Medi@Invest PLC - Interim Results

December 16 1999 - 2:30AM

UK Regulatory

RNS Number:6199C

Medi@Invest PLC

16 December 1999

Medi@Invest PLC

INTERIM RESULTS FOR THE SIX MONTHS ENDED 30 SEPTEMBER 1999

The Board of Medi@Invest PLC (the "Group"), the media and internet investment

company, announce their interim results for the six months ended 30 September

1999.

Highlights

- The Group has been granted an option to acquire between 55% and 65% of KZN

Media Limited, the developer of KZuk.net, the UK's first safe and secure

family friendly Internet Service and Content Provider, with an arrangement

in place to acquire the balance of shares in due course.

- KZuk.net expected to launch in January 2000, with over 30,000 pages of

content, licensed rights to animated characters and numerous marketing and

sponsorship deals.

- Successful share issue of 44 million new ordinary shares in November,

raising #2.4 million.

- Strong cash position; current cash balance of #3 million.

Commenting on the results, Sir James Harvie-Watt, Chairman, said:

"Our successful fund-raising in November has enabled us to make our first

strategic investment in KZuk.net. We believe that, as the UK's first safe and

secure family oriented ISP, there is enormous potential to meet the demands of

the fastest growing internet population of 7 to 17 year olds. The ultimate

intention is for KZuk.net to become an interactive digital TV channel."

The text of full interim results to be posted to shareholders follows:

"Medi@Invest PLC

Chairman's Interim Statement

Overview

The first half of the 1999/2000 financial year and its immediate aftermath,

has been an exciting time for Medi@Invest PLC (the "Group"). Following an

Extraordinary General Meeting of shareholders on 12 October 1999, the Group

completed on the sale of the business trading as Edwards Hardy Fencing (the

"Fencing Division"), renamed itself Medi@Invest PLC, raised funds and changed

its strategy to focus on the opportunities currently available in the

development of media and the Internet. Since the EGM, it has raised further

funds and has announced its first new investment. This is a loan with an

option that will result in a majority shareholding in KZN Media Limited

("KZN"), a company developing a family oriented Internet Service and Content

Provider ("ISP") called KZuk.net.

Fund Raisings

The placing and open offer, which closed in October, successfully raised cash

of # 1.2m. Subsequent to the announcement that the Group had agreed to provide

an initial debt facility to KZN, a further capital raising was completed on 23

November by issuing 44m new ordinary shares to raise # 2.4m. At this time the

Group also appointed Insinger Townsley as its new Nominated Broker.

The Group currently has cash balances of approximately # 3.0m, which the

Directors believe will be sufficient to complete the development and promotion

of KZuk.net.

KZN Media Limited

KZN is a new company that is developing the UK's first family-friendly ISP and

content channel with the aim to provide a secure and safe zone for 5-12 year

olds to explore largely proprietary educational and entertainment content,

with password-controlled access to the worldwide web for adults and older

children. One in four UK children who are 17 or under are regular Internet

users - an estimated three million. This group represents the fastest growing

Internet population, with NOP estimating a global total of 77m under 18-year

olds by 2005. KZuk.net will be launched in January 2000 with over 30,000

pages of content, licensed rights to animated characters and numerous

marketing and sponsorship deals. With greater bandwidth and further content

development, the ultimate intention is for KZuk.net to become an interactive

digital TV channel.

The core management team at KZN comprises Peter Hitchen, Gary Lorimer, Paul

Bailey, Alexander Watson and Nissim Cohen. They have many years experience in

TV and film finance, marketing, sales and licencing, IT management and

software development for ISPs.

The Group has agreed to fund the development and launch of KZuk.net through a

loan agreement secured by a debenture of between #2,250,000 and #2,750,000.

The Group has been granted an option to acquire a shareholding of between 55%

and 65% of the enlarged issued share capital of KZN by way of capitalisation

of part of the loan for the nominal value of these shares (the "Option") and

has agreed to issue shares in the Group to the current shareholders of KZN if

certain conditions in relation to the ISP are satisfied. There are also

provisions to acquire the minority shareholding balance of KZN through the

issue of further new shares in the Group. A circular is expected to be issued

shortly to shareholders providing further details of this transaction and

calling an EGM to seek approval to exercise the Option.

Results for six months to 30 September 1999

The operating loss from continuing activities of #59,000 reported for the six

months to 30 September 1999 was the overhead cost of the parent company. The

Directors endeavoured to minimise the costs of running the Group during this

period prior to the refinancing.

The period under review also includes the results of the Fencing Division.

This discontinued operation is shown in a separate column and made no

contribution to the Group results at the operating profit level.

Dividend

The Board consider it inappropriate to declare an interim dividend, as the

Group's priority is to concentrate its available resources on its Internet

investment in KZN and other complementary growth investment opportunities.

Future Strategy

In the last circular to shareholders the Board stated that it intended to

pursue investment opportunities within the areas of 'media and the Internet'.

In order to concentrate management time, the expertise of any new employees

and increase the cross-benefits of investments your Directors believe that a

greater degree of focus on entertainment, education, publishing and

merchandising will deliver the greatest value for shareholders.

Profit and Loss Account

UNAUDITED UNAUDITED AUDITED

6 months to 6 months to 12 months to

30 September 30 September 31 March

1999 1998 1999

Contin- Discon- Total Contin- Discon- Total Contin- Discon- Total

-uing -tinued -uing -tinued -uing -tinued

#'000 #'000 #'000 #'000 #'000 #'000 #'000 #'000 #'000

Turnover - 198 198 - 2710 2710 - 2946 2946

Cost of sales - -150 -150 - -2437 -2437 - -2713 -2713

Gross profit - 48 48 - 273 273 - 233 233

Administration -59 -48 -107 -193 -339 -532 -384 -413 -797

expenses

Operating loss -59 - -59 -193 -66 -259 -384 -180 -564

Loss on disposal

of business - - - - -119 -119 - -119 -119

Loss on ordinary

activities before

interest and

taxation -59 - -59 -193 -185 -378 -384 -299 -683

Interest payable

and similar charges - -11 -12

Interest received 1 13 20

Loss on ordinary

activities

before taxation -58 -376 -675

Taxation on loss

on ordinary activities - - -

Loss on ordinary

activities

after taxation -58 -376 -675

Loss per share (pence) (see note 1)

- basic (0.09) (0.59) (1.05)

- diluted (0.09) (0.59) (1.05)

The results of operations which have been discontinued in the six months ended

30 September 1999 have been restated in the prior periods' comparisons in

order to be consistent with the treatment in the current period's accounts.

Balance Sheet

UNAUDITED AUDITED

at 30 September at 31 March

1999 1999

#'000 #'000 #'000 #'000

Fixed Assets

Tangible assets - 5

Current Assets

Stock - 18

Debtors 33 140

Cash and bank balances 47 104

80 262

Creditors:

amounts falling due

within one year 58 213

Net Current Assets 22 49

Net Assets 22 54

Called up share capital 1855 1829

Reserves

Share premium account 318 318

Capital redemption reserve 10 10

Profit and loss account -2161 -2103

-1833 -1775

Shareholders' funds 22 54

Shareholders' funds include #227,000 (31 March 1999: #227,000) relating to

non-equity interests.

Notes:

1 The basic loss per share is based on 64,215,917 ordinary shares, (1998:

64,079,524 ordinary shares), being the weighted average number of ordinary

shares in issue during the six month period, and on the loss after taxation

for the respective periods.

2 The financial information set out herein does not comprise full financial

statements within the meaning of the Companies Act 1985. Full accounts of

the Group for the year ended 31 March 1999, on which the auditors gave a

qualified opinion arising from limitation of audit scope, have been

delivered to the Registrar of Companies.

3 All recognised gains and losses have been included in the profit and loss

account.

4 There is no material difference between the results disclosed in the profit

and loss account and the results prepared on an historical cost basis.

5 Copies of this statement of interim results will be sent to shareholders

of Medi@Invest PLC. Further copies are available to the public free of

charge from the Company's registered office at One Portland Place, London,

W1N 3AA."

Enquiries

Robin Jones Medi@Invest PLC 0171 706 3000

Jonathan Hinton Arthur Andersen Corporate Finance 0171 438 3000

Simon Fox Insinger Townsley 0171 377 6161

Rupert Ashe GCI Focus 0171 398 0800

END

IR TABPBLLTBBLL

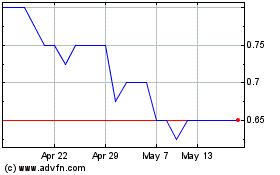

Minoan (LSE:MIN)

Historical Stock Chart

From Aug 2024 to Sep 2024

Minoan (LSE:MIN)

Historical Stock Chart

From Sep 2023 to Sep 2024