Paragon Group Of Companies PLC Trading Update (2567V)

January 27 2017 - 2:00AM

UK Regulatory

TIDMPAG

RNS Number : 2567V

Paragon Group Of Companies PLC

27 January 2017

THE PARAGON GROUP OF COMPANIES PLC

Trading Update

The Paragon Group of Companies PLC ("the Group" or "Paragon"),

the specialist lender and banking group, today publishes its

Trading Update based upon the business performance from 1 October

2016 to date, including a commentary on the unaudited financial

information for the period from 1 October to 31 December 2016.

Financial performance

Underlying operating profits for the quarter of GBP33.1 million

were in line with management's expectations and were supported by

good underlying trends in volumes, margins, cost control and bad

debts. As previously guided, the carry cost of the Group's

subordinated bonds will dampen reported profits in the early part

of the year prior to the repayment of the GBP110 million bond

maturing in April 2017.

Trading activity

Each of the Group's lending and investment entities generated

quarter on quarter volume growth, with total originations and

investments of GBP380.7 million compared to GBP254.4 million in the

previous quarter as detailed below:

GBP million Q1 2016 Q4 2016 Q1 2017

------------------ -------- -------- --------

Buy-to-let 400.9 171.3 185.2

------------------ -------- -------- --------

Asset finance* 17.9 49.0 55.7

------------------ -------- -------- --------

Car finance 20.6 18.5 20.7

------------------ -------- -------- --------

Second mortgages 11.4 9.6 13.6

------------------ -------- -------- --------

Development

finance 0.0 6.0 10.1

------------------ -------- -------- --------

Idem Capital 9.8 0.0 95.4

------------------ -------- -------- --------

Total 460.6 254.4 380.7

------------------ -------- -------- --------

Of which BTL 87.0% 67.3% 48.6%

------------------ -------- -------- --------

* Q1 2016 represents 2 months due to the completion of the Five

Arrows acquisition on 3 November 2015

Throughout the final months of 2016 the buy-to-let market saw

lenders tightening criteria ahead of the PRA underwriting changes

which took full effect on 1 January 2017. Paragon had implemented

the majority of these changes a year ago, in January 2016, and, as

market criteria tightened during the last quarter, the Group's

pipeline continued to grow from its low point in the summer. It is

too early to determine the full extent of the PRA changes on the

market, and the further changes due later in the year, however the

strong pipeline, as detailed below, positions the Group to achieve

its anticipated new business volumes for the year.

Month end December 2015 September December 2016

pipeline 2016

----------- ----------------- ----------------- -----------------

Buy-to let GBP595.7 million GBP321.1 million GBP639.8 million

----------- ----------------- ----------------- -----------------

Idem Capital had a strong trading period, with GBP95.4 million

of gross investments, following the temporary withdrawal of vendors

from the market around the EU referendum. Idem Capital continues to

see a healthy pipeline of opportunities.

The asset finance business maintained its post-acquisition

quarter-on-quarter growth trend. The upgrade to the division's new

business systems is scheduled to be delivered at the end of the

current quarter, which is expected to support further volume

growth.

The Group's specialist residential mortgage proposition is

currently in its soft-launch phase, with a roll-out to a broader

distribution network scheduled over the coming months.

All portfolios have been performing strongly in cash and credit

terms, and continue to display positive behavioral score

characteristics when compared to the position a year earlier.

Funding

The Group's funding focus continues to be based upon its retail

deposit taking activities through Paragon Bank, where deposit

levels grew further during the quarter to GBP2.03 billion (December

2015: GBP1.05 billion). Immediately after the period end, Paragon

Bank made its first drawing under the Bank of England's new Term

Funding Scheme, to support further lending growth and we expect

additional drawings over the rest of the year. This focus of retail

deposit funding has resulted in the Group not renewing one of its

warehouse lines, resulting in aggregate re-draw facilities reducing

by GBP300 million from its position at the Group's 2016

year-end.

Free cash balances stood at GBP269 million at the quarter end,

having financed the strong Idem Capital flows in the period and the

annual equity injection of GBP78.1 million to Paragon Bank to

support its 2017 growth. External debt is expected to be raised

against the Idem Capital assets during this quarter.

Capital

The Group continues to benefit from strong capital ratios and

the Group's CET1 ratio rose to 16.1%* at the quarter end.

Good progress has been made with the share buy-back programme,

with over 25% of the year's GBP50.0 million investment being

made.

Outlook

The Group continues to see progress in each of its operating

divisions and remains confident in achieving its expectations for

the year.

Nigel Terrington, the Group's Chief Executive, said:

"We have made a strong start to a year that will see the Group

continue its transition to a lending and operational model that is

orientated around Paragon Bank. The lending growth we have seen in

asset finance is encouraging and reflects the increasing

diversification of the Group. Lending across all divisions and the

strong growth in the buy-to-let pipeline bodes well for the year as

a whole".

The Group intends to announce its half-year results for the six

months ending 31 March 2017 on Tuesday 23 May 2017.

* based on unverified reserves

For further information, please contact:

Nigel S Terrington Richard Woodman

Chief Executive Finance Director

Tel: 0207 Tel: 0121 712 2607

786 8451

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTOKADDOBKDCDB

(END) Dow Jones Newswires

January 27, 2017 02:00 ET (07:00 GMT)

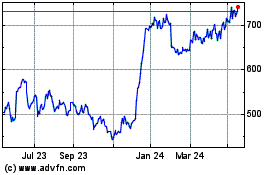

Paragon Banking (LSE:PAG)

Historical Stock Chart

From Sep 2024 to Oct 2024

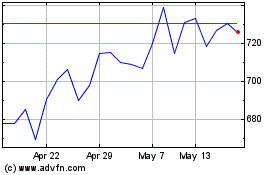

Paragon Banking (LSE:PAG)

Historical Stock Chart

From Oct 2023 to Oct 2024