TIDMMRL

RNS Number : 2663R

Marlowe PLC

26 June 2020

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT (THE

"ANNOUNCEMENT") IS DEEMED BY THE GROUP TO CONSTITUTE INSIDE

INFORMATION AS STIPULATED UNDER THE MARKET ABUSE REGULATION (EU)

NO. 596/2014. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA

REGULATORY INFORMATION SERVICE, THIS INSIDE INFORMATION IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN.

26 June 2020

Marlowe plc

Results of the Placing

Further to the announcement of 26 June 2020 of the acquisition

of Elogbooks and the proposed placing to raise a minimum of GBP35

million (the "Placing Announcement"), Marlowe plc ("Marlowe" or the

"Group"), the specialist services group focused on developing

companies which assure safety and regulatory compliance, announces

that, following significant investor demand, it has successfully

raised GBP40 million before expenses under the Placing. The Placing

Price of 478 pence per share represents a nil discount to the

closing price on 25 June 2020.

Definitions

Other than where defined, capitalised terms used in this

announcement have the meanings given to them in the Placing

Announcement.

Results of the Placing

Pursuant to the Placing Announcement, the Group is pleased to

announce that a total of 8,368,200 Placing Shares have been

successfully placed at a price of 478 pence per Ordinary Share,

with institutional investors. The Placing was significantly

oversubscribed. Pursuant to the Placing, the Group has raised gross

proceeds of GBP40 million (net proceeds of approximately GBP39

million after expenses).

A total of 4,410,430 Ordinary Shares have been placed pursuant

to the First Placing and a total of 3,957,770 Ordinary Shares have

been placed pursuant to the Second Placing. The issue of the Second

Placing Shares remains subject to, inter alia, the granting by

Shareholders of authorities to the Directors to dis-apply the

pre-emption rights contained within the Articles and to issue the

Second Placing Shares.

Cenkos and Berenberg acted as lead bookrunners in connection

with the Placing, and Stifel acted as bookrunner.

General Meeting

A General Meeting to consider and approve the Second Placing

will be held at 20 Grosvenor Place, London SW1X 7HN at 11.00 a.m.

on 15 July 2020. A circular convening the General Meeting is

expected to be posted to Shareholders on 29 June 2020 and will be

made available on the Group's website at www.marloweplc.com .

Recommendation and voting intentions

The Directors believe the Second Placing to be in the best

interests of the Group and its Shareholders as a whole.

Accordingly, the Directors unanimously recommend Shareholders to

vote in favour of the Resolutions as they intend so to do in

respect of their beneficial shareholdings.

Other than where defined, capitalised terms used in this

announcement have the meanings given to them in the Placing

Announcement.

Expected Timetable of Principal Events

2020

Announcement of the Acquisition and Placing 7.00 a.m. on 26 June

Latest time for announcement of the results 3.00 p.m. on 26 June

of the Placing

Posting of the Circular and Form of Proxy 29 June

First Admission and commencement of dealings 8.00 a.m. on 30 June

of the First Placing Shares

First Placing Shares credited to CREST 30 June

stock accounts

Despatch of definitive share certificates week commencing 6

for First Placing Shares July

Latest time and date for receipt of Forms 11.00 a.m. on 13

of Proxy July

General Meeting 11.00 a.m. on 15

July

Second Admission and commencement of dealings 8.00 a.m. on 17 July

of the Second Placing Shares if the Resolutions

being passed

Second Placing Shares credited to CREST 17 July

stock accounts, subject to the Resolutions

being passed

Despatch of definitive share certificates week commencing 20

for Second Placing Shares, subject to July

the Resolutions being passed

Notes:

(i) References to times are to London time (unless otherwise stated).

(ii) If any of the above times or dates should change, the

revised times and/or dates will be notified by the Group via an

announcement to an RIS.

(iii) The timing of the events in the above timetable are

indicative only.

Total Voting Rights

Application has been made for the First Placing Shares to be

admitted to trading on AIM, and it is expected that Admission will

occur at 8.00 a.m. on or around 30 June 2020. Following Admission

of the First Placing Shares, the Group's issued ordinary share

capital will comprise 50,455,989 Ordinary Shares, none of which are

held in treasury.

Therefore, following Admission of the First Placing Shares, the

total number of Ordinary Shares with voting rights in the Group

will be 50,455,989, which may be used by Shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the Group under the FCA's Disclosure Guidance and

Transparency Rules.

Application will be made for the Second Placing Shares to be

admitted to trading on AIM following the General Meeting.

For further information:

Marlowe plc www.marloweplc.com

Alex Dacre, Chief Executive Tel: +44 (0) 203 841

6194

Mark Adams, Group Finance Director IR@marloweplc.com

Cenkos Securities plc - Nominated Adviser, Joint Broker &

Lead Bookrunner

Nicholas Wells Tel: +44 (0)20 7397

8900

Ben Jeynes

Harry Hargreaves

Joh. Berenberg, Gossler & Co. KG, London Branch - Joint Broker

& Lead Bookrunner

Mark Whitmore Tel: +44 (0)20 3207

Ben Wright 7800

Yudith Karunaratna

Stifel Nicolaus Europe Limited - Bookrunner

Matthew Blawat Tel: +44 (0)20 7710 7600

Francis North

FTI Consulting

Nick Hasell Tel: +44 (0)20 3727

1340

Alex Le May

About Marlowe plc

Marlowe is a UK leader in specialist services which assure the

safety and regulatory compliance of commercial properties, whilst

managing risk for businesses across the country. The Group was

formed to create sustainable shareholder value through the

acquisition and development of businesses that provide regulated

inspection, testing and compliance services. It is focused on

health & safety, fire safety, security, water safety, water

treatment, air quality and environmental services - all of which

are vital to the wellbeing of its customers operations and are

invariably governed by regulation. Marlowe currently provides

services to over 10% of Britain's commercial properties and is

increasingly attractive to customers who require a single

outsourced, nationwide, provider of a comprehensive range of

regulated safety services. Our customers can be found in most

office complexes, high streets & leisure facilities,

manufacturing plants and industrial estates, and include SMEs,

local authorities, facilities management providers, multi-site NHS

trusts and FTSE 100 companies.

Cenkos and Stifel, each of which is authorised and regulated in

the United Kingdom by the FCA, and Berenberg, which is authorised

and regulated by the Federal Financial Supervisory Authority in

Germany and subject to limited regulation in the UK by the

Financial Conduct Authority, are acting for the Company and for no

one else in connection with the Placing and will not be responsible

to anyone other than the Company for providing the protections

afforded to clients of Cenkos, Stifel and Berenberg or for

providing advice in relation to the Placing, or any other matters

referred to in this Announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ROIFLFVVRRIRFII

(END) Dow Jones Newswires

June 26, 2020 09:39 ET (13:39 GMT)

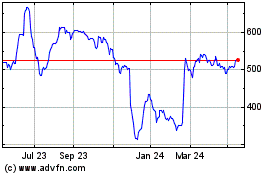

Marlowe (LSE:MRL)

Historical Stock Chart

From May 2024 to Jun 2024

Marlowe (LSE:MRL)

Historical Stock Chart

From Jun 2023 to Jun 2024