TIDMMCM

RNS Number : 0418T

MC Mining Limited

15 March 2023

ABN 98 008 905 388

FINANCIAL REPORT

FOR THE HALF-YEARED

31 DECEMBER 2022

CORPORATE DIRECTORY

REGISTERED OFFICE Suite 8, 7 The Esplanade

Mt Pleasant, Perth, WA 6153

Telephone: +61 8 9316 9100

Facsimile: +61 8 9316 5475

Email: perth@mcmining.co.za

SOUTH AFRICAN OFFICE Ground Floor

Greystone Building

Fourways Golf Park, Roos Street

Fourways

2191

Telephone: +27 10 003 8000

Facsimile: +27 11 388 8333

BOARD OF DIRECTORS Non-executive

Nhlanhla Musa Nene

Andrew David Mifflin

Brian He Zhen

Khomotso Brian Mosehla

An Chee Sin

Ontiretse Mathews Senosi

Yi He

Julian Hoskin

Executive

Godfrey Gomwe

COMPANY SECRETARY Tony Bevan

AUSTRALIA UNITED KINGDOM SOUTH AFRICA

AUDITORS Mazars Assurance Pty N/A Mazars

Ltd 101 on Olympus

Level 11, 307 Queen Pentagon Park

Street, Brisbane QLD Bloemfontein

4000 South Africa

Australia

BANKERS National Australia ABSA Bank

Bank Limited North Campus

Level 1, 1238 Hay Street 15 Alice Lane

West Perth WA 6005 Sandton

Australia South Africa

CORPORATE DIRECTORY (CONTINUED)

AUSTRALIA UNITED KINGDOM SOUTH AFRICA

BROKERS N/A Tennyson Securities N/A

65 Petty France

London SW1H 9EU

United Kingdom

LAWYERS K&L GATES N/A FALCON & HUME

Level 31 2nd Floor, 8 Melville

1 O'Connell Street Road Illovo

Sydney, NSW 2000 Johannesburg, 2196

Australia South Africa

NOMINATED N/A Strand Hanson Investec Bank

ADVISER/ CORPORATE 26 Mount Row Limited

SPONSOR London W1K 3SQ 100 Grayston Drive

United Kingdom Sandton

2196

Johannesburg

South Africa

Index

The reports and statements set out below comprise the half-year

report presented to shareholders:

Contents Page

Directors' Report 4

Condensed Consolidated Statement of Profit or Loss

and Other Comprehensive Income 10

Condensed Consolidated Statement of Financial Position 11

Condensed Consolidated Statement of Changes in Equity 12

Condensed Consolidated Statement of Cash Flows 13

Notes to the Condensed Consolidated Half-year Report 14

Directors' Declaration 27

Auditor's Independence Declaration 28

Independent Auditor's Review Report 29

The directors of MC Mining Limited (MC Mining or the Company)

submit herewith the financial report of MC Mining and its

subsidiaries (the Group) for the half-year ended 31 December 2022.

A ll amounts are expressed in US dollars ($) unless stated

otherwise.

In order to comply with the provision of the Corporations Act

2001, the directors report as follows:

Directors

The names of the directors of the Company during or since the

end of the half-year are:

Nhlanhla Nene (Chairman) Khomotso Mosehla

Godfrey Gomwe* An Chee Sin

Andrew Mifflin Mathews Senosi

Brian He Zhen Junchao Liu**

Yi He*** Julian Hoskin***

* Executive director (Managing Director & Chief Executive Officer (CEO))

** Resigned 10 March 2023

*** appointed 10 March 2023

Review of Operations

Principal activity and nature of operations

The principal activity of the Company and its subsidiaries is

the mining, exploration and development of coking and thermal coal

properties in South Africa.

The Company's principal assets and projects include:

-- Uitkomst Colliery, an operating metallurgical and thermal coal mine (Uitkomst);

-- Makhado Project, a hard coking and thermal coal exploration

and evaluation project (the Makhado Project or Makhado);

-- Vele Aluwani Colliery, a semi-soft coking and thermal

colliery (Vele) previously on care and maintenance but outsourced

and recommissioned in December 2022; and

-- Three exploration stage coking and thermal coal projects,

namely Chapudi, Generaal, and Mopane, in the Soutpansberg Coalfield

(collectively the GSP).

The Company's focus on safety continued with three lost time

incidents (LTIs) recorded during the six months under review (H1

FY2022: three incidents).

Uitkomst Colliery - Utrecht, KwaZulu-Natal (84% owned)

The Uitkomst Colliery recorded three LTI's during the period (H1

FY2022: three LTIs).

Uitkomst comprises the existing underground coal mine with a

planned life of mine (LOM) extension directly to the north of

current operations, approximately 15 years remaining LOM. The LOM

extension requires the development of adit 2k (horizontal shaft)

and the development is subject to receipt of the regulatory

approvals, available funds and prevailing market conditions.

Uitkomst sells a 0 to 40mm (duff) product into the metallurgical

domestic market for use as pulverised coal. The colliery also sells

unsized coal into the export coal market via the Coal Sales and

Marketing Agreement (Marketing Agreement) with Overlooked

Collieries (Pty) Ltd (Overlooked). Uitkomst supplies sized coal

(peas) products to local energy generation facilities and also

sells smaller volumes of a high-ash, coarse discard coal

(middlings) product.

The initial Marketing Agreement with Overlooked was signed in

July 2022 and was due to expire on 31 December 2022. During the

period, the key terms of the Marketing Agreement were extended for

a further six months to June 2023 ensuring Uitkomst has a route to

market for the majority of its coal, at prices linked to

international coal indexes rather than at floating and fixed price

domestic prices.

Uitkomst produced 225,389 tonnes (t) (H1 FY2022: 217,228t) of

run of mine (ROM) coal during the period and the colliery had

27,058t (H1 FY2022: 10,803t; FY2022: 15,534t) at site at the end of

the period with a further 36,764t at port (H1 FY2022: nil t;

FY2022: 22,169t). Uitkomst sold 104,855t of coal during the six

months consisting of 98,924t of high-grade peas and duff, with

71,955t exported (H1 FY2022: nil t) and the balance sold

domestically. The exported volumes are 5,352t lower than previously

reported following the subsequent receipt of an updated third party

confirmation. The colliery also sold 5,931 tonnes of lower grade

middlings coal (H1 FY2022: 11,655t).

The Uitkomst Colliery generated pleasing results for the period

with revenue of $14.0 million (H1 FY2022: $13.0 million) yielding a

gross profit of $3.9 million (H1 FY2022: $2.1 million).

MC Mining increased its interest in the Uitkomst Colliery during

the period when it bought back the 14% interest belonging to a

black industrialist shareholder, for $0.5 million. The terms of the

transaction ensure that the Uitkomst equity purchased satisfies the

'once empowered, always empowered' principle in South Africa.

Makhado Coking Coal Project - Soutpansberg Coalfield, Limpopo

(67.3% owned)

No LTIs were recorded at Makhado during the period (H1 FY2022:

nil LTIs).

MC Mining's flagship Makhado Project is situated in the

Soutpansberg Coalfield and all regulatory approvals are in place

and surface rights over the mining and processing areas have been

secured. MC Mining is heavily invested in the Makhado Project as

the complex regulatory environment in South Africa demanded

significant capital and time investment to achieve its current

'shovel ready' status.

The development of the Makhado Project is expected to deliver

positive returns for shareholders and position MC Mining as South

Africa's pre-eminent hard coking coal (HCC) producer. During the

period, the Company appointed Erudite (Pty) Ltd (Erudite) to

complete the detailed planning for a full process design for the

Makhado coal processing plant (CPP). Erudite expects to complete

the planning during H1 CY2023 and this plan is also required by

potential funders to complete their assessments.

The Company also employed independent consultants to review the

Makhado mine plan and this forms part of the detailed execution

plan. MC Mining's directors approved the commencement of early

works Makhado and the Company allocated ZAR71.3 million ($4.1

million) to this and expects to have this completed at the end of

H1 CY2023. The early works commenced in February 2023 and include

amongst others, a bridge and internal roads, initial bulk

earthworks, site security and communication infrastructure.

The Makhado CPP optimisation study was completed by independent

experts during the period and the results of this study are being

used in Erudite's detailed CPP and infrastructure design work. The

planned Makhado CPP annual ROM feed capacity is expected to result

in an increase of the ROM capacity from 3.0 million tonnes per

annum (Mtpa) to 4.0 Mtpa in addition to further refinements of the

plant design.

Makhado is expected to produce HCC with an ash content of less

than 10% and would be the only significant HCC producer in South

Africa resulting in obvious advantages for South African steel

producers. Development of Makhado is also expected to have a

positive impact on employment and the general Limpopo province

economy resulting in the creation of 650 direct jobs. The funding

initiatives for Makhado continued during the period and these are

expected to be finalised in first half of CY2023 following

completion of the detailed designs for the Makhado CPP and updated

mine plan.

Vele Colliery - Tuli Coalfield, Limpopo (100% owned)

The Vele Colliery recorded no LTIs during the period (H1 FY2022:

nil LTIs) .

The Vele Colliery had been on care and maintenance since late

CY2013 and the Company assessed various strategies to utilise the

asset. These assessments confirmed the significant capital and

technical investment required to optimise production at the

colliery. Following the increase in international thermal coal

prices in CY2022, the outsourcing of operations at Vele was

identified as the optimal strategy as this would secure the

necessary investment from a third party to de-water the opencast

pit, modify and recommission the CPP and remove a significant

portion of the ongoing costs associated with the colliery.

The assessment of outsourcing opportunities resulted in the

conclusion of a five-year Contract Mining Agreement (Mining

Agreement) with Hlalethembeni Outsourcing Services (Pty) Ltd (HOS)

in December 2022. HOS is mining in terms of an agreed mine plan on

an exclusive basis until 22 December 2027 and is targeting monthly

production of 60,000t of saleable thermal coal from Vele. HOS is

responsible for all mining and processing costs while the Company

remains responsible for the colliery's regulatory compliance,

rehabilitation guarantees, relationships with authorities and

communities as well as the supply of electricity and water.

HOS recommissioned the Vele CPP in late December 2022 and first

coal sales commenced in early CY2023. Operations at the colliery

are expected to ramp-up to full production during Q2 CY2023. The

recommissioning of the Vele Colliery adds a further cash generating

unit to MC Mining's portfolio, with limited financial or human

capital contributions and is a potential funding contributor for

Makhado. The recommencement of operations at Vele created

approximately 245 permanent job positions and also alleviates any

'use it or lose it' risk associated with unutilised mining assets

in South Africa.

Greater Soutpansberg Projects - Soutpansberg Coalfield, Limpopo

(74% owned)

The GSP reported no LTIs during the period (H1 FY2022: nil LTIs)

.

The South African Department of Mineral Resources & Energy

(DMRE) has granted mining rights for the three project areas

comprising the GSP, namely, Chapudi, Mopane and Generaal.

The three GSP project areas contain over 7.0 billion gross

tonnes in situ of inferred HCC, semi-soft coking coal and thermal

coal resources. The exploration and development of the GSP is the

catalyst for MC Mining's long-term growth and positions the Company

to be a potential long-term domestic and export metallurgical coal

supplier. The Company anticipates commencing with the various

studies required for the outstanding water and environmental

regulatory approvals following the construction of the Makhado

Project.

Corporate

The Industrial Development Corporation of South Africa Limited

(IDC) is a 6.7% shareholder in MC Mining's subsidiary, Baobab

Mining & Exploration (Pty) Ltd (Baobab), the owner of the

Makhado Project. The bank continues to provide support for the

development of Makhado. MC Mining previously utilised the existing

IDC loan facility to develop the project and during the period, the

IDC extended the date for repayment of the ZAR160 million loan

($9.4 million) plus interest thereon, as well as the terminal draw

down date of the new ZAR245 million ($14.4 million) loan facility,

to 30 June 2023. Draw down of the additional ZAR245 million ($14.4

million) loan facility remains subject to the IDC confirming its

due diligence and credit approval.

In November 2022, MC Mining completed a fully underwritten 1.012

for 1 renounceable rights offer (the Rights Offer) of new ordinary

shares of no par value in the Company (each, a New Share) at an

issue price of A$0.20 per New Share for eligible shareholders in

Australia and New Zealand, and at ZAR2.36 per New Share for

eligible shareholders in South Africa. The Rights Offer raised

gross proceeds of A$40 million (equivalent to approximately ZAR472

million) from the issue of 200,026,719 New Shares.

The funds raised from the Rights Issue will be used to meet the

Company's equity contribution (required for the IDC's proposed debt

funding) in relation the continued development of Makhado including

an enhanced development strategy that optimises HCC production and

capex, general working capital and costs of the Rights Issue. The

Rights Issue also resulted in a reduction of debt owed under the

ZAR60 million Standby Facility ($3.5 million) owing to Dendocept

(Pty) Ltd (Dendocept).

The Company also repaid the ZAR20 million ($0.4 million) loan

owing to the Senosi Group Investment Holdings (Proprietary) Limited

(SGIH), during the period.

Financial review

The loss after tax attributable to the owners of the parent for

the six months under review was $1,275,553 or 0.50 cents per share

compared to a loss after tax of $773,579 or 0.54 cents per share

for the prior corresponding period.

The loss after tax for the period under review of $1,309,550

(FY2022 H1: $828,362) includes:

-- revenue of $14,049,152 (FY2022 H1: $13,030,159) and cost of

sales of $10,136,800 (FY2022 H1: $10,912,725), resulting in a gross

profit of $3,912,352 (FY2022 H1: gross profit of $2,117,435);

-- income tax expense of $1,045,821 (FY2022 H1: credit of $510,083);

-- net foreign exchange gain of $19,971 (FY2022 H1: loss of

$186,698) arising from the translation of borrowings and cash due

to movement in the ZAR:USD and ZAR:AUD exchange rates during the

period;

-- employee benefit expense of $2,078,638 (FY2022 H1:

$1,201,849) which included non-cash employee expenses of $609,388

(FY2022 H1: $389,025) and cash employee expenses of $1,469,250

(FY2022 H1: $812,824)

-- other expenses of $1,961,130 (FY2022 H1: $1,661,537); and

-- depreciation of $47,914 (FY2022 H1: $45,570) included in administrative expenses.

As at 31 December 2022, the Company had cash and cash

equivalents of $20,090,399 compared to cash and cash equivalents of

$2,993,504 at 30 June 2022.

Authorised and issued share capital

MC Mining had 397,681,589 fully paid ordinary shares in issue as

at 31 December 2022. The holders of ordinary shares are entitled to

one vote per share and are entitled to receive dividends when

declared.

Dividends

No dividends were declared by or paid by MC Mining during the

six months.

Basis of preparation and going concern

The interim financial statements for the half-year ended 31

December 2022 contains an independent auditor's review report which

includes an emphasis of matter paragraph with regards to the

existence of a material uncertainty that may cast significant doubt

about the Group's ability to continue as a going concern.

The directors have prepared a cash flow forecast for the

12-month period ending 31 March 2024, taking into account available

facilities, additional funding that is expected to be raised and

expected cash flows to be generated by the Uitkomst Colliery and

the Vele Colliery which indicates that the Group will have

sufficient cash to fund its operations for at least the

twelve-month period from the date of signing this report.

The existing ZAR160 million ($9.4 million), excluding accrued

interest, IDC facility is repayable on 30 June 2023 and the

Company's cash flow forecasts include the assumption that it can

negotiate a deferred settlement to when the Makhado Project is at

steady state production, as opposed to being payable in June 2023,

with the balance being added to the new R245 million ($14.4

million) IDC facility. The construction of the Makhado Project is

conditional on the Company raising further funding (the Additional

Funding ). MC Mining is exploring and progressing a number of

alternatives to raise the Additional Funding including, but not

limited to, the issue of new equity for cash in both the Company

and its subsidiary companies which own the Makhado Project, the

sale of minority stakes in the corporate entities holding the

Makhado Project, further debt funding and contractor funding, such

as build, own, operate, transfer ( BOOT ) arrangements.

The conclusion of the Additional Funding is by its nature an

involved process and is subject to successful negotiations with the

external funders and shareholders, as well as the potential

funder's due diligence procedures. As such, whilst the directors

are confident, there can be no guarantee that the required funds

will be raised. In the event that the parties cannot reach

agreement on further deferment terms or the Company does not repay

the loan by the repayment date, the financing documentation allows

for the existing IDC facility to be converted into equity.

For further information, refer to note 2 of the interim

financial statements together with the auditor's review report.

Events after the reporting period

Director resignation

Mr Junchao Liu, Haohua Energy International (Hong Kong) Co.

Ltd's ( HEI ) shareholder representative director, resigned as a

Non-Executive Director on 10 March 2023. HEI is MC Mining's sixth

largest shareholder, owning 5.8% of the issued shares.

Appointment of Non-Executive Directors

Ms Yi (Christine) He and Julian Hoskin were appointed as

Non-Executive Directors of the Company on 10 March 2023. Ms He is

the Managing Director of Dendocept, a 7.1% shareholder in the

Company and holds a further 2.2% in her personal capacity and joins

the board as a shareholder nominee Director for the Dendocept

Consortium, which collectively holds 23.9% of MC Mining's issued

shares. Mr Hoskin was appointed as an Independent Non-Executive

Director and is an Australian resident.

Rounding off of amounts

The Company is of the kind referred to in ASIC Legislative

Instrument 2016/191, and in accordance with that Instrument amounts

in the directors' report and the half-year financial report are

rounded off to the nearest thousand dollars, unless otherwise

indicated.

Auditor's Independence Declaration

The auditor's independence declaration is included on page 28 of

the half-year report.

The half-year report set out on pages 10 to 27, which has been

prepared on a going concern basis, was approved by the board on 15

March 2023 and was signed on its behalf by:

Nhlanhla Nene Godfrey Gomwe

Chairman Managing Director & Chief Executive

Officer

15 March 2023 15 March 2023

Dated at Johannesburg, South Africa, this 15(th) day of March

2023.

Six months Six months

ended ended

31 Dec 31 Dec

2022 2021

Note $'000 $'000

--------------------------------------------- ----- ----------- -----------

Continuing operations

Revenue 4 14,049 13,030

Cost of sales 5 (10,137) (10,913)

----------- -----------

Gross profit 3,912 2,117

Other operating income 6 352 42

Other operating gains 7 205 188

Expected credit loss reversal 8 291 -

Administrative expenses 9 (4,089) (2,909)

Operating profit/(loss) 671 (562)

Interest income 128 73

Finance costs (1,063) (850)

----------- -----------

Loss before tax (264) (1,339)

Income tax (expense)/credit 10 (1,045) 510

----------- -----------

LOSS AFTER TAX (1,309) (829)

Other comprehensive loss, net of

income tax

Items that may be reclassified subsequently

to profit or loss

Exchange differences on translating

foreign operations (2,373) (9,817)

----------- -----------

Total comprehensive loss for the

period (3,682) (10,646)

----------- -----------

Loss after tax for the period attributable

to:

Owners of the parent (1,275) (774)

Non-controlling interests (34) (55)

----------- -----------

(1,309) (829)

----------- -----------

Total comprehensive profit/(loss)

attributable to:

Owners of the parent (3,648) (10,591)

Non-controlling interests (34) (55)

----------- -----------

(3,682) (10,646)

----------- -----------

Loss per share

Basic and diluted (cents per share) 12 (0.50) (0.54)

The accompanying notes are an integral part of these

condensed consolidated financial statements

31 Dec 30 June

2022 2022

Note $'000 $'000

--------------------------------------- ----- ---------- ----------

ASSETS

Non-current assets

Exploration and evaluation assets 13 66,232 67,839

Development assets 13 16,919 17,739

Property, plant and equipment 22,745 23,475

Right-of-use assets 14 2,733 3,132

Other financial assets 4,965 4,599

Restricted cash 15 261 100

Total non-current assets 113,855 116,884

---------- ----------

Current assets

Inventories 16 6,944 4,445

Trade and other receivables 1,438 1,093

Cash and cash equivalents 15 20,090 2,993

---------- ----------

Total current assets 28,472 8,531

Total assets 142,327 125,415

---------- ----------

LIABILITIES

Non-current liabilities

Provisions 8,289 8,048

Deferred tax liability 4,266 4,232

Lease liabilities 17 1,716 2,057

Total non-current liabilities 14,271 14,337

---------- ----------

Current liabilities

Borrowings 19 16,394 21,656

Trade and other payables 9,814 9,307

Bank overdraft 15 1,132 1,529

Provisions 195 203

Tax liabilities 741 362

Lease liabilities 17 818 885

Total current liabilities 29,094 33,942

Total liabilities 43,365 48,279

---------- ----------

NET ASSETS 98,962 77,136

---------- ----------

EQUITY

Issued capital 20 1,070,278 1,045,395

Accumulated deficit (927,520) (926,245)

Reserves (42,938) (41,190)

---------- ----------

Equity attributable to owners of

the parent 99,820 77,960

Non-controlling interests (858) (824)

---------- ----------

TOTAL EQUITY 98,962 77,136

---------- ----------

The accompanying notes are an integral part of these condensed

consolidated financial statements

Issued Accumulated Share Capital Warrants Foreign Attributable Non-controlling Total

capital deficit based profits reserve currency to owners interests equity

payment reserve translation of the

reserve reserve parent

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

--------------- ---------- ------------ -------- -------- --------- ------------ ------------- ---------------- ---------

Balance at 1

July 2022 1,045,395 (926,245) 1,263 91 - (42,544) 77,960 (824) 77,136

Total

comprehensive

profit/(loss)

for the

period - (1,275) - - - (2,373) (3,648) (34) (3,682)

---------- ------------ -------- -------- --------- ------------ ------------- ---------------- ---------

Loss for the

period -

continuing

operations - (1,275) - - - - (1,275) (34) (1,309)

Other

comprehensive

loss,

net of tax - - - - - (2,373) (2,373) - (2,373)

Performance

rights issued - - 625 - - - 625 - 625

Shares issued 26,503 - - - - - 26,503 - 26,503

Share issue

costs (1,620) - - - - (1,620) - (1,620)

Balance at 31

December

2022 1,070,278 (927,520) 1,888 91 - (44,917) 99,820 (858) 98,962

---------- ------------ -------- -------- --------- ------------ ------------- ---------------- ---------

Balance at 1

July 2021 1,041,884 (907,202) 1,494 91 1,177 (30,199) 107,245 (721) 106,524

Total

comprehensive

profit/(loss)

for the

period - (774) - - - (9,817) (10,591) (55) (10,646)

---------- ------------ -------- -------- --------- ------------ ------------- ---------------- ---------

Loss for the

period -

continuing

operations - (774) - - - - (774) (55) (829)

Other

comprehensive

loss,

net of tax - - - - - (9,817) (9,817) - (9,817)

---------- ------------ -------- -------- --------- ------------ ------------- ---------------- ---------

Share based

payments - - 277 - - - 277 - 277

Performance

rights

expired - 369 (369) - - - - - -

Balance at 31

December

2021 1,041,884 (907,607) 1,402 91 1,177 (40,016) 96,931 (776) 96,155

The accompanying notes are an integral part of these

condensed consolidated financial statements

Six months ended 31 Dec 2022 Six months ended 31 Dec 2021

Note $'000 $'000

----------------------------------------------- ----- ----------------------------- -----------------------------

Cash Flows from Operating Activities

Receipts from customers 14,394 17,798

Payments to employees and suppliers (14,336) (15,179)

----------------------------- -----------------------------

Cash generated in operatio ns 58 2,619

Interest received 128 16

Interest paid (126) (129)

Tax (paid)/refund (464) 45

Net cash generated in operating activities (404) 2,551

----------------------------- -----------------------------

Cash Flows from Investing Activities

Purchase of property, plant and equipment (626) (567)

Investment in exploration and evaluation

assets 13 (732) (30)

Increase in other financial assets (326) (101)

Payments for development assets 13 (273) (3)

Restricted cash movement (161) -

-----------------------------

Net cash used in investing activities (2,118) (701)

----------------------------- -----------------------------

Cash Flows from Financing Activities

Proceeds from issue of shares 23,039 -

Share issue costs (1,620) -

Lease repayments 17 (415) (424)

Proceeds from borrowings 19 289 -

Borrowings repayments 19 (1,610) (351)

Net cash generated/(used) in financing

activities 19,683 (775)

----------------------------- -----------------------------

NET INCREASE IN CASH AND CASH EQUIVALENTS 17,161 1,075

Cash and cash equivalents at the beginning of

the half-year 1,464 1,023

Foreign exchange differences 333 (192)

----------------------------- -----------------------------

Cash and cash equivalents at the end of the

half-year 15 18,958 1,906

----------------------------- -----------------------------

The accompanying notes are an integral part of these condensed

consolidated financial statements

1. Significant Accounting Policies

Statement of compliance

The half-year financial report is a general purpose financial

report prepared in accordance with the Corporations Act 2001 and

AASB 134: 'Interim Financial Reporting'. Compliance with AASB 134

ensures compliance with International Financial Reporting Standard

IAS 34 'Interim Financial Reporting'. The half-year report does not

include notes of the type normally included in an annual financial

report and should be read in conjunction with the most recent

annual financial report.

Basis of preparation

The condensed consolidated financial statements have been

prepared on the basis of historical cost, except for the

revaluation of financial instruments and assets held for sale. Cost

is based on the fair values of the consideration given in exchange

for assets.

All amounts are presented in United States dollars, unless

otherwise noted.

The Company is of a kind referred to in ASIC Legislative

Instrument 2016/191, relating to the 'rounding off' of amounts in

the financial statement. Amounts in the directors' report and the

half-year financial report have been rounded off in accordance with

the instrument to the nearest thousand dollars, or in certain

cases, to the nearest dollar.

The accounting policies and methods of computation adopted in

the preparation of the half-year financial report are consistent

with those adopted and disclosed in the Company's 2022 annual

financial report for the financial year ended 30 June 2022, except

for the impact of the Standards and Interpretations described

below. These accounting policies are consistent with the Australian

Accounting Standards and with International Financial Reporting

Standards (IFRS).

Where applicable, certain comparatives have been adjusted to

conform with current year presentation.

The Group has adopted all of the new and revised Standards and

Interpretations issued by the Australian Accounting Standards Board

(the AASB) that are relevant to their operations and effective for

the current reporting period.

2. Going Concern

The Consolidated Group has incurred a net loss after tax for the

six months ended 31 December 2022 of $1.3 million (31 December

2021: loss of $0.8 million). During the period ended 31 December

2022, net cash outflows from operating activities were $0.4 million

(31 December 2021 net inflow: $2.6 million). As at 31 December 2022

the Consolidated Group had a net current liability position of $0.6

million (30 June 2022: net current liability position of $25.4

million).

During November 2022, the settlement date of the $9.4 million

(ZAR160 million) IDC loan facility, excluding accrued interest, was

extended to 30 June 2023. The IDC also agreed to extend the

terminal drawdown date in respect of the conditional $14.4 million

(ZAR245 million) term loan agreed to partially finance the

development of the Makhado Project, also to 30 June 2023, subject

to the satisfaction of the outstanding conditions, including the

IDC reaffirming its financial due diligence and credit

approval.

The Directors have prepared a cash flow forecast for the

12-month period ended 31 March 2024, taking into account available

facilities, additional debt and equity funding that although not

yet concluded is expected to be raised, and expected cash flows to

be generated by Uitkomst and the Vele Colliery. On the basis of

these equity and debt funding initiatives being successfully

implemented, the forecast indicates that the Group will have

sufficient cash to fund their operations for at least the

twelve-month period from the date of signing this report.

These cash flow forecasts referred to above include the

following assumptions:

-- Meeting commitments to creditors arising from continuing operations;

-- Deferring the settlement of the existing IDC loan (plus

accrued interest) to when Makhado is at steady state production as

opposed to being payable in June 2023 (refer note 19) and/or

converting this facility to equity;

-- Continued favorable coal prices and utilization of cash

generated by the Company's collieries;

-- A drawdown of the new IDC term facility of $14.4 million (ZAR245 million);

2. Going Concern (continued)

-- Contractor funding including a BOOT arrangement of $6.5 million (ZAR110 million); and

-- In addition to the $14.4 million (ZAR245 million) new IDC

term loan facility and $6.5 million (ZAR110 million) BOOT

arrangement referred to above, securing additional composite

debt/equity funding of approximately $82.4 million (ZAR1.4 billion)

required ( Additional Funding ) to finance the development of the

Makhado Project, through either a debt or equity.

The Group is still in negotiations with the IDC on the deferral

of the existing loan repayment, which may have an impact on its

ability to draw down on the new facility. This is due to the new

facility being subject to certain conditions precedent which are

still to be met, one of which is the settlement of the current

facility. In addition, draw down on the conditional $14.4 million

(ZAR245 million) term loan is subject to successful conclusion of a

due diligence exercise and credit approval.

The Group is exploring and progressing several alternatives to

raise the Additional Funding including, but not limited to:

-- The issue of new equity for cash in the Company or its

subsidiary that owns the Makhado project;

-- Further debt funding;

-- Cash generated by the Company's Collieries;

-- Further contractor BOOT funding arrangements; and

-- The sale of a minority stake in the subsidiary companies holding the Makhado Project.

The conclusion of the debt and equity raise funding initiatives

as included in the cash flow forecast and for purposes of obtaining

the Additional Funding as outlined above, and renegotiations with

the IDC on current and further funding, is by its nature an

involved process subject to successful negotiations with the

external funders and shareholders. In addition, any equity or debt

raised is likely to be subject to a due diligence process.

These conditions create a material uncertainty that may cast

significant doubt on the entity's ability to continue as a going

concern and, therefore, the Group may be unable to realize its

assets and discharge its liabilities in the normal course of

business.

The Directors are of the opinion that the going concern basis

remains appropriate as a result of the following

considerations:

-- The Group is already in discussions with the IDC on the

deferral of the settlement of the existing loan and the

restructuring of the conditions precedent in relation to the new

facility;

-- The Group has a history of successful capital raisings to

meet the Group's funding requirements; and

-- The Group has the capacity if necessary to reduce its

operating cost structure in order to minimise its working capital

requirements and defer the timing of any future capital

raising.

Subject to raising the required funding noted above, the

development of the Makhado Project is expected to commence within

the twelve months following the signing of these interim financial

statements.

Based on the above, the directors are satisfied at the date of

signing the interim financial statements that there are reasonable

grounds to believe that they will be successful in obtaining the

required funding and that the Group will have sufficient funds to

meet its obligations as and when they fall due and are of the

opinion that the use of the going concern basis remains

appropriate

These consolidated interim financial statements do not give

effect to adjustments that would be necessary to the carrying value

and classification of assets and liabilities, should the Group be

unable to continue as a going concern. Such adjustments could be

material.

2. Segment Information

AASB 8 requires operating segments to be identified on the basis

of internal reports about components of the Group that are

regularly reviewed by the chief operating decision maker in order

to allocate resources to the segment and to assess its

performance.

Information reported to the Group's Managing Director and Chief

Executive Officer (CEO) for the purposes of resource allocation and

assessment of performance is more specifically focused on the stage

within the mining pipeline that the operation finds itself in.

The Group's reportable segments under AASB 8 are therefore as

follows:

-- Exploration

-- Development

-- Mining

The Exploration segment is involved in the search for resources

suitable for commercial exploitation, and the determination of the

technical feasibility and commercial viability of resources. As of

31 December 2022, projects within this reportable segment include

four exploration stage coking and thermal coal complexes, namely

the Chapudi Complex (which comprises the Chapudi project, the

Chapudi West project and the Wildebeesthoek project), Generaal

(which comprises the Generaal Project and the Mount Stuart

Project), Mopane (which comprises the Voorburg Project and the

Jutland Project) and the Makhado Project.

The Development segment is engaged in establishing access to and

commissioning facilities to extract, treat and transport production

from the mineral reserve, and other preparations for commercial

production. As at 31 December 2022, projects included within this

reportable segment includes the Vele Colliery, in the early

operational stage with the ramp-up to full production expected in

Q2 FY2023 and Klipspruit, which is included in the Uitkomst

Colliery.

The Mining segment is involved in day to day activities of

obtaining a saleable product from the mineral reserve on a

commercial scale and consists of Uitkomst Colliery.

The Group evaluates performance on the basis of segment

profitability, which represents net operating (loss)/profit earned

by each reportable segment.

Each reportable segment is managed separately because, amongst

other things, each reportable segment has substantially different

risks.

The Group accounts for intersegment sales and transfers as if

the sales or transfers were to third parties, i.e. at current

market prices.

The Group's reportable segments focus on the stage of project

development and the product offerings of coal mines in

production.

The following is an analysis of the Group's results by

reportable operating segment for the period under review:

For the six months ended 31 December 2022

$'000 $'000 $'000 $'000

-------------------------------- ------------

Exploration Development Mining Total

------------ ------------ ---------

Revenue - - 14,049 14,049

Cost of sales - (4) (10,130) (10,134)

------------ ------------ ---------

Gross Profit - (4) 3,919 3,915

Other operating income - 6 13 19

Expected credit loss

reversed - - 291 291

Other operating gains/(losses) 2 2 8 12

Administrative expenses (269) (425) (48) (742)

Profit/(loss) before

interest (267) (421) 4,183 3,495

Interest income 32 4 24 60

Finance costs (272) (318) (311) (901)

------------ ------------ ---------

Profit/(loss) before

tax (507) (735) 3,896 2,654

------------ ------------ ---------

For the six months ended 31 December 2021

$'000 $'000 $'000 $'000

-------------------------------- ------------

Exploration Development Mining Total

------------ ------------ ---------

Revenue - - 13,030 13,030

Cost of sales - - (10,913) (10,913)

------------ ------------ ---------

Gross Profit - - 2,117 2,117

Other operating income 2 22 14 38

Other operating gains/(losses) - - 62 62

Administrative expenses (533) (333) (85) (951)

Profit and loss before

interest (531) (311) 2,108 1,266

Interest income 5 - 15 20

Finance costs (360) (203) (288) (850)

------------ ------------ ---------

Loss before tax (886) (514) 1,835 435

------------ ------------ ---------

The following is an analysis of the Group's assets by reportable

operating segment:

31 Dec 2022 30 June

2022

$'000 $'000

------------ --------

Exploration 78,196 86,031

Development 17,513 31,337

Mining 28,944 31,418

------------ --------

Total segment assets 124,653 148,786

------------ --------

Reconciliation of segment information to the consolidated

financial statements:

31 Dec 2022 31 Dec

2021

$'000 $'000

------------ --------

Total profit/(loss) before tax for reportable

segments 2,654 435

Other operating gains 193 126

Administrative expenses (3,347) (1,957)

Other operating income 334 5

Interest income 68 52

Finance costs (164) -

Cost of sales (2) -

Loss before tax (264) (1,339)

------------ --------

31 Dec 2022 30 June

2022

$'000 $'000

------------ --------

Total segment assets 124,653 115,999

Unallocated property, plant and equipment 5,436 4,964

Other financial assets 4,084 4,037

Other receivables 261 100

Unallocated exploration and evaluation assets 312 1

Unallocated current assets 7,581 314

Total assets 142,327 125,415

------------ --------

The reconciling items relate to corporate assets.

4. Revenue

Revenue consists of the sale of coal by the Uitkomst Colliery.

Coal sales during the period were made to customers in the steel

industry in South Africa and domestic and export thermal coal

sales.

5. Cost of sales

Cost of sales consists of:

31 Dec

31 Dec 2022 2021

$'000 $'000

------------ ---------

Salaries and wages (4,447) (4,537)

Underground mining (1,395) (2,048)

Depreciation and amortisation (1,208) (1,245)

Logistics 579 (52)

Other direct mining costs (4,275) (3,447)

Inventory adjustment 2,322 498

Other (1,713) (82)

------------ ---------

(10,137) (10,913)

------------ ---------

6. Other operating income

Other operating income includes:

31 Dec 31 Dec

2022 2021

$'000 $'000

------- -------

Sale of scrap 10 -

Other 342 42

------- -------

352 42

------- -------

7. Other operating gains

Other operating gains or losses include:

31 Dec 31 Dec

2022 2021

$'000 $'000

------- -------

Foreign exchange (loss)/profit

Unrealised (71) (170)

Realised 91 (16)

Other 185 374

------- -------

205 188

------- -------

8. Expected credit loss reversal

31 Dec 31 Dec

2022 2021

$'000 $'000

Reversal of expected credit losses 291 -

291 -

------- -------

9. Administrative expenses

31 Dec

2022 31 Dec 2021

$'000 $'000

-------- ------------

Employee costs (2,079) (1,201)

Depreciation and amortisation (48) (46)

Other (1,962) (1,662)

-------- ------------

(4,089) (2,909)

-------- ------------

10. Income tax expense/(credit)

The income tax expense/(credit) relates to the following:

31 Dec

2022 31 Dec 2021

$'000 $'000

------- ------------

Current income tax expense 849 (45)

Deferred tax current year 196 (465)

1,045 (510)

------- ------------

11. Dividends

No dividend has been paid by MC Mining or is proposed in respect

of the half-year ended 31 December 2022 (FY 2021 H1: nil)

12. Loss per share

31 Dec 31 Dec

2022 2021

---------- -----------

12.1 Basic loss per share

Cents per Cents

share per share

---------- -----------

Basic loss per share

From continuing operations (0.50) (0.54)

$'000 $'000

---------- -----------

Loss for the period attributable to owners of

the parent (1,275) (774)

31 Dec 31 Dec

2022 2021

------------ ------------

'000 shares '000 shares

------------ ------------

Weighted number of ordinary shares

Weighted average number of ordinary shares for

the purposes of basic loss per share 254,493 154,420

------------ ------------

12.3 Diluted loss per share

Diluted loss per share is calculated by dividing the loss

attributable to owners of the Company by the weighted average

number of ordinary shares outstanding during the year plus the

weighted average number of dilutive ordinary share that would be

issued on conversion of all the dilutive potential ordinary shares

into ordinary shares.

As the Company is in a loss position, the diluted potential

ordinary shares impact is anti-dilutive.

12.4 Headline loss per share (in line with JSE listing requirements)

The calculation of headline loss per share at 31 December 2022

was based on the headline loss attributable to ordinary equity

holders of the Company of $1,275,550 ( FY 2022 H1 : $773,579) and a

weighted average number of ordinary shares outstanding during the

period ended 31 December 2022 of 254, 493,063 ( FY 2022 H1 :

154,419,555).

The adjustments made to arrive at the headline loss are as

follows:

31 Dec 31 Dec

2022 2021

$'000 $'000

-------- -------

Loss after tax for the period attributable

to ordinary shareholders (1,275) (774)

Headline loss (1,275) (774)

-------- -------

Headline loss per share (cents per share) (0.50) (0.54)

13. Development, Exploration and Evaluation Assets

A reconciliation of development, exploration and evaluation

assets is presented below:

Exploration and evaluation assets

31 Dec 30 June

2022 $'000 2022 $'000

------------ ------------

Balance at beginning of period 67,839 93,467

Additions 732 134

Movement in rehabilitation asset 21 88

Foreign exchange differences (2,360) (11,000)

Impairment - (14,850)

------------ ------------

Balance at end of period 66,232 67,839

------------ ------------

Development assets

31 Dec 30 June

2022 2022 $'000

$'000

------------ ------------

Balance at beginning of period 17,739 19,055

Transfer to property, plant and equipment (651) -

Additions 273 5

Movement in rehabilitation asset 250 1,115

Foreign exchange differences (692) (2,436)

------------ ------------

Balance at end of period 16,919 17,739

------------ ------------

14. Right-of-use assets

The Group leases various assets including land, buildings, plant

and machinery and vehicles. The movement in the right-of-use assets

is as follows:

31 Dec 30 June

2022 2022

$'000 $'000

-------- --------

Balance at beginning of the period 3,132 2,588

Additions - 119

Depreciation (270) (637)

Modification - 1,462

Foreign exchange differences (129) (400)

-------- --------

Balance at end of period 2,733 3,132

-------- --------

15. Cash and cash equivalents

30 June

31 Dec 2022 2022

$'000 $'000

------------- --------

Bank balances 20,090 2,993

Bank overdraft (1,132) (1,529)

18,958 1,464

------------- --------

Restricted cash 261 100

261 100

------------- --------

The bank overdraft relates to an ABSA Bank Limited (ABSA)

facility for $1.5 million (ZAR24.9 million). The facility is for

short-term working capital requirements and potential expansion

opportunities. It has a floating coupon at the South African Prime

rate (currently 10.75% per annum) plus 3.0%, with a general

notarial bond over Uitkomst's assets as well as a cession of the

colliery's trade receivables. The facility is subject to annual

review.

16. Inventory

30 June

31 Dec 2022 2022

$'000 $'000

------------- --------

Consumable stores 671 580

Consignment inventory 3,418 1,460

Finished goods 2,854 2,450

Other 33 8

Provision for obsolete inventory (32) (53)

------------- --------

6,944 4,445

------------- --------

17. Lease liabilities

The movement in the lease liabilities is as follows:

30 June

31 Dec 2022 2022

$'000 $'000

------------- --------

Balance at beginning of the period 2,942 2,412

Modification (8) 1,339

Additions - 119

Interest 134 281

Repayments (415) (864)

Foreign exchange differences (119) (345)

------------- --------

Balance at end of period 2,534 2,942

------------- --------

The maturity of the Group's undiscounted lease payments is as

follows:

30 June

31 Dec 2022 2022

$'000 $'000

------------- --------

Not later than one year 818 885

Later than one year and not later than five

years 2,155 2,707

Later than five years 313 332

------------- --------

3,286 3,924

Less future finance charges (752) (982)

------------- --------

Present value of minimum lease payments 2,534 2,942

------------- --------

18. Deferred consideration

30 June

31 Dec 2022 2022

$'000 $'000

-------------- --------

Opening balance - 2,796

Interest accrued - 39

Repayments - (2,670)

Foreign exchange differences - (165)

-------------- --------

- -

--------------------------------------------- --------

18. Deferred consideration (continued)

Lukin and Salaita deferred consideration

In the 2019 financial year, the Company's subsidiary, Baobab,

completed the acquisition of the properties Lukin and Salaita, the

key surface rights required for its Makhado Project for an

acquisition price of $4.1 million (ZAR70 million). $2.1 million

(ZAR35 million) of the acquisition price has been deferred to the

earlier of:

-- the third anniversary of the transfer of the properties; or

-- the first anniversary of production of coal underlying the properties; or

-- completion of a potential land claims and expropriation

process. In terms of current legislation, this would result in

Baobab receiving market related compensation and would be followed

by negotiations with the Minister of Land Affairs and the

successful claimants, who are shareholders in Baobab, for long-term

access to the properties.

The deferred consideration and accrued interest payments owed

were settled on 1 March 2022.

19. Borrowings

31 Dec 30 June

2022 2022

$'000 $'000

-------- --------

Opening balance 21,656 19,482

Loans acquired during the year 289 7,953

Transfer to share capital - (3,024)

Repayments (5,074) (644)

Interest accrued 460 537

Foreign exchange differences (937) (2,648)

Balance at end of period 16,394 21,656

-------- --------

Non-current - -

Current 16,394 21,656

------- -------

16,394 21,656

------- -------

Industrial Development Corporation of South Africa Limited

The IDC has provided longstanding financial support for the

development of the Makhado Project. In March 2017 MC Mining secured

a facility of which ZAR160 million ($9.4 million) was drawn to

progress Makhado to its fully-permitted status and to partially

fund the acquisition of the surface rights over the project area.

The Company is required to repay the loan amount plus an amount

equal to the after tax internal rate of return equal to 16% of the

amount of each advance. In terms of the IDC facility, as a result

of ZAR160 million of the facility being drawn, the IDC was issued

with 6.7% of the shares in MC Mining subsidiary, Baobab, the owner

of the Makhado Project. The IDC has extended the date for repayment

date for the ZAR160 million (plus accrued interest) to 30 June

2023.

The IDC also agreed to extend the terminal draw down date in

respect of the conditional July 2019 ZAR245 million ($14.4 million)

new facility for the development of the Makhado Project, to 30 June

2023, which facility is still subject to successful conclusion of a

due diligence exercise and credit approval. The ZAR245 million new

facility remains part of the composite Makhado funding package,

subject to the repayment of the March 2017 facility, along with

accrued interest thereon.

MC Mining is required to issue warrants, in respect of MC Mining

shares, to the IDC on the drawdown of the March 2017 facility. The

warrants for the first $7.1 million (ZAR120 million) draw down

equated to 2.5% (equating to 2,408,752 shares) of the entire issued

share capital of MC Mining as at 5 December 2016. The IDC was

entitled to exercise the warrants for a period of five years from

the date of issue and these warrants expired on 16 June 2022. The

price at which the IDC was entitled to purchase the MC Mining

shares was equal to a thirty percent premium to the 30-day volume

weighted average price of the MC Mining shares as traded on the

JSE. The warrants for the second draw down of ZAR40 million ($2.4

million) equate to 0.833% of the entire share capital of MC Mining

as at 1 October 2020, and it is not known if or precisely when

these warrants will be issued as the Company is in discussions with

the IDC to restructure the ZAR160 million facility. Furthermore,

upon each advance, Baobab is required to

19. Borrowings (continued)

issue new ordinary shares in Baobab to the IDC equivalent to 5%

of the entire issued share capital of Baobab if the drawdown was

ZAR120 million. Following the total drawdowns of ZAR160 million,

the IDC is a 6.7% shareholder in Baobab.

Dendocept (Pty) Ltd

The R60 million ($3.5 million) Standby Loan Facility obtained

from Dendocept is unsecured and bears interest at the South African

Prime plus 3% with a maturity date of June 2023. The outstanding

balance on the final maturity date was payable in cash or MC Mining

equity. The R60 million owing in terms of the Standby Loan Facility

was settled by the issue of MC Mining equity as part of the

November 2022 Rights Issue.

Senosi Group Investment Holdings (Pty) Ltd

During February 2022, MC Mining and its subsidiary Limpopo Coal

Company Proprietary Limited ( Limpopo Coal ), entered into a staged

ZAR86 million ($5.1 million) Convertible Advance and Subscription

Agreement (the SGIH Agreement) with SGIH. In terms of the SGIH

Agreement, SGIH paid ZAR46 million ($2.7 million) and 38.3 million

new MC Mining shares were issued to SGIH on 6 April 2022.

SGIH also conditionally agreed to subscribe for a further 33.3

million new MC Mining shares, raising an additional ZAR40 million

($2.4 million), conditional on shareholder approval. The Company's

shareholders declined to approve the issue of the shares to SGIH at

a general meeting on 15 July 2022. As a result, the two tranches of

ZAR10 million paid by SGIH during April and May 2022, plus

interest, were due to be repaid by Limpopo Coal. The ZAR20 million

($1.2 million) loan from SGIH plus interest at the South African

prime interest rate, was repaid during the period.

20. Issued Capital

During the reporting period the Company issued 200,026,719

ordinary shares.

31 Dec 2022 30 June

2022

$'000 $'000

------------- ----------

397,681,589 (FY2022: 197,654,870) fully

paid ordinary shares 1,070,278 1,045,395

------------- ----------

Fully paid ordinary shares carry one vote per share and carry

the right to dividends.

Options

Shareholders authorised the issue of 12,000,000 share options to

the Managing Director and CEO on 30 November 2022. The options were

granted subsequent to period end.

Performance Rights

During July 2022 the directors issued 9,183,906 performance

rights to management in terms of the shareholder approved

Performance Rights Scheme.

Shareholders authorised 7,000,000 performance rights for issue

to MC Mining directors on 30 November 2022. The performance rights

were granted subsequent to period end.

During November 2022, 381,219 performance rights granted to

management in 2019 vested and a further 1,602,393 special incentive

performance rights granted to management in September 2020 vested

on the commissioning of the Vele Colliery CPP in December 2022. As

at 31 December 2022, the ordinary MC Mining shares due for these

performance rights had not been issued. The South African

regulatory approval for the issue of the ordinary MC Mining shares

was received subsequent to period end and the ordinary MC Mining

shares are expected to be issued in March/April 2023.

No further performance rights expired or were cancelled during

the period.

21. Contingencies and Commitments

Contingent liabilities

The Group has no significant contingent liabilities at reporting

date.

Commitments

As at 31 December 2022, the Group had a $0.2 million commitment

which relate to its social and labour plan at Uitkomst Colliery. In

addition to the amount provided in the consolidated statement of

financial position.

In addition to the commitments of the parent entity, subsidiary

companies have typical financial commitments associated with their

mining rights granted by the South African Department of Mineral

Resources & Energy (DMRE) .

22. Events subsequent to reporting

Director resignation

Mr Junchao Liu, HEI's shareholder representative director,

resigned as a Non-Executive Director on 10 March 2023. HEI is MC

Mining's sixth largest shareholder, owning 5.8% of the issued

shares.

Appointment of Non-Executive Directors

Ms Yi (Christine) He and Julian Hoskin were appointed as

Non-Executive Directors of the Company on 10 March 2023. Ms He is

the Managing Director of Dendocept, a 7.1% shareholder in the

Company and holds a further 2.2% in her personal capacity and joins

the board as a shareholder nominee Director for the Dendocept

Consortium, which collectively holds 23.9% of MC Mining's issued

shares. Mr Hoskin was appointed as an Independent Non-Executive

Director and is an Australian resident.

23. Key management personnel

Remuneration arrangements of key management personnel are

disclosed in the annual financial report.

24. Financial Instruments

Fair value of financial assets and liabilities

The fair value of a financial asset or a financial liability is

the amount at which the asset could be exchanged or liability

settled in a current transaction between willing parties in an

arm's length transaction. The fair values of the Group's financial

assets and liabilities approximate their carrying values, as a

result of their short maturity or because they carry floating rates

of interest.

All financial assets and liabilities recorded in the

consolidated financial statements approximate their respective fair

values.

The following table provides an analysis of financial

instruments that are measured subsequent to initial recognition at

fair value, grouped into Level 1 to 3, based on the degree to which

the fair value is observable.

Level 1 fair value measurements are those derived from quoted

prices in active markets for identical assets or liabilities. The

balances classed here are financial assets comprising deposits and

listed securities.

Level 2 fair value measurements are those derived from inputs

other than quoted prices included within Level 1 that are

observable for the asset or liability, either directly or

indirectly. The financial assets classed as Level 2 comprise of

investments with investment firms. These investments serve as

collateral for rehabilitation guarantees. The fair value has been

determined by the investment firms' fund statement.

Level 3 fair value measurements are those derived from valuation

techniques that include inputs for the asset or liability that are

not based on observable market data.

There were no assets reclassified into/out of fair value through

profit and loss (FVTPL) during the period nor were any assets

transferred between levels.

As at 31 December 2022 ($'000) Level Level Level Total

1 2 3

-------------------------------- ------------ --------- --------- ---------

Other Financial Assets - 4,965 - 4,965

- 4,965 - 4,965

--------------------------------------------- --------- --------- ---------

As at 30 June 2022 ($'000) Level Level Level Total

1 2 3

-------------------------------- ------------ --------- --------- ---------

Other Financial Assets - 4,599 - 4,599

- 4,599 - 4,599

--------------------------------------------- --------- --------- ---------

Directors' Declaration

The Directors declare that in the directors' opinion,

1. The condensed financial statements and notes of the

consolidated entity are in accordance with the following:

a. complying with accounting standards and the Corporations Act 2001; and

b. giving a true and fair view of the consolidated entity's

financial position as at 31 December 2022 and of its performance

for the half-year ended on that date.

2. There are reasonable grounds to believe that the Company will

be able to pay its debts as and when they become due and

payable.

This declaration is made in accordance with a resolution of the

Board of Directors, made pursuant to section 303(5) of the

Corporations Act 2001.

On behalf of the Directors

Nhlanhla Nene Godfrey Gomwe

Chairman Managing Director and Chief Executive

Officer

15 March 2023 15 March 2023

Dated at Johannesburg, South Africa, this 15(th) day of March

2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUVOBROSUOARR

(END) Dow Jones Newswires

March 15, 2023 03:40 ET (07:40 GMT)

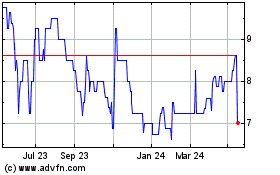

Mc Mining (LSE:MCM)

Historical Stock Chart

From Jun 2024 to Jul 2024

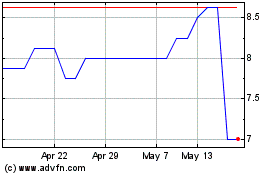

Mc Mining (LSE:MCM)

Historical Stock Chart

From Jul 2023 to Jul 2024