Northern 2 VCT PLC Miscellaneous: issue of linked offer document

January 10 2013 - 5:15AM

UK Regulatory

TIDMNTV

10 JANUARY 2013

NORTHERN 2 VCT PLC

ISSUE OF LINKED OFFER DOCUMENT

Further to the announcement made on 21 November 2012, Northern 2 VCT PLC

("Northern 2") announces in conjunction with Northern Venture Trust PLC ("NVT")

the issue of an offer document in respect of Offers of new ordinary shares for

subscription in the 2012/13 and 2013/14 tax years ("the Offers"). The Offers

seek to raise a total of up to GBP4,000,000 (before expenses) for each of NVT and

Northern 2 by the issue of ordinary shares at an initial issue price ("Initial

Offer Price") for NVT of 91.4p per share and for Northern 2 of 82.1p per share.

Under the terms of the Offers, the Initial Offer Price will be calculated using

a formula based on the latest published net asset value of each of NVT and

Northern 2 respectively adjusted for any dividends declared but not yet paid,

divided by 0.965 to allow for issue costs of 3.5% of the amount raised under the

Offers. The pricing of the Offers may be adjusted in accordance with a pricing

formula which takes into account the latest published net asset values of NVT

and Northern 2 respectively, together with the level of adviser charges,

commission waived and a loyalty bonus applicable to existing shareholders in

NVT, Northern 2 and Northern 3 VCT PLC. It is not expected that either NVT or

Northern 2 will announce an updated net asset value during the period of the

Offers but should this become necessary then the pricing of the Offers in

respect of any new shares not already allotted will be adjusted accordingly.

The amounts being raised by each of NVT and Northern 2 fall within the Euros

5,000,000 limit specified by the Prospectus Regulation for share issues where a

full prospectus is not required to be published, after taking account of shares

offered for subscription within the previous 12 months.

The Offers opened on 10 January 2013 and will close no later than 5.00pm on 5

April 2013 for the 2012/13 tax year and 5.00pm on 15 April 2013 for the 2013/14

tax year, unless previously extended.

Copies of the offer document, including an application form, can be downloaded

from the NVM Private Equity Limited website at http://www.nvm.co.uk/vctoffer, or

can be requested by telephoning NVM Private Equity Limited on 0191 244 6000 or

by emailing vct@nvm.co.uk.

Enquiries:

Alastair Conn/Christopher Mellor, NVM Private Equity Limited - 0191 244 6000

Website: www.nvm.co.uk

Neither the contents of the NVM Private Equity Limited website nor the contents

of any website accessible from hyperlinks on the NVM Private Equity Limited

website (or any other website) is incorporated into, or forms part of, this

announcement.

This announcement is distributed by Thomson Reuters on behalf of

Thomson Reuters clients. The owner of this announcement warrants that:

(i) the releases contained herein are protected by copyright and

other applicable laws; and

(ii) they are solely responsible for the content, accuracy and

originality of the information contained therein.

Source: Northern 2 VCT PLC via Thomson Reuters ONE

[HUG#1669539]

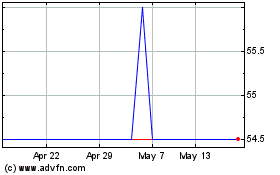

Northern 2 Vct (LSE:NTV)

Historical Stock Chart

From Oct 2024 to Nov 2024

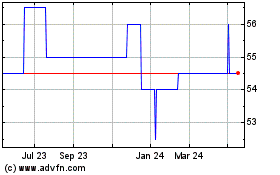

Northern 2 Vct (LSE:NTV)

Historical Stock Chart

From Nov 2023 to Nov 2024