RNS Number:4413I

Morgan Sindall PLC

14 August 2001

MORGAN SINDALL PLC

("Morgan Sindall" or "the Group")

Interim Results for the six months to 30 June 2001

Morgan Sindall Plc, the construction brands group, today announces interim

results for the six months to 30 June 2001.

6 months to 6 months to Percentage Year to

30 June 2001 30 June 2000 Increase % 31 December 2000

Turnover (#m) 407.3 288.8 + 41 654.8

Profit before tax (#m) 10.1 5.8 + 75 15.4

Earnings per share (p) 19.45 11.08 + 76 29.75

Interim dividend (p) 4.00 3.00 + 33 10.50

- Record results driven by improved performances from all Divisions

- Acquisitions of Miller Civil Engineering Services ("MCES") and

Carillion Housing demonstrate strategic development of Group

- Lovell now the market leader and largest specialist provider of

affordable housing

- Infrastructure Services market has exciting potential - MCES will be a

leading player

- Fit Out and Construction Divisions ahead of previous year

- Balance sheet remains strong showing net cash of #15 million

John Morgan, Executive Chairman of Morgan Sindall plc, said:

"This year has seen significant growth both organically and through

acquisition. Our core Divisions continued to perform well, yet again achieving

record performances. We are particularly delighted with the acquisitions of

MCES and Carillion Housing and believe that both businesses will drive growth

into new areas and bring substantial rewards."

14 August 2001

Enquiries:

Morgan Sindall Tel: 020 7307 9200

John Morgan, Executive Chairman

John Bishop, Finance Director

College Hill Tel: 020 7457 2020

Kate Pope/Matthew Smallwood

Chairman's Statement

We have seen a successful start to the year with record profits and two

acquisitions being the key highlights. Profits before tax increased to #10.1

million (2000: #5.8 million) on turnover of #407 million (2000: #289 million),

predominately driven by improved performances from our existing businesses.

The acquisition of Miller Civil Engineering Services Ltd ("MCES"), completed

on 10 May, made a small contribution but more importantly gives the Group a

strong entry to the Infrastructure Services market.

The acquisition of Carillion Housing, was completed on 31 July and will expand

our range of expertise in Affordable Housing. The consideration was #6.25

million satisfied from cash resources. This will prove to be a major

strategic development for the Division.

Our balance sheet remains strong and shows net cash of #15 million. The #20

million cost of purchasing MCES was in part funded by an issue of ordinary

shares which raised #8.4m. This placement helped restore tangible net worth

which was reduced by the goodwill content of the acquisition.

Earnings per share are 19.45p (2000: 11.08p) and the Board has agreed to

declare an interim dividend of 4.00p (2000: 3.00p).

Operating Performance

Affordable Housing

Lovell has made an excellent start to the year with turnover of #66 million

(2000: #50 million) and operating profit of #1.90 million (2000: #1.1

million). The acquisition of Carillion Housing will add approximately #80

million per annum of turnover and makes Lovell the largest specialist provider

of affordable housing. It also gives a unique skill set capable of meeting

all the demands of the social housing market embracing PFI, design and build,

refurbishment and open market development. This increased breadth of expertise

will be particularly advantageous with large stock transfer schemes and those

financed by PFI.

Construction

Turnover increased 35% to #193million (2000: #143 million) and profits were

also ahead by 39% to #2.37 million (2000: #1.70 million). Whilst I am pleased

to see the strong growth in volume, we continue to seek further improvement in

margin and accept that changes may well be needed to achieve the goal of a

consistent minimum margin of 3% in all brands.

Fit Out

Operating profits for the six months to June were #5.66 million (2000: #4.24

million) on turnover of #113 million (2000: #97 million). This record

performance has been achieved by working closely with a client base that has

been built up over the last twenty years and ensuring that we set ourselves

ever-higher standards of delivery. Opportunities to expand both geographically

and into other niche fit out markets will ensure this Division keeps moving

steadily forward.

Infrastructure Services

MCES is a highly experienced infrastructure services provider operating in

three distinct sectors: water, tunnelling and civils. In the two months

following acquisition MCES contributed a modest #0.56 million of operating

profit from #24 million turnover, which met our expectation that the company

would be earnings enhancing from acquisition. We believe that the

infrastructure services market is strong and growing and will be dominated by

a smaller number of bigger well-funded operators. The MCES staff are confident

that, with their track record and the support of Morgan Sindall, they will be

one of the leading providers to this sector.

Investments

The improvement in property profits and interest of #2.13 million (2000: #0.78

million) reflects the successful sale of our refurbished property in Shepherds

Bush. Our redeveloped building in Wigmore Street, where the office element

became income producing in February, is now fully let. Our joint venture,

Primary Medical Properties, has completed its six year development programme.

It will now focus on managing its investment portfolio which will yield an

increasing profit stream over the coming years. Together with returns from

future PFI investments we will have a more predictable income stream from our

balance sheet investment.

The Board

As previously announced, Jack Lovell, a founding director of Morgan Sindall,

relinquished his executive responsibilities from the end of July. The Group

will retain his input and counsel as he remains a Non-Executive Director and

substantial shareholder. I would particularly like to record my thanks to

Jack with whom I have worked for twenty-four years and wish him well as he

pursues new interests.

Outlook

With record results and two acquisitions broadening our offering, Morgan

Sindall is in good shape. Whilst we cannot be immune to the economy we operate

within, our order book is strong, future potential work shows no sign of

abating and we have strength in those areas where government expenditure is

growing rapidly.

John Morgan

Executive Chairman

14 August 2001

Group Profit and Loss Account (Unaudited)

Unaudited Unaudited Audited

Six Six Year to

months to months to December

June 2001 June 2000 2000

#'000s #'000s #'000s

Turnover

Continuing operations 384,287 289,003 655,980

Acquisitions 23,641 - -

Less share of joint venture turnover (672) (249) (1,144)

407,256 288,754 654,836

Cost of sales (365,842) (257,799) (588,180)

Gross profit 41,414 30,955 66,656

Administrative expenses (32,263) (25,433) (52,804)

Other operating income 587 394 897

Operating profit

Continuing operations 9,179 5,916 14,749

Acquisitions 559 - -

Total operating profit 9,738 5,916 14,749

Share of losses of joint venture (255) - -

Net interest receivable 612 553 1,295

Exceptional loss on closure of

discontinued operation - (684) (684)

Profit on ordinary activities

before taxation 10,095 5,785 15,360

Tax charge on ordinary activities (2,625) (1,590) (3,964)

Profit on ordinary activities after

taxation 7,470 4,195 11,396

Dividends on equity and

non-equity shares (1,644) (1,238) (4,163)

Retained profit for the period 5,826 2,957 7,233

Earnings per ordinary share 19.45p 11.08p 29.75p

Diluted earnings per ordinary share 18.47p 10.67p 28.58p

Group Balance Sheet (Unaudited)

Unaudited Unaudited Audited

June 2001 June 2000 December 2000

#'000s #'000s #'000s

Fixed assets

Intangible assets 29,615 11,426 11,218

Tangible assets 19,850 12,981 11,865

Share of joint venture gross assets 19,209 15,291 17,929

Share of joint venture gross (18,375) (14,498) (16,840)

liabilities

Investment in joint venture 834 793 1,089

Investments 1,293 1,213 1,245

51,592 26,413 25,417

Current assets

Stocks 39,970 33,813 35,355

Debtors 147,747 104,384 117,964

Cash at bank and in hand 15,441 14,057 23,474

203,158 152,254 176,793

Creditors: amounts falling

due within one year (193,722) (137,765) (156,510)

Net current assets 9,436 14,489 20,283

Total assets less current liabilities 61,028 40,902 45,700

Creditors: amounts falling due after

more than one year (729) - -

Net assets 60,299 40,902 45,700

Capital and reserves

Called up share capital 5,794 6,714 5,686

Share premium account 21,729 11,810 13,064

Revaluation reserve 4,259 3,963 4,259

Profit and loss account 28,517 18,415 22,691

Total shareholders' funds 60,299 40,902 45,700

Shareholders' funds are attributable

to:

Equity shareholders' funds 56,506 36,049 41,907

Non-equity shareholders' funds 3,793 4,853 3,793

60,299 40,902 45,700

Group Cash Flow Statement (Unaudited)

Unaudited Unaudited Audited

June 2001 June 2000 December 2000

#'000s #'000s #'000s

Net cash inflow/(outflow) from

operating activities 4,412 (4,475) 8,211

Returns on investments and

servicing of finance

Interest received 812 677 1,411

Interest paid (549) (281) (615)

Dividends paid to preference (107) (136) (253)

shareholders

Interest paid on finance lease (6) - -

charges

150 260 543

Taxation

Corporation tax paid (1,820) (214) (2,563)

Capital expenditure and financial

investment

Receipts from sale of tangible 163 104 8

fixed assets

Payments to acquire tangible fixed (1,223) (1,434) (2,288)

assets

Payments to acquire fixed asset (194) (43) (155)

investments

(1,254) (1,373) (2,435)

Acquisitions and disposals

Purchase of subsidiary undertakings (20,162) - 750

Net cash acquired 4,720 - -

(15,442) - 750

Equity dividends paid (2,852) (2,199) (3,316)

Net cash (outflow)/inflow before (16,806) (8,001) 1,190

financing

Financing

Issue of share capital, net of 8,773 16 242

expenses

Net cash inflow from financing 8,773 16 242

activities

(Decrease)/increase in cash (8,033) (7,985) 1,432

Statement of Movements in Shareholders' Funds (Unaudited)

Unaudited Unaudited Audited

June 2001 June 2000 December 2000

#'000s #'000s #'000s

Opening shareholders' funds 45,700 37,929 37,929

Retained profit for the period 5,826 2,957 7,233

Options exercised 408 16 242

New shares issued net of 8,365 - -

expenses

Surplus on revaluation - - 296

Closing shareholders' funds 60,299 40,902 45,700

Notes to the Interim Report

1. Analysis of turnover and operating profit

Unaudited six months to Unaudited six months to

June 2001 June 2000

#'000s #'000s #'000s #'000s

Turnover Profit/ Turnover Profit/

(losses) (losses)

Construction 193,107 2,371 142,585 1,699

Fit out 113,334 5,662 96,578 4,235

Affordable housing 66,167 1,899 49,591 1,103

Infrastructure 23,641 559 - -

Services

Investments 11,007 1,513 - 223

Group activities - (2,266) - (1,344)

407,256 9,738 288,754 5,916

2. Acquisition of Miller Civil Engineering Services Limited

On 10 May 2001 the Company acquired Miller Civil Engineering Services Limited.

Consideration of #20 million was paid in cash on completion and there were

costs of approximately #0.2 million which have been capitalised. Tangible net

assets acquired were nil and in addition provisional fair value adjustments

have been made recognising assets totalling #1.3 million. The resultant

goodwill capitalised of #18.9 million is provisional and will be subject to

any subsequent adjustments to fair value of the net assets acquired.

3. Earnings per share

The calculation of the earnings per ordinary share is based on the weighted

average number of 37,850,000 ordinary shares in issue during the period and on

the profit for the period attributable to ordinary shareholders of #7,363,000.

In calculating the diluted earnings per share, earnings are adjusted for the

preference dividend of #107,000 giving adjusted earnings of #7,470,000. The

weighted average number of ordinary shares are adjusted for the dilutive

effect of the convertible preference shares by 1,517,000, share options by

691,000 and contingent awards under the Long Term Incentive Plan of 383,000

giving an adjusted number of ordinary shares of 40,441,000.

4. Taxation

Taxation on current period profits is charged at 26% being the estimated

effective rate of taxation for the year.

5. Reconciliation of operating profit to net cash inflow/(outflow)

from operating activities

Unaudited Unaudited Audited

Six Six Year to

months to months to December

June 2001 June 2000 2000

#'000s #'000s #'000s

Operating profit 9,738 5,916 14,749

Depreciation of tangible fixed 1,334 1,006 2,082

assets

Amortisation of goodwill 472 342 650

Loss/(profit) on sale of fixed 5 (21) (360)

assets

Increase in stocks and work in (3,876) (8,844) (10,044)

progress

Increase in debtors (543) (15,564) (28,564)

(Decrease)/Increase in creditors (2,718) 13,374 30,382

Exceptional loss - (684) (684)

Net cash inflow/(outflow) from 4,412 (4,475) 8,211

operating activities

6. Reconciliation of net cash flow to movement in net cash

2001 2000

Net cash Net cash

#'000s #'000s

At 1 January 2001 23,474 22,042

Cash (outflow)/inflow (8,033) 1,432

Cash at bank at 30 June 2001 15,441 23,474

7. Interim dividend

The interim dividend of 4.00p per share (2000: 3.00p) will be paid on 17

September 2001 to shareholders on the register at 24 August 2001. The

ex-dividend date will be 22 August 2001.

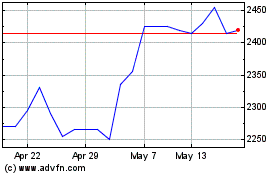

Morgan Sindall (LSE:MGNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

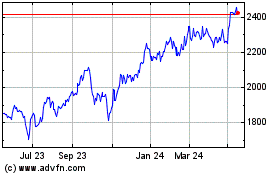

Morgan Sindall (LSE:MGNS)

Historical Stock Chart

From Jul 2023 to Jul 2024