TIDMMHC

RNS Number : 0386V

MyHealthChecked PLC

03 April 2023

MyHealthChecked PLC

( " MyHealthChecked " or the "Company " )

Proposed Share Consolidation and Notice of AGM

MyHealthChecked PLC (AIM: MHC), the consumer home-testing

healthcare company, announces that it will today post a circular to

shareholders detailing the Board's proposal to consolidate the

Company's share capital with the aim of improving the marketability

of the Ordinary Shares. The Circular will also contain the Notice

of the Annual General Meeting to be held on 11 May 2023.

A copy of the Circular and Notice of the Annual General Meeting

will be available on the Company's website:

www.investors.myhealthcheckedplc.com later today. Extracts from the

Circular are set out below:

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

2023

Posting of the Circular and the 3 April

form of proxy

Latest time and date for receipt 11.00 a.m. on 9 May

of forms of proxy for the Annual

General Meeting

Annual General Meeting 11.00 a.m. on 11 May

Announcement of the result of 11 May

the Annual General Meeting

Record Date in respect of the 6.00 p.m. on 11 May

Share Consolidation and final

date for trading in Existing

Ordinary Shares

Admission expected to become 8.00 a.m. on 12 May

effective and dealings expected

to commence in the New Ordinary

Shares on AIM

CREST accounts expected to be 12 May

credited in respect of New Ordinary

Shares in uncertificated form

Expected date by which certificates By the week commencing on 29

in respect of New Ordinary Shares May

are to be despatched to certificated

Shareholders

DEFINITIONS

The following definitions apply throughout this document, unless

the context requires otherwise.

"Admission" the admission of the New Ordinary Shares

to trading on AIM in accordance with Rule

6 of the AIM Rules;

"Annual General Meeting" the Annual General Meeting of Shareholders

or "AGM" to be held at 11.00 a.m. on 11 May 2023

and any adjournment thereof, to consider

and, if thought fit, pass the Resolutions,

notice of which is set out at the end

of this document

-----------------------------------------------

"AIM" the market of that name operated by London

Stock Exchange plc

-----------------------------------------------

"AIM Rules" the AIM Rules for Companies whose securities

are traded on AIM, as published by the

London Stock Exchange from time to time

-----------------------------------------------

"Articles" the Company's articles of association

-----------------------------------------------

"Board" or "Directors" the directors of the Company at the date

of this Document, whose names are set

out on page 6 of this Document

-----------------------------------------------

"Circular" or "Document" this document dated 3 April 2023

-----------------------------------------------

"Company" MyHealthChecked PLC, a company registered

in England and Wales with registered number

06573154

-----------------------------------------------

"CREST" the computerised settlement system to

facilitate transfer of title to or interests

in securities in uncertificated form operated

by Euroclear UK & International Limited;

-----------------------------------------------

"Existing Ordinary the 780,088,967 o rdinary shares of 0.1p

Shares" each in the capital of the Company in

issue at the date of this document, which

are admitted to trading on AIM

-----------------------------------------------

"form of proxy" the form of proxy accompanying this Document

(or otherwise available) for use at the

Annual General Meeting

-----------------------------------------------

"London Stock Exchange" London Stock Exchange plc

-----------------------------------------------

"New Ordinary Shares" the Ordinary Shares of 1.5p each in the

capital of the Company arising on the

completion of the Share Consolidation

-----------------------------------------------

"Ordinary Shares" ordinary shares of 0.1p (or, following

the Share Consolidation, 1.5p) each in

the capital of the Company

-----------------------------------------------

"Record Date" 6.00 p.m. on 11 May 2023 (or such other

time and date as determined by the Directors)

-----------------------------------------------

"Resolutions" the resolutions set out in the notice

of Annual General Meeting

-----------------------------------------------

"Share Consolidation" the proposed consolidation of the Company's

ordinary share capital pursuant to which

every 15 Existing Ordinary Shares are

consolidated into 1 New Ordinary Share

-----------------------------------------------

"Shareholders" holders of Ordinary Shares in the Company

from time to time

-----------------------------------------------

"Sterling" or "GBP" the lawful currency of the UK

-----------------------------------------------

"UK" or "United Kingdom" the United Kingdom of Great Britain and

Northern Ireland

-----------------------------------------------

"US" or "United States" the United States of America, its territories

and possessions, any states of the United

States of America and the District of

Columbia and all other areas subject to

its jurisdiction.

-----------------------------------------------

STATISTICS

Number of Existing Ordinary Shares 780,088,967

Number of Ordinary Shares in issue as at the

Record Date 780,088,980

Conversion ratio of Existing Ordinary Shares

to New Ordinary Shares 15 : 1

Nominal value of an Ordinary Share following

the Share Consolidation 1.5p

Number of Ordinary Shares in issue immediately

following the Share Consolidation 52,005,932

New ISIN Code following the Share Consolidation GB00BN7K5L93

New SEDOL Code following the Share Consolidation BN7K5L9

TIDM MHC

LEI 213800RBHY6LZDG13168

1. Introduction

I am writing to you to set out the details of your Board's

proposal to consolidate the Company's share capital with the aim of

improving the marketability of the Ordinary Shares.

In addition, I am pleased to inform you that this year's annual

general meeting will be held on 11 May 2023 at 11.00 a.m. in the

Malt Room at The Maltings, East Tyndall Street, Cardiff, CF24

5EA.

The purpose of this document is to provide you with details of

the Share Consolidation and the Resolutions to be proposed to

Shareholders at the forthcoming Annual General Meeting. The formal

Notice of Annual General Meeting is set out at the end of this

document (together with a set of explanatory notes) and a form of

proxy is also enclosed for you to complete, sign and return.

2. Background to and reasons for the Share Consolidation

As at the date of this document, the Company has 780,088,967

Ordinary Shares in issue, with a closing mid-market price of 1.05

pence per Existing Ordinary Share (as at 31 March 2023, being the

latest practicable Business Day prior to the date of this

document). The Board believes that the Share Consolidation will

improve the marketability of the Ordinary Shares by way of a higher

share price and hopes to reduce volatility in the Company's share

price by narrowing the spread of its bid and offer price.

It is therefore proposed that the existing ordinary shares of

0.1 pence each are consolidated on a 15 for 1 basis, such that

every 15 Existing Ordinary Shares are consolidated into 1 ordinary

share of 1.5p pence in nominal value. It is intended that 13 new

Ordinary Shares will be allotted to the Company's registrars,

Neville Registrars Limited, following the AGM so that the total

number of existing Ordinary Shares is exactly divisible by 15 for

the Share Consolidation. Assuming a share capital of 780,088,980

Existing Ordinary Shares immediately prior to the Record Date,

following completion of the Share Consolidation, the Company will

have 52,005,932 New Ordinary Shares in issue.

Application will be made in accordance with the AIM Rules for

the New Ordinary Shares arising from the Share Consolidation to be

admitted to trading on AIM, subject to Shareholders passing

Resolutions 6 and 7 at the Annual General Meeting. It is expected

that if such Resolutions are passed, Admission in respect of such

New Ordinary Shares will become effective and that dealings in

those New Ordinary Shares will commence on 12 May 2023.

No Shareholder will be entitled to a fraction of a New Ordinary

Share. Instead, their entitlement will be rounded down to the

nearest whole number of New Ordinary Shares. Remaining fractional

entitlements to New Ordinary Shares will be aggregated and sold on

behalf, and for the benefit of, the Company. If a Shareholder holds

fewer than 15 Existing Ordinary Shares at the Record Date, then the

rounding down process will result in that Shareholder being

entitled to zero New Ordinary Shares and as a result of the Share

Consolidation they will cease to hold any Ordinary Shares.

3. Annual General Meeting

Set out at the end of this document is a notice convening the

Annual General Meeting to be held on 11 May 2023 at 11.00 a.m. in

the Malt Room at The Maltings, East Tyndall Street, Cardiff, CF24

5EA, at which the Resolutions will be proposed.

We are keen to welcome Shareholders in person to the Annual

General Meeting this year and an explanation of the business to be

considered at the Annual General Meeting is set out at the end of

the formal notice of the Annual General Meeting which is set out at

the end of this document.

Shareholders wishing to vote but who are unable to attend the

Annual General Meeting in person, are urged to appoint the Chairman

of the meeting as their proxy, in accordance with the relevant

instructions on the form of proxy, and to submit their form of

proxy so as to be received as soon as possible and by no later than

11:00 a.m. on 9 May 2023. This will ensure that your vote will be

counted even if you are unable to attend in person.

4. Resolutions

A summary of the resolutions to be proposed at the Annual

General Meeting is set out below. Please note that this is not the

full text of the Resolutions and you should read this section in

conjunction with the Resolutions contained in the formal notice at

the end of this document (together with the explanatory notes set

out at the end of such notice).

The following resolutions will be proposed at the Annual General

Meeting:-

Resolution 1 , which will be proposed as an ordinary resolution,

relates to the adoption of the Company's annual accounts for the

financial year ended 31 December 2022

Resolution 2 , which will be proposed as an ordinary resolution,

seeks Shareholder approval to appoint Gravita Audit Limited as the

Company's auditor and to authorise the directors to determine their

remuneration. Jeffreys Henry LLP, the Company's current auditor,

has indicated that it will not seek re-appointment as the Company's

auditor at the Annual General Meeting as, following a business

reorganisation, the firm will provide audit services to clients

from another company in its group, Gravita Audit Limited.

Resolution 3, which will be proposed as an ordinary resolution,

seeks the re-appointment of Penny McCormick as a director of the

Company.

Resolution 4, which will be proposed as an ordinary resolution,

seeks the re-appointment of Neil Mesher as a director of the

Company.

Resolution 5, which will be proposed as an ordinary resolution,

seeks the re-appointment of Lyn Rees as a director of the

Company.

Resolution 6 , which will be proposed as an ordinary resolution,

seeks Shareholder authority to approve the Share Consolidation.

Resolution 7, which will be proposed as a special resolution,

seeks to alter the Articles to reflect the change to the nominal

value of the Ordinary Shares following the passing of Resolution

6.

Resolution 8 , which will be proposed as an ordinary resolution,

seeks Shareholder authority to issue shares.

Resolution 9 , which will be proposed as a special resolution,

seeks Shareholder authority to dis-apply shareholder pre-emption

rights on any issue of shares under the authority granted in

resolution 8.

Resolution 10 , which will be proposed as a special resolution,

seeks authority for the Company to make market purchases of its own

Ordinary Shares.

As special resolutions, each of Resolutions 7, 9 and 10 requires

votes in favour representing 75 per cent. or more of the votes cast

(in person or by proxy) at the Annual General Meeting in order to

be passed.

5. Action to be taken by Shareholders

A form of proxy for use at the Annual General Meeting is

enclosed. Whether or not you intend to be present at the Annual

General Meeting, you are requested to complete, sign and return the

form of proxy in accordance with the instructions thereon to the

Company's Registrars at Neville House, Steelpark Road, Halesowen,

West Midlands B62 8HD, so as to arrive no later than 11.00 a.m. on

9 May 2023. The return of the form of proxy will not prevent you

from attending the Annual General Meeting and voting in person

should you wish to do so.

If you hold your shares in uncertificated form in CREST you may

appoint a proxy or proxies by utilising the CREST electronic proxy

appointment service in accordance with the procedures described in

the CREST Manual as set out in the Notice of Annual General Meeting

at the end of this document. Proxies submitted via CREST must be

received by Neville Registrars Limited (ID 7RA11) no later than

11.00 a.m. on 9 May 2023. The appointment of a proxy using the

CREST electronic proxy appointment service will not preclude a

Shareholder from attending and voting in person at the Annual

General Meeting should they wish to do so.

6. Board Recommendations

The Directors consider that all the proposals to be considered

at the Annual General Meeting are in the best interests of the

Company and its shareholders as a whole and are most likely to

promote the success of the Company. Accordingly, the Directors

unanimously recommend that you vote in favour of the Resolutions to

be proposed at the Annual General Meeting as they intend to do in

respect of their own beneficial holdings currently amounting to

approximately 1.9 per cent. of the issued share capital of the

Company. "

For further information contact:

MyHealthChecked PLC www.myhealthchecked.com

Penny McCormick, Chief Executive via Walbrook PR

Officer

SPARK Advisory Partners Limited Tel: +44 (0)20 3368 3550

(NOMAD)

Neil Baldwin

Dowgate Capital Limited (Broker) Tel: +44 (0)20 3903 7715

David Poutney / Nicholas Chambers

Walbrook PR Ltd (Media Tel: +44 (0)20 7933 8780 or myhealthcheckedplc@walbrookpr.com

& IR)

Paul McManus / Alice Woodings Mob: +44 (0)7980 541 893 / +44

(0)7407 804 654

About MyHealthChecked PLC ( www.myhealthcheckedplc.com )

MyHealthChecked PLC, based in Cardiff, is an AIM-quoted

pioneering UK healthcare company focused on a range of at-home

healthcare and wellness tests.

MyHealthChecked is the umbrella brand of a range of at-home

rapid tests, as well as DNA, RNA and blood sample collection kits

which have been created to support customers on their journeys to

wellness. The tests are lateral-flow self-tests, and the sample

collection kits enable the collection of blood, urine, nasal or

mouth swab samples that are analysed in partner laboratories for a

range of biomarkers. The tests will also be made available online

and will be viable for over-the -counter purchase.

The MyHealthChecked portfolio has been identified as part of a

change in mindset as customers become more familiar with the

concept of accessible healthcare in the growing at home testing kit

market with a focus on accessibility at the right price, led by

UK-based experts.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOALFLFBXZLXBBK

(END) Dow Jones Newswires

April 03, 2023 02:01 ET (06:01 GMT)

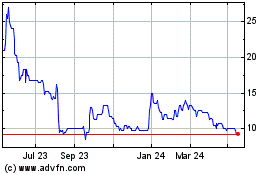

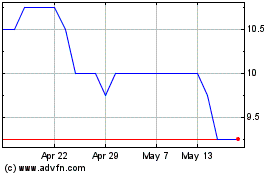

Myhealthchecked (LSE:MHC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Myhealthchecked (LSE:MHC)

Historical Stock Chart

From Dec 2023 to Dec 2024