TIDMMHC

RNS Number : 8273M

MyHealthChecked PLC

19 September 2023

MyHealthChecked PLC

("MyHealthChecked", the "Group" or the "Company")

Half-Year Report

MyHealthChecked PLC, the consumer home-testing healthcare

company, announces its unaudited half-year report for the six

months ended 30 June 2023.

Financial highlights

-- Revenue of GBP2.5m (H1 2022: GBP9.8m)

-- Adjusted EBITDA loss GBP296,000 (H1 2022: GBP372,000 profit)

-- Cash balance of GBP5m available to self-fund next growth phase

Commercial and operational highlights

-- Launch of an extensive range of wellness tests into the UK's top pharmacy retailer

-- Investment in IT infrastructure to support customer journey

of extensive range of blood and urine tests

-- H1 investment in stockholding (GBP1.7m) to meet 2023 demand

-- Achievement of Healthcare Inspectorate Wales accreditation

-- Cyber Essentials Plus renewed for digital security

-- Operational streamlining to minimise cash burn

-- Appointment of Amber Vodegel as a Non-Executive Director post-period end

Penny McCormick, Chief Executive Officer of MyHealthChecked PLC,

said: "Despite the reduction in demand for COVID testing during the

period under review, we have been very pleased with the delivery

and retail launch of a broad range of blood and urine tests,

progress with the capabilities of our digital platform, regulatory

approval of our portfolio under CE marking, and achievement of

Healthcare Inspectorate Wales accreditation.

"Post-period end we have seen increased demand for COVID testing

as we move towards the winter season, and the Eris and Pirola

strains are in the news. We remain well-placed to provide a

reliable and effective supply chain at large volumes to retail.

"During the period we have further demonstrated the Company's

agile and ambitious capabilities and are poised to build awareness

of this vast new range of tests in a dynamic category, whilst

making progress in this new and exciting sector."

Investor presentation

Penny McCormick, Chief Executive Officer and Adam Reynolds,

Chairman will provide a live presentation relating to the Half-Year

Report via the Investor Meet Company platform on Tuesday 19

September 2023 at 4.30pm. The presentation is open to all existing

and potential shareholders.

Investors can sign up to Investor Meet Company for free and

register for the presentation via the link below:

https://www.investormeetcompany.com/myhealthchecked-plc/register-investor

MyHealthChecked PLC www.myhealthcheckedplc.com

Adam Reynolds, Chairman via Walbrook PR

Penny McCormick, Chief Executive

Officer

SPARK Advisory Partners Limited Tel: +44 (0)20 3368 3550

(NOMAD)

Neil Baldwin / Jade Bayat

Dowgate Capital Limited (Broker) Tel: +44 (0)20 3903 7715

David Poutney / Nicholas Chambers

Walbrook PR Ltd (Media Tel: +44 (0)20 7933 8780 or myhealthcheckedplc@walbrookpr.com

& IR)

Paul McManus / Alice Woodings Mob: +44(0)7980 541 893 / +44(0)7407 804

654

About MyHealthChecked PLC ( www.myhealthcheckedplc.com )

MyHealthChecked PLC, based in Cardiff, is an AIM-quoted

pioneering UK healthcare company focused on a range of at-home

healthcare and wellness tests.

MyHealthChecked is the umbrella brand of a range of at-home

rapid tests, as well as DNA, RNA and blood sample collection kits

which have been created to support customers on their journeys to

wellness. The tests are lateral-flow self-tests, whilst the sample

collection kits enable the collection of blood, urine, nasal or

mouth swab samples that are analysed in partner laboratories for a

range of biomarkers. The tests will also be made available online

and will be viable for over-the-counter purchase.

The MyHealthChecked portfolio has been identified as part of a

change in mindset as customers become more familiar with the

concept of accessible healthcare in the growing at home testing kit

market with a focus on accessibility at the right price, led by

UK-based experts.

CHAIRMAN AND CEO JOINT STATEMENT

Whilst the market has been challenging in 2023, and the

inevitable seasonal COVID reduction has had an impact, we have been

able to make significant inroads into the consumer healthcare space

and carve out an identity for ourselves as a consumer health and

wellness test provider. The successful launch of a strong portfolio

of multi-platform tests into the UK's biggest pharmacy retailer has

been a major milestone for MyHealthChecked.

Financial performance

Sales for the six months ended 30 June 2023 fell to GBP2.5m (six

months ended 30 June 2022: GBP9.8m; year ended 31 December 2022:

GBP22.3m) due to the anticipated fall in demand for COVID Lateral

Flow Tests ("LFTs"). The new product range was launched in May 2023

into 801 Boots stores and www.boots.com , alongside direct sales

via www.myhealthchecked.com. This has been a new category launch

and awareness levels will build over time, driven by marketing

activity and store initiatives. 2023 will be a period of bedding-in

whilst awareness is driven through, and customer behaviour is

understood in this new space.

Gross margin increased to 41.3% (six months ended 30 June 2022:

15.4%; year ended 31 December 2022: 20.8%) due to the release of a

surplus accrual for the processing of COVID PCR nasal swab kits

sold in earlier years which were not returned by customers and have

now expired. Excluding this adjustment, the gross margin achieved

on sales in the period was 13.5% reflecting the dominance of

competitively priced LFTs in the product mix.

Overheads were broadly in line with prior years. As previously

announced, we continue to focus on the commercialisation and

development of our digital platform. Total spend on the development

and maintenance IT infrastructure during the period under review

amounted to GBP686,000 (six months ended 30 June 2022: GBP295,000;

year ended 31 December 2022: GBP856,000) of which GBP374,000 (six

months ended 30 June 2022: GBP145,000; year ended 31 December 2022:

GBP310,000) has been capitalised. This investment has been in the

expansion of the recommendation engine and development of the

codebase for new blood and urine tests, as well as enhancements to

our Laboratory Information Management System ("LIMS") to enable

medical oversight and compliance with Healthcare Inspectorate

Wales, and the customer dashboard that allows all customers to

securely activate their test kits and enter their personal data,

regardless of their point of purchase. The development of the

platform also ensures that users of our tests have access to a high

standard of clear guidance and information provided by doctors,

within a secure digital environment, that is accessible to

healthcare professionals.

Adjusted EBITDA is calculated as follows:

Unaudited Unaudited Audited

30 June 2023 30 June 2022 31 December 2022

GBP'000 GBP'000 GBP'000

--------------------------------- -------------- -------------- ------------------

Operating (loss)/profit (404) 12 1,506

Depreciation and amortisation 89 169 222

Impairment of intangible assets - - 378

Closure of laboratory costs * - 87 171

Share based payments 19 104 (20)

--------------------------------- -------------- -------------- ------------------

Adjusted EBITDA (296) 372 2,257

--------------------------------- -------------- -------------- ------------------

* Excluding loss on disposal of equipment

At 30 June 2023 our cash amounted to GBP5,015,000 (six months

ended 30 June 2022: GBP6,995,000; year ended 31 December 2022:

GBP7,608,000). At 31 December 2022 the Group had open purchase

orders to the value of GBP2.8m for the delivery of COVID LFTs

(which are manufactured with a 24 month shelf life) during 2023; by

30 June 2023 this stock had all been received and paid for in full.

Stock at 30 June 2023 amounted to GBP3.0m, an increase of GBP1.7m

during the period under review. There are no additional contractual

commitments to purchase COVID LFT stocks during 2023.

Business Review

The consumer healthcare space is dynamic and exciting, and

consumers are in a period of considerable behavioural change

post-COVID which will have a major impact on the future of consumer

healthcare in the UK. As a high calibre provider in the sector we

are well-placed, and funded, to build upon our strong portfolio and

explore broader opportunities for business growth as the market

evolves at pace. This is a new phase for MyHealthChecked as our

reliance on COVID reduces, and we are eager to take the next steps

through H2 2023 and beyond.

The retail category launch on 18 May 2023 of such a vast

multi-platform, multi-sample range of tests has been unprecedented.

MyHealthChecked's range is unique insofar as it covers saliva,

blood, urine and stool collection, across lateral flow and

laboratory assays to deliver a varied portfolio of wellness and

health self-checks and laboratory biomarker and DNA tests. The

creation and launch of a comprehensive range of 20 tests was

extremely ambitious, and the successful delivery of this to a major

retailer will remain one of our biggest product launches - and

successes - in perpetuity. The ambitious launch positions us well

in the market and demonstrates, as we did with COVID, our ability

to move with pace to deliver quality and compliant physical and

digital products and services to a tight timescale.

The priority, as agreed with our primary retail partner, has

been to achieve product 'go-live', followed by a period of

awareness-building to achieve product rotation and recommendation.

New categories required an investment in on-shelf fixtures, and we

are now firmly focused on educating end-users and store-staff. We

have commenced a journey to achieving this primarily via social

media advertising and PR, along with partnership activity with

retail. This is allowing us to utilise traditional routes such as

leafleting within ecommerce orders in Q3 and trialling social media

influencer activity as we did around Father's Day. We are seeing an

improvement in key KPIs including unit sales, pieces of media

coverage and web engagement times and, as we continue to

communicate with our extensive database of existing customers

alongside outreach to new customers, performance tracking will be

key to us.

With a focus on ongoing performance, we appointed Amber Vodegel

to our Board on 3 July 2023. Amber's expertise, which includes

mobile app development, digital transformation, and platform

development within the health space, with a focus on driving

consumer obsession and maximising user engagement, will support our

focus on launch activation. With her input we can also ensure a

high calibre of marketing expertise in driving the performance of

our portfolio. This will accompany efforts to grow our customer

footprint and strengthen our presence in the market through new

retail channels.

Looking ahead, our focus is on growing awareness of this new

category and helping to educate customers on the benefits of

self-testing. The category is very new, and digital service and

information enhancements will take precedence over new assays in

the short term. However, we will continue to work closely with our

Scientific Advisory Board to continually assess all new market

requirements, and progress should the market demand such

developments.

We are also working with a talented team of technical developers

to build out our digital infrastructure and user journey. Our

requirements here are twofold: that overall, we provide a positive

user experience by ensuring our results are accurate and correct,

that our customers can receive and interpret their test results and

actionable guidance correctly, and that we are compliant with the

requirements of Healthcare Inspectorate Wales; and that we ensure

robustness in cyber security, which we have demonstrated

successfully with the renewal of our Cyber Essentials Plus

certification.

We have met the technology challenges we set ourselves, for

example our sexual health blood and urine tests require an enhanced

level of medical oversight and customer interaction, as the British

Association for Sexual Health and HIV guidelines require a

different pathway for ongoing guidance. Some of the complexities

around our tests have required an intense technical, product and

customer care delivery to meet our ambitious timelines, and we are

satisfied that these brand-new builds provide a solid foundation

for ongoing customer journey enhancements.

The period saw us meet the high standards of governance and

patient safeguarding required to achieve Healthcare Inspectorate

Wales Certification ("HIW"). HIW is the equivalent of England's

Care Quality Commission ("CQC") and is the required standard of

healthcare-providing organisations that are headquartered in Wales.

As governance and compliance continuously remain a high focus for

us, we are well-placed in 2023 to achieve ISO 13485 and have made

significant progress towards achievement of this in the second half

of the year.

Supply chain management through COVID has challenged all players

in the space, and MyHealthChecked has been responsive throughout

the pandemic and has delivered in an exemplary fashion to

high-demand retailers. As demand in Q1 2023 grew we honoured our

stock commitments and invested accordingly during the period.

Subsequently, as demand has tapered off, we have no further

commitments to stock and are well-placed to meet post-period

uplifts that are arising due to immunity waning, new strains

appearing, and winter/flu season impacting.

Our cost base and cash resources are also being closely

monitored and kept under review, and we have actively reduced our

staff costs post-period, alongside a detailed review and

renegotiation where appropriate of recurring costs. In Q4 we will

also reduce our office space. This will ensure we move forward in a

position to invest in awareness building and improvements that will

directly benefit the customer, with a focus on financially valuable

capital allocations that will strengthen our position and drive

growth and longevity.

Outlook

We will continue to work closely with our retail partners to

build awareness and expect that traction for the new product

portfolio will build momentum in 2024 as we activate key

initiatives and look to build on the Q1 2024 new year period when

customers are motivated and ready for a new wellness outlook.

Whilst we expect that H2 trading on the wellness tests will remain

broadly in line with run rate, we are working with our partners to

drive awareness and evolve the positioning of the range so that it

maximises the opportunity that home-testing brings. We continue to

explore new initiatives around sample collection including

phlebotomy services that will further meet the needs of the

customer, alongside the continuing evolution of our digital user

platform to ensure we continue to excel in our user experience.

Post-period we have seen an uplift in the demand for COVID

lateral flow tests, and as outlined our stock investment means that

we are well placed to service the market. Signs indicate that COVID

may become seasonal like flu, and there may be a cyclical market

emerging based on infection rates, for which MyHealthChecked is

well placed to serve.

Driving awareness and educating customers around the benefits of

home-testing, whilst enhancing our services, and growing our retail

footprint are our primary aims ahead. As the dynamic healthcare and

investment market evolves, we will also be open to strategic

exploration and welcome conversations that could bring earnings

enhancing strategic opportunities for MyHealthChecked. As well as

delivering ISO 13485 as a strategic goal, we will continue to

evaluate the very best routes to support our customers, our retail

partners, and the NHS as we all navigate a changing healthcare

system, and new behaviours.

As always, we thank our committed staff team and our valued

shareholders for their ongoing investment in the future of

MyHealthChecked.

Adam Reynolds Penny McCormick

Chairman Chief Executive Officer

18 September 2023

Consolidated statement of comprehensive income

For the 6 months ended 30 June 2023

Unaudited

Unaudited 6 months Audited

6 months ended ended Year ended

30 June 30 June 31 December

2023 2022 2022

Notes GBP'000 GBP'000 GBP'000

----------------------------- ------ ---------------- ------------ -------------

Revenue 3 2,464 9,832 22,314

Cost of sales (1,446) (8,321) (17,667)

----------------------------- ------ ---------------- ------------ -------------

Gross profit 1,018 1,511 4,647

----------------------------- ------ ---------------- ------------ -------------

Sales and marketing

costs (245) (282) (798)

Other administrative

expenses (1,158) (960) (2,087)

Closure of laboratory - (153) (226)

Impairment of intangible

assets - - (50)

Share-based payments (19) (104) 20

----------------------------- ------ ---------------- ------------ -------------

Administrative expenses (1,177) (1,217) (2,343)

----------------------------- ------ ---------------- ------------ -------------

Operating (loss)/profit (404) 12 1,506

Finance payable (1) (3) (5)

Interest receivable 50 - 3

Impairment of goodwill

arising on the acquisition

of Nell Health - - (987)

Contingent consideration

no longer payable on

the acquisition of

Nell Health Limited - 1,000 1,000

----------------------------- ------ ---------------- ------------ -------------

(Loss)/profit before

income tax 3 (355) 1,009 1,517

Tax credit 36 - -

(Loss)/profit for

the period (319) 1,009 1,517

----------------------------- ------ ---------------- ------------ -------------

Attributable to owners

of the parent: (319) 1,009 1,517

(Loss)/earnings per

Ordinary Share - basic 4 (0.61)p 1.95p 2.94p

Fully diluted earnings

per Ordinary Share 4 (0.61)p 1.94p 2.92p

Consolidated statement of financial position

As at 30 June 2023

Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

Notes GBP'000 GBP'000 GBP'000

----------------------------- ------ ---------- ---------- -------------

Non-current assets

Property, plant and

equipment 118 88 75

Right-of-use assets 63 88 75

Intangible assets 1,397 2,520 1,098

Total non-current

assets 1,578 2,696 1,248

----------------------------- ------ ---------- ---------- -------------

Current assets

Inventories 3,004 711 1,284

Trade and other receivables 537 3,224 1,288

Cash and cash equivalents 5,015 6,995 7,608

----------------------------- ------ ---------- ---------- -------------

Total current assets 8,556 10,930 10,180

----------------------------- ------ ---------- ---------- -------------

Total assets 10,134 13,626 11,428

----------------------------- ------ ---------- ---------- -------------

Current liabilities

Trade and other payables 1,544 5,094 2,525

Lease liabilities 28 26 29

Total current liabilities 1,572 5,120 2,554

----------------------------- ------ ---------- ---------- -------------

Non-Current liabilities

Lease liabilities 12 40 24

Total non-current

liabilities 12 40 24

----------------------------- ------ ---------- ---------- -------------

Total liabilities 1,584 5,160 2,578

----------------------------- ------ ---------- ---------- -------------

Net assets 8,550 8,466 8,850

----------------------------- ------ ---------- ---------- -------------

Share capital 5 780 780 780

Deferred shares - 6,359 6,359

Share premium account - 16,887 16,887

Capital redemption

reserve - 1,815 1,815

Reverse acquisition

reserve (6,044) (6,044) (6,044)

Retained earnings 13,814 (11,331) (10,947)

-------------

Total equity 8,550 8,466 8,850

----------------------------- ------ ---------- ---------- -------------

Consolidated statement of changes in equity

For the 6 months ended 30 June 2023

Capital Reverse

Share Deferred Share redemption acquisition Retained

capital shares Premium reserve reserve earnings Total

GBP

'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- --------- ----------- ---------- ------------- ------------- ----------- --------

Equity as

at

1 January

2022 756 6,359 16,671 1,815 (6,044) (12,444) 7,113

Profit for

the year - - - - - 1,517 1,517

------------------- --------- ----------- ---------- ------------- ------------- ----------- --------

Total

comprehensive

profit - - - - - 1,517 1,517

The Genome

Store deferred

consideration 24 - 216 - - - 240

Share-based

payments - - - - - (20) (20)

--------- ----------- ---------- ------------- ------------- ----------- --------

Equity as

at

31 December

2022 780 6,359 16,887 1,815 (6,044) (10,947) 8,850

Loss for the

period - - - - - (319) (319)

------------------- --------- ----------- ---------- ------------- ------------- ----------- --------

Total

comprehensive

profit - - - - - (319) (319)

Share-based

payments - - - - - 19 19

Capital reduction - (6,359) (16,887) (1,815) - 25,061 -

Equity as

at

30 June 2023 780 - - - (6,044) 13,814 8,550

------------------- --------- ----------- ---------- ------------- ------------- ----------- --------

Consolidated statement of cash flows

For the 6 months ended 30 June 2023

Unaudited Unaudited

6 months ended 6 months ended Audited

30 June 30 June Year ended

2023 2022 31 December 2022

GBP'000 GBP'000 GBP'000

---------------- ----------------- ------------------

Cash flows from operating activities

(Loss)/profit before taxation (355) 1,009 1,517

Adjustments for:

Non-cash movement in provisions and accruals (760) (1,000) (1,000)

Depreciation and amortization 89 169 222

Impairment of intangible assets - - 1,365

Loss on sale of laboratory assets - - 55

Finance income (50) - (3)

Finance expenses 1 3 5

Share-based payments 19 104 (20)

Adjusted operating (loss)/profit before changes in

working capital (1,056) 285 2,141

Changes in working capital

Increase in inventory (1,720) (214) (787)

Decrease/(increase) in trade and other receivables 751 (892) 1,044

(Decrease)/increase in trade and other payables (221) 1,779 (790)

Cash (used)/generated in operations (2,246) 958 1,608

Bank interest received 50 - 3

Interest paid (1) (3) (5)

------------------

Net cash (outflow)/inflow from operating activities (2,197) 955 1,606

---------------------------------------------------------- ---------------- ----------------- ------------------

Investing activities

Purchase of property, plant and equipment (45) (17) (22)

Purchase of intangible assets (374) (296) (316)

---------------------------------------------------------- ---------------- ----------------- ------------------

Net cash flows used in investing activities (419) (313) (338)

Taxation

Research and development tax credit 36 - -

---------------------------------------------------------- ---------------- ----------------- ------------------

Cash inflow from taxation 36 - -

---------------------------------------------------------- ---------------- ----------------- ------------------

Financing activities

Repayment of lease liability (13) (34) (47)

---------------------------------------------------------- ---------------- ----------------- ------------------

Cash outflows from financing activities (13) (34) (47)

---------------------------------------------------------- ---------------- ----------------- ------------------

Net change in cash and cash equivalents (2,593) 608 1,221

Cash and cash equivalents at the beginning of the period 7,608 6,387 6,387

---------------------------------------------------------- ---------------- ----------------- ------------------

Cash and cash equivalents at the end of the period 5,015 6,995 7,608

---------------------------------------------------------- ---------------- ----------------- ------------------

Notes to the unaudited interim financial information for the 6

months ended 30 June 2023

1. General information

MyHealthChecked PLC (the "Group") is a public limited company

incorporated and domiciled in England and Wales. The registered

office of the Company is The Maltings, East Tyndall Street,

Cardiff, CF24 5EA. The registered company number is 06573154.

The principal activity of the Group is in the development and

commercialisation of diagnostic healthcare products.

2. Significant accounting policies

Basis of preparation

The interim financial information for the six months ended 30

June 2023, which was approved by the Board of Directors on 18

September 2023, does not constitute statutory accounts as defined

by section 434 of the Companies Act 2006.

These interim consolidated financial statements have been

prepared in accordance with IAS 34 Interim Financial Reporting.

They do not include all disclosures that would otherwise be

required in a complete set of financial statements.

The financial information presented is unaudited and has been

prepared using the same accounting policies as those adopted in the

financial statements for the year ended 31 December 2022 and

expected to be adopted in the financial year ending 31 December

2023.

The interim financial information includes unaudited comparative

figures for the unaudited 6 months to 30 June 2022 and comparatives

for the year ended 31 December 2022 that have been extracted from

the audited financial statements for that year. The financial

statements for the year ended 31 December 2022 were reported on by

the Company's auditors and delivered to the Registrar of Companies.

The report of the auditors was unqualified and did not contain an

adverse statement under section 498 (2) or (3) of the Companies Act

2006.

In the opinion of the Directors, the interim financial

information for the period presents fairly the financial position

and the results from operations and cash flows for the period.

Going concern

The interim financial statements have been prepared under the

going concern basis as the Directors have undertaken a review of

the future financing requirements of the ongoing operation of the

Group and considers the Group is able to meet its working capital

requirements.

3. Segment information

In the opinion of the directors, the Group has one class of

business, being that of the provision of diagnostic healthcare

products. All the segment assets associated with the provision of

diagnostic healthcare products are located in the UK.

Unaudited Unaudited Audited

30 June 2023 30 June 2022 31 December 2022

GBP'000 GBP'000 GBP'000

------------------------------------------------------------------ -------------- -------------- ------------------

Covid related products 2,342 9,832 22,305

Other 122 - 9

Revenue from the provision of diagnostic healthcare products 2,464 9,832 22,314

Loss/(profit) for the period from provision of diagnostic

healthcare products (88) 433 1,987

Corporate costs (316) (421) (481)

Net finance income/(expense) 49 (3) (2)

Deferred consideration adjustment - 1,000 13

------------------------------------------------------------------ -------------- --------------

Group (loss)/profit before tax (355) 1,009 1,517

------------------------------------------------------------------ -------------- -------------- ------------------

Cash 5,015 6,995 7,608

Segment assets 5,066 6,579 3,778

Corporate assets 53 52 42

------------------------------------------------------------------ -------------- -------------- ------------------

Total assets 10,134 13,626 11,428

------------------------------------------------------------------ -------------- -------------- ------------------

Segment liabilities 1,444 4,973 2,105

Corporate liabilities 140 187 473

------------------------------------------------------------------ -------------- -------------- ------------------

Total liabilities 1,584 5,160 2,578

------------------------------------------------------------------ -------------- -------------- ------------------

4. (Loss)/profit per Ordinary Share

Unaudited Unaudited Audited

30 June 2023 30 June 2022 31 December 2022

(restated) (restated)

Basic and diluted (loss)/profit per Ordinary Share (restated)

(Loss)/profit for the period GBP(319,000) GBP1,009,000 GBP1,517,000

Weighted average number of shares - basic 52,005,932 51,628,000 51,620,000

Weighted average number of shares - fully diluted 52,005,932 51,981,000 51,881,000

(Loss)/profit) per share - basic (0.61)p 1.95p 2.94p

Fully diluted (loss)/profit per share (0.61)p 1.94p 2.92p

--------------------------------------------------------------- -------------- -------------- ------------------

Basic (loss)/profit per share is calculated by dividing the

(loss)/profit attributable to equity holders of the Company by the

weighted average number of Ordinary Shares in issue during the

period. Due to the loss in the six month period ended 30 June 2023

the effect of the share options was considered anti-dilutive. The

comparative figures been restated to reflect the impact of the

share consolidation referred to in note 5 below.

5. Share capital

On 17 January 2023 the Court approved the reduction of the share

capital of the Company, involving the cancellation of all the

Deferred Shares, the Share Premium Account and the Capital

Redemption Reserve. The purpose of the Capital Reduction was to

create distributable reserves.

On 11 May 2023, 13 new Ordinary Shares were allotted to the

Company's registrars, Neville Registrars Limited, so that the total

number of existing Ordinary Shares would be exactly divisible by 15

for the share consolidation. On 12 May 2023 the 780,088,980

existing Ordinary Shares of 0.1 pence each were consolidated on a

15 for 1 basis, such that every 15 existing Ordinary Shares were

consolidated into 1 Ordinary Share of 1.5p pence in nominal value.

On completion of the share consolidation the Company had 52,005,932

new Ordinary Shares in issue.

This interim financial statement will be released in accordance

with the AIM Rules for Companies, available shortly on the

Company's website at https://investors.myhealthchecked.com/.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DVLFFXKLBBBB

(END) Dow Jones Newswires

September 19, 2023 02:00 ET (06:00 GMT)

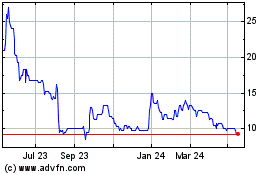

Myhealthchecked (LSE:MHC)

Historical Stock Chart

From Nov 2024 to Dec 2024

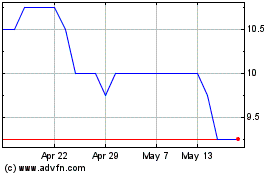

Myhealthchecked (LSE:MHC)

Historical Stock Chart

From Dec 2023 to Dec 2024