissions (against

Petra's 2019 baseline). Management continues to monitor

progress against annual climate change

targets set for on-mine water and electricity consumption

and efficiency.

----------------------------------------------------------

11. Capital Projects Higher - Whilst the CC1E and C-Cut extension projects at

Risk appetite: Medium the Cullinan Mine and the Lower

Risk Rating: High Block 5 3 Levels SLC at Finsch remain on-track to deliver

Nature of risk: Short to medium term production growth over the next

three years, management have proactively initiated

various mitigating actions and expedited

Trackless Mining Machinery and drill rig availability to

address the risk of these projects

falling behind project plans. Alternate labour sourcing

strategies are also being considered.

----------------------------------------------------------

12. Supply Chain Governance Higher - An independent external expert was engaged to

Risk appetite: Medium conduct a gap analysis of existing

Risk Rating: High Supply Chain processes and systems, and this has resulted

Nature of risk: Short to medium term in management initiating a project

to address areas that require improvement. During FY

2023, the diagnostic and design phases

of the project were largely completed, with

implementation to commence during Q1 FY 2024.

Management expects to roll-out and embed the new way of

working during FY 2024. The project

focuses on Supply Chain processes, systems and structures

with enhancements expected in compliance,

governance and risk management, improved procurement,

tender and supplier registration procedures

and filling critical roles in the function. An online due

diligence platform, administered

by an external third party, went live in December 2022 to

improve the vetting and screening

of suppliers.

----------------------------------------------------------

PETRA DIAMONDS LIMITED

CONDENSED CONSOLIDATED INCOME STATEMENT

FOR THE YEARED 30 JUNE 2023

US$ million Notes (Unaudited) (Restated)

Year ended Year ended

30 June 30 June

2023 2022

---------------------------------------------------- ------ ------------ ------------

Revenue 325.3 563.7

Mining and processing costs (297.6) (356.6)

Other direct mining expense (12.9) (1.0)

Other direct mining income 12.3 -

Corporate expenditure including settlement

costs 5 (22.9) (14.1)

Other corporate income 1.0 0.6

Impairment reversal of non-financial assets 15 52.7 21.4

Impairment charges of non-financial assets 15 (32.7) -

Impairment charge of other receivables 15 (4.9) (1.5)

Total operating costs (305.0) (351.2)

Financial income 6 11.1 18.7

Financial expense 6 (70.8) (91.7)

Gain on extinguishment of Notes net of unamortised

costs 6,8 0.6 -

(Loss) / profit before tax (38.8) 139.5

Income tax charge (23.1) (37.8)

---------------------------------------------------- ------ ------------ ------------

(Loss)/profit for the year from continuing

operations (61.9) 101.7

Loss on discontinued operation including

associated impairment charges (net of tax) 18 (40.5) (13.6)

---------------------------------------------------- ------ ------------ ------------

(Loss)/profit for the Year (102.4) 88.1

---------------------------------------------------- ------ ------------ ------------

Attributable to:

Equity holders of the parent company (105.3) 69.0

Non-controlling interest 2.9 19.1

---------------------------------------------------- ------ ------------ ------------

(102.4) 88.1

---------------------------------------------------- ------ ------------ ------------

(Loss) / Profit per share attributable to the equity holders of the

parent during the Period:

From continuing operations:

Basic (loss)/earnings per share - US$ cents 13 (38.10) 40.74

Diluted (loss)/earnings per share - US$ cents 13 (38.10) 40.74

From continuing and discontinued operations:

Basic (loss)/earnings per share - US$ cents 13 (54.21) 35.53

Diluted (loss)/earnings per share - US$ cents 13 (54.21) 35.53

PETRA DIAMONDS LIMITED

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 30 JUNE 2023

US$ million (Unaudited) (Audited)

Year ended Year ended

30 June 30 June

2023 2022

----------------------------------------------------- ------------ ------------

(Loss) / profit for the Year (102.4) 88.1

Exchange differences on translation of the

share-based payment reserve 0.2 (0.3)

Exchange differences on translation of foreign

operations(1) (50.4) (46.8)

Exchange differences on non-controlling interest(1) (1.9) (0.4)

Total comprehensive (loss) / income for the

Year (154.5) 40.6

------------------------------------------------------ ------------ ------------

Total comprehensive income and expense attributable

to:

Equity holders of the parent company (155.5) 21.9

Non-controlling interest 1.0 18.7

------------------------------------------------------ -------- -----

(154.5) 40.6

----------------------------------------------------- -------- -----

(1) These items will be reclassified to the consolidated income

statement if specific future conditions are met.

PETRA DIAMONDS LIMITED

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2023

US$ million Notes (Unaudited) (Audited)

30 June 30 June

2023 2022

--------------------------------------- ------ ------------- ----------

ASSETS

Non-current assets

Property, plant and equipment 7 598.1 633.2

Right-of-use assets 26.6 21.9

BEE loans and receivables 11 37.3 44.6

Other receivables 2 6.6 2.6

Total non-current assets 668.6 702.3

--------------------------------------- ------ ------------- ----------

Current assets

Trade and other receivables 42.0 49.8

Inventories 88.4 70.6

Cash and cash equivalents (including

restricted amounts) 61.8 288.2

--------------------------------------- ------ ------------- ----------

Total current assets 192.2 408.6

--------------------------------------- ------ ------------- ----------

Total assets 860.8 1,110.9

--------------------------------------- ------ ------------- ----------

EQUITY AND LIABILITIES

Equity

Share capital 12 145.7 145.7

Share premium account 12 609.5 959.5

Foreign currency translation reserve (499.3) (448.9)

Share-based payment reserve 3.9 1.9

Other reserves (0.8) (0.8)

Accumulated reserves / (losses) 12 61.7 (183.6)

--------------------------------------- ------ ------------- ----------

Attributable to equity holders of the

parent company 320.7 473.8

Non-controlling interest (3.9) 4.7

--------------------------------------- ------ ------------- ----------

Total equity 316.8 478.5

--------------------------------------- ------ ------------- ----------

Liabilities

Non-current liabilities

Loans and borrowings 8 222.4 353.9

Provisions 2 104.1 97.7

Lease liabilities 25.8 19.2

Deferred tax liabilities 82.0 71.3

--------------------------------------- ------ ------------- ----------

Total non-current liabilities 434.3 542.1

--------------------------------------- ------ ------------- ----------

Current liabilities

Loans and borrowings 8 25.1 12.3

Lease liabilities 3.0 3.2

Trade and other payables 69.0 74.8

Provisions 2 12.6 -

--------------------------------------- ------ ------------- ----------

Total current liabilities 109.7 90.3

--------------------------------------- ------ ------------- ----------

Total liabilities 544.0 632.4

--------------------------------------- ------ ------------- ----------

Total equity and liabilities 860.8 1,110.9

--------------------------------------- ------ ------------- ----------

PETRA DIAMONDS LIMITED

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEARED 30 JUNE 2023

US$ million Notes (Unaudited) (Restated)

Year ended Year ended

30 June 30 June

2023 2022

-------------------------------------------------- ------ ------------ ------------

(Loss)/profit before taxation for the Year

from continuing and discontinued operations (79.3) 125.9

Depreciation of property plant and equipment 82.5 82.5

Amortisation of right-of-use asset 3.2 2.5

Impairment reversal of non-financial assets 15 (52.7) (21.4)

Impairment charges of non-financial assets 15 32.7 -

Impairment charge - other receivables 15 4.9 1.5

Movement in provisions 7.0 1.0

Dividend received from BEE partner (0.5) (0.6)

Gain on extinguishment on Notes (0.6) -

Non-cash items relating to discontinued

operations 21.5 1.2

Financial income 6 (11.1) (18.7)

Financial expense 6 70.8 91.7

Loss on disposal of property, plant and

equipment 1.4 1.6

Share based payments 2.3 1.1

Operating profit before working capital

changes 82.1 268.3

Increase in trade and other receivables 0.4 (7.1)

Increase in trade and other payables (9.9) 24.5

Increase in inventories (26.1) (1.7)

-------------------------------------------------- ------ ------------ ------------

Cash generated from operations 46.5 284.0

Net realised gains on foreign exchange contracts 1.9 12.6

Finance costs paid (8.4) (6.3)

Income tax received / (paid) 0.6 (7.8)

-------------------------------------------------- ------ ------------ ------------

Net cash generated from operating activities 40.6 282.5

-------------------------------------------------- ------ ------------ ------------

Cash flows from investing activities

Acquisition of property, plant and equipment (113.0) (54.0)

Proceeds from sale of property, plant and 1.0 -

equipment

Loan repayment from BEE partners - 0.2

Dividend paid to BEE partners (3.8) (3.5)

Dividend received from BEE partners 0.5 0.6

Repayment from KEMJV 0.5 2.5

Finance income received 3.9 1.3

Net cash utilised in investing activities (110.9) (52.9)

-------------------------------------------------- ------ ------------ ------------

Cash flows from financing activities

Cash paid on lease liabilities (4.6) (3.2)

Repayment of borrowings (including Notes

redemption premium of US$1.5 million; 30

June 2022: US$nil) 8 (146.1) (98.2)

Net cash utilised by financing activities (150.7) (101.4)

-------------------------------------------------- ------ ------------ ------------

Net (decrease) / increase in cash and cash

equivalents (221.0) 128.2

Cash and cash equivalents at beginning of

the Year 271.9 156.9

Effect of exchange rate fluctuations on

cash held (6.8) (13.2)

-------------------------------------------------- ------ ------------ ------------

Cash and cash equivalents at end of the

Year(1) 44.1 271.9

-------------------------------------------------- ------ ------------ ------------

1. Cash and cash equivalents in the Consolidated Statement of

Financial Position includes restricted cash of US$17.7 million (30

June 2022: US$16.3 million) and unrestricted cash of US$44.1

million (30 June 2022: US$271.9 million.

PETRA DIAMONDS LIMITED

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 30 JUNE 2023

(Unaudited) Share Share Foreign Share-based Other Accumulated Attributable Non-controlling Total

capital premium currency payment reserves reserves / to the interest equity

account translation reserve (losses) parent

US$ million reserve

-------- -------- ------------ ------------ --------- ------------ ------------- ---------------- --------

At 1 July 2022 145.7 959.5 (448.9) 1.9 (0.8) (183.6) 473.8 4.7 478.5

(Loss) / profit

for the Year - - - - - (105.3) (105.3) 2.9 (102.4)

Other

comprehensive

(expense) /

income - - (50.4) 0.2 - - (50.2) (1.9) (52.1)

Conversion of

share premium

(refer note 12) - (350.0) - - - 350.0 - - -

Dividend paid to

non-controlling

interest

shareholders - - - - - - - (9.6) (9.6)

Equity settled

share-based

payments - - - 2.4 - - 2.4 - 2.4

Transfer between

reserves - - - (0.6) - 0.6 - - -

At 30 June 2023 145.7 609.5 (499.3) 3.9 (0.8) 61.7 320.7 (3.9) 316.8

----------------- -------- -------- ------------ ------------ --------- ------------ ------------- ---------------- --------

PETRA DIAMONDS LIMITED

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE FOR THE YEARED 30 JUNE 2023

(Unaudited) Share Share Foreign Share-based Other Accumulated Attributable Non-controlling Total

capital premium currency payment reserves losses to the interest equity

account translation reserve parent

US$ million reserve

----------------- -------- -------- ------------ ------------ --------- ------------ ------------- ---------------- -------

At 1 July 2021 145.7 959.5 (402.1) 1.8 (0.8) (253.3) 450.8 (10.5) 440.3

Profit for the

Year - - - - - 69.0 69.0 19.1 88.1

Other

comprehensive

expense - - (46.8) (0.3) - - (47.1) (0.4) (47.5)

Dividend paid to

non-controlling

interest

shareholders - - - - - - - (3.5) (3.5)

Equity settled

share-based

payments - - - 1.1 - - 1.1 - 1.1

Transfer between

reserves: - - - (0.7) - 0.7 - - -

At 30 June 2022 145.7 959.5 (448.9) 1.9 (0.8) (183.6) 473.8 4.7 478.5

----------------- -------- -------- ------------ ------------ --------- ------------ ------------- ---------------- -------

NOTES TO THE CONDENSED CONSOLIDATED PRELIMINARY FINANCIAL

STATEMENTS

FOR THE YEARED 30 JUNE 2023

1. GENERAL INFORMATION

Petra Diamonds Limited (the "Company"), a limited liability

company listed on the Main Market of the London Stock Exchange, is

registered in Bermuda with its Group management office domiciled in

the United Kingdom. The Consolidated Preliminary Financial

Statements of the Company for the year ended 30 June 2023 comprise

the Company and its subsidiaries, joint operations and associates

(together referred to as the "Group").

2. ACCOUNTING POLICIES

This preliminary report, which is unaudited, does not include

all the notes of the type normally included in an annual financial

report. This condensed report is to be read in conjunction with the

Annual Report for the year ended 30 June 2022, and any public

announcements made by the Group during the reporting period. The

annual financial report for the year ended 30 June 2022 was

prepared in accordance with International Financial Reporting

Standards as adopted by the European Union ("IFRS's") and the

accounting policies applied in this condensed preliminary report

are consistent with the polices applied in the annual financial

report for the year ended 30 June 2022 unless otherwise noted. The

preliminary report has been prepared in accordance with accounting

policies compliant with International Financial Reporting Standards

as adopted by the European Union.

Accounting policy for discontinued operations

Where an operation within the Group is separately identified or

forms part of a separate reporting structure, the Group will

classify the asset as a discontinued operation, in accordance with

IFRS 5 . For this to be the case, the asset must represent a

separate major line of business or geographical area of operations,

is part of a single coordinated plan to dispose of a separate major

line of business or geographical area of operations or is a

subsidiary acquired exclusively with a view to resale. Non-current

assets (or disposal groups) to be abandoned include non-current

assets (or disposal groups) that are to be used to the end of their

economic life and non-current assets (or disposal groups) that are

to be closed rather than sold. The disposal group's assets are

measured at the lower of their carrying amount and recoverable

value less costs to sell. An impairment loss is recognised for any

initial or subsequent write-down of the asset to recoverable value

less costs to sell. A gain is recognised for any subsequent

increases in recoverable value less costs to sell of an asset but

not in excess of any cumulative impairment loss previously

recognised. The assets and liabilities of a disposal group are

presented separately from the other assets and liabilities in the

statement of financial position.

A discontinued operation is a component of the entity that has

been disposed of or is classified as held for sale, or if it is

designated as abandoned and represents a separate major line of

business or geographical area of operations, is part of a single

coordinated plan to dispose of such a line of business or area of

operations, or is a subsidiary acquired exclusively with a view to

resell. The results of discontinued operations are presented

separately in the statement of profit or loss.

Unrealised foreign exchange gains and losses on historic

retranslation of the subsidiaries results into US Dollars are

recycled to the consolidated income statement upon cessation of the

subsidiary. The Group designates the results of discontinued

activities, including those of disposed subsidiaries, separately in

accordance with IFRS and reclassifies the results of the operation

in the comparative period from continuing to discontinued

operations.

Basis of preparation including going concern

Going concern

The twelve-month period to 30 June 2023 delivered US$113.1

million in adjusted EBITDA and US$40.6 million in cash from

operating activities, while total capital expenditure amounted to

US$117.1 million for the Year following the ramping up of

underground development projects at both Cullinan Mine and Finsch.

Consolidated Net Debt increased from US$40.6 million at 30 June

2022 to US$176.8 million as at 30 June 2023. This was largely

driven by the decision to defer a portion of Tender 5 (May) and the

majority of Tender 6 (June) in FY 2023 on account of seasonal

weakness coupled with a more cautious and disciplined approach with

regards to inventory management by the mid-stream as a result of

high finance costs. Based on the previous definition of Exceptional

Stones (diamonds sold for US$5 million or more each), FY 2023

realised US$12.6 million as a contribution from these Exceptional

Stones, compared to US$89.1 million in FY 2022. Applying the

updated definition of Exceptional Stones (diamonds sold for US$15

million or more each), there was no contribution from Exceptional

Stones in FY 2023, compared to US$40.2 million realised in FY

2022.

Operational Update

The first half of FY 2023 saw Petra's operations having to deal

with operational challenges. CDM experienced lower grades in the

C-Cut block cave on account of earlier than expected waste ingress,

resulting in lower ROM carats being recovered, while also lowering

the projected ROM carat production for the remainder of FY 2023 and

FY 2024. FDM challenges were as a result of low machine

availability owing to an aging underground fleet, challenges with

the centralised blasting system and emulsion quality and an

extended rock-winder breakdown. WDL was performing well during H1

FY 2023, until the Tailings Storage Facility (TSF) incident in the

1st week of November 2022, which led to a suspension of operations

for the remainder of the Year. Finally, KDM continued to struggle

in achieving its budgeted production targets and was subsequently

placed on Care & Maintenance (C&M) in November 2022.

Several mitigation steps were initiated during H2 FY 2023 to

minimise the above impacts. At CDM, these included re-opening of

Tunnels 36 (which has already occurred) and 41 and the addition of

pillar retreats, while the addition of two more tunnels (T46 and

T50) adjacent to the current C-Cut centre was also approved during

H2 FY 2023, both of which are anticipated to deliver on relatively

higher-grade ore towards the end of FY 2024 (compared to the

current grades being achieved from the balance of the C-Cut). The

CC1E project, which is expected to significantly increase the

overall ROM grade at CDM, remains on track for production to

commence in FY 2025.

At FDM, mitigation steps included new underground equipment

being delivered and commissioned, coupled with positive changes to

the blasting process, the introduction of new long hole drill rigs

and Load Haul Dump (LHDs) loaders as well as the appointment of

individuals to a number of key positions. Furthermore, the 3-Level

SLC project scope was amended to go up to 90L, which adds

additional production tonnes to the Life of Mine plan. The

mitigation steps undertaken are expected to stabilise production at

FDM, while the 3-Level-SLC 90L project is planned to start

contributing to production from FY 2025 onwards, supporting

increased grades at FDM.

At Williamson, the TSF failure in November 2022 significantly

disrupted WDL's operational run-rate which had largely stabilised

after a lengthy care & maintenance period post the COVID-19

pandemic. There were no serious injuries as a result of the

failure, both at the mine and the surrounding communities. Since

the TSF incident, WDL has been focused on rehabilitation efforts

due to the tailings failure, with new infrastructure being built to

further safe-guard the communities downstream of the mine. In

parallel, a new TSF was constructed, which received the required

permits and complies with the GISTM standards. Subsequently,

production resumed at WDL in July 2023, shortly after Year-end,

with a steady ramp-up currently underway. While most of the

activities were funded by WDL's on-mine cash reserves, PDL and the

mining contractor, Taifa, have advanced priority loans totalling

US$12m to assist WDL's liquidity requirements, with a local

overdraft facility also in place. WDL's short term liquidity needs

are receiving focused attention to ensure WDL remains as a going

concern.

As noted above, KDM was placed on C&M in November 2022. The

KDM workforce was retrenched through a Section 189(3) process, as

set out in the South African Labour Relations Act. Certain of the

retrenched employees were appointed on fixed-term contracts to

carry out C&M activities. In parallel, the KDM sales process

failed to identify a possible buyer. Consequently, the mine has

commenced with detailed closure planning, with the main focus on

obtaining the required permits to cease dewatering of the

underground workings, which remains a significant cost element

during the C&M period. The Social transition, including

implementation of the committed Social & Labour Plans (SLP)

also continue in parallel to the C&M activities and the closure

roadmap planning.

Diamond prices and Market Outlook

The diamond prices consolidated their gains from FY 2022 up

until the Q3 FY 2023, but experienced softness in Q4 of FY 2023.

The softening of the diamond prices during Q4 FY 2023 is ascribed

to two main factors, namely the seasonal weakness due to summer

holidays and lack of festive induced demand coupled with high

financing costs, on account of the elevated interest rates,

resulting in a far more cautious and disciplined approach applied

by the midstream for their inventory management. Indications are

that interest rates have now peaked and will start to decline,

providing support to our view of improved demand in the medium-term

because of the structural supply deficit, as well as entering the

seasonally stronger period ahead of Diwali, Thanksgiving, Christmas

and the Chinese New Year, with an anticipated increase in demand

for diamond jewellery.

The Group achieved an all-in diamond price of US$135/ct during

FY 2023 (excluding contributions from Exceptional Stones, applying

the previous definition) compared to an all-in diamond price of

US$140/ct during FY 2022 (also excluding contributions from

Exceptional Stones, again applying the previous definition). This

represents a marginal reduction of 3.6% year-on-year and was partly

also influenced by lower contributions from both WDL and KDM

product mix, which averages higher US$/ct prices, albeit at reduced

volumes. Post period end, Tender 1 of FY 2024 closed in August, and

realised prices in line with expected levels.

Williamson updates

The Group announced the signing of a framework agreement with

the Government of Tanzania (GoT) in December 2021, which sets out

key principles on the economic benefit sharing amongst

shareholders, treatment of outstanding VAT balances, as well as

agreement reached on the blocked parcel of diamonds and settlement

of historic disputes, amongst others. During the Year, it came to

Petra's attention that the GoT sold the blocked diamond parcel,

either partially or fully. The framework agreement provides for the

proceeds of the sale of this parcel to be allocated to Williamson.

The GoT has not yet remitted the proceeds to the mine, and Petra

has opened discussions with the GoT to resolve this matter in due

course. Should the proceeds not be remitted, in accordance with the

terms of the framework agreement, the obligation to commence with

payments towards settling an amount of US$20 million owed to the

GoT related to historic disputes, would not be triggered.

The framework agreement is expected to provide fiscal stability

for the mine and its investors and is expected to become effective

during the second half of FY 2024, pending satisfaction of certain

suspensive conditions.

During FY 2023, Petra and Taifa (previously Caspian) executed a

Sale of Shares Agreement, to give effect to a Memorandum of

Understanding (MOU) entered into in December 2021, for Taifa to

acquire 50% of Petra's stake in Williamson for a purchase

consideration of US$15m. This agreement is subject to certain

regulatory approvals and is anticipated to become effective during

the second half of FY 2024.

Williamson short term liquidity outlook

It should be noted that the Group's Going Concern assessment is

performed excluding Williamson's trading results, as Williamson is

considered a ring-fenced operation for these purposes, as per the

definitions and requirements set forth in the Group's Financing

agreements.

Williamson continues to focus on steadily ramping-up production

post its restart in July 2023, and is currently performing ahead of

its assumed ramp-up profile. Williamson has also successfully

upsized its overdraft facility from US$7 million to US$10 million,

effective September 2023. Williamson may, however, encounter

short-term liquidity challenges over the next 12 - 18 months. These

may be mitigated by means of optimising tender timings, initiating

cost reduction/deferral opportunities, and/or benefitting from the

faster-than-anticipated startup and increasing production.

From a Group perspective, if these levers at Williamson

materialise, then as a last resort, there may be further

contribution of up to US$5 million from the Group to Williamson, as

a priority shareholder loan, during the going concern assessment

period. This further cash contribution to Williamson will be at the

discretion of the Petra Board and is not expected to impact the

Group's ability to continue as a Going Concern, should this

materialise.

Bond tender offer and South African banking facilities

During FY 2023, the Group carried out a successful tender offer

to its Noteholders, repaying the Noteholders US$144.6 million

(principal plus interest), utilising existing cash reserves,

resulting in further deleveraging of the Group. This will save the

Group c.US$15 million per annum in interest.

The Group's ZAR 1 billion senior Revolving Credit Facility (RCF)

facility remained undrawn at 30 June 2023, with the Group having

access to the full ZAR 1 billion (US$53.1 million). Post Year-end,

the Group utilised ZAR 850 million following a decision to defer

tenders during Q4 FY 2023, as noted above. The Group anticipates

settling the drawn balances during H1 FY 2024 from the proceeds of

sales tenders.

The Group continues to assess opportunities for further debt

optimization in the current market, with the Group's bonds maturing

in March 2026.

Forecast liquidity and covenants

The Board has reviewed the Group's forecasts with various

sensitivities applied for the Going Concern assessment to December

2024, including both forecast liquidity and covenant measurements.

As per the First Lien agreements, the liquidity and covenant

measurements exclude contributions from Williamson's trading

results and only recognises cash distributions payable to Petra

upon forecasted receipt, or Petra's funding obligations towards

Williamson upon payment.

The Board has given careful consideration to potential risks

identified in meeting the forecasts under the review period.

Therefore, the following downside sensitivities have been performed

(sensitivities applied throughout the period) in assessing the

Group's ability to operate as a going concern (in addition to the

Base Case) at the date of this report:

-- ZAR stronger by 5%

-- Revenue down 10%

-- OPEX up by 5% (could be higher inflation, logistics costs, direct energy costs, etc.)

-- Extension CAPEX up by 5%

-- Combined Sensitivity: Revenue down 5% + ZAR stronger by 5%

(effectively resulting in OPEX and total CAPEX up by 5% in USD

terms)

The forward-looking covenant measurements for the base case and

sensitised cases do not project any breaches for any of the

covenants, other than the potential minimum liquidity covenant for

the unmitigated Combined- and Revenue down 10% sensitivities during

the 18-month review period.

Any potential liquidity breaches as a result of the above

sensitivities could be cured by means of the following levers at

Management's disposal:

a. Hedging opportunities - the Group actively monitors the

USD:ZAR exchange rate and pro-actively locks in hedges to benefit

from periods of weaker ZAR, which results in cash flow savings

compared to the base case USD:ZAR forecast;

b. Deferral of Feasibility Studies - this includes planned costs

associated with feasibility studies on future extension

opportunities;