TIDMPAY

PayPoint Plc

Trading update for the three months ended 30 June 2023(1)

28 July 2023

A positive quarter across the PayPoint Group with further

revenue growth and strategic progress delivered

Nick Wiles, Chief Executive of PayPoint Plc, said:

"This has been another positive quarter for the PayPoint Group

where we have delivered further net revenue growth across the Group

and continued the strong performance seen in FY23. Our enhanced

platform and expanded capabilities across the Group, combined with

our business-wide partnership philosophy and intensity of

execution, give the Board confidence in delivering further progress

in the year and meeting expectations.

In Shopping, our enhanced retailer proposition has continued to

drive further value and opportunities to earn for our retailer

partners, with more FMCG campaigns delivered, the further rollout

of Counter Cash and our Net Promoter Score moving from negative to

positive. Our sales momentum across the Group has also continued to

grow in the quarter across both Handepay and PayPoint, with strong

site growth in our EVO card processing estate driven by further

proposition enhancements, including EPoS and loyalty, and supported

by positive results from our increased focus on customer

retention.

In E-commerce, the positive momentum built in FY23 has

continued, with strong volumes delivered over the quarter and

detailed plans in place with all our carrier partners to drive

further growth. We have seen excellent volumes in Vinted parcels,

which is being supported by the expansion of Zebra printers into

more stores and the launch of our new Store to Store service in

partnership with Yodel.

In Payments and Banking, our integrated digital payments

platform, MultiPay, continues to deliver positive revenue and

transaction growth, with two major new clients in Housing launched

in the quarter. Our Open Banking solutions continue to attract

strong demand, delivered in partnership with OBConnect, with 13

clients signed for Confirmation of Payee services, Ovo becoming our

first client live for Payment Information Services (PISP) and both

Ovo and Citizens Advice signed up for Account Information Services

(AIS).

In Love2shop, there has been growing momentum over the quarter

in Love2shop Business, with a strong pipeline of new clients and a

positive performance and retention of existing clients delivered.

Park Christmas Savings is on track for a return to growth this

year, supported by an enhanced proposition, increased agent

engagement and reinforcing the important role this service can play

in helping consumers budget during the current economic challenges.

We were also delighted to launch our partnership with The Fed

(Federation of Independent Retailers) to create a network of 1,500

Super Agents over the coming months for the Christmas 2024 savings

season.

Our compelling characteristics of strong cash flow and resilient

earnings remain constant, and our materially enhanced platform is

positioned to deliver sustainable and profitable growth for our

shareholders, and further progress in the delivery of these

objectives in the current year."

HIGHLIGHTS

Positive performance across the Group

PayPoint Group

Group net revenue increased by 19.7% in the quarter to GBP35.8

million (Q1 FY23: GBP29.9 million)

Shopping

Shopping divisional net revenue increased by 3.4% to GBP15.8

million (Q1 FY23: GBP15.3 million), driven by the growth of our

PayPoint One estate, the annual RPI increase and further

enhancements to our retailer and SME propositions.

-- Retail services net revenue increased by 5.3% to GBP7.8 million (Q1 FY23:

GBP7.4 million), reflecting growth in the number of revenue-generating

PayPoint One sites to 18,612 (31 March 2023: 18,453) and the impact of

the annual RPI increase

-- Card payment net revenue increased by 1.5% to GBP8.0 million (Q1 FY23:

GBP7.8m), with further enhancements to our Handepay proposition delivered,

including EPoS, loyalty and legal support, as well as positive results

from our increased focus on customer retention driven by AI and data

analytics

-- Card payment sites in the Handepay EVO estate grew strongly to 18,941 (31

March 2023: 18,397) driven by the enhanced proposition, expanded range of

features delivered via our Android terminal and the increased

optimisation of our sales and retention efforts

-- Strong quarter of FMCG activity, leveraging our consumer engagement

solution, PayPoint Engage, and partnering with Coca-Cola, Amazon, AG Barr

and JTI

-- Positive progress on retailer partner Net Promoter Score, moving from

negative to positive, driven by our enhanced proposition and additional

value and opportunities to earn delivered over the past year

-- UK retail network increased to 28,489 sites (31 March 2023: 28,478), with

70.0% in independent retailer partners and 30.0% in multiple retail

groups

E-commerce

E-commerce divisional net revenue increased strongly by 65.9% to

GBP2.4 million (Q1 FY23: GBP1.4 million) and transactions grew by

68.4% to 19.2 million (Q1 FY23: 11.4 million) through our

e-commerce technology platform, Collect+.

-- Excellent transaction volumes driven by continued growth in Vinted, the

launch of Consumer Send for FedEx and an increase in Amazon sites to

7,109 in time for Prime Day 2023

-- Store to store service launched for Yodel/Vinted, averaging circa 100k

parcels per week

-- New partnership launched with OOHPod in Northern Ireland, enabling Yodel

Click & Collect customers to have their parcels delivered to secure

lockers when checking out online

-- Zebra printer expansion plans underway to rollout a further 2,000 devices

ahead of Christmas Peak 2023

Payments & Banking

Payments & Banking divisional net revenue decreased by 5.8%

to GBP12.4 million (Q1 FY23: GBP13.1 million), driven by continued

growth in digital transactions, but offset by a reduction in cash

bill payments as consumer behaviour has adjusted following the end

of government support schemes.

-- Continued digital payments growth to 12.3 million transactions (Q1 FY23:

11.0 million) and net revenue increasing by 14.7% to GBP3.4 million (Q1

FY23: GBP2.9 million)

-- Further client wins for our integrated digital payments platform,

MultiPay, and Open Banking services: 2 major new clients in Housing

(Network Homes and POBL), first Open Banking client live for PISP (Ovo),

2 clients signed for AIS services (Ovo and Citizens Advice) and 13

clients signed for Confirmation of Payee. In addition, we successfully

tendered for the new government framework (DPS) through the Crown

Commercial Service.

-- Over GBP263 million of Energy Bills Support Scheme vouchers were redeemed

across PayPoint's extensive network of over 28,000 retailer partners by

the end of the government support scheme in June 2023, providing a GBP400

payment to households across the UK, leveraging our Cash Out digital

capability

-- Cash through to digital net revenue decreased slightly by 4.5% to GBP1.7

million (Q1 FY23: GBP1.8 million) and transactions decreased to 2.1

million (Q1 FY23: 2.2 million). In addition to the range of digital

brands we work with, we are launching new partnerships with neo-banks,

including JPMorgan Chase, enabling withdrawals and deposits across our

extensive network of retailer partners

-- Cash payments net revenue decreased by 13.2% to GBP7.3 million (Q1 FY23:

GBP8.4 million) and transactions decreasing by 17.1% to 35.8 million (Q1

FY23: 43.2 million), with growth seen in housing and a stable performance

in mobile top ups, but offset by a reduction in energy transactions

Love2shop

Love2shop divisional net revenue of GBP5.2 million, driven by

positive performance in Love2shop Business and continued momentum

in Park Christmas Savings as it returns to growth.

-- Love2shop Business growing momentum over the quarter, with building

pipeline of new clients, strong retention and performance of existing

clients and reshaped Business Development team to focus on small/medium

accounts and drive opportunities ahead of seasonal peak

-- Park Christmas Savings on track to return to growth for first time since

2018, with an enhanced proposition bringing more choice, partner offers

and value for customers and increased engagement activity with Agents

leading to improved saver retention

-- Partnership launched with the Fed (Federation of Independent Retailers)

to create a Super Agent network of 1,500 stores within the PayPoint

retailer partner network, with pilot launched in June 2023 to test

appetite, review tools and best practices ahead of rollout over the

summer

-- 8 new partners onboarded to our multi-retailer products to ensure our

products continue to offer choice and flexibility, including B&Q, WHSmith,

Robert Dyas and Matalan

BALANCE SHEET AS AT 30 JUNE 2023

The Group had net corporate debt of GBP74.8 million (31 March

2023: GBP72.4 million) comprising cash balances of GBP14.7 million

(31 March 2023: GBP22.0 million), less loans and borrowings of

GBP89.5 million (31 March 2023: GBP94.4 million).

DIVID

The Board have declared an increased dividend of 18.6 pence per

share, consistent with our progressive dividend policy, and

representing an increase of 3.3% vs the final dividend declared on

26 May 2022 of 18.0 pence per share. The dividend is payable in

equal instalments of 9.3 pence per share on 1 September 2023 and 22

September 2023

Enquiries

PayPoint plc FGS Global

Nick Wiles, Chief Executive (Mobile: 07442 Rollo Head

968960)

Alan Dale, Finance Director (Mobile: 07778 James Thompson

043962)

(Telephone: 0207 251 3801)

(Email:

PayPoint-LON@fgsglobal.com)

ABOUT PAYPOINT GROUP

For tens of thousands of businesses and millions of consumers,

we deliver innovative technology and services that make life a

little easier.

The PayPoint Group serves a diverse range of organisations, from

SME and convenience retailer partners, to local authorities,

government, multinational service providers and e-commerce brands.

Our products are split across four core business divisions:

-- In Shopping, we enhance retailer propositions and customer experiences

through EPoS services via PayPoint One, card payment technology, Counter

Cash, ATMs and home delivery technology partnerships in over 60,000 SME

and retailer partner locations across multiple sectors. Our retail

network of over 28,000 convenience stores is larger than all the banks,

supermarkets and Post Offices put together

-- In E-commerce, we deliver best-in-class customer journeys through

Collect+, a tech-based delivery solution that allows parcels to be picked

up, dropped off and sent at thousands of local stores

-- In Payments and Banking, we give our clients and their customers choice

in how to make and receive payments quickly and conveniently. This

includes our channel-agnostic digital payments platform, MultiPay,

offering solutions to clients across cash, card payments, direct debit

and Open Banking. PayPoint also supports its eMoney clients with purchase

and redemption of eMoney across its retail network.

-- In Love2shop, we provide gifting, employee engagement, consumer incentive

and prepaid savings solutions to thousands of consumers and businesses.

Love2shop is the UK's number one multi-retailer gifting provider,

offering consumers the choice to spend at more than 140 high-street and

online retail partners. Park Christmas Savings is the UK's biggest

Christmas savings club, helping over 350,000 families manage the cost of

Christmas, by offering a huge range of gift cards and vouchers from some

of the biggest high street names.

Together, these solutions enable the PayPoint Group to create

long-term value for all stakeholders, including customers,

communities and the world we live in.

(1) PayPoint's auditors have not been requested to review the

performance

Attachment

-- Trading update Q1 FY24 - Final

https://ml-eu.globenewswire.com/Resource/Download/ff5d4e65-5af9-4715-8e96-c718481b7598

(END) Dow Jones Newswires

July 28, 2023 02:00 ET (06:00 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

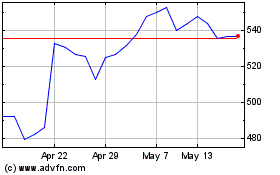

Paypoint (LSE:PAY)

Historical Stock Chart

From Jun 2024 to Jul 2024

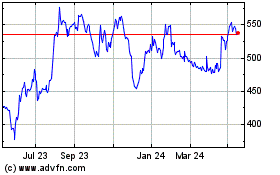

Paypoint (LSE:PAY)

Historical Stock Chart

From Jul 2023 to Jul 2024