RNS Number:8655H

CardioMag Imaging, Inc.

21 August 2006

FOR IMMEDIATE RELEASE 21 August 2006

CardioMag Imaging, Inc. ('CMI' or 'the Company')

Interim results for the 6 months ended 30 June 2006

CardioMag Imaging, Inc. (AIM: CMI/L), the developer of a new non-invasive heart

function visualization system, called a Magnetocardiograph ("MCG"), for use by

the medical and cardiology communities, announces its interim results for the

six months ended 30 June 2006.

HIGHLIGHTS

Financials

* Net loss of $2.2m

* Cash used by operations of $2.6m

Operational

*FDA approval for ischemia detection on course

*New Chinese distributors being evaluated

*Excellent interaction with clinical physicians continues

*Establishment of First Cardiac Wellness Screening Centre on track

For further details, please contact:

CardioMag Imaging, Inc. Buchanan Communications - UK

Carl H. Rosner, Executive Chairman Lisa Baderoon

Tel: +1 - 518-381-1000, Ext. 4341 Tel: +44-207-4665000

Eric Burns

Company website - www.cardiomag.com Tel: +-44-1943-833990

CardioMag ImagingTM, Inc., is a public company formed in 1999 to transition

results from over 40 years of worldwide MCG research and development based upon

SQUID (Superconducting Quantum Interference Device) sensors into clinically

useful, non-invasive cardiac diagnostic products. The Company is focused upon

collecting clinical data to position itself to provide safe, lifesaving medical

equipment, leading to cost containment solutions to the cardiac health care

community, specifically by designing, manufacturing and marketing innovative

medical diagnostic devices for early detection and monitoring of heart disease.

As of December 2005, the Company is listed on the AIM Market of the London Stock

Exchange under the symbol CMI/L.

Safe Harbor Statement: The statements presented in this press release which are

not historical facts are forward looking statements which involve various

important assumptions, risks, uncertainties and other factors set forth here,

including but not limited to, market acceptance by healthcare providers,

obtaining FDA approval for future claims, insurance reimbursement policies, and

growth of the market.

CardioMag Inc. ("CMI" or the "Company")

Interim Results for the 6 months ended 30 June 2006

Overview

The major focus for the period ended 30 June 2006 was in marketing and promotion

as well as in manufacturing systems in preparation for deliveries in the second

half of 2006. We have also implemented plans to expand our facility and

commenced the hiring of additional marketing and technical personnel.

As was previously reported, we terminated a distribution agreement with our

Chinese distributor and this has, inevitably, delayed the achievement of sales

into China. However, we are in discussions with other agents and are confident

that alternative distribution arrangements currently under consideration will

lead to sales into China in the second half of the year.

We have made important progress in communications with the FDA regarding

approval for our MagnetoCardioGraphy (MCG) system for the detection of

myocardial ischemia. Once formally obtained, this will allow us to promote the

MCG system as clinical diagnostic medical equipment for such use.

Financial results

Our results for the first half of the year 2006 reflect the delay in achieving

sales to China and therefore show no revenues from the sale of any diagnostic

systems. We have seen an increase in our operating expenses to $2.2 million (6

months ended 30 June 2005: $1.8 million), reflecting the investment that we have

made in marketing resource, people, advertising, R&D and the additional costs of

being a public company. As a result we are reporting a net loss of $2.2 million

(2005: $1.4 million).

Cash outflow from operations was $2.6 million (2005: $1.1 million), representing

operating expenses and investment in fixed assets and building up of inventories

for orders expected later in the year.

Our balance sheet position at the period end showed net assets of $2.3 million

and a net cash balance of $3.0 million. During the period we also upgraded our

IT infrastructure and expanded our facilities with a net investment (after

depreciation) of $380,000.

Regulatory approvals

As stated above, we have made good progress with the FDA towards gaining

approval of our MCG System and we believe that thereafter the ability to promote

it as diagnostic medical equipment provides us with a much more powerful message

to the medical and hospital community than is possible under the current

approval gained in July 2004. We are hopeful that we can obtain this approval by

the end of the year.

Market and Sales

Following the termination of our Chinese distribution agreement, we have

implemented a different strategy for sales into China by having a consultant

identify distribution channels approved by high level government officials.

We have been pursuing interactions and collaborations with physicians at

clinical sites and are pleased to report that 4 out of 19 publications in the

field of magnetocardiography were based upon use of the CMI system.

We also have gained valuable feedback from users of our equipment which is

allowing us to implement upgrades in operating features that, we believe, can

expand the potential market.

Employees

On 30 June 2006 we had a full time staff of 27, up from 24 on 30 June 2005, and

temporary staff of 4. We do expect these numbers to increase only modestly in

the near term as we now have most of the necessary infrastructure in place to

implement our strategy.

Our Executive Vice President of Operations, Bruce Hegstad, retired on 1 July

2006 and we thank him for his contribution to the development of the Company

over the past 5 1/2 years. He has valuable knowledge of the business and our

systems and remains available to us as a consultant.

Current trading and outlook

We expect to put in place new distribution arrangements for China and are

confident of raising orders for delivery beginning in the second half of the

year.

We are increasingly convinced of the extremely important role our safe and

non-invasive cardiac diagnostic MCG tool can play in providing greatly improved

and cost-effective cardiac healthcare through the early detection of functional

abnormalities and the planned establishment of Cardiac Wellness Screening

Centres nationally, and later worldwide.

Accordingly, despite the disruption of having to put in place new distribution

arrangements for China, your Board of Directors is confident that our system is

gaining recognition in the medical community and that this will be more visible

through sales during this year and thereafter.

CardioMag Imaging, Inc.

Unaudited Balance Sheet

(in US $)

30-Jun-06 30-Jun-05 31-Dec-05

----------- ----------- -----------

ASSETS

Total Current Assets $4,687,353 $1,440,185 $8,335,716

Total Property and Equipment 682,444 360,126 382,301

Total Other Assets 161,761 137,734 150,755

----------- ----------- -----------

Total Assets $5,531,557 $1,938,045 $8,868,772

=========== =========== ===========

LIABILITIES AND CAPITAL

Total Current Liabilities 3,241,817 7,669,123 4,373,583

Total Long-Term Liabilities 6,870 8,383 6,506

----------- ----------- -----------

Total Liabilities 3,248,688 7,677,506 4,380,089

Total Capital 2,282,870 (5,739,461) 4,488,683

----------- ----------- -----------

Total Liabilities & Capital $5,531,557 $1,938,045 $8,868,772

=========== =========== ===========

CardioMag Imaging, Inc.

Unaudited Income Statement

(in US $)

6 months ended 6 months ended 12 months ended

30-Jun-06 30-Jun-05 31-Dec-05

----------- ----------- -----------

Total Revenues $819 $672,358 $793,881

Total Cost of Sales 0 155,713 172,358

----------- ----------- -----------

Gross Profit 819 516,645 621,523

----------- ----------- -----------

Operating Expenses

--------------------

Salaries Expense 679,437 699,248 1,475,082

Research & Development Expense 327,088 264,001 537,752

Consultant Fees 205,451 142,734 466,017

Directors' Fees 154,531 0 0

Rent Expense 100,418 110,276 241,698

Other Operating Expenses 781,474 543,366 816,794

----------- ----------- -----------

Total Operating Expenses 2,248,399 1,759,625 3,537,343

Interest Income 84,649 2,598 9,193

Interest Expense 48,260 204,059 447,511

----------- ----------- -----------

Net Loss $2,211,191 $1,444,441 $3,354,138

=========== =========== ===========

Loss per share

basic $0.10 $0.17 $0.16

diluted 0.10 0.15 0.15

CardioMag Imaging, Inc.

Unaudited Statement of Cash Flow

(in US $)

6 months ended 6 months ended 12 months

ended

30-Jun-06 30-Jun-05 31-Dec-05

----------- ----------- -----------

Cash Flows from operating activities

Net Income $(2,211,191) $(1,444,441) $(3,354,138)

Adjustments to reconcile net income to

net cash provided by operating activities

Depreciation and Amortization 85,188 72,633 141,142

Inventory (372,714) (6,334) (74,517)

Prepaid Expenses 62,376 (27,665) (63,412)

Accounts Payable and accrued expenses (146,582) 229,786 282,106

Income Taxes Receivable 0 12,336 43,718

Other Assets 0 5,301 5,301

Accrued Payroll and related deductions (29,597) 86,770 119,023

Accrued Interest Payable 30,694 0 426,547

----------- ----------- -----------

Total Adjustments (370,635) 372,827 879,908

----------- ----------- -----------

Net Cash provided by

Operations (2,581,826) (1,071,614) (2,474,230)

----------- ----------- -----------

Cash Flows from investing

activities

Used For

Purchases of fixed assets (385,332) (64,014) (154,648)

Acquisition of Intangible

Assets (11,006) (7,576) (20,647)

----------- ----------- -----------

Net cash used in investing (396,338) (71,590) (175,295)

----------- ----------- -----------

Cash Flows from financing activities

Proceeds From

Shareholder Loan Receivable (1,612) (1,612) (3,250)

Liability under Capital Leases (3,579) (1,791) (3,668)

Issuance of Common Stock 7,000 375,000 8,002,819

Repayment of Current

Portion Long-Term Debt (1,005,000) 0 (385,000)

Issuance of Convertible

Debt-Shareholder 0 927,000 2,017,000

----------- ----------- -----------

Net cash used in financing (1,003,191) 1,298,597 9,627,901

----------- ----------- -----------

Net increase (decrease) in

cash $(3,981,355) $155,393 $6,978,376

=========== =========== ===========

Cash Balance at End of Period 3,014,662 173,033 6,996,016

Cash Balance at Beg of Period 6,996,016 17,640 17,640

----------- ----------- -----------

Net increase (decrease) in cash $(3,981,355) $155,393 $6,978,376

----------- ----------- -----------

CardioMag Imaging, Inc.

Notes to Unaudited Interim Financial Statements

For the six months ended 30 June 2006

1. Basis of Preparation

The accompanying unaudited financial statements have been prepared in accordance

with generally accepted accounting principles for interim financial information

and do not include all the information and footnotes required by generally

accepted accounting principles for complete financial statements. In the opinion

of management, all adjustments (consisting of normal recurring accruals)

considered necessary for a fair presentation have been included.

The interim financial information has been prepared on the basis of the

accounting policies set out in CardioMag Imaging's statutory accounts for the

year ended 31 December 2005.

Operating results for the interim six month period ended 30 June 2006 are not

necessarily indicative of results that may be expected for the year ended 31

December 2006.

2. Loss Per Share

Loss per share has been calculated by dividing the loss for the period by the

average number of shares of 21,141,059 in issue during the period versus

8,570,114 in issue June 30, 2005.

3. A copy of this report is being sent to all shareholders and further copies

are available from the Company's registered office located at 450 Duane Avenue,

Schenectady, New York, 12304, USA.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR AKFKQPBKDFFD

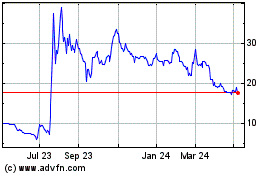

Optibiotix Health (LSE:OPTI)

Historical Stock Chart

From Sep 2024 to Oct 2024

Optibiotix Health (LSE:OPTI)

Historical Stock Chart

From Oct 2023 to Oct 2024