RNS Number:7739Y

Morgan Sindall PLC

13 February 2001

MORGAN SINDALL PLC

Preliminary results for the year ended 31 December 2000

Morgan Sindall plc, the construction brands group, today announces a sixth

consecutive year of record results.

2000 1999 Increase

Turnover #655m #521m +26%

Pre-tax profits on ordinary activities #15.36m #10.08m +52%

Earnings per share 29.75p 22.17p +34%

Net assets #45.7m #37.9m +20%

Net cash funds #23.5m #22.0m +6%

Proposed final dividend 7.5p 6.0p +25%

Financial

* Strong financial performance - sixth record year despite lower property

profits

* Strong organic growth and improved profitability in all core operational

Divisions

* Strong position for 2001 with a year-end order book of #406m (1999: #

273m)

Operational

* Fit out #229m turnover; #8.7m operating profit (1999: #7.6m)

- Market continues to be healthy

- Wider spectrum of contract size delivered growth in

volume

* Construction #318m turnover; #4.5m operating profit (1999: #3.1m)

- Dramatic growth in margin and profit

- Trend towards more negotiated work

* Affordable housing #108m turnover; #2.7m operating profit in first full

year of ownership

- Affordable housing beginning to show its potential

- Margin increase to 2.5% (+55%) despite continued

investment

- Order book for 2001 of #102m - margins set for

continued growth

John Morgan, Executive Chairman said:

"Our businesses have again demonstrated their ability to consistently grow.

With healthy market conditions spanning all of our Divisions and a sound

financial position, 2001 will be a year of acceleration and pace."

13 February 2001

ENQUIRIES:

Morgan Sindall plc Today: 020 7457 2020

John Morgan, Executive Chairman Thereafter: 020 7307 9200

John Bishop, Finance Director

College Hill Tel: 020 7457 2020

Matthew Smallwood

MORGAN SINDALL PLC

Preliminary results for the year ended 31 December 2000

Chairman's Statement

It is always a pleasure to report on a successful year, 2000 being the sixth

consecutive record performance. More importantly, I believe 2001 can be even

better. The Group entered the year with an order book of #406m, an improvement

of 49% on last year. Our three core business Divisions are stronger from a

management perspective than ever before. With a restructured central

management team in support and increased potential returns from the investment

of our balance sheet we look ahead with confidence.

Financial Results

Turnover in 2000 of #655m is 26% ahead of the previous year and whilst this is

flattered by a full year's turnover from Lovell compared to six months in

1999, the second half Group turnover was still ahead of last year by 22%.

Profit before tax on ongoing businesses increased by 16% to #16.0m despite

reduced contribution from property investment, where one major property

completion originally expected for 2000 is now anticipated this year. The

bottom line result is that profits available to ordinary shareholders are up

41% to #11.2m. The Board is pleased to recommend a further increase in

dividend with a proposed final dividend of 7.5p (1999: 6.0p) to make a total

of l0.5p for the year (1999: 8.5p).

Board Changes

Against a backdrop of good news I am sorry to inform you that Andy Stoddart

our Managing Director will today be resigning due to ill health. His

contribution to the Group over the last six years has been immense and all of

us wish him success in overcoming his health problems and a long and happy

retirement. It is typical of the man that he leaves us with a newly reshaped

and improved structure. Whereas previously all Brands reported to the centre,

this year has seen the creation of three Divisional boards moving more of the

decision-making closer to the operational front. The Divisions are supported

at the centre by Paul Whitmore, who joined us in April 2000 as Commercial

Director, and Jack Lovell and John Bishop who have been with the Group since

its creation in 1994. The three Divisional Managing Directors will now report

to me as Executive Chairman and as such the Board believes the structure needs

no further expansion at this time.

Trading Overview

The Fit Out Division traded well throughout 2000. Changes in procurement

patterns such as partnering, framework agreements and ongoing maintenance

support have demanded greater flexibility and closer co-operation between our

Fit Out Brands. The new divisional structure will assist in ensuring that we

offer the best service to our clients irrespective of historic Brand

boundaries. In addition, I believe that a divisional structure will accelerate

the opportunities of expansion of this business into related areas.

MORGAN SINDALL PLC

Preliminary results for the year ended 31 December 2000

Chairman's statement (cont'd)

The Construction Division is headed by Chris Saxton who, as Managing Director

of Snape, was responsible for transforming that company from losses to a

successful regional Brand with margins of over 3%. All seven Brands are

profitable and have reached varying degrees of success in establishing

themselves as regional forces. The formation of the Division will not only

improve the Brands' individual performances, but enable them to respond better

to national clients and initiatives.

The Affordable Housing Division has undergone intense scrutiny and significant

strengthening since its acquisition in June 1999. I have always been confident

that Lovell's Brand strength and the Morgan Sindall resource and motivation

would be a winning combination. The results for 2000 are a welcome improvement

ahead of expectation. The fact that the improvement has been achieved whilst

investing in new staff and increasing Lovell's forward opportunity levels

augurs well for the future.

Fit Out

It was a lively year for Fit Out. The market sector has been healthy and the

Division was able to generate increased levels of repeat orders from a

customer base that has been carefully nurtured.

The growth of the Fit Out Division continued with a turnover of #229m and

operating profits of #8.7m, a 15.2% profit increase from last year. A

significant proportion of growth came from the major projects team which has

successfully become a leading contender for large projects in London and the

Home Counties. Our newest team, Overbury Special Projects, established to

manage small works, had a good first year and proved an effective way of

consolidating established customer relationships. The Fit Out Division is now

able to offer customers a service from the smallest to largest project that we

believe will enable us to further lock out competitors.

Both Morgan Lovell and Overbury have continued their successful growth in the

southern Home Counties and particularly the Thames Valley, working with a

broad mix of old and new economy customers. Growth outside of London will

continue with Morgan Lovell seeking to establish themselves in the northern

Home Counties with a new Milton Keynes office.

Current order levels show a strong start for the year ahead. The establishment

of a divisional structure gives the Overbury and Morgan Lovell Brands a unique

opportunity to learn from each other's strengths and consequently offer

customers a strong and effective service, regardless of procurement route. It

also gives us a wider base from which to investigate opportunities to expand

the Fit Out Division into new related areas.

MORGAN SINDALL PLC

Preliminary results for the year ended 31 December 2000

Chairman's statement (cont'd)

Construction

In 2000, the Construction Division delivered a record annual turnover of #318m

and a record operating profit of #4.5m up 47% on last year's profit. The

second half result demonstrated a continuing improvement in our business. All

our Construction Brands are profitable, have strong order books for 2001 and

are in a good position to show further growth in the coming year.

Since 1994 seven Brands have been acquired providing a network which now

covers England and Wales. Dramatic organic growth in turnover has been

achieved and the opportunity for future expansion remains as exciting. The

present emphasis however is to lift margins by improving Brand performance and

building lasting relationships with our clients and our supply chain. We will

achieve this by promoting the individual abilities of the profit centre units,

all of which are continually developing a track record in specific areas of

construction.

Collectively, we are also able to pool the resources of our network to respond

to national clients and national initiatives. Our divisional management

structure will facilitate our ability to respond to such market opportunities.

Strong profit centre teams who deliver on promises to clients are the key to

achieving net margins over industry norms. The Morgan Sindall culture of

decentralised management will continue to encourage the enthusiasm and

motivation of our people upon whom our future success depends.

Affordable Housing

Lovell produced very pleasing results in 2000 with turnover of #108m and

operating profit of #2.7m, an increase in margin of 55% to 2.5%. This was

despite considerable continued investment in people, premises and new systems.

The value of new contracts secured in the year was #l56m with an even mix

between partnership housing and open market in line with the business plan.

The Government continues its commitment to increase the provision of social

and affordable housing from which Lovell is ideally positioned to benefit,

particularly in mixed tenure urban regeneration schemes. One such project

secured this year is the #l6m regeneration of the Trowbridge Estate in Hackney

which involves the building over three years of 220 mixed tenure homes. Price

was only one of many factors considered in the award of this project. Other

opportunities for Lovell include Private Finance Initiative housing schemes.

In 2000 eight Pathfinder schemes were announced with a further thirty schemes

expected to be released in 2001.

MORGAN SINDALL PLC

Preliminary results for the year ended 31 December 2000

Chairman's statement (cont'd)

Whilst lead in times are lengthy on these types of project, Lovell entered

2001 with a healthy forward order book significantly ahead of this time last

year. A considerable proportion of this new work was secured under the

principles of Best Value. In addition Lovell is in discussions on a range of

exciting projects where they have been appointed preferred developer and from

which they will secure work for 2002 and beyond.

Investments

In 2000 the return from our property profits and interest was #2.2m (1999 #

3.7m) which was lower than expected due to a delay in the letting of our

office development in Wigmore Street, London. Our refurbishment of offices in

Shepherds Bush which we purchased in 2000 will also be completed shortly and

is already attracting interest from potential tenants.

Whilst we will continue to look for further property opportunities, we have

established a company for investing in PFI projects. This will assist the core

Divisions in pursuing PFI opportunities, and will also become an important

investment vehicle gradually acquiring a quality stream of income through its

holdings in individual project companies.

Primary Medical Property, our joint venture business, which develops and

retains primary care buildings, continues to expand its portfolio and now has

#41m of projects either completed or under construction. This investment has

excellent capital growth potential, provides construction work opportunities

for Group companies and is proving invaluable as a partner when we are dealing

with national Government procurement of medical facilities.

It remains the Group's policy to keep strengthening the balance sheet, as

buyers of construction services increasingly favour companies whose turnover

is sufficiently supported by assets. Our policy has been to invest our

reserves in a mixture of cash and property and to be proactive but

conservative.

Future Prospects

I feel optimistic for the coming year with the three Divisions all in good

shape. Returns from property should be ahead as the delayed 2000 project

completes and this will give us extra income to offset the early costs of

investing in PFI projects, which in the longer term will give us a more steady

income flow. I see that there is both the potential and the determination to

achieve substantial organic growth. This will not preclude us from looking at

further strategic developments but should ensure that we only make moves that

are truly capable of taking the Group up to the next level.

John Morgan

Executive Chairman

MORGAN SINDALL PLC

Preliminary results for the year ended 31 December 2000

Group Profit and Loss Account

for the year ended 31 December 2000 (unaudited)

2000 1999

# #'000s # #'000s

'000s '000s

Turnover

Continuing operations 655,980 519,385

Discontinued operations - 1,900

Less share of joint venture (1,144) (658)

turnover

Group turnover 654,836 520,627

Cost of sales (588,180) (465,584)

Gross profit 66,656 55,043

Administrative expenses (52,804) (44,299)

Other operating income 897 983

Operating profit

Continuing operations 14,749 12,377

Discontinued operations - (650)

Total operating profit 14,749 11,727

Exceptional loss on closure of (684) (3,129)

discontinued business

Share of profits of joint venture - 51

Net interest receivable 1,295 1,426

Profit on ordinary activities 15,360 10,075

before taxation

Tax charge on profit on ordinary (3,964) (1,910)

activities

Profit on ordinary activities after 11,396 8,165

taxation

Dividends on equity and non-equity (4,163) (3,439)

shares

Retained profit for the year 7,233 4,726

Earnings per ordinary share 29.75p 22.17p

Diluted earnings per ordinary share 28.58p 21.34p

MORGAN SINDALL PLC

Preliminary results for the year ended 31 December 2000

Group Balance Sheet

at 31 December 2000 (unaudited)

2000 1999

#'000s #'000s #'000s #'000s

Fixed Assets

Intangible assets 11,218 11,768

Tangible assets 11,865 12,637

Share of joint venture gross 17,929 13,697

assets

Share of joint venture gross (16,840) (12,904)

liabilities

Investment in joint venture 1,089 793

Investment in own shares 1,245 1,170

25,417 26,368

Current Assets

Stocks 35,355 24,812

Debtors 117,964 88,820

Cash at bank and in hand 23,474 22,042

176,793 135,674

Creditors: amounts falling due (156,510) (124,113)

within one year

Net current assets 20,283 11,561

Net assets 45,700 37,929

Capital and reserves

Called up share capital 5,686 6,714

Share premium account 13,064 11,794

Revaluation reserve 4,259 3,963

Profit and loss account 22,691 15,458

Total shareholders' funds 45,700 37,929

Shareholders' funds are

attributable to:

Equity shareholders' funds 41,907 33,076

Non-equity shareholders' funds 3,793 4,853

45,700 37,929

MORGAN SINDALL PLC

Preliminary results for the year ended 31 December 2000

Group Cash Flow Statement

for the year ended 31 December 2000 (unaudited)

2000 1999

#'000s #'000s

Net cash inflow from operating activities 8,211 12,648

Returns on investments and servicing of finance

Interest received 1,411 1,494

Interest paid (615) (395)

Dividends paid to preference shareholders (253) (275)

543 824

Taxation

Corporation tax paid (2,563) (2,191)

Capital expenditure and financial investment

Payments to acquire tangible fixed assets (2,288) (3,286)

Receipts from sale of tangible fixed assets 8 778

Payments to acquire fixed asset investments (155) (480)

(2,435) (2,988)

Acquisitions and disposals

Repayment of purchase consideration 750 -

Purchase of subsidiary undertakings - (20,689)

Net cash acquired with subsidiary undertakings - 9

750 (20,680)

Equity dividends paid (3,316) (2,427)

Net cash inflow/(outflow) before financing 1,190 (14,814)

Financing

Issue of shares, net of expenses 242 8,470

Net cash inflow from financing activities 242 8,470

Increase/(decrease) in cash 1,432 (6,344)

MORGAN SINDALL PLC

Preliminary results for the year ended 31 December 2000

Statement of Total Recognised Gains and Losses

for the year ended 31 December 2000 (unaudited)

2000 1999

#'000s #'000s

Profit for the financial year before dividends 11,396 8,165

Share of joint venture's surplus on revaluation of investment 296 558

property

Surplus on revaluation of investment property - 925

Total recognised gains and losses 11,692 9,648

Note of Historical Cost Profits and Losses

for the year ended 31 December 2000 (unaudited)

2000 1999

#'000s #'000s

Profit on ordinary activities before taxation 15,360 10,075

Realisation of property valuation gains of prior years - 140

Difference between the historical cost depreciation charge and

the actual

depreciation charge for the year calculated on the revalued 73 6

amount

Historical cost profit on ordinary activities before taxation 15,433 10,221

Historical cost profit on ordinary activities

after taxation and dividends 7,306 4,872

MORGAN SINDALL PLC

Preliminary results for the year ended 31 December 2000

Combined Statement of Movements in Reserves and Shareholders' Funds

for the year ended 31 December 2000 (unaudited)

2000 1999

Share Revalua- Profit Share- Share-

premium tion and loss Total Share holders' holders'

account reserve account reserves capital funds funds

Group #'000s #'000s #'000s #'000s #'000s #'000s #'000s

Balance at 11,794 3,963 15,458 31,215 6,714 37,929 23,182

1 January

Retained - - 7,233 7,233 - 7,233 4,726

profit for

year

New shares - - - - - - 8,151

issued

Converted 1,038 - - 1,038 (1,038) - -

preference

shares

Options 232 - - 232 10 242 319

exercised

Goodwill - - - - - - 68

realised

on

discontinued

operation

Surplus on - 296 - 296 - 296 1,483

revaluation

Balance at 13,064 4,259 22,691 40,014 5,686 45,700 37,929

31 December

Included within the profit and loss account balance at 31 December 2000 is an

amount for unrealised goodwill totalling #7,034,000 (1999: #7,034,000).

MORGAN SINDALL PLC

Preliminary results for the year ended 31 December 2000

Notes (Unaudited)

1. Analysis of turnover, operating profit and net assets

2000 1999

Profits/ Net Profits/ Net

Turnover (losses) assets Turnover (losses) assets

#'000s #'000s #'000s #'000s #'000s #'000s

Construction 317,605 4,542 (2,366) 274,516 3,097 (684)

Fit out 229,350 8,716 (13,817) 174,146 7,564 (4,427)

Affordable housing 107,709 2,715 16,879 65,065 1,057 8,546

Investments 172 892 22,487 5,000 2,235 14,866

Group activities - (2,116) (957) - (1,576)(4,190)

Continuing operation 654,836 14,749 22,226 518,727 12,377 14,111

Discontinued - - - 1,900 (650) 1,776

operations

654,836 14,749 22,226 520,627 11,727 15,887

Net cash balances 23,474 22,042

Net assets 45,700 37,929

Segmental net assets are stated after deducting interest bearing net cash

balances. All activities are carried out in the United Kingdom and Channel

Islands.

2. Tax charge on profit on ordinary activities

2000 1999

#'000s #'000s

Corporation tax payable at 30% (1999: 30.25%) 4,073 3,000

Under/(over) provision in prior years 96 (143)

Share of tax of joint venture - -

Tax on exceptional loss (205) (947)

3,964 1,910

The tax charge for the year is lower than the standard rate due to the

availability of tax losses brought forward.

3. Dividends on equity and non-equity shares

2000 1999

#'000s #'000s

Non-equity dividends on preference shares

Paid 197 219

Accrued 46 56

243 275

Equity dividends on ordinary shares

Interim paid 3.00p (1999: 2.50p) 1,113 929

Final proposed 7.50p (1999: 6.00p) 2,839 2,235

3,972 3,164

Total dividends 4,215 3,439

Dividends on shares held in trust relating to the Long Term (52) -

Incentive Plan

4,163 3,439

The proposed final dividend will be paid on 12 April 2001 to shareholders on

the register at 9 March 2001. The ex-dividend date is 7 March 2001.

4. Earnings per ordinary share

The calculation of the earnings per share is based on the weighted average

number of 37,494,000 (1999: 35,591,000) ordinary shares in issue during the

year and on the profits for the year attributable to ordinary shareholders of

#11,153,000 (1999: #7,890,000).

In calculating the diluted earnings per share, earnings are adjusted for the

preference dividend of #243,000 (1999: #275,000) making adjusted earnings of #

11,396,000 (1999: #8,165,000). The weighted average number of ordinary shares

are adjusted for the dilutive effect of the convertible preference shares by

1,517,000 (1999: 1,941,000) and share options by 554,000 (1999: 722,000) and

contingent Long Term Incentive Plan shares by 290,000 (1999: nil) giving an

adjusted number of ordinary shares of 39,855,000 (1999: 38,254,000).

5. Reconciliation of operating profit to net cash inflow from operating

activities

2000 1999

#'000s #'000s

Operating profit 14,749 11,727

Depreciation of tangible fixed assets 2,082 1,660

Amortisation of goodwill 650 379

(Profit)/loss on sale of fixed assets (360) 28

Increase in stocks and work in progress (10,044) (242)

Increase in debtors (28,564) (8,177)

Increase in creditors 30,382 10,334

Exceptional loss (684) (3,061)

Net cash inflow from operating activities 8,211 12,648

6. Reconciliation and analysis of net cash flow to movement in net cash

1999 Cash flow 2000

#'000s #'000s #'000s

Cash at bank and in hand 22,042 1,432 23,474

7. Accounting Policies

This announcement is prepared on the basis of accounting policies as stated in

the financial statements for the year ended 31 December 1999.

The financial information set out above does not constitute the Company's

statutory accounts for the years ended 31 December 2000 and 1999. No accounts

for the Company or its subsidiaries in respect of the year ended 31 December

2000 have been delivered to the Registrar of Companies, nor have the auditors

of the Company or its subsidiaries made a report under Section 236 of the

Companies Act 1985 in respect of any accounts for that financial year.

The statutory accounts for the year ended 31 December 2000 will be finalised

on the basis of the financial information presented by the directors in this

preliminary announcement and will be posted to shareholders by 2 March 2001

and delivered to the Registrar of Companies following the Company's Annual

General Meeting.

Full accounts for the Group for the year ended 31 December 1999 have been

delivered to the Registrar of Companies and contain an unqualified audit

report, and did not contain a statement under Section 237 (2) or (3) of the

Companies Act 1985.

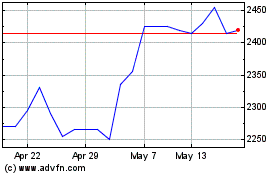

Morgan Sindall (LSE:MGNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

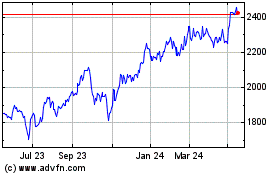

Morgan Sindall (LSE:MGNS)

Historical Stock Chart

From Jul 2023 to Jul 2024